U4AOS2: Aggregate Supply Policies

1/118

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

119 Terms

What are Aggregate Supply (AS) Policies?

Government strategies that seek to grow the productive capacity of the economy, especially in the long term, by increasing the willingness and ability of producers to produce goods and services

Often involve increasing the quantity and quality of production

They need to be done deliberately (e.g. not natural disasters)

AS policy works in the long-term to influence businesses willingness/ability to produce by influencing supply side conditions

What are the goals?

Full Employment → The goal of Full Employment is to achieve the lowest level of unemployment without causing inflationary pressures where cyclical unemployment is non-existent and natural unemployment is at NAIRU which is said to be 4-4.5%.

Low and stable Inflation → The goal of low inflation refers to the general level of prices increasing at a rate of 2-3% pa on average over time

SSEG → The government's goal of SSEG is to achieve the highest growth rate possible consistent with strong employment growth, but without running into unacceptable inflationary, external or environmental pressures.

What is trade Lib?

Any government policy that is designed to promote free trade or reduce restrictions or barriers to free trade with other countries such as reduction of tariffs or reduction in assistance to local producers, free trade agreements.

What might government AS side policies try to improve/increase production?

These policies try to increase national production by making aggregate supply-side conditions more favourable

increase the efficiency in our use of resources so that the output of goods and services grows faster than the rise in inputs

increase the quality of productive resources available

increase the quantity or volume of productive resources available

increase incentives to motivate individuals and businesses to expand production and capacity (e.g. by reducing COP)

increase the level of competition in markets so they are more responsive and effective

reduce any instances of market failure in allocating resources.

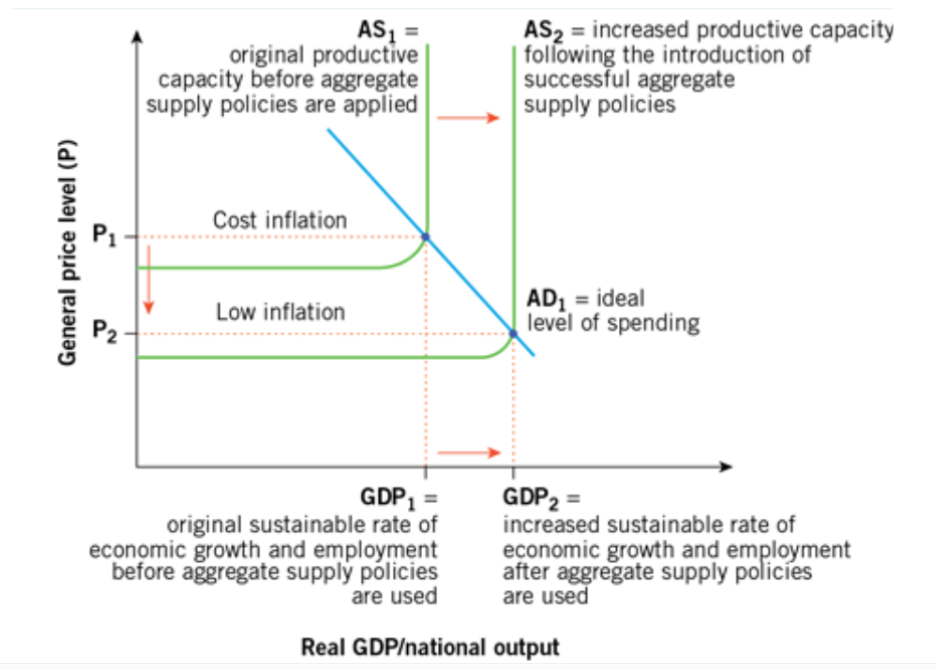

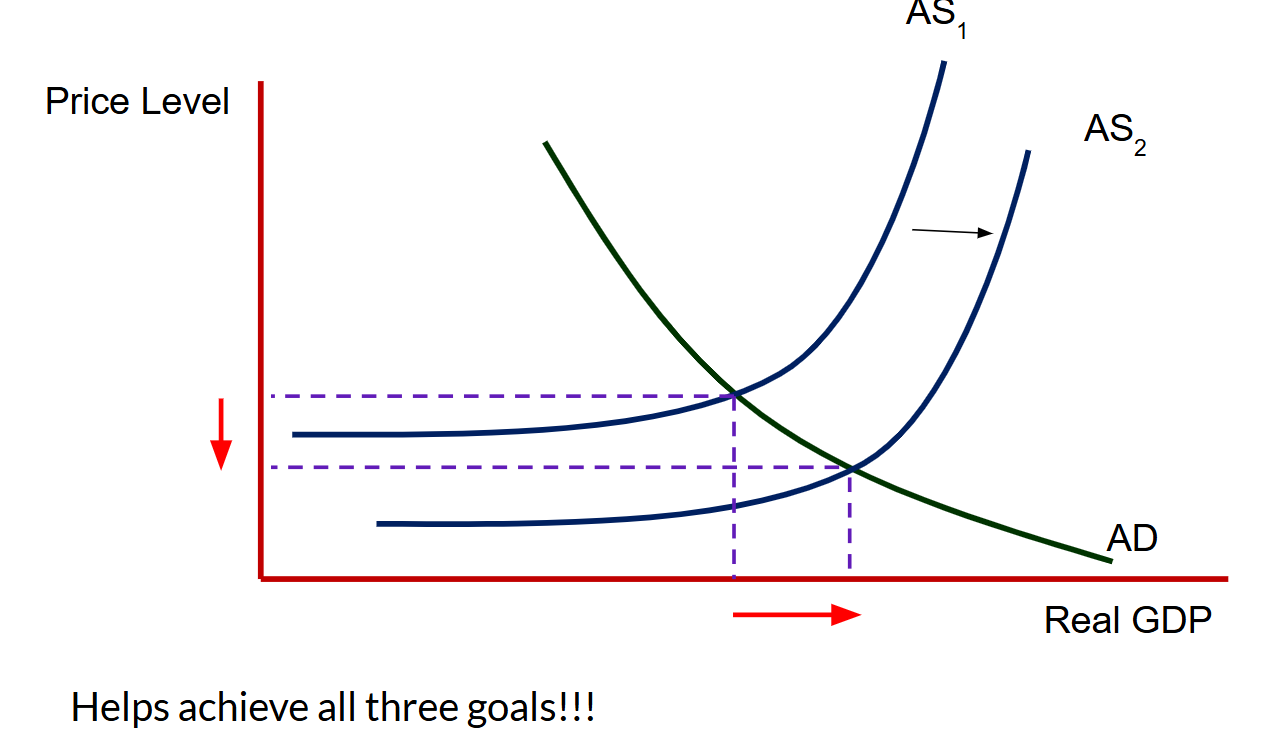

How does AS annd AD work on the diagram?

Always think about the long-term

If we want to ease cost inflation we need to increase the supply therefore there will be fewer shortages

What is AD policy?

AD policy works in the short-term to influence the level of spending in an economy, they also work counter cyclically to the business cycle

What are the differences between AD and AS policies overall?

AS Policy aims to improve living standards by improving supply side conditions impacting businesses and production through lifting efficiency, quantity or quality of resources, offering incentives, lifting the level of competition or reducing market failure resulting in a long term structural change in economic activity.

AD policy focuses on expenditure by consumers in the economy and manipulating the level of demand and spending to influence economic activity in the short term countercyclically

Differences between AD/AS: They work in different ways and use different theories

Aggregate demand policies influence Australia’s domestic macroeconomic conditions by stabilising the growth in the level of spending (AD). This is based on Keynesian economic theory where ‘demand creates supply’.

Aggregate supply policies try to grow our capacity to produce or supply output (AS), perhaps by using incentives and competition to boost efficiency.

Differences between AD/AS: They work on slightly different problems

By helping to stabilise spending, aggregate demand policies can help to avoid cyclical problems caused by booms and recessions — such as demand inflation and cyclical unemployment — that undermine our living standards.

Aggregate supply policies deal with economic problems of a structural nature — such as cost inflation, natural unemployment and the sustainable speed limit or non-inflationary rate of economic growth.

Differences between AD/AS: They operate in different time frames

Aggregate demand policies often focus more on the short- to medium-term drivers of the economy

Aggregate supply policies tend to concentrate more on longer term factors determining the economy’s performance.

How can AD and AS policies work together?

In the short term AD policy may stimulate growth and create jobs but can also increase inflationary pressures.

For example you could use MP to expand the lvl of economic activity, but this may lead to demand inflation if AS cannot keep up. Therefore AS policies aim to improve the supply side conditions, this leads to more sustainable or non-inflationary economic growth because there is less likely to be shortages of resources as the AS Policies work to increase productive capacity and increase spare capacity so the economy can handle more increases in demand before inflation accelerates.

In order to grow sustainably AS policies must work to increase the capacity of the economy over the longer-term.

What is Allocative Efficiency and its relationship with AS?

Allocative efficiency needs to increase to ensure that resources are directed into areas where they best help to satisfy society’s immediate and future needs and wants.

For example, allocative efficiency may be improved by using AS policies to promote stronger competition between sellers of goods and services in various markets, by undertaking market deregulation and through labour market reforms.

This ensures that resources are directed into areas of comparative cost advantage (where opportunity costs are minimised). However, government policy intervention may be needed to overcome market failure and lift efficiency in the allocation of resources.

DEF: How are resources allocated into producing the g/s to meet the maximum needs and wants of a society to maximise societies wellbeing

What is Productive or technical efficiency and its relationship with AS?

This occurs when businesses using the least-cost method of production.

AS policies (such as research and development grants) can help firms to cut their costs and employ the best international production practices, skills, technology and equipment available.

DEF: Maximising output and minimising input

What is Dynamic efficiency and its relationship with AS?

This involves firms being adaptive and creative in response to changing economic circumstances.

AS policy needs to encourage market flexibility and resilience when faced with changing tastes among buyers.

Dynamic efficiency is also enhanced when employees upgrade their skills and training, when there is a culture of market research and product development, and when firms are encouraged to be innovative and creative.

DEF: Refer to how quickly producers can reallocate resources in response to changing market conditions

What is Intertemporal efficiency and its relationship with AS?

This entails ensuring there is a suitable balance between resources being allocated towards current consumption on the one hand, and adequate national saving for financing future investment to grow the economy’s capacity on the other.

AS-side policies (such as tax reform and investing in infrastructure) can help promote this

DEF: The right balance of allocating resources between current and future generations

How does the implementation of AS Policies lead to ‘Improving supply-side conditions’?

You need to determine how the different AS Policies lead to an:

Increase the quality or quantity of resources available

Decrease the cost of production for Australian businesses

Increase in productivity

…All of these increase the willingness and ability of suppliers to produce goods and services and they will lead to an increase in productive capacity and international competitiveness.

How do AS Policies lead to an increase in international competitiveness?

AS policies make local businesses more competitive internationally at home AND abroad, by helping them to be able to offer more attractive goods and services at a lower price that better meet customer needs.

They do this by:

Encouraging the conducting R&D

Increasing efficiency

Keeping production costs and inflation rates lower

This might involve measures to

Increase competition in some key markets

Create greater incentives for investing and work

As a consequence, Australian firms should be able to grow their market share of sales and income. This supports rises in Australia’s living standards.

How to answer questions about how AS policies can increase international competitiveness?

1)

AS policies aim to improve supply side conditions

They do this by increasing the quantity and quality of resources

AS policies reduce COP

W/A to produce increases

Reduce final selling price, as they can reduce selling price without impacting their profit margins

Decrease Prices makes aus g/s more competitive against imports and aus goods more competitive in the global market

OR

2) COMPETE IN QUALITRY

Increase quality of machinery and equipment

Higher quality g/s

Therefore get a more competitive advantage in terms of their actual final product

How to answer AS policy questions in general

Usually think of a specific resource (e.g. labour) and then work your way through the question with that

Always link to efficiency if possible

Link to W/A to produce

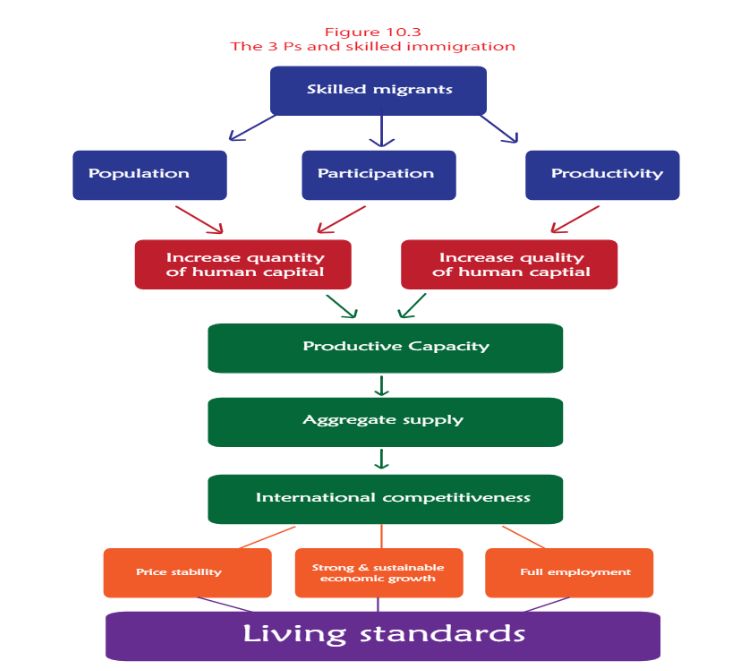

How to answer a PPP question

Write about the population (refer to quantity)

Write about the participation (refer to quantity)

Write about the productivity (refer to quality)

Then write about how quantity and quality improves, favourable supply side conditions, increase w/a, increase productive capacity and output, refer to LS (this last paragraph should just answer the question)

What is labour productivity?

The ratio of output to labor input. It measures how much output is produced by each worker or hour worked

What is Capital productivity?

The ratio of output to capital input. It measures how much output is produced by each unit of capital.

What is the quality of factors of production?

Refer to our resources, such as labour and capital, are more capable of generating output. An increase in the quality of:

Human capital (i.e. labour)

Physical capital (e.g.machinery)

Natural capital (e.g. land)

Will raise productivity by increasing the volume or real value of production relative to the inputs used in the production process

How can the government improve the quality of Human capital?

The government can devote more funding to vocational education and training, or provide employers with tax concessions or subsidies to incentivise greater expenditure on training and development

This is designed to improve the quality of human capital, as younger Australians will ultimately exit these courses/ programs with enhanced workplace skills, improving labour productivity as they should be able to contribute to greater output for each hour of employment

More experience/ Education

How can the government improve the quality of Physical capital?

The government can undertake invest in infrastructure itself (e.g. investment in telecommunications, road, port or rail infrastructure) or encourage the private sector to investment in more ‘high tech’ capital (e.g. by providing research and development grants or subsidies)

The greater investment in infrastructure and/or capital will result in benefits such as better connectivity between Australian producers to markets, including export markets, through better highways or rail for example

The upgraded infrastructure should increase productivity levels over time, as the cost and speed of transportation services will improve

In addition, greater investment in capital, such as new and improved technology or robotics, will enable producers to achieve an increase in output with fewer resources, once again raising productivity

How can the government improve the quality of Natural capital?

They can lower the rate of depletion by limiting or making it harder/more expensive to emit carbon in the production process (Environmental Policies) aim to increase environmental sustainability

Additionally, through R&D by creating viable alternatives instead of using natural resources or reducing the damage to the natural resources that are available

This largely relates to government environmental policies, but it also relates to policy initiatives such as those that improve the quality of agricultural land for farmers or the quality of mineral resources for miners

Quality of soil

Link to intertemporal efficiency

How can the government improve the quantity resources?

Increasing the skills and knowledge of workers making them more employable and increasing the supply of suitable labour decreasing structural unemployment.

Skilled Migration Policies, this increases the number of skilled workers available, to fill labour shortages in specific industries/occupations.

Availability of workers can also increase by increasing incentive to work through lowering income taxes (which increase reward for working) and provision of a childcare subsidy making childcare more affordable allowing primary caregivers to re-enter the workforce.

Capital resources can increase in quantity via R&D Policies which incentivise the development of newer more technically efficient capital resources.

Increase the availability or access to capital resources via more transportation avenues (ports/railways)

Can’t just say increase quantity improves productivity → NEED TO TALK ABOUT IT IN TERMS OF SUPPLY OF LABOUR ON A MACRO LEVEL (EASING SHORTAGES OF LABOUR THROUGH MIGRATION)

How are AS policies better at tackling the problem of stagflation than compared to AD policies?

Stagflation is the situation where there is high inflation and low rates of economic growth. If AD policies are used, they may work to increase spending and economic growth through AD but they also generate demand inflation in the short term through a temporary shortage as producers strive to meet the new increased demand in the economy

AS policies work to increase economic growth by creating favourable conditions for suppliers which increase productive capacity. They do this by increasing efficiency and increasing the quality and/or quantity of the resources used in the production process, this ultimately leads to lower costs of production and an easing of cost inflation.

In a situation of stagflation, the intention should be to increase economic growth to sustainable levels, this will mean increasing Real Output and reducing the upwards pressure on prices and this is what AS policies aim to achieve

What is the main difference between the quantity and quality of production?

A higher quality of factors of production leads to higher productivity and output. This is because more skilled workers can produce more output in a given amount of time, more advanced technology can help to automate tasks and improve technical efficiency, and more abundant natural resources can reduce the cost of production.

A higher quantity of factors of production can also lead to higher productivity and output, but only up to a point. Once a business has reached the point where it is using all of its resources efficiently, increasing the quantity of factors of production will no longer lead to proportionally more output (compared to inputs)

What are capacity constraints and how can AS policy help alleviate them?

A capacity constraint is a limitation that restricts production or output so that production cannot keep up with aggregate demand

AS policies relating to efficiency and productivity and labour force participation can assist in alleviating capacity constraints because access to labour may increase via skilled migration or education and training policies can be implemented to make labour more productive and increase technical efficiency in order for production to keep up with aggregate demand

What is spending on Education and training

Government spending on training and education used in the long term to cultivate the skills, productivity and creativity of Australia’s labour resources (grow our human capital). These help grow our productive capacity and increase aggregate supply

Educational support for families and students

Capital or investment spending on buildings, equipment, facilities and

Infrastructure for pre-school, primary and secondary schools, VET training, universities, TAFE education and libraries.

What is the spending on Education and training example we will be using?

“Free TAFE to drive better access to vocational training opportunities and to help to deliver on Australia’s skills needs”

Higher skills in occupations which are high in demand (and who have a shortage of workers)

Increases the quality of labourers → Productivity increases → COP decreases → w/a of producers increase → AS increases

Increases quantity of labourers

Education and training: SSEG

In the long term, it improves the quality of our labour resources (grows our human capital resources), making workers more productive, adaptive and innovative, and lifting the dynamic and technical efficiency of businesses

It helps to ease Australia’s skills shortages or bottlenecks that would otherwise limit national production.

By increasing efficiency and easing labour shortages, it slows the growth in wage costs and makes aggregate supply conditions more favourable, encouraging the growth of businesses

Education and training: Price Stability

Spending on education and training can slow production costs for businesses

In the long term, this promotes AS and eases cost inflation pressures by helping to make labour more technically efficient and more dynamically efficient (and therefore more innovative), easing business costs and allowing firms to sell their goods profitably at lower prices and helping ease the skills bottlenecks that would normally be reflected in higher wage costs and prices.

Also eases labour shortages in sectors that cannot find workers, easing labour shortages reduces wages and therefore costs of production

Education and training: Full Employment

In the long term, budget outlays on education and training help to reduce structural unemployment

Having the right skills can help to make our labour force more employable, reducing the structural unemployment that is often caused by the mismatch of skills and job requirements

Easing skills shortages, education outlays slow the growth in wage costs that otherwise would occur. This encourages business expansion, fewer closures and improved competitiveness leading to less structural unemployment.

What is Research and Development?

Government provision of R&D grants to institutions, universities, industry and individuals is aimed at cultivating society’s knowledge and improving technology.

Either cash payments or generous tax incentives or write-offs up to 150 percent of R&D expenditure seek to grow:

quality of our resources (especially capital goods and human capital),

technical and dynamic efficiency

Why is R&D kinda risky

Returns on R&D can sometimes be low and uncertain if it doesn’t work out

Any returns often take time to produce results

Any research and development can be stolen by others

What is the spending on R&D example we will be using?

125% to 175% tax write-off is available to eligible companies that engage in R&D

The R&D tax incentives as they are over 100%, reduce the amount of tax paid to the ATO. The reduction in cash out of the business as corporate tax reflects an effective cash grant as instead of an increase in a cash inflow, there a reduction in a cash outflow.

R&D: SSEG

R&D grants help increase Australia’s sustainable rate of economic growth and potential GDP by encouraging innovation, expanding information, understanding and new ideas, government R&D grants can promote dynamic and technical efficiency

This grows our access to resources (human capital) needed to develop our production possibility frontier or capacity

They help to lower the COP and raise the profitability of firms wanting to develop new products. This can make them more internationally competitive and ultimately lead to greater economies of large-scale production, strengthening economic growth

R&D: Price Stability

R&D grants can eventually help to improve the efficiency of resources so more output is gained from fewer inputs. This can translate into lower production costs for producers and ease cost inflationary pressures.

R&D: Full Employment

R&D grants can have mixed effects on Australia’s unemployment rate by increasing innovation, or the restructuring production so as to cater for new processes and products

Unfortunately, this can lead to structural unemployment in the short term.

However, in the long term, failure to innovate will cause industries to go into decline. So although there should be many new jobs created by innovative businesses, these may be in different industries or areas, and involve the employment of staff with different skills, requiring effective education and training policies.

What are Subsidies and Industry assistance?

Subsidies are generally cash payments or tax concessions given by the government to businesses, industries or individuals.

Reduce COP → encourage firms to restructure their operations more efficiently to become internationally competitive → expand their productive capacity → grow aggregate supply in the long term

How does Subsidies and Industry assistance help to alleviate market failure?

They can also help to promote society’s general interests by reducing market failure, perhaps associated with externalities and the provision of public goods.

help to cover the cost of an input (such as subsidies for employing older workers or the long-term unemployed)

help to offset the losses made by businesses to avoid their closure

be given in the form of a loan or a grant targeted at businesses in a particular industry or geographic area.

What is the Subsidies and Industry assistance we will be using?

Childcare subsidies/rebates: allows access to affordable childcare encourages participation in the labour force

Subsidies and Industry assistance: SSEG

Help to boost productive capacity and AS, and accelerate the long-term sustainable rate of economic growth by using subsidies in ways that help businesses restructure their operations, leading to better technical efficiency and sometimes allocative efficiency (in instances of market failure)

In this way, they can grow Australia’s productive capacity and the size of our production possibility frontier

Government subsidies can help to cover some of the production costs of local businesses, making them more profitable. This makes firms more willing and able to increase their capacity and output.

Subsidies can allow local businesses to sell more competitively at a lower price. This can also help local firms grow their market size and sales volumes, enabling them to gain economies of large-scale production.

Subsidies and Industry assistance: Price Stability

Government spending on subsidies can reduce COP and easing inflationary pressures, businesses can sell their goods and services profitably at lower prices, slowing inflation AND subsidies are used to encourage businesses and industries to restructure their operations more efficiently, they again help reduce cost pressures and inflation.

Subsidies and Industry assistance: Full Employment

Subsidies are used to improve the efficiency of local businesses, they can help to reduce structural unemployment by making firms more profitable by covering some of their costs or by encouraging greater technical

In turn, lowering costs and improving competitiveness, causing fewer business closures and encourage business expansion

This lowers structural unemployment in the long term (despite a possible rise in unemployment in the shorter term during the industry’s restructuring phase)

What is investment in national infrastructure?

Infrastructure investment can be regarded as capital expenditure (G2) that are in turn used by suppliers to produce other goods and services.

Infrastructure often involves external benefits (positive externalities) where the economic and social returns are far beyond those directly received by individual investors

This leads to its underproduction, market failure and capacity restrictions

Correcting this problem requires government intervention through investment in infrastructure.

What is the investment in national infrastructure example we will be using?

$7.2 billion for safety upgrades on the Bruce Highway

If transport is faster and safer and cheaper, then technical efficiency is likely to increase through a reduction of costs per unit

Fuel reduction, less congestion, improve transportation, labour mobility (to get to work easier)

OR

Hydrogen production - investing $2 billion in Hydrogen Headstart, a new program to support hydrogen production.

Less blackouts = more time on the grid = more efficient

Investment in national infrastructure: SSEG

Infrastructure investment helps to accelerate the long-term sustainable rate of economic growth by boosting the economy’s productive potential and the level of aggregate supply

Allows them to increase their production of other goods and services by growing the availability of capital resources to alleviate bottlenecks

New infrastructure has superior technology which boosts productive efficiency

Reduce costs for suppliers associated with transport, utilities and telecommunications.

Investment in national infrastructure: Price Stability

Increasing intertemporal, technical and allocative efficiency

Improved efficiency translates into lower per unit production costs allowing sellers to have lower prices, slowing cost inflation pressures. eg fuel, maintenance and time that follow improvements in road and other types of transport infrastructure.

Transport infrastructure grows the mobility of workers (and raw materials) and thus their ability to find work and make a productive contribution to the size of the economy, growing participation rates and the usable labour force. Growing the supply of labour, reduces labour costs.

Investment in national infrastructure: Full Employment

In the long term, infrastructure investment can help keep structural (and cyclical) unemployment lower

Infrastructure investment helps to lift efficiency and holt rises in production costs

This strengthens business profitability and encourages new and existing firms to expand their operations rather than close down

This boosts aggregate supply and reduces structural unemployment

Lower production costs helps make local suppliers more internationally competitive and profitable, both here and overseas, encouraging the expansion of business and employment opportunities.

What is the Tax and Welfare reform debate?

Over recent years, there have been many discussions about changing the Australian taxation system

A need to reduce the disincentives associated with increasing numbers of taxpayers moving into higher marginal income tax brackets (bracket creep) and to ensure greater incentives to work

Issues associated with repairing the budget to reduce budget deficits and a need for increased revenue

Issues associated with an ageing population and managing the increased outlays and reduced revenue that this implies

A need to reduce the company tax rate in Australia as the relative higher company tax rates in Australia are acting as a barrier to both improving international competitiveness and the discouragement of foreign investors

Reducing the complexity of the system which operates as a disincentive to business and achieving higher levels of efficiency and productivity

What are tax Reforms?

Tax reform often involves changing the way budget revenue is collected. As an aggregate supply policy, tax reform usually focuses on:

reducing the tax burden through lower tax rates paid by individuals and companies as a proportion of their income or the price of a good

reviewing the tax base, coverage or inclusiveness of what particular types of things are to be taxed or not taxed (which goods or services, which income, what assets)

improving the tax mix or combination of different types of tax used to raise revenue (direct versus indirect, consumption versus income taxes)

reducing tax avoidance and improving the integrity of the tax system.

What is the Tax reform we will be using?

$20,000 instant asset write-off provisions (accelerate depreciation allowance) for small business (with annual turnover below $10 million) to encourage investment in new equipment and capital (2024/25)

*DO NOT talk about stage 3 tax cuts

What are the key areas Tax reforms focus on?

Tax concessions/rebates/allowances

Alterations to direct taxes

Reducing compliance costs for businesses

Tax Reforms: Tax concessions/rebates/allowances

Reduce the tax liability if there is investment in specific assets or activities. Encourage investment in particular areas and therefore impact resource allocation

Rebates or Tax offsets directly reduce the amount of tax payable on your taxable income. Rebates can reduce your tax payable to zero. They are additional tax deductions on top of already allowable tax deductions.

Rebates are only available for particular business activities so they can be used by the government to encourage particular types of investment.

Accelerated depreciation: asset write off scheme allows business to write off the entire cost of the assets in the first financial year instead of over a number of years. The benefit has been brought forward and there is a higher chance that the tax payable will be reduced. It encourages firms to purchase non-current assets to increase technical efficiency.

Tax Reforms: Alterations to direct taxes

Decreasing the rate of tax increases after-tax profits allowing businesses with more left over funds to invest in expanding their businesses, plant and equipment (this initially boosts I in AD) but then leads to a boost in productive capacity as technical efficiency improves. These business attract foreign capital investors

Changes to income tax rates work to improve AS conditions by:

Creating incentives to work harder

Labour force participation rates increase as discouraged job seekers enter the labour market, encourage migration and create a larger labour pool that puts pressure of those currently employed to boost their productivity.

Increased labour supply puts downward pressure on wages as a cost of production

Tax Reforms: Reducing compliance costs for businesses

Administration to do with lodging income tax returns, business activity statements (BAS) and making sure there’s compliance with tax legislation

The more complex the tax, the more expensive it will be to work out if the business is eligible and how to apply and calculate tax payable

Therefore if the govt improves the efficiency of the tax system, then costs of production for business should decrease

Tax Reform: SSEG

The government’s tax reforms involving generally lower tax rates and some adjustments to the tax mix have helped to maximise incentives for investment, effort, work and efficiency

They have made Australia’s AS conditions for businesses and individuals more favourable, thereby growing our productive capacity

Lower personal income tax rates can create greater rewards or incentives, and motivate individuals to work harder, work longer hours and gain promotion

They can also encourage higher rates of participation in the labour force (helping individuals avoid the welfare trap)

Reduction of tax compliance costs for business also reduces costs of production

Tax Reform: Price Stability

Lower rates of personal income tax increase disposable incomes and might help to slow demands for higher wages

This reduces cost pressures

In addition, lower rates can act as an incentive to work even harder and gain new skills, thereby lifting labour productivity, again slowing cost inflation

Lower company tax rates allow firms to gain stronger after-tax profits. They can sell more competitively at a lower price.

With better retained profits, firms are more able to afford new technology, boosting their technical efficiency and suppressing cost inflation pressures.

Tax Reforms: Full Employment

Lower marginal rates of personal income tax can strengthen incentives to work and get a job

Lower rates also lift worker productivity, slow business costs and make local firms more competitive at home and abroad

This can reduce the number of business closures, encourage expansion and cut structural unemployment.

A reduction in the company tax rate for small business can improve after-tax profits, reduce company closures by making local firms more internationally competitive, encourage investment and expansion, and cut structural unemployment.

Spending on Education and Training: LS

Through accelerating the sustainable rate of GDP growth, slowing inflationary pressures and assisting employment, these outlays help to grow average real incomes and purchasing power.

This creates optimal conditions for better material living standards. Outlays on education make workers more employable and less likely to be unemployed because they have wanted skills that can grow the economy’s productive capacity.

Employment improves happiness, health, and feelings of self-worth and therefore non-material living standards and education helps individuals gain employment.

R&D: LS

Material living standards may be strengthened by using R&D grants to raise efficiency and hence real GDP, incomes and consumption per capita. Grants also make local firms more internationally competitive and thereby create more employment opportunities. In addition, through greater efficiency, R&D grants can lower inflation. This too helps to improve the purchasing power of incomes.

Non-material living standards may benefit from specific R&D grants for renewable energy and the reduction of emissions that would otherwise reduce the quality of life. In addition, by creating new jobs in the long term, unemployment could be lowered, improving outcomes for health, happiness, family and community.

Subsidies and industry assistance: LS

By helping to accelerate the sustainable rate of GDP growth, slowing inflationary pressures and assisting employment in the long term, subsidies can help to grow average real incomes creating better material living standards.

Subsidies paid to consumers of goods and services (like solar panels and rainwater tanks) can help ease environmental problems (such as carbon emissions and climate change), reduce negative externalities (such as those associated with power production and consumption) and improve non-material living standards.

Investment in national infrastructure: LS

Accelerating the sustainable rate of GDP growth, slowing inflationary pressures and assisting employment, investment in infrastructure can grow average real incomes creating optimal conditions for better material living standards.

In the long term, lower unemployment can especially improve non-material living standards through improved happiness and feelings of self-worth, lower crime rates and better health outcomes.

Investment in infrastructure can help to reduce market failure and the underproduction of public goods caused by the existence of positive externalities (that are usually ignored by profit-seeking private owners of resources). In so doing, it can strengthen allocative efficiency and more fully maximise the extent to which society’s wants and wellbeing are actually met.

Tax Reforms: LS

By promoting lower cost inflation, tax reform has helped to grow the purchasing power of incomes, consumption and material living standards.

It has helped to offset the negative effects of an ageing population on the rate of income growth.

In helping to keep structural unemployment lower through greater efficiency and competitiveness, tax reform has generated higher real disposable incomes for individuals (because earnings from paid work have been higher than welfare benefits), improving our material living standards.

Lower unemployment is beneficial to the general happiness and health of families, and potentially may have helped to keep crime rates lower strengthening non-material living standards.

However, the abolition of the mining and carbon taxes has probably accelerated environmental damage and eroded the material and non-material living standards of future generations.

What are the 3 P’s?

Population, Productivity and Participation

If a question does not specifically ask about one of them, then it is expected you discuss all of them briefly with the sentences you have pre-prepared

What is skilled migration in Australia?

Skilled migration policy involves the government granting visas to people from overseas who possess the requisite or unique skills, knowledge and abilities.

The list of desired skills and professions is constantly reviewed by the Australian Government to ensure that they are still filling areas of skills shortages

POPULATION: Skilled Migration

Immigration policy of skilled migrants assists in increasing the quantity of labour resources to replace the labour lost through those retiring

Australia has an ageing population which can lead to capacity constraints

As these people leave the labour force, the available supply of labour will fall

Additionally, they stop paying income taxes and may start to claim pension payments and support for medical assistance.

Skilled migration (people of working age) increases the proportion of people who are able to participate in the LF and fill the gaps (replace) left by our ageing population

Which means that there will be a high dependency on the 15-64 year olds to support the rest of the Australian population

It is predicted that by 2054-55, that the ratio of working age people to people aged 0-14 and 65+ will be for every 1 person working they support 2.7 people

PARTICIPATION: Skilled Migration

Almost 100% of skilled migrants will enter the labour force immediately, hence the labour force participation rate (number of people willing and able to work) will increase, by increasing the quantity of labour resources available and ready to work, labour shortages are relieved and wage growth eases, this increases economic growth

As participation rate increases, more income tax is collected by the government to support the welfare being paid to the increasing number of pensioners

PRODUCTIVITY: Skilled Migration

Skilled migrants increase the quality of labour as skilled workers bring with them new processes and knowledge/skills that increase the productivity of the production process

The also fill skills shortages leading to fewer capacity constraints/bottlenecks

Skilled Migration: SSEG

There are a number of ways in which immigration has boosted Australia’s productive capacity, aggregate supply and the potential or sustainable rate of GDP:

Increase quantity (supply) of labour resources, filling bottlenecks that would otherwise limit our productive capacity. It also slows wage growth due to shortages being filled.

Quality is improved because skilled labour has unique skills and knowledge increasing labour productivity.

Immigration has grown the overall size of the population, increased the number of consumers and helped local firms gain greater efficiency through economies of scale lowering average COP as fixed costs a spread over al larger number of units.

Skilled Migration: Price Stability

Depends on its effect on the level of AD versus the effect on AS.

Immigration might slow cost inflation in the long term by

Slowing wage rises because the quantity of labour has increased and bottlenecks eased

Quality of labour resources has also improved, increasing productivity and decreases costs of production.

Leads to technical efficiency → more units produced (fixed costs more spread out) —> COP decreases → Cost inflation decreases

Note that Skilled Migrations Policy is specifically referred to as an AS Policy in the Study Design and so should be referred to in this way

Skilled Migration: Full Employment

Grow aggregate supply by increasing the size and skills of our labour force.

This reduces structural u/e by reducing the mismatch between the skills of the labour force and the skills required by industry.

Unemployment rate will fall with time because migrants also become consumers of goods and services adding to aggregate demand, economic activity and the derived demand for labour reducing cyclical unemployment.

The skilled migrants act as ‘job multipliers’. Also, as international competitiveness increases (due to productivity gains), derived demand for labour increases and cyclical u/e decreases in the longer term

Skilled Migration: LS

Material

To the extent that immigration alleviates skills shortages, increases supply of labour and eases wage costs, goods and services become more affordable.

Access to goods and services and economic well being increases

Non-Material

To the extent that immigration brings new cultures and improves the multiculturalism and acceptance in Australia

Increasing wellbeing and quality of life

Discuss questions

YOU NEED TO TALK ABOUT THE LONG TERM AND THE SHORT TERM EFFECTS

What is the nature and impacts of government free trade and protectionist policies?

Basically, the government chooses between free trade and protectionist policies

Free trade involves the removal of barriers to trade and makes it easier and more affordable to trade with Australia for Australia to be involved in the global economy.

Protectionist policies restrict imports and trade. Government's Policies to protect Australian businesses and markets from the global economy.

What are some Protectionist Policies?

Tariffs: tax on imports with the view to make them less competitive with local products

Subsidies to producers (local): cash payments to local producers to assist them in covering production costs and being able to offer goods and services at lower prices to compete with imports

Import quotas: restrictions of quantity and volume of a products imported into Australia (increases price of imports → harder to compete with Aus g/s)

Anti-dumping legislation: the restriction on the sale of items in another market at below cost – local producers cannot compete with this price

Preferential treatment and local content laws: Government contracts are given to local producers who have received preferential treatment even though their prices are higher.

Local content laws require that a % of programs be locally sourced.

Preferential treatment: restrictions on the level of foreign ownership in sensitive industries (airline, banking etc), large foreign investment is required to be approved by the Foreign Investment Review Board.

What are some Advantages of Protectionist Policies?

Protect infant industries

Retaliation against the protective barriers set up in other countries

Protection of long term security – Australia can provide for itself in the longer term including defence, food and energy supplies

Protection of local culture and identity

Protection to maintain jobs domestically

Protect high product standards

What are some disadvantages of Protectionist Policies?

Inefficient industries can continue to operate

This can also raise input costs

Contribution towards inflationary pressures short term (depreciation of AUD) and long term (inefficiency and erosion of competitiveness)

Inflationary pressures could cause depreciation of AUD over time as demand for Australian goods/services decreases

Legislation makes it difficult to dismantle the protection once enacted

What are some Advantages of Trade Liberalisation?

Greater efficiency, economic growth and incomes

Efficiency needs to be maximised in order for the firms to be able to compete.

Allocation of resources will only flow into areas/businesses which have a comparative cost advantage

Specialisation will also lead to greater cost reductions through economies-of-scale

Increased international trade

Volume of goods traded will grow quickly assuming we have access to other foreign markets

More jobs and employment

In the long term after inefficient operations have been closed (structural unemployment) resources needed to be moved into profitable areas of production.

Lower inflation and more choice

Increased competition means that generally prices will be lower, increasing the purchasing power of residents. Local firms are required to cut production costs in order to compete with the overseas presence.

Trade Lib in the Short-term

Broadly negative impact in the short-term

As Trade Liberalisation is implemented, local industries are exposed to overseas competition via removal of tariffs (for example) and loss of subsidies/assistance for local producers

Businesses are forced to reduce the costs of production to be able to offer a lower selling price in order to compete (without cutting profit margins).

Some businesses and industries may not be be to adapt and so will shut down

Structural unemployment may increase and hurt the goal of full employment

Strong and sustainable growth GDP may slow due to increase spending on overseas goods/services (M) and decreased spending on local goods/services as markets as the Australian economy is exposed to increased levels of competition

Cheaper imports coupled with the decreased local prices as local businesses try to compete, decrease in AD and result in downward pressure on prices = better able to achieve price stability

Trade Lib in the Long-Term?

Broadly positive in the long-term

As firms adjust to the new level of competition they innovate and increase productivity in order to survive.

This improves productive efficiency as resources get reallocated and productivity improves

Comparative advantages start to emerge as Australian businesses lower their average costs of production, this reduces cost inflation and helps achieve Price Stability

There is an increase in international competitiveness as business decrease their prices or improve the quality of their offerings

As competitiveness increases (due to more favourable supply side conditions), AD will increase as private consumption and private investment increase (consumers now purchase locally made g&s instead of imports) and export spending increases as well increasing ability to achieve Strong and Sustainable Economic Growth

In the long term, unemployment rate should fall due to the higher demand for Australian products locally and globally (cyclical unemployment) so Full Employment is able to achieved in the longer term.

Trade Lib: Material LS

Increase because there is greater access to goods and services as cost inflation eases, purchasing power increases.

Increase because in the longer term as cyclical unemployment decreases average income increases and access to goods and services increase.

Decrease because in the shorter term, there is an increase in structural unemployment which causes loss of income and reliance on government welfare programs.

Trade Lib: Non-Material LS

Increase quality of life through increased utility from purchases due to greater variety of goods and services available.

Decrease because in the shorter term, there is an increase in structural unemployment which causes decrease in self-esteem and feelings of isolation and loneliness.

WHAT TO DO WITH TRADE LIB QS FIRST

ALWAYS DEFINE TRADE LIB FIRST IN ANY TRADE LIB QS

“The freeing up of trade between countries”

What is Absolute Advantage in Trade Lib?

Occurs when a country can produce more of a good than other countries, using the same amount of resources

What is Comparative Advantage in Trade Lib?

This dictates that a country should specialise in the production of those goods where the opportunity cost is lower than other countries.

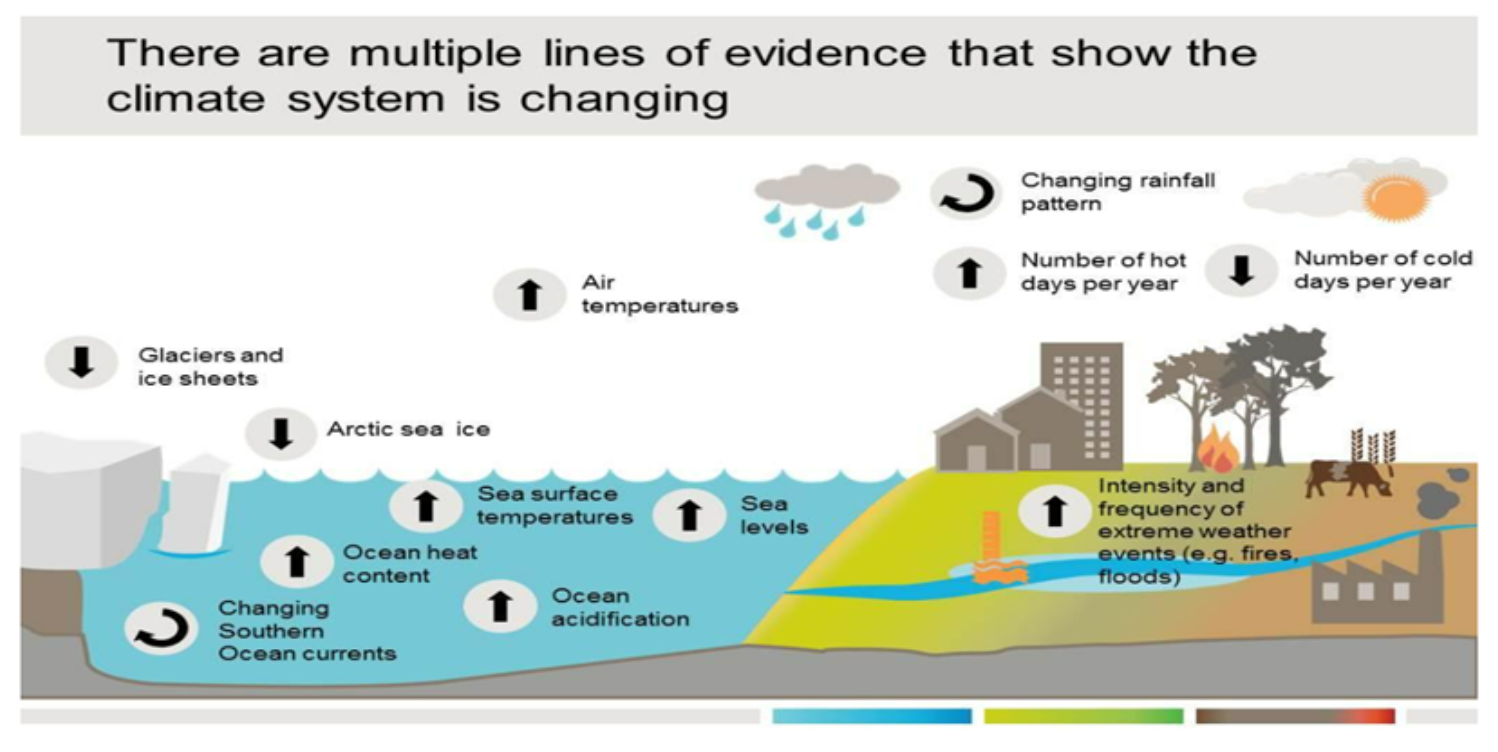

What are some evidences that show that climate system is changing?

What are the effects of Co2 (and other emission) on the environment?

If the government does not do anything to stop businesses from having processes that negatively impact the environment (excessive release of Co2); we will see:

Rising sea levels

Increased frequency and severity of extreme weather events (bushfires/droughts in Australia)

Impact on biodiversity

These in the long-term will affect the w/a of producers to continue production

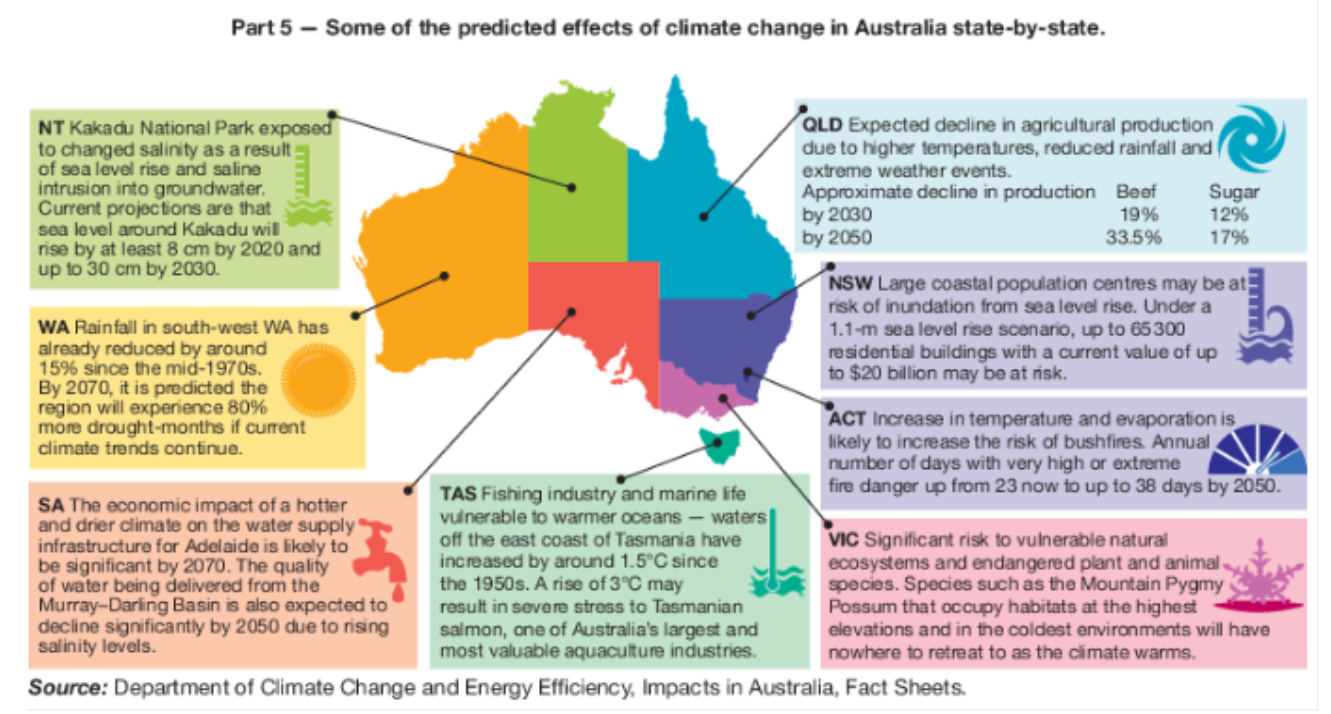

What are some predicated impacts of climate change on Australia

We need to know the impacts of climate change, then we can know why it is bad and hence can explain why the government is using policies to stop this

What are some of the effects of carbon emissions on AS

These impacts can reduce the productive capacity of an economy and the ability and willingness of businesses to produce

Non-renewable resources deplete and become more scare

Natural resources become less available for producers and costs increase

Might need to import more → expensive

What are some of the effects of carbon emissions on LS

Material living standards are impacted as the price of goods and services increase due to COP increasing, lowering access to goods and services and economic wellbeing

Non-material living standards are impacted via access to clean air and drinking water as waterways are contaminated or clean drinking water is harder to obtain

What is Environmental Policy?

Actions by the government seeking to protect long term economic prosperity by managing the impact that human activity has on the physical environment.

Really focused on HUMAN impact

What do current environmental policies revolve around

Current environmental policies seek to:

Respond to climate change

Reduce emissions of pollutants (we focus on this one)

Reduce waste

Minimise depletion of natural resources

What are market based policies?

Policies designed to positively change the behaviour of producers and consumers of goods and services that damage the environment

e.g. The cost of permits to emit CO2 increases cost of production so there is an incentive to find more sustainable methods of production

What is the aim of market based policies?

Aim is to reduce market failure involving negative environmental externalities resulting from some types of economic activity, thereby improving intertemporal efficiency

What is an emission trading scheme?

Emissions Trading Scheme involve the creation of market for tradable permits that allow producers to emit carbon during the production process.

Placing a price on carbon and creating demand for permits. The cost of the permits will be absorbed by businesses who emit carbon during their production process.

The government issues the permits and will restrict supply in line with their emissions reduction target.

How do emission trading schemes work?

Buyers and sellers negotiate a price, or determine the cost of pollution to be paid by polluters

Buyers of pollution permits are the businesses that must own or purchase the required number of permits (each permit allowing the release of one tonne of CO2) so they can undertake production

Supplier of permits is the government that in the first instance who distributes these free to firms, or auctions them off (this adds to COP)

Businesses that do not need these permits (due to their production process evolving to be more greener) can sell them to other businesses

The government could also ‘cap’ the number of permits issued at a certain level, so that an emissions reduction target can be achieved

VERY IMPORTANT THING TO SAY

The government will buy the permits back to slowly reduce the number in circuit to meet the goals

Permits are credits = the right to emit carbon into the environment

Credits are then traded for a market price between carbon emitting firms

If firms need to emit more carbon into the atmosphere, then they need to purchase ‘Carbon credits’, this increases their COP.