microeconomics ch 10 monopolistic competition and oligopoly

1/43

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

44 Terms

monopolistically competition

feature a large number of competing firms, but the products that they sell are not identical

oligopoly

when a few large firms have all or most of the sales in an industry

ex., boeing and airbus

oligopolistic markets

type of imperfectly competitive market

those which a small number of firms dominate

differentiated products

physical aspects

location from which it sells the product

intangible aspects of the product

guarantee of satisfaction or money back

reputation for high quality

free delivery

offering a loan to purchase product

perceptions of the product

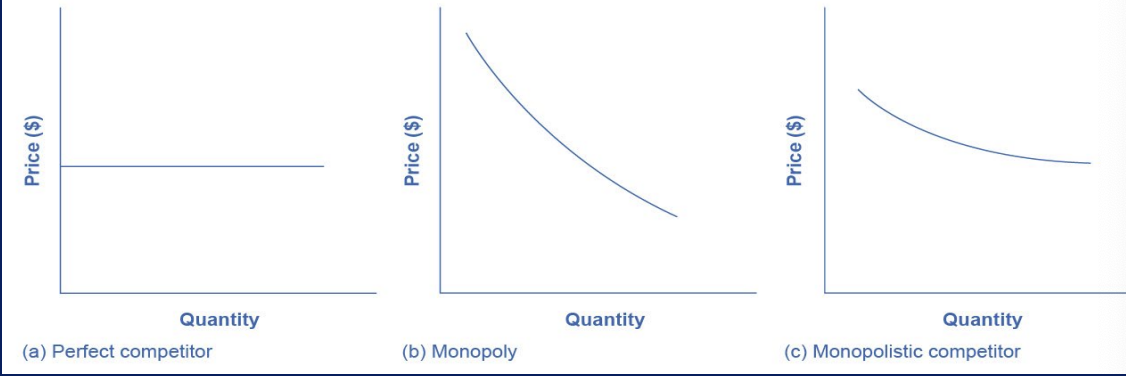

monopolistically competitive firm demand

perceives a demand for its goods that is an intermediate case btw monopoly and perfect competition

when price goes up by 1%, qty will fall by 3%, bc other firms are selling “similar not exact” products

perfect competitor

price is fixed no matter how the qty changes

monopoly

if price goes up by 1%, qty demanded will fall by less, lets assume 0.25%

monopolistic competition

if price goes up by 1%, qty will fall by 3%, bc other firms are selling “similar not exact” products

monopolistic competitor for demand curve

downward sloping

can arise its price wo losing all of its cstomers or lower the price and gain more customers

monopolistically competitive demand curve

more elastic than a monopoly’s where there are no close substitutes

monopolist raises price

some consumers will choose not to purchase its product but will then need to buy a completely different product

monopolistic competitor raises its price

some consumers will choose not to purchase the product at all, but others will choose to buy a similar product from another firm

it will not lose as many customers as a perfectly competitive firm would, but it will lose more customers than would a monopoly that raised its prices.

profits

if price a monopolistic competitor charges is above the avg cost of production, the firm will experience ?

losses

if price a monopolistic competitor charges is below the avg cost of production, the firm will experience ?

monopolistic competitor profit maximzing

choose a qty where marginal revenue = marginal cost

Q where MR=MC

monopolistic competitors and entry

more firms enter market→ qty demanded at any given price for a particular firm will decline

firm’s perceived demand curve will shift to L

marginal revenue curve shifts to L

this changes the profit-maximizing qty that the firm chooses to produce, since marginal revenue will then = marginal cost at a lower qty

entry and exit in monopolistic competition

end result is that firms end up with a price on the downward-sloping portion of the avg cost curve

can make an economic profit/loss in short run

zero economic profit outcome in long run

different than zero economic profit outcome in perfect competition

instead of firms selling at price level determined by lowest on AC curve (perfectly competitive market), now price will intersect the avg cost curve at a point where price > avg cost, and productive efficiency won’t be reached in the long run

in a perfectly competitive market, ea firm produces at a qty where price = marginal cost (short and long run), which why it always displays allocative efficiency

when P>MC (monopolistically competitive market), benefits to society of providing addt’l qty, as measured by the price that ppl are willing to pay, exceed the marginal costs to society of producing those units

set product apart, gain market share, economic profit

You run a company in a monopolistically competitive market. Why would you want to find ways to differentiate your product from the products of your competitors?

differentiating product and reduce qty

Aside from advertising, how can monopolistically competitive firms increase demand for their products?

monopolistic competition

Shopping malls typically lease retail space to a large number of clothing stores. When this group of retailers competes to sell similar but not identical products, they engage in what economists call ?

will decline

If a monopoly or a monopolistic competitor raises their prices, the quantity demanded

downward sloping

The demand curve as perceived by a monopolistic competitor is

price is higher than marginal revenue.

In a monopolistically competitive market, the rule for maximizing profit is to set MR = MC, which means

A. price is higher than marginal revenue.

B. price is equal to marginal revenue.

C. price is equal to marginal cost.

D. price is lower than marginal revenue.

the perceived demand and marginal revenue curves for each firm will shift to the left

When entry occurs in a monopolistically competitive industry,

A. the perceived demand and marginal revenue curves for each firm will shift to the right.

B. the perceived demand and marginal revenue curves for each firm will shift to the left.

C. the perceived demand curve for each firm will shift to the right. D. the marginal revenue curves for each firm will shift to the right.

perceived demand and marginal revenue curves will shift to the right

When exit occurs in a monopolistically competitive industry the

A. perceived demand and marginal revenue curves will shift to the right.

B. perceived demand and marginal revenue curves will shift to the left.

C. perceived demand curve will shift to the left.

D. marginal revenue curve will shift to the left.

oligopoly

when a small number of large firms have all or most of the sales in an industry

if they compete hard, they act similarly to perfect competitors (drive down costs and lead to zero profits for all)

if they collude w/ ea other, they may act like a monopoly, and succeed in pushing up prices and earning consistently high levels of profit

oligopolies

exist bc of combo of barriers to entry that create monopolies and the product differentiation that characterizes monopolistic competition

ex., boeing x airbus duopoly

collusion

when firms act together to reduce output and keep prices high

holding down industry output

charging higher price

dividing profit among themselves

illegal in US

anticompetitive behavior (violates antitrust law)

but difficult to find evidence to enforce

most is tacit, where firms implicitly reach an understanding that competition is bad for profits

cartel

a group of firms that have a formal agreement to collude to produce the monopoly output and sell at the monopoly price

formal agreements to collude

provide evidence of collusion, so rare in US

game theory

a branch of mathematics that analyzes situations in which players must make decisions and then receive payoffs based on what other players decide to do

prisoner’s dilemma

a scenario in which the gains from cooperation are larger than the rewards from pursuing self-interest

oligopolist version is that if each of them cooperates in holding down output, then high monopoly profits are possible

however, each oligopolist must worry that while it’s holding down output, other firms are taking advantage of the high price by raising output and earning higher profits

duopoly

an oligopoly with only 2 firms

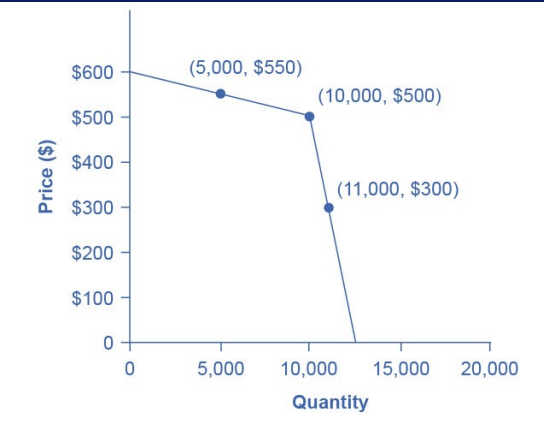

kinked demand curve

way to enforce cooperation for colluding oligopolists

if member firms expands output, price per unit falls dramatically bc other firms also cut prices immediately

if firm raises its price, its sales decline sharply other firms won’t raise prices also

pre-agreed levels of qty and price thru a strategy of matching all price cuts but not matching any price increases

monopolistic competition

probably the single most common market structure in US economy

incentives for innvation

entry assures that firms don’t earn economic profits in long run (even though firms want profits in short run)

endless search to impress consumers thru product differentiation may lead to excessive social expenses on advertising and marketing

oligopoly

prob 2nd most common market structure

when they result from patented innovations or from taking advantage of economies of scale to produce at low avg cost, they may provide considerable benefits to consumers

often buffered by significant barriers to entry

earn sustained profits over long periods of time

don’t typically produce at the min of their avg cost curves

if they lack vibrant competition, may lack incentives to produce innovative products and high quality service

imperfect competition trade off

monopolistically competitive market structure provides powerful incentives for innovation but never achieve productive efficiency in long run

Yes; consumers will buy from competitors offering lower priced substitutes

Would raising the price for a product create a larger decline in quantity demanded for a monopolistic competitor's than it would for a monopoly?

A firm selling a differentiated product is essentially a monopolist for that product, and so is able to exercise some market power.

What is the relationship between product differentiation and monopolistic competition?

There is an incentive for members of a cartel to cheat in order to gain more profits for the individual firm, so such arrangements tend to be unstable.

What stops oligopolists from acting together as a monopolist and earning the highest possible level of profits?