Bachelor Project

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

48 Terms

What is the Research Question?

What are the factors that influence tourists' willingness to pay a tourism tax, in the case of Copenhagen?

What are the research objectives

1.) to understand the willingness to pay as a part of the tourist's decision-making process

2.) to explore what factors influence their willingness to pay tourism taxes

- Factors playing a role in the tourists' decision-making processes, which may ultimately influence tourists' willingness to pay will be explored.

- The factors to be analyzed within the scope of this study are socio-demographic factors, psychographic characteristics, attitudes and experiences.

- Experiences will be further divided into the experience of the destination, the experience of tourism as resident in the home country and the experience of previously having paid tourism taxes.

3.)The third objective is to explore whether the suggested tax purposes of the original tax proposal would be supported by visiting tourists.

Overall, this study aims to provide insights into the case of Copenhagen and contribute to the political dialogue concerning tourism taxes in Denmark.

Limitation to Scope

- Limited to the geographical area

- time frame of 3 months

- his can be placed into the boarder context of consumer behavior, not all related consumer behavioral theories and concepts will be mentioned or incorporated into the theoretical framework. This paper's focus on decision-making, entails that other concepts of consumer behavior may be mentioned but not in depth analyzed.

- page maximum of 60 pages.

Literature Review = An Overview of Consumer Behavior - Cohen et al

Cohen, et al. (2014)

- The authors define nine key concepts of travel behavior including: decision making, values, motivations, self-concept and personality, expectations, attitudes, perceptions, satisfaction, trust and loyalty.

- consumer behavior describes how consumers satisfy their needs and wants by making certain decisions and participating in activities or experiences, allowing them to consume a certain product or service

- Tourism research has often been influenced by the theory of buyer-behavior.

- The authors argue for the importance of understanding decision-making as a process.

- Values guide tourists' product and destination choices, forming motivations and influencing actions, emotions, and behavior.

- Motivations are defined as tourists' needs and wants, which can be of psychological or biological nature.

It's important to understand both motivations and the formation thereof.

- Self-concept and personality describe how tourists perceive themselves and respond to surroundings, affecting travel choices.

- Expectations reflect tourists' desires and needs or the expected standard of a product, determining satisfaction and post-purchase evaluation.

- Attitudes influence whether tourists favor one product over another and serve as a predictor of behavior.

- Perceptions are shaped by previous experiences, motivation, or values.

- Satisfaction reflects how content a consumer is with the product and is a central part of consumer behavior.

- Loyalty indicates whether a tourist remains committed to a product, provider, or destination, built on trust and leading to re-purchasing.

- These key concepts are intrinsically interlinked, each shaping consumer behavior.

- External factors, such as technology or ethical concerns, further influence behavior.

Literature Review = An Overview of Consumer Behavior - Kahneman (2011)

To understand the Decision - Making process

- The idea of thinking fast and slow through two systems

System 1 = unconsious, intutitive thinking

System 2 =

Deloberate logical through process

system 1 influences system 2 which is quite is effortless and fast process which is influeced by priming

- Priming is the idea of a simple word leading to priming of certain behaviors, reinforcing the original word or idea

= Even though, the process happens unconsciously without the awareness of the individual, priming guides how consumers decide and form judgements.

Literature Review = An Overview of Consumer Behavior - Maslow's (1954)

Maslows ranks human needs and ranks them based on importance

1.) Physiological: the basic needs for survival

2.) Safety: which includes stability and security

3.) Social belonging: including the need for love and affection

4.) Esteem: which is achieved through self-respect or the respect of others

5.) Self-actualisation: which is the need for self-development

= Applying Maslow hierarchy of needs to tourism, entails that traveling allows the individual to meet their needs of esteem and self-actualization.

Taxation in Tourism - Gago et al (2009)

- tourism activities = indirect taxes --> tourists pay for consuming goods and services

- There are over 40 different applications of tourism taxes used across the world

- Examples of tourism taxes include air travel fees, accommodation taxes, surcharges to restaurants and car rentals, road taxes, entry fees for tourism attractions, environmental and gambling taxes (WTO,1998)

- tourism taxes are used for revenue generation so it becomes a lower burden on residents and counteracts negative externalities

Taxation in Tourism - The Advantage of revenue generation

1.) It allows for the correction of market failures like monopoly powers in relation to tourism activities and the correction of negative externalities (Gooroochurn and Sinclair, 2005).

2.) Sustainability- or eco-taxes can be used as an efficient tool to protect the environment and provide funding to repair environmental damages (Arino, 2002)

3.) South Carolina, Litvin, et al. (2005) --> revenue generated from tourism taxes --> promote and fund cultural events, enabling effective tourism growth in small communities.

Taxation in Tourism - The Disadvantages of revenue generations

1.) may introduce distortions and may be perceived as unfair by tourists (Gago, et al.,2008).

2.) Agulió, et al. (2005) --> fewer tourist arrivals.

- The authors note that a tourism tax causes an increase in relative prices and exchange rates.

- Furthermore, the study finds that income and pricing related factors seem to play a central role in determining international tourism demand.

3.) Gooroochurn and Sinclair (2005)

- tourism taxes are often imposed too hasty by governments, without the consideration of possible negative economic consequences.

- In their case study of Mauritius, they find that the current taxation policy on tourism is rather inefficient, raising the rate of inflation and decreasing the overall GDP.

4. Reduce destinations competitiveness on an international level.

Taxation in Tourism - Week (2012)

Tourists:

- seek short holidays

- acting ignorant towards local cultures

- spend lavishly

- portray the image of the stereotypical mass tourist by taking pictures with their camera

Traveler:

- seek real and authentic tourism experiences

- refraining from typical tourist activities.

- more frugal

- as an attempt to differentiate themselves from the regular tourist.

- immerses themselves in the local culture and respects the culture.

= travelers contribute even less to sustainable tourism growth.

=In the context of this study, these findings suggest that not every tourist type may accept to pay specific tourism taxes.

Taxation in Tourism - To avoid negative consequences

- Raise Value added tax (VAT) rates on tourism activites

- Kristjánsdóttir, et al. (2020) shows VAT does not significantly affect the number of tourists visiting

- Our opinion: VAT is usually listed in the pricing so it can change the perceptions of costs

Accommodation Taxes in Tourism

- Accommodation taxes --> public revenue generation, which can be used as a government tool --> diversify revenue collection.

- AT are easier to collect and can target many tourist

- reinvested in expanding public services for visitors (do Valle et al, 2012).

- AT --> impact on the industry based on elasticity of demand for hotel rooms, and possible substitutes, such as choosing an alternative accommodation not affected by AT.

- Elasticity of demand for hotel rooms is small (combs and elledge, 1979)

Dwyer and Forsyth (1999)

- AT have to be designed properly otherwise it can be a burden

- Because of the slim profit margin of the hospitality industry, even a small fee, can affect the industries operations negatively --> bear the cost

Heffer - Flaata, et al. (2020)

- The travelers might be sensitivity toward taxes and may have negative impact

- Depends on seasonality

- sensitivity towards taxes to the ability to substitute between locations, mainly for summer tourists who are able to choose untaxed alternatives

- major destinations like Venice and Barcelona had a lower impact on visitor demand, likely related to their strong market power and visitor loyalty

Tourists' Willingness to Pay for Tourism Taxes - Part 1

- Willingness to pay does essentially describe the highest price a consumer is willing to accept, when making a purchase (Breidert, 2006).

Two areas are studies:

1.) tourism taxes in relation to the purpose of the tax

2.) he factors and determinants which influence tourists' willingness to pay tourism taxes

Durán-Román et al. (2021) = case of Andalusia in Spain

- They find --> higher willingness to pay for taxes related to environmental conservation and tourism services

- taxes for activities such as hiking, entrance fees for national parks, entrance to eco tourism areas, taxes linked to attractions and entrance fees for museums and theatres

- an opportunity to generate income for sustainability initiatives --> tourist preference should be considered --> might have a negative impact on destinations competitiveness

Çetin, et at., 2017 - The case of Istanbul

- tourists are less willing to pay taxes for environmental protection --> they think it is the locals responsibility

- more WTP taxes for improving their experience

Göktaş and Çetin, 2023 - The case of Istanbul another

- Tourists WTP for environmental protection is lower than to pay for cultural heritage and community welfare.

- More WTP when they know where the money is going

Tourists' Willingness to Pay for Tourism Taxes - Part 2

Cárdenas-García et, al. (2022)

- Their study investigates tourists' willingness to pay for 15 different kinds of tourism taxes, including accommodation taxes.

- Influencing factors include income, country of residence, profession, purpose, frequency of the trip, and accommodation type.

- Tourists motivated by culture are more willing to pay.

- Preferences for the use of tax revenue, such as improvements in the tourism experience, also influence willingness to pay.

Göktaş and Çetin (2023)

-suggest gender, relationship status, age, and education level positively affect willingness to pay.

- Men have a higher willingness to pay for accommodation taxes than women.

- Willingness to pay increases with age and education level.

- Results are linked to income, values, and motivations, which vary by age and education.

- Travel behavior, including accommodation level and prior experience of the destination, affects willingness to pay.

- Awareness of tourism taxes, including having paid them before, positively influences willingness to pay.

- Existing literature suggests that tourists' willingness to pay taxes may vary depending on the destination they visit

- The observed differences suggest a gap in the literature and the need for further case studies to generalize conclusions.

- This gap is further emphasized by the limited studies specifically considering tourists' willingness to pay for accommodation taxes.

- Existing studies have mainly analyzed socio-demographic and psychographic factors, with few exploring willingness to pay in relation to consumer behavior or decision making.

- The purpose of this paper is to address this research gap by exploring tourists' willingness to pay as part of decision making and integrating it into consumer behavior in tourism.

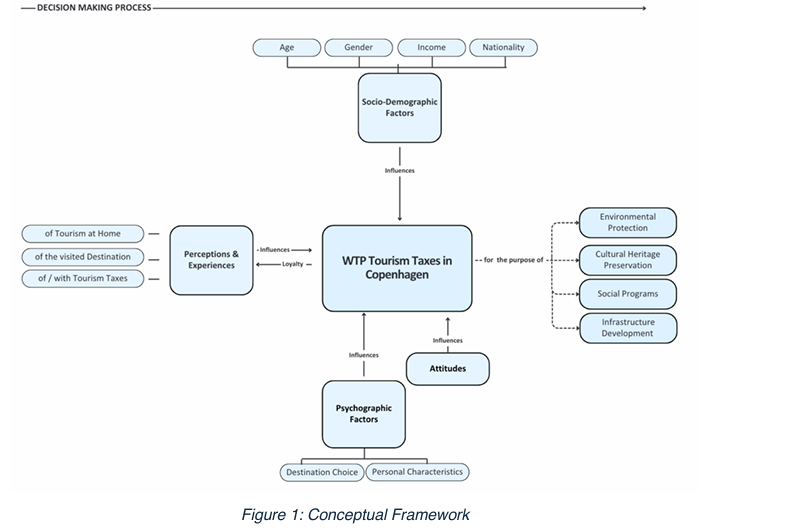

Conceptual Framework

- The conceptual framework connects relevant concepts and themes identified, while additionally allowing for the visualization and application of relevant theories in this research

- Incorporates the factors which according to the buyer characteristics and decision process, shape decision-making, and visualizes how these subsequently relate to and influence tourists' willingness to pay tourism taxes

- combine the theory of willingness to pay with the stimulus response model of buyer behavior

- stimulus response model of buyer behavior, the tourist model by Jafari (1987), the tourists gaze by Urry (2005), and the tourist typology by Plog (2001) --> to support the understanding of the model and overall conceptual framework

- Tourist gaze and tourist model --> understanding of perceptions and experiences

- Plogs typology --> understand the influence of physiographic factors, by segmenting tourists into archetypes according to their psychographic characteristics

- Socio-demographic factors deemed relevant for the purpose of this study have been selected with the help of the reviewed literature

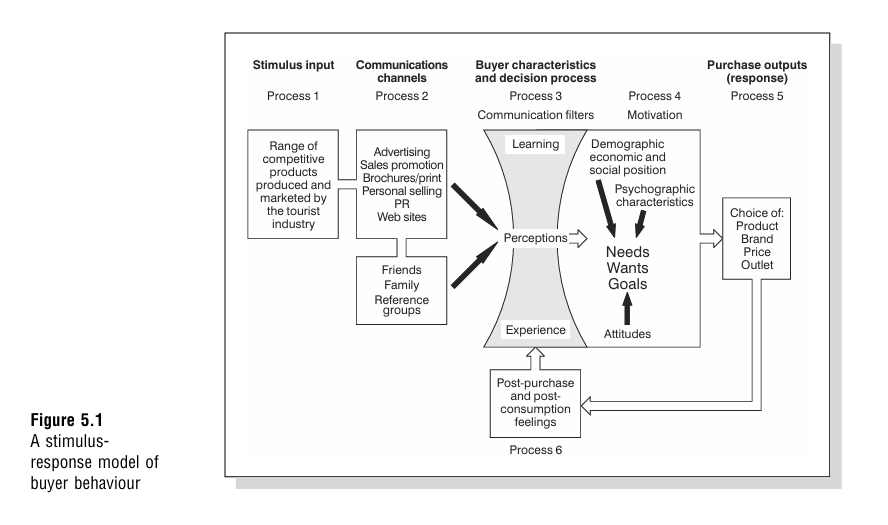

Stimulus-Response Model of Buyer Behaviour

- Developed by Middleton and Clarke (2001)

- Has 6 processes

1.) Product input: represents all products available to tourists which motivate tourists to travel with diverse offers, including prices, quality and types of experiences.

2.) Communication channels: paid advertising, brochures, sales promotion and public relations, and informal through close networks such as friends and family, which include "word-of-mouth advertisement"

3. Buyer characteristics and decision process: Learnings and past experiences act as a perception filters, guiding the consumer or tourist on their experiences

- Perceptions may change over time

4.) Motivations

- Perception filters are linked to tourists' motivations, which are defined as the consumer's needs, wants and goals

- Range from survival needs of an individual to the individuals need for self-development

- tourists who have self-development stage are likely to be motivated by the idea of travel being a necessity rather than a luxury

- socioeconomic and demographic--> boundaries for consumers can accomplish their needs, wants and goals

- attitudes: tourist's beliefs and knowledge and preferences

5.) purchase output or response

- tourist chooses between products, brands, prices or outlets

6.) Post-purchase and post-consumption feelings

- tourists evaluate the purchase experience

- tourist's needs, wants, and goals have been satisfied influences their future purchases

- Satisfaction leads to the promotion of the experience or service through positive word of mouth

- negative experience will have the opposite effect and may discourage other travelers

The Tourist Model from Corporate body to Animation stage

- by Jafari (1987), describes traveling as a journey, where the tourist experience is shaped by differed travel stages.

- The model helps to explain tourists motivations to travel and follows their journey

1.) Corporate body: segmented into two parts, the first vista and the second vista.

- This stage is set in the ordinary life of the tourist, prior to the trip.

- 1st vista represents the tourist developing a motivation to travel away from their daily life. The motivation of the tourists is highly individual and rooted in their ordinary routines, which influences their choice of destination and type of vacation.

2.) Emission stage: The tourist begins to prepare mentally and physically for the trip by gathering information and purchasing travel arrangements. The transition between ordinary and non-ordinary life

3.) Emancipation stage: A sense of freedom is formed from the confinement of daily life.

- This stage consists of two components, separation and declaration.

- The separation phase begins as the tourists physically distance themselves from the ordinary, which is symbolised by "spatial markers", like passing through the departure gates.

- Declaration phase, the tourist's distance is marked through typical touristic items, allowing the tourist to mask their real identity --> This stage marks the completion of the transformation from normal life to tourist life

4.) Animation stage: The tourist ignore the cultural norms and breaks the rules at these stages, adapting to a new tourist culture, tolerated within the tourist magnet.

- host - guest relationship is playing a vital role

- mass tourism encourages a new tourist culture changes the ordinary culture of the host.

- the host and guest can become strained --> "burnout of the receiving system", causing a loss of culture

The tourist model - Repatriation stage

5.) Repartriation stage: When the touirst returns from the tourist role

- Reversion: from time of departure

- Submission: tourist mask is shedding off

6.) Emulsion stage:

- depressed both physically and mentally

7.) Incorporations: overcoming the experience of the re-entry shock

- evaluates their experience in retrospective and begins to plan a new journey

The Tourist Gaze

- Urry (2005) describes how the tourists perceive the surroundings

- The tourist gaze is constructed against the non-tourism experience, contrasting ordinary life and routines.

- A particular destination is chosen because of fantasies and daydreaming, with anticipation built through visual media before the trip.

- During the trip, tourists' consumption and gaze are guided away from ordinary signs by tourism infrastructure and industry.

- Tourists focus on non-ordinary objects such as unique landmarks and unfamiliar or ordinary aspects in a different setting.

- Familiar tasks are undertaken in a different environment, transforming the ordinary into the extraordinary.

- The division between the ordinary and extraordinary is an essential element of the tourism experience

- By directing the tourist gaze towards the unordinary, tourists experience a destination through hyperrealism and remain isolated from the host.

- Real life happens backstage and remains inaccessible to the tourist.

- This allows tourists to avoid the strange and unfamiliar, relieves them from responsibility, and protects them from harsh reality.

- How the gaze is constructed may lead tourists to over-romanticize a destination and overlook negative externalities created by tourism

Plog's Tourist Typology

- To understand tourists' psychographic characteristics shaping decision-making, Plog's (2001) tourist typology is incorporated into the theoretical framework.

- According to Plog, psychographic characteristics influence traveler behavior and destination choice, linked to willingness to experience unfamiliarity or novelty.

- Plog categorizes tourists on a spectrum from venturers to dependables, based on personality profile.

Venturer archetypes (allocentric):

1.) Seek new or alternative destinations, prefer non-touristic areas.

2.) Curious, active, independent, confident, fast decision-makers, spend more willingly.

3.)Participate in local customs, travel frequently, take longer trips.

Dependable archetypes (psychocentric):

Prefer familiar tourist destinations, revisit known places.

5.) Cautious, self-conscious, rely on authority figures, like structure and routine.

6.) Travel less, favor developed tourism destinations, participate in recreational activities, and are more restrictive with spending.

Mid-centric tourists:

1.) Balanced experience-seekers, share traits of both venturers and dependable.

- Venturers influence near-venturers by sharing experiences with friends and family.

- Plog notes that venturers make up a small percentage of tourists, while most are dependables or mid-centric.

- Destinations evolve over time as venturers influence near-venturers and dependables, changing from unexplored locations to tourism hotspots (Plog, 2001).

Ethical Considerations

- The study contributes positively to society

- The subject should only partake voluntarily with informed consent

- all participants are treated equally to ensure that their values and decisions are equally respected

- Recording and analysis are done precisely and honestly

- Data collection is done anonymously and confidentially due to GDPR rules

Methodological Limitations

Covenience sampling

1.) Chosen for budget and time constraints, but may lead to biases affecting generalizability (Ahmed, 2024).

2.) Location (hostel) likely biased income distribution, not representative of all tourists.

3.) Age distribution influenced as younger tourists were more willing to participate; possibly due to technological, language barriers, and time constraints for other age groups.

4.) Conducted as a case study, so generalization was not an objective.

5.) Aimed to contribute to literature and political discussions in Copenhagen.

Choice of techniques and procedures

- Questionnaire-based e-survey:

1.) Possible response bias due to exaggeration or underreporting.

2.) Self-completion for anonymity and time-saving may lead to incomplete responses (Veal, 2018).

- Focus groups

1.) Conformity may prevent full disclosure, leading to polarization of other views (Sussman et al., 1991, in Morgan, 1997).

2.) Socially acceptable views may dominate due to participants dominating the discussion.

- Document analysis

1.) Consider who produced the document and for what purpose (Flick, 2022).

2.) Documents may reflect selective biases aligned with organizational procedures/agendas (Yin, 1994 in Bowen, 2009).

3.) Online documents may become inaccessible due to archiving and technical barriers (Flick, 2022).

Cross-sectional design

1.) Only captures a specific point in time when tourists are already in Copenhagen.

2.) Accommodation taxes are often paid before the trip, which this study design does not address.

3.) The design of the research does not consider how willingness to pay tourism taxes may change during different stages of the travel journey.

4.) Does not account for possible seasonal effects on tourists' willingness to pay tourism taxes.

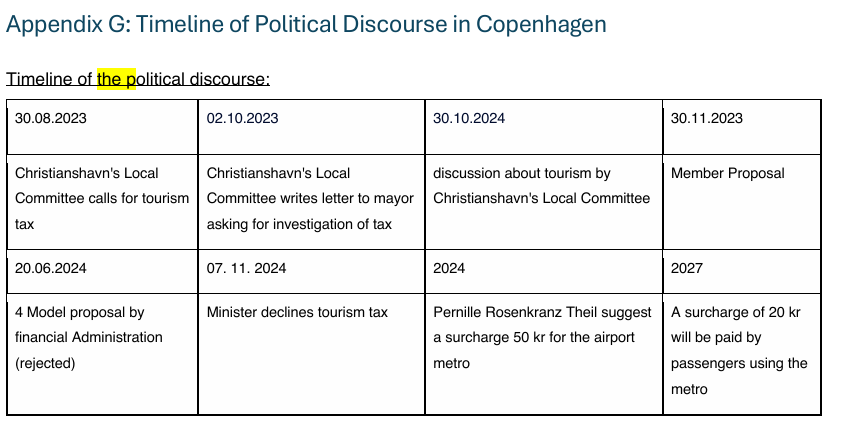

Key points: Case and Context of the Study

Copenhagen's tourism image and strategy

- world's most green and sustainable tourism cities (Bærenholdt and Meged, 2023).

- marketed, with extensive cycling lanes and sustainability programs like "CopenPay"

Tourism statistics for Denmark (2023):

- Denmark: most visited country in the Nordic region.

- Main international tourists from Germany, Norway, Netherlands, Sweden, UK (Statistica, 2024b).

Inner Copenhagen: 9.5 million overnight stays; ~2/3 from international tourists

Tourism tax proposal (2023):

- Christianshavns Lokaludvalg proposed a tourism tax in Copenhagen's metropolitan region.

- Christianshavns Lokaludvalg: 12 local committees in Copenhagen, 25 members representing residents

- Tax motivated by tourism's negative impacts on residents' daily life

Goals: maintain city facilities, reduce air pollution and noise, increase quality of life, conserve cultural heritage, support social programs

- Proposed as an accommodation tax on hotels, Airbnbs, campsites, cruise ships.

Rate could vary by hotel star rating or season, aiming to spread tourism to city outskirts

Municipal response:

- Financial administration developed four taxation models:

- Concerns: potential loss of domestic tourism and jobs.

- Parliament and Minister M. Dahlin (Venstre) rejected the models but acknowledged the need for solutions to seasonality and rising tourist numbers (2024; Berlingske, 2024).

Current political discourse:

- Konservative Folkeparti and Radikale Venstre oppose the tax.

- Alternativet party supports evaluating tourism tax benefits

Issue of tourism tax remains politically relevant and unresolved.

Recent development:

- Indirect tax on the Copenhagen Airport M2

- Socialdemokraterne have tourists and visitors contribute financially, alongside locals

- From 2027: 20 DKK surcharge for travel to/from the airport.

Why did you choose these theories?

We chose the stimulus-response model to understand tourist decision-making and therefore used it as a framework while incorporating the other theories to support and understand the different part

Jafari model was used to understand the perception filters in the stimulus response model and examine how a tourist gains motivation from their home to travel and how that influences their WTP while also looking at the host-guest realationship

Urrys tourist gaze was also used for the perception filters and their perception of Copenhagen and its influence on WTP

Plogs typology help with the psychographic aspect by understand what type of traveler habit are WTP tourism taxes

Why did you choose deductive approach?

- deductive approach = logic of inquiry

-entails adopting a theory driven approach in order to test a theoretical position.

-The research begins with a theory, which has been developed by identifying relevant themes and ideas in the existing literature.

- not the usual hypothetical-deductive because of the exploratory nature

- Data collected by descriptive statistical measures to allow for drawing a conclusion

- Descriptive statistics refers to the process of summarising numerical and categorical data in a concise and informative manner.

- Along it is deductive it is flexible for unexpected findings

- also flexible because it is constantly updating

Why did you choose a focus group and survey(mixed methods)?

- pragmatic philosophy = practical implication of research

- combines post - positivist and interpretive paradigm --> no single view will show the complete picture

- Theories are seen as a tool

- the pragmatic paradigm --> complex mixed method design and a sequential exploratory research

- qualitative methods followed by quantitative methods

- qualitative methods = detailed non - numerical information

- quantitative methods = large bodies of data to find patterns and trends

- document analysis = secondary data, to help construct the case and understand the context

- focus group = to understand the decision making of tourists and how they respond to the idea of tourism taxes

- e-survey = convenience sampling, to gain a larger sample size with a limited time

Define Ontology

- Reality is perceived differently by subjects

- which is a result of their experience and ideas and their is subjective

- therefore the complexity is recognized

Define Epistemology

- remaining objective and distances when doing research

- limited engagement with the study subject

- Focus on relevant problem and their solving

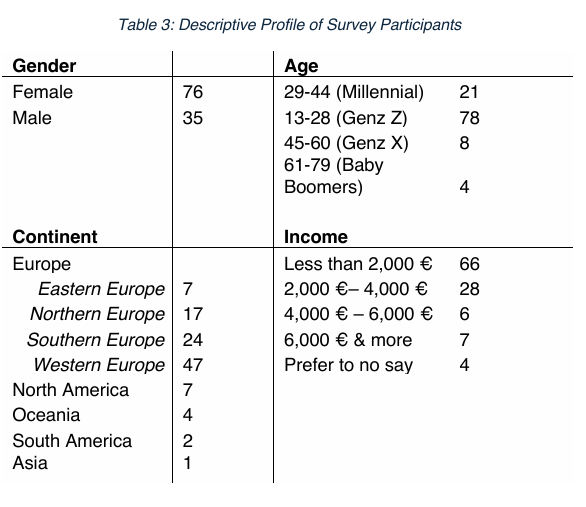

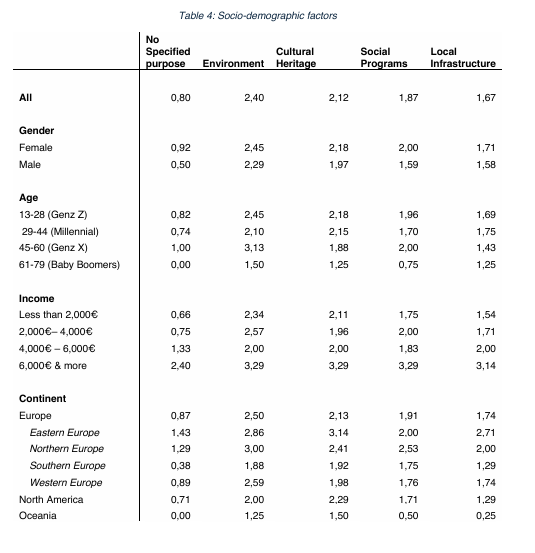

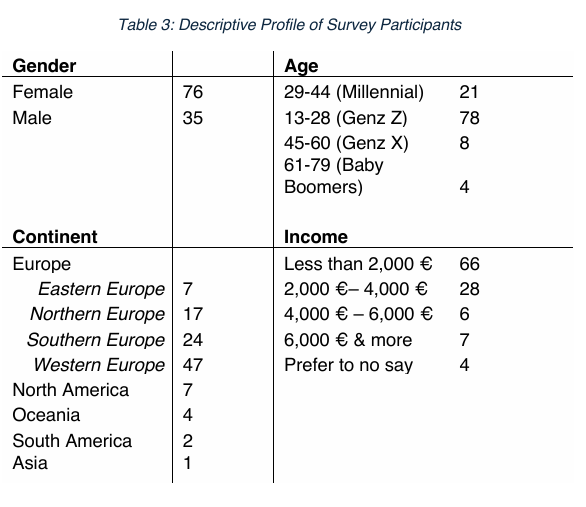

Quantitative Results Key Points - Sociodemographic Factors in Relation to Willingness to Pay

Survey

- 111 participants

- more females then males that answers

- 29 countries, 5 continents

- Gen x = highest WTP of tourist tax for no specific purpose

- Baby boomers = lowest WTP for no specific purpose

- European = highest WTP + Eastern European

- Most WTP for the environment + cultural

- Millennials' WTP for cultural heritage other groups' WTP for Environment

- Higher income = higher WTP except for culture

- Northern + Easterns = higher WTP

Quantitive Results Key Points - Perceptions and Experiences in Relation to Willingness to pay

- Venturers = higher WTP

- Negative experience = higher WTP

- Paid tourism taxes before = higher WTP

- Positive experiences of tourists = higher WTP of environment, social program

- Negative experiences of tourists = lowest WTP of environment, cultural heritage

- Tourists who have not paid tourism taxes = highest WTP for cultural heritage + social program

- Tourists who have paid tourism taxes = environment + local infrastructure

- The majority said they would revisit Copenhagen when with a tourism taxes with the majority wanting environmental protection + cultural protection

Quantitative Results Key Points - Correlations between Perceptions and Willingness to Pay

- strong correlation between how Copenhagen is experienced by the tourists and their willingness to pay tourism tax

- weak correlation may indicate the existence of a relations providing further insights into tourists' WTP

- negative correlation between WTP and perceiving CPH as expensive

- Participants' WTP for specific tax purposes positively correlated --> perception of Copenhagen as welcoming.

- (Weak) positive correlation = seeing Copenhagen as culturally rich + WTP all tax purposes.

- Stronger correlation = WTP for cultural heritage taxes + perceiving Copenhagen as culturally rich.

- Most participants saw Copenhagen = as very sustainable and environmentally friendly =Positive correlation between perceiving Copenhagen as environmentally friendly and WTP for all tax purposes, except for environmental protection, which had a slightly negative correlation.

- Perceiving Copenhagen as modern, well-organized,= efficient infrastructure positively correlated with WTP for all tax purposes.

= Correlation is stronger for WTP taxes for cultural heritage + social programs.

- Perceiving Copenhagen = expensive destination had a (weak) negative correlation with WTP for all tax purposes.

- Negative correlation was slightly stronger for willingness to pay for environmental protection.

Qualitative Results - Focus Group

Mixed understanding of tourism taxes:

- Some knew about them, others didn't realize their country also charged tourists.

- Overall positive attitude toward tourism taxes = if they had a negative experiences

Suggested amounts:

- From less than 1 euro per night to 10 euros one-time.

- Most agreed it should depend on length of stay.

- Participants want to know where the tax money goes.

- They valued taxes for local communities, environmental protection, and infrastructure.

Factors influencing willingness to pay:

- Destination's cost/expensiveness (high cost = lower willingness to pay).

- Payment methods (cash/local currency could be a barrier).

- Concerns about travel freedom in the EU.

- Access to better services abroad (like Copenhagen's transport) could increase willingness to pay.

where the taxe are going?

- The participant agreed tourists are held responsible

- Tourists should respect local cultures, but tourism also supports the local economy.

- One participant suggested educating tourists about cultural norms instead of blaming them = Others disagreed --> tourists should pay for damages.

- Most participants thought a tourism tax is needed for sustainable tourism, but other sustainability solutions should also be implemented.

- No definition of sustainable tourism was given to see what tourists think it means.

Mixed views about whether a tourism tax is needed in Copenhagen:

- Participants described Copenhagen as sustainable, clean, well-organized, not crowded.

- They felt they already paid high taxes on goods/services.

- They were uncertain if a tourism tax was necessary for sustainability.

- They wanted to know where the tourism tax money would go.

Analysis Structure

- Aligning with theory driven approach of the study the stages of the buyer characteristic and decision process of the stimulus response model.

- Adopted from the theoretical framework combined with the stimulus-response model + buyer behavior with the theory of willingness to pay in the analysis.

- decision-making as a multistage process

Analysis: Perception Filters - Destination Experience Influences Willingness to Pay

Uses the theory of tourist gaze by Urry

1.) Copenhagen is expensive:

- Experiencing it as expensive negatively correlates with willingness to pay for tourism taxes.

- Cost acts as a filter, tourists are reminded of what they have already spent and become cautious.

- Focus group participants worried about paying more due to the high existing costs.

- One participant said places like Tivoli already feel like an indirect tourist tax.

2.) Copenhagen as sustainable:

- Most tourists saw Copenhagen as very sustainable and eco-friendly.

- This perception was formed even before the trip, influenced by media images of Copenhagen as a "sustainable urban destination."

- Focus group participants were uncertain if a tax for sustainability was needed because they already saw the city as sustainable.

- This explains why there was no positive correlation between sustainability perception and willingness to pay for environmental protection.

- Tourists stay in their "tourist bubble," not seeing deeper sustainability challenges (the "backstage" remains hidden).

3.)Copenhagen as culturally rich:

- Positive correlation between seeing it as culturally rich and willingness to pay for cultural heritage conservation.

- Tourists focus on cultural sights and find them unique and valuable.

- Stronger cultural engagement increases perceived value and willingness to pay to protect it.

Analysis: Perception Filters - Experience of Tourism at Home

1.)Tourist model (Jafari, 1987):

- Travel journey starts at home motivation + trip planning shaped by home life and routine.

- Decision-making as a tourist influenced by home experiences, including being a tourism host.

2.) Survey results:

- Participants who saw tourism negatively as residents had a higher willingness to pay tourism taxes.

- Even when traveling, these tourists remain aware of tourism's negative impacts and want to support sustainable tourism in Copenhagen.

3.)Overtourism's impact:

- Strains host-guest relationships (Jafari, 1987).

- Focus group participants noted tourists misbehaving in their home countries should pay taxes.

- Example: A participant from Paris mentioned tourists damaging their city.

4.)Host experiences as a filter:

- Experiences as a resident shape tourists' behaviour when travelling.

- Negative resident experiences may lead to a willingness to pay tourism taxes to "make up" for the issues.

5.) No link to tax purpose choice:

- Positive or negative experiences in their home country did not impact which tax purposes tourists chose.

- This suggests a stronger link to individual motivations.

6.) Environmental motivations:

- Some tourists with neutral experiences as hosts still willing to pay taxes, especially for environmental protection.

- Motivated by global issues like climate change and pollution.

- Focus group participants recognised tourism's environmental impact and supported taxes to address it.

- Example: One participant suggested paying taxes to reduce pollution and carbon dioxide emissions

Analysis: Perception Filters - Paying Taxes as a Learning Experience

Uses Jafari to explain the repetition of the travel journey

1.) Jafari (1987) - Repetition of the travel journey:

- Travel cycle repeats when tourists return home and start planning their next trip.

- Jafari doesn't detail how these cycles influence later decisions, but repetition may help tourists draw on past experiences.

2.)Study findings (Figure 3):

- Tourists who paid taxes before had a higher willingness to pay for tourism taxes again.

- Repetition acts as a learning experience, making tourists more aware and accepting of tourism taxes.

3.) Focus group insights:

- Some participants didn't know tourism taxes existed in their home countries.

- During discussions, they realized they had paid such taxes in the past.

- Familiarity and experience with paying taxes increases understanding and overall willingness to pay in future trips

Analysis: Motivation

- 2nd part of buyer characteristics and decision process.

- Motivation = guiding the tourist to act on their felt needs.

- need & want shaped = by socio-demographic factors, psychographic characteristics and attitudes.

- While socio-demographic factors constrain the tourist when traveling, attitudes and physiographic characteristics guide how the tourist feels and acts.

Analysis: Motivation - Socio-Demographic Factors & Attitudes Influence Willingness to Pay

1.)Stimulus-Response Model

- Socio-demographic factors (gender, income, age, nationality) influence tourists' decision-making.

- These factors can constrain how much tourists can fulfill their needs and goals, shaping their motivations and willingness to pay tourism taxes.

2.)Income's impact

- Lower income limits spending and lowers willingness to pay.

- Higher income enables more spending, increasing willingness to pay.

- Disposable income changes with life stages (age), with a general increase in willingness to pay as income rises with age—except when retired.

- Income also varies by nationality, influencing willingness to pay.

3.) Study results

- Despite income constraints, most participants showed a generally positive attitude towards tourism taxes.

- Attitudes are shaped in part by socio-demographic factors.

4.) Attitudes by gender and region

- Focus group: both genders saw tourism taxes as good, but survey showed differences in willingness between men and women.

- Some regional attitudes were positive about tourists and economic benefits; others were negative, citing rule-breaking and disrespect.

- Survey: willingness to pay was higher when the tax purpose was clear.

- Different attitudes towards tax purposes (sustainability, culture, community welfare) across regions/countries, reflecting cultural differences.

5.) Socio-demographic and attitude interplay

- Socio-demographics and attitudes together determine tourists' ability and desire to support certain causes.

- Some tourists may personally want to support sustainability or culture but feel constrained by socio-demographics.

- Whether tourists overcome these constraints depends on their attitudes.

- Psychographics also shape tourists' motivations—covered in the next section.

Analysis: Motivation - Psychographic Factors Influence Willingness to Pay.

Plog is used to see the motivation based on the type of traveler

1.) Psychographic factors & tourist motivations

- Tourists' psychographic attributes influence their travel decisions, spending, and willingness to pay tourism taxes.

- Plog's tourist typology (2001) helps segment tourists into archetypes based on their psychographic.

2.) Venturer tourists

- Venturers showed the highest willingness to pay tourism taxes, especially for cultural heritage conservation.

- Motivated by authentic, local, and cultural experiences.

- Value of experience outweighs cost concerns, so more willing to spend for taxes that preserve local culture.

3.) Dependable tourists

- Dependables had the lowest willingness to pay across all tax categories.

- Prefer routine, budget-friendly holidays; additional taxes disrupt this.

- Less interested in seeing the "real backstage" or deeper tourism impacts.

4.) Mid-centric tourists

- Mid-centrics had lower willingness to pay compared to venturers, but highest willingness to pay for environmental protection taxes.

- More aware of general environmental issues than cultural preservation.

- Most participants identified as mid-centric, enjoying a balance of typical sightseeing and local experiences.

Analysis: Evaluation & Loyalty

1. )Purchasing Output Process = Stimulus-Response Model

- Final decision phase where tourists consciously decide on purchases and evaluate satisfaction.

- Allows analysis of whether tourists would return to Copenhagen despite taxes.

2.) Influence of Tax Purpose on Willingness to Pay

- Tourists least willing to pay tourism taxes with no specified purpose.

- Most willing to pay taxes for environmental protection, followed by cultural heritage conservation (see figure 6).

- Willingness to pay is influenced by perception filters and motivations—purpose must align with tourist values.

3.) Overall Evaluation & Satisfaction

- Post-purchase feelings shape tourists' acceptance of taxes.

- If the experience and purpose of the tax align with expectations, tourists are more accepting and willing to pay again.

- Purpose and price must match perceived value; otherwise, tourists may feel overcharged.

- Low willingness to pay for unspecified tax purposes suggests that lack of understanding reduces willingness.

4.)Satisfaction & Future Behavior

- Satisfaction central to purchasing decisions—directly influences future willingness to pay.

- Tourists satisfied with taxes' purpose and value are more likely to return to Copenhagen despite tourism taxes

Discussion - Implications on the Role of the Traveler

1.)Venturous travelers were most willing to pay tourism taxes, especially for cultural heritage conservation.

- Week, 2012 --> Travelers claim to be more respectful and knowledgeable of local cultures, seeking authentic experiences.

- Week, 2012 --> They avoid typical tourist activities and modernity, spend less money, and stay longer.

- Week, 2012 --> Travelers try to avoid accepting responsibility for tourism issues, claiming to be better than mass tourists.

2.) Our paper:

- This study suggests that adventurous travelers are willing to pay taxes, challenging Week's view that they avoid paying.

- Findings align with Plog's (2001) typology that culturally motivated venturers are more willing to pay to protect authenticity.

- This study finds culturally motivated travelers willing to pay taxes to preserve authentic cultural experiences.

- Durán-Román et al. (2021) also suggest culturally motivated tourists have higher willingness to pay.

3.)Link to Maslow's Hierarchy of Needs

- Motivation to travel linked to self-esteem and self-actualization (Maslow, 1954).

- Paying taxes to protect heritage may boost travelers' self-esteem and align with being a "better tourist."

- Could indicate a shift where travelers acknowledge responsibility for tourism impacts.

4.)Limitations & Further Research

- Motivation to travel is individual; not all travelers share the same reasons.

- Study doesn't cover general travel motivations or influence of values (Cohen et al., 2014), which could offer deeper insights.

- Further research needed to explore these areas.

Discussion - Implications for Policy Making

1.) Tourism Tax Proposal & Willingness to Pay

- Parliament rejected Copenhagen's tourism tax proposal.

- Even low-income tourists in the sample were willing to pay, supporting the idea of a tax.

- Well-planned taxes are needed to create benefits.

2.)Tourists' Willingness vs. European Averages

- Tourists' average willingness to pay (1.80 euros/night) is below European averages (3.64 euros/night).

- Differences in willingness to pay across destinations (e.g., higher in Istanbul).

- Istanbul's lower overall trip costs may explain lower price sensitivity there.

- Copenhagen perceived as expensive; tourists aware of high VAT rates.

3.) Design of Tourism Taxes

- Copenhagen shouldn't solely rely on other European tax rates as references.

- Taxes should consider tourists' consumer profiles, particularly socio-demographic factors.

- Income found to be the most influential factor.

- Existing literature supports income as a key factor (Göktaş & Çetin, 2023; Cohen et al., 2014).

- Proportional taxes (varying with income and accommodation type) may be more effective than fixed rates.

- Same rate for all accommodations could increase transparency and lower administrative complexity

4.) Nationality & Market Considerations

Tourists from Northern & Eastern Europe most willing to pay, but Western Europe (esp. Germany) is Denmark's largest market.

Potential for destination substitution if taxes are too high ..

Implications for Policy Making pt-2

5.) Purpose of Taxes & Willingness to Pay

- Tourists more willing to pay if the purpose is clear and aligned with their values (environment, culture, social programs).

- Support for tax purposes varies by location (Spain, Istanbul, etc.).

- Copenhagen tourists most supportive of environmental protection, followed by cultural heritage conservation.

- Little support for unspecified tax purposes—transparency is crucial.

- Marketing should educate tourists about the tax's purpose to build trust and support.

6.) Transparency & Sustainability Perception

- Many tourists equate sustainability with environmental protection, not cultural or community welfare.

- Varied definitions of sustainability among tourists highlight differing understandings.

- Sustainability linked by tourists to environmental issues (pollution, overcrowding, cleanliness).

7.)Decision-Making Influences & Priming

- Kahneman's "thinking fast and slow" explains how subconscious decision-making can be influenced (Kahneman, 2011).

- Marketing can prime perceptions, e.g., linking taxes to meaningful causes.

- Tourists' subconscious attitudes shaped by experiences as residents or hosts.

- Nudging tourists to sympathize with hosts may boost their willingness to pay, feeling responsible for tourism's impacts (Jafari, 1987; Urry,

Key point: Conclusion

1.) Study Objective & Framework

- Investigated factors influencing tourists' willingness to pay (WTP) in Copenhagen.

- Built on the stimulus-response model of buyer behavior (Middleton & Clarke, 2001).

- Supported by Jafari's tourist model (1987), Urry's tourist gaze (2005), and Plog's tourist typologies (2001).

Focused on decision-making as consumer behavior.

2.)Methodology

- Exploratory research design using mixed methods: focus group, e-survey, and document analysis.

- Triangulation achieved through multiple data collection methods.

Context of Copenhagen constructed via document analysis.

4.)Key Findings

- All explored factors influenced tourists' WTP, with income being the most influential socio-demographic factor.

- Psychographic characteristics and experiences of the destination also influenced WTP, though the latter correlation was weak.

- Prior experience of paying taxes and negative tourism experiences at home positively related to WTP.

- Interplay of factors (experiences, socio-demographics, attitudes, psychographics) shapes WTP, but values, norms, and travel motivations likely also play a role (not fully analyzed in this study).

5.)Recommendations for Further Research

Investigate WTP of domestic tourists, who make up 1/3 of visitors.

- Study the impact of taxes on tourism demand, including loyalty and price sensitivity.

- Explore the influence of values, norms, and travel motivations on WTP and attitudes toward specific tax purposes.

- Research differences between group and solo travelers regarding WTP.

- Conduct further case studies with explanatory designs to generalize findings, explore causality, and identify contextual differences.

- Use findings to guide policymakers and DMOs in decision-making.

Conclusion part 2

6.) Implications for Policy & Marketing: Recommend collaboration between political parties and Wonderful Copenhagen for tourism tax implementation.

7.)Suggest marketing efforts (by Wonderful Copenhagen) to inform tourists about the purpose and benefits of tourism taxes.

6.) Focus marketing on creating awareness and acceptance of the taxes.

- Leverage visitor insights from Wonderful Copenhagen to design taxes aligned with tourist preferences.

7.) Conclusion

- Findings support a relationship between -Middleton and Clarke's decision-making model factors and tourists' WTP in Copenhagen.

- Conclude that experiences, socio-demographics, attitudes, and psychographic characteristics influence WTP.

- Encourage further research and careful planning to design sustainable and fair tourism tax policies.

New theory: Schwartz model

- Values influence norms and attitidues

- Embeddedness: Emphasises social order, obedience, and respect for tradition. This is opposed to Autonomy.

Autonomy: Divided into two types:

1. Intellectual Autonomy: Emphasises broadmindedness and curiosity

2. Affective Autonomy: Emphasises pleasure.

- Hierarchy: Emphasises authority. This is opposed to Egalitarianism.

- Egalitarianism: Emphasises social justice and equality.

- Mastery: Emphasises ambition and daring. This is opposed to Harmony.

- Harmony: Emphasises unity with nature and a world at peace

The three bipolar cultural value dimensions are formed by these opposing orientations:

- Embeddedness versus Autonomy

- Hierarchy versus Egalitarianism

- Mastery versus Harmon

Applying: Schwartz model

1. Understanding Tourist Motivation through Values:

2.Connecting Individual Values to Psychographic Archetypes: the project to explore the specific individual value priorities that are characteristic of each psychographic archetype. might show a higher willingness to pay taxes earmarked for environmental protection. Tourists who highly value 'Social Justice' or 'Equality' (related to Egalitarianism) might be more willing to pay for social programs.

3.Exploring the Influence of Cultural Background (Nationality): By classifying the home countries of the tourists according to Schwartz's cultural dimensions (e.g., Autonomy vs. Embeddedness, Egalitarianism vs. Hierarchy, Harmony vs. Mastery

4. Understanding Attitudes towards Tax Purposes:Tourists' individual values, shaped by their cultural background, would likely influence their attitudes towards different tax purposes (e.g., supporting environmental protection, cultural heritage conservation)

Timeline for context