3.7 supply side policies

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

48 Terms

supply side policies

Supply-side policies are government actions done to increase the aggregate supply of the economy, by improving the quality and quantity of factors of production.

supply-side policies aim to shift the LRAS/PPC to the right, focusing on the production side of the economy

goals of supply side policies

1. Achieve long-term growth by increasing productive capacity

2. Improve competition and efficiency

3. Reduce labor costs and unemployment through labor market flexibility

4. Reduce inflation to improve international competitiveness

5. Increase firms' incentives to invest in innovation by reducing costs

successful supply side policies will...

successful supply side policies will increase the long run aggregate supply

this equates to an increase in the production possibilities of an economy

market-based policies

provide incentives so that private decision makers will choose to solve the problem on their own

aim to remove obstructions in the free market that are holding back improvements to the long-run potential, increase LRAS

setting up a regulator to prevent monopolies from forming

what are market based policies centered around

freeing up markets (remove the government's role) to make them run more efficiently, and are more neoclassical

(i) to increase incentives

▪︎ reducing income/corp. tax rates incentivises workers to work harder

▪︎ provides firms with extra funds which they can use to invest in new machinery/technology

▪︎ reducing capital gains tax

incentive related policies

- personal income tax cuts

- business and capital gains tax cuts

Personal income tax cuts

If less money is taxed, people may be more incentivized to work harder as they will get to keep more of that money than before.

Business and capital gains tax cuts

This encourages more investment. If businesses get to keep more of their profits, they can invest more. Capital gains taxes are taxes on the profit you make on investments, so if this tax decreases, more people are incentivized to invest.

effects of increasing incentives

taxes decrease → firms/individuals retain more money for themselves → incentives increase → productivity improves → long term growth increases

(ii) to improve competition and efficiency

- deregulation

- privatisation

- anti-monopoly regulation

- trade liberalization

deregulation

Remove rules and regulations from the markets. In many countries there were legal monopolies on utilities, telecoms, mail, etc. but these laws have been removed, improving markets (things should be cheaper and more efficient).

privatisation

Sell state-owned enterprises to the private sector. In theory, privately run businesses have greater incentive to innovate than government-run ones as they need to make money.

anti-monopoly regulation

Laws that limit the power of monopolies in the economy. By preventing large mergers and sometimes splitting up companies, more competition will be created.

trade liberalization

Remove barriers for international trade. If countries remove tariffs and quotas, international trade will increase, which may lead to more competition and efficiency.

(iii) to reduce labour costs and create labour market flexibility (labour market policies)

▪︎ decreasing trade union power so wages can be decreased

▪︎ decreasing/abolishing minimum wages to lower costs of production

▪︎ restructuring unemployment benefits system to incentivise unemployed to seek work

labour market policiea

- reduce power of labour unions

- reduce unemployment benefits

- abolish minimum wages

Reduce power of labor unions

Labor unions are organizations that act in the best interest of workers. This means lobbying for higher wages and better working conditions. This is bad for efficiency in the markets as costs of production will increase.

reduce unemployment benefits

Fewer unemployment benefits will in theory incentivize more people to look for work than if they got government money.

abolish minimum wage

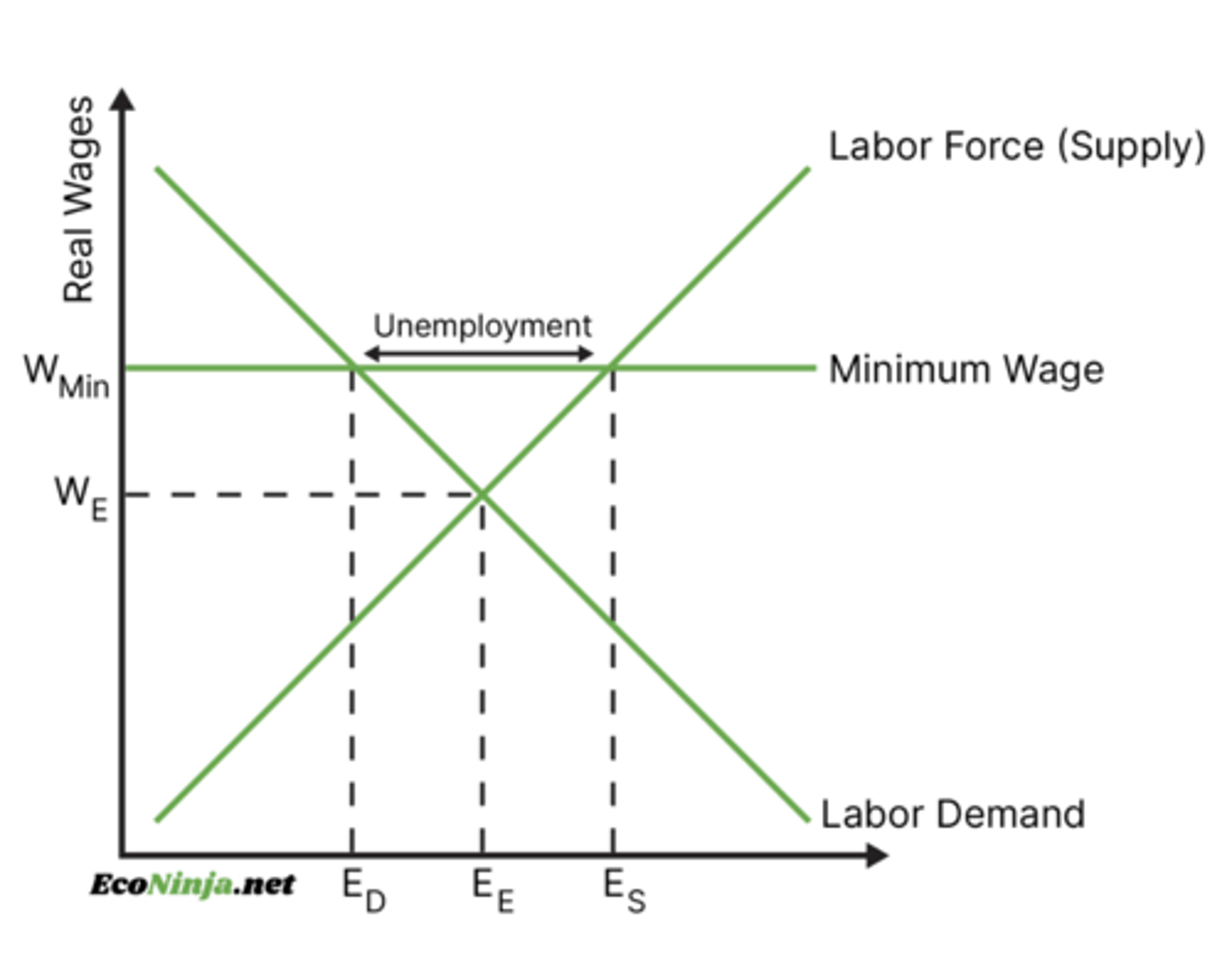

Minimum wages function like price floors, and create more unemployment than in equilibrium (see chart). This is because the cost of labor is too high for many firms, and they will reduce their headcount, creating more unemployment.

minimum wage

a minimum price that an employer can pay a worker for an hour of labor

Minimum wages are above the equilibrium of actual wages (because why else would a minimum wage level be needed).

minimum wage diagram

Minimum wages are above the equilibrium of actual wages (because why else would a minimum wage level be needed).

This set wage means the demand for labor is at ED while the supply of labor is at Eₛ, because more people will be willing to work at these wages than there are firms willing to pay that much.

This disparity creates a gap in employment (E), meaning unemployment.

By abolishing minimum wages, equilibrium will go to Wₑ and Eₑ, closing this unemployment.

interventionist policies

require government intervention in order to increase full employment level of output

used to correct market failure/ensure market imperfections are fixed by the government/increase the full employment level of output

facilitate education & training

By improving education levels of the population, new skills can be acquired and people can work better and more productive jobs. This is especially effective in developing countries.

education & training : advantages

- increase in quality of human capital

- increase in the quality of the factor of production

- improvements in efficiency or productive capacity due to skill level increases

- COP falls for firms → lower selling prices → international competitive improves

- LRAS → shifts

education & training : disadvantages

- potential loss of manufacturing jobs

- opportunity costs

- political decisions behind where the money is spent

- once training level increases, costs of production increases

Improve quality, quantity, and access to healthcare

increasing government spending on healthcare so that productivity improves

Improve quality, quantity, and access to healthcare: advantages

- increase in quality of human capital

- increase in the quality of the factor of production

- improves efficiency as more people are able to work to their full capacity

- human capital improves → productivity improves → COP falls → lower selling prices → international competitiveness

Improve quality, quantity, and access to healthcare: disadvantages

- could create a burden on society as people live longer → society has to take care of people longer

- depends on government priorities

R&D

By handing out grants, etc., more R&D can be done which improved productivity. This may also increase aggregate demand as more money is injected into the economy (jobs, new machinery, etc.)

R&D : advantages

- increase the quality of FOP by increases in physical capital

- new industry emerges → new infrastructure → more jobs created → rGDP increases → increase in long term economic growth

R&D : disadvantage

a gamble on whether the money will have an impact

infrastructure

If the government provides water, electricity, internet services, etc., companies don't have to worry about that, and can rather focus on their specializations. Provisions such as highways and rail networks allow for greater efficiency.

infrastructure : advantages

- increase quality/quantity of FOP

- better transportation increase efficiency as people/businesses can move easily

- people will want work in places with better infrastructure

- COP falls for firms → lower selling prices → international competitive improves

infrastructure : disadvantages

- opportunity cost

- anything the govt. decides to spend their money on = they are not spending on something else

- should prioritize making a plan

industrial policies

policies that encourage specific industries or investment in specific regions, support firms/industries in the form of subsidies [ protectionist policies, tariff, quotas, grants, tax breaks ]

industrial policies : advantages

- encourage private investment

- can encourage foreign direct investment

- COP falls for firms → lower selling prices → international competitive improves

industrial policies : disadvantages

- protectionist policies can negatively impact the market for consumers

- grants and tax breaks impact the government budget

How do interventionist policies differ from market-based policies?

Market-based policies favor less government intervention, while interventionist policies favor more.

Why shouldn't you mix market-based and interventionist policies?

Because it's contradictory to suggest the gov’t should both provide and privatize infrastructure at the same time.

demand-side effects of interventionist policies

Interventionist supply-side policies involve government spending, which is a component of aggregate demand. Such policies will therefore boost AD to some extent even though the main desired outcome was AS.

demand-side effects of market-based policies

Market-based supply-side policies include tax cuts on both households and businesses, which will increase their disposable incomes/profits. This will result in more consumption and investment, boosting AD.

supply-side effects of interventionist policies

supply-side effects of demand side policies

Some demand-side policies such as lowering taxes overlap with supply-side policies because they affect both supply and demand.

Raising interest rates as part of monetary policy will increase the cost of investment, which will hamper the long-run aggregate supply.

Market-Based Supply-Side Policies: strengths

- No burden on the government budget: In fact, the sale of state-owned enterprises will benefit the government's balance.

- Improved resource allocation: Because private entities are generally better at determining equilibrium, resources will be allocated more efficiently in many markets.

- Reduce unemployment: Its labor policies may reduce unemployment as work is incentivized more.

Market-Based Supply-Side Policies: weaknesses

- Equity issues: Market-based policies primarily aim to make markets run more efficiently, but does not consider well-being of people. Abolishing the minimum wage might reduce costs of production, but will not make the lives of the workers any better. It will, however, benefit the owners of the firms.

- Time lags: It takes a significant amount of time for the economy to show any real impact of these policies.

- Vested interests: When state-owned enterprises privatize, for example, it is often bought up by private investors who want their own benefits rather than actually provide a satisfactory good/service to the people.

- Environmental impact: Deregulation may improve the market, but the creation of negative externalities will occur. This is partly why regulations existed in the first place.

Interventionist Supply-Side Policies: advantages

- They can directly support sectors deemed important for growth: It is easy to target one industry and encourage R&D there, for example.

- Education and training is effective in growing the productive capacity of an economy over time.

Interventionist Supply-Side Policies: disadvantages

- Costs: They will take a toll on government budgets and may increase national debt.

- Time: It takes a lot of time to see any change. If the government invests in education, it will take at least 12 years to see any meaningful change, for example.

- Inflation: Increased government spending may raise inflation levels in the short run as AD shifts to the right, but could decrease in the long run as the supply effects kick in.