Corporate Finance [Lectures] PART 1

1/140

Earn XP

Description and Tags

1-38 -> Lecture 1 | 39-79 -> Lecture 2 | 80-94 -> Lecture 3 | 95-121-> Lecture 4 | 122-133 -> Lecture 5 | 134-141 -> Lecture 6 (no WC) |

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

141 Terms

Sources of corporate financing for EQUITY

trade credit, shares, write-offs from profit, business investors (angels)

Sources of corporate financing for DEBT

factoring, bonds and short-term debt securities, leasing

Sources of corporate financing NEUTRAL

EU capital, mezzanine capital

Criteria for selecting sources of financing

availability, cost, elasticity, financial leverage effect, risk

The value depends on

investment’s expected from FCF (free cash flow), cost of funds

By using the capital for investments with long-term benefits, the company

produce value

The company uses its funds and

earn equity

The company borrows a loan and

fall into debt

The cost of capital is important in

investment decision-making, valuation of the company, rate of return and opportunity cost

When the rate of return is HIGHER than the cost of capital

the company creates value

When the rate of return is LOWER than the cost of capital

the company destroys value

Accurate Estimation

important for corporate financial management and the evaluation of investment programmes

Rate of Return (RoR)

the percentage change in investment value over time, serving as compensation for capital providers (owners and bondholders).

Opportunity cost for capital

the forgone return from choosing one investment over another of similar risk, aiding investors in decision-making by comparing alternative opportunities.

When the required return on investment is 10%, it means that the investment will have a positive NVP only if its return >10%.

TRUE, because the investment's return must exceed 10%.

When the required return on investment is 10%, it means that the firm must earn more than 10% on the investment to compensate its investors for using the capital needed to finance the project.

FALSE, because the firm needs to earn at least a 10% return to adequately compensate its investors for the use of their capital.

When the required return on investment is 10%, it means that 10% is the cost of capital associated with the investment.

NEUTRAL (it is neither TRUE nor FALSE)

In the case of a risk-free project, the current rate offered by risk-free investments should be used to discount the project’s cash flows.

TRUE, because it represents the opportunity cost of capital without any risk premium.

In the case of a risk-free project, the cost of capital for a risk-free investment is lower than the risk-free rate.

TRUE, because the cost of capital is lower than the risk-free rate because there's no additional risk premium required

If a project is risky the required return is lower than the risk-free rate.

FALSE, because the required return for a risk-free project is equal to the risk-free rate because there's no additional compensation needed for risk.

If a project is risky the appropriate discount rate exceeds the risk-free rate.

TRUE, because it includes a premium for factors such as opportunity cost and inflation.

required return ≈ cost of capital ≈ appropriate discount rate

TRUE

The cost of capital associated with an investment depends on the risk of the investment.

TRUE, because investors require higher returns for riskier investments to compensate for the increased uncertainty and potential losses.

The cost of capital for an investment depends primarily on how and where the capital is raised.

TRUE, because different sources of capital have varying costs associated with them, such as interest payments for debt or required returns for equity.

The cost of capital depends primarily on the use of the funds, not the source.

FALSE, because it depends primarily on the source of funds, not just their use, as different sources (debt, equity) have different associated costs and risks.

The cost of capital of a company

the required rate of return demanded by investors of a company for average risk investment

Weighted Average Capital Cost (WAAC)

also referred to as MCC (marginal cost of capital) as the cost hat a company incurs for additional capital

For an average-risk project, the opportunity cost of capital is the company’s WACC.

TRUE, because it reflects the average return expected by both debt and equity investors.

Free Cash Flows to the Firm (FCFF)

cash flows available for the company's supplirs of capital (apply WACC in valuation)

Free Cash Flows to the Equity (FCFE)

cash flows available to holders of the company's common equity (use the cost of equity capital in valuation)

Investemnt Opportunity Schedule (IOS)

the investment opportunities are arranged by their IRRs from greater (more desirable) to lower (less desirable); a downward slope

Marginal Cost of Capital (MCC)

reflects more money will cost more (the more money a company wants to raise, the more expensive it will become); upward slope

What is an accurate representation of the relationship between the cost of capital and investment returns?

The optimal capital budget is the amount of invested capital at MCC = IOS.

Net Present Value (NPV)

discounted at the opportunity cost of capital applicable to the specific project

If an investment’s NVP < 0, the company should undertake the project.

FALSE, we shouldn’t even consider undertaking the project.

If an investment project is more risky than the average-risk project of the company, its WACC can be used in the calculation of the NVP.

FALSE, it’s pointless to use WACC for calculation NVP when the average risk is more risky.

If WACC is used for calculating NVP, it is assumed that the project will have a constant target capital structure throughout its useful life.

FALSE, the project will have a constant target capital structure only during the evaluation period, not necessarily throughout its entire useful life.

If the systematic risk of the project is BLANK relative to the company’s current portfolio of projects, an BLANK adjustment is made to the company’s WACC.

above average, upward/below average, downward

Other souces of cost of capital

seniority, potential value as a tax shield, contractual commitments

Cost of debt

financing to a company from issuing a bond or taking a loan

Approaches to calculate the cost of debt

yield-to-maturity, debt rating

Yield-to-maturity (YTM)

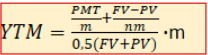

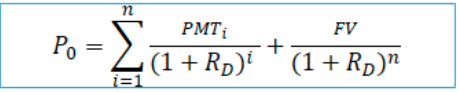

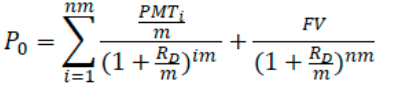

annual return on a body of bonds by an investor, who purchased and held on to it until maturity

simplified banking formula for YTM

annual PMT

annual PMT (for more frequent payments m >1)

Debt rating approach

it is applied to estimate the before-tax cost of debt when the current price for a company’s debt is unavailable by using the yield to comparably rated bonds for maturities that are similar to the company’s existing debt

Issues in estimating cost of debt

fixed-rate debt vs floating-rate debt; debt with option-like feature; nonrated debt; leases

Fixed-rate debt

the interest on debt is a fixed amount in each period

Floating-rate debt

debt in which the interest adjusts periodically according to a prescribed index, such as prime rate or LIBOR

The yield of a callable is BLANK than the yield of a noncallable bond because it is BLANK.

better (>); more attractive to the investor

The yield of a bond with a put feature option is BLANK than the yield of a nonputtable bond because it is BLANK.

worse (<); less attractive to the investor

In case of nonrated debt

the approaches for estimating a company’s synthetic debt rating can be used (based on financial rotations)

The cost of borrowing lease is

similar to that of other long-term debt

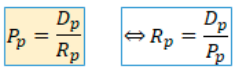

Cost of preferred stock

the cost that a company has committed to pay preferred stockholders as a preferred dividend when it issues preferred stock

fixed-rate perpetual preferred stock

Preferred stock has BLANK and BLANK

fixed dividend rate; no maturity date

Fixed-rate perpetual preferred stock

the present value of a preferred stock that is also the present value of perpetuities

Features of preferred stock affecting its cost

a call option, cumulative dividends, convertibility into common stock

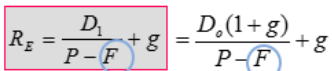

Cost of newly issued preferred equity

we take into accoun the floatation costs per shares (Fp) which reduce the stock price

Cost of common equity

the return (Re) that equity investors require on their investment in the firm

Approaches to estimating cost of equity

Capital Assets Pricing Model (CAPM), dividend discount model, bond yield + risk premium model

Cost of equity is difficult to estimate because of

the future cash flows in terms of amount and timing

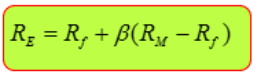

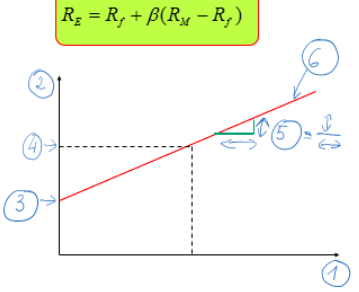

Capital Asset Priging Model (CAPM) theory

a relationship between risk and expected return (the higher the risk, the higher the expected return and the other way around)

The required or expected rate of return on a risky investment depends on

risk-free rate (Rf); the difference between expected retur on the market and investor’s compensation for incurring systemetic risks [E(Rm)-Rf]; the beta coefficient (ß)

1. ß - risk coefficient; 2. Re - (common) equity cost; 3. Rf - risk-free rate; 4. Rm - return on the market; 5. Rm - Rf - market risk premium; 6. SML - Stock Market Line

The ß coefficient ilustrates

the total risk of investing in shares of a given company bc it expresses the relationship between the volatility of the company’s share price and the volatility of share prices of all companyies listed on the market represented by the volatilty of the main stock index

Feature of the beta coefficient - ß > 1

is more risky than an average market investment (shows higher prices of fluctuations than the stock market index)

Feature of the beta coefficient - 0 < ß < 1

indicates a lower risk of a given investment compared to the market (weaker fluctuations than the index)

Feature of the beta coefficient - ß = 1

the same level of risk as average systematic risk (the price changes at the same pace as the stock market index)

Feature of the beta coefficient - ß = 0

the rate of return on shares does not change when the market rate changes (no reaction to changes on the market; ß = 0)

Feature of the beta coefficient - ß < 0

the rate of return of shares decreases (increases) as the market rate increases (decreases)

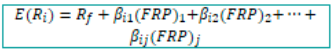

Alternative to the CAPM

multifactor model

Multifactor Model incorporates

sources of priced risk (includes macroeconomic and company-specific factors)

Examples when the risk is NOT captured by the CAPM beta coefficient

inflation, business cycle, exchange rate, default risk

Approaches to estimating ERP

historical, implied risk premium, survey approach

Historical Approach

requires compiling historical data to find the average rate of return of a country’s market portfolio and the average rate of return for the risk-free country; estimates are sensitive to the method of estimation and the historical period covered; the period estimated should cover complete market cycles (to capture e.g. bubble bursts); limitations; based on the assumption that the realised ERP observed over a long period is a good indicator of the expected ERP

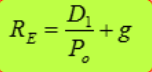

Implied Risk Premium Approach

based on the relationship between the value of an index and expected dividends, which are assumed to grow constantly; assumes that for developed markets earnings often meet the model’s assumption of a long-run trend growth rate; the premium is extracted by analysing how the market prices an index; the expected return on the market is the sum of the dividend yield (D/P0) and the growth rate in dividends (g); based on the Gordon growth model (constant-growth dividend discount model)

Limitations

the level of risk of the stock market index and investors' risk aversion may change over time

Survey Approach

ERP is the mean of experts’ responses; based on the estimate of a panel of experts

Common Equity Debt

can use the dividend discount model approach; portrayed by the Gordon Growth Model; but also the risk premium approach

What is the basic assumption of common equity debt?

the constant dividend growth rate (g) that is expressed yearly

Dividend Discount Model

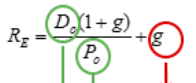

basic information provided by the company’s statement reports where we only need to estimate the dividend growth rate (g)

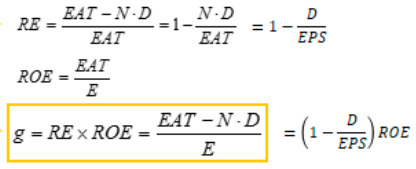

How to calculate the g variable?

by using the historical data; forecasted growth rate from a published source; calculating g as the retention rate (RE) and return on equity (ROE)

Using the retention rate (RE) and return on equity (ROE) method of calculation the g variable is presented as

the sustainable growth rate

cost of common equity capital including flotation costs

Common Equity Cost - Bond Yield Plus Risk Premium Approach

theory that states that the cost of capital of riskier cash flows have more of potencal risk than the cost of a less riskier cash flows

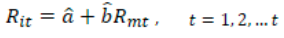

Estimating Beta (ß) and Determining a project beta

mostly based on the Capital Asset Pricing Model (CAPM) which portrays the ß estimations, e.g. by a market model regression of the company’s stock returns (Ri) against market returns (RM) over t periods

Issues to consider when estimating beta (ß)

estimation period, periodicity of the return interval, selection of market index, use of smoothing techniques (to make betas revert to 1), adjustments for small-capitalisation stocks

In general, BLANK estimation periods are applied for companies which have undergone significant structural changes in the recent past or changes in financial and operating leverage.

longer

In general, BLANK estimation periods are used for companies with a long and stable operating history

shorter

Small-capitalisation stocks generally demonstrate the BLANK risk and BLANK returns than large capitalisation stocks in the long run..

greater/greater

Another way to estimate beta

regressing rates of return from a given security on rates of return from a market portfolio

BUSINESS RISK

uncertainty of revenues, sales risk, operating risk, elasticity of demand, ciclicity of revenues, competition structure in the industry, companies operating within same industry, structure of operating costs

FINANCIAL RISK

uncertainty of NCF, increase in use of fixed-financing, heavy dependence on debt, financial leverages

Country Risk

the uncertainty associated with investing in a particular country; refers to the possibility of default on locally issued bonds

Factors of country risk

policy, economy, exchange rate, ecological influence

Adjusting the equity cost estimated by CAPM

add country risk premium to the market risk

Other names for country risk

country spread or sovereign yield spread

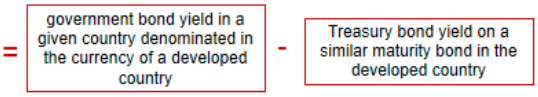

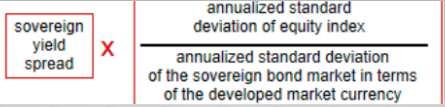

sovereign yield spread; the simplest estimation

country equity premium