ITM Tilburg IBA 2025

1/90

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

91 Terms

Disadvantage of a large firm

Beyond a certain point, an increasing firm size can be disastrous due to inertia

Structural differences between small and large firms

Large firms are more hierarchial than small firms

Large firms are more vulnerable to stakeholder pressures

Large firms’ managers are more susceptible to cognitive inertia and agency concerns

Innovation

Transformation of an existing state of things to introduce something new

Process of innovation

Identify a need or a problem

Develop a feasible solution

Produce/Manufacture and market the solution

Achieve adoption/diffusion of the innovation

Innovation from an entrepreneur’s/innovator’s perspective

A problem-solving process that involves searching for new combinations of various information and knowledge

The use of new knowledge (technological or/and market-related) to offer a new product or service that customers want

Economic Value

The value that a person places on an economic good based on the benefit that they derive from the good

Technology-Push factors

Technology-Push factors are driven by invention and commercialization of science and R&D, as well as by competition. They create new knowledge and methods

Demand-Pull factors

Originate from new needs and demand of consumers, which depend on their nature, type, size, and distribution

Schumpeterian view of innovation

Creative Destruction: Both small and large firms can create innovations by creating new technological knowledge —> Technology-Push innovations

Kirznerian view of innovation

Assumes the availability of knowledge and emphasizes the role of entrepreneurship in staying alert to demand-side opportunities and applying knowledge to address the demands and needs of consumers

Key organizational variables of innovation

Firm size

Scale of operations: Asset base and customer base

Scope of operations: Vertical scope, horizontal scope, and geographic cope

Age and experience

Awareness, level of knowledge, path dependence, and inertia

Market power and competition

Monopoly and incumbency

These factors play a crucial role in shaping the nature and type of innovations firms can imagine, foster, and produce

Types of innovation

Competence-enhanding

Incremential innovation

Knowledge for a new product built on current knowledge

iPhone 15

Competence-destroying

Radical innovation

Knowledge for a new product different from current knowledge

ChatGPT

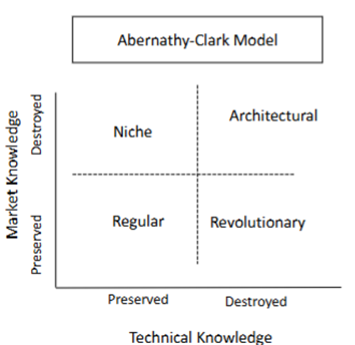

Abernathy-Clark Model

It takes a product market perspective and distinguishes between technical and market knowledge

Regular innovation

Niche innovation

Revolutionary innovation

Architectural innovation

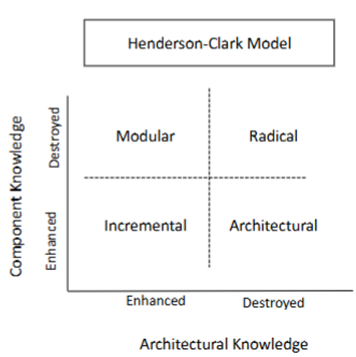

Henderson-Clark Model

Emphasizes on the components of a product and the linkages between them. Distinguishes between component knowledge and architectural knowledge

Incremental Innovation

Modular Innovation

Architectural Innovation

Radical Innovation

Component Knowledge

The individual parts or technical tools that make up the product

Architectural Knowledge

The structural framework that defines how these components are integrated and interact

Organizational Economics

A branch of economics that focuses on the structure and behavior of organizations. It examines how firms and other institutions make decisions and how their structures affect their performance.

It includes the following three theories:

Information Economics

Transaction Cost Economics (TCE)

Resource-Based Theory

Information Economics

Both small and large firms face informational risks when dealing with their employees (internal) as well as when transacting with external parties

Hidden information risks

Adverse selection risks. Impedes the firm’s ability to secure resources and strike business partnerships

Hidden action problem

Moral hazard problem. A firm’s inability to verify and observe the actions and contributions of its employees, external contractors, etc.

Reduce hidden information risk for outsiders

Engage in costly signaling that helps them distinguish the underlying quality of their technology or activities (which are typically non-verifiable, non-measurable, and non-observable)

Mitigate hidden action problems

Through incentives and careful contract designs

Transaction Cost Economics (TCE)

Focuses on the challenges and costs associated with making business transactions

Transaction Costs

The extra costs incurred when making an economic exchange. These costs include the costs of gathering information, negotiating, making decisions, and enforcing contracts

Asset-Specificity

How specialized an asset is to a particular transaction or firm. Higher asset-specificity can lead to higher transaction costs because it limits the asset’s use in other transactions

Resource-Based Theory

Defines firms as a bundle of heterogeneous and complementary resources, which can be tangible and intangible

Key advantages of small firms

Knowledge Advantage

Small firms often have a head start due to their deep understanding or unique insight into specific technology or market needs

Key Individuals

Founders, investors, and intermediaries

Market Positioning Advantage

Their ability to identify and occupy niche markets or emerging opportunities before larger competitors can

Effectuation

Taking a set of means as given and focusing on possible outcomes that can be created with that set of means

Challenges of small firms

Lack of resources and networks

Lack of organizational history/experience, knowledge repositories, and stable organizational processes and routines

Lack of legitimacy and credibility: New market entrants often struggle to establish trust and authority in their domain

Sources of ideas, resources, knowledge, and opportunities in small firm innovation

Local technical, social, and user environment

Resource capital, assets, human capital

Prior work experience of employees; Prior failure experience

Social capital and embeddedness in local entrepreneurial and innovation context

Creativity and Personality traits

Analysis of the external environment and stakeholders include:

Paradigm analysis - Status-quo of a product or service

Market analysis

Competitor analysis

Community analysis

Interest group analysis

Government analysis

Interdependent components of start-up innovation strategy

IP strategy

Organizational strategy

Product market strategy

Digital and marketing strategy

Finance Strategy

IP Strategy

Patents, trademarks, copyrights, and secrecy

Organizational Strategy

Scale, scope, and vertical and horizontal boundaries

Product Market Strategy

A product’s price, quality, margin, target sales growth, and differentiation vs cost

Digital and Marketing Strategy

Digital and AI tools, and social media

Finance Strategy

Financial contracts: Loan convenants, options, and staging and milestone financing

Types of financing: Outside vs Self, debt vs equity, going public

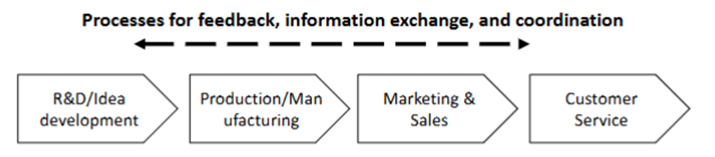

Processes for feedback, information exchange, and coordination

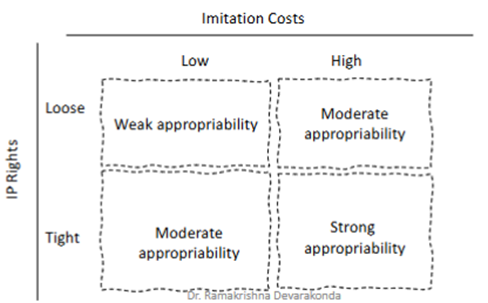

Appropriability

The ability of an innovator to seize some of the social gains that result from an innovation

Appropriability Regime

Determines the extent to which knowledge and innovations can be protected from imitation

Two critical drivers for small firm innovation

Access to complementary assets

Knowledge Capital

Financial Capital

Commercialization Capital

Safeguards against the risk of imitation and appropriation

Employee Mobility Risk

IP infringement and litigation

Core Assets and Competencies

Unique strengths deep inside a firm that differentiate them from other firms

Managerial Intentionality

Top-level managers seek to balance private and common interests

Innovative Performance

Super additive function of resources and managerial incentives

ITM = f(Resources) + g (Managerial Inducements) + h(Resources * Managerial Inducements)

Functional Capabilities

Capabilities from functional areas such as operations, purchasing, logistics, SCM, design, engineering, R&D, marketing, distribution, customer service, and financial management

Organizational Capabilities

Coordination and orchestration among functional areas

Corporate Renewal

A firm can modify its asset and capability base to gain and sustain a competitive advantage

Organizational Hierarchy

Board of Directors

Top level managers

Divisional managers

Other managers / Team leaders

Team members

Firms face the need for external sourcing of innovation, due to:

Pressures that firms face due to environmental changes and competition

Limited capabilities to adjust to changes; lack of relevant up-to-date complementary information and assets

Time-compressed diseconomies of scale and scope

Flexibility and Uncertainty

Pressure to act and respond fast

Main forces shaping innovation and technology on an industry level

Factor conditions

Demand conditions

Competitive rivalry and intensity

Related and supporting industry

Firms seeking international expansion strategies to commercialize their innovations or locate their value chain activities for innovation examine these conditions

Factor conditions

A nation’s endowments in terms of natural, human, and other resources

Universities, S&T centers of excellence

Demand conditions

Specific characteristics of demand in a firm’s domestic market

Market size, sophistication, specialized demand

Competitive rivalry and intensity

Firm networks and rivalry

Innovation intensity among firms

Highly competitive environments tend to stimulate firms to outperform others

Related and supporting industries

Supporting services, designs, distribution, and suppliers for other activities in the value chain

Complementarity

Leadership in related and supporting industries can also foster world-class competitors in the downstream industry

IP assets key characteristics

Publicness

Depreciation

Transfer costs

Property rights

Enforcement

Publicness IP

If IP assets are revealed, they become largely public, allowing others to access and use them if they are not properly protected

Depreciation IP

IP assets do not wear out physically, but they can lose value rapidly over time due to competition or loss of exclusivity

Transfer costs IP

The costs associated with transferring IP assets are hard to determine and increase when knowledge is more tacit (hard to codify and transfer)

Property rights IP

IP protection is limited to legal mechanisms such as patents, trade secrets, copyrights, and trademarks

Enforcement IP

Protecting IP assets is challenging

Legal forms of IP

Patents

Trade secrets

Trademarks

Copyrights

Patents

Legal rights to exclude others

Granted based on inventive step (non-obviousness), and industrial applicability (utility)

Protect an invention

But also, costly to obtain and protect from imitation

High enforcement costs

Trade secrets

Right to make, use and sell secret, as well as protect against misuse

Confidential, proprietary information - costly to maintain (protect)

High enforcement costs

Trademarks

Forbid against misuse of brand, misrepresent source

Protects goodwill - costly to maintain

Moderate enforcement costs

Copyrights

Right to produce, distribute, and use for further work

Protects ideas and artworks (e.g., software) - not costly to maintain (protect)

Costly to enforce

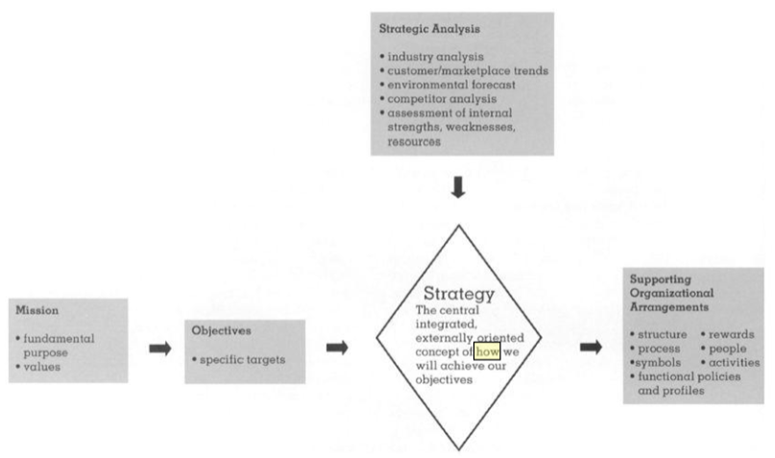

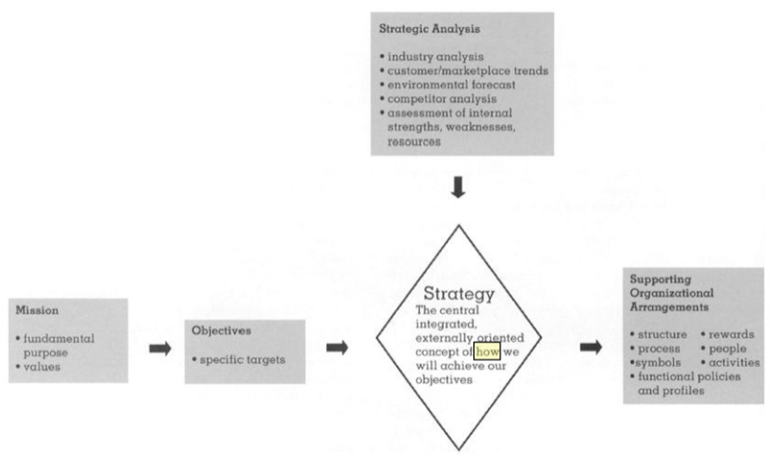

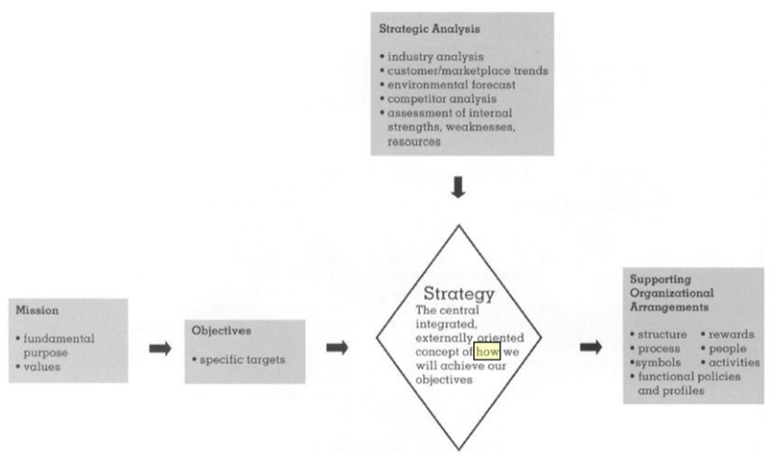

Strategy

The central integrated, externally oriented concept of how we will achieve our objectives

Strategic Analysis

Industry analysis

Customer / Marketplace trends

Environmental forecast

Competitor analysis

Assessment of internal strengths, weaknesses, and resources

Supporting Organizational Arrangements

Structure

Process

Symbols

Rewards

People

Activities

Functional policies and profiles

These arrangements are made to access knowledge, resources, and capabilities. They cause a relational view of competitive advantage and allow the firms to obtain flexibility and reduced uncertainty

Ideas

Ideas are based on imagination, passion, and creativity, in combination with cross-disciplinary thinking

Creativity & Innovation

Creativity: The ability to produce work that is novel and useful

Innovation: The ability to turn creative ideas into viable solutions

Individual creativity is a function of:

Knowledge

Environment

Personality

Motivation

Intellectual abilities

Style of thinking

Enabling Technologies

Equipment and methodology that, alone or in combination with associated technologies, provides the means to generate giant leaps in performance and capabilities of the user

Preference effect

Researchers and firms engage in certain types of knowledge due to their intrinsic interests and incentives

Researchers might accept lower wages because they value working in science

Productivity effect

Efficiently generating valuable insights or innovations, and gaining spillover effects

If scientific work boosts a firm’s success, companies may share those gains with researchers through higher wages

Three key challenges in the management of human capital for innovation

Worker’s objectives do not perfectly align

Worker’s effort is hardly observed directly by managers - hidden action concern

Worker’s output is hardly unambiguously verified - hard to use as a contractual term

Autonomy

A worker’s freedom to make decisions within given organizational resource constraints for a specific task

Delegation

The act of transferring decision rights from the manager to the worker

Firm’s benefits (bF)

(𝜶 + 𝟏 − 𝝀) 𝒆𝒔𝑨

Worker’s benefits (bW)

𝝀𝒆𝒔𝑨

Disutility function of W

(1/2) * e2

Outside option of W

(1/2) (𝒔 2 + 𝜸)

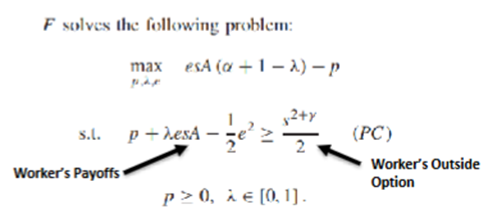

Firm’s payoffs (𝝅)

(𝜶 + 𝟏 – 𝝀) 𝒆𝒔𝑨 – 𝒑

Where p = salary

Worker’s payoffs

𝒑 + 𝝀𝒆𝒔𝑨 – (1/𝟐)𝒆2

F solves the following problem

You want to set the ingredients 𝝀 and 𝒑 that will connect the decision rights (autonomy) and payment (and the unobserved effort e) with the project-specific skills s

Project Relevant Capital

Represents the resources and capabilities that contribute to both scientific and commercial value

Autonomy (𝝀)

The degree of independence in decision-making, which influences the trade-off between scientific and commercial value. A larger 𝝀 suggests greater freedom, which can enhance scientific outcomes but may reduce commercial viability (Change from p to p1). A smaller 𝝀 does the opposite

Positive association with Scientific Value

Local development unit (LDU)

Project size

Project budget

Positive association with Commercial Value

Project size

Project Relevant Capital (PRC)

Negative association with Commercial Value

Age of workers

Budget

Secondary Effect

Lower autonomy → Lower effort

Higher autonomy → Higher effort

Delegation with Low and High PRC

Low PRC pushes for more delegation due to motivational purposes

High PRC pushes for more delegation due to efficiency considerations (spillover effects)