Momentum Trading Flashcards

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

38 Terms

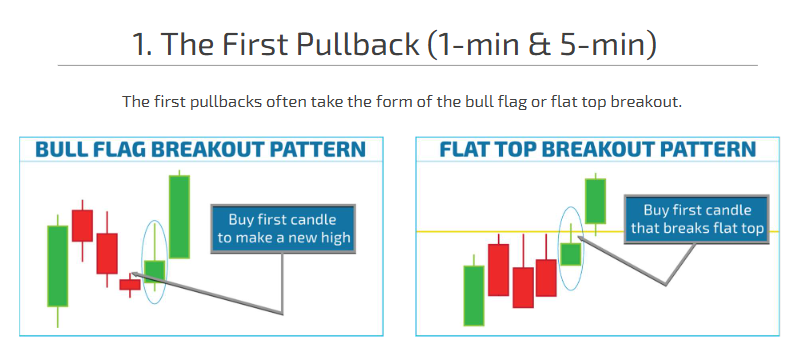

Where is your entry on the first and second pullback? How can an early entry be triggered?

Triggered by the first candle making a new high in a bull flag/flat top pattern.

breaking through a psychological level below the apex (half dollar/whole dollar) or by surge in buying (level 2)

Why is an early entry preferred for the first and second pullback?

To mitigate the risk of bull traps and false breakouts.

NOTE: Price should move up immediately

What is the profit target range for optimal profit-taking? When should you take partial profit? (First and Second Pullback)

The profit target range is 10-20-40 cents, focusing on retesting the high of the day and breakout price squeezes.

Take partial profit during the first momentum surge. High of day is the main target.

What should traders be wary of when targeting the high of day in trading? (First and Second Pullback)

Be wary of double tops or rejections requiring formation of new patterns such as flat top breakout or ABCD

What are the key risk factors when trading that traders should be aware of? What should traders confirm to avoid failures in their trades? (First and Second Pullback)

Risks of false breakouts and double top rejections.

Traders should confirm the absence of large sellers, check 9 EMA positioning, current price, and retracement size

Where should your stop loss be? (First and Second Pullback)

low of the last 5-minute candle or arbitrary stops (5-10-20 cents)

What can traders do in a strong market to maximize profits?

In a strong market, traders can hold and add to their position (second or third leg up after 2-3 micro pullbacks setup) instead of selling partial positions prematurely.

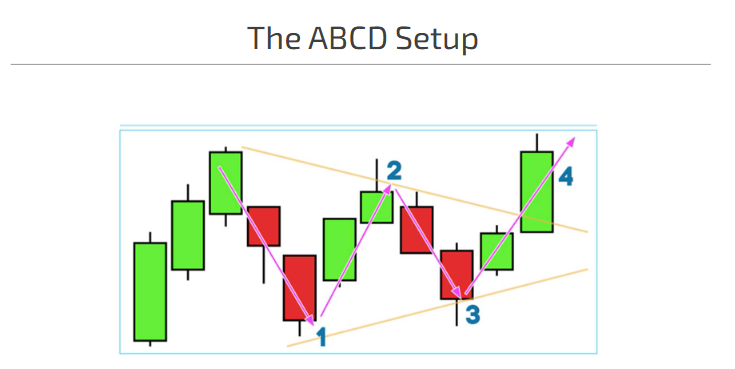

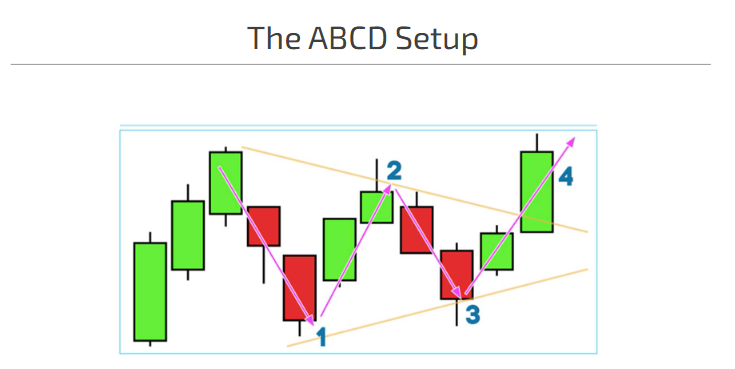

What is the ideal entry point for the ABCD pattern?

The ideal entry is at apex point B (2) of the ABCD pattern, specifically the break of point #2 when the stock moves back up.

What may happen if traders take an early, lower entry during the ABCD pattern?

Taking an early, lower entry at the previous bull flag's first candle may sacrifice confirmation.

What context is necessary for a proper ABCD pattern setup?

The context of a 5-min bull flag is necessary, where a 5-min ABCD pattern should provide logical 1-min entries

What does the target depend on the ABCD pattern? What should traders watch for during breakouts to avoid failures?

The target depends on formation, with flat top configuration targeting 25-50 cents, and otherwise targeting the high of day.

Traders should watch for volume at breakouts to avoid false breakouts and double tops.

What’s the risk factor of the ABCD pattern?

Weakness due to a failed bull flag creates risk

Where should a stop loss be set? What is the importance of consolidation above the 9 EMA ? (ABCD Pattern)

A stop loss should be set at the low of the last 5-min candle or at arbitrary stops of 5-10-20 cents below the entry point

Consolidation above the 9 EMA is important as it indicates the potential for patterns to evolve into MA breakout setups.

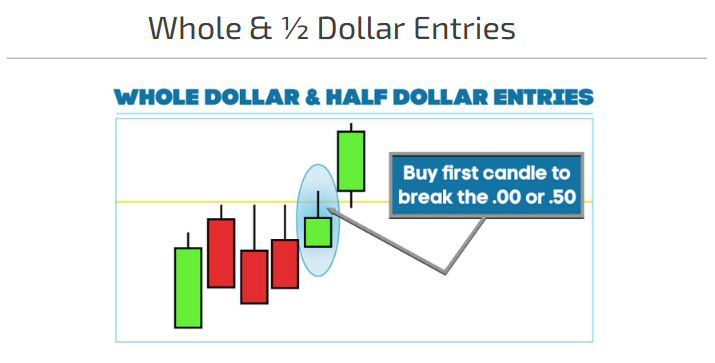

What is the preferred buy range near half or whole dollar levels?

The preferred buy range is at or just below half or whole dollar (e.g., 4.90 for a 5.00 breakout), with entries typically between .85 to .95 and additions at .96 to .99 in hot markets.

What must occur after a successful breakout at the whole dollar level? What should traders look for immediately after breaking a level in trading setups?

After a successful breakout, the dip must hold at the whole dollar level to show strength.

Traders should look for a quick surge immediately after breaking the level to confirm strength.

What is the significance of the first dip after a breakout? (Half and Whole Dollar Breakout)

The first dip must hold to show that the breakout is strong and not a false breakout.

What is the typical profit target range? (Half and Whole Dollar Breakout)

10-25 cents or up to the next whole dollar (e.g., 3.10 to 3.25).

What are the risk for for the half and whole dollar breakout?

Ineffective in slow markets; where there is FOMO half and whole dollars are good entries

Where should a stop loss be set?

Tight stops, less than 10 cents for risk management.

What effect do traders' stop placements around half and whole dollars have on breakout volumes? What must traders do to confirm a breakout price as it approaches?

Placing stops around half and whole dollars increases breakout volumes due to attention from both long and short traders.

Traders must closely monitor level 2 and time and sales to confirm the surge of buying at breakout prices.

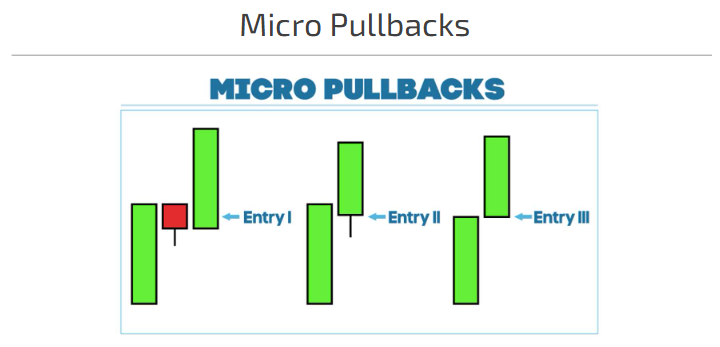

What is the ideal entry strategy for a micro pullback?

Enter within a 1-minute candle as the stock dips and quickly rebounds

preferred in hot markets, particularly with low float stocks after a 5-minute breakout (5-minute bull flag or ABCD pattern) or significant news, when market opens.

What’s the target for the micro pullback?

The profit target range is 10-20-40 cents

Aim for a potential parabolic move and to build a cushion for larger positions later

What are the risk factors associated with aggressive entries? (Micro Pullback)

Aggressive entries carry potential for high losses, especially in low volume situations

Where is your stop loss in the micro pullback? Why is a micro pullback method needed?

Stop can be low of last 1-min candle, or arbitrary stops at 5-10-20 cents.

This method is typically required to profit from parabolic squeezes, where quick movements necessitate 1-minute micro pullback.

What is the entry strategy for buying into the high of day? What can quick momentum lead to when buying at the high of day?

Buying at or just below the high of day

Quick momentum can lead to short covering

What is the target when trading the Break Of High Of Day?

Quick profits are essential; watch closely for resistance levels and sellers.

What are potential risk factors? (Buying A Break Of High Of Day)

Potential for double tops or extreme resistance levels, such as daily resistance or 200 EMA.

What should you focus on when entering as the price approaches the VWAP? What does the VWAP serve as?

Focus on volume shift and short covering potential around the breakout.

The VWAP serves as a critical support/resistance level

What’s the target on the VWAP Breakout?

High of day re-tests or aggressive moves in a hot market.

What’s the risk factors and stop loss of the VWAP Breakout?

Early weakness can indicate strong selling pressure; avoid entering without confirming strength.

Set right below VWAP to limit losses in volatile conditions.

What is the strategy for buying into or out of a halt?

The strategy involves buying a stock when it is squeezing up to aim for a gap up after a micro pullback. The safest entry is a micro pullback setup

What’s you target and profit target? (BUYING INTO OR OUT OF A HALT)

Look for high openings and aim to squeeze into another halt.

Profit Target: 10-20-40 cents

What should traders be cautious of when entering positions based on halts?

Beware of false halts where prices initially appear stable but quickly reverse.

What is a recommended stop loss? (BUYING INTO OR OUT OF A HALT)

Stop can be low of last 1-min candle, or arbitrary stops at 5-10-20 cents

What is the primary condition for executing a dip buy strategy?

Execute only after trading a stock very well and having a cushion.

What is the target when executing a dip buy strategy? What should traders be cautious of when taking profit during a dip buy?

The target is to bounce back to halfway to the highs or take profit quickly into the pop.

Traders should be careful of resistance at the ask price if sellers are stacked up.

What is a significant risk factor when executing a dip buy strategy?

High risk due to the unpredictability of the stock dropping; proper timing is essential.

What is the recommended stop loss for a dip buy strategy? On what type of stocks does the dip buy setup work best?

Between 25-50 cents to secure against significant losses.

It works best on parabolic stocks with big range.