accounting midterm 3

1/66

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

67 Terms

Working Capital

Current assets - current liabilities

key working capital accounts: A/R, Inventory, A/P

Working Analysis

Assess operational efficiency and liquidity

i.e collecting from customers fast enough? selling inventory too slow? paying off suppliers too fast/slow?

Accounts Receivable Turnover (ART)

the number of times a company collects its average accounts receivable balance during a period (receivable → cash)

high ration is better: credit is turning into cash faster.

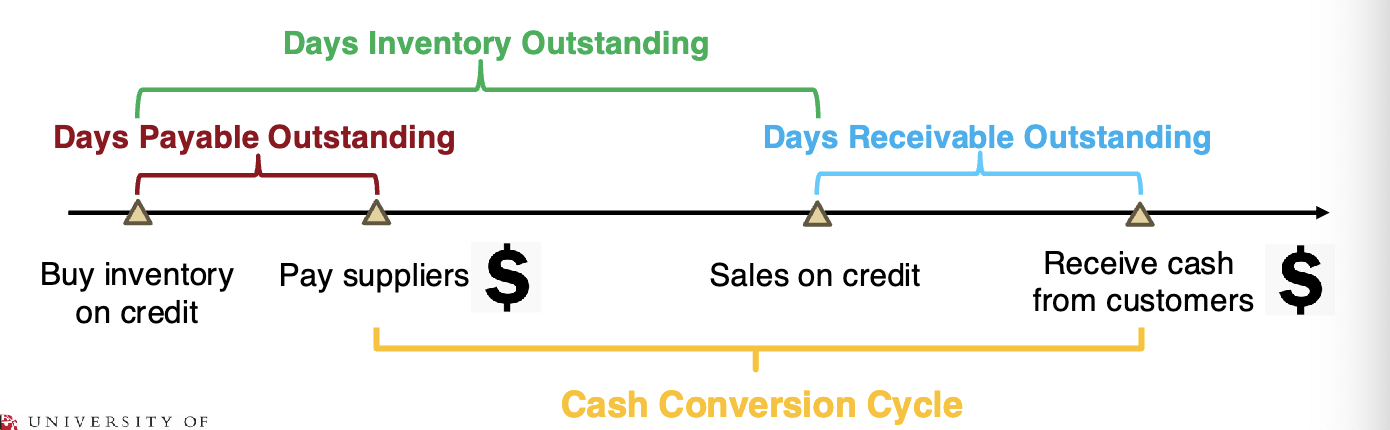

Days Receivable Outstanding

the average number of days to collect cash payment for a sale

365/ART

Inventory Turnover (IT)

how many times a company sells and replaces its inventory during a period

Days Inventory outstanding

average number of days that a company holds inventory before turning it into sales

365/IT

Accounts Payable Turnover (APT)

how many times a company purchases on account and pays off its bill during the period.

Days Payable Outstanding

average number of days it takes a company to pay back its accounts payable to suppliers

365/APT

Cash Conversation Cycle

the number of days it takes to convert the cash spent on inventory back into cash from sales

CCC= Days Inventory Outstanding + Days Receivable Outstanding - Day Payable Outstanding

measures working capital efficiency

Negative CCC represents strong bargaining power over suppliers.

Debt Securities

issued by other institutions and corporations

i.e short-term debt securities, CDs, commercial paper, treasury bills, corporate bonds

if apple bought debt securities (bonds) from other company, the company pays apple interest and return the principal at the end of the term.

Equity securities

investments in stocks of other company

voting rights:

less that 20%: no influence (just an investor)

20-50%: can exert significant influence, but no control

more than 50%: has control over investee.

Passive Investments (type of intercorporate investments)

debt or equity securities (less than 20% voting rights)

no influence or control

earn interest, dividend, and capital gain

accounting method: fair value or historical cost

3 types: Held-To-Maturity, Trading, Available for Sale

Significant influence

equity securities (20-50% voting rights)

can exert significant influence, but no control

results from legal agreements and being a sole supplier/customer

Control

equity securities (more than 50%)

has control over investee company

sometimes occur through legal agreements

Why do companies make investments

short-term use of excess cash (generate cash during slow periods, counter strategic moves by competitors, quickly respond to acquisition opportunities)

alliances for strategic purposes (gain access to R&D, supply or distribution channels, or marketing and production expertise)

market penetration or expansion (vertical or horizontal intergration, enter new or growing markets)

Held To Maturity Securities

Intention: hold until they mature

includes only debt securities

interest income is recognized on IS

unrealized gain/loss is not recognized on IS

accounting method: historical cost method

Trading Securities

intention: actively buy and sell for trading profits

includes all marketable equity securities and debt securities that are actively traded

Interst/dividend income is recognized on the IS

unrealized gains/losses recognized on the IS at the end of accounting cycle

realized gains/losses recognized on the IS at the time of sale

accounting method: fair value (mark-to-market) method

Available for sale Securities

intention: hold for a longer term for capital gains and interest income, but to sell before they mature

includes only debt securities

interest income is recognized on the IS

unrealized gain/loss bypass IS → recorded in accumulated other comprehensive income (AOCI) part of SE without affecting Net Income

realized gain/losses are recognized on IS at the time of sale

accounting method: fair value (mark-to-market)

Fair Value Accounting

reports fair value on the B/S

Potential for manipulation

when market value is increasing: AFS → Trading or sell AFS. allows unrealized or realized gains to be recognized on the Income Statement

when market value is decreasing: Trading → AFS so unrealized losses bypass the income statement

Long-lived (long-term) Assets

assets that company expects to use for more than 1 year

tangible assets (PP&E)

intangible assets: patents, trademarks, copyrights, goodwill

How do PP&E affect income statement

cost of PP&E assets is allocated to expenses over the time period that the assets help to generate revenue.

depreciation: cost transferred from BS to the IS

How are PP&E reported on the BS

net book value (net PP&E): Cost (Gross PP&E) - Accumulated Depreciation

Identifiable Intangibles

separately transferable

can be sold, licensed, or transferred on its own

e.g patents, trademarks, copyrights, franchise rights, customer lists, or unpatented technology

Goodwill

not separately transferable

the excess of purchase price over the fair value of net assets acquired in a business combination

Goodwill = purchase price - FV of identifiable net assets of the target (how much target company is worth: assets - liabilities)

why? pay premium because of future growth potential, synergies, intangibles

indefinite life → intangible assets → no amortization of goodwill

patents

exclusive right to use, manufacture, and sell product (20 years) to prevent someone copying innovation

if purchased from another company → capitalized (assets)

if developed internally → all costs are expensed

Trademarks

registed name, logo, package design, image, jingle, or slogan associated with a product

if purhcased from another company → capitalized

if developed internally → expense it

generally, trademarks and patents have indefinite lives → do not amortize

not present on BS

accounting for intangibles

purchased (acquire externally) → acquisition costs are capitalized → definite lives (amortization) or indefinite lives (no amortization)

internally developed → costs are expensed (except legal costs and software cost when technological feasibility [company has established that product can be produce to meet design specification] is established)

R&D

US GAAP required that R&D costs be expensed as incurred.

Amortization

cost allocation process for intangible assets

only intangible assets that have definite lines are amortized

merger

describes two firms joining forces to move forward as a single new entity

acquisition

one company purchasing most or all of another company’s shares to gain control of that company

common stock

the most common class of stocks in a corporation

with voting rights

class A vs class B

company must issues these

preferred stock

has liquidation and dividend preference relative to common stock

hybrid between common stock & bonds

usually w/o voting rights

treasury stock

contra-SE account

when a company repurchases its stocks and hold them

par value

arbitrary amount set by company organizers at the time of formation

specifies the allocation of proceeds from stock issuances between par value (common stock) and additional paid-in capital

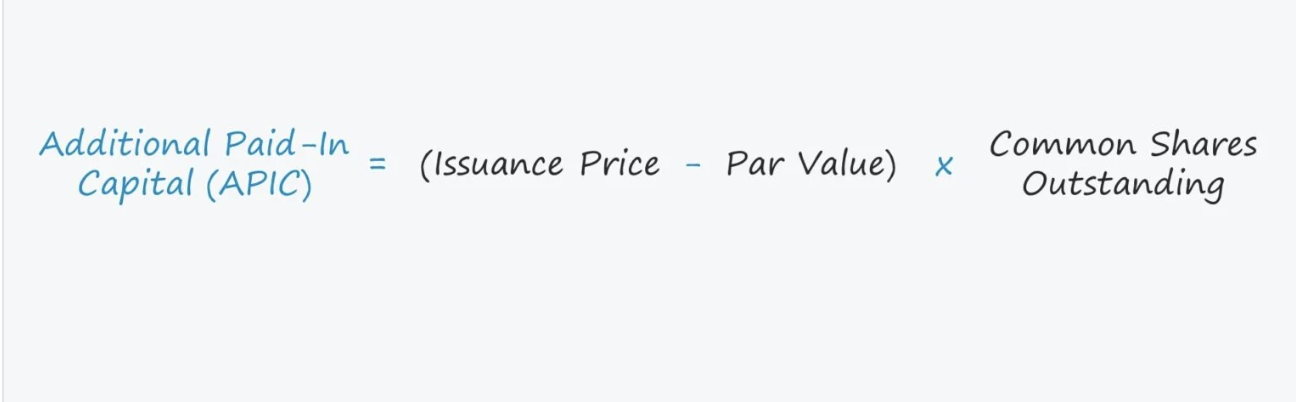

additional paid-in capital

paid-in capital (contributed capital) in excess of par

reflects differences between the amount provided by shareholders and the par value of issued shares.

(the premium investors are willing to pay for stock)

accounting for contributed capital

contributed capital: amount of cash or assets that shareholders have given a company in exchange for stock

accounted for at historical costs.

fluctuations in stock price after IPO do not directly affect the financial statements of the issuing company

never any gain/loss reported on the purchase and sale of the company’s own stock or payment of dividends

total proceeds from stock issuance

common stock = par value per share x # shares issued

common stock + additional paid-in capital = total proceeds from stock issuance.

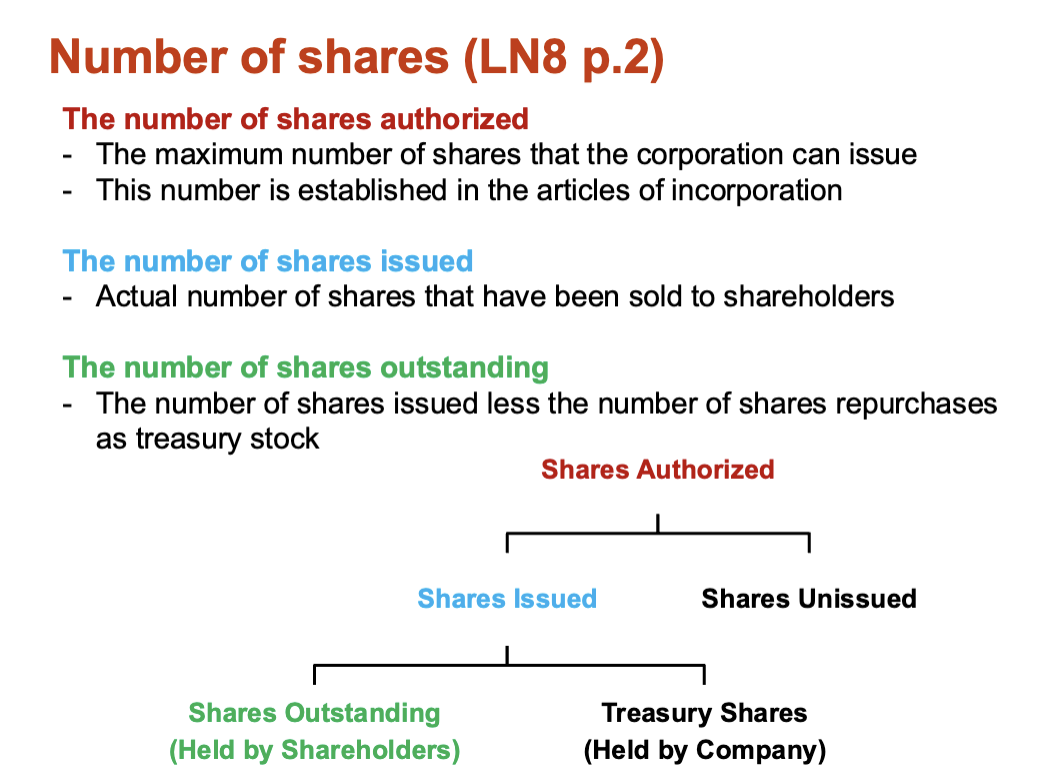

The Number of Shares authorized

maximum number of shares that the corporation can issue

established in the articles of incorporation

the number of shares issued

actual number of shares that have been sold to shareholders

the number of shares outstanding

the number of shares issued less than the number of shares repurchases as treasury stock.

Why do companies buy their stock back

to increase stock price if price is undervalue

stock price is closely link to executive compensation

to increase earnings per share (EPS)

tax-efficient way to return capital to investor (tax is only applicable on the actual sale of shares and receiving dividends)

stock splits

increase the number of shares outstanding → lower price per share

e.g 2-for-1 split: number of shares is doubled, price per share (EPS) is halved

True Split

adjust the numbers proportionately

number of shares (authorized, issued, and outstanding) and all per share amounts (EPS, dividend per share, stock price per share, par value per share)

split effected in the form of a stock dividend.

Why do a stock split

increase shareholder base (more affordable to small investors)

increase stock liquidity

signal management’s expectation on future growth

Numbers affected by stock split

IS: EPS, shares used in computing EPS

BS: shared authorized, issued, and outstanding

SSE: dividend per share

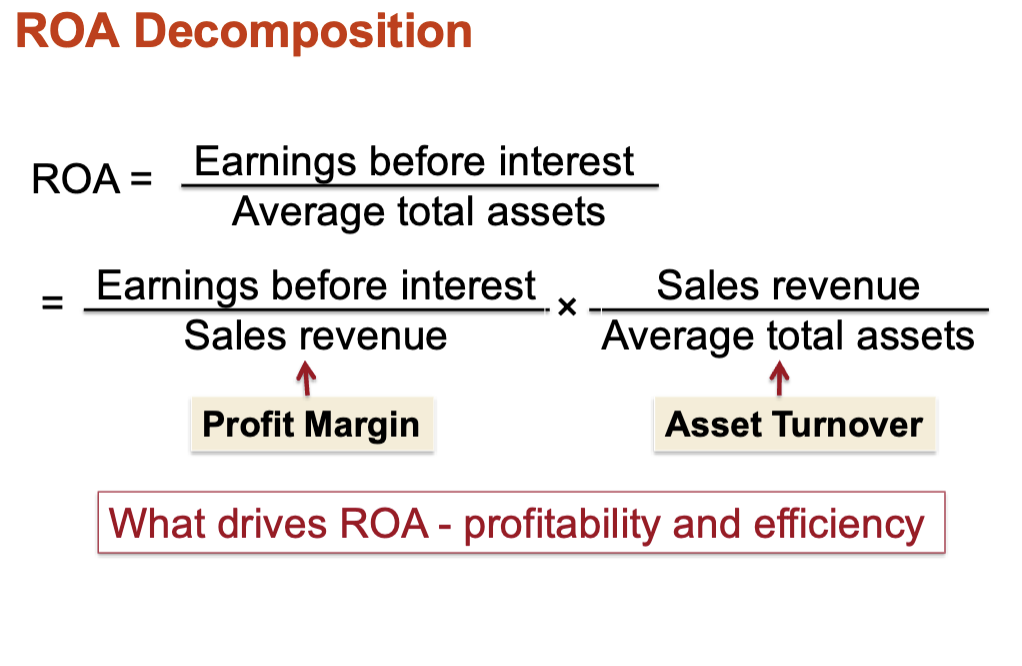

Return on Assets (ROA)

the return earned on assets that company invests in

earnings before interest / average total assets

affected by asset turnover and net profit margin

Return on Equity

the return earned on investments made by company shareholders

net income / average shareholder’s equity

Gross profit margin

the % of revenue left after deducting direct cost of sales

Gross Profit / Sale Revenue

gross profit = sale revenue - COGS

so (Sale Revenue - COGS) / Sale Revenue

Net profit margin

the % of revenue left after deducting operating expenses, depreciation, amortization, interest, and income taxes.

net income / sale revenue

financial ratios

time-series analysis: comparing its own performance

cross-sectional analysis: comparing across industry peers

Alternative Data

not disclosed by firms in their official reports

more objective since generated by 3rd parties, more timelier than 10K, 10Q

ex: social media, sentiment, satellite image, point of sale retail scanner data

Why types of info do analysts gather?

10k, 10q, press release, earnings conference call, management guidance (earnings forecast), corporate site visits, alternative data