Discounted Free Cash Flow method for valuing stock

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

What is the first step of Discounted Free Cash Flow method for valuing stock

Step 1: Estimate the free cash flows that the firm will generate with its underlying operating assets in the future.

For EACH year from now to infinity, estimate

Free Cash Flow = (Sales – COGS – SG&A – R&D – other op expenses – D&A) *(1 – tax rate)+ D&A – capex – change in NWC + asset sales

Analyze and predict expected sales, costs, investments, economy, market share, prices, competitors...

This step is 99% of the work. It’s the bulk of what analysts do.

What is the second step of Discounted Free Cash Flow method for valuing stock

Find the firm’s WACC

Net debt = Debt – Cash & marketable securities

What is the third step of Discounted Free Cash Flow method for valuing stock

Discount the FCFs at the firm’s WACC to get the total value of the operating assets– the Enterprise Value.

TV=Terminal Value. Terminal Value is the discounted value of FCFs from when we stop explicitly projecting FCFs to infinity.

What is the fourth step of Discounted Free Cash Flow method for valuing stock

Subtract net debt out from EV to get market value of equity.

We just found what we think EV is. Subtract Net Debt and bingo, that’s what we think Market Value of Equity should be.

What is the fifth step of Discounted Free Cash Flow method for valuing stock

Divide market value of equity by the number of shares outstanding to get your estimate of price per share. Just like it says. What we (or an analyst) come up with as an estimate of the share price may be similar to or different from the actual market share price.

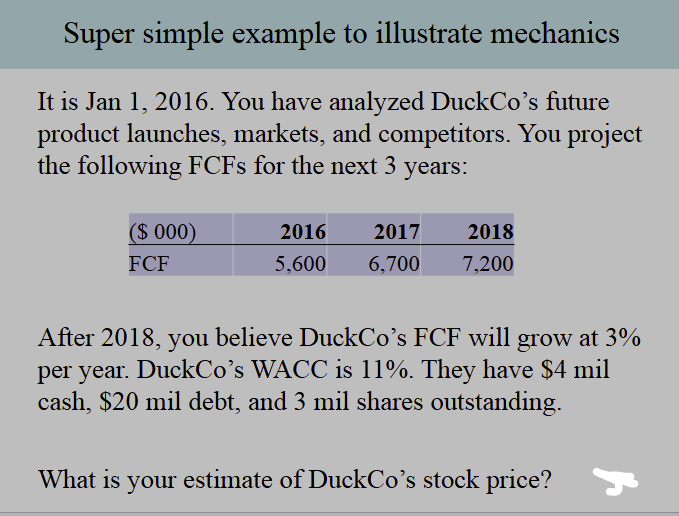

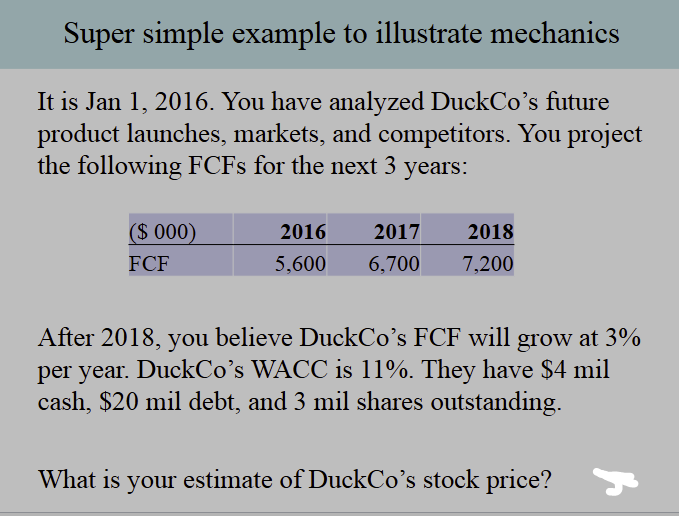

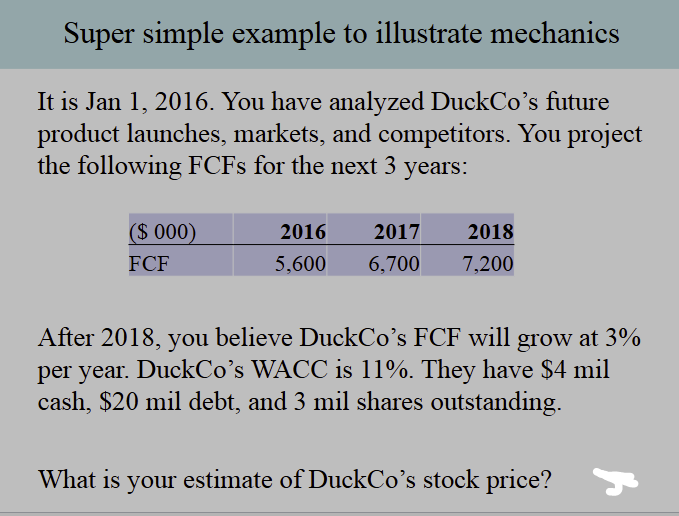

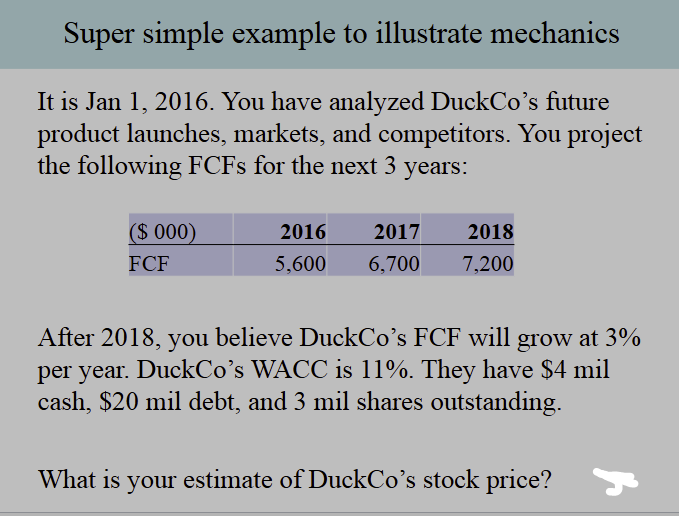

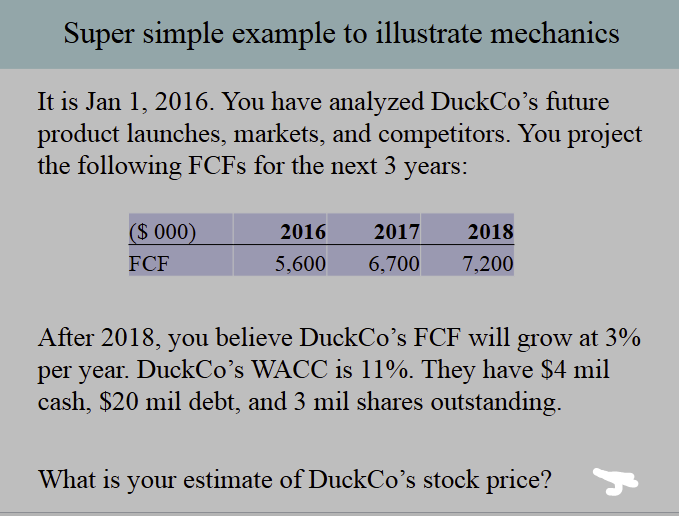

What is step 1 in this problem?

The Free cash flows of 5600, 6700, and 7200.

What is step 2 in this problem?

The WACC of 11%.

What is step 3 in this problem?

Find the enterprise value using the Free Cash Flows and WACC.

Remember: TV=Terminal Value.

So you use FCF and WACC to find the TV, and then you use the TV to find the EV.

What is step 4 in this problem?

Step 4: Subtract the net debt out from the EV to get the market value of equity.

Enterprise Value = Market Value of Equity + Debt – Cash

In this case, we’re trying to find the market value of equity, since we already found the Enterprise value and we are given cash of 4 million in the problem and debt of 20 million in the problem.

So…

83.529 = Market value of equity + 20 – 4

Market value of equity=$67.529 million

What is step 5 in this problem?

Step 5: Divide market value of equity by the number of shares outstanding to get your estimate of price per share.

We found the market value of equity last problem to be $67.529 million in step 4. And it is stated in the problem that we have 3 million outstanding shares. So, putting that together, we get $67.529 million/3 million shares = $22.51 per share stock price

When we calculate a firm’s WACC to be 17%, what does that

really mean?

• It means projects like the ones that firm has been doing

should have a discount rate of 17%.

• It does NOT mean that anything the firm does should have

a discount rate of 17%!

• A WACC is not some inherent property of a firm.

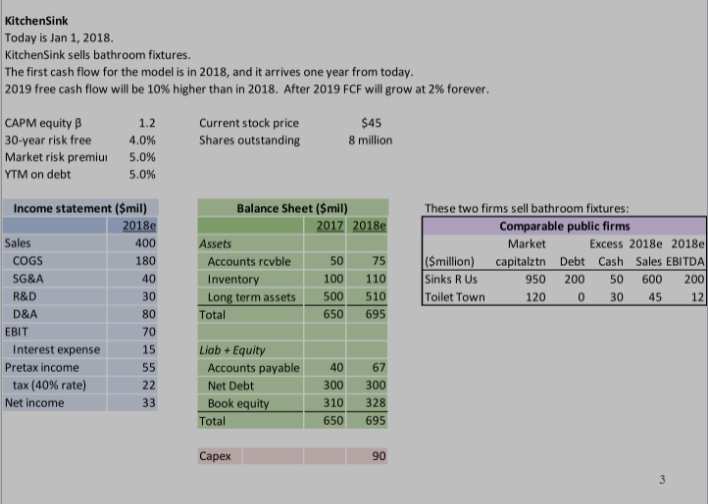

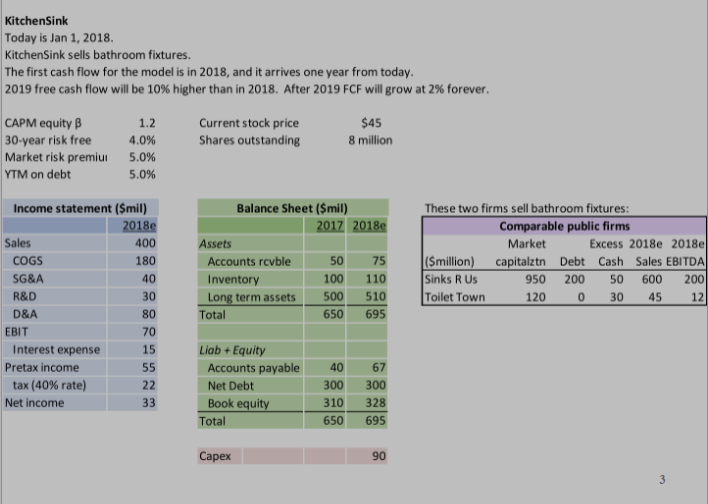

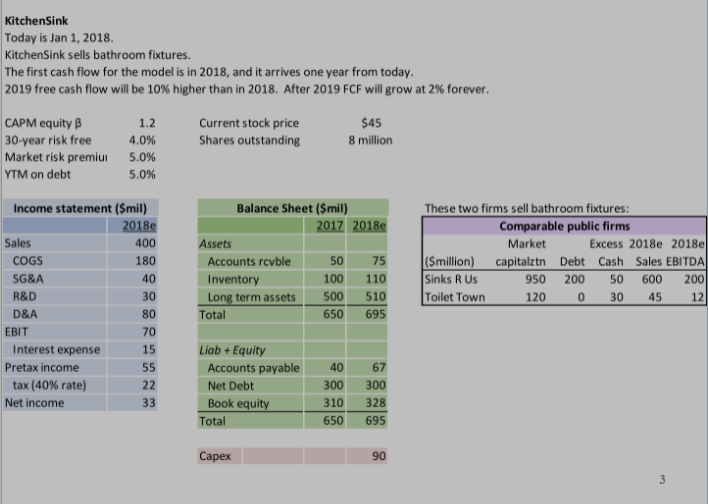

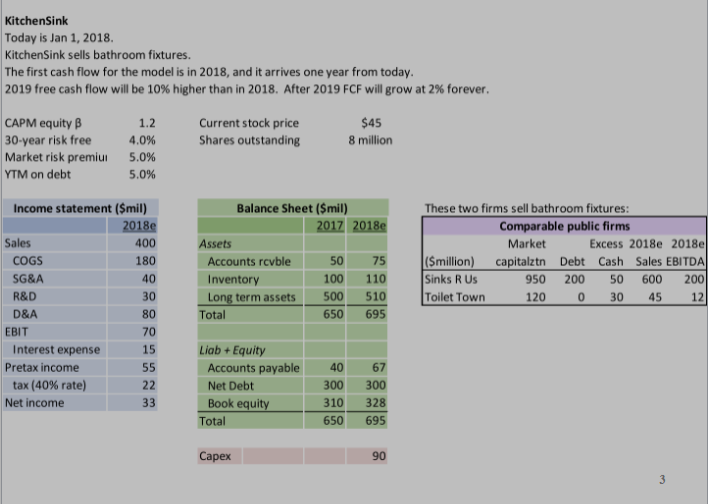

What is step 1? How do we get the free cash flows?

Step 1:

Free Cash Flow = (Sales – COGS – SG&A – R&D – other op expenses – D&A) *(1 – tax rate)+ D&A – capex – change in NWC + asset sales

EBIT:400-180-40-30-80=70

Taxed income70*(1-40%)=42+80

Capital expenditures:42+80-90=32

Change in NWC: (75+110-67)-(50+100-40)=8

NWC=Accounts receivable + Inventory - Accounts payable

+ salvage value or net proceeds from asset sales=0

32-8=24

FCF in 2018 = 42+80-90-8 = 24

FCF in 2019 is 10% higher, so = 24*(1.1) = 26.4

FCF will be 2% higher each year after that.

What is step 2? How do we find the WACC?

Step 1: Identify

Beta=1.2

Risk free rate=4%

Equity Premium=5% (Market risk premium).

Step 2 Use CAPM Equation:

re=rrf+Be(E[rm]-rrf)

4%+1.2×5%=10%

Step 3: Identify and plug into WACC equation.

rdebt=5%

requity=10%

Tax rate=40%

Equity=#Shares*price=8×45=360mil

Net debt=300

WACC=10%*360/660+5%*(1-0.4)*300/660=6.8%

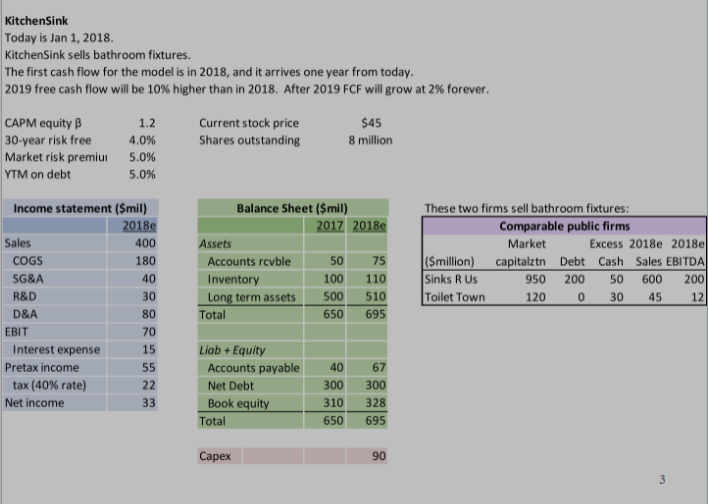

What is step 3 in this equation: How do we find the Enterprise Value?

Step 1: Find the Terminal Value

So all the way back in step 1, we got 24 as our FCF, and the problem states that it increases by 10% in 2019, which makes the FCF of 2019 24/(1.1)²=26.4

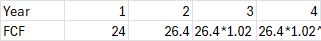

Year | 1 | 2 | 3 | 4 |

FCF | 24 | 26.4 | 26.4*1.02 | 26.4*1.02^2  |

(26.4×1.02)/.068-.02=561→TV is like a cash flow in year 2

.068=WACC .02=g

Step 2: Now that the TV has been found, we can find the EV.

24/1.0681 +26.4/1.068²+561/1.068²=537.45

What is step 4 in this process: How do we find the Market Value of Equity?

EV = Market Value of Equity + Debt – Cash

Since we found the EV in step 3, all that’s left to do is solve for Market Value of Equity

537.45=MVE+300

MVE=237.45

What is step 5 in this process: How do we get our estimate of price per share?

MVE=237.45

237.45/8=$29.68