Aggregate demand

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

19 Terms

What is aggregate demand

Aggregate demand (AD) is the total demand for all goods/services in an economy at any given average price level

How is aggregate demand calculated

AD = Consumption (C) + Investment (I) + Government spending (G) + (Exports-Imports)(X-M)

What is consumption?

Consumption is the total spending on goods/services by consumers (households) in an economy

What is investment?

Investment is the total spending on capital goods by firms

What is government spending?

Government spending is the total spending by the government in the economy: Includes public sector salaries and public goods etc. It does not include transfer

What are net exports?

Net exports are the difference between the revenue gained from selling goods/services abroad and the expenditure on goods/services from abroad.

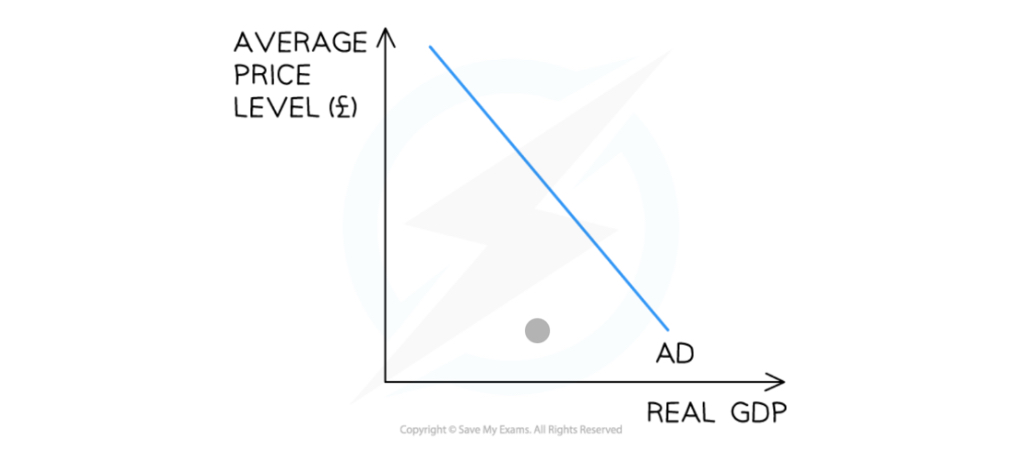

What is shown on an AD curve

The relationship between the average price level and the total output in an economy

Due to three reasons: The interest rate effect, The wealth effect and the exchange rate effect

Explanation of interest rates

At higher average price (AP) levels, there are likely to be higher interest rates.

What is the wealth effect

As AP increases, the purchasing power of households decreases and the AD falls and vice versa

What is exchange rate

With a lower exchange rate, the economy's goods/services are more attractive abroad and exports increase, thereby increasing real GDP

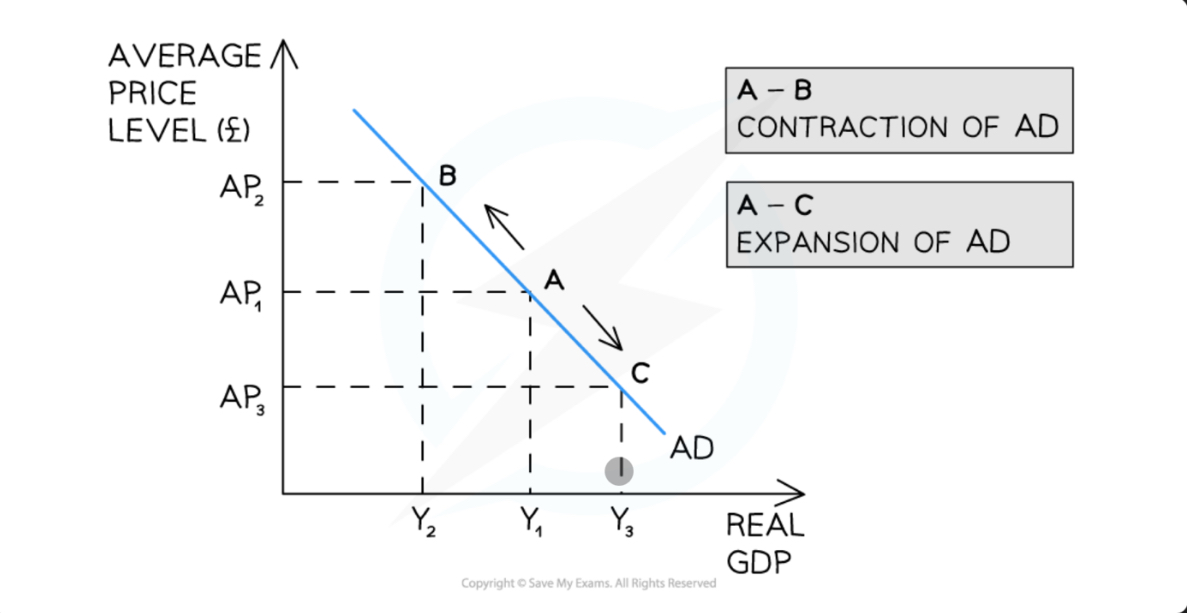

What is a movement along the AD curve

Whenever there is a change in the average price level (AP) in an economy, there is a movement along the aggregate demand (AD) curve

What is A-B

Contraction of AD

What is A-C

Expansion of AD

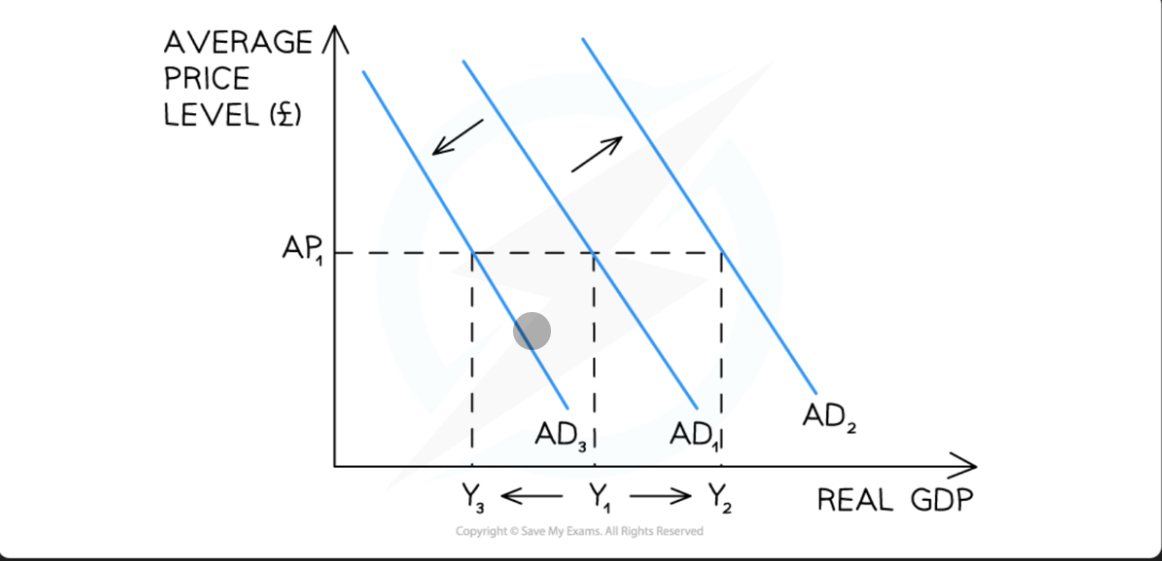

What is a shift of the entire AD curve

Whenever there is a change in any of the determinants of aggregate demand (AD) in an economy, there is a shift of the entire AD curve

What is disposable income

Disposable income is the money that households have left from their salary/wages after they have paid their direct taxes and have received any transfer payments/benefits

Effect of tax on disposable income

If direct taxes like income tax increase, then disposable income decreases and vice

Effect of consumption on disposable income

Consumption increases as disposable income increases and vice versa