Chapter 11-Commerce 1MA3 (Marketing)

1/46

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

47 Terms

Importance of price in the marketing mix

Price is a top factor in buying decisions

It’s the only part of marketing that brings in money

It’s the hardest of the 4Ps to manage

Managers often misunderstand it

Company objectives (orietntation

Profit oriented

Sales oriented

Competitor orientation:Competitive parity

Customer orientation

Profit oriented

Target profit pricing: sets price to reach a specific sales level and profit per unit. Make a specific amount of total profit.

Sets price to hit a sales goal with a set profit per unit.

Maximizing profits: uses a detailed math model to find the price that gives the highest total profit

Target return pricing means setting a price to earn a set profit based on how much money the company spent.

Example: If they spend $100, they might want to make $20 back — so they price to get that 20% profit. Earn a certain % return on the money invested.

Sales oriented

The company aims to grow sales, believing it's more helpful than just boosting profits.

Competitor orientation:Competitive parity

Focus on beating or matching competitors.

Competitive parity: Set prices similar to competitors’ prices.

Customer orientation

It focuses on value and customer satisfaction, setting prices to align with consumer expectations.

5C’s of pricing

company objectives

customers

costs

competition

channel members

customers

Understanding consumers reactions to different prices

Demand curves: Price vs. quantity demanded

Price elasticity: How demand changes with price

Income effect: How income changes buying habits

Substitution effect: Switching products due to price changes

Complementary products: Products that go together, affecting each other's demand

Cross price elasticity: How price change in one product affects demand for another

Costs

Variable costs: Costs that change with production level

Fixed costs: Costs that stay the same regardless of production

Total costs: The sum of variable and fixed costs

Break-even analysis: A calculation to determine when total revenue equals total costs.

Break-even analysis formula

Fixed costs/ (sales revenue-varaible costs)

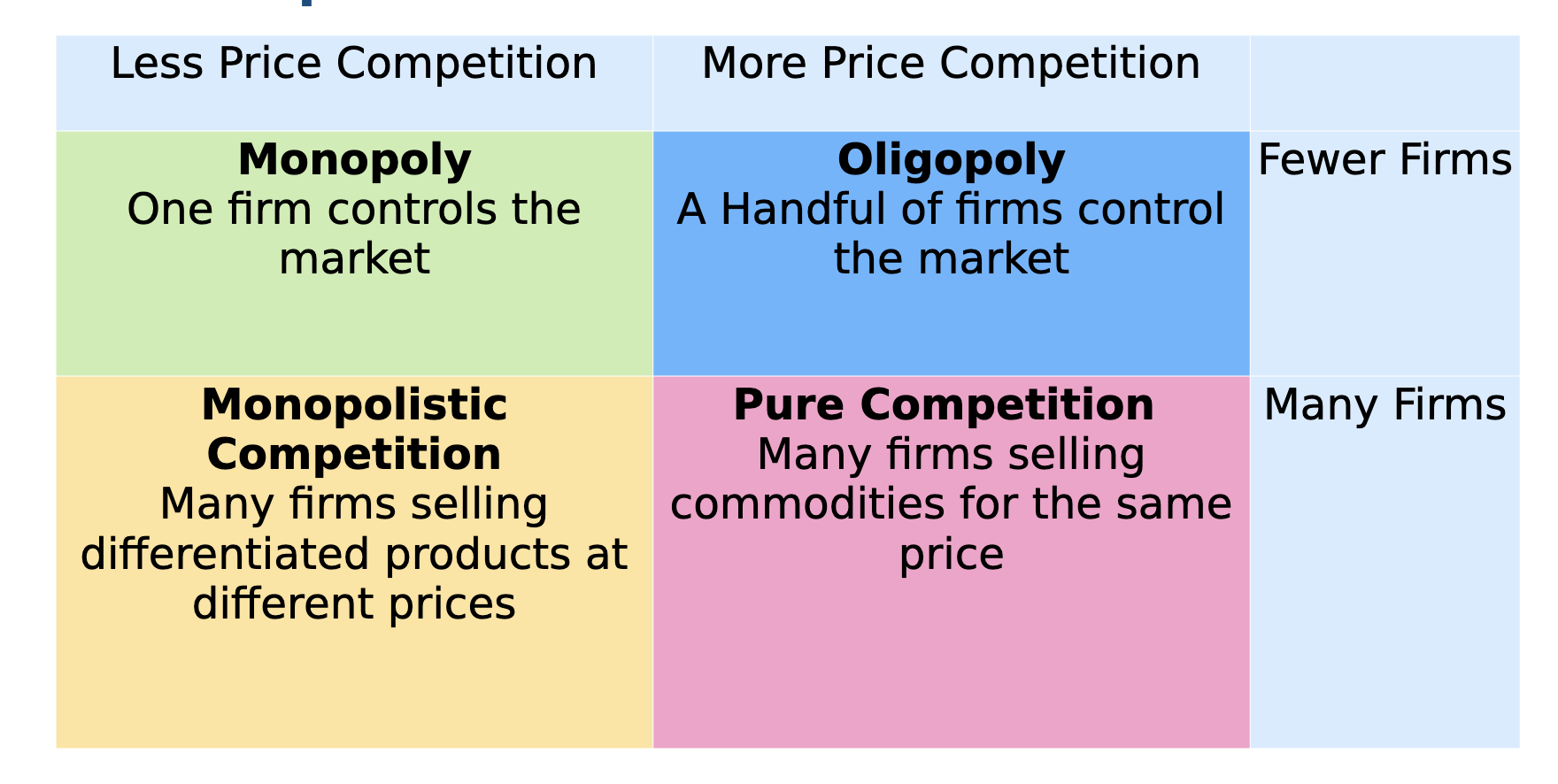

competition graph

different firms price differently

channel members

Different pricing goals can lead to grey-market sales, where products are legally sold through unofficial sellers at lower prices, so brands warn that warranties don’t count unless bought from approved dealers.

Pricing Methods

Cost based pricing:

Competitor based pricing:

Value based pricing:

Improvement value:

Cost of ownership method:

Cost based pricing:

Sets the final price by starting with the cost of making the product, ignoring consumer demand or competitor prices.

Competitor based pricing:

Sets prices based on how the firm wants consumers to view its product compared to competitors.

Setting the price based on how you want your product to look compared to others — cheaper, same, or more expensive.

Value based pricing

Sets prices based on how much the customer believes the product is worth.

Example of value-based pricing:

Apple prices the iPhone high because customers see it as a premium product with strong brand value, design, and features—even if it costs less to make.

Improvement value:

How much more customers are willing to pay for a product because it’s better than similar ones.

estimate of how much more consumers are willing to pay for a product relative to other comparable products

Example: Customers may pay more for a vacuum with stronger suction and longer battery life than cheaper models.

Cost of ownership method:

Cost of ownership method: setting prices that determines the total cost of owning the product over its useful life

cost

compeitior

value

nON SENSE

Cost-based pricing starts with the cost per unit and assumes costs don't change with production levels.

NON SENSE

Sets high prices to show that a product is superior to competitors.

premium pricing

non sense

Value-based pricing: Sets prices based on how consumers perceive the overall value of the product.

Psychological Factors Affecting Value-Based Pricing

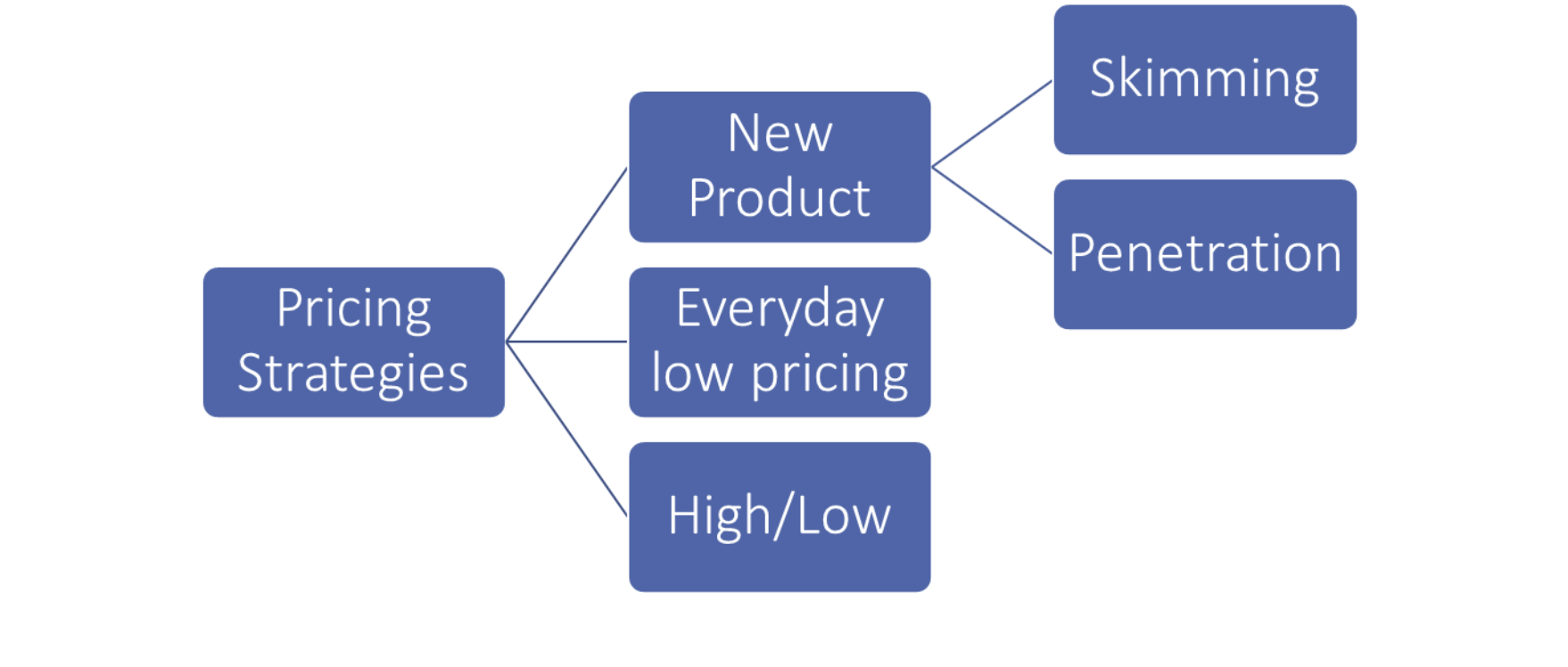

Strategies

Everyday low pricing (EDLP)

Setting prices consistently lower than regular prices but higher than discounts to offer better value than competitors.

high/low pricing

Temporarily lowering prices to encourage more purchases.

Price skimming:

Selling a new product at a high price initially, then lowering it over time to attract more price-sensitive customers as the market saturates.

Market penetration:

Setting a low initial price to quickly gain sales, market share, and profits.

Experience curve effect:

As sales increase, unit costs decrease, allowing for further price reductions.

Shrinkflation

decrease food package sizes while leaving prices unchanged

what are some Price Tactics- CONSUMER

Price lining:

Price bundling:

Leader pricing:

what is pricing tactics

short term methods used to focus on company objectives

Price lining:

Setting a price floor and ceiling for a group of similar products to create a clear range of prices within the product line

Price bundling:

Pricing multiple products together at a single, lower price.

MCDONALDS MEAL

Leader pricing:

Selling an item at a low price to attract customers, hoping they'll buy more.

Consumer Price Reductions

Markdowns:

Coupon:

Rebate: manufactuerur issues discount in which a portion of the purchase price is returned to the buyer in cash

Rebate:

A discount where the manufacturer returns a portion of the purchase price to the buyer in cash.

Business-to-business Pricing Tactics:

Seasonal discounts:

Cash discounts:

Allowances:

Advertising allowances:

Listing allowances:

Quantity discounts:

Seasonal discounts:

An additional discount offered to retailers as an incentive to order merchandise before the usual buying season.

Example of preseason discount: A shoe manufacturer offers retailers a 15% discount on sneakers if they order them before the back-to-school season starts, encouraging early purchases.

Cash discounts:

Cash discount: An additional reduction in price offered to buyers who pay their invoice before the discount period ends.

Example: A supplier offers a 5% discount if the retailer pays the invoice within 10 days.

Allowances:

allowances offered in return to specific behaviors

Discounts given for doing something specific (like early orders or advertising the product).

Advertising allowances: Discounts for featuring the product in ads.

Listing allowances: Payments to get products on shelves or more shelf space.

Quantity discounts

Offering a lower price based on the amount purchased.

Example of quantity discount: A supplier offers a 10% discount if a retailer buys 100 or more units of a product.

Unethical Tactics

Loss leader pricing:

Bait and switch:

Predatory pricing:

Price discrimination:

Price fixing:

Loss leader pricing:

Loss leader: Selling a product at a loss to attract customers, hoping they will buy more profitable items.

Example: A store sells a printer at a very low price, hoping customers will buy ink and paper, which have higher profit margins

Bait and switch:

Attracts customers with a low-priced item, then pressures them to buy a higher-priced item by criticizing the cheaper one.

Predatory pricing:

Setting a low price to drive competitors out of business.

Price discrimination:

Selling the same product to different resellers at different prices.

Price fixing:

Working with other firms to control prices.