Econ externalities

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

25 Terms

Market failure

When goods are underproduced or overproduced, so resources are mis-allocated andthe market is not allocatively efficient

Externality

An externality exists anytime the productionor consumption of a good creates spillover benefits or spillover costs on a third-party not involved in the market.

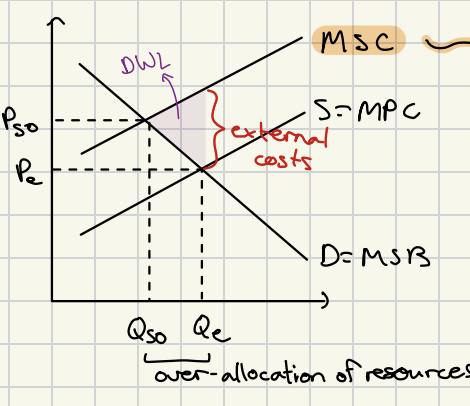

Negative externality

demerit goods, over-allocated

positive externality

under-allocated

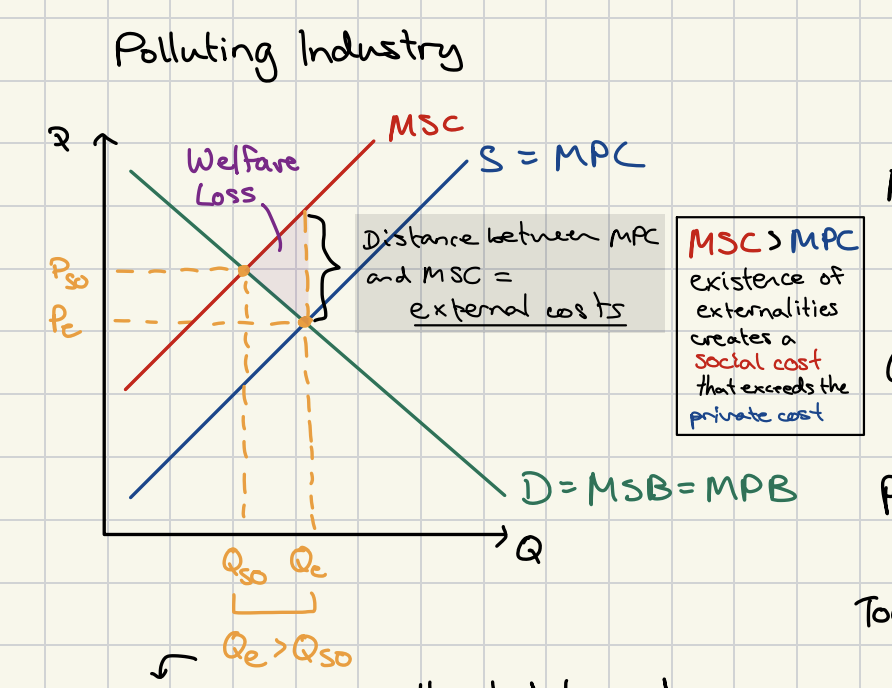

Negative externality production diagram, eg.

polluting firm,

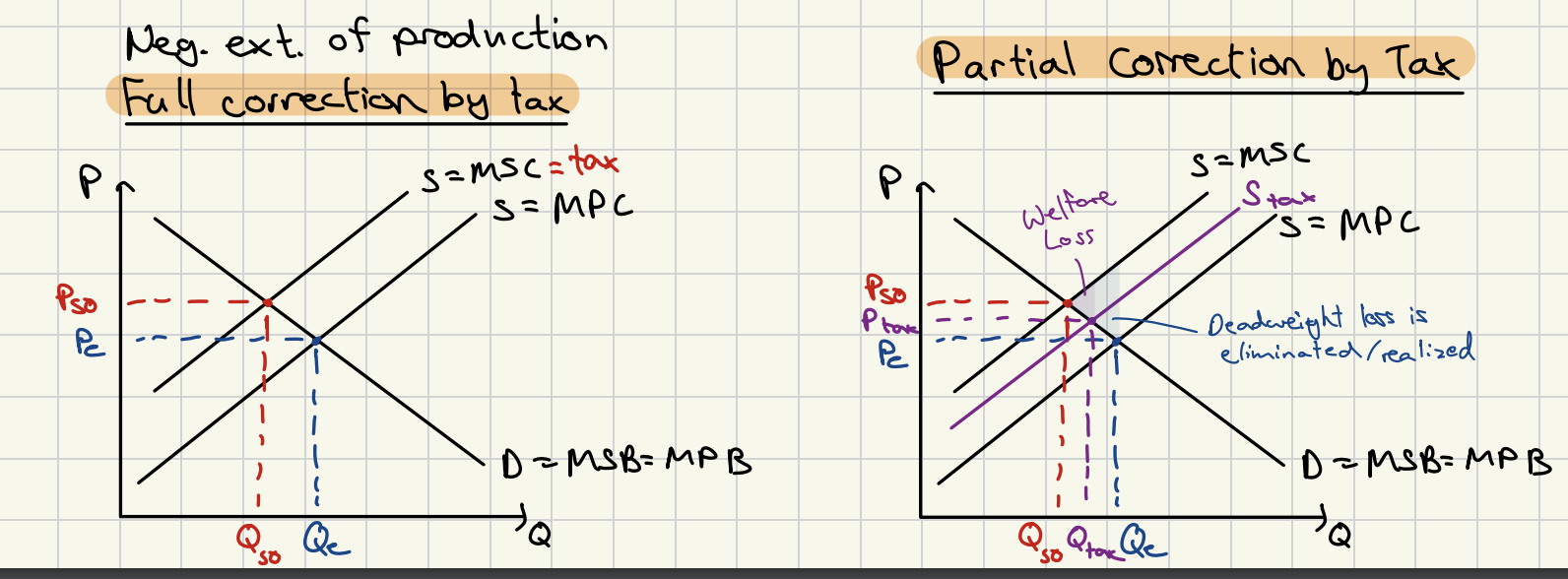

negative externality production diagram - partial and full correction by tax, adv/dis

ADV

Encourages firms to deal with problem in the most efficient way. Causing investment there. |

Irresponsible firms are penalised – but doesn’t affect clean firms. Encourages innovation |

Government revenue is generated |

promotes long term sustainability |

DIS

Policing Costs

Reduces competitiveness – if other countries don’t have tax

Difficult to measure externality – so difficult to set correct tax

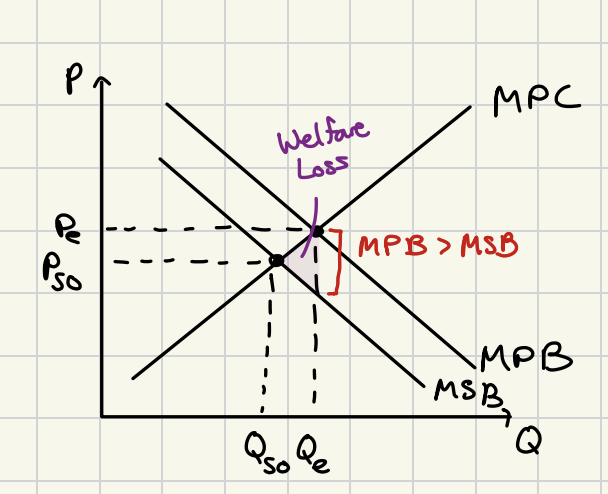

Negative externality consumption diagram, eg

alcohol, cigarettes

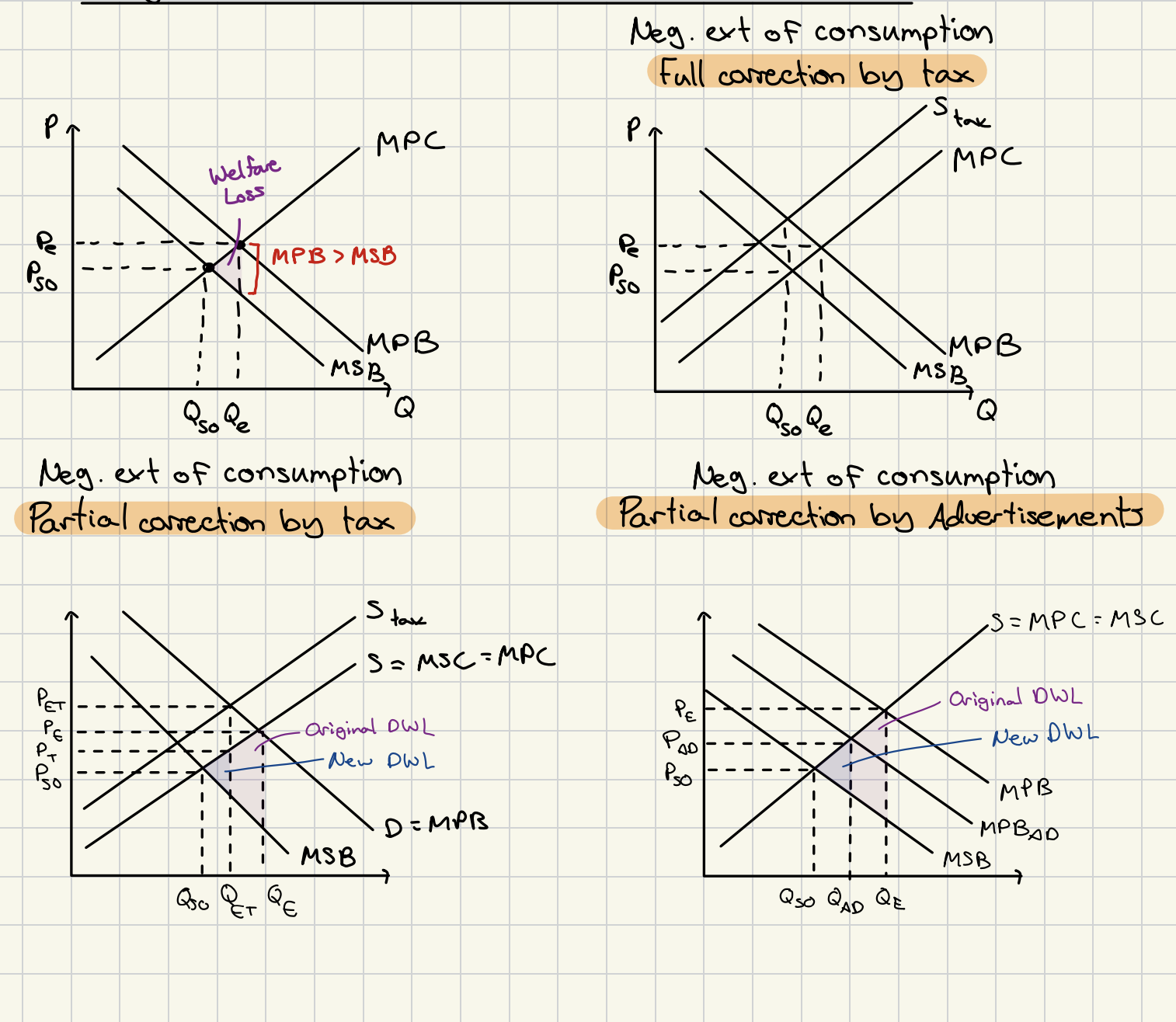

Negative externality consumption

diagram partial and full correction by tax, partial correction by advertisements

adv, dis

Maintains free choice |

Equitable – doesn’t penalise poor like a regressive tax |

May create lasting change |

Generate political support |

Costs money |

Will be ignored by some – so never fully successful |

corrective tax

Per-unit tax on a good meant to reduce supply , increase price, and reduce QD to a more socially optimal level. Meant to correct a failing market and help market achieve a higher level of efficiency 4> Unlike a tax on a good produced efficiently by the free market

carbon tax

Aims to shift consumption - away from carbon-intensive fuel sources

Regulation and legislation

form of partial correction Passing laws or making rules that require certain behaviors of producers and consumers -> to try and produce more socially optimal outcomes

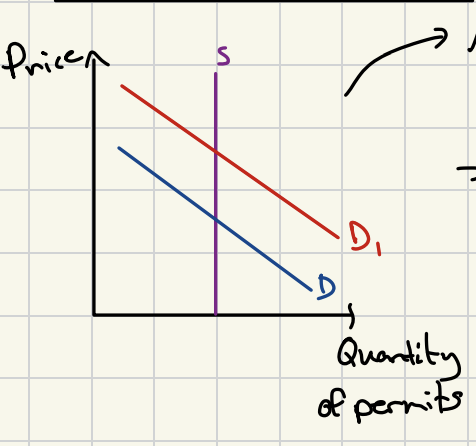

Tradeable permits

only for negative externalities of production

As demand for pollution permits rises, higher prices reward and incentivize 'greenerfirms - > Supply is constant - governments can control the number of Di permits issued to limit pollution

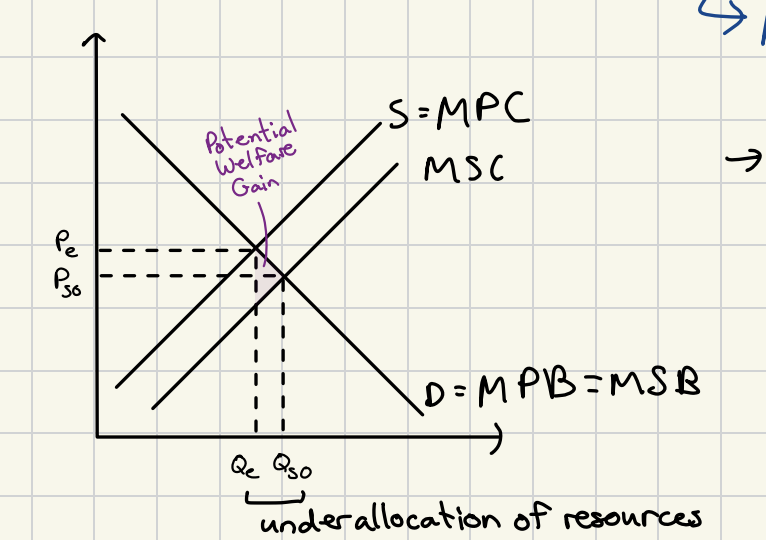

POsitive externality production - diagram and eg

beekeeping, eco-tourism

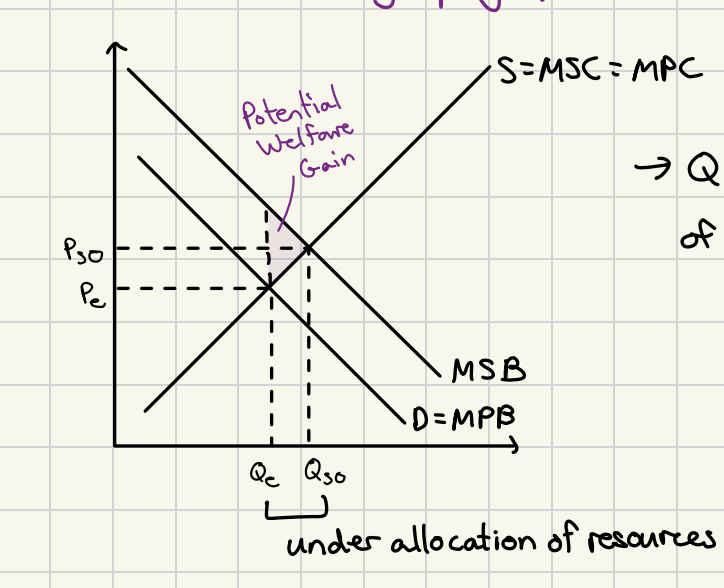

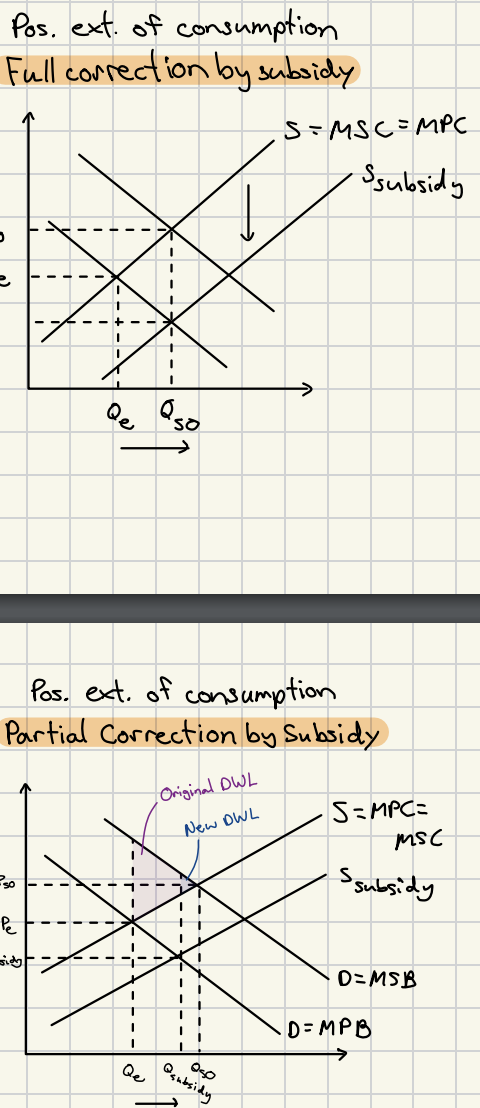

Positive externality consumption diagram and eg

vaccines, education

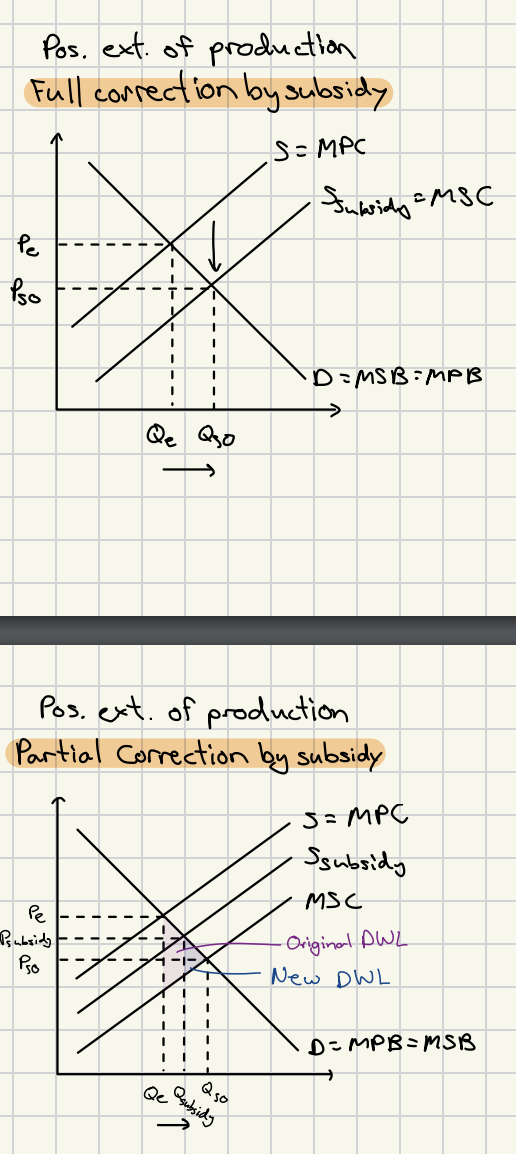

corrective subsidy

a payment from the gov't to producers , lowering the marginal private costs of production, increasing the supply , reducing the price, and increasing the QD

corrective subsidies for consumers

a subsidy to consumers of a good will increase the marginal private benefit on consumption (since individuals get paidto buy a good), increasing thedemand for a ter good. Higher price incentivizes firms to supply grea Exam Question : quantity, causing a more efficient allocation of - > Subsidy Q's resources towards the good .

Government provision

Many merit goods are provided directly by the gov't ↳ Ex. education, healthcare, infrastructure, police security

Positive advertising

Gov't programs that educate consumers about the positive private andsocial benefits ofa good to increase demand, incentivizing firms to produce more

Public good

A good which provides benefits to society which are non-rivalrous, and the benefits of which are non-excludable by the provider of the good

non -excludable

once the good is provided, you can't prevent people from consuming the good

non-rivalrous

one consumer's enjoyment of the benefits of the good does not diminish others enjoyment of its benefits

Common pool access goods/public goods

natural resources over which there is no private ownership, and therefore no effective means of regulating the use of the resource

Rivalrous and provided by government bcs of free riders

Tragedy of the commons

Lack of ownership over the resources creates an incentive for potential users to exploit them to the fullest extent possible

People try to exploit the resource as much as possible before other users extract and exploit this resource

Ultimately leads tothe depletion of the resource

Tragedy of commons diagram

same as negative externality of production

solutions for common access resources

Privatization - assigning private ownership ofa resource, creating an incentive among private owners to protect and manage its use in a sustainable manner, so as to benefit from it's existence into the future

Government Management - strict gov't control over the access to and use of common resources may limit access to them to a sustainable level -

Tradeable Permits - Issuing permits to private users to allow a 4 certain amount of extraction in a period of time may limit the exploitation of the resource to a sustainable level (eg. fishing permits)