Edexcel A-level Economics Theme 4

1/134

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

135 Terms

Globalisation

The process in which national economies have become increasingly integrated and interdependant

Trade liberalisation

Trading blocs

Growth of MNCs

Technological advances

Greater mobility of labour and capital

Causes of globalisation (5)

Advantages of globalisation (5)

Lower prices

Benefits of trade

Greater employment

Large economies of scale

Free movement of labour and captial

Disadvantages of globalisation (6)

Growing inequality

Higher structural unemployment

Environmental costs

Trade imbalances

Risk of external shocks

Less cultural diversity

Absolute advantage

When a country can produce a product using fewer factors of production than another nation

Comparative advantage

A country should specialise in the goods and services it can produce at the lowest opportunity cost, and then trade with another country

Specialisation

When a worker, firm, region or country produces a narrow range of goods and services

Advantages of specialisation (5)

Larger range of goods and services

Greater output

Greater quality

Benefits of trade

Reduces problem of scarcity

Disadvantages of specialisation (5)

Finite resources

Over-reliance on weather

Changing tastes/fashions

Interdependence

De-industrialisation

Terms of trade equation

(Weighted average of export prices) x (Weighted average of import prices) x100

Terms of trade

Indicates the quantity of exports that must be sold to purchase a given level of imports

Factors influencing the terms of trade (short run)

Change in demand/supply of exports/imports

Inflation rates

Exchange rate movements

Factors influencing the terms of trade (long run)

Incomes

Productivity

Technology

Trading bloc

A group of countries that join together and agree to increase trade between themselves

Free trade area

No trade barriers

Can trade with other countries

Customs union

No trade barriers

Common external barrier

Common market

No trade barriers

Common external barrier

Free movement of labour and capital

Monetary union

No trade barriers

Common external barrier

Free movement of labour and capital

Common currency and central bank

World Trade Organisation (WTO)

International organisation that regulates world trade

WTO's ideal world trade (5)

Non-discriminatory

Free from barriers/protectionism

Predictable

Promotes fair competition

Beneficial for developing countries

Role of WTO (7)

Set and enforce rules of international trade

Resolve trade disputes

Provide a forum for negotiating trade liberalisation

To monitor further trade liberalisation

Increase transparency of decision making process

Help developing countries benefit

Cooperate with other major economic instituions

How WTO conflicts with trading blocs (5)

Distort world trade

Averse effects on non-member states

Inefficient allocation of resources

Increased protectionism

WTO loses power as trading blocs become more powerful

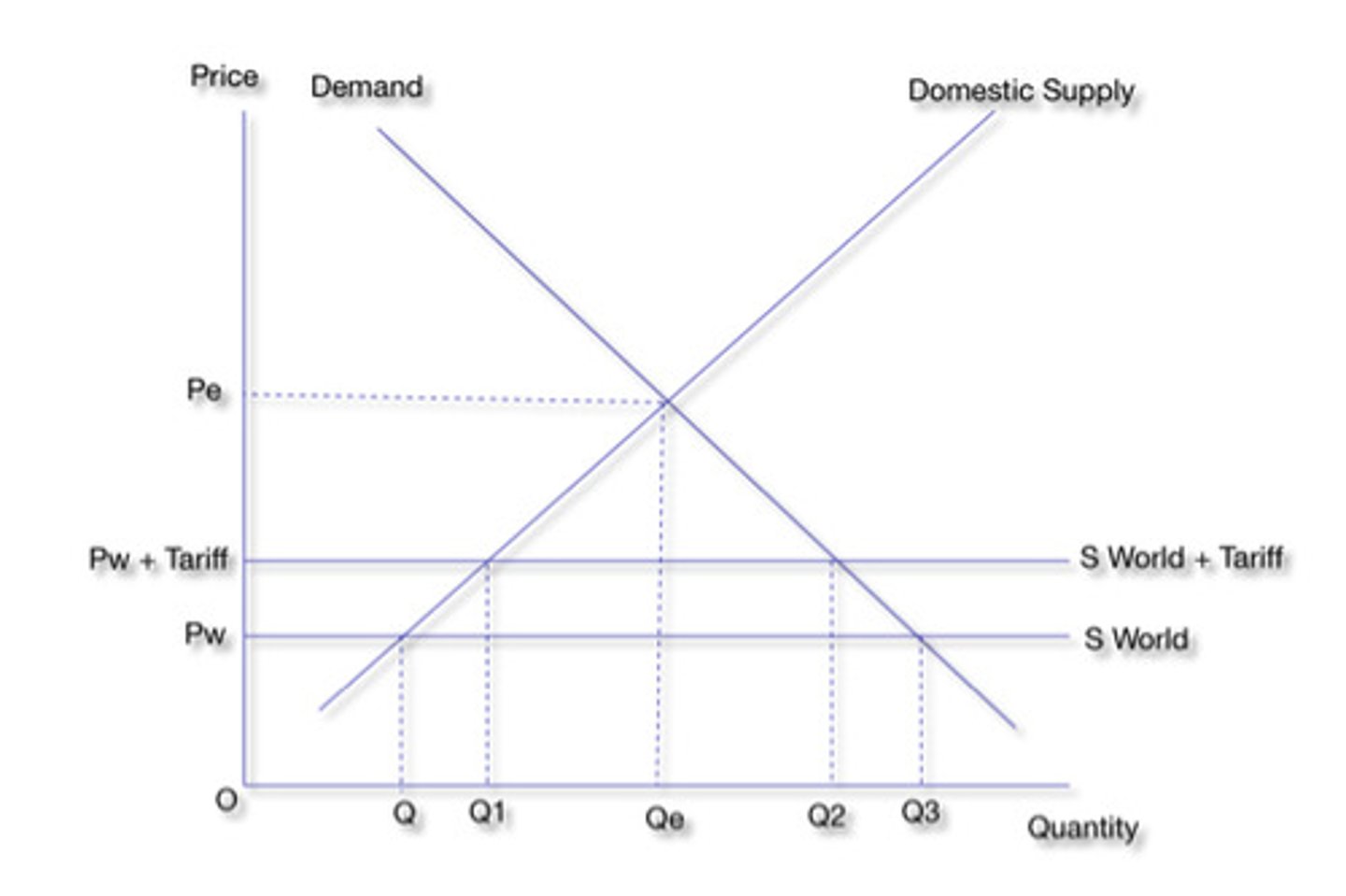

Tariff

Tax on imports

Tariff revenue =

(Sw+t-Sw) x (Q4-Q3)

Quota

Quantity limit on amount of imports

Trade subsidy

Subsidy given to domestic suppliers

Aim of trade subsidy

To reduce costs of production → passed onto consumer as lower prices → makes firm more competitive

Non-tariff barriers

Voluntary export restraint (countries limit exports to each other

Intellectual property laws (patents, copyright etc)

Technical barriers (health and safety etc)

Financial protectionism (govt. tells banks to prioritise local firms when allocating loans)

Hidden protectionism (discrimination against foreign workers)

Exchange controls (limit of capital flows between countries)

Currency intervention (competitive devaluation)

Balance of Payments

Measures the inflows and outflows of money into and out of a country

Components of the current account

Trade in goods (trade balance)

Trade in services (trade balance)

Income e.g. remittances (income balance)

Transfers - govt. fees e.g. aid, EU payments (income balance)

Causes of current account surplus (6)

Exporting more than importing

Recession

Competitive exports (deflation/disinflation/high quality exports)

High level of natural resources

Exports worth more than imports

High levels of exports

Causes of current account deficit (6)

Importing more than exporting

Sustained economic growth

Uncompetitive exports (inflation/poor quality products)

Low level of natural resources

Exports worth less than imports

Low levels of exports

Components of financial account (3)

FDI

Portfolio investment

Reserves

Capital account

Minor payments/transfers

Floating exchange rate

Currency value set by market

No govt. intervention

No target for exchange rate

Speculation causes change in floating exchange rate

e.g. British Pound

Advantages of a floating exchange rate (4)

Reduces need to hold large foreign currency reserves

Freedom to set interest rates

Automatic correction

Less risk

Disadvantages of floating exchange rate (2)

Can be volatile - reduces FDI

A lower, more competitive exchange rate does not guarantee a current account surplus

Fixed exchange rate

Govt. fixes currency value to another currency

Central bank must hold sufficient currency reserves

e.g. Chinese Yuan

Advantages of a fixed exchange rate

Stability attracts FDI

Stability controls inflation

Leads to lower borrowing costs

Less speculation

Disadvantages of a fixed exchange rate

Cannot use interest rates in macro policies (monetary policy)

Developing countries may not have sufficient foreign currency reserves to fix

Devaluation of exchange rate leads to cost-push inflation

Managed exchange rate

Currency value set by market forces

Central bank occasionally intervenes

Currency is a key target of monetary policy

e.g. Japanese Yen

Competitive devaluation intentions

Make exports cheaper and imports more expensive

Increases growth

Increases inflation

Improved current account

Revaluation

When the value of the currency is adjusted

Appreciation

When the value of the currency increases

Devaluation

When the value of the currency is lowered in a fixed exchange rate system

Depreciation

When the value of the currency falls

Factors influencing exchange rates

Inflation

Speculation

Other currencies

Govt. finances

Balance of payments

International competitiveness

Government intervention in the currency markets - interest rates (hot money)

An increase in interest rates is more attractive for foreign investors

This increases demand for currency, appreciating the value of the currency

Government intervention in the currency markets - quantitative easing

Increases supply of money and depreciates currency

Government intervention in the currency markets - foreign currency transactions

Buying and selling foreign currency to manipulate domestic currency

International competitiveness

The ability of a nation to compete successfully overseas and to sustain improvements in living standards and output

Components of international competitiveness

Price competitiveness

Non-price competitiveness

Ability to attract FDI

Unit labour costs =

Total labour cost / output

Relative export prices

Ratio of one country's export prices relative to another country

Factors that influence international competitiveness (8)

Unit labour costs

Labour flexibility

Labour skills

Tax regimes

Innovation

Infrastructure

Regulation

Economic stabilility

Absolute poverty

Cannot access the most basic, life sustaining goods and services

Relative poverty

Incomes below a given average in society

Equity

Fair distribution of income

Equality

Equal distribution of income

Causes of poverty (10)

Unemployment - structural and cyclical

Poor education/skills

Poor health/healthcare

Born into poverty

Tax cuts for the rich

Subsistence agriculture

Natural disasters

Corruption

Wars and conflicts

Regressive taxes

Income

A flow measured over a given period of time

Wealth

A stock; assets with a market value that can generate income

What are the 2 measurements of inequality?

Lorenz curve - visual indicator

Gini coefficient - mathematical indicator

Causes of inequality

Wages - underemployment and discrimination

Regressive payments and taxes

Unemployment

Inequality between countries

What 3 areas does the Human Development Index (HDI) measure and how?

Education - adult literacy, school enrolment

Health - life expectancy

Living standards - GDP/capita, PPP

How is each measure in the HDI weighted?

Equally

Advantages of the HDI

Broad measure

Focuses on development outcomes

Allows progress to be measured over time

Disadvantages of the HDI

Distribution of income/inequality not measured

No weighted averages

No measures of freedom and choice

Other factors not measured (e.g. crime, corruption, negative externalities, poverty)

Other indicators of development

Gender-related Development Index (GDI)

Human Poverty Index (HPI)

Factors influencing growth and development (11)

Primary product dependency

Harrod-Domar Model

Foreign currency gap

Capital flight

Demographic factors

Debt

Access to credit and banking

Infrastructure

Education/skills

Property rights

Non-economic factors

Primary product dependency

Developing countries rely on primary products/raw materials

Volatile prices makes long-term planning difficult

Fall in prices leads to fall in export incomes, funding for infrastructure and education falls

Not sustainable as resources are finite

Harrod-Domar Model

Investment, saving and technological change are required for economic growth

(Developing countries do not have this)

Harrod-Domar Model: rate of growth =

Savings ratio / capital output ratio

Foreign currency gap

Current account deficit > value of capital inflows

Capital flight

When money leaves the economy through outward investment

Triggered by economic threat (e.g. hyperinflation)

Demographic factors

High birth rate links with poverty and environmental damage

Debt

Links with poverty and inequality

Access to credit and banking

Difficult to save in a country with a poor banking system

Infrastructure

Poor infrastructure discourages FDI due to high production costs

Education/skills

Important for developing human capital

Ensures that the economy can be productive and produce high quality goods and services

Property rights

No property rights mean that entrepreneurs cannot protect their ideas

No incentive to innovate

Non-economic factors (3)

War

Corruption

External shocks

Market-orientated strategies for growth and development (7)

Trade liberalisation

Promotion of FDI

Removal of subsidies

Floating exchange rate systems

Microfinance schemes

Privatisation

Trade liberalisation

Free trade increases world GDP

Promotion of FDI

Creates employment

Encourages innovation

Promotes long-term, sustainable growth

Provides developing countries with funds to invest and develop

Removal of subsidies

Subsidies distort the free market

Leads to inefficient allocation of resources

However, certain goods will be under-provided (e.g. farming)

Floating exchange rate systems

Determined by the market mechanism

Microfinance schemes

Distribution of small loans to individual entrepreneurs to stimulate growth

Reduces dependency on primary products

Reduces inequality

Privatisation

Govt. sells a firm to a private company

Increases efficiency

Increases quality

Increases allocative effieciency

Increases govt. revenue

Interventionist strategies for growth and development (6)

Development of human capital

Protectionism

Managed exchange rates

Infrastructure development

Joint ventures with global companies

Buffer stock schemes

Development of human capital

Improves productivity

Helps countries move up supply chain

Advantages of protectionism

Reduces trade deficit

Protects infant industries

Disadvantages of protectionism

Distorts the market → loss of allocative efficiency

Higher prices

Less choice

No competition → no incentive to increase efficiency

Tariffs are regressive

Risk of retaliation

Infrastructure development

Lower supply costs

Increases mobility of labour

Attracts FDI

Increases employment

Joint ventures with global companies

Partnership between 2 global firms

Increases technological knowledge

Foreign markets

Advantages of buffer stock schemes

Reduces price volatility

Incomes of farmers remain stable

Disadvantages of buffer stock schemes

Historically unsuccessful

Govt. may not have financial resources to buy up stock

Storage is difficult and expensive

Other strategies for growth and development (3)

Fairtrade

Aid

Debt relief

Advantages of fairtrade schemes

Ensures farmers recieve fair price for goods

Helps farmers plan for long-term due to stable income

Encourages sustainability, environmental protection and stops child labour

Disadvantages of fairtrade:

Distorts market

Non-fairtrade