Exchange Rates

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

24 Terms

Exchange Rate Systems

An exchange rate is the price of one currency in terms of another e.g. £1 = €1.18

International currencies are essentially products that can be bought & sold on the foreign exchange market (forex)

The Central Bank of a country controls the exchange rate system that is used in determining the value of a nation's currency

There are three exchange rate systems

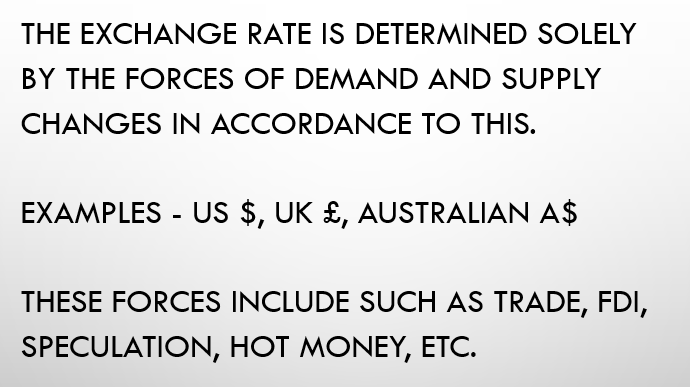

A floating exchange rate

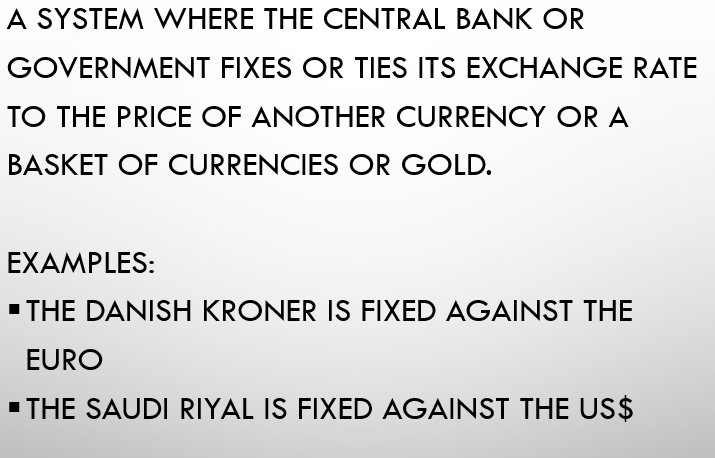

A fixed exchange rate

A managed exchange rate

Exchange Rate Systems

Exchange Rate System | Explanation |

|---|---|

Floating

|

|

Fixed

|

|

Managed

|

|

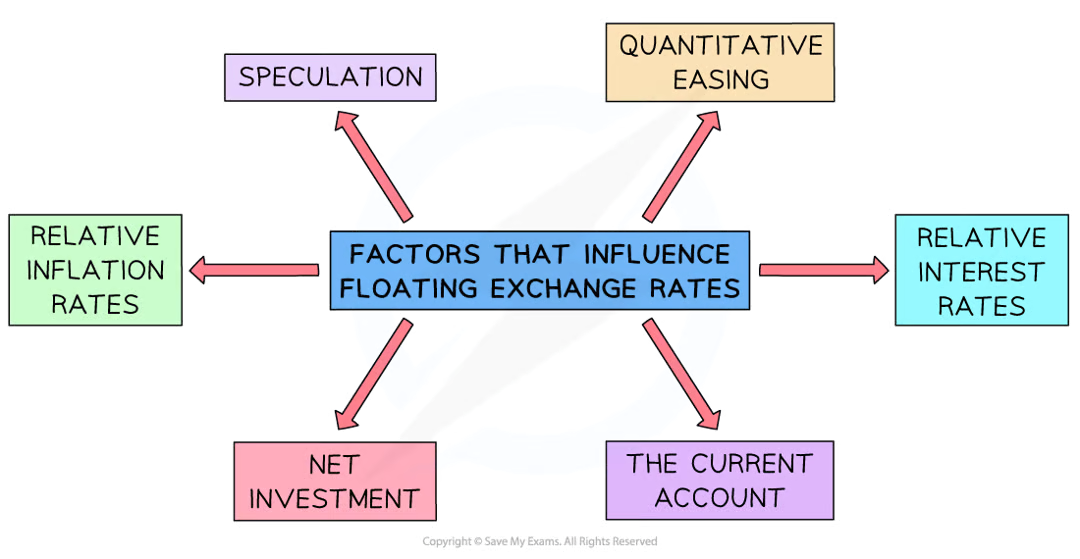

Factors Influencing Floating Exchange Rates

Numerous factors influence floating exchange rates, resulting in an appreciation or depreciation of a currency

Relative interest rates:

influence the flow of hot money between countries. If the UK increases its interest rate, then demand for £'s by foreign speculators increases & the £ appreciates. If the UK decreases its interest rate, then the supply of £'s increases as speculators sell their £'s in favour of other currencies & the £ depreciates

Relative inflation rates:

as inflation in the UK rises relative to other countries, its exports become more expensive so there is less demand for UK products by foreigners, which means there is less demand for £s & so the £ depreciates

Net investment:

oreign direct investment (FDI) into the UK creates a demand for the £ which leads to the £ appreciating. FDI by UK firms abroad creates a supply of £'s which leads to the £ depreciating

The current account:

UK exports have to be paid for in £'s. UK imports have to be paid for in local currencies, which requires £'s to be supplied to the forex market. Due to this, an increasing trade surplus will result in an appreciation of the £ & an increasing deficit will result in a depreciation of the £

Speculation:

the vast majority of currency trades are speculative. Speculation occurs when traders buy a currency in the expectation that it will be worth more in the short to medium term, at which point they will sell it to realise a profit

Quantitative easing:

involves increasing the money supply & much of the new supply is used to buy back gilts. Many of these gilts are owned by foreigners who then exchange the £s received for their own currency. The increase in the supply of £'s depreciates the £

Intervention in Markets Using Forex Transactions & Interest Rates

Changing interest rates: if the Central Bank wants to appreciate the country’s currency, it would raise interest rates thereby making it more attractive for foreigners to move money into the country's banks (hot money). Decreasing interest rates has the opposite effect & causes a depreciation

Buying & selling currency in the forex market: The Central Bank can change the demand or supply for their currency using their reserves. If they want to appreciate the currency then they buy it on the forex market using foreign currencies e.g. to bolster the value of the £, the Central Bank could take US$'s from their reserves & buy £'s. If they want to depreciate the currency then they sell their own currency & buy foreign currencies

The Consequences of Competitive Devaluation/depreciation

When a currency is intentionally devalued/depreciated by a government, it makes the country's exports cheaper

If demand for their exports is price elastic, then the country is likely to experience higher export volumes & higher export revenues

E.g. for many years China prevented the value of their currency from appreciating & saw a boom in their export sales

Intentional devaluation/depreciation has several consequences

It is anticompetitive & upsets international competitors

Large countries usually have more financial resources to manipulate markets & so gain unfair advantages over smaller countries

Other countries may respond by also lowering the value of their currencies resulting in very little change to market share

The devaluation/depreciation raises the cost of imports used in production & with little change to the value of exports - profits decrease

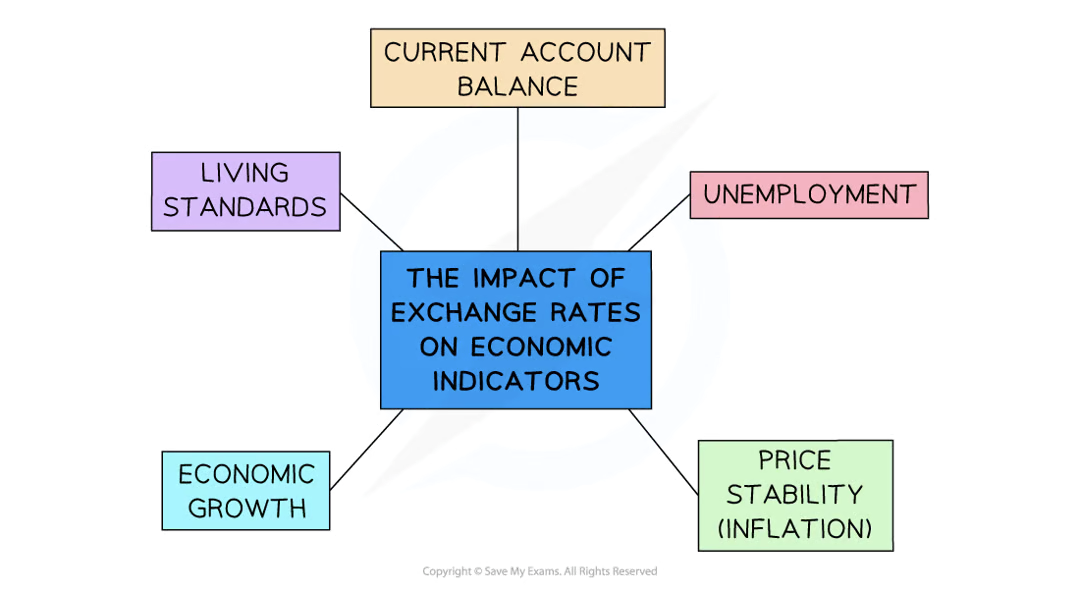

Impacts of Changes in Exchange Rates

Changes to exchange rates may have far-reaching impacts on an economy

The impact of changes to exchange rates on an economy

Economic Indicator | Explanation |

|---|---|

The Current Account |

|

Economic growth |

|

Inflation |

|

Unemployment |

|

Living standards |

|

Foreign direct investment (FDI) |

|

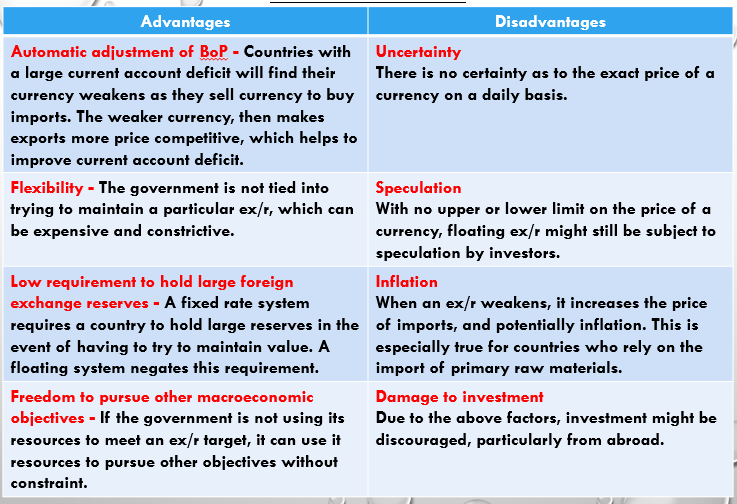

Floating exchange rates:

Advantages and disadvantages of floating exchange rates

Fixed exchange rates:

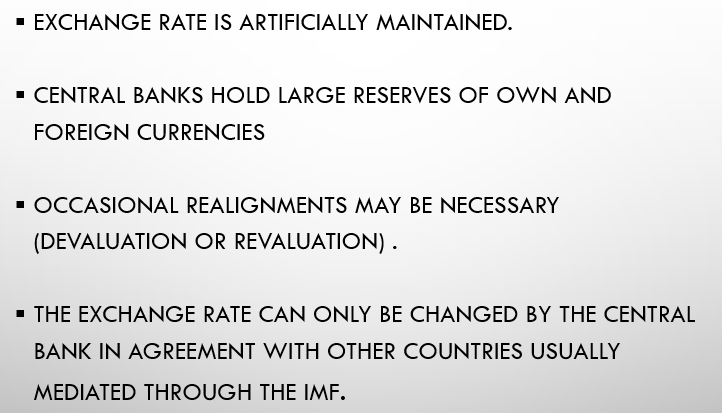

CHARACTERISTICS OF A FIXED EXCHANGE RATE SYSTEM

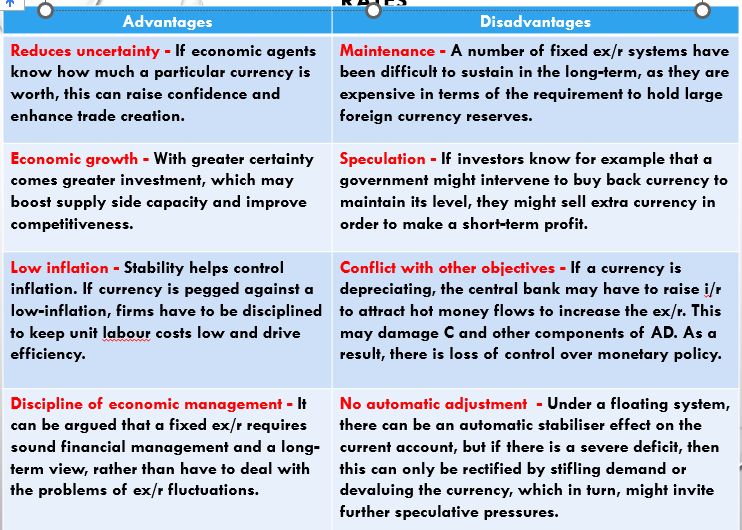

Advantages and disadvantages of fixed exchange rates

Managed floating exchange rate

Exchange rate is primarily determined by demand and supply, but the central bank or government may intervene on occasion to influence its value (in the event of a danger of the upper or lower limits being breached).

The exchange rate is controlled through the buying and selling of the country’s currency on the forex market and through changes in interest rates.

The currency becomes a key target of monetary policy

Higher rate as instrument to stabilise inflation

- ‘competitive devaluation’ to improve competitiveness

Managed floating was a policy pursued in the UK from 1973-1990

Distinction between revaluation and appreciation and devaluation and depreciation of a currency

Revaluation and devaluation occurs under a fixed ex/r system when a government decides to officially adjust the value of its currency upwards or downwards.

Appreciation or depreciation occurs under a floating ex/r system when the value of a currency changes due to D&S.

Which Factors influence the value of a currency in a floating exchange rate system?

Relative inflation rates

Relative interest rates

The CA of the Balance of Payments –

Net investment

Speculation – (hot money)

Quantitative Easing

Domestic and global income levels