BU111 - Midterm

1/96

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

97 Terms

SWOT

Strengths, Weaknesses & Opportunities, Threats

Why is SWOT important?

Use the strengths to take advantage of opportunities or build competitive advantage.

Understand weaknesses and mitigate or fix them.

Identify threats and use or build strengths to protect

Role of Strategy

Good strategy aligns with environment and utilizes internal resources; unique to each organization

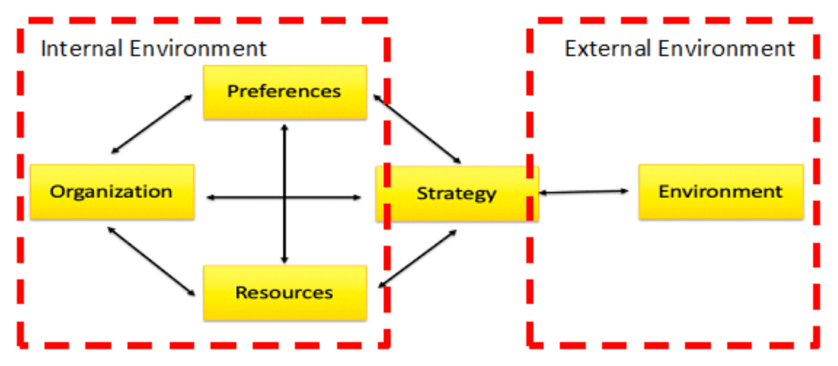

Diamond-E Framework

Brings more structure to the SWOT by identifying specific categories of items to consider and recognizing how the individual factors connect.

External Environment

Identify opportunities and threats in the external environment.

Understand market trends, competitor actions, and regulatory factors.

Determine what actions are necessary to capitalize on opportunities or mitigate threats.

Internal Environment

Assess management preferences, organizational resources, and capabilities.

Determine what the organization wants to achieve and what it's capable of achieving.

Identify strengths and weaknesses within the organization.

Alignment of Strategy

Develop a strategy that aligns with the opportunities and threats in the external environment.

Ensure the strategy is consistent with the organization's goals, resources, and capabilities.

Adjust internal organization as needed to support the chosen strategy.

Strategic Implementation

Execute the strategy while considering both external and internal factors.

Monitor environmental changes and adapt strategy accordingly.

Ensure internal processes and structures support the strategy's execution.

Canon & Kodak example

Canon's early investment in digital photography was risky due to uncertainty about its success and popularity. However, Canon's investment paid off, positioning them ahead in the digital photography and in contrast, Kodak's failure to adapt to digital photography led to bankruptcy.

Highlights the importance of strategic decision-making in response to changing environmental conditions.

KSF (Key Success Factors)

Gathers all the required activities and resources that are crucial to business success

Employees - KSF

Enable operation for the company and make it possible for the company to function. Ultimately bring value to the company

Acquiring loyal and productive employees = a high level of performance in the workplace.

Hire, train, motivate

Customers - KSF

Pay for products and services - provide revenue.

Create local advocates. Happy customers = less likely to switch competitor products & more free promoters.

Target, understand, anticipate, satisfy - NARROW DOWN THE TARGET MARKET

Products and Services - KSF

Create revenue means

Hold value, consistency, reliability. Offer products and services at the level of expectations target customers expect; providing it consistently and reliably.

Choose what quality levels to pursue and how many features to add. Provide and sell something valuable. Define, inputs, processes.

Innovation & Creativity - KSF

Improve and become more efficient or effective. Environmental alignment; improvement.

Meaningful and valuable change. Developing and implementing new approaches; includes everything from strategy to the hiring process.

EXTERNAL: Determines what would be innovative vs. just a change.

INTERNAL: How the structure and reward is created.

Culture, structure, rewards. Recognize ideas implemented and encourage even risk-taking.

Uniqueness - KSF

Market advantage - Ability to charge higher prices and attract/retain customers. allows for higher supplier power.

Allows the firm to be strategically, and financially valuable amongst its competitors. Valuable and sustainable differentiation from competitors.

Ex: serving a particular group, producing more cheaply than others, better quality inputs than anyone else, or simply more innovative (providing something brand new).

Understanding market values and competitor strategy. NEEDS TO BE TOUGH for other competitors to acquire, do, or copy.

Competitor and market insight; Unique resources or capabilities.

Financial Resources - KSF

Enables growth - Allows the firm to pay for the activities needed for the organization to function.

Achieved through good strategic decisions and efficient use financial resources. Comparatively better than other firms & improving profit, ROI.

Affected by prices charged, how much money is borrowed, and how much interest expenses are paid. Consider economic conditions at stake: spending habits (inflation, recession, etc.). Sound Strategic decisions; Efficient and effective execution.

ROI (Return on Investment)

A ratio that measures the profitability of an investment by comparing the gain or loss to its cost

KPI (Key Performance Indicators)

An overview of the performance that links back to the key activities needed for success in each area, to properly achieve KSFs.

Tracking performance allows firms to anticipate issues, causes of problems, and identify explicit targets to work towards for improvement in performance.

Employee Commitment - KPI

Turnover: Percentage of people who leave and must be replaced.

Applications: Number of applications for a job determines attractiveness of a job. Also determined by reputation of employer or your employer brand equity —> important for hiring the best talent.

Productivity: Measured by sales generated per salesperson or number of units produced per employer.

Customer Satisfaction - KPI

Market share: Analysis of a firm’s market share compared to other firms of similar size within the same industry. Obtains understanding of how the company is viewed by consumers.

Share of wallet: Overviews percentage of consumers who spend their total spending on the firm’s specific product in comparison to other firms within the same industry of the SAME product.

Churn: # of customers leaving for competitors per year.

Net promoter score: The likelihood a customer would recommend the company/product/service to someone else.

Quality Products and Services - KPI

Returns: The percentage of products returned to company after purchasing.

Defects & warranty claims: Indicate a product is not delivering the expected level of reliability.

Waste: Measures the number of inputs relative to outputs; computes the consistency of processes.

Innovation & Creativity - KPI

Idea generation: Significant starting point for innovation; measuring how many ideas are inputted, is valuable – indicates how the culture, structure and reward system is within a firm.

New products: Development and launch of new/original goods or services in the market, reflecting tangible manifestations of innovation.

New approaches: Innovative strategies, methods, or processes introduced to solve problems or achieve goals.

Cycle time: measures how fast an idea becomes an adopted approach or product.

Uniqueness - KPI

Strong & unique reputation: Whether the company thrives based off its reputation (known for something specific) or known for doing something different from its competitors. Gages type of uniqueness.

Superior comparative: Overviewing financial statement, compared to its competitors, we can gains a quantitive measure of our advantages and disadvantages.

Performance: Comparing, we understand that others may have better gross margins, charge higher prices yet retain lots of customers, able to product at lower costs than others, or higher applications/lower turnover for its employees.

Financial Resources - KPI

Profitability: measures revenues, gross profit, profit margin, return on investment (ROI)

Growth: In all sectors (revenues, profit, ROI), indicates that the company is continuously getting better at how well it is executing strategy and operations.

Firm value: significant measure if the company is going to try to use equity financing by selling shares of if the owners are planning on selling the company.

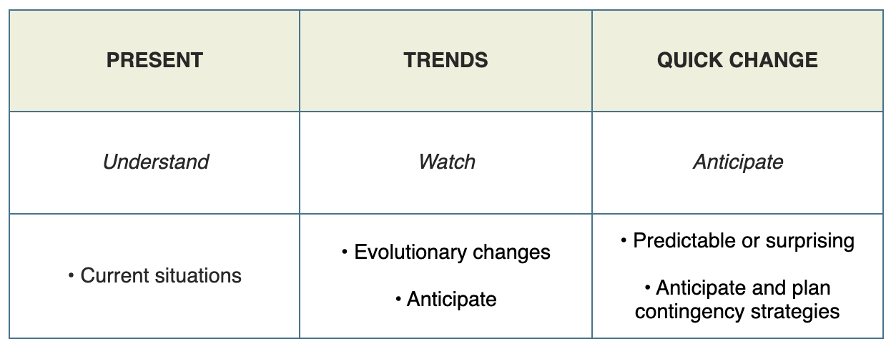

Two types of changes in External Environment

Evolutionary change: Occurs with trends over time when circumstances change. An example – there is a trend toward buying online and doing more research online before you buy; there is a trend toward healthier living. Trends are easy to identify if you look for them and should be incorporated into your strategic planning.

Revolutionary change: Occurs when it is relatively quick in comparison to trends, such as a change in legislation, a new trade agreement, a change in interest rates, a change in the value of the dollar, or a new technological advancement.

How to look and what to for in an External Analysis

The Macro-Environment

P - Political

E - Economical

S - Social

T - Technological

Political - PEST

Affect consumer and business protection and can create expansion opportunities through trade agreements.

Government regulations influence industry entry barriers, like banking regulations.

Fair competition and competition intensity are maintained through legislation, trade agreements, and regulations.

Economic - PEST

Impact operating costs, including inflation and exchange rates for imported supplies.

GDP, inflation, and interest rates affect consumer spending and expansion funds availability.

Social - PEST

Encompass customer and employee values, attitudes, habits, and customs, shaping product offerings and company actions.

Demographics, including income, education, location, and age, influence consumer and employee interactions and needs.

Technology - PEST

Availability and quality dictate product capabilities, operational methods, and innovation necessity.

Advancements can lower entry barriers and demand continuous adaptation and learning.

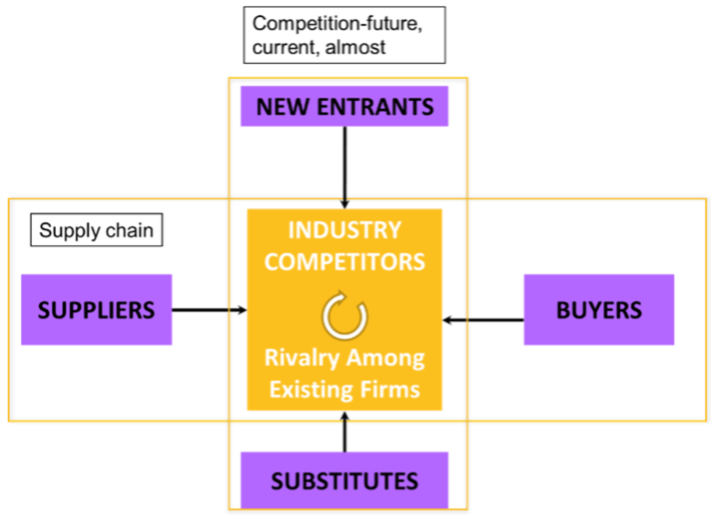

Industry Analysis

Developed by Harvard prof Michael Porter

Assess industry competition and value chain dynamics.

Finds challenges, competitive environment, profitability factors, entry opportunities, and barriers.

Porter’s Five Forces: used to assess attractiveness of an industry by determining the level of threat to profitability.

Porter’s Five Impacts on Financial Performance

Each force affects parts of the income statement, influencing profitability.

Competition:

—> High Competition: Lowers prices, reduces sales volume, and increases marketing costs.

Potential Entrants:

—> Easy Market Entry: Increases competition, reduces prices, decreases market share, and raises marketing expenses.

Suppliers:

—> Many Suppliers: Enables price negotiation, reducing costs.

—> Few Suppliers: Increases supplier power, raises input costs, and reduces profitability.

Buyers:

—> Many Buyers: Increases sales volume and allows higher prices; lowers marketing costs.

—> Few Buyers: Decreases prices and volume; raises marketing expenses due to increased persuasion efforts.

Substitutes:

—> Improved Substitutes: Intensify competition, increase marketing costs, and cap pricing due to affordability of alternatives.

Profit Calculation

Profit before taxes = revenues - cost of goods sold - other expenses.

Porter’s Five Forces

Rivalry

Level of competition among the firms already competing; affects profitability.

Factors Affecting: Number of Competitors, Industry Growth, Excess Capacity, Low Switching Costs, Commodities and Perishables, High Exit Barriers.

Mitigating Competition: Growth Strategies, Differentiation, Customer Lock-in, Niche Markets, Build Loyalty.

Substitutes

Different products performing similar functions that can be used instead (e.g., mass transit vs. automobile, laser eye surgery vs. prescription glasses). Industries are more attractive with low threat of substitutes.

Factors Affecting: Price Ceiling, Competitive Pressure.

Mitigating Competition: Marketing, Customer Lock-in.

Potential Entrants

Chances of introducing new technologies/business models that change customer expectations and industry rules.

Factors Affecting: High Capital Intensity, Scale Economies, Access to Key Assets, Exclusive Agreements, Regulatory Barriers, Switching Costs and Brand Loyalty, Incumbent Advantage, Expansion Challenges.

Mitigating Competition: Brand Importance, Customer Lock-in, Lobbying, Growth and Scale, Exclusive Partnerships.

Suppliers

Power intensifies rivalry as firms strive to maintain profitability through higher prices or increased volumes. Lower power makes an industry more attractive.

Factors Affecting: Fewer Suppliers, High Switching Costs, Substitute Inputs, Firm's Importance, Supplier Integration.

Mitigating Competition: Reducing Supplier Power, Self-Supply, Strategic Alliances, Product Redesign, Technological Advances.

Buyers

Retailers gain power by influencing consumer decisions, common in sectors like audio components, jewellery, and appliances. Lower buyer power makes an industry more attractive.

Factors Affecting: Buyer Concentration, Standard Products, Cost Significance, Buyer Profitability, Product Importance, Cost Savings, Backward Integration Threat

Mitigating Competition: Alliances, Product Differentiation.

Backward Integration Threat

Buyers may threaten to produce the product themselves, increasing their negotiating power (e.g., auto producers).

Product Differentiation

Differentiate products to create perceived value and build brand loyalty, psychologically locking in consumers.

Self-Supply

Firms produce their own inputs to reduce dependence, but this can be costly and risky.

Strategic Alliances

Form partnerships or buy controlling interest in suppliers to mitigate supplier power.

High Switching Costs

Contractual lock-ins or integrated activities raise costs of switching - suppliers.

Supplier Integration

Suppliers gaining power by integrating forward and becoming competitors (e.g., Disney's streaming service vs. Netflix).

Substitute Inputs

When more available substitutes reduce supplier power.

Customer Lock-in

Use contracts to retain customers. Use rewards points or other incentives to retain customers.

Lobbying

Advocate for protective legislation favoring incumbents.

Incumbent Advantage

High entry barriers make industries attractive for existing firms but deter potential new entrants.

Expansion Challenges

High entry barriers can deter firms from entering new industries for expansion.

Scale Economies

Large firms (e.g., Walmart) deter new entrants by capturing scale economies.

Access to Key Assets

Difficult access to technology, know-how, or patents limits entry.

Exclusive Agreements

Distribution agreements (e.g., WLU’s exclusive agreement with Coke) limit market access.

Marketing

Convince buyers there is no true substitute for your product/service.

Price Ceiling

Substitute presence limits the price charged before customers switch.

Competitive Pressure

Increases with lower relative prices of substitutes and lower consumer switching costs.

Brand Loyalty

Strengthen consumer relationships to create psychological lock-in and loyalty.

Tangible assets

Physical and measurable resources. Clear physical presence and can often be valued relatively easily.

ex: buildings, machinery, inventory, and cash.

Intangible assets

Non-physical resources that can still hold significant value. Not physically tangible but can greatly influence a company's value and performance.

ex: patents, trademarks, brand reputation, intellectual property, and customer relationships.

Internal Consistency

Focus on what the firm “wants to do” or “can do”, rather than what it “should do.”

Firm must acquire consistency and alignment with its internal strategy and external environment.

To succeed, the firm must believe in the appropriateness of the strategy.

Management Preferences

Bias affects managers' analysis and decisions. Underlying say in decisions due to understanding of issues.

Managers' backgrounds and experiences shape strategic direction.

Address gaps between management preferences and strategy for effectiveness

Resources

Identify required resources and compare them to current availability.

Includes human, capital, and financial resources, both tangible and intangible.

Resources provide competitive advantage and influence strategy implementation.

Financial Resources

Determine what the firm can and cannot afford to do.

Human Resources

Required for carrying out activities and providing expertise to enhance performance.

Physical Resources

Specialized equipment improves productivity and reduces costs.

Key Distribution & Supplier Relationships

Essential for long-term strategy execution; strong brand, IP, or reputation can strengthen consumer relationships and create new opportunities.

Organization

Links firm's capabilities by analyzing work division and coordination among jobs and units.

Structure affects communication and resource allocation; management and culture influence behavior.

Compare required and available elements to identify gaps, acknowledging that organizational change is challenging and time-consuming.

Closing gaps to find internal consistency

Organization: Know the firm’s capabilities and add appropriate resources that fit job requirements and culture.

Management: Prioritize, develop, and acquire resources based on needs; structure work, develop policies, and influence corporate culture.

Resource: Proper organization is essential to prevent disarray and ensure effectiveness.

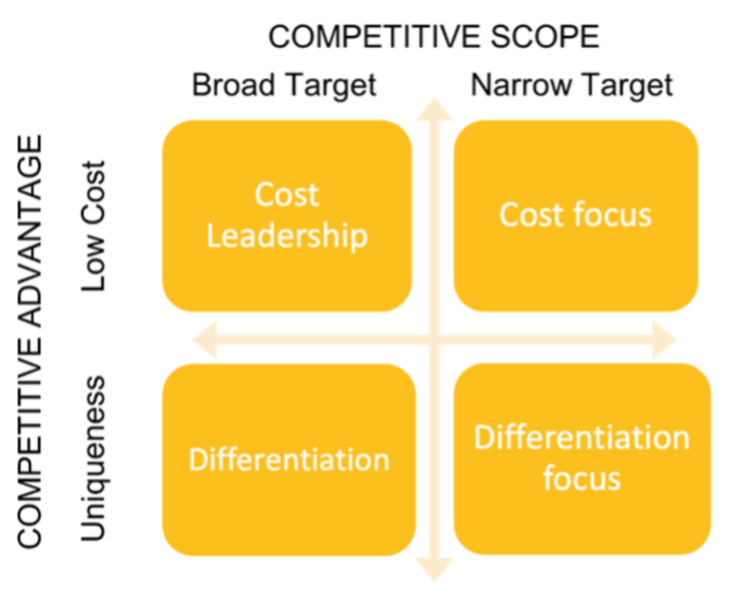

Porter’s Generic Strategy

Firms adopt unique strategies despite similar external conditions, allowing multiple competitors to succeed in the same industry.

Michael Porter categorizes strategies by competitive advantage source and market scope into four groups.

Helps firms identify where they can succeed by targeting specific customers and competing effectively.

Porter’s Generic Strategy - Groups

Four Groups:

Cost Leadership

Cost Focus

Differentiation Focus

Differentiation

Cost Leadership

If the firm's strength is in production and operational efficiency, consider a low-cost strategy targeting a broad market.

Example: Walmart offers a wide array of products at the lowest cost.

Cost Focus

Focus on being the cheapest within a smaller market segment.

Example: A store specializing in selling tires at the lowest price possible.

Differentiation

Strength in unique product features, brand name, or quick response, not just cost.

Charge higher prices or lock in customers through uniqueness.

Example: Apple offers electronics with superior perceived performance and seamless integration.

Differentiation Focus

Focus on being unique within a smaller market segment while maintaining high profitability per customer.

Example: A luxury boutique offering exclusive fashion items to a niche market segment.

Environment:

Strategy aligned with environment is essential.

If organization doesn't adapt to its environment it can lead to internal inconsistency.

Risks arise from inconsistencies between strategy and environment, including short-term risks like timing miscalculations or competitive reactions.

Management Preferences and External Conditions

Influence and interpret their external conditions.

Changes can affect resource availability and their value to the organization.

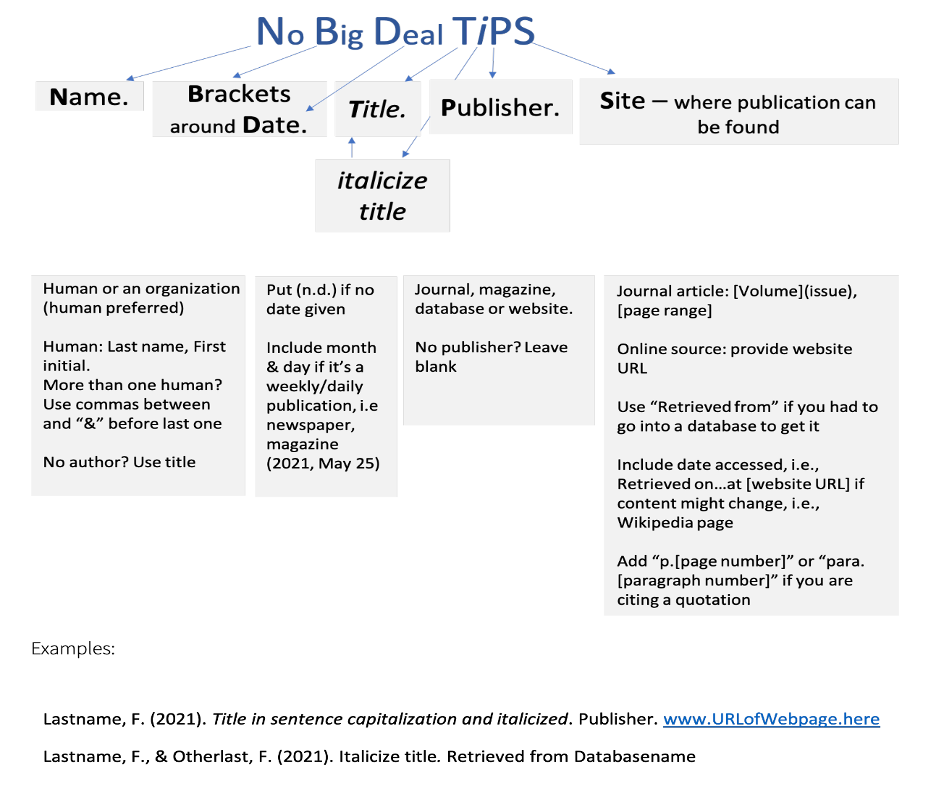

Formatting References

Who: Last name, First initial. (or Organization if no human author)

When: Date of publication or creation ("n.d." if no date)

What: Document title (used as author if no human author)

Where: Location to access the research (e.g., journal issue, URL, city & publisher)

Period between sections, comma to separate pieces within section.

Use hanging indent (second line indented).

Capturing and Tracking Sources

Avoid Copy-Pasting:

Paraphrase immediately to avoid using source's wording.

Quotation Marks for Direct Quotes:

If copying, use quotation marks and note page or paragraph for potential direct quotations.

Immediate Source Capture:

Copy-paste hyperlink into endnote or footnote for immediate source tracking.

When to Cite

Non-Common Knowledge:

Anything beyond common knowledge requires citation.

Includes your own work from previous assignments.

Quantitative Information:

Almost always cite quantitative data.

Numerical values often depend on specific sources (e.g., population statistics).

Citing Lectures

Author (prof), date, title, WLU, URL

Analytical Thinking

Breaks down issues into manageable pieces and utilizes appropriate tools for better solutions; there is no single right answer to a problem.

Understanding problems, researching, and developing answers independently is crucial.

Knowing right questions to ask and concluding appropriate models and research.

Finding “Good” Solutions

Feasible

Complete

Effective

Feasible

A solution that the organization can implement. Understanding the company’s ability for resources, capability, and desire to implement it.

Complete

Identifies all critical components required to fully execute the solution. Observes how, what, when, where, and who are related to the solution.

Effective

Considering objectives and if the solution is likely to be achieved on time.

Case Analysis

Develops thinking in tackling real-life problems faced by decision makers within a complex business context.

Identifies right questions to ask, can practice applying various models to understand them better and improve your problem-solving skills.

Benefits of case analysis

Building analytical thinking by knowing what questions to ask

Developing experience and insight on appropriate model application

Familiarizing with decision-making environments

Enhancing problem-solving and solution-creating skills.

How to Analyze a Case

Know who is making the decision

Illustrates the preferences, aspirations, resources, and constraints. These insights inform what makes an ideal solution (the decision criteria).

Understand what industry the company is in

Recognize where it is located

Asses when the events are occurring

Objectives & Aspirations

Help assess key performance indicators to prove it is able to achieve expected objectives.

Models

Are used to identify issues and solutions that are important in finding a complete solution. Also important for identifying gaps in what we need and what we have; what is feasible (or not) for the company.

Constraints

Helps figure out what options are worth considering

Complications

The most important challenge(s) that must be addressed to move forward with a solution

Case Analysis Process

Following the required steps are carried out differently depending on unique conditions, however following required steps will help identify and recommend good solutions.

Case Analysis Steps

Identify the issues (Immediate AND Underlying) and summarize as a question

Identify & apply relevant models and do research to enhance understanding, identify complications & constraints

Identify the objectives and aspirations

Develop and evaluate hypotheses (options)

Propose good solution with implementation

Identify risks, mitigation and contingency strategies

Demonstrate impact of solution

Immediate Issue

The explicit decision, issue, or opportunity the decision-maker faces, which must be resolved in recommendation.

Underlying Issue

Root cause of the immediate issue

Must also be addressed to ensure the immediate issue does not reoccur.