Efficient Diversification in Investment Management

1/67

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

68 Terms

Asset Allocation

Distribution of investments among various assets.

Optimal Risky Portfolio

Portfolio maximizing return for a given risk level.

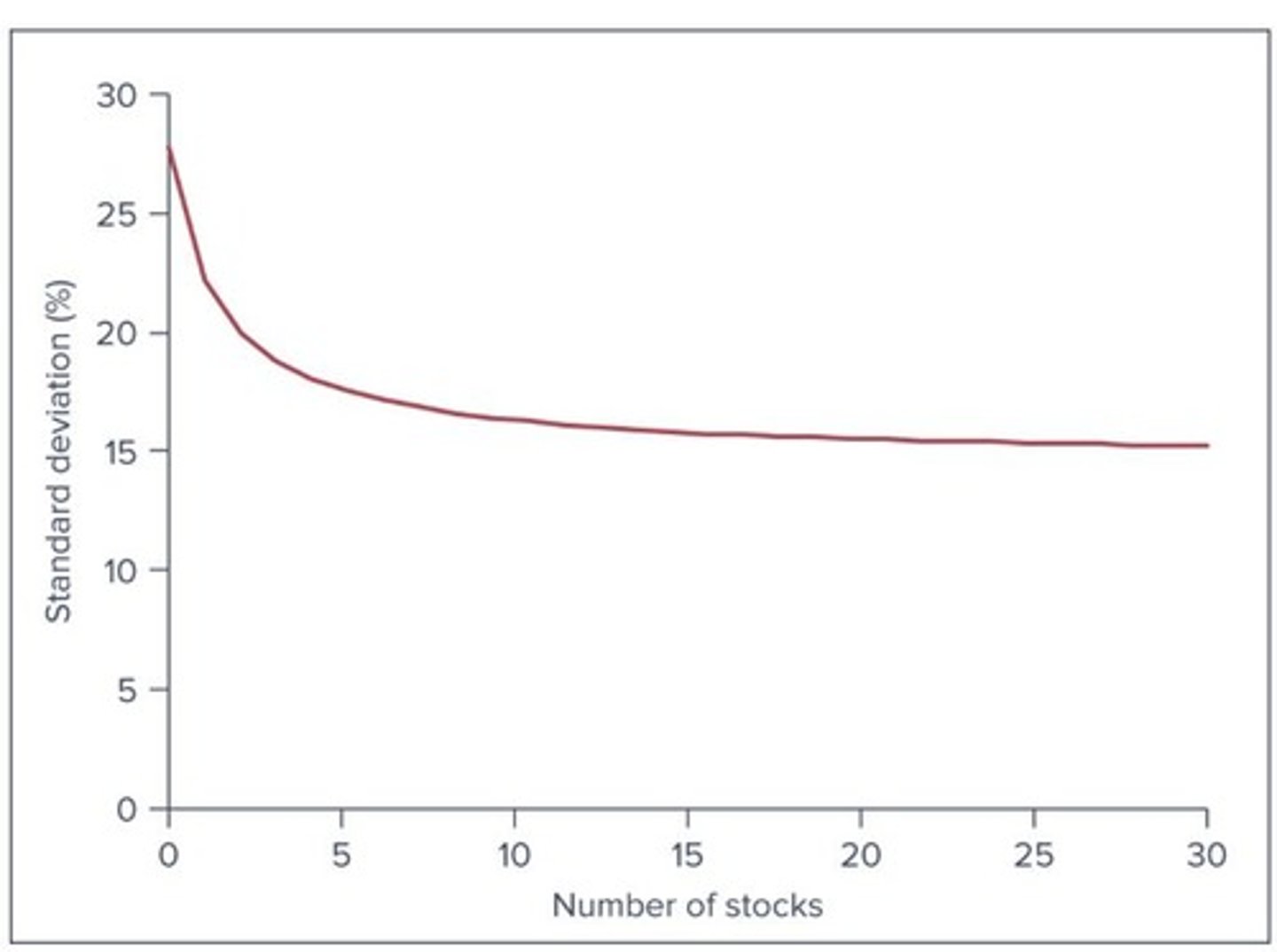

Diversification

Spreading investments to reduce overall portfolio risk.

Portfolio Risk

Risk associated with the combined assets in a portfolio.

General Economic Conditions

Macro factors affecting stock returns, like inflation.

Firm-Specific Factors

Company-specific elements influencing stock performance.

Diversification

Reduces firm-specific risk through varied investments.

Unique Risk

Risk specific to a single asset or firm.

Market Risk

Risk affecting all firms, non-diversifiable.

Efficient Diversification

Constructs portfolios minimizing risk for expected return.

Asset Allocation

Distribution of investments among various asset categories.

Optimal Risky Portfolio

Best combination of risky assets for investors.

Risk Pooling

Combining independent risks to reduce overall risk.

Risk Sharing

Mitigates exposure to individual investment risks.

True Diversification

Spreads fixed investment across multiple uncertainties.

Time Diversification

Investing over time reduces market exposure.

Covariance

Measures how asset returns vary together.

Correlation Coefficient

Scale of covariance from -1 to 1.

Rate of Return on Portfolio

Weighted average of component securities' returns.

Expected Rate of Return

Weighted average of expected returns on assets.

Risk-Return Trade-Off

Balancing risk against expected portfolio returns.

Investment Opportunity Set

Available portfolio risk-return combinations for investors.

Mean-Variance Criterion (MVC)

Investors prefer higher mean, lower variance assets.

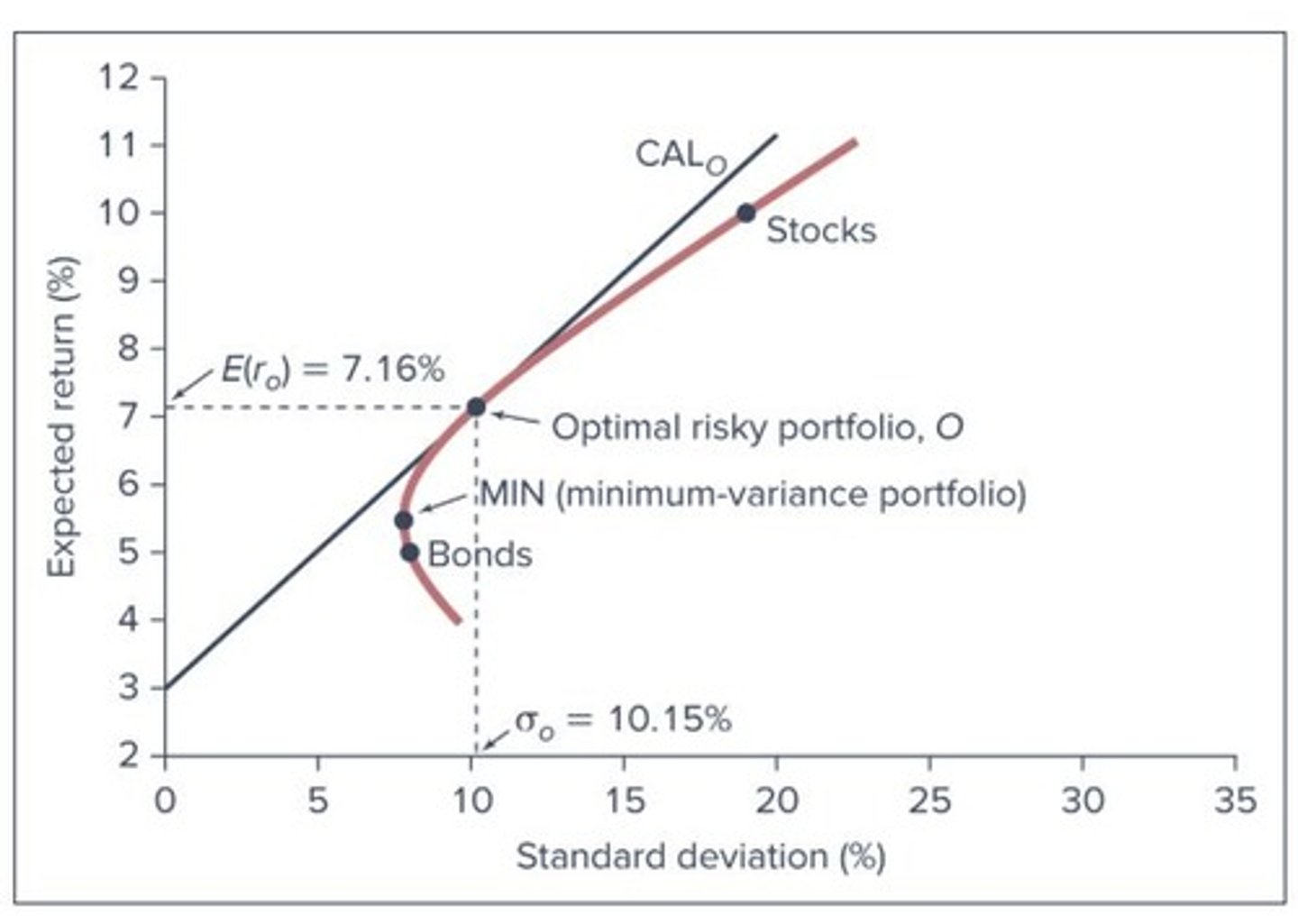

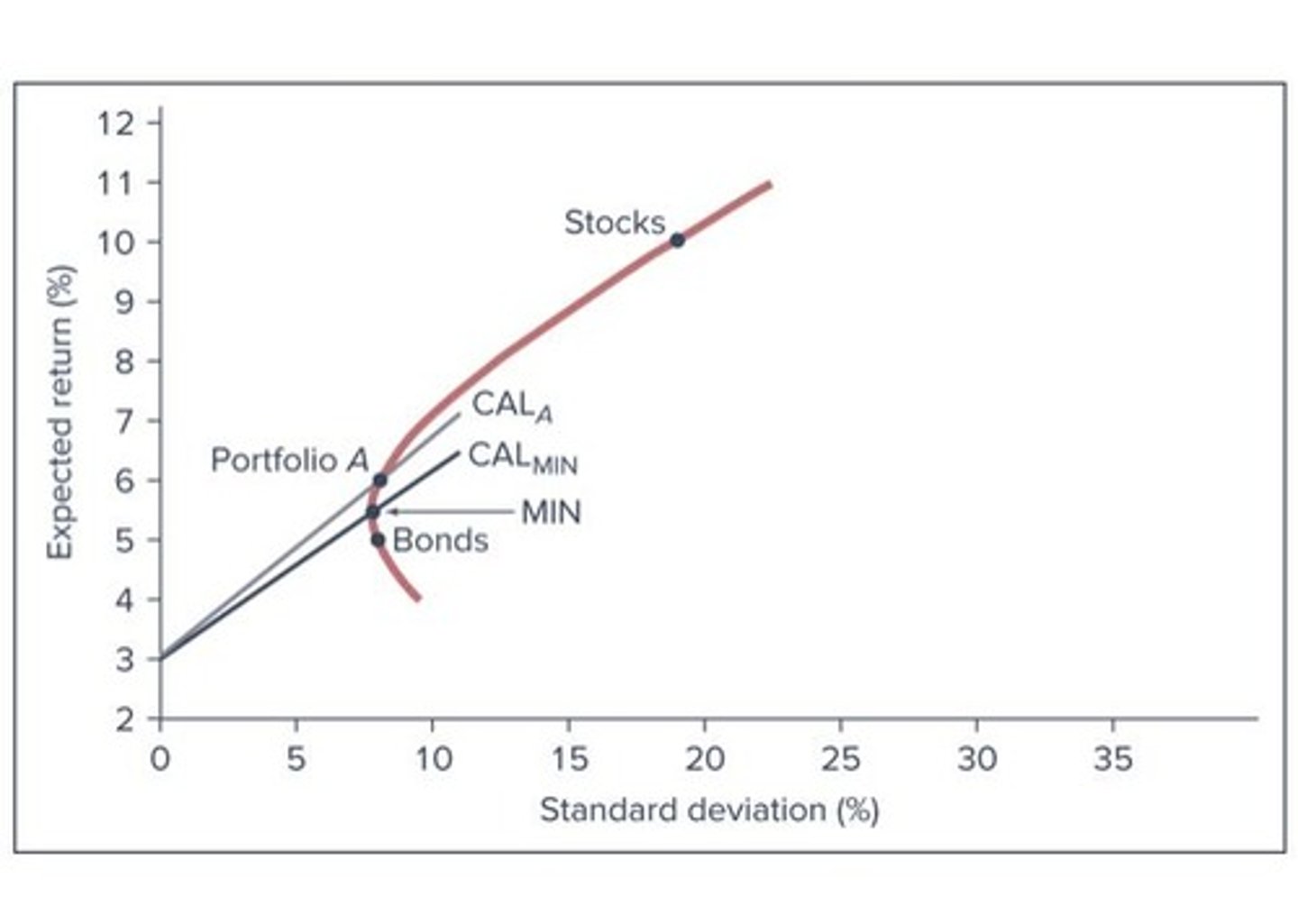

Capital Allocation Line (CAL)

Graph showing risk-return trade-off with risk-free asset.

Sharpe Ratio

Measures risk-adjusted return of an investment.

Optimal Portfolio

Best mix of risky and safe assets.

Investor Risk Aversion

Preference for lower risk investments by investors.

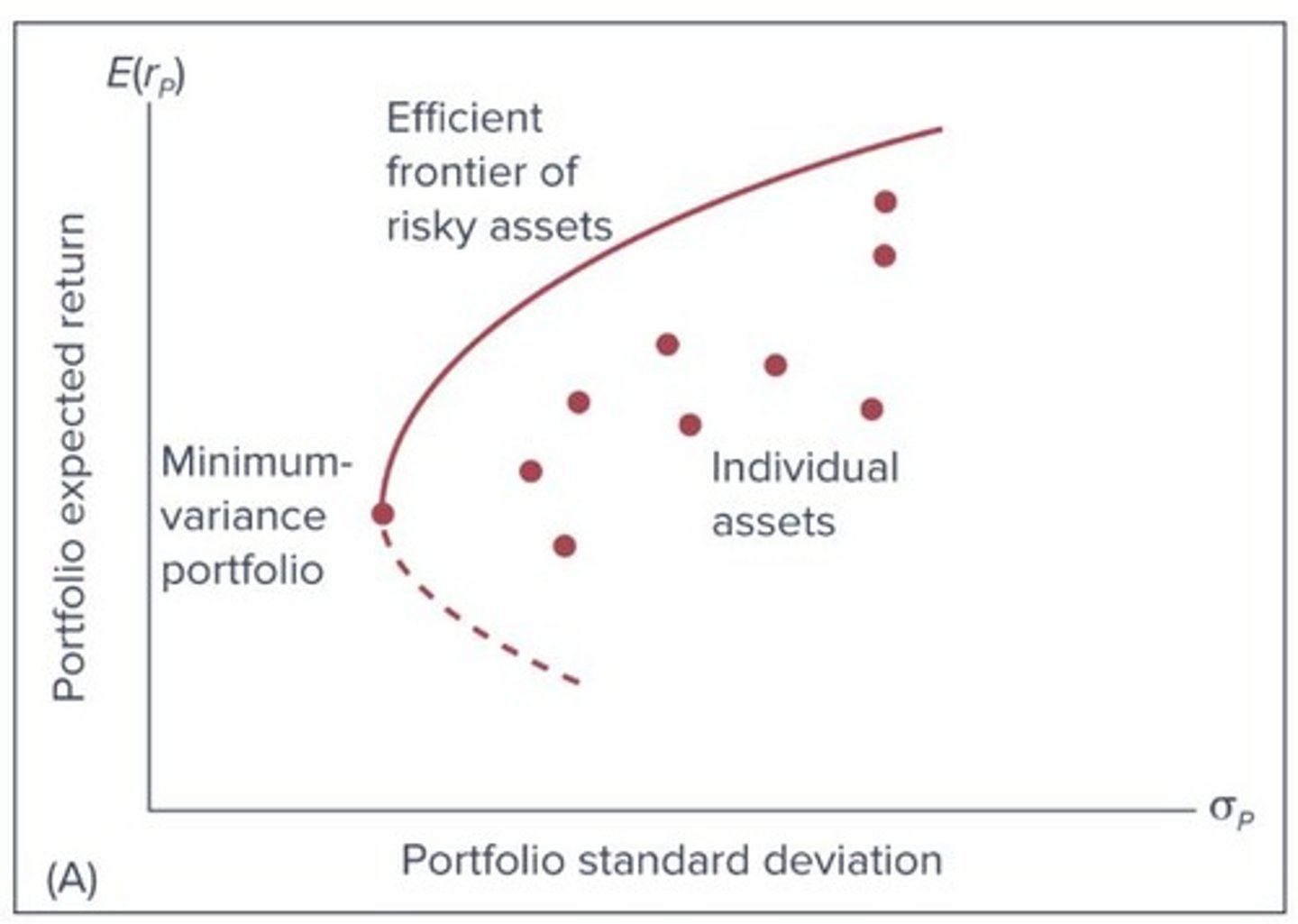

Efficient Frontier

Maximizes expected return for given portfolio volatility.

Markowitz Model

Finds efficient frontier through risk-return optimization.

Short-Sale Restriction

Limitations on selling borrowed securities.

Dividend Yield

Annual dividend payment divided by stock price.

SRI Constraints

Socially Responsible Investing limitations on portfolio.

ESG Constraints

Environmental, Social, Governance criteria for investments.

Optimal Portfolio

Portfolio with highest Sharpe ratio on CAL.

Capital Allocation Line (CAL)

Graph showing risk-return trade-off of portfolios.

Sharpe Ratio

Measure of risk-adjusted return of an investment.

Asset Allocation

Distribution of investments across various asset classes.

Optimal Risky Portfolio

Portfolio maximizing expected return for given risk.

Single-Index Stock Market

Market model using a single index for analysis.

Markowitz Model

Framework for constructing efficient portfolios based on risk.

Efficient Frontier

Graph of optimal portfolios offering highest returns for risk.

Standard Deviation (SD)

Measure of investment return volatility or risk.

Expected Return (E(r))

Projected return of an investment over time.

Short-Sale Restriction

Limitations on selling borrowed securities in trading.

Minimum Dividend Yield

Lowest acceptable dividend return for investments.

Finding Optimal Allocation

Process of determining best asset distribution.

Separation Property

Independence of risky portfolio and risk-free asset choice.

Optimal Risky Portfolio

Best portfolio for all clients, regardless of risk aversion.

Capital Allocation Line (CAL)

Graphical representation of risk-return trade-off.

Index Model

Relates security returns to market index and firm factors.

Systematic Risk

Risk common to the entire economy, measured by beta.

Alpha (α)

Expected excess return when market excess is zero.

Beta (β)

Sensitivity of a security's return to market return.

Residual (ei)

Return variance component independent of market factors.

Security Characteristic Line (SCL)

Plot of predicted excess returns against market return.

Variance of Return

Sum of systematic risk and firm risk components.

R-squared

Measure of systematic variance's importance in total variance.

Cyclical Stock

Higher sensitivity to market conditions (β > 1).

Defensive Stock

Lower sensitivity to market conditions (β < 1).

Mean Reversion

High-β securities tend to lower β over time.

Sharpe Ratio

Measure of return per unit of risk taken.

Treynor-Black Model

Combines active and passive portfolio management.

Weight (wi)

Proportion of total portfolio allocated to security.

Excess Return (Ri)

Difference between security return and risk-free rate.

Market Excess Return (RM)

Return of the market above the risk-free rate.

Scatter Diagram

Visual representation of security versus market relationship.

Slope of Scatter Diagram

Indicates sensitivity to market conditions.

Optimization Difficulty

Challenges in acquiring accurate input data for models.