CHAPTER 5: PRICE CONTROLS & QUOTAS, MEDDLING WITH MARKETS (SESSION 7 & 8)

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

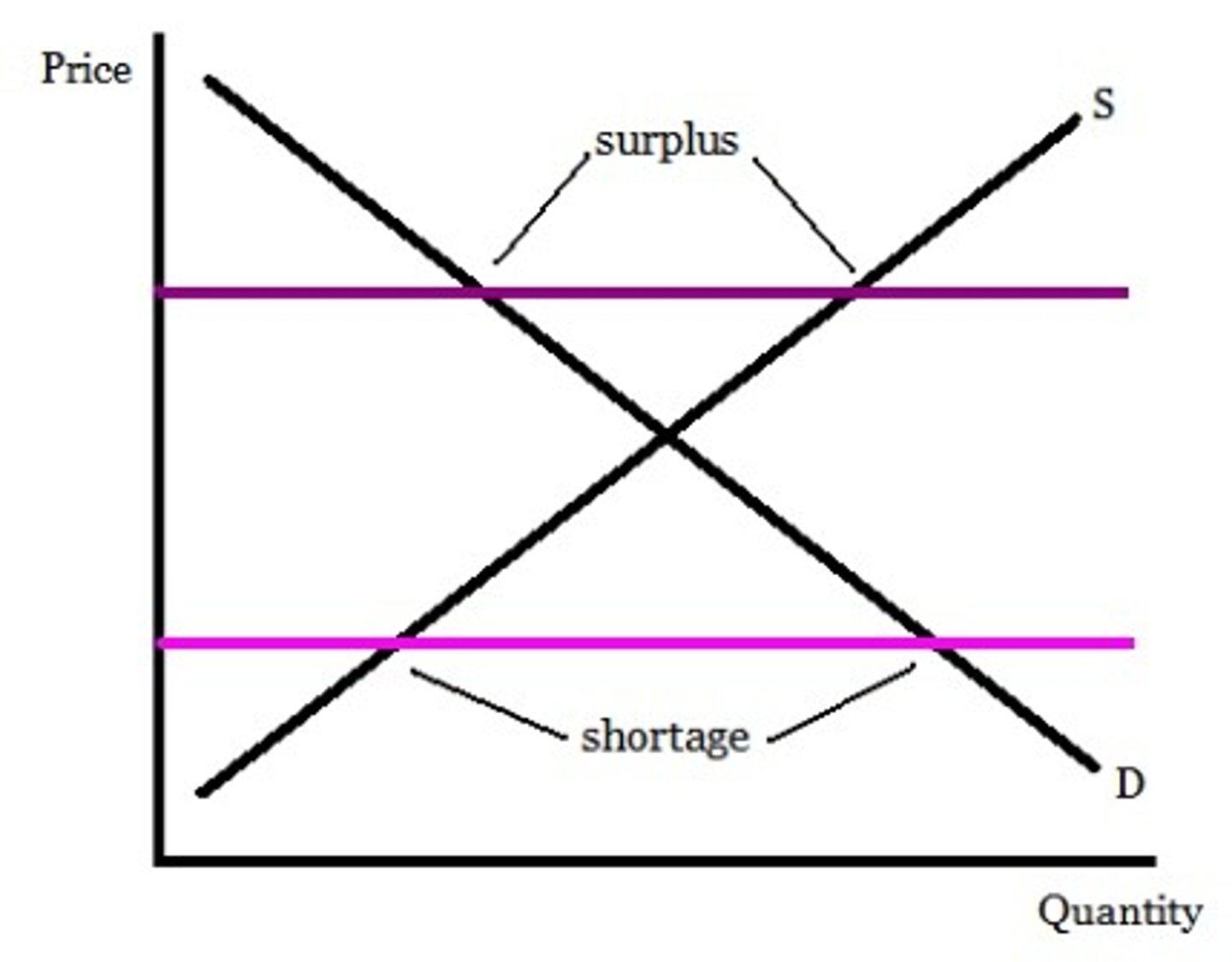

Interference in Markets Has Consequences

Distorted price signals cause resources to be misallocated.

If prices are distorted, they cannot give good information to buyers and sellers.

Price Controls

Price controls: legal restrictions on how high or low a market price may go. There are two main types: price ceiling & floor

Price ceiling

a maximum price sellers are allowed to charge for a good or service (usually set BELOW equilibrium).

Price floor

a minimum price buyers are required to pay for a good or service (usually set ABOVE equilibrium).

How Price Ceilings Cause Inefficiency

Price ceilings cause predictable side effects:

- Inefficiently low quantity

- Inefficient allocation to customers

- Wasted resources

- Inefficiently low quality

- Black markets

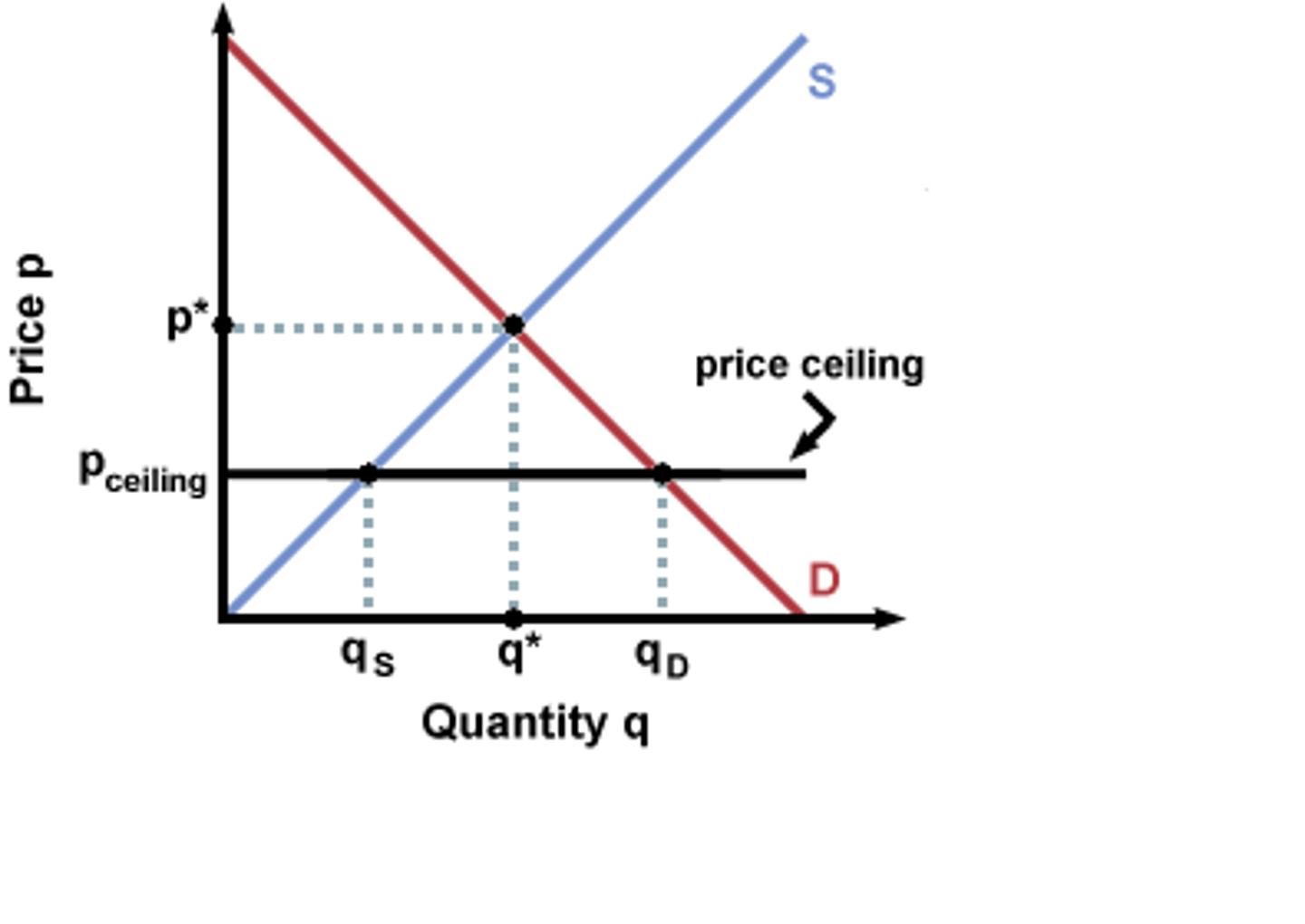

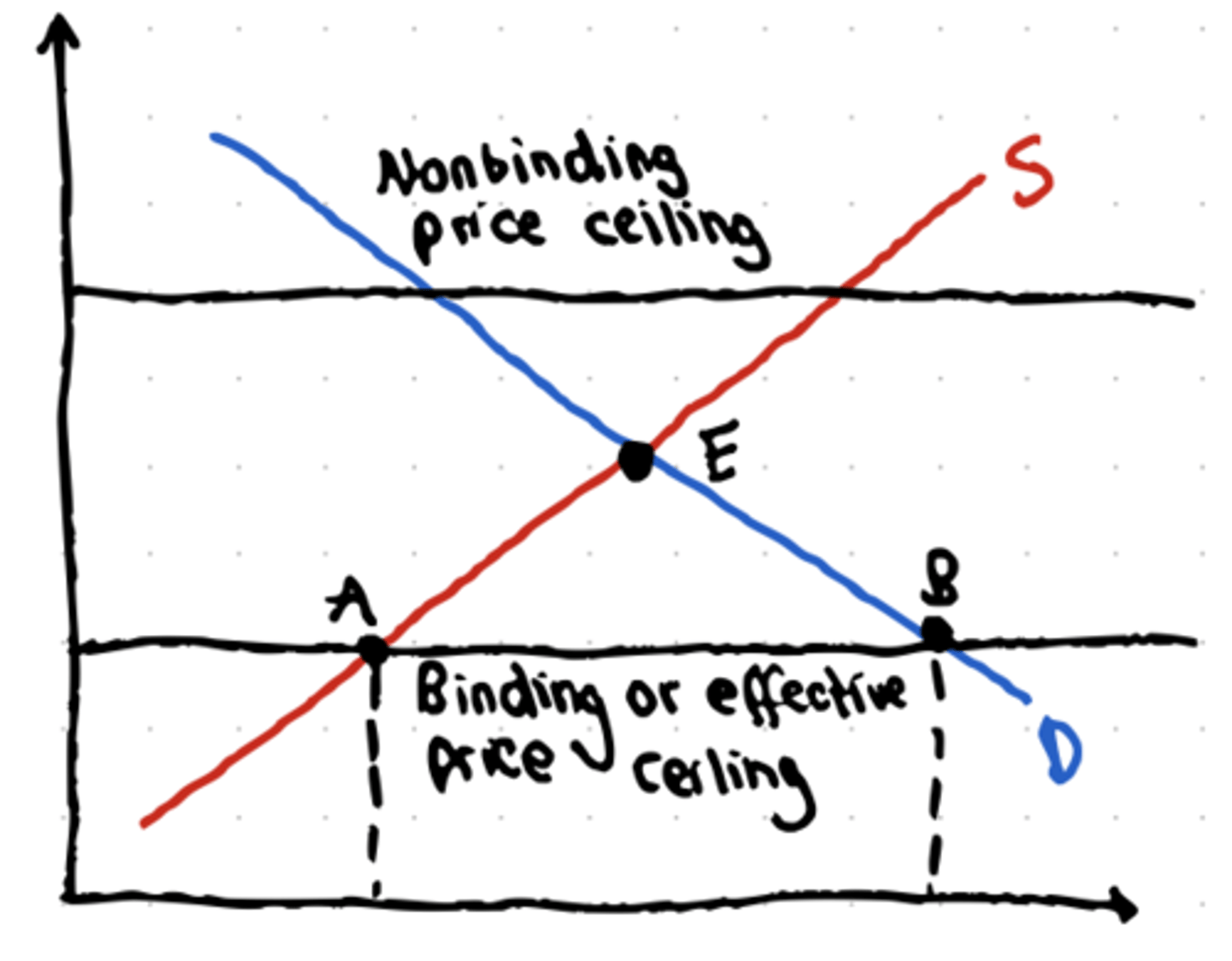

Binding, or Effective, Price Ceilings

If a price ceiling is set above equilibrium, it will have no effect (called non binding).

Only a price ceiling that forces price below equilibrium will have any effect (called binding or effective)

Inefficiently Low Quantity

When prices are held below the market price,

shortages are created.

The lower the controlled price relative to the market equilibrium price, the larger the shortage.

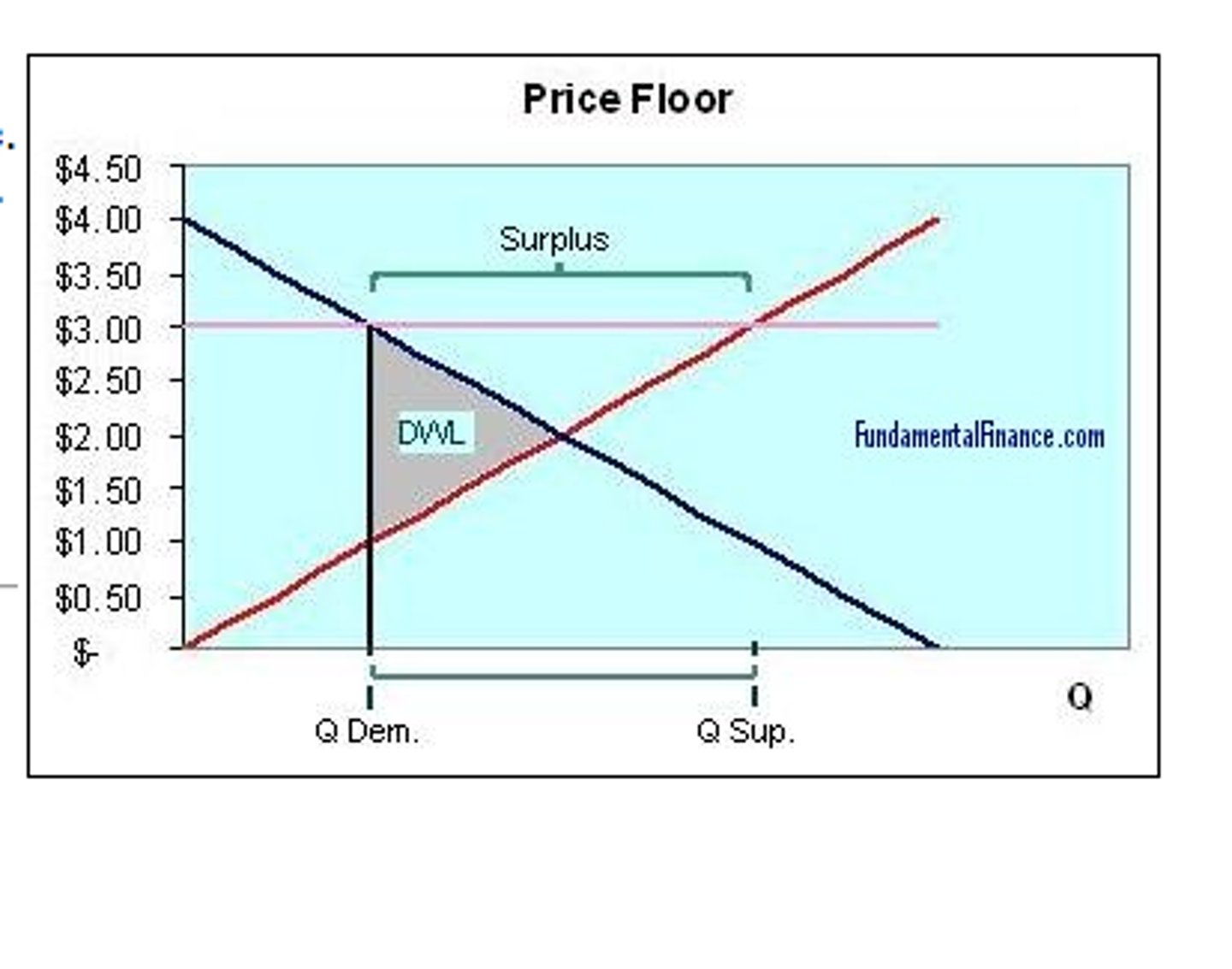

Price Controls Cause Losses

Deadweight loss: the loss in total surplus that occurs whenever an action or a policy reduces the quantity transacted below the efficient market equilibrium quantity.

((P2 - P1) x (Q1 - Q2)) ( / 2 maybe)

A Price Ceiling Causes Inefficiently Low Quantity

Deadweight loss from fall in number of apartments rented

Inefficient Allocation to Customers

Price controls distort signals that would help the goods get allocated their highest-valued uses.

Consumers who value a good most don’t necessarily get it.

So producers have no incentive to supply the good to the “right” people first.

As a result, goods are misallocated.

Wasted Resources

Price controls that create shortages lead to bribery and wasteful lines.

Shortages: not all buyers will be able to purchase the good.

Normally, buyers would compete with each other by offering a higher price.

If price is not allowed to rise, buyers must compete in other ways (waiting in line, illegal bribes and favours).

Inefficiently Low Quality

At the controlled price, sellers have more customers than goods.

In a free market, this would be an opportunity to profit by raising prices.

But when prices are controlled, sellers cannot.

Sellers respond to this problem in two ways:

Reduce quality

Reduce service

Black Markets

markets in which goods or services are bought and sold illegally—either because they are prohibited or because the equilibrium price is illegal.

Why Are There Price Ceilings?

They do benefit some people (who are typically better organised and more vocal than those who are harmed by them).

If the price ceiling is longstanding, buyers may not have a realistic idea of what would happen without it.

Government officials often do not understand supply and

demand analysis.

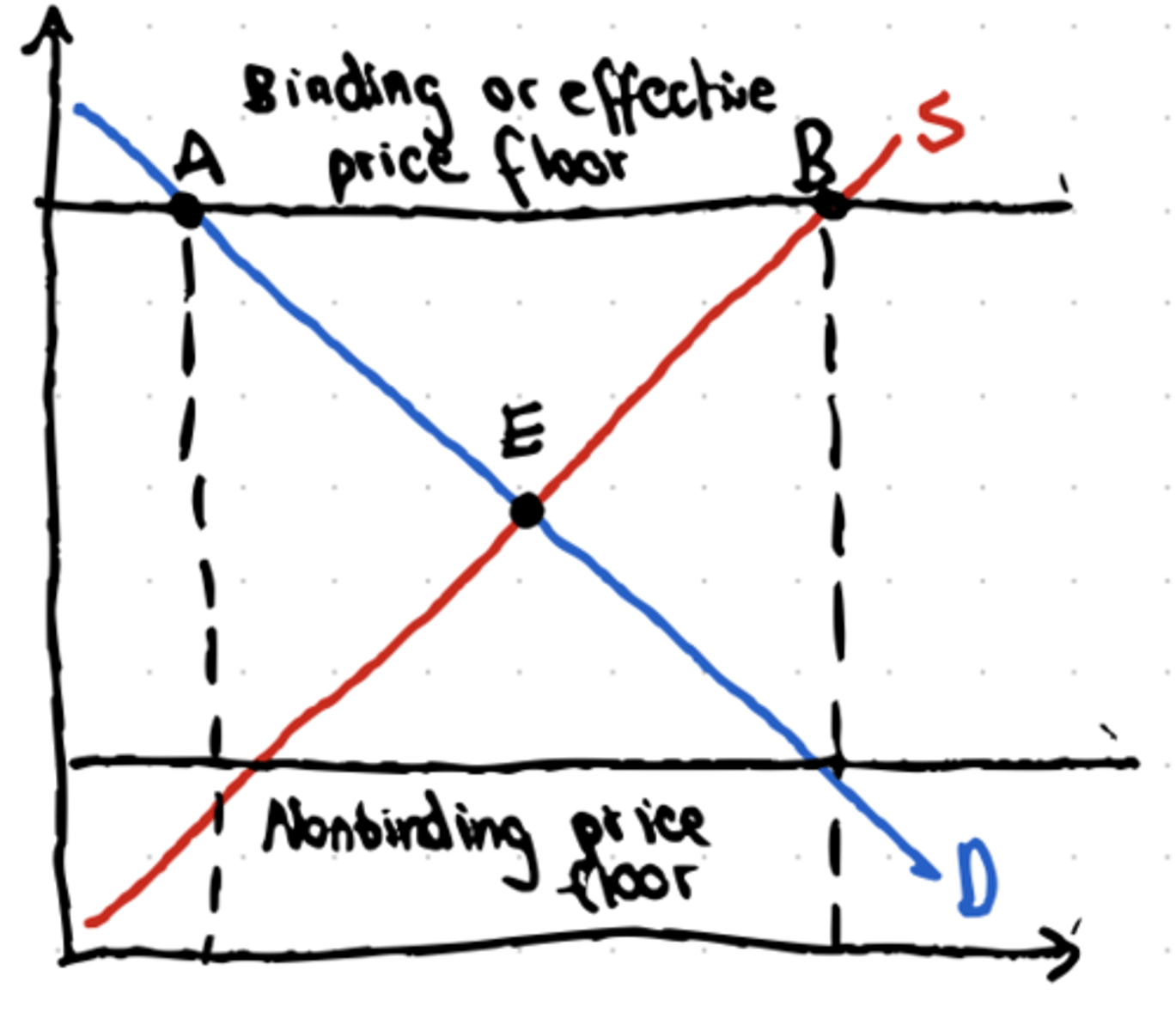

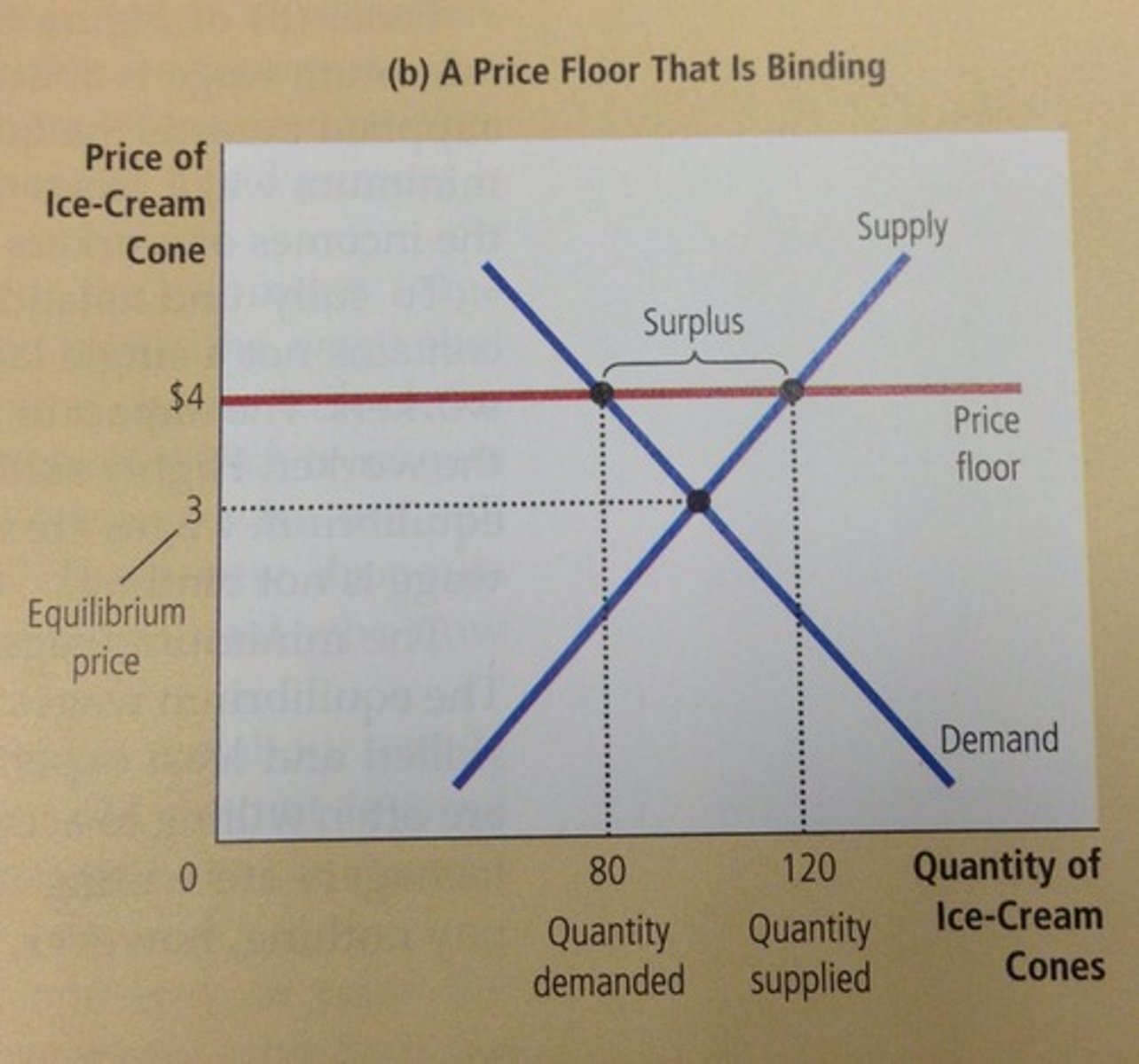

Price Floors

Sometimes governments intervene to push market prices up instead of down.

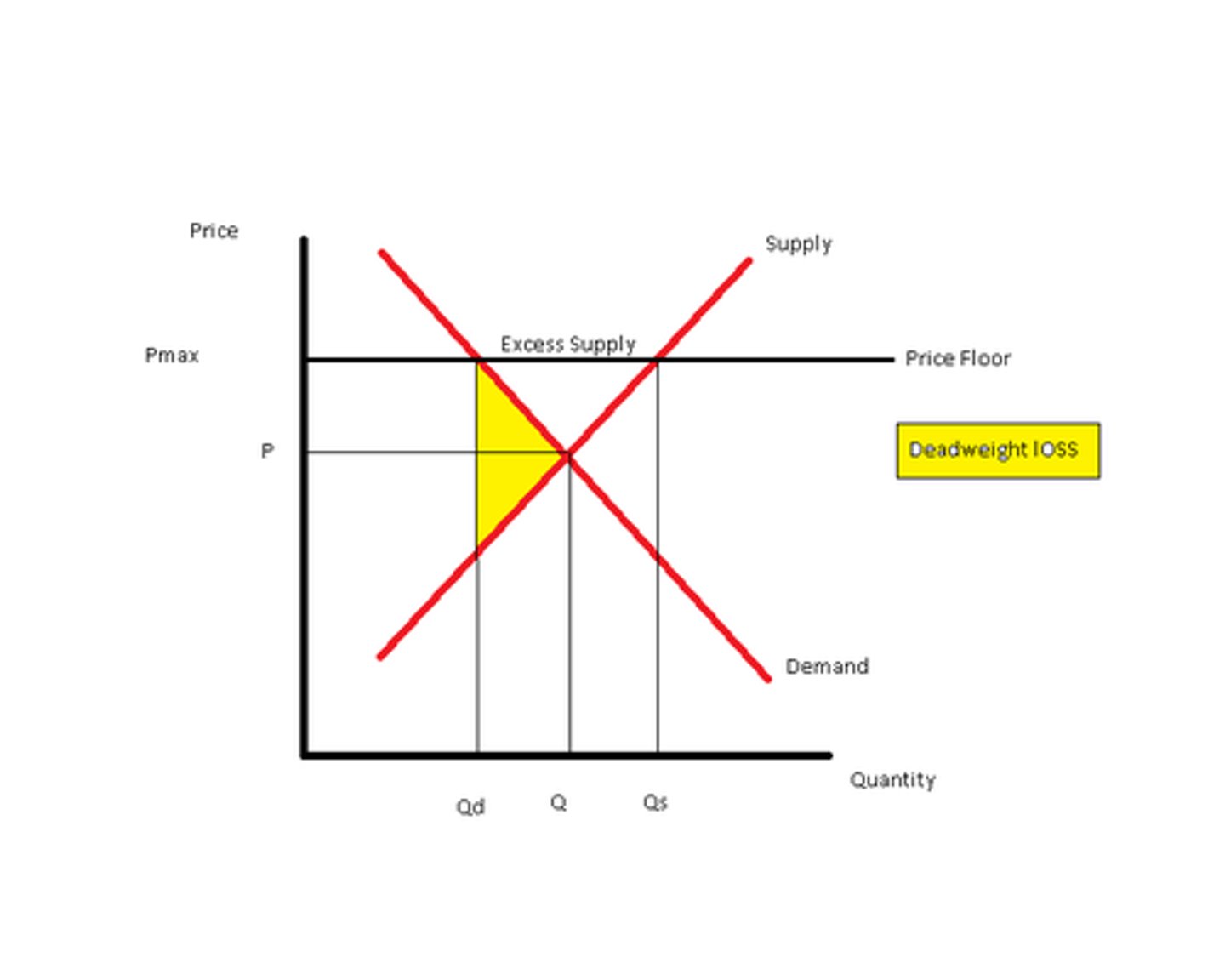

Binding, or Effective, Price Floors

If a price floor is set below equilibrium, it will have no effect (called non binding).

Only a price floor that forces price above equilibrium will have any effect (binding, or effective).

How a Price Floor Causes Inefficiency

Price floors cause predictable side effects:

- Deadweight loss from inefficiently low quantity

- Inefficient allocation of sales among sellers

- Wasted resources

- Inefficiently high quality

- Temptation to break the law by selling below the legal price

Inefficient Allocation of Sales Among Sellers

Price floors misallocate sales by:

Allowing high-cost firms to operate.

Preventing low-cost firms from entering the industry.

Wasted Resources

Price floors encourage waste.

To deal with the surplus generated by agricultural price floors, the U.S. government sometimes buys back the excess and donates or destroys it.

Inefficiently High Quality

Higher quality raises costs and reduces sellers’ profit. Buyers get higher quality but would prefer a lower price. Price floors encourage sellers to waste resources:

higher quality than buyers are willing to pay for

Illegal Activity

Price floors encourage black markets.

There are willing sellers (and buyers) at illegal prices, so they are tempted to break the law and trade with each other.

Why Are There Price Floors?

Same as price ceilings:

They do benefit some people (who are typically better organised and more vocal than those who are harmed by them).

If the price floor is longstanding, buyers may not have a realistic idea of what would happen without it.

Government officials often do not understand supply and demand analysis.

Don’t be confused: price ceilings , floors and quotas

all decrease the amount traded and therefore create deadweight loss.

A price ceiling pushes the price of a good down; fewer sellers will want to sell.

A price floor pushes the price of a good up; fewer buyers will want to buy.

A quota, by definition, reduces sales.

If sellers don’t want to sell as much as buyers want to buy, it’s the sellers who determine the actual quantity sold, because buyers can’t force unwilling sellers to sell and vice versa.

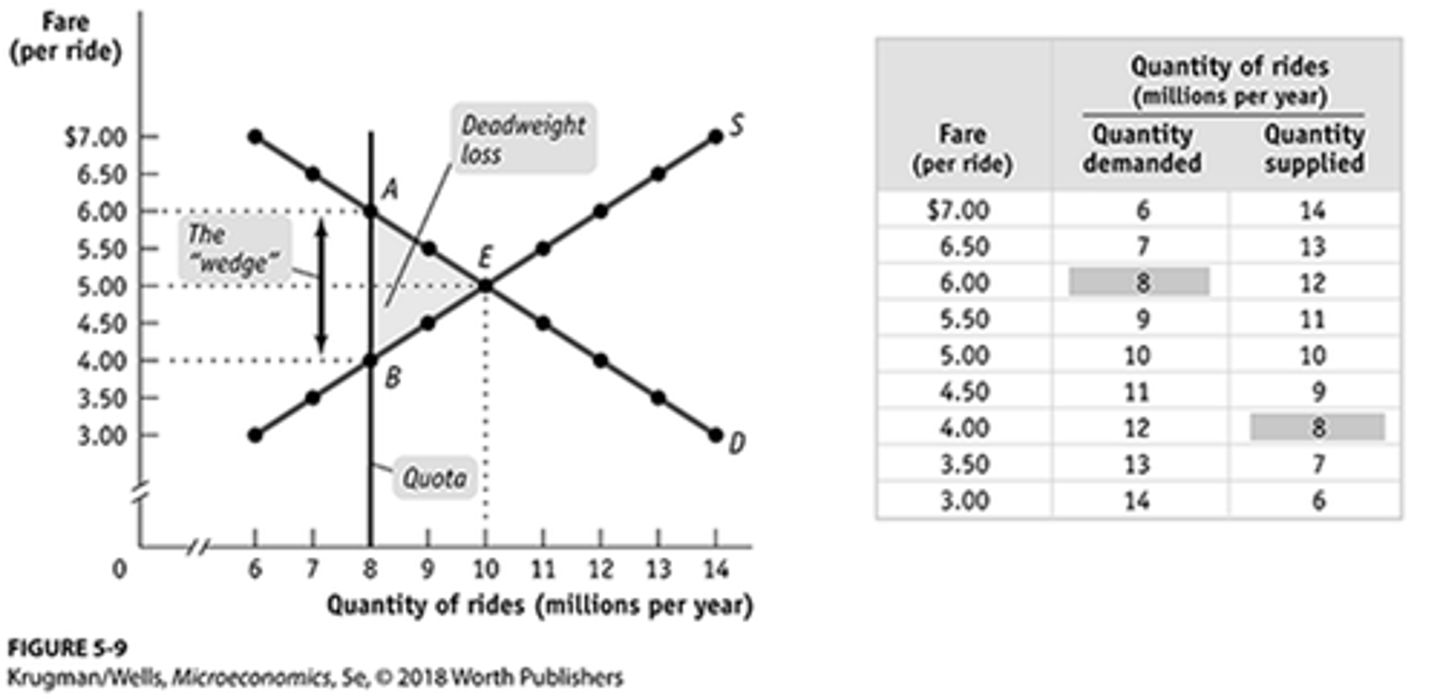

Controlling Quantities

Governments sometimes control quantity instead of price.

Quota: an upper limit, set by the government, on the quantity of some good that can be bought or sold; also referred to as a quantity control.

Quota limit: the total amount of a good under a quota or quantity control that can be legally transacted.

License: the right, conferred by the government, to supply a good.

Demand price

the price of a given quantity at which consumers will demand that quantity.

Supply price

the price of a given quantity at which producers will supply that quantity.

The Wedge, or Quota, rent:

The difference between the demand price and the supply price at the quota limit. Equal to the market price of the

license when the license is traded.

The Costs of Quantity Controls

Like price controls, quotas impose losses on society.

Deadweight loss (some mutually beneficial transactions don’t occur)

Incentives for illegal activities