F4 - Liabilities

1/64

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

65 Terms

Unemployment tax

Unemployment tax (FUTA/SUTA): Employer‑paid payroll tax.

Accrue as a current liability when employees earn covered wages

Expense when incurred

Settle when remitted (paid).

Employer’s share of payroll taxes that is liability =

Accrued employer payroll taxes (unpaid):

employer portion of FICA (Social Security & Medicare - medicare for the elderly)

FUTA/SUTA owed but not yet remitted.

Don’t confuse w. payroll deductions which are not liability

What is accrued vacation?

Compensated absences:

Employees’ earned but unused paid time off.

Accrue a liability if:

(1) if employee has already worked for you/provided service

(2) you have an obligation to pay because they are employee rights that vest/accumulates

(3) amount is probable & estimable.

Self-insurance liability

When a company doesn’t buy insurance but instead takes on the risk itself.

No “reserve” is booked.

Under GAAP: record a liability only for losses already incurred that are probable & estimable.

What is an exit or disposal activity (ASC 420)? + 3 examples

Costs to terminate or restructure operations.

Examples:

Facility closure

One‑time termination benefits (layoffs)

Contract termination costs (e.g., cancel a lease).

You book a liability for these amounts.

Asset Retirement Obligation

A legal obligation to retire (clean up/dismantle) a long‑lived asset when it’s reached the end of its useful life or matured (e.g., dismantle an oil rig).

Record a liability at fair value (PV) when incurred. → Slowly increase the ARO to bring it to expected maturity value.

Asset Retirement Cost

The capitalized asset associated with an ARO.

Add ARC to the asset’s carrying amount and depreciate over its useful life.

Accretion expense

Interest‑like increase in the ARO liability due to the passage of time (unwinding of discount).

Recognized each period.

Example JE for ARO

At initial recognition (when we first start constructing the oil rig) - PV of expected cash outflows:

Dr Asset (ARC)

• Cr ARO (Liability)

Each period:

Dr Accretion Expense

Cr ARO

Dr Depreciation Expense (this affects the ARC)

Cr Accumulated Depreciation.

Settlement:

Dr ARO

Cr Cash (recognize gain/loss if actual $ ≠ estimate of ARO).

What is a contingency?

A possible gain or loss from an uncertain future event that will be resolved by future outcomes.

Think: outcome of lawsuit… if we win, might be a gain, if we lose, might be a loss. Level of probability depends.

3 categories of contingencies:

Probable

Reasonably possible

Remote.

Example of a loss contingency and how to record?

Example: Lawsuit.

Likelihood | Type of Recognition |

probable & estimable | accrue loss and liability and disclose |

reasonably possible | disclose only |

remote | usually no disclosure (exceptions apply) |

How is a Gain Contingency recorded?

Do not accrue gains.

Disclose if probable/possible

Recognize only when realized (virtually certain).

If range of probable contingent losses is given, how much liability do you recognize?

In range of probable losses: | Accrued Liability Amount: | Disclosure: |

best estimate exists | accrue best estimate | N/A |

no best estimate | accrue the minimum in the range | disclose the range |

How do you treat remote and reasonably probable contingencies?

Likelihood: | Disclosure: |

Reasonably possible | nature & range |

Remote | no disclosure except for guarantees, certain off‑balance‑sheet risks |

What’s an example of a remote contingency that still requires disclosure?

Guarantee: e.g., parent company guarantees a subsidiary’s loan.

Off–balance sheet risk: e.g., bank issues a standby letter of credit or has unused loan commitments (potential future obligation not yet on the books).

What is a premium?

A type of free gift, coupon or discount that a customer can redeem if certain conditions are met.

A loss contingency

Estimate expected redemptions and accrue:

Dr Premium Expense

Cr Premium Liability.

What is a warranty?

A promise to repair/replace products sold.

A loss contingency

Accrue estimated costs at sale:

Dr Warranty Expense

Cr Warranty Liability.

How do you record a Note Payable?

At issuance:

Dr Cash

Cr Note Payable (at PV).

If issued at a discount/premium, record

Dr. Discount

Cr. Premium

and amortize discount/premium using effective interest.

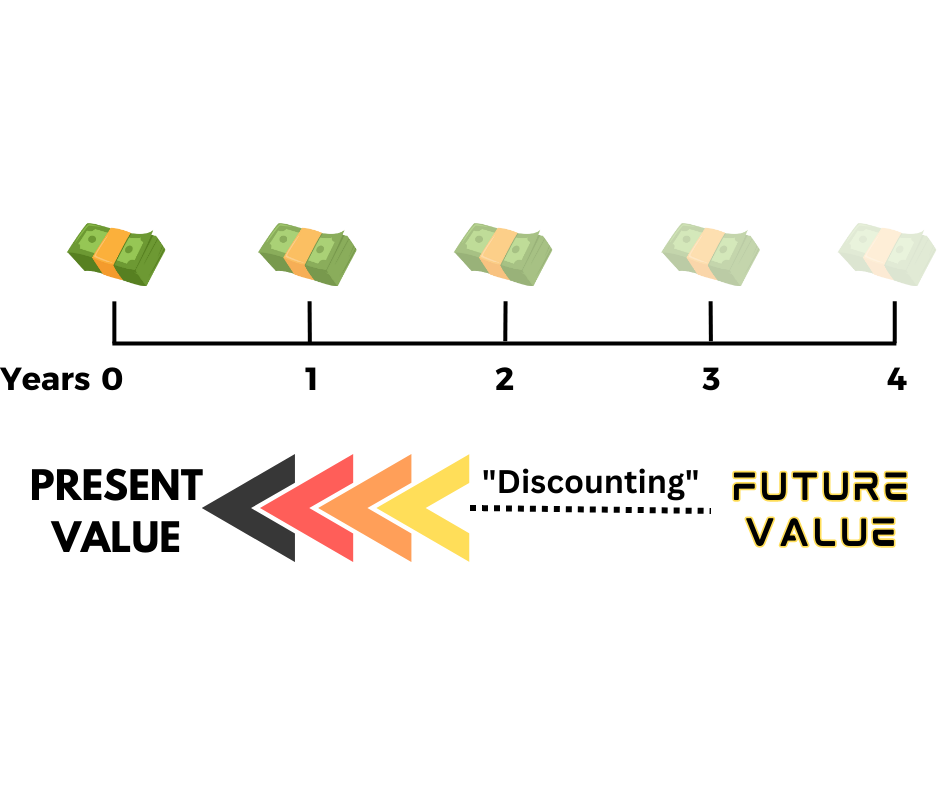

What is time value of money?

A dollar today > a dollar tomorrow because $ today can earn a return.

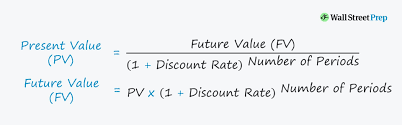

What is present value?

The current value of future cash flows discounted at an appropriate rate.

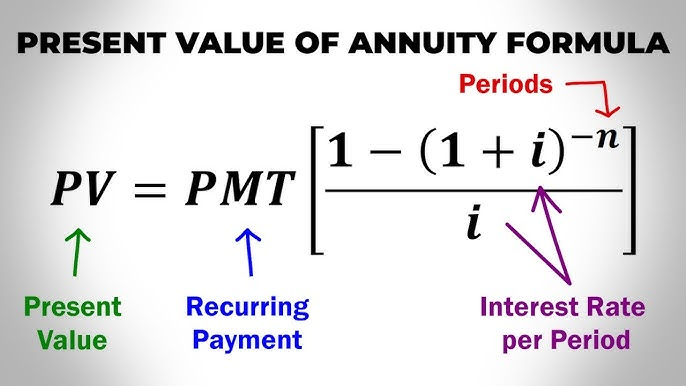

Present value of annuity/ annuity due

PV of Ordinary Annuity: Equal payments made at the end of each period.

PV of Annuity Due: Equal payments made at the beginning of each period → always worth more than an ordinary annuity (one extra compounding).

Ex of Annuity Payments:

Leases

Interest

What is a debt covenant?

A lender‑imposed condition/limit (e.g., leverage ratio) designed to protect the creditor.

What happens if you violate a debt covenant?

May trigger “technical default”

Debt can become current, higher rate, or penalties unless a waiver is obtained.

Disclose the situation.

What is a bond?

A long‑term debt instrument with periodic interest and principal repayment at maturity.

Bond Carrying Value = (PV + PV of Annuity) - Amortization

How do you record a bond?

Record at proceeds ($$ we received as part of our debt instrument).

Dr Cash

Dr. Discount (if Discounted bond)

Cr. Premium (if Premium bond)

Cr Bonds Payable (face)

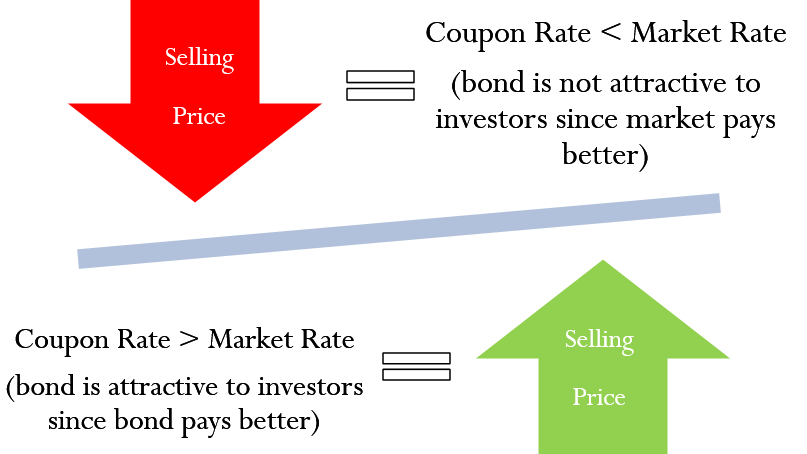

What determines if a bond is issued at a discount or premium?

Compare stated (coupon) rate to market (yield) rate:

Stated < Market → Discount (investors demand higher return, pay less up front).

Stated > Market → Premium (bond pays more interest, investors pay more up front).

Stated = Market → Par.

or

Discount → Sold < Face value

Premium → Sold > Face Value

What is a Term Bond vs a Serial Bond?

Term: Entire principal due at one maturity date.

Serial: Principal repaid in installments over time.

What is a Secured Bond vs a Debenture?

Secured: Backed by collateral (e.g., mortgage bond).

Debenture: Unsecured; relies only on issuer’s credit.

What is a Callable Bond?

Issuer can repay early at a specified call price.

What is a Convertible Bond?

Bondholder can convert debt into stock.

What is a Zero-Coupon Bond?

Sold at deep discount

No periodic interest

Pays face at maturity

What is a Registered Bond vs a Bearer Bond?

Registered: Owner’s name recorded; interest paid directly to them.

Bearer: No owner record; whoever holds the bond gets paid (like cash).

Differece between Bond Payable and Note Payable

Both are debt.

Bonds are typically issued to many investors in standardized units

Notes often with a single lender, may be installment based.

What does "Face Value" of bond mean?

Principal amount to be repaid at maturity

Cash interest = face × stated rate.

What is a market rate vs. stated rate?

Stated (coupon) rate: on the bond.

Market (yield) rate: current return demanded.

If stated > market → premium

If stated < market → discount

If equal → par.

What does a "quoted" price of a bond mean?

Percentage of par (e.g., 101 = 101% of face; 98 = 98% of face).

What is a bond's selling price?

PV interest + PV principal

What determines the market rate for a bond?

Prevailing interest rates (economy)

Issuer credit risk

Time to maturity

Liquidity

Features (options, security)

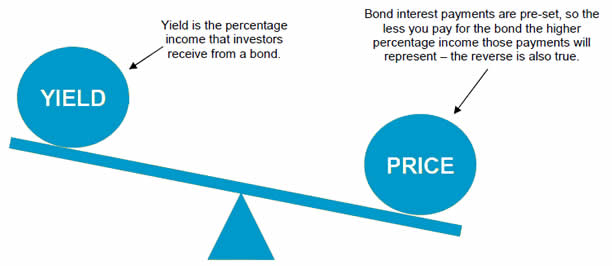

Coupon rate

Yield

Effective rate

Coupon = Stated interest rate → what’s on the face of the bond

Yield = Market interest rate (this is the same as effective rate), return that market demands

Why would one bond be sold at a higher price than another?

Higher coupon (stated interest rate)

Lower risk

Shorter maturity

Favorable features (e.g., put option)

What are bond issue costs and how do they affect the carrying value of the liability?

Fees to issue bonds

Under GAAP, deduct from the debt’s carrying amount (like a discount) and amortize to interest expense over the term.

Ex: If a $1,000,000 bond is issued with $20,000 underwriting & legal fees:

Record:

Dr Cash 980,000

Dr Bond Issuance Costs 20,000

Cr Bonds Payable 1,000,000

Then amortize the $20,000 (like a discount) to interest expense over the bond term.

👉 Net effect: carrying value starts at $980,000, not $1,000,000.

What is the effective interest method?

Interest expense = carrying amount × market (effective) rate.

Amortization = expense – cash interest.

Updates carrying amount toward par.

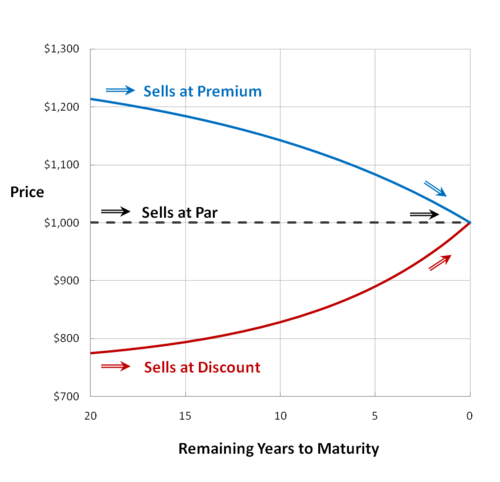

What does it mean to amortize a bond?

Allocate the discount/premium (and issuance costs) to interest expense over time so carrying value moves toward face value.

What is the difference between interest expense and interest payable with bonds?

Interest expense: based on effective (market) rate × carrying value.

Interest payable: the cash interest owed (stated rate × face value ) for the period.

Difference = amortization.

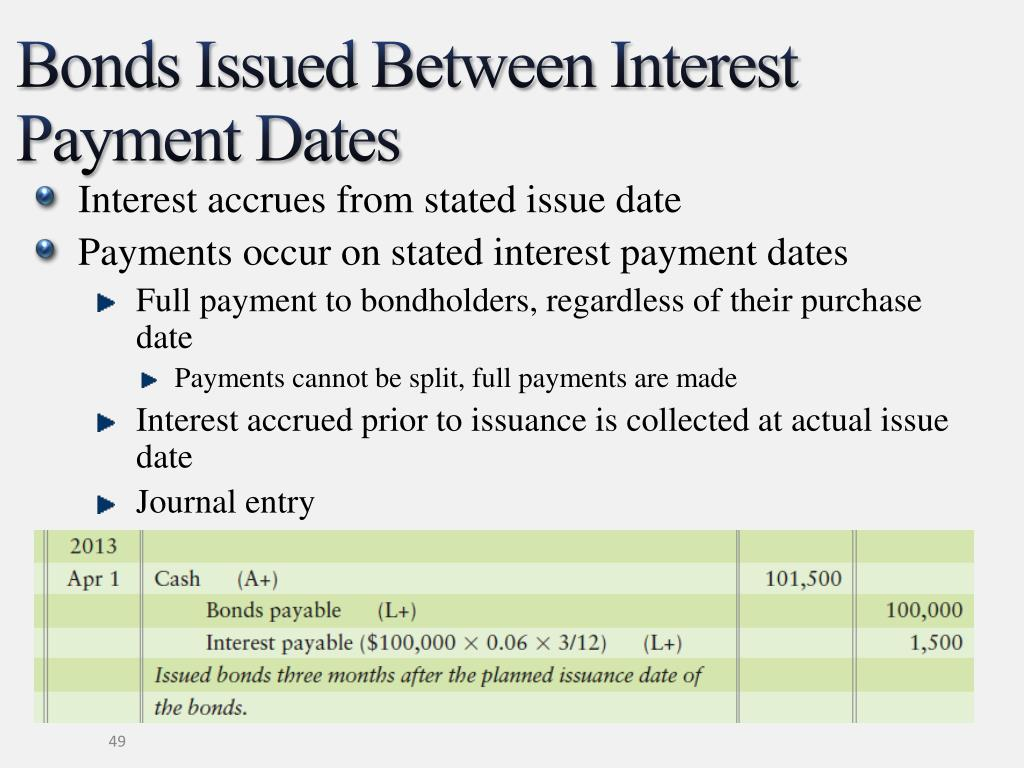

What happens to bond price when it is issued between interest payment dates?

Buyer pays accrued interest to seller at issuance (price = clean price + accrued). First coupon goes entirely to the holder.

Purpose→ simplifies interest payments because then the issuer can just pay the same amount of interest to all bond holders, regardless of when they purchased and how much interest was accrued.

What kind of bond matures in installments?

Serial bond (matures in staggered installments).

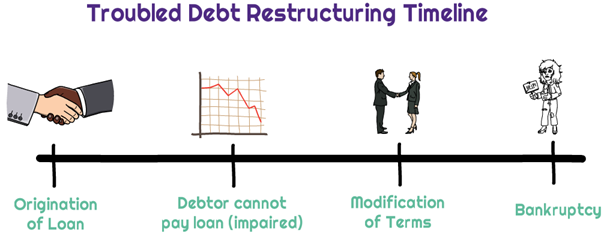

What is Troubled Debt Restructuring

modification of loan terms by a creditor to a debtor who is experiencing financial difficulties. This involves a lender granting a concession, such as a reduced interest rate or an extended maturity date, that they wouldn't normally offer to improve the likelihood of recovering their investment.

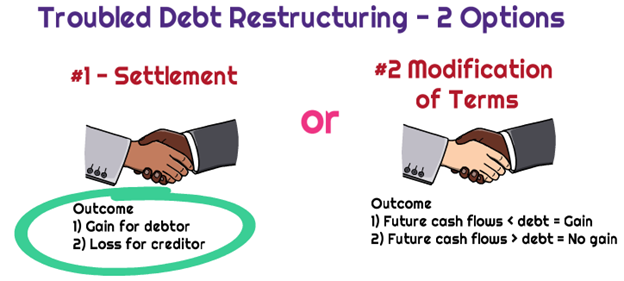

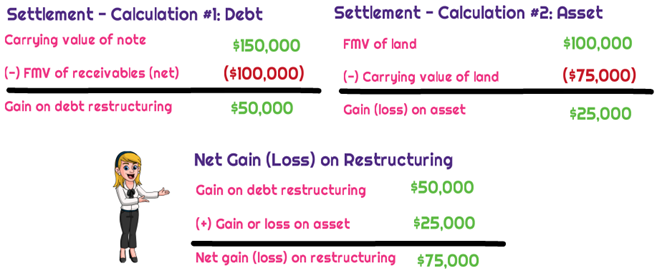

What are concessions?

Creditor grants favorable terms (rate reduction, principal forgiveness, extended maturity) to a troubled debtor.

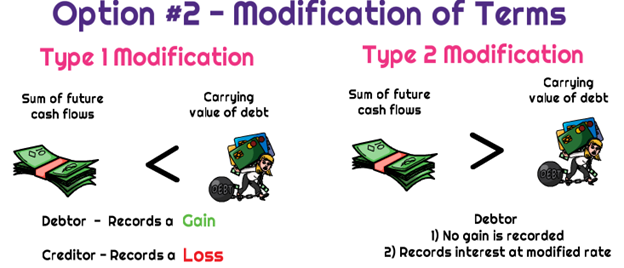

How are concessions recognized by a debtor?

If the total undiscounted cash flows under new terms < carrying amount, recognize a gain and reduce the carrying amount; otherwise, recompute interest using a new effective rate.

What happens if a creditor makes concessions and modifies the terms of debt?

For the debtor in a TDR: possibly recognize a restructuring gain (if cash flows < carrying amount). Then amortize the revised carrying amount using the new terms; disclose the restructuring.

What is a callable bond?

Issuer can redeem early at a specified call price.

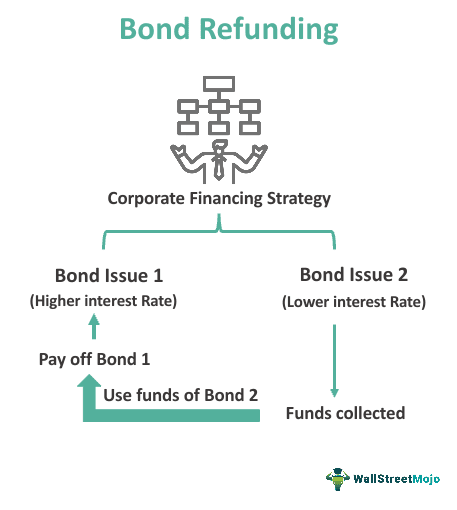

What is a refundable bond?

A callable bond that may be retired with proceeds of new (refunding) debt when advantageous.

What does it mean to extinguish a liability?

Derecognize a liability when paid, legally released, or substantially modified.

Recognize gain/loss = carrying amount – consideration paid (incl. fees).

What is a lease and the 2 types?

Right to control the use of an identified asset in exchange for payments.

Lessee types:

Finance

Operating.

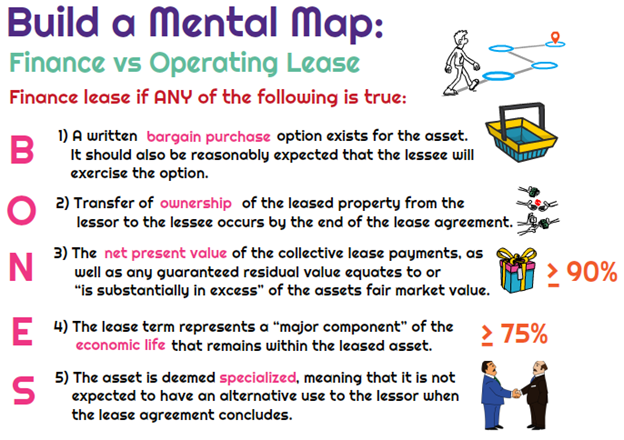

If any of these 5 conditions are true, then it is a finance lease…

Bargain purchase option

Ownership is transferred at the end of the term

PV of lease payments >= 90% market value

Lease term >= 75% economic life

Specialized item that has no alternate use

What is a ROU (Right of Use) asset?

Lessee’s Dr. asset entry representing the right to use the underlying asset during the lease term.

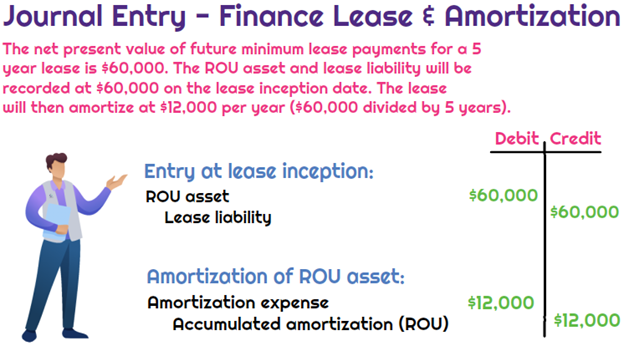

How is an ROU amortized?

Finance lease: separate amortization of ROU (straight‑line) + interest on lease liability.

Operating lease: single lease expense; ROU amortization is the plug to achieve straight‑line expense.

Difference in recording a finance vs operating lease

Both recognize ROU asset and lease liability.

Finance: two expenses (interest + amortization)

Operating: single lease expense.

Cash flows:

Finance principal → financing CF; interest → operating CF.

Operating payments → operating CF.

Who is lessee vs lessor?

Lessee: uses the asset and makes payments.

Lessor: provides the asset (classifies as sales‑type, direct financing, or operating).

What is an exception about lease terms of 12 months or less?

Short‑term lease election: Lessee may not recognize ROU/lease liability

Instead, can expense payments straight‑line.

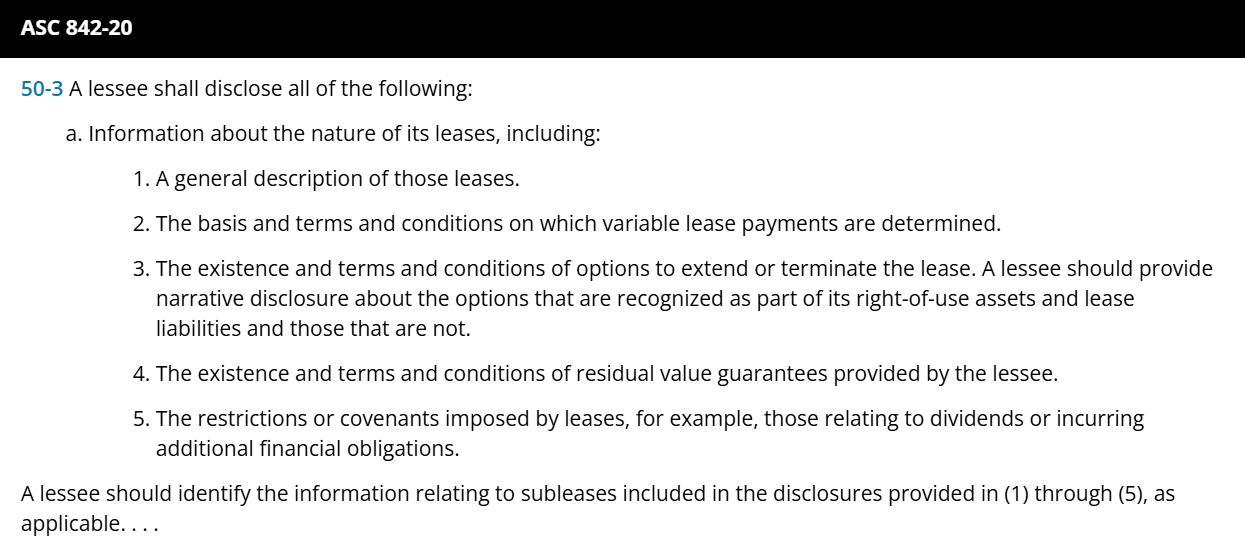

What kind of disclosures are needed about leases?

Disclosures:

qualitative info

terms

options

restrictions

quantitative info

maturity analysis of payments

lease expense components

ROU additions

cash paid

weighted‑average term

discount rate.

What is the implicit rate in a lease?

The interest rate the lessor charges, built into lease payments.

What is the incremental borrowing rate?

The rate the lessee would pay to borrow the money to buy the asset.

Which rate does the lessee use to measure the lease liability?

Use the implicit rate if known; if not, use the incremental borrowing rate.