⭐️ Study Guide Qs 5,7, & 10

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

33 Terms

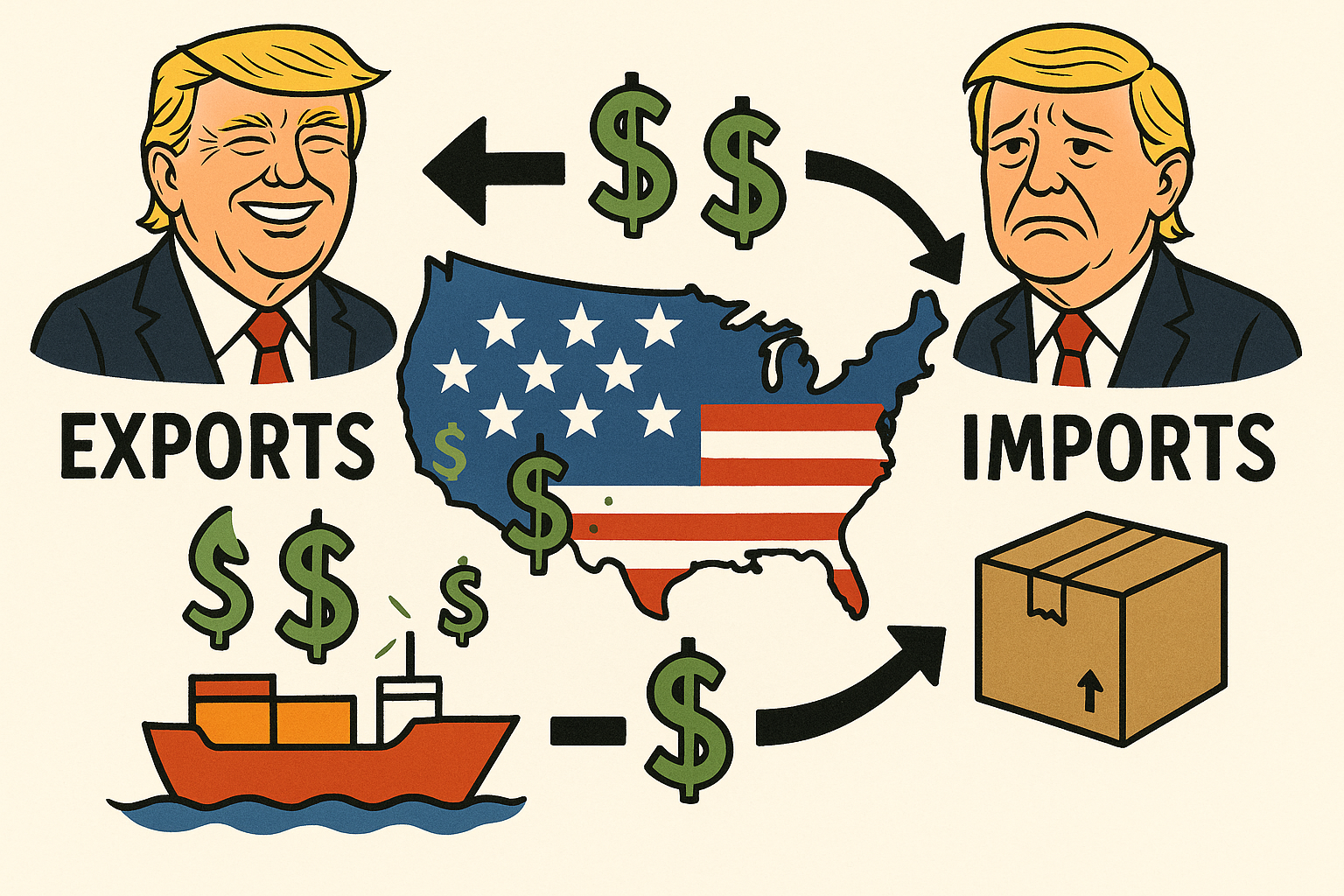

Trade Deficit

a nation imports more than it exports

Trade Surplus

a nation EXPORTS more than it IMPORTS

Balance of Trade

Exporting, Selling more = Surplus → More Money! 🙂

Importing, Buying more = Deficit → Less Money ☹

“More exports? Yay! 🙂 || More imports? Gotta pay! ☹ “

Mercantilism

The old idea that a country gets richer by selling more to other countries (exports) and buying less from them (imports).

The goal: bring in more gold and silver.

“Sell more, buy less, get rich with gold.”

Exports = 💰 coming in

Imports = 💰 going out

More exports = More treasure 🪙

Absolute Advantage

Abundantly producing a specific resource over other countries

🍌 Example: The U.S. and Brazil

The U.S. can produce 100 tons of wheat or 30 tons of bananas in a year.

Brazil can produce 50 tons of wheat or 100 tons of bananas in a year.

📊 Who has the absolute advantage?

The U.S. makes more wheat → it has an absolute advantage in wheat.

Brazil makes more bananas → it has an absolute advantage in bananas.

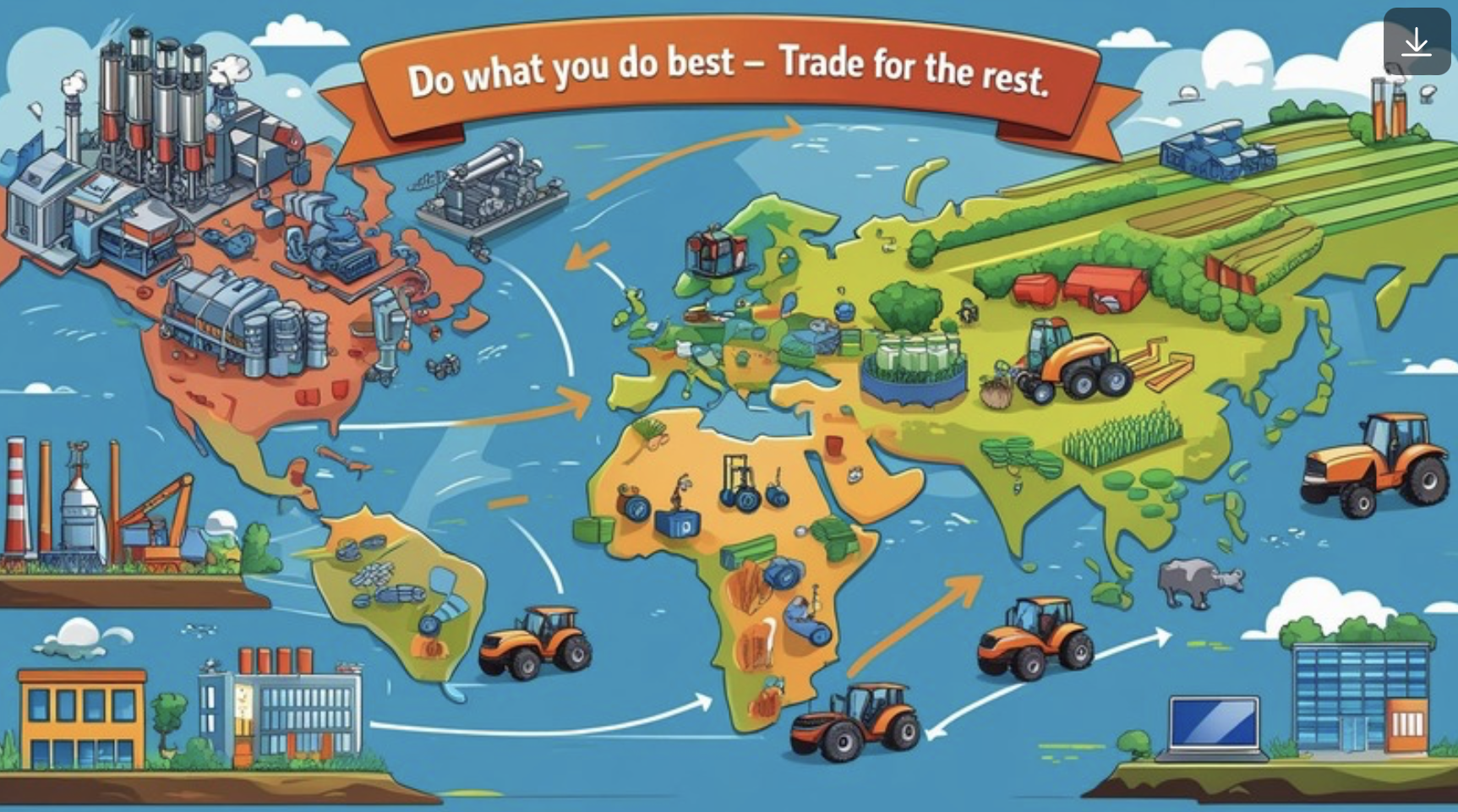

Comparative Advantage

A country focuses its energy on what they do best. (Manufacturing, services, or agriculture) and trades for what others produce more efficiently.

Product Life Cycles (International Trade Theory)

| Stage | Goal |

| ------------------- | ----------------------------------------- |

| Development 🛠 | Build and test the product (no sales yet) |

| Introduction 🌱 | Create awareness and attract early users |

| Growth 🚀 | Increase sales and market share |

| Maturity 🌳 | Maximize profits and defend market share |

| Decline 🍂 | Cut losses or reinvent the product |

Strategic Trade (International Trade Theory)

Governments can strategically intervene in big industries by providing funding — like Boeing and Airbus

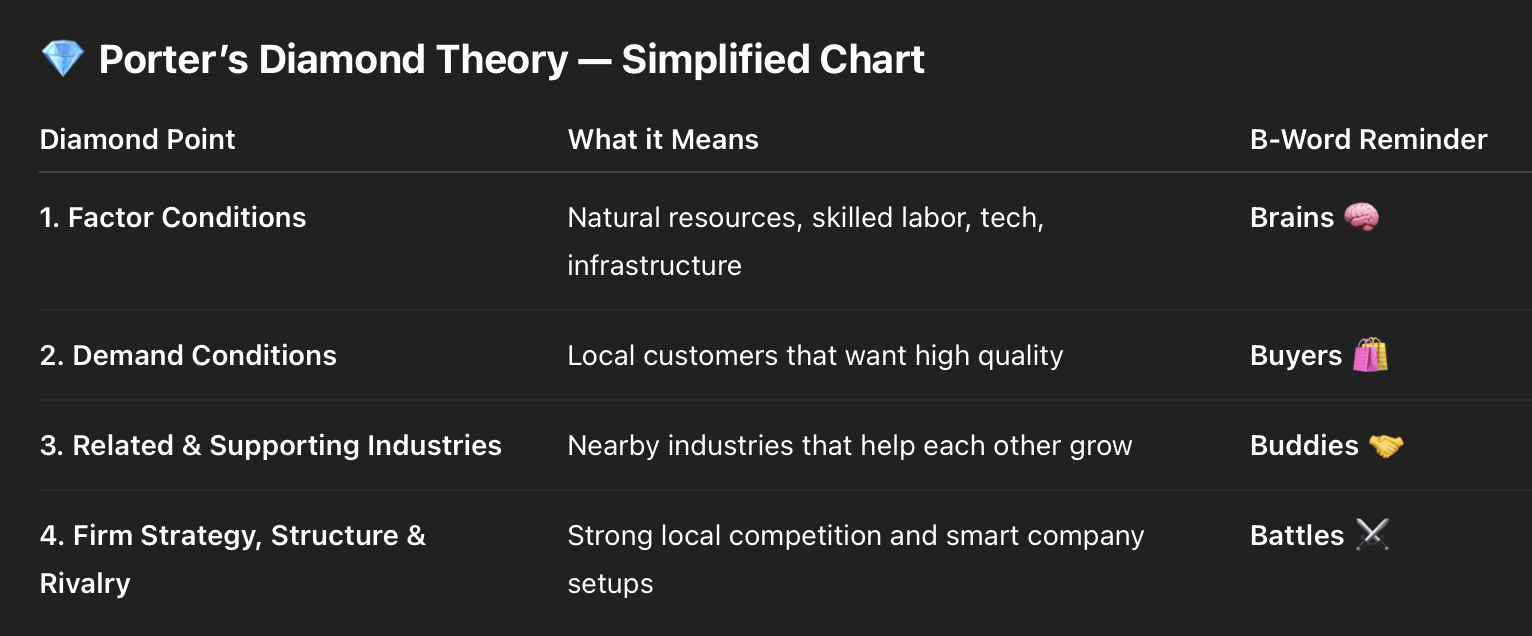

Diamond (International Trade Theory)

Brains, Buyers, Buddies, Battles — build advantage!

Exchange Rate

Exchange rate tells the trade fate—how much of one money you swap for another on any given date.

Exchange rates move like a seesaw — always going up and down depending on what people think and do. Like at Bed Bath and Beyond, prices changed daily

What are the determinants of supply and demand for an exchange

rate market?

| Exchange Rate | | Supply or Demand? | __________________________________________________

| 🔼 Exchange Rate ↑ | 📈 Demand ↑ or 📉 Supply ↓ |

| 🔽 Exchange Rate ↓ | 📉 Demand ↓ or 📈 Supply ↑ |

Purchasing Power Parity

🛒🌍💵 = 🛒🌍💶

“Same stuff, same price, no matter the country.”

What does it mean if a country’s currency depreciates?

Appreciates?

Depreciation – Currency loses value

Appreciation – Currency gains value

Fixed Exchange Rate

High and strict govt intervention

Keeps currency at a fixed value by buying/selling currency reserves constantly

Pegged Exchange Rate

High but Flexible Govt Intervention

Allows currency to fluctuate within a set range; intervenes when it goes outside band

Floating (Clean) Exchange Rate

None or Minimal Govt Intervention

No direct intervention; market forces fully determine exchange rate

Managed (Dirty) Float Exchange Rate

Moderate and Occasional Govt Intervention

Mostly lets market decide but occasionally steps in to prevent excessive fluctuations

Exchange Rate Relationship Chart

| Factor | Effect on Exchange Rate (📈 = up, 📉 = down) |

| ----------------- | --------------------------------------------- |

| 🔼 Interest Rate | 🔼📈 Exchange rate up (currency stronger) |

| 🔽 Interest Rate | 🔽📉 Exchange rate down (currency weaker) |

| 🔼 Inflation Rate | 🔼📉 Exchange rate down (currency weaker) |

| 🔽 Inflation Rate | 🔽📈 Exchange rate up (currency stronger) |

🔼 Interest Rate goes UP

Exchange Rate GOES UP (currency value increases)

🔽 Interest Rate GOES DOWN

Exchange rate down (currency value gets weaker)

🔼 Inflation Rate GOES UP

Exchange rate GOES DOWN (currency gets weaker)

🔽 Inflation Rate GOES DOWN

Exchange Rate GOES UP (currency value is stronger)

Transaction Risk (foreign countries) Example

You agree today to pay 100 euros for a cool gadget.

Today, 1 euro = 1.10 dollars, so you expect to pay $110.

But on payment day, if 1 euro = 1.20 dollars, suddenly you need $120 instead — that extra $10 is the transaction risk!

Currency Hedging

Locking in a price (This occurs in forward transactions)

🟩 Spot Transactions

🟩 Exchange currency right now (within 2 days)

🟦 Forward Transactions |

🟦 Agree today to exchange currency at a fixed price later to avoid surprises

(Currency Hedging)

🟧 Swap Transactions

Buy one currency now and agree to sell it back later at a set price — like a two-step exchange happening at the same time.

If a company seeks to limit foreign exchange rate exposure in the

forward direction, what is the most effective way to do this?

The company should enter a forward contract to fix the exchange rate now for future currency payments or receipts

An example of first mover advantage

Amazon was one of the first to launch a large online marketplace.

Advantages:

Builds strong brand recognition early

Can set the standards and customer expectations

Gains early access to key resources and locations

Disadvantages:

Faces higher risks and costs (uncertain demand)

Has to educate the market

Competitors can learn from their mistakes

Late mover example

Walmart entered the online marketplace after Amazon.

Advantages:

Can learn from the first mover’s mistakes

Can improve on products or services

Usually lower initial costs

Disadvantages:

Harder to build customer loyalty

May face tough competition from established firms

Less control over market standards

Two modes of foreign market entry

Exporting

Federal Direct Investment

What is EXPORTING?

What it is: Selling products made in your home country to customers in another country.

Scale: Usually a smaller-scale, low-risk way to enter a foreign market.

Example: A U.S. coffee company shipping its beans to cafes in Europe.

ONE WAY TO ENTER THE FOREIGN MARKET

What is FDI?

Foreign Direct Investment

What it is: Setting up operations or buying assets inside the foreign country (like factories, offices, or stores).

Scale: A large-scale, higher-risk entry method involving more commitment.

Example: Toyota building a manufacturing plant in the U.S.

ANOTHER WAY TO ENTER THE FOREIGN MARKET