Ch 31: Open-Economy Macroeconomics: Basic Concepts

1/70

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

71 Terms

What’s a closed economy?

Economies that don’t interact w/ other economies in the world

What’s an open economy?

A economy that trades with other countries around the world. Trading stocks and products

What are exports?

goods produced domestically, sold abroad

What are imports

Foreign goods sold domestically

What is Net Exports? (Trade balance)

Exports - Imports

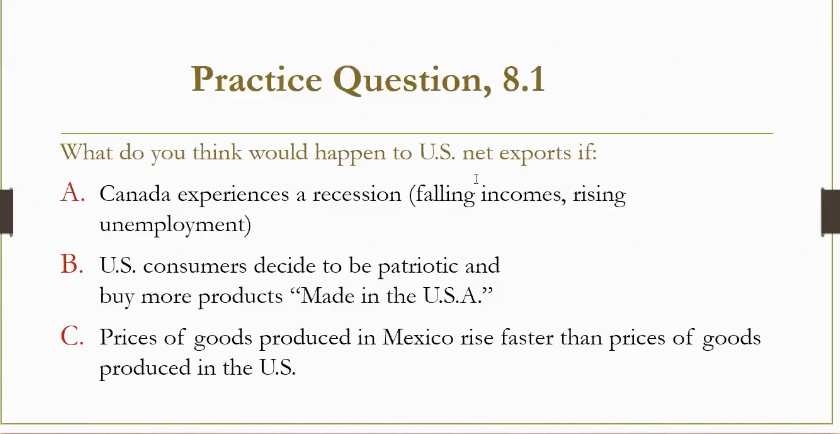

Net exports decrease, sell less & import cheaper goods

net exports increase, purchase fewer imported goods

net exports increase, goods in the U.S are cheaper, so Mexico purchases America’s goods

What are the 6 factors that influence NX?

consumer preferences

prices of goods, domestic & abroad

exchange rates

incomes of consumers both domestically & abroad

transportation

government policies

What’s trade surplus?

NX is positive & greater than 0

When we export > import

country sells more than it buys

What’s trade deficit? (- NX)

NX is negative & less than 0

imports > exports

country purchases more than it sells

What’s balanced trade?

NX is 0

Exports = Imports

countries buy and sell the same amount

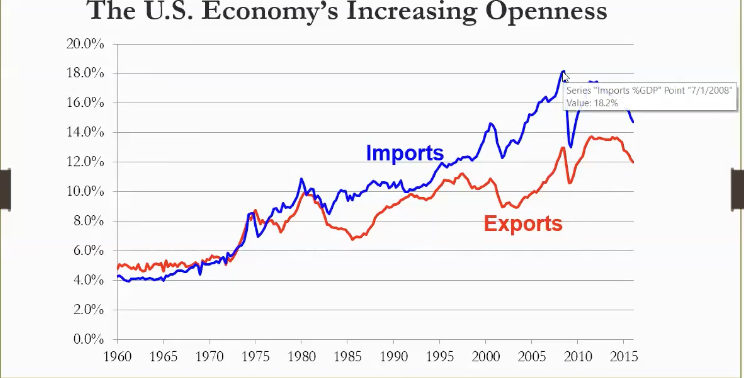

What does this data show?

U.S. increase openness

lots of trade deficits

2018, both imports and exports fall, cuz of recession

What’s the Net Capital Outflow (NCO)?

Purchase of a foreign asset by a domestic residence - purchase of a domestic asset by a foreign residence

aka

What is bought by others in America, what America buys from others

What are the two types of flow of capital abroad?

foreign direct investment

foreign portfolio investment

what’s foreign direct investment (FDI)

domestic residence manages a foreign investment

ex: American builds factory in mexico and runs it

what’s the foreign portfolio investment?

When a domestic resident purchases foreign stocks or bond and doesn’t manage the firm

What does the NCO measure?

The imbalance of assets in a country, wether one country is receiving more or less capital

What happens when NCO > 0?

There’s capital outflow

Domestic purchase of foreign assets exceed foreign purchase of domestic assets

What happens when NCO < 0

There’s capital inflow

Foreign purchases of domestic assets exceed domestic purchases of foreign assets

What variables influence NCO?

Real interest rates paid on foreign assets

Real interest rates paid on domestic assets

Risks of holding foreign assets

Government policies affecting ownership of domestic assets

What is the accounting identity?

NCO = NX

Why does NCO = NX?

Where the U.S. increase, exports goods for the foreigner to purchase, the U.S. acquires some foreign assets

Ex: if an American firm sells laptops to a foreign firm, and gets paid in pounds, what happens to NX & NCO

NX increases, bc exports increase, because they are exporting goods for the foreigners to purchase.

NCO increases, bc domestically sold and foreignly purchased increases, because they are using their foreign assets (pounds) to purchase the laptop. America can use china’s money to purchase their stocks

Ex: if the U.S. imports toys from China, the chinese seller gets U.S. dollars as payment, what happens to the NX & NCO?

NX decreases, imports increase, the U.S. is purchasing foreign goods for its country

NCO decreases, America is using dollars to purchase China’s products, China can purchase america’s stocks. Which increases Foreign purchases of domestic assets

What’s the relationship between savings and investing in a closed economy?

S = I

What is Y (real gdp) in a open economy?

Y = C + I + G + NX

What is national savings in an open economy?

S = Y - C - G

What is investments in an open economy?

I + NX = Y - C - G (this segment is the same as S)

What’s the relationship between Savings & Investing in an open economy?

S = I + NX

If NX = NCO, what does savings equal to in terms of investing?

S = I + NCO

Saving = domestic investment + Net Capital Outflow

If there’s a trade surplus, what happens to net exports, Savings & NCO?

net exports > 0

savings > investment

NCO > 0

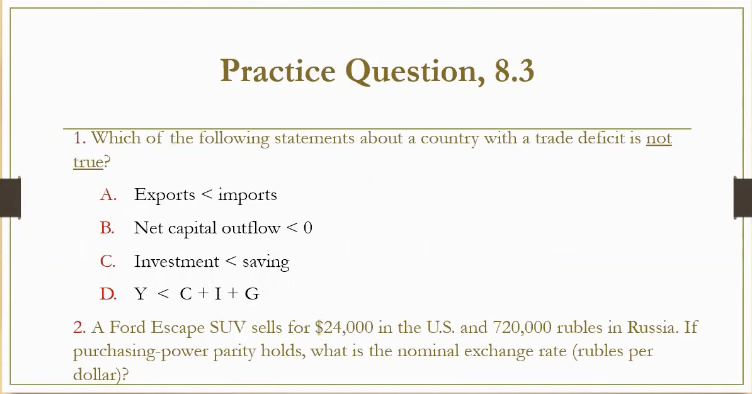

If there’s a trade deficit, what happens to net exports, Savings & NCO?

NX < 0

Savings < Investment

NCO < 0

What happens when I > S, in terms of NCO?

That means that the investments are being funded by the foreigners,

whereas if S > I,

that means that most of the investments are being financed by domestic people

What’s the relationship between, NX, S & I, and NCO?

NX equals, S - I, which also equals NCO

Why has the U.S. been having a trade deficit?

gov budget deficits & low private savings made overall national savings low

nation savings ended up increasing, but domestic investment, boomed cus of tech

Is trade deficit bad?

while it’s not the best, it didn’t depress domestic investment, so firms could still borrow from abroad

What’s the nominal exchange rate?

how much one countries currency trades for another

exchange rate = foreign currency/unit of domestic currency

What does appreciation/strengthening of a currency?

increase in the value of a domestic currency, aka increase in America’s purchasing power, by the amount of foreign currency it can buy

ex.

old: 80 yen/dollar

new: 90 yen/dollar

Yen depreciates, dollar appreciates

What's the real exchange rate?

rate g & s of one country trade for the g & s of another

What’s the real exchange rate formula?

e x P / P*

e= nominal exchange rate

P = domestic price

P* = foreign price (in foreign currency)

Practice Question:

If a big mac costs $2.50 in the U.S. & 400 yen in Japan.

nominal exchange rate (e) = 120 yen / $

What’s the real exchange rate?

Real exchange rate = e * P/ P*

step 1: e x P: 120 y/d x $2.50 per big mac = 300 yen / per big mac

step 2: (e x P) / P*: 300 yen per U.S. big mac / 400 yen per big mac = 0.75 Japanese big macs per U.s. Big macs

What does “0.75 Japanese Big Macs per U.S. Big Macs?”

To buy a Big Mac in the U.S., a Japanese Citizen must sacrifice an amount that could purchase 0.75 Big Macs in Japan.

What is the units in Real Exchange Rate?

The rate is in terms of the good, big mac, not price or money relative to each other

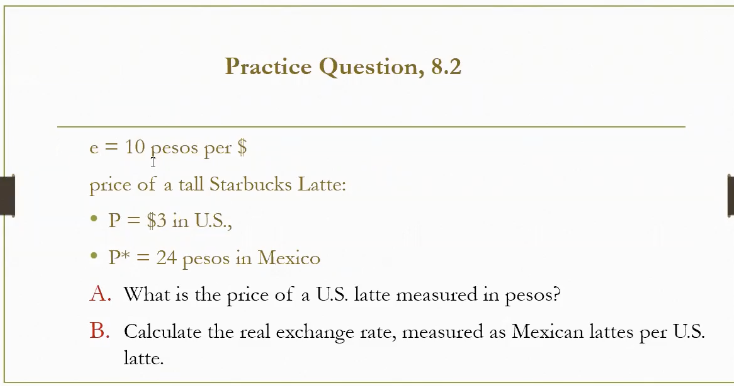

e = 10 peso/$

P = $3

P* = 24 peso

A: U.S latte in pesos: e x p = 10 × 3 = 30 pesos/latte

B: real exchange rate: (e x p)/p* = 30/24 = 5/4 = 1.25 mexican lattes per u.s. lattes

What’s the real exchange rate w/ many goods?

the same as before but price is basket of goods

real exchange rate: (e x P) / P*

What happens if the U.S. real exchange rate appreciates?

U.S. goods become more expensive relative to foreign goods

What happens when theres an appreciation (rise) in the U.S. real exchange rate?

U.S. goods become more expensive compared to foreign goods

consumers at home & abroad both buy fewer U.S. goods and more foreign goods

lower exports

higher imports

lower net exports

What is the law of one price?

a good should sell for the same price in all markets

What’s arbitrage?

When someone takes advantage of price differences for the same item in different markets

Why is there arbitrage in this scenario:

Coffee sells $4/pound in Seattle, $5/pound in Boston, transporting is affordable

you can make a quick profit by purchasing coffee in Seattle, and selling it in Boston

What happens to the prices of coffee when you do this:

you can make a quick profit by purchasing coffee in Seattle, and selling it in Boston

you drive up the prices in Seattle, and drive down the prices in Boston, until both prices are equal

What’s Purchasing Power Parity, aka PPP?

PPP:

the theory of exchange rates

a unit of any given currency should be able to buy the same quantity of goods in all countries

aka

one price for the same good across all locations

What’s the PPP formula?

What happens when a basket contains a Big Mac.

P = price of U.S. good (in $)

P* = price of Japanese good (in yen)

e = exchange rate, yen per dollar

e = P* / P

Practice problem:

The cost of a basket of goods in the U.S. is $1k, in Europe its 500 pounds

According to PPP: e = P* /P, e = 500 pounds / 1000 dollars

e = 0.5 pounds/$

0.5 is the exchange rate if you can buy the same amount of goods w/ two different currencies

What happens to the real interest rate if purchasing power is the same both home & abroad

if the PPP makes goods from home & abroad the same, then the real exchange rate can’t change

What’s the theory of PPP?

nominal exchange rate between the currencies of two countries must reflect the price levels in those countries

What is drawn from the PPP?

nominal exchange rates change when price levels change

when a central bank in any country increases the money supply…

it causes price levels to rise

cause countries currency to depreciate relative to other countries in the world

What happens to nominal interest rate (e) whentwo countries have different inflation rates?

PPP = e = P* / P

If inflation in foreign country > inflation in domestic country, e will increase

If inflation in foreign country < inflation in domestic country, e will fall

What are the limitations of PPP?

many goods are not easily traded,

even tradable goods aren’t always perfect substitutes

it isn’t a perfect theory of exchange rate determination

there might be large & persistent movements in nominal exchange rates

many goods are not easily traded

so arbitrage doesn’t happen

even tradable goods aren’t always perfect substitutes

price differences reflect difference in tastes

it isn’t a perfect theory of exchange rate determination

real exchange rates fluctuate

there might be large & persistent movements in nominal exchange rates

they show changes in prices at home & abroad

C

e = P* / P, e = 720,000 / 24,000 = 30 rubles / dollar

How can an economy’s savings be used?

either to finance investment at home or to buy assets abroad

national savings (s) = domestic investment (I) + net capital outflow (NCO)

According to the PPP, what does the nominal exchange rate (e) reflect?

the price levels in those countries

According to PPP, countries w/ high inflation and low inflation should have appreciating or depreciating currencies?

high inflation = depreciating, less purchasing power

low inflation = appreciating, more purchasing power

How do you calculate future price?

future price = current price x ((1 + inflation rate) ^years)

New exchange rate between two countries, formula

New Exchange Rate of x /y =Initial Exchange Rate x (1 + inflation rate in x)^ years / (1 + inflation rate in y)^ years