❤️🔥 1.5 - Growth and Evolution

1/42

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

43 Terms

Acquisition

Method of external growth that involves one company buying a controlling interest (majority stake) in another company, with the agreement and approval of the target company's Board of Directors.

Average costs

Refers to the cost per unit of output.

Backward vertical integration

Occurs when a business amalgamates with a firm operating in an earlier stage of production, such as a car manufacturer taking over a supplier of tyres or other components.

Conglomerates

Businesses that provide a diversified range of products and operate in a range of different industries.

Demerger

Occurs when a company sells off a part of its business, thereby separating into two or more businesses. It usually happens due to conflicts, inefficiencies and incompatibilities following an earlier merger of two or more companies.

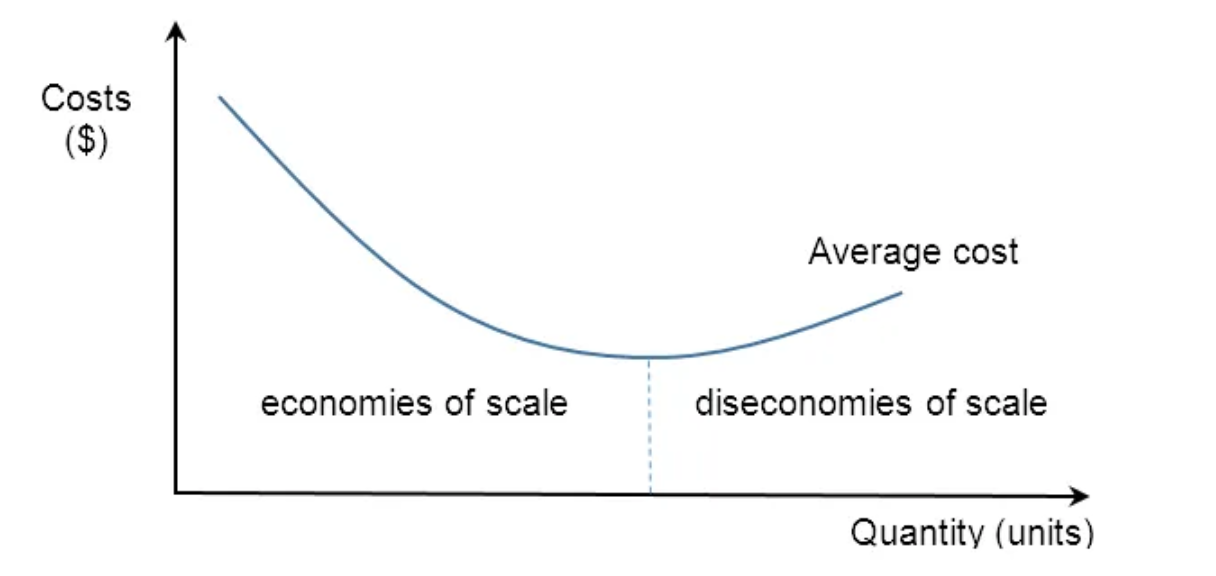

Diseconomies of scale

Cost disadvantages of growth. Average costs are likely to eventually rise as a firm grows due to a lack of control, coordination and communication.

Economies of scale

Lower average costs of production as a firm operates on a larger scale due to gains in productive efficiency, such as easier and cheaper access to source of finance.

External diseconomies of scale

Occur due to factors beyond its control which cause average costs of production to increase as an industry grows.

External economies of scale

Occur when an organization's average cost falls as the industry grows. Hence, all firms in the industry benefit.

External growth (inorganic growth)

Occurs when a business grows and evolves by collaborating with, buying up or merging with other organizations.

Financial economies of scale

Cost savings made by large firms as banks and other lenders charge lower interest (for overdrafts, loans and mortgages) because larger businesses represent lower risk.

Forward vertical integration

Growth strategy that occurs with the amalgamation of a firm operating at a later stage in the production process, such as a book publisher acquiring book retailers.

Franchising

Refers to an agreement between a franchisor selling its rights to other businesses (franchisees) to allow them to sell products under its corporate name in return for a fee and regular royalty payments.

Horizontal integration

External growth strategy that occurs when a business amalgamates with a firm operating in the same stage of production.

Internal diseconomies of scale

Occur due to internal problems of mismanagement, causing average costs of production to increase as a firm grows.

Internal economies of scale

Occur within a particular organization (rather than the industry as a whole) as it grows in size.

Internal growth (organic growth)

Occurs when a business grows using its own capabilities and resources to increase the scale of its operations and sales revenue.

Joint venture

Growth strategy that combines the contributions and responsibilities of two or more different organizations in a shared project by creating a separate legal enterprise.

Lateral integration

Refers to external growth of firms that have similar operations but do not directly compete with each other, such as PepsiCo acquiring Quakers Oats Company.

Marketing economies of scale

Occur when larger businesses can afford to hire specialist managers, thereby improving the organization's overall efficiency and productivity.

Merger

Form of external growth whereby two (or more) firms agree to form a new organization, thereby losing their original identities.

Optimal level of output

Most efficient scale of operation for a business. This occurs at the level of output where the average cost of production is minimized.

Purchaser

Refers to the acquiring company in an acquisition or the buyer of another company in a takeover.

Purchasing economies of scale

Occur when larger organizations can gain huge cost savings per unit by purchasing vast quantities of stocks (raw materials, components, semi-finished goods and/ or finished goods).

Risk bearing economies of scale

Occur when large firms can bear greater risks than smaller ones due to having a greater product portfolio.

Specialization economies of scale

Occur when larger firms can afford to hire and train specialist workers, thus helping to boost their level of output, productivity and efficiency.

Strategic alliances

Formed when two or more organizations join together to benefit from external growth, without having to set up a new separate legal entity.

Synergy

Benefit of growth, which occurs when the whole is greater than the sum of the individual parts when two or more business operations are combined. Synergy creates greater output and improved efficiency.

Takeover (hostile takeover)

Occurs when a company buys a controlling interest in another firm without the prior agreement or approval of the target company's Board of Directors.

Target company

Refers to the organization that is purchased by another in an acquisition or takeover deal.

Technical economies of scale

Cost savings by greater use of large-scale mechanical processes and specialist machinery, such as mass production techniques which help to cut average costs of production.

Vertical integration

Takes place between businesses that are at different stages of production.

How might the notion of economies and diseconomies of scale be shown on a diagram?

Optimal size of a business

Appropriate size of a business to operate efficiently and maximize profit, whilst keeping average costs low.

Main types of external economies of scale

Technological progress

Improved transportation networks

Skilled labor

Regional specialization

Main reasons why businesses seek to grow?

Market share

Total sales revenue

Size of workforce

Profit

Capital employed

Main reasons why some businesses stay small?

Cost control

Loss of control

Financial risks

Government aid

Local monopoly power

Personalized services

Flexibility

Small market size

‘Mergers and acquisitions (M&As)’

Integration of two or more businesses to form a single company. New and larger business entity will benefit from improved synergies.

Merger vs aquisition

Merger: integration of businesses of similar sizes

Acquisition: occurs between two companies that are not of equal stature.

Reasons why businesses become takeover targets:

Growth potential but lack sufficient funds for internal growth

Seen as a small rival that has growth potential

Widely recognized corporate name or brand but face a liquidity or financial crisis.

Vulnerable due to drop in profits or share price

Evaluation of joint ventures

Advantages:

Competitive advantage

Entry to foreign markets

Relatively cheap

Synergy

Disadvantages:

Rely heavily on the resources and goodwill of their counterparts

Dilution of the brands

Possibility of organizational cultural clashes

Benefits and drawbacks of franchising for the franchisee.

B:

lower start-up costs as the idea has been developed

low risks

lower costs due to ‘free’ advertising and promotion

larger degree of autonomy

D:

hinder entrepreneurial talents of the franchisee

expensive to buy the franchise

have to pay a significant percentage of sales revenues to the franchisor.

Benefits and drawbacks of franchising for the franchisor.

B:

rapid growth and cheaper as the franchisee pays for the rights

lack of running costs

receive royalty payments and membership/registration free

D:

high risk as reputation may be damaged

difficult to control daily operations

not as quick as external methods such as M&As