Thẻ ghi nhớ: Accouting gki | Quizlet

1/73

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

74 Terms

Which of the following best explains the term 'capital expenditure'?

on the acquisition of non-current assets, or improvement in their earning capacity

Which of the following should be accounted for as capital expenditure?

D Legal fees incurred on the purchase of a building

W hich of the following transactions should be treated as capital expenditure in the financial statements of Sydney, sole trader?

B £800 spent on purchasing a new laptop to replace the secretary's old one

W hich of the following is an aspect of relevance, according to the IFRS Foundation's Conceptual

Framework for Financial Reporting (the Conceptual Framework for Financial Reporting)

D Materiality

A ccording to the Conceptual Framework for Financial Reporting, which of the following are

enhancing qualitative characteristics?

A Comparability, understandability, timeliness, verifiability

Information is relevant if it is capable of making a difference in the decisions made by users.

According to the Conceptual Framework for Financial Reporting, financial information is capable of

making a difference in decisions if it has which of the following?

(1) Predictive value

(2) Comparative value

(3) Historic value

(4) Confirmatory value

1 and 4 only

he accounting principle which, in times of rising prices, tends to understate asset values and overstate profits, is:

D historical cost

Which of the following statements about accounting concepts and the characteristics of financial

information is correct?

A Financial statements are required to give a true and fair view. These terms have clear definitions which are included in IAS 1, Presentation of Financial Statements .

Listed below are two comments on accounting conventions.

(1) A ccording to the Conceptual Framework for Financial Reporting , financial information must be

either relevant or faithfully represented if it is to be useful.

(2) Materiality means that only items having a physical existence may be recognised as assets.

Requirement

Which, if either, of these comments is correct?

không cái nào

W hich of the following is the best description of fair presentation in accordance with IAS 1, Presentation of Financial Statements ?

D T he financial statements are reliable in that they faithfully reflect the effects of transactions, other events and conditions .

W hich of the following definitions of the going concern concept in accounting is consistent with the

definition given in IAS 1, Presentation of Financial Statements ?

A The directors do not intend to liquidate the entity or to cease trading in the foreseeable future.

A ccording to IAS 1, Presentation of Financial Statements , compliance with IFRS Standards will

normally ensure that:

D the entity's financial position, financial performance and cash flows are presented fairly

The directors of Lagon plc wish to omit an item from the company's financial statements on the grounds that it is commercially sensitive. Information on the item would influence the users of the information when making economic decisions.

Requirement

According to IAS 1, Presentation of Financial Statements, the item is said to be:

material

The International Sustainability Standards Board (ISSB) was established in 2021 and will issue IFRS

Sustainability Disclosure Standards.

Requirement

Which of the following statements regarding sustainability reporting is true?

B The ISSB will initially focus on climate-related disclosures.

Which of the following statements is correct?

C T he ICAEW Code of Ethics applies to its members, employees of member firms and ICAEW

students.

W hich of the following statements best describes ethical guidance in the UK?

B Ethical guidance is a framework containing a combination of rules and principles, the application of which is dependent on the professional judgement of the accountant based on the specific circumstances.

T he accounting equation is correctly expressed as:

C A ssets - liabilities - opening capital + drawings = profit

T he capital of a sole trader would change as a result of:

D personal petrol being paid for out of the business's petty cash

A business can make a profit and yet have a decreased bank balance. Which of the following might

cause this to happen?

C The lengthening of the period of credit given to customers

T he purpose of the financial statement that lists an entity's total assets and total capital and liabilities

is to show:

D the financial position of the entity at a particular point in time

A sole trader is £5,000 overdrawn at their bank and receives £1,000 from a credit customer in respect

of its account.

Requirement

Which element(s) of the accounting equation will change due to this transaction?

A Assets and liabilities only

A sole trader purchases goods on credit.

Requirement

Which element(s) of the accounting equation will change due to this transaction?

A A ssets and liabilities

A sole trader borrows £10,000 from a bank.

Requirement

Which element(s) of the accounting equation will change due to this transaction?

A A ssets and liabilities

A sole trader sells goods for cash for £500 which had cost £300.

Requirement

Which element(s) of the accounting equation will change due to this transaction?

B A ssets and capital

A sole trader increases the business's number of motor vehicles by adding their own car to the

business's fleet.

Requirement

Which element(s) of the accounting equation will change due to this transaction?

C A ssets and capital

W hich of the following is a source document that would be recorded in an entity's cloud-based accounting software?

B Credit note

W hich of the following best explains the imprest system of petty cash?

B The exact amount of petty cash expenditure is reimbursed at intervals to maintain a fixed float.

George purchases goods on credit from Hardeep for £1,000; £100 of these goods are defective and

George returns them to Hardeep.

Requirement

What document would Hardeep issue to George in respect of the returned goods?

C Credit note

River downloads their bank transaction report for the day. The report shows a cash payment of £412

which the computerised accounting system has not been able to match to a transaction.

Requirement

The unmatched payment is most likely the result of:

A the purchase of a new laptop for £412

The petty cash float in a business has an imprest amount of £200. At the end of March, vouchers in

the petty cash box totalled £136 and the amount of cash remaining in the box was £54.

Requirement

Which of the following explains the difference?

A A petty cash voucher for £10 is missing.

Blake is a 1 VAT registered trader whose sales and purchases carry VAT at the standard rate of 20%.

Blake sells a customer goods on credit for £4,800 exclusive of VAT.

Requirement

What is the double entry to record this?

C Debit Receivables £5,760, Credit Sales £4,800, Credit VAT £960

W hat transaction is represented by the entries: Debit Rent, Credit Payables?

C T he receipt of an invoice for rent payable by the business

In double-entry bookkeeping, which of the following statements is true?

B Debit entries decrease income and increase assets.

A debit balance of £3,000 brought down on America Ltd's account in Brazil Ltd's accounting records means that Brazil Ltd ... America Ltd £3,000.

lends

A Lt owes to B Ltd.

Crimson plc paid an invoice from a credit supplier and took advantage of the early settlement

discount offered. When the invoice was received and recorded, Crimson plc did not expect to take

the discount.

Requirement

The journal entry to record the payment of the invoice is:

A Debit Payables, Credit Purchases, Credit Cash at bank account

W hat is the correct double entry to record an invoice raised to a credit customer who is not expected

to take advantage of an early settlement discount?

C Debit Receivables, Credit Revenue

A payment has been received from a credit customer in settlement of an invoice. The customer was

expected to take advantage of an early settlement discount offered, however, payment was not

made within the required timeframe and the discount was not taken.

Requirement

The correct double entry to record the receipt of funds from the customer in full settlement of the

invoice is:

A Debit Cash at bank, Credit Receivables, Credit Revenue

W hich of the following should be classified as a non-current asset?

Lands

Gerrard Ltd is registered for VAT. In the month of April, it sells goods to customers for a total of

£89,436 excluding VAT and purchases goods from suppliers for a total of £86,790 including VAT.

Requirement

What is the net amount shown in Gerrard Ltd's VAT account at the end of April?

C £3,422 credit

W hich of the following statements concerning the preparation of financial statements is true?

D Loss for the year is a credit entry in the statement of profit or loss ledger account.

W hich of the following would be a credit balance in the trial balance?

A Bank overdraft

W hen performing a reconciliation between the bank transaction report and the cash at bank account,

which two of the following would require an entry in the cash at bank account?

A Deposits credited after date

B Direct debit shown on bank transaction report only

C Bank charges

D Bank error

E Cheque presented after date

B Direct debit shown on bank transaction report only

C Bank charges

—> only record in bank statement

Epsilon Ltd's cash at bank account at 31 December 20X3 shows a balance of £565 overdrawn. On

comparing this with the transaction report downloaded from the electronic banking system, the

accountant discovers the following:

(1) A payment of £57 made by Epsilon Ltd on 31 December 20X3 has not yet cleared its bank.

(2) A n electronic funds transfer of £92 from a customer, which was paid into the bank on

30 December 20X3, has been dishonoured (bị từ chối) by the customer's bank on 31 December 20X3.

Requirement

The correct balance in Epsilon Ltd's cash at bank account as at 31 December 20X3 is:

C £657 credit

A company's initial trial balance includes a balance of £25,000 in a suspense account. On reviewing

the exception report, the bookkeeper identified the amount as a purchase of machinery for £25,000.

The amount had been correctly recorded in cash at bank, but the other side of the transaction had

not been matched by the accounting system.

Requirement

Which of the following journal entries would remove the suspense account and correctly record the

purchase of machinery?

C DEBIT, Plant and machinery, £25,000; CREDIT, Suspense account £25,000

Peri's customer unexpectedly took advantage of an early settlement discount for £300, paying

£3,700 on an invoice which totalled £4,000. Peri's bookkeeper was not sure how to record the

discount taken and so posted the following journal entry:

Requirement

Which of the following journal entries will remove the suspense account and correctly record the

discount?

B Debit Revenue £300, Credit Suspense account £300

A n error of principle would occur if plant and machinery purchased:

B was debited to the purchases account

Asela's exception report showed £265 received in the business bank account, and correctly recorded

in cash at bank, could not be matched by the accounting system and so had been posted to a

suspense account. Asela discovered that the receipt was in respect of a sales invoice for £295 on

which the customer had unexpectedly taken a prompt payment discount of £30. The customer had

paid within the required timeframe and so was entitled to take the discount.

Requirement

Which of the following journal entries should Asela post to correctly record the receipt and clear the

suspense account?

B Debit Revenue £30, Debit Suspense account £265, Credit Trade receivables £295

W hich of the following statements about bank reconciliations are correct?

(1) A ll differences between the cash at bank account and the bank statement must be corrected by

means of a journal entry.

(2) In preparing a bank reconciliation, payments received from credit customers before the period

end but credited by the bank after the period end should reduce an overdrawn balance in the

bank statement.

(3) Bank charges not yet entered in the cash at bank account should be dealt with by an adjustment

to the balance per the bank statement.

(4) If an electronic payment received from a credit customer is subsequently dishonoured by their

bank, a credit entry in the cash at bank account is required.

A 2 and 4

B 1 and 4

C 2 and 3

D 1 and 3

2,4

An error of commission is one in which:

C one side of a transaction has been recorded in the wrong account, and that account is of the same class as the correct account

Owais's trial balance included a suspense account which had been automatically opened by the

computerised accounting system. Using the exception report, the bookkeeper identified that the

balance in the suspense account was due to the following unmatched transactions:

(1) A payment to a credit supplier for £135 related to an invoice for £120. The business missed the

deadline to take the early settlement discount it had expected to take.

(2) A receipt of £90 from a credit customer who had unexpectedly (but appropriately) taken an early

settlement discount of £10.

(3) Interest received in the business bank account of £70.

Requirement

What is the balance on the suspense account?

B Credit £25

A ll of Elmo's sales and purchases attract VAT at 20%. A customer has just returned goods sold for

£230 excluding VAT.

Requirement

The double entry for this transaction is:

C Debit Revenue £230, Debit VAT £46, Credit Trade receivables £276

Incorrectly recording the purchase of stationery by debiting the computer equipment account would

result in:

A an overstatement of profit and an overstatement of non-current assets

In the trade payables of Magma Ltd, an invoice of £807 from Ferdinand has been recorded as a

credit note.

Requirement

After correcting this error, the trade payables balance will be:

D increased by £1,614

Supplier Ruffle Ltd has a debit balance of £26 in Staint plc's payables ledger.

Requirement

Which of the following would, alone, explain this balance?

A Staint plc paid an invoice for £26 even though it had recorded a credit note that Ruffle Ltd had issued in respect of this amount.

On reviewing its cash at bank account and the transaction report downloaded from its electronic

banking system, Probla plc discovers the following errors:

(1) A payment received from a credit customer for £1,095 was manually recorded in trade

receivables and cash at bank account as £1,509.

(2) A cheque to a credit supplier for £89 was entered incorrectly in trade payables and the cash at

bank account as £98.

Requirement

What is the journal entry to correct these errors?

A Debit Receivables £414, Credit Payables £9, Credit Cash at bank £405

W hich of the following statements about inventory for the purposes of the statement of financial position is correct?

D It may be acceptable for the cost of inventories to be based on selling price less estimated profit

margin.

In preparing its financial statements for the current year, a company's closing inventory was

understated by £300,000.

Requirement

C T he current year's profit will be understated and next year's profit will be overstated.

W hen calculating the cost of inventory, which of the following shows the correct method of arriving

at cost?

C Include inward delivery costs, Include production overheads

trader who sets her selling prices by adding 50% to cost, only managed to achieve a mark-up of

45%.

Requirement

Which of the following factors could account for the shortfall?

B T he value of the opening inventories had been overstated.

T he gross profit margin is 20% where:

B cost of sales is £100,000 and sales are £125,000

W hich of the following factors could cause a company's gross profit margin to fall below the

expected level?

B T he incorrect inclusion in purchases of invoices relating to goods supplied in the following

period

For many years Wrigley plc has experienced rising prices for raw material X and has kept constant

inventory levels. It has always used the average cost (AVCO) method to arrive at the cost of inventory.

Requirement

What would the result be if Wrigley plc had always used the first in first out (FIFO) method in each

successive year's financial statements?

A Lower cost of sales and higher closing inventory

During the year ended 31 March 20X4 Boogie plc suffered a major fire at its factory, in which

inventory that had cost £36,000 was destroyed. An insurance payment of 80% of the cost has been

agreed but not received at the year end.

Requirement

Which of the following correctly completes the journal entry to take account of these matters?

Debit trade and other receivables with £28,800 and:

C Debit Administrative expenses £36,000, Credit Purchases £36,000, Credit Other income £28,800

Percy plc started trading on 1 April 20X4 and made a loss in the year to 31 March 20X5. The cost of

inventory shown in Percy plc's statement of financial position at 31 March 20X5, using the average

cost (AVCO) basis, was £6,420. Had the first in first out (FIFO) basis been used, the cost would have

been £8,080.

Requirement

What is the effect of adopting the FIFO basis on Percy plc's financial statements for the year ended

31 March 20X5?

B increase current assets and decrease losses by £1,660

Kane Ltd has completed its inventory count for the period ended 30 June 20X8. The inventory count

concluded that there were inventories costing £32,340 of which £1,280 were found to be damaged

and had a net realisable value of nil.

Requirement

What is the journal entry to record closing inventories at 30 June 20X8?

D Dr Inventories: £31,060; Cr Cost of sales: £31,060

What is the reasoning behind charging depreciation in historical cost accounting?

To match the cost of the non-current asset with the revenue that the asset generates

W hich of the following is excluded from the initial cost of a tangible non-current asset?

Costs of a design error

W hich of the following statements about intangible assets in public company financial statements are

correct?

(1) Internally generated goodwill should not be capitalised.

(2) Goodwill arising on acquisition of a business should be capitalised and subsequently amortised

through the statement of profit or loss.

(3) Development expenditure must be capitalised if certain conditions are met.

1,3

T he carrying amount of machinery has reduced by £10,000 following the disposal of one item of machinery. Requirement

Which of the following statements relating to the disposal are correct?

Disposal proceeds were £15,000 and the profit on disposal was £5,000

Y vette purchased a plant on 1 January 20X0 for £38,000. The payment for the plant was correctly

entered in the cash at bank account but was incorrectly entered on the debit side of the plant repairs

account.

Yvette charges depreciation monthly on the straight-line basis over five years and assumes no scrap

value at the end of the life of the asset.

Understated by £36,100

T he directors of Ellen Ltd are considering whether any impairment has arisen in respect of its plant

and machinery in the year ended 31 March 20X2.

Requirement

Which of the following are indicators that an impairment of plant and machinery may have occurred:

(1) T here have been technological advances which means the plant and machinery is not as efficient

as that currently available

(2) T he market capitalisation of Ellen Ltd is above the value of its non-current assets

(3) T he plant and machinery are being used to produce a new product which is generating more

sales than the previous product

1

W hich of the following may appear as current liabilities in a company’s statement of financial

position?

(1) Loan due for repayment within one year

(2) T axation

(3) W arranty provision

123

W hich of the following journals could be used to correctly record a bonus issue of shares?

Debit Share premium, Credit Share capital

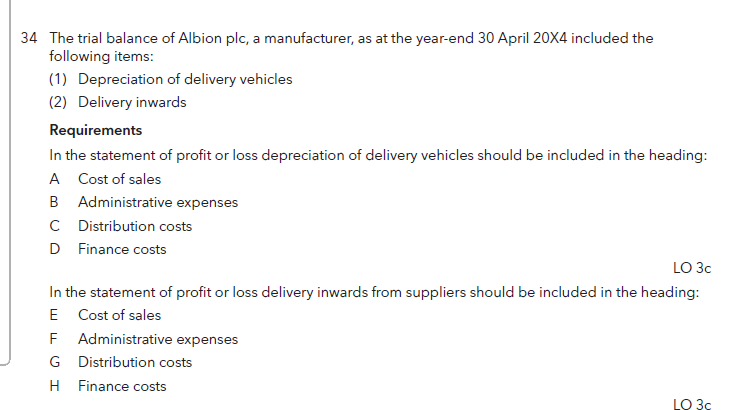

Distribution costs

Cost of sales