unit 8 market failure, gov intervention

1/113

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

114 Terms

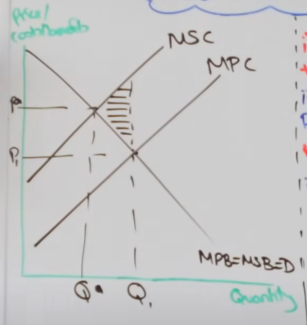

negative production externalities

social costs on third parties as a result of a separate agent

air pollution

waste

MSC > MPC (sc = pc + ec)

analysis

market allocates resources at the private optimum (Q1, P1)

self interest

over production

price is too low

encourages more consumption

misallocation of recourses

allocative inefficiency

resulting in a welfare loss

allocative efficiency = P* Q* - social optimum

externality def

a consequence of an economic activity that is experienced by unrelated third parties

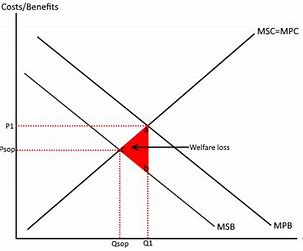

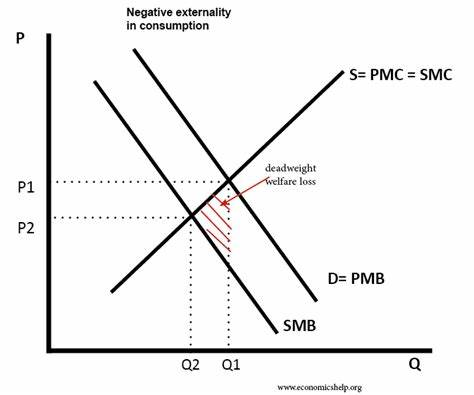

negative consumption externalities

cost to a third parties as a result of actions of consumers

MPB > MSB

smoking

alcohol

analysis

self interest - consumers ignoring social costs

misallocation of resources at Q1 P1

overconsumption and overproduction

allocative inefficiency

allocative efficiency = P* Q*

welfare loss to society

sb = pb + eb

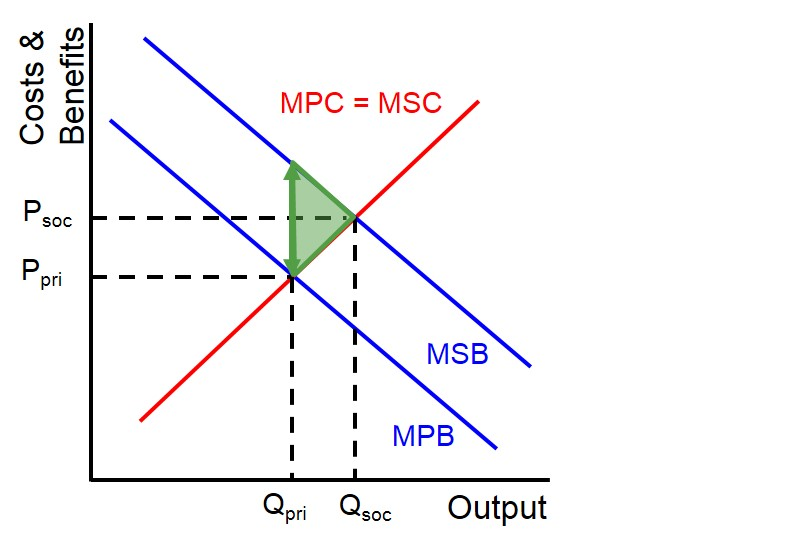

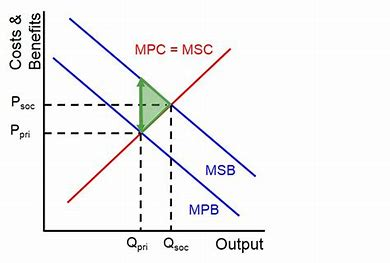

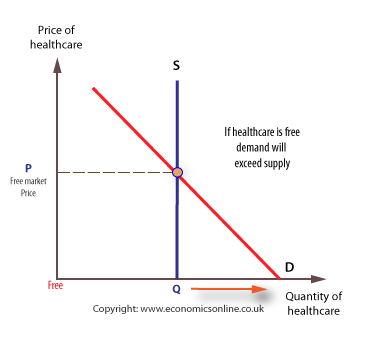

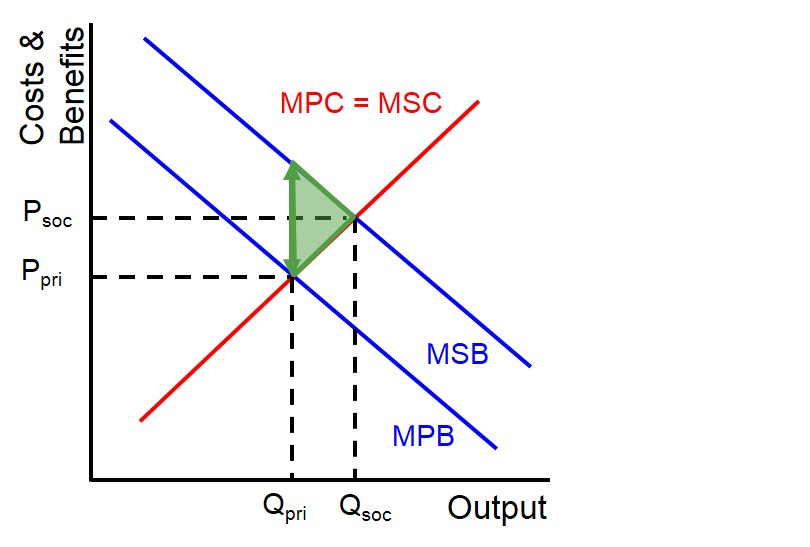

positive consumption externality

benefit to third parties as a result of consumers action

healthcare

education

MSB > MBP

sb = pb + eb

greater external benefit

by not producing at q*, society is losing out on potential social benefit

analysis

self interest - consumers ignoring social benefit

under consumption

misallocation of resources

too few resources being allocated to this market

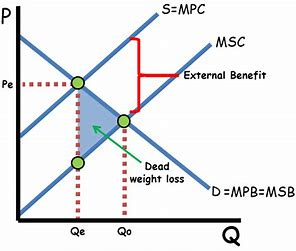

positive production externality

benefit to third parties as a result of actions of producers

training

R and D

MPC > MSC

by not producing the extra units (Q1 to Q*) society is losing out on welfare

analysis

producers only consider private costs - self interest

under production

resources are allocated at the private optimum not the social optimum

misallocation of resources

allocative inefficiency

welfare loss

merit good def

goods that are more beneficial to consumers than they realise - generate positive consumption externalities

healthcare

education

reasons for this

imperfect information

information failure - consumers don’t understand the benefit

asymmetric information

imperfect information

one party do not have complete or accurate information to make informed decisions, leading to suboptimal choices

asymmetric information

one party has more information that another

moral hazard

a situation where one party takes risks because they do not bear the consequences

insurance is an example where the insured party may engage in riskier behaviour, knowing that they are protected from the costs of that risk

adverse selection

buyers or sellers of a product are able to use their private knowledge of the risk factors involved in the transaction to maximize their outcomes, at the expense of the other parties to the transaction

de merit goods

goods deemed more harmful to consumers than they realise

why

information failure - information is ignored / not presented

asymmetric information - producers have full information but don’t share it with consumers

generates negative consumption externalities

alcohol

gambling

overconsumed / overproduced

irrational decisions

merit goods diagram

underconsumption (P1 Q1) causes welfare loss

too many resources being allocated

allocative inefficiency

due to information failure

irrational decisions made by consumers

demerit goods diagram

too many resources being allocated

allocative inefficiency

overconsumed

welfare loss

pure public good

non excludable

no price can be charged for a public good

the benefits of consuming a public good cant be confined to an individual who has paid for it

no cost efficient price

non rivalrous

quality of the good doesn’t diminish upon consumption

road signs

street lights

free rider problem

when individuals benefit from resources or services without paying for them, leading to under provision of public goods

missing market

a market does not supply a good or service

due to

lack of demand

improper incentives

free rider problem

leading to inefficient allocation of resources

quasi public good

mix of a public and private good

roads can be excludable - toll roads, can be rivalrous

beaches - can be excludable, rivalrous during peak times

tragedy of the commons

a situation in which individuals acting in their own self-interest deplete shared resources, leading to environmental market failure and long-term damage to the resource

common access resources

natural resources over which no private ownership has been established

air

forests

how lack of private ownership causes tragedy of the commons

producers act in self interest and exploit common access resources

depreciation of resource because of profit motive

even if a producer stops because of concerns, other producers will take all the resources, meaning only the producers that has stopped will lose out

income inequality

those on lower incomes are unable to consume

underconsumption

allocative inefficiency

factor immobility

refers to the inability of factors of production to move easily from one industry to another, leading to unemployment and inefficiency in the economy

occupational immobility of labour

inability of workers to change jobs or industries due to lack of skills, training, or experience needed

geographical immobility of labour

workers who cannot move to different locations for employment due to factors such as housing constraints, family ties, or lack of information about job opportunities

effect of unemployment in micro

FOP not being fully utilised

allocative inefficiency

economy is inside PPF

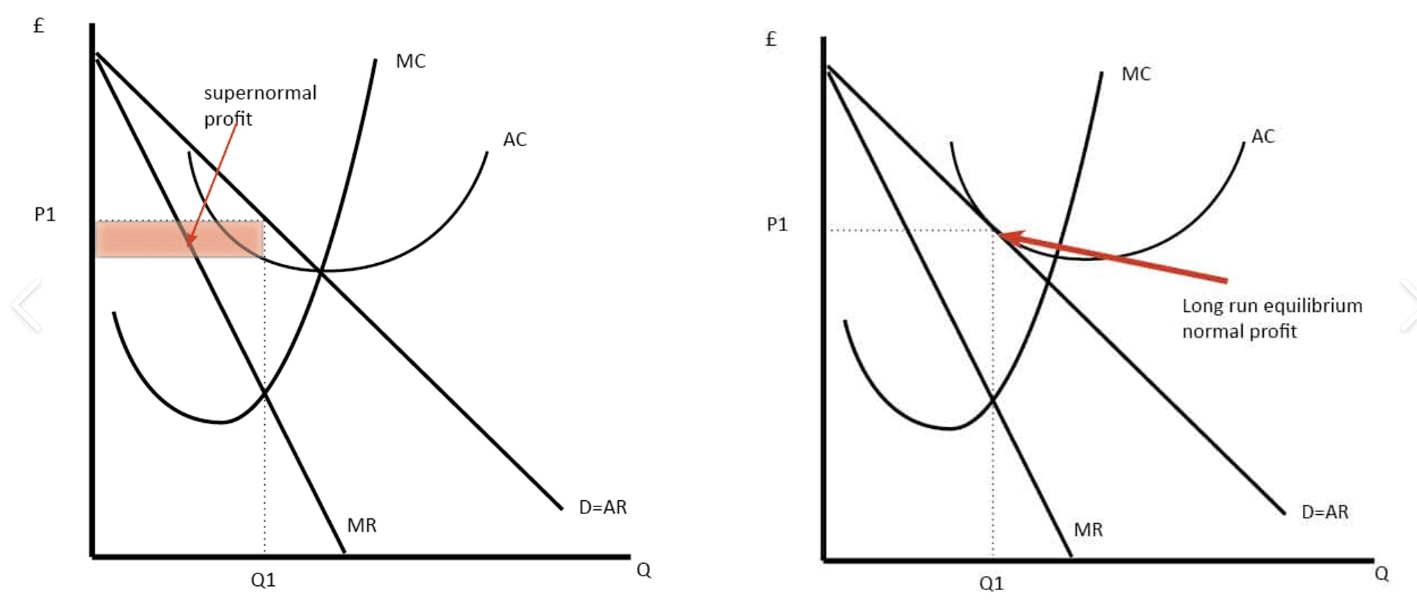

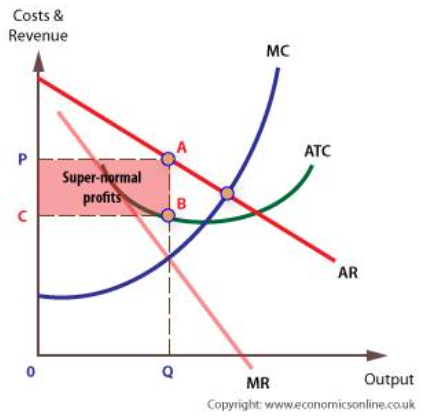

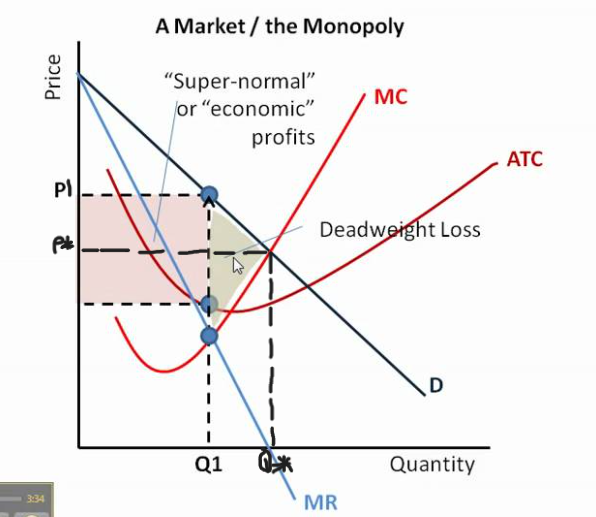

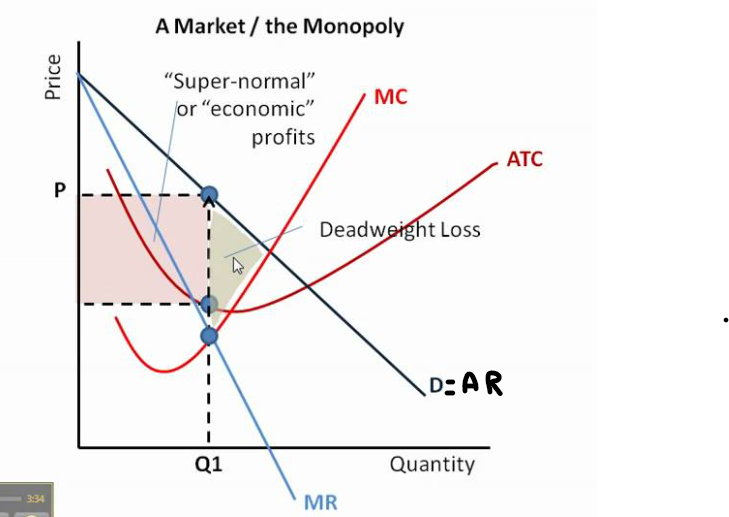

monopoly cuases market failure

as a monopoly is profit maximising, price is set to MR = MC

restricts output as some consumers are priced out the market

underconsumption of the good

misallocation of resources

lower consumer surplus

allocative inefficiency

also x inefficient - no incentive to lower costs or reduce waste - no competition

are able to charge a price below AC to force new entrants out the market

once rivals leave, price increases

characteristics of a monopoly

profit maximisers (MR = MC)

price makers

unique goods

supernormal profit

high barriers to entry

absence of property rights - market failure

def - legal right to control and benefit from a resources, e.g. land

production

factory pollutes a river - no one owns the river

costs of polluting the river are dumped on society

negative production externality

consumption

if people overconsume a public park, it becomes overcrowded and degraded

each person gets a MPB

but the cost of wear and tear is on everyone else

negative consumption externality

tragedy of the commons

complete market failure

market is unable to allocate resources efficiently, leading to a total lack of supply for a good or service

partial market failure

market produces the wrong quantity, leading to inefficient allocation of resources

fails to deliver socially optimum outcome

government intervention

the actions taken by a government to correct market failures, regulate markets, or provide public goods and services

subsidies

tax

regulation

information provision

price controls / pollution permits

state provision

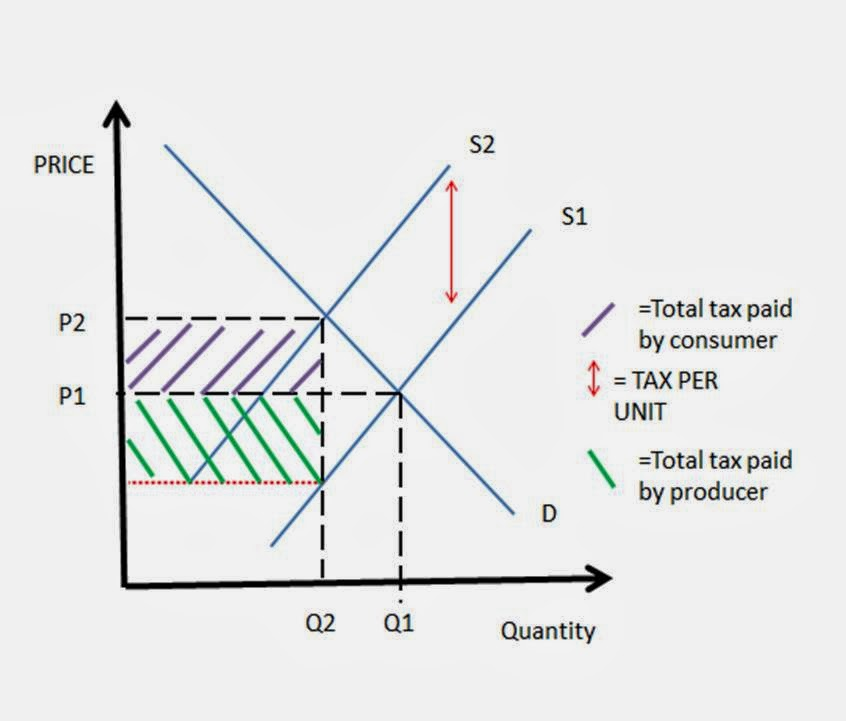

indirect tax

uses

correct market failure

raise government revenue

def - expenditure tax, an extra charge when goods and services are sold

increase costs of production for firms

can be passed onto consumers in the form of higher prices

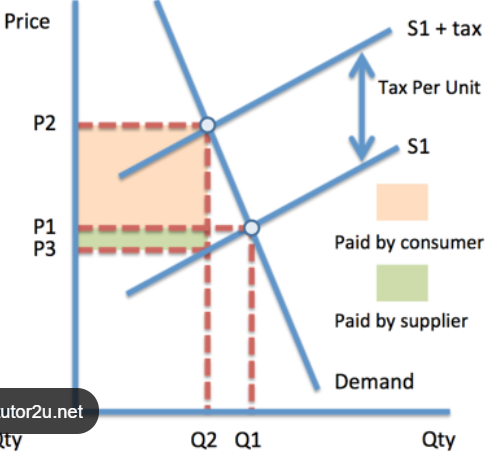

specific unit tax

tax placed on each item regardless of price

increase cost of production

solves overconsumption/production

promotes allocative efficiency whilst generating government revenue

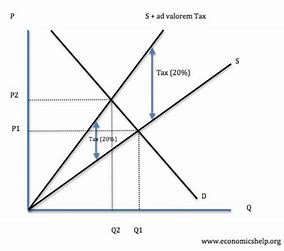

ad valorem tax

percentage tax on top of price

increase cost of production

solves overconsumption/production

promotes allocative efficiency whilst generating government revenue

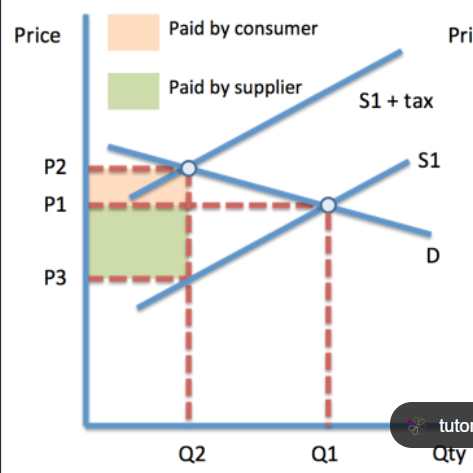

price elastic indirect tax

consumer burden - lower

producer burden = higher

tax revenue = lower

price inelastic indirect tax

consumer burden = higher

producer burden = lower

tax revenue = higher

indirect tax evaluation

effectiveness at reducing consumption depends on PED

if demand is price inelastic - quantity demand wont fall

if gov have imperfect information, tax rate could be too hight

consumers avoid tax

black market

smuggling

firms shut down / leave country

unemployment

lost tax revenue

regressive tax promotes income inequality

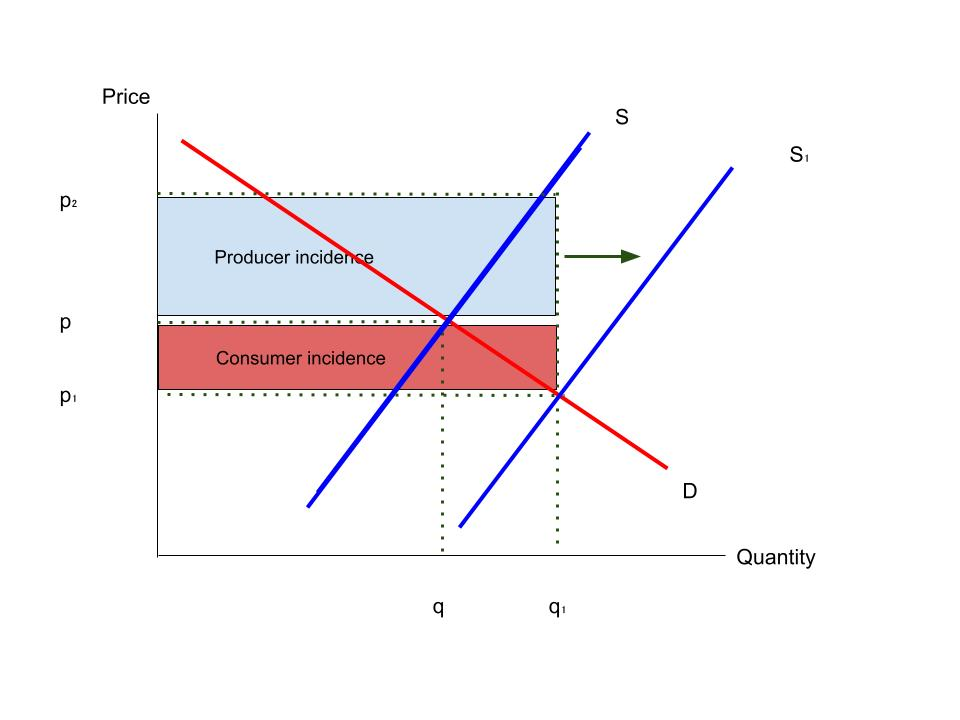

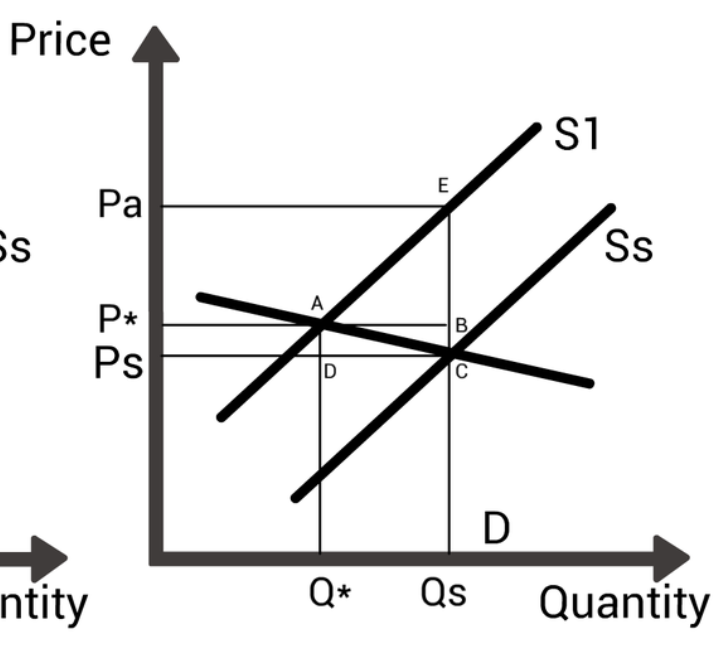

subsidies

money grant to firms by the government to reduce costs of production and encourage an increase in output

uses

solve market failure

increase affordability - necessity’s, under consumed goods

consumer + producer incidence = gov spend

price elastic subsidy

producer benefit increase

consumer benefit decrease

price inelastic subsidy

producer benefit decrease

consumer benefit increase

benefits of subsidies

encourage production of merit goods

benefit society

lower price encourages competition

supports unestablished industries

solves underconsumption/production

allocatively efficient

welfare gain

subsidies evaluation

firms may become reliant of subsidies which can lead to inefficiencies

opportunity cost of subsidy - cuts to healthcare spending

is government acting with perfect info - could be a higher cost to government

effectives depends on elasticity

needs to be price elastic demand to solve market failure

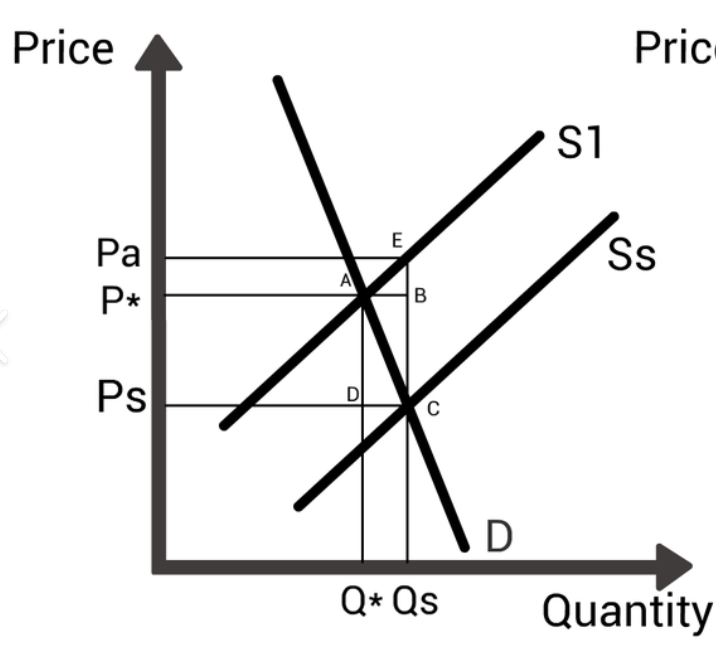

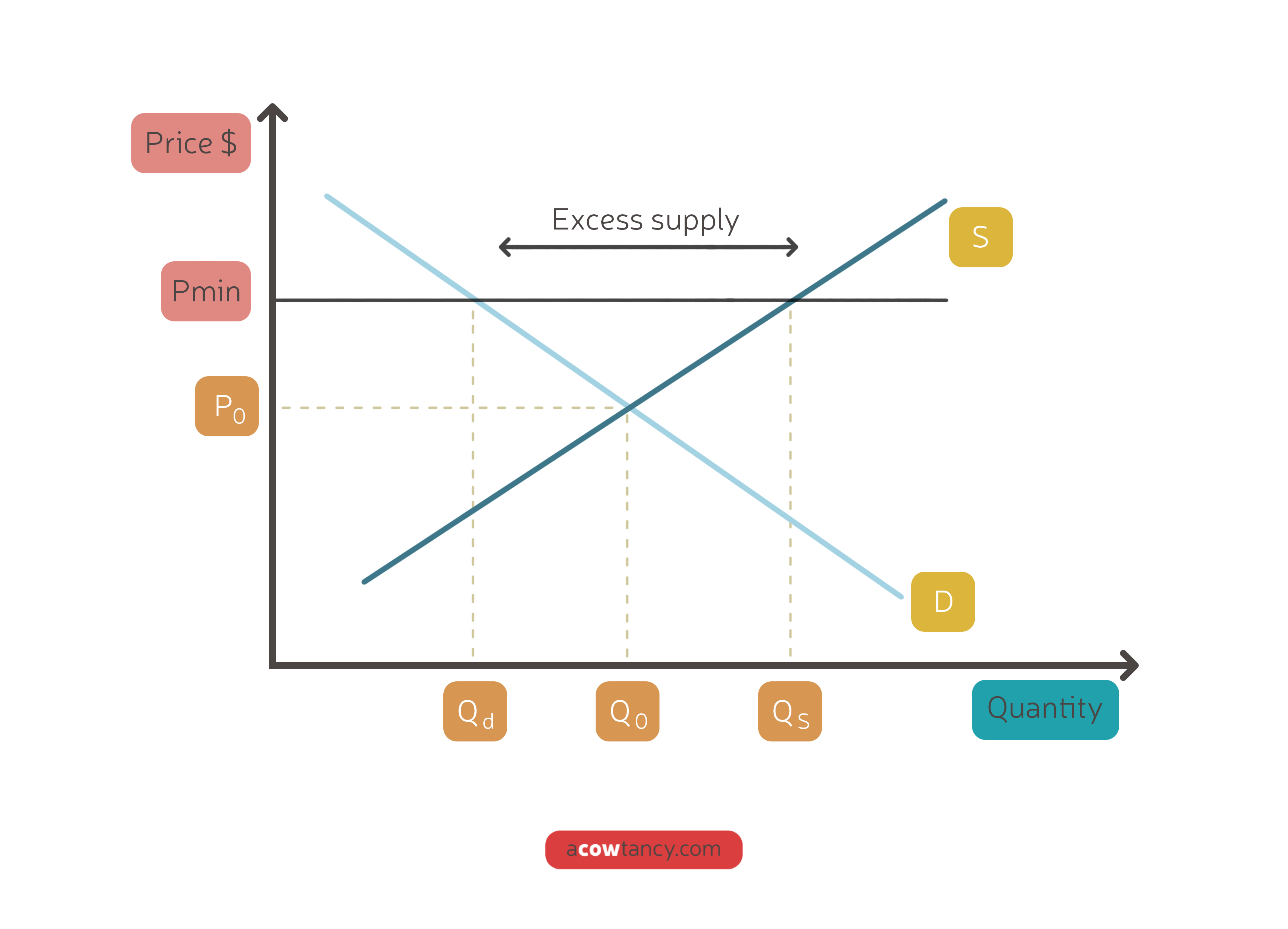

minimum price / price floor

a fixed price enacted by the government usually set above the equilibrium price\

why

protect producers from price volatility

solve market failure - discourage consumption of demerit goods

ADV minimum price

producers have guaranteed minimum income

encourage investment and dynamic efficiency

stockpiles can be used when supply is reduced

discourages consumption of demerit goods, increasing society welfare

DIS minimum price

consumers pay more - less consumer surplus, less PP

producer revenue depends on if the government are intervention buying

if PED is inelastic it may not solve market failure - but consumers revenue will increase

can incentivise black markets or find alternatives

recourses used to producer excess supply could be used elsewhere - opportunity cost, allocative inefficiency

dumping excess supply - worsen international relations

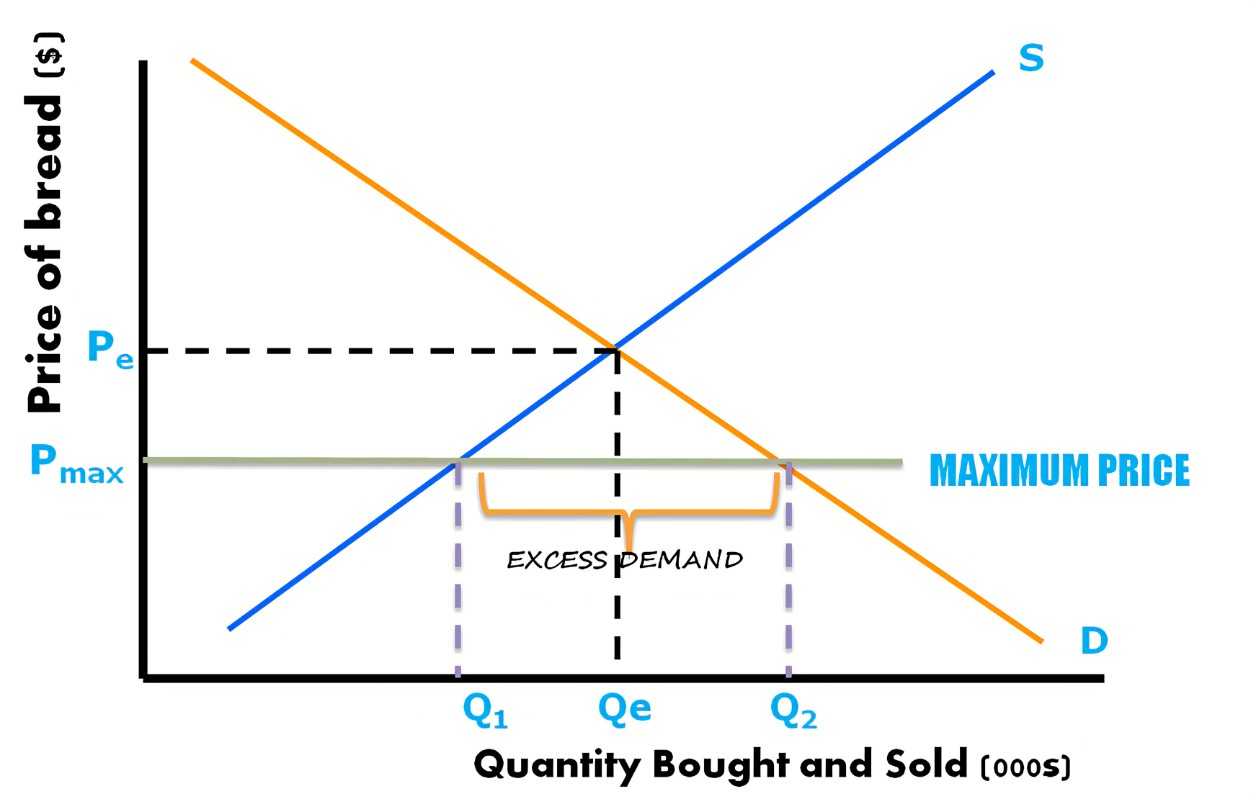

maximum price / price ceiling

a fixed price enacted by the government usually set below the equilibrium market price

uses

improve affordability of necessity’s

doesn’t exclude those on lower incomes

extension in QD

contraction in supply

producers are less willing and able to supply

producers cant satisfy demand

lower producer revenue - dynamically inefficient

ADV maximum price

affordability increases

DIS maximum price

some consumers cant access the good due to excess demand - shortage

may be forced to alternative supply

smuggling, black markets

fall in producer revenue and surplus

unintended consequences - black markets

may have to intervene with subsidy to meet demand

enforcement costs - high admin costs

state provision

direct provision of goods and services by the government free at the point of consumption

why

free market fails to produce at the right quantity

merit goods are under consumed and underproduced

public goods, missing market

inequitable distribution of income

DIS state provision

cost to taxpayer

may lack information about price and quantity

gov may lack dynamic, productive and X efficiency as they are not profit maximisers

excess demand

regulation

rule / law enacted by the government that must be followed by economic agents to encourage a change in behaviour

aim

reduce negative externalities

change monopoly / oligopoly behaviour

improve inequitable distribution of income

can be restrictive or prohibitive

DIS regulation

cost - regulators (administration)

fines for breaking rules may not be enough of a deterrent

unintended consequences - high regulation causes firms to shut down or leave the country

lots of regulation may reduce productive efficiency (red tape)

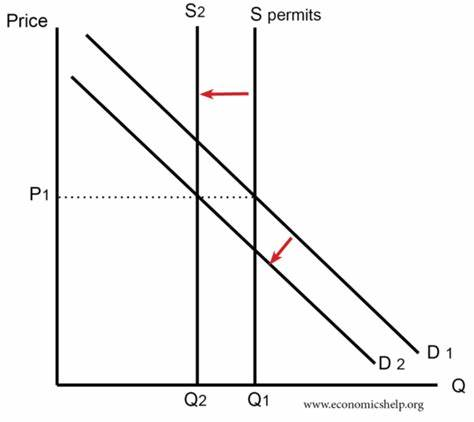

pollution permits

giving firms a legal right to pollute a certain amount

if a firm pollutes less it can sell its pollution permits to other firms

if a firm pollutes more a firm has to buy more from the government

promotes long run incentives to invest in green technology

increase profits through selling pollution permits

DIS pollution permits

enforcement costs - opportunity cost

gov may have imperfect information - cap may be set at the wrong level

unintended consequences - increases cost of production for firms - may shut down - or pass on costs to consumers

information provision

government funded information provision to encourage or discourage consumption through advertising or education

information provision with merit goods

there is under consumption and production

demand shift as consumers make rational decisions

with info provision, MPB will move right to MSB ( MSB = MPB + provision) at the socially optimum level

allocative efficiency and more welfare

information provision with demerit goods

there is over consumption and production

demand shift as consumers make rational decisions

with info provision, MPB will shift left to MSB (MSB = MPB + provision) at the socially optimum

allocative efficiency and more welfare

DIS information provision

expensive - opportunity cost

no guarantee of success

only effective in the long run

gov may not have perfect information

property rights

incentive not to exploit common access resources

negative externality internalised to producer / owner of land

if enforced, will reduce quantity to socially optimum level

DIS property rights

can they be efficiently distributed

enforcement needed - cost

equity - who gets rights

government failure

occurs when the government intervenes in a failing market but fail to improve the allocation of resources

costs of intervening outweigh the benefits

may make existing market failure worse or create whole new market failure

less social welfare

distortion of the price signal - gov failure

refers to government intervention that alters the natural information conveyed by prices, leading to inefficient resource allocation

information failure - gov failure

government may not have full / correct information to enable them to make an effective decision about the best ay to allocate resources - not at Q*

excessive administration costs - gov failure

correcting market failure can come with high militance and enforcement costs

regulation

subsidies

state provision

price controls - excess supply / demand cost

opportunity cost

unintended consequences - gov failure

intervention leads to am unexpected / unintended effect

black markets

negative impacts that aren’t part of the policy

poor - min price, taxation, less PP

impact on firms - subsidies can make them wasteful - X inefficient

employment

regulatory capture - gov failure

interests of society are overlooked for the interests of firms

because firms influence regulators

political self interest - gov failure

pursuit of self interest amongst politicians and government officials can lead to a misallocation of resources

policy myopia - gov failure

short-sightedness in policy-making that focuses on immediate benefits rather than long-term effects, often leading to negative outcomes

free market

any place where buyers and sellers meet to exchange goods and services, free from government intervention

ADV free markets

allocative efficiency

encourage competition

dynamic efficiency - investment

job creation, economic growth

no risk of government failure

DIS free markets

markets can fail - monopoly / oligopoly

inequity given inequality - may exclude consumers

creative destruction - cost cutting in dangerous areas like safety

price volatility

price volatility

the tendency for prices to fluctuate significantly over short periods due to market instability or changes in supply and demand

why are primary commodities volatile

demand and supply are inelastic

lack of substitutes

production lag

hard to store'

regular shifts in demand and supply

supply - weather

demand - global growth

consequences of price volatility

less tax revenue

less revenue for firms

recessions

lower investment

UK competition body

competition policy is government regulation which aims to make markets more competitive

the competition market authority (CMA) in the government agency responsible for overseeing competition policy

ADV competition policy

lower prices for consumers

more choice

improved efficiency

innovation is encouraged

DIS competition policy

enforcement costs

regulatory failure

reduced EOS

compliance costs for firms

example of competition policy

competition markets authority blocked Microsoft from acquiring Activision in 2022 but then it was allowed later with approved conditions

competition policy 3 focuses

monopolies

mergers

restrictive trading practices

monopoly busting

compulsory breakup of monopolistic firms to promote competition in the market

ADV monopoly busting

encourages competition

prevents abuse of monopoly power - reduces chance of price fixing or limiting supply

benefits consumers - lower prices more choice

supports smaller businesses

DIS monopoly busting

high implementation costs

disruption of EOS - could incr3ease costs and prices

windfall taxes

a levy imposed by the government on firms that have benefitted from something they where not responsible for

ADV windfall taxes

revenue generation for government

redistribution of wealth

DIS windfall taxes

disincentive to invest - firms may resist investing in markets prone to windfall taxes

complexity and fairness

potential for pass-through costs - firms may pass on the tax burden to consumers

ADV price control promoting competition

protects consumer - ensures affordability for consumers

prevents exploitation - stops dominant firms charging high prices

economic stability - helps manage inflation

DIS price control promoting competition

market distortions - lead to shortage if firms cant cover their costs

disincentive for investment

black markets

administrative burden

promoting competition and contestability

enhance growth of small businesses

give training and grants to entrepreneurs

tax incentives or subsidies

lowing barriers to entry

deregulation

monopoly to monopolistic competition

lower prices

better quality

innovation

less waste - x efficiency

more choice

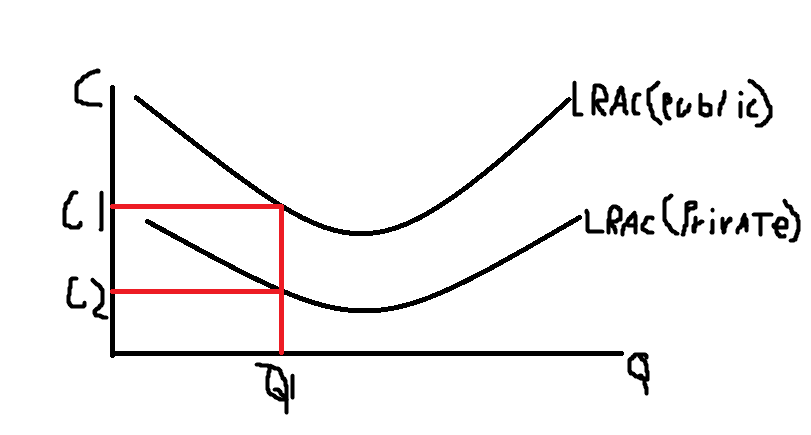

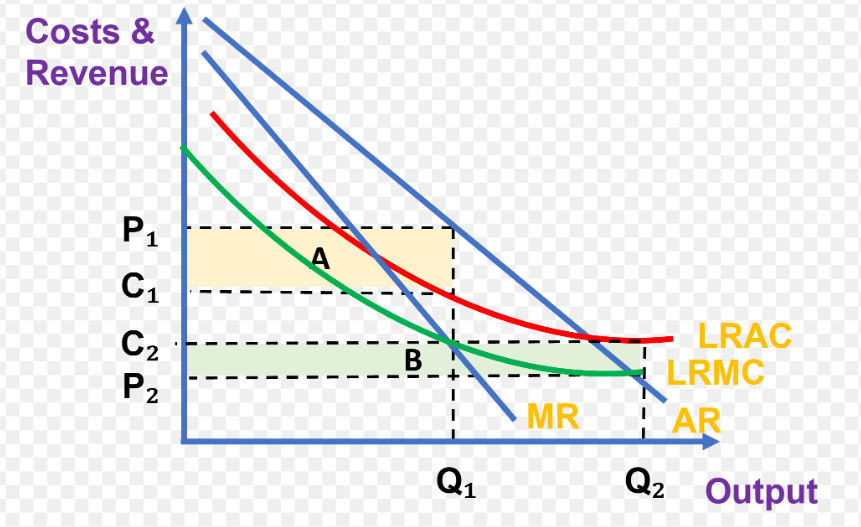

privatisation

the transfer of ownership from the public sector to the private sector

ADV privatisation - x efficiency

in the private sector firms have stronger incentive to minimise costs and reduce waste to maximise their profits for shareholders

ADV privatisation - dynamic efficiency

the public sector may lack supernormal profits to innovate as they have pressure to produce at the allocatively efficient point (P=MC) rather than the profit maximising point (MR=MC)

other ADV of privitisation

raises one off revenue for government

reduces public spending

increased tax revenue

improved resource allocation as private firms respond to signal of demand and supply

DIS privatisation - productive inefficiency

if the market becomes dominated by a single firm, it may reduce productive efficiency

a natural monopoly sauch as the railway network may involve high fixed costs and EOS that make competition wasteful - wasteful duplication of resources

so privatisation may result in higher prices without improving quality

DIS privatisation - x inefficiency

without the discipline of the market, nationalised firms may become complacent

leading to higher costs and more waste

DIS privatisation - allocative inefficiency

if there is limited competition firms don’t need to produce at the highest quality

may charge higher prices than necessary, resulting in a misallocation of resources and reduced consumer welfare

DIS privatisation - income inequality

privatisation may disproportionally affect low income groups

when essential services like public transport are privatised, higher prices can exclude poorer households, leading to increased income inequality and reduced welfare due to allocative inefficiency

income inequality

misallocation of resources

other DIS privitisation

a privatised public monopoly needs regulation - cost

may be in danger to short term profits - dividends to shareholders

may sell the firm too cheaply

privatisation eval

costs - natural monopoly

quality of regulation and cost

types of good

externalities generated

depends of level of competition - monopolies, oligopolies

nationalisation

taking a privately owned industry into government hands

operated for the benefit of consumers not private shareholders, prices can fall and output can rise

used to achieve social objectives, address market failure and manage essential services