Slides - 9. Statement of Cash Flows

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

31 Terms

explains how the amount of cash on the balance sheet at the beginning of the period became the amount of cash reported at the end of the period.

Cash flow statement

are short-term (3-mo or less.), highly liquid investments that can be readily converted to cash.

Cash equivalents

Examples of cash equivalents

Money market funds, treasury bills, commercial paper

Directly related to earnings from normal operations.

Operating Activities

Related to the acquisition or sale of fixed assets and investments in other companies.

Investing Activities

Related to transactions with owners and creditors

Financing Activities

Operating Inflows are cash received from:

1. Customers

2. Dividends or interest on investments

Operating Outflows are cash paid for:

1. Purchase of goods for resale and services (electricity, etc.)

2. Salaries and wages

3. Income taxes

4. Interest on liabilities

Investing inflows are cash received from:

1. Sale or disposal of property, plant, and equipment

2. Sale of investments in securities

Investing outflows are cash paid for:

1. Purchase of property, plant, and equipment

2. Purchase of investments in securities

Financing inflows are cash received from:

1. Borrowings on notes, mortgages, bonds, etc. from creditors

2. Issuing stock to owners

Financing outflows are cash paid for:

1. Repayment of principal to creditors (excluding interest, which is an operating activity)

2. Repurchasing stock from owners

3. Dividends to owners

What are the two formats for reporting operating activities?

direct and indirect methods

Reports the cash effects of each operating activity

Direct method

Starts with accrual net income and converts to cash basis

Indirect method

preferred but is rarely used

direct method

Under the direct and indirect method you get the same total operating (BLANK) under both methods

cash flow

Direct Method Formula

Operating cash receipts - Operating cash payments = net cash provided (used) by operating activities

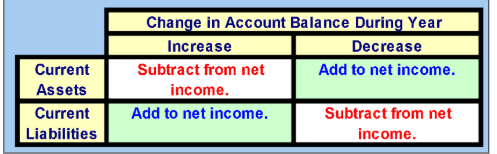

Draw Indirect Method Chart

y

Purchasing fixed assets by issuing debt or common stock

Converting debt into common stock

Exchanging assets with another company

Non-cash financing and investing activities

Non-cash financing and investing activities are commonly reported in a footnote such as

supplemental cash flow information

The amount of cash flow generated beyond what is needed to operate the business at its current productive capacity

free cash flow

Free cash flow =

cash flow from operating activities - capital expenditures

Measures a company’s ability to pay its current liabilities using operating cash flows.

Operating cash flow to current liabilities ratio

Operating cash flow to current liabilities ratio =

cash flow from operating activities/average current liabilities

Operating Cash Flow to Capital Expenditures Ratio =

Cash flow from operating activities/Annual net capital expenditures

Measures a company’s ability to finance its capital expenditures from operating cash flow.

Operating Cash Flow to Capital Expenditures Ratio

For Operating cash flow to capital expenditures ratio a ratio > (BLANK) indicates that current operating activities are generating sufficient cash to fund capital investment.

1.0

Firms in a (BLANK) phase of their life cycle will likely have a lower Operating Cash Flow to Capital Expenditures Ratio than firms in a (BLANK) phase

growth, mature

When a company’s receivables increase during the year, cash from operating activities is (BLANK) than net income by the increase in receivables.

lower

When a company’s payables increase during the year, cash from operating activities is (BLANK) than net income by the increase in payables

higher