63 Lesson 3: Cash Flow Statement Analysis

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

23 Terms

Why is cash flow analysis important for businesses?

Cash flow analysis helps evaluate how well a business is being run and estimate its future cash flows.

What are the steps of the cash flow analysis?

Understanding the sources and uses of cash.

Determining which components of the cash flow statement these sources and uses can be attributed to.

Evaluate the determinants of each of the components.

In the early growth stage of a company, what characterizes its cash flow?

Negative Operating Cash Flows due to inventory rollout and receivables, supported by financing inflows from debt or equity issuance.

What characterizes the cash flow in the mature growth stage of a company?

Positive Cash Flows from Operating Activities, used for debt repayment, stock repurchases, and expanding operations.

What is important for the long-term sustainability of a company's cash flows?

Inflows from Financing Activities are not sustainable, so the company must generate positive cash flows from operating activities exceeding capital expenditures and payments to debt/equity providers.

How should high net income ideally translate into operating cash flow?

Ideally, high net income should translate into high operating cash flow.

What happens if net income doesn't align with operating cash flow?

Aggressive revenue recognition policies may be in use.

What is the ideal scenario in terms of Operating Cash Flow vs. Net Income?

Why is the variability of Operating Cash Flow vs. Net Income important in Operating Cash Flow Analysis?

It is an important determinant of overall company risk.

What are the key points to consider in Investing Cash Flow Analysis?

Analyze long-term asset and investment changes to assess investing cash flows.

Increasing outflows may indicate capital expenditures; consider financing sources.

What should you evaluate when a company has increasing outflows in Investing Cash Flow Analysis?

You should evaluate how the company plans to finance these investments, which can include excess operating cash flow or financing activities.

What are the key points to consider in Financing Cash Flow Analysis?

Determine financing cash flow sources and uses by analyzing interest-bearing debt and equity changes.

Consider the debt repayment schedule if debt issuance is significant.

Evaluate the significance of cash use for debt repayment, stock repurchase, or dividends as it relates to investment opportunities.

Utilize Common-Size Analysis to express items as percentages for trend identification and forecasting.

What is the purpose of "Common-Size Analysis" in Financing Cash Flow Analysis?

It is used to express each item as a percentage, typically of net revenues or total cash inflows/outflows, to aid trend identification and cash flow forecasting.

How is Free Cash Flow (FCF) defined?

FCF is defined as the excess of operating cash flows over capital expenditure for the year.

What are the more precise measures of Free Cash Flow (FCF)?

The more precise measures of FCF include Free Cash Flow to the Firm (FCFF) and Free Cash Flow to Equity (FCFE).

What is Free Cash Flow to the Firm (FCFF) and who is it available to?

FCFF is available to equity and debt holders after meeting operating expenses, capital expenditure, and working capital requirements.

What is the formula for calculating Free Cash Flow to the Firm (FCFF)?

The formula for FCFF is:

FCFF = Net Income + Noncash Charges + [Interest Expense × (1 - Tax Rate)] - Fixed Capital Investment - Working Capital Investment.

The simplified formula for FCFF is:

FCFF = Cash Flow from Operations (CFO) + [Interest Expense × (1 - Tax Rate)] - Fixed Capital Investment (FCInv).

What are some important considerations for calculating FCFF under IFRS?

Under IFRS, if interest and dividends received are classified as investing activities, they should be added to CFO to determine FCFF. If dividends paid were deducted from CFO, they should be added back to CFO to calculate FCFF. Dividends must not be adjusted for taxes as they are not tax-deductible.

What does Free Cash Flow to Equity (FCFE) refer to, and who is it available to?

FCFE refers to cash available only to common shareholders.

What is the formula for calculating Free Cash Flow to Equity (FCFE)?

The formula for FCFE is:

FCFE = CFO - FCInv + Net Borrowing.

What does a positive FCFE suggest about the company's financial situation?

A positive FCFE suggests that the company has operating cash flows available after payments for capital expenditure and debt repayment, and this excess belongs to common shareholders.

What is the note related to FCFE calculation under IFRS regarding dividends paid?

Under IFRS, if the company has deducted dividends paid in calculating CFO, dividends must be added back to calculate FCFE.

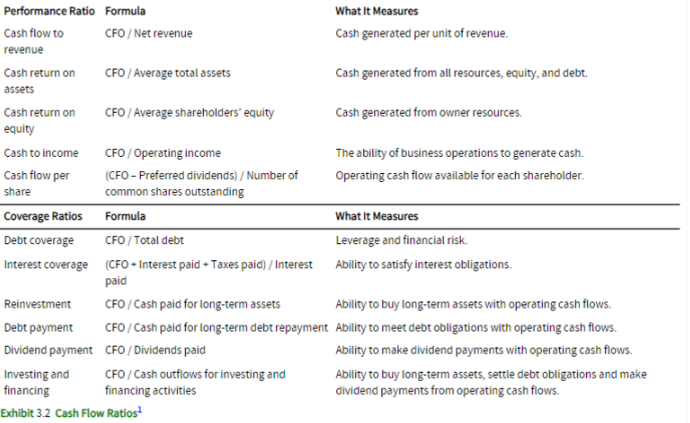

State some cash flow ratios