macroeconomics 1 2 exam

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

Introduction

Huge difference in comparison to life in past, people can afford far more than just necessities, there is a lot of competition between goods, companies, workers, nations to get advantage over others, competition became more intense because money and goods flow easily over national borders, easier than ever before, everyone is following the same rules / rules of global market economy. Overriding reason why people study economics> without economics the dice of life are loaded against you, your future doesn’t only depends on your own abilities but also upon how economic forces beyond your control affect your wages.

Scarcity and efficiency

Economics is the study of how societies use scarce resources to produce valuable commodities and distribute them among different people. Two main ideas: goods are scarce 2. society must use its resources efficiently.. economic goods-goods that are scarce or limited in supply. Without two main ideas, economics would no longer be interesting or even useful. Goods are limited while wants seem infinite. Efficiency: given unlimited wants, its important that an economy make the best useo f its limited resources; absence of waste, or using the ecconomy’s resources as effectively as possible to satisfy people’s needs and desires. The economy is producing efficiently when it cannot produce more one one good without producing less of something else. Society must use resources the most efficiently.

Study of economics

Economics dated in 1776 when adam smith published the classic „an inquiry into the natures and causes of the wealth nations“ – basic principles of market economy. He can be considered as founder of microeconomics – branch of economics concerned with behavior of individual entities as markets, firms etc. Macroeconomics – branch of economics that is concerned with the overall performance of economy, exist since 1936, founder John Maynard who published „General theory of employment, interest and money“. The microeconomics and macroeconomics formed modern economics. Streams between those two merged as economists have applied tools of microeconomics into macroeconomic topics.

Three problems of economic organization

because of scarcity, every society needs to make choices. So, every society must determine what commodities are produced and in what quantities 2. how they are produced, techniques, what resources will ne used, who will do the production etc 3. and for whom they are produced, three fundamental questions. Positive economics describes the facts of a economy -the what, how and for whom and its behavior (why do doctors earn more than janitors), difficult to answer but can be resolved. Normative economics: ethical precepts and value judgments about what, how and for whom. There are no right or wrong answers to these questions, involve ethics rather than facts (whould welfare be eliminated).

Market, command and mixed economies

economics studies different mechanisms that a society use to allocate scarce resources. 2 extremes of organizing economy: 1. command economy where government makes all decisions about production and distribution, it owns most of the means of production and directs the operation of enterprises in most industries 2. market economy is one where individuals and private firms make major decisions about production and consumption. There a system of prices, markets, profits and losses and rewards determines 3 fundamental questions. 3. laissez-faire economy is extreme of market economy where government has almost no economic role 4.mixed economy, mostly used, with elements of market and command economy. Usually most decisions are made in marketplace but government plays important role in modifying the functioning of the market.

Society’s technological possibilities

economy is deciding how to alocate its recources among thousands of different possible commodities and services, how to cope with limited resources, mist choose among different potential bundles of goods, different techniques of production and who will consume the goods – 3 fundamental questions. To answer it, society make choices about inputs and outputs. Inputs or factors of production are commodities or services used by firms in production process, economy uses existing technology to combine inputs to produce outputs. Outputs are various useful goods or sevices that result from production process and are either consumed oru sed for future production. Factors of production can be classified in 3 categories: 1. land or natural resources are gift of nature to our productive process. 2. labor consists of human time spent in production 3. capital resurces form the durable goods o fan economy produced in order to produce yet other goods. There is accumulation of capital goods.

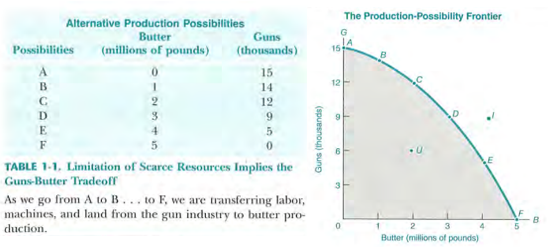

Production-possibility frontier

imagine producing only guns (military) and butter (civilian good). If economy want to throw all energy into producing butter, there is a maximum amount of butter that can be produced per year which depends on quantity and quality of resources and productie efficiency of it. At other extreme, resources are now devoted to production of guns, again bcs of recource limitations, the economy can produce only limited quantity of guns. These are two exteme possibilities and in between are many others. If we are willing to give up some butter, we can have more guns, and give up more butter leads to more guns.

Point F shows extreme where

All butter and no guns are

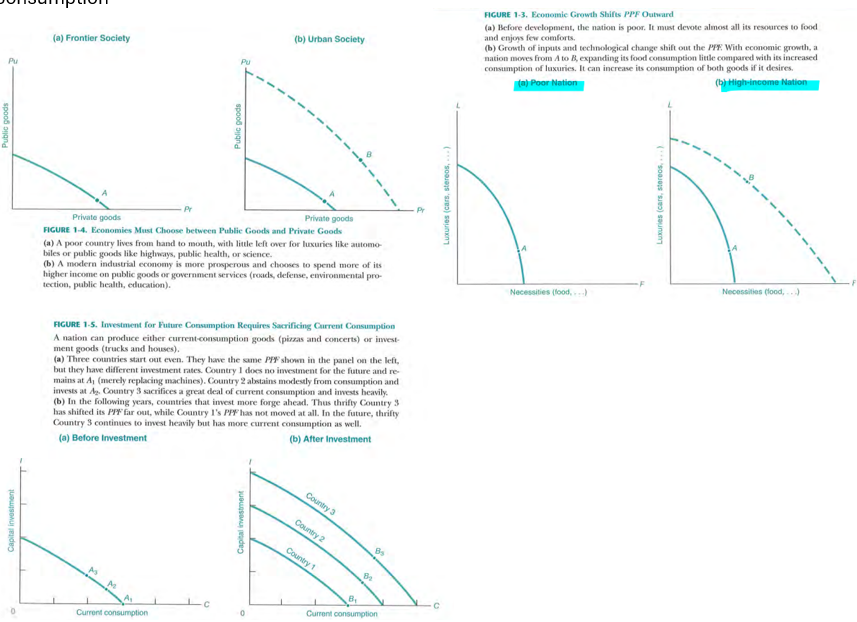

Produced and opposite for A. In between, increasing amount of butter is given up in return for more guns. So, butter is transformed into guns, not physically but by the alchemy of diverting the economy’s resources from one use to the other. In graph, if we fill in all intermediate positions with the new blue points representing all the different combinations of guns and butter, we have the continuous aqua curve shown as PPF, production-possibility frontier. I is unatainable and U indicates that some resources are unemployed or not used in best possible way. The PPF shows the maximum amounts of production that can be obtained by an economy given its technological knowledge and quantity of inputs available, it represents the menu of choices available to society. Same applies for other goods. The more the society decides to consume today, the less can be its production ofcapital goods to turn out more consumption goods in the future. Important applications of PPFs: economic growth shifts PPF ouward, 2. economies must choose between public goods and private goods 3. investment for future consumption requires sacrificing current consumption.

The PPF can also show the crucial economic notion of tradeoffs, example is that time is scarce. People have limited time available to pursue different activities.

Efficiency

efficiency means that economy is rather on than inside PPF, or that resources are being used as effectively as possible to satisfy people’s needs and desires. No more of one good can be produced without less of another, so it is on PPF. But why is ppf efficient? IF we try to produce I, more butter without less guns, but I is impossible region so cant do that. Productive efficiency occurs when society cannot increase output of one goods without cutting back on abother good. Efficient economy is on PPF. That is substitution. Anyway, society has unemployed resources in form of idle of workers, idle fractories and idle land. With unemployed resources, we are inside PPF. By putting resources to work we can increase output of all goods, can move to PPF and improve economy’s efficiency. One source of inefficiency occurs during business cycles. In great depression, 1929-1933, total output produced in US declined by almost 25%. Aksi an economy can suffer frim inefficiency because of strikes, political changes or revolution

What is a market, economic order, not chaos

the vast web of economic activity is required to stock the shelves in a market. Entire system works without centralized direction by anybody, millions of businesses and consumers engage in voluntary trade and their actions and purposes are invisibly coordinated by a system of prices and markets. Most of economic life proceeds without government intervention- which is true strenght of market economy.

The market mechanism

market economy is mechanism for coordinating people, activities and business through a system of prices and markets. In market economy, no single individual or organization is responsible for production, consumption, distribution and pricing.determining prices, wages and outputs in a market – market is an actual place where buyers and sellers could engage in face-to-face bargaining. Today in us there are still this type of markets, but more generally, a market should be thought of as a mechanism by which buyers and sellers can determine prices and exchange goods and services. It can be centralized, like stock market, decentralized as in case of houses or labor, or to exist only electronically, traded by computer. Market brings buyers and sellers to set prices and determine quantity of good or service. There, everything has price which is a value of a good in terms of money. Prices are used to exchange different commodities between people and firms. They serve as signals to producers and consumers, if consumers want more of good the price will rise and producers will know that supply is needed. Prices coordinate the decisions of producers and consumers in a market. Higher prices tend to reduce consumer purchases and encourage production, opposite also applies. Prices are the balance wheel in the market mechanism. At every moment, some people are buying while others are selling. Markets tend to fin dan equilibrium of supply and demand. Market equilibrium represents a balance among all the different buyers and sellers. Equilibrium price is the one that meets the desires of buyers and sellers, those prices for which buyers desire to buy exactly the quantity that sellers desire to sell yield an equilibrium in supply and demand.

How markets solve the three economic problems

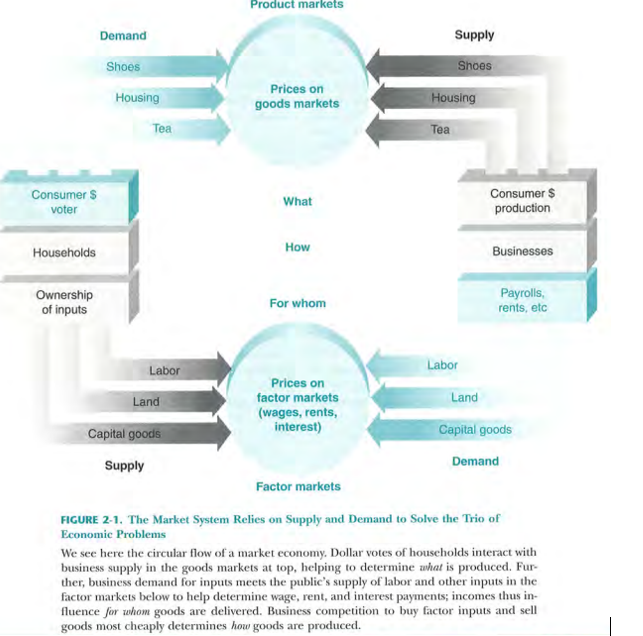

markets work simultaneously to determine a general equilibrium of prices and production. By matching sellers and buyers (supply and demand) in each market, a market economy simultaneously solves the three problems of what, how, and for whom. 1. What goods and services will be produced is determined by the dollar votes of consumers in their daily purchase decisions. A century ago, many dollar votes for transportation went for horses and horseshoes; today much is spent on automobiles and tires. Firms, in turn, are motivated by the desire to maximize profits. Profits are net revenues or the difference between total sales and total costs. Firms abandon areas where they are losing profits; by the same token, firms are lured by high profits into the production of goods in high demand. 2. How things are produced is determined by the competition among different producers. The best way for producers to meet price competition and maximize profits is to keep costs at a minimum by adopting the most efficient methods of production. 3. For whom things are produced—who is consuming and how much—depends, in large part, on the supply and demand in the markets for factors of production. Factor markets determine wage rates, land rents, interest rates, and profits. Such prices are called factor prices. The same person may receive wages from a job, dividends from stocks, interest on a bond, and rent from a piece of property. By adding up all the revenues from all the factors, we can calculate the person’s market income. The distribution of income among the population is thus determined by the quantity of factor services (person-hours, acres, etc.) and the prices of the factors (wage rates, land rents, etc.).

Who rules the market

: If we examine the structure of a market economy carefully, we see a dual monarchy shared by consumers and technology. One fundamental determinant is the tastes of the population. These innate and acquired tastes—as expressed in the dollar votes of consumer demands— direct the uses of society’s resources. They pick the point on the production-possibility frontier ( PPF ). The other major factor is the resources and technology available to a society. The economy cannot go outside its PPF. You can fly to Hong Kong, but there are no flights yet to Mars. Therefore, the economy’s resources limit the candidates for the dollar votes of consumers. Consumer demand has to dovetail with the business supply of goods and services to determine what is ultimately produced. Market system deals out profits and losses to induce firms to produce desired goods efficiently. Markets act as the go-betweens that reconcile the consumer’s tastes with technology’s capabilities.

A picture of prices and markets: circular flow of economic life

that is how consumers and producers interact to determine prices and quantities for both inputs and outputs. there are two different kind of markets in circular flow: at top the product markets and at the bottom are the markets for inputs or factors of production like land and labor, and by different entities: households and businesses. This sounds complicated, but it is simply the total picture of the intricate web of interdependent supplies and demands, interconnected through a market mechanism to solve the economic problems of what, how, and to whom. study it carefully.

the invisible hand and perfect competition

Smith proclaimed the principle of the “invisible hand” which holds that, in selfishly pursuing only his or her personal good, every individual is led, as if by an invisible hand, to achieve the best good for all. We know that there are “market failures,” that markets do not always lead to the most efficient outcome. One set of market failures concerns monopolies and other forms of imperfect competition. A second failure of the “invisible hand” comes when there are spillovers or externalities outside the marketplace— positive externalities such as scientific discoveries and negative spillovers such as pollution. A final reservation comes when the income distribution is politically or ethically unacceptable. When any of these elements occur, Adam Smith’s invisible-hand doctrine breaks down and government may want to step in to mend the fawed invisible hand. Adam Smith discovered a remarkable property of a competitive market economy. Under perfect competition and with no market failures, markets will squeeze as many useful goods and services out of the available resources as possible. But where monopolies or pollution or similar market failures become pervasive, the remarkable efficiency properties of the invisible hand may be destroyed.

trade, money and capital

market economies have evolved enormously; three distinguishing features: trade and specialization, money, and capital. 1. An advanced economy is characterized by an elaborate network of trade that depends on specialization and an intricate division of labor. 2. Modern economies today make extensive use of money, which provides the measure for measuring economic values and is the means of payment. 3. Modern industrial technologies rest on the use of vast stocks of capital. Capital leverages human labor into a much more efficient factor of production and allows productivity many times greater than that possible in an earlier age.

trade, specialization, and division of labor

today’s economies depend heavily on the specialization of individuals and firms, connected by an extensive network of trade. as increasing specialization has allowed workers to become highly productive in particular occupations and to trade their output for the commodities they need. Specialization occurs when people and countries concentrate their efforts on a particular set of tasks—it permits each person and country to use to best advantage the specific skills and resources that are available. it is better to establish a division of labor—dividing production into a number of small specialized steps or tasks. Capital and land are also highly specialized. The enormous efficiency of specialization allows the intricate network of trade among people and nations that we see today. Very few of us produce a single finished good; we make but the tiniest fraction of what we consume. In exchange for this specialized labor, we will receive an income adequate to buy goods from all over the world. The idea of gains from trade forms one of the central insights of economics. Different people or countries tend to specialize in certain areas; they then engage in the voluntary exchange of what they produce for what they need. Trade can enrich all nations and increase everyone’s living standards. Specialization and trade are the key to high living standards. By specializing, people can become highly productive in a very narrow field of expertise. People can then trade their specialized goods for others’ products, vastly increasing the range and quality of consumption and having the potential to raise everyone’s living standards.

money: the lubricant (mazivo) of exchange

If specialization permits people to concentrate on particular tasks, money then allows people to trade their specialized outputs for the vast array of goods and services produced by others. Money is the means of payment in the form of currency and checks used to buy things. Money is a lubricant that facilitates exchange. When everyone trusts and accepts money as payment for goods and debts, trade is facilitated(olakšano). Because everyone accepts money as the medium of exchange, the need to match supplies and demands is enormously simplified. Market system can go haywire in a monetary economy. For example, money can lose its value with high inflation or a financial crisis. When that happens, people concentrate more on spending their money quickly, before it loses its value, rather than investing it for the future.

Capital

a produced and durable input which is itself an output of the economy. As we have seen, capital is one of the three major factors of production. The other two, land and labor, are often called primary factors of production, which means their supply is mostly determined by noneconomic factors, such as the fertility rate and the country’s geography. Capital, has to be produced before you can use it. Note that capital inherently involves time-consuming, indirect, roundabout methods of production. Indirect and roundabout production techniques often are more efficient than direct methods of production. If people are willing to save—to abstain from present consumption and wait for future consumption—society can devote resources to new capital goods. A larger stock of capital helps the economy grow faster by pushing out the PPF - forgoing current consumption in favor of investment adds to future production possibilities.US economy is lagging behind other countries in the growth race because it saves and invests too little. But there surely is a limit to the amount of useful capital. Too much roundabout investment would cause too great a reduction in today’s consumption. Much of economic activity involves forgoing current consumption to increase our capital. Every time we invest – building a new factory or road, increasing the years or quality of education or increasing the stock of useful technical knowledge – we are enhancing the future productivity of our economy and increasing future consumption.

capital and private property, property rights

In a market economy, capital typically is privately owned, and the income from capital goes to individuals. Property rights grant to their owners the ability to use, exchange, paint, dig, drill, or exploit their capital goods. These capital goods also have market values, and people can buy and sell the capital goods for whatever price the goods will fetch. The ability of individuals to own and profit from capital is what gives capitalism its name. property rights are limited. You are not free to sell yourself; you must rent yourself at a wage. Property rights define the ability of individuals or firms to own, buy, sell, and use capital goods and other property in a market economy.