Lecture 4: effective annual interest, annual percentage rate

1/5

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

6 Terms

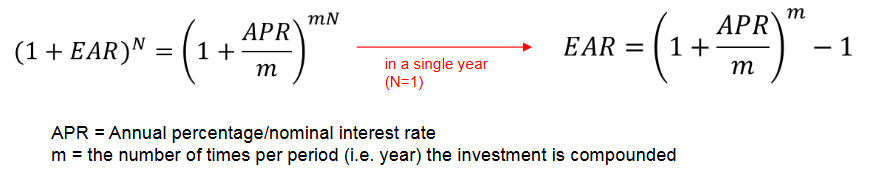

What is annual percentage rate (APR)?

The annual interest rate without considering compounding

found by multiplying the per-period rate (r) by the number of periods in a year

What is effective annual rate (EAR)?

The interest rate annualized using compound interest

same result as r = APR/m compounded m times

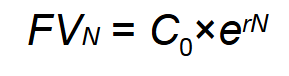

What is continuous compounding?

the general formula for the future value of an investment compounded continuously over many periods

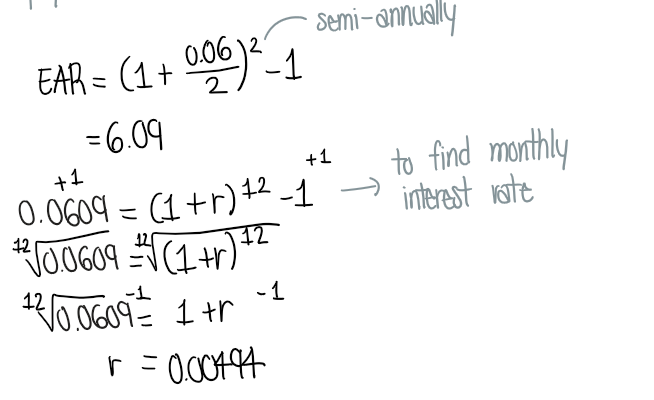

How do you find the rate of a mortgage?

Mortgage rates in Canada use semi-annual compounding but interest is actually calculated/compounded monthly!

Convert the APR to EAR

Calculate the monthly rate by setting the answer of 1 = (1+r)^m - 1

What is ammortization?

To kill

to extinguish the mortgage

How do you add cash flows?

Only if the time of the cash flows are the same!

can’t add a cash flow at t=2 to a cash flow at t=3