2.6 Macroeconomic objectives and policies

1/88

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

89 Terms

Monetary policy

Central bank manipulates the base interest rate or the money supply in order to influence aggregate demand.

UK Central Bank in bank of England.

Central Bank only lends to High Street Banks.

Central bank increase base interest rate High Street will increase interest rates vice versa. Affect firms and consumers.

Definition for the base interest rate.

The rate at which central bank will lend to Highstreet banks.

What four main channels does base interest rate effect?

savings

mortgages

investment

net exports

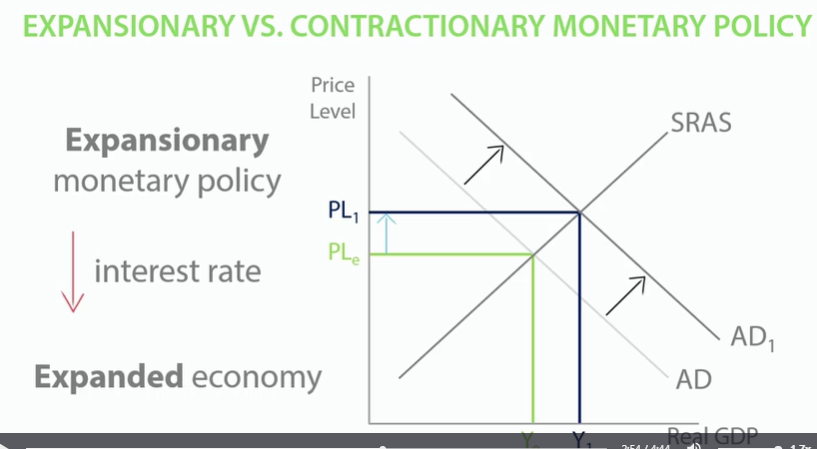

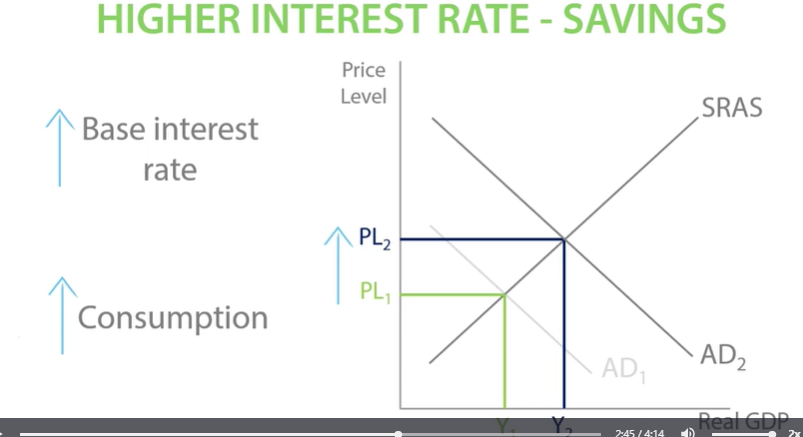

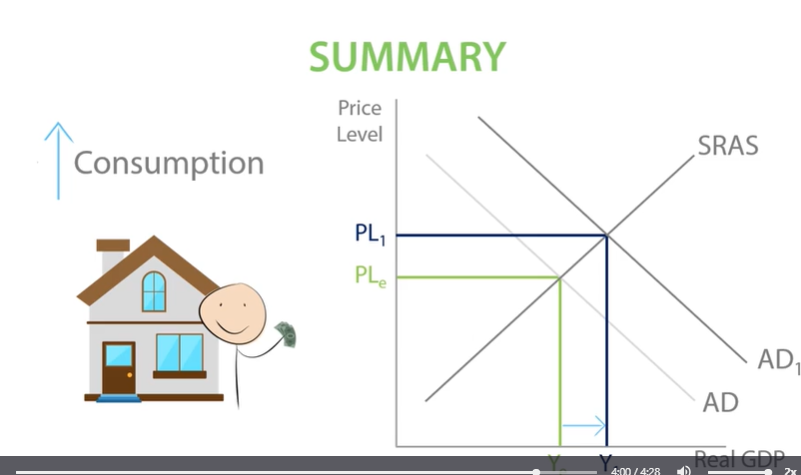

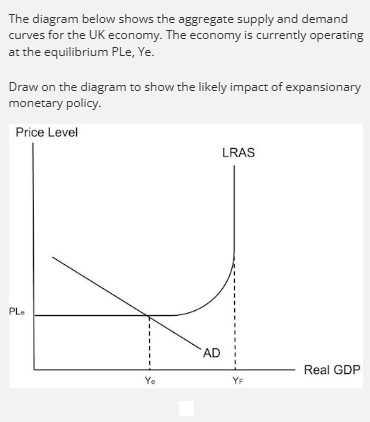

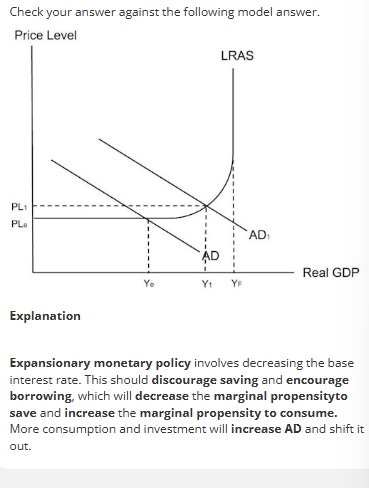

Expansionary Monetary Policy

Decrease the base interest rate or increase the money supply in order to increase aggregate demand and increase rate of inflation

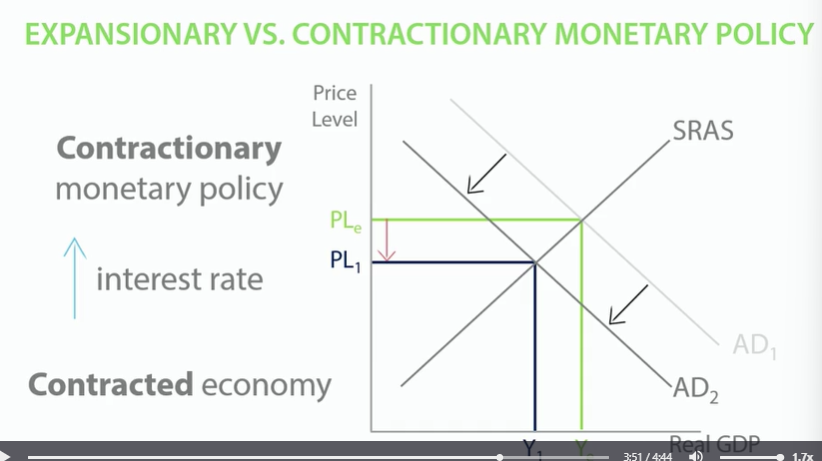

Contractionary monetary policy

Increase the base interest rate or decrease money supply to decrease aggregate demand and decrease the rate of inflation.

EXPLANSIONARY MONETARY POLICY:

If inflation is below the target, what is the Bank of England likely to do?

-If inflation below targe which means weak demand in the economy, Bank of England will want to increase AD to bring price level up.

-They reduce interest rate, encourage consumers to save less and consume more.

-It will also encourage firms to invest as it is cheaper to borrow.

-This will increase AD and inflation.

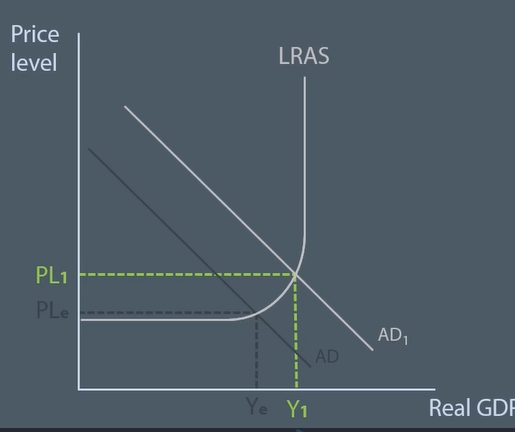

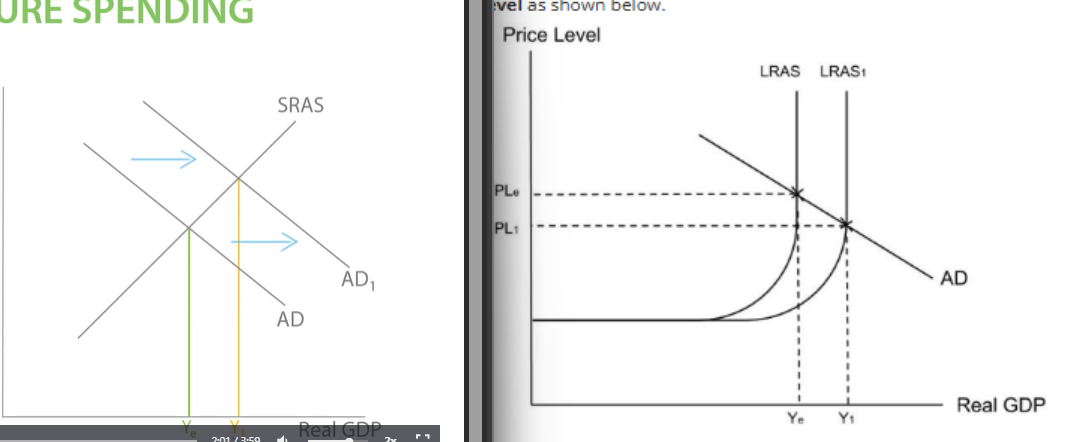

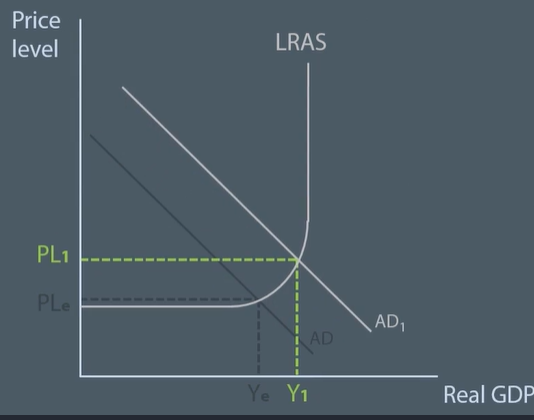

-Consumption is between 60 and 65% of AD will shift out, increasing price level from PLe to PL1 , creating Demand-pull inflation and pulling inflation into target range.

CALLED EPANSIONARY MONETARY POLICY- decrease interest rate, which expanded the economy.

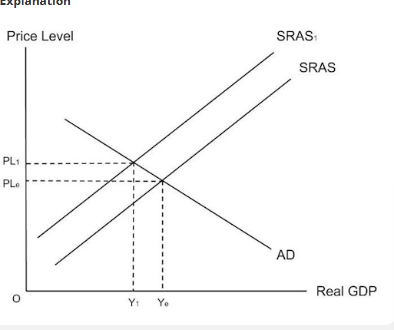

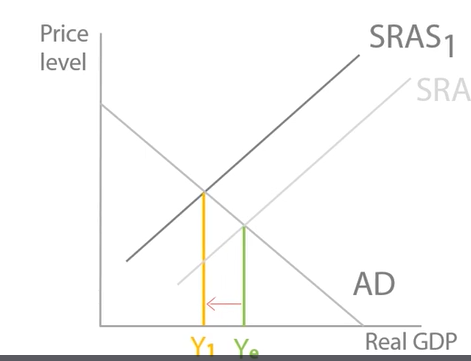

CONTRACTIONARY MONETARY POLICY:

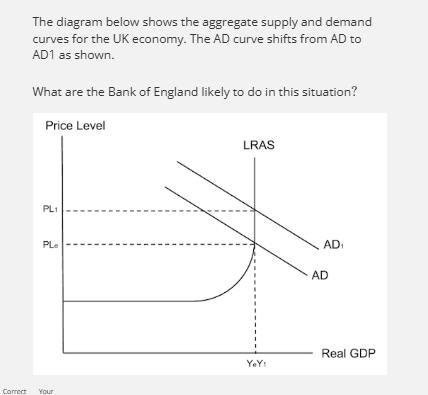

If inflation is above the target, what is the Bank of England likely to do?

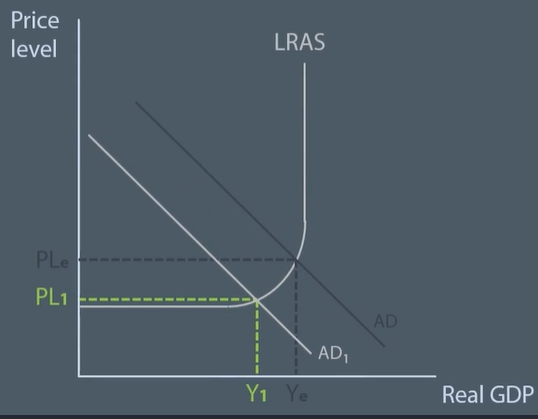

-Pursue contractionary monetary policy.

-Increasing base interest rate in order to decrease aggregate demand and reduce inflation.

-consumers will receive higher return on savings, save more , spend less decreasing consumption.

-reducing inflation back into target range.

-Helps push down price level and keep inflation under control.

What are the Bank of England likely to do if the inflation rate in the UK reaches 1%?

-Inflation target in the UK is 2.

-If inflation rate is 1, the Bank of England will want to increase the inflation rate so it is back within the target range,

-They increase the inflation rate by increasing AD and expanding the economy.

-Increase AD by decreasing the base interest rate to discourage saving and encourage borrowing.

Recession

A recession is two consecutive quarters of negative economic growth.

2 consecutive quarters- two 3-month periods in a row.

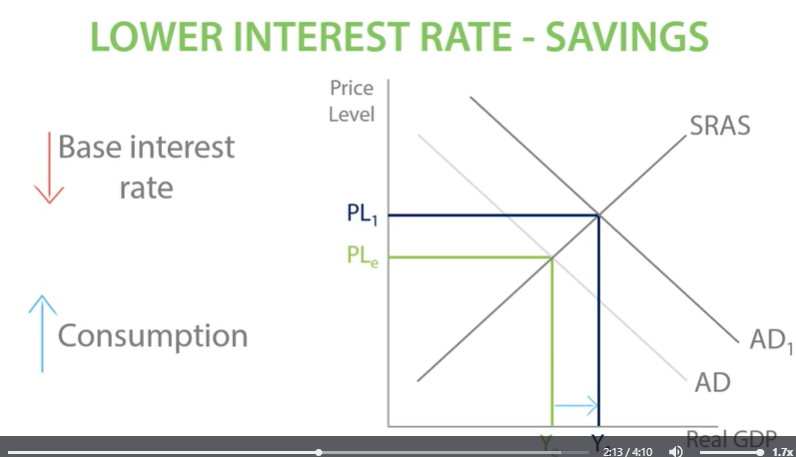

LOWER INTEREST RATE- SAVINGS

Which policy is the Bank of England likely to have used in order to bring the UK economy out of recession?

During a recession, the Bank of England wants to expend the economy and increase AD.

-This means expansionary policy by decrease interest rate.

-Lower interest rate encourages consumers to spend rather than save and it encourages firms to borrow to invest.

-This will increase AD and inflation.

-It will lead to an increase in real GDP.

-Feb 2008 5.5% - March 2009 0.5%

-However, drop in base interest rate isn’t good for everyone.

-Some people need the interest in their savings for income.

1/6 people in UK are pensioners, rely on return on savings, pensioners have less disposable income to spend.

They will spend less and this will reduce consumption, which is a component of aggregate demand.

The AD curve will shift to the left and there will be fall in real GDP.

LOWER INTEREST RATE- SAVINGS

Why did the Bank of England reduce the interest rate to 0.5% during the recession?

A reduction in the interest rate will discourage people from saving as they get a lower return.

This means they are likely to choose to spend rather than save which means their marginal propensity to consume will increase.

MPC is the proportion of additional income that gets spent.

If people are spending more of their income, consumption will increase and this will increase AD.

However, pensioners…

decrease consumption and decrease real GDP,

LOWER INTEREST RATE- SAVINGS

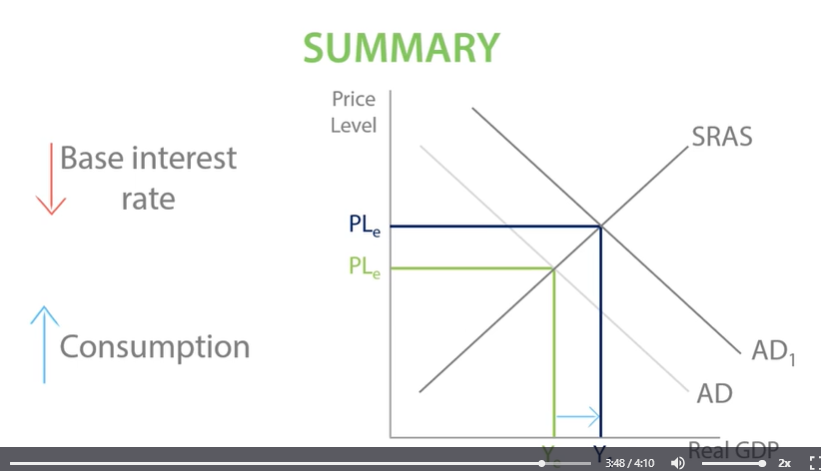

To stop the inflation rate getting higher than 3% what does the Bank of England do?

An increase in the base interest rate will increase the return from saving.

This means the marginal propensity to save will increase while marginal propensity to consume will decrease.

-Reduce price level, reduce AD 60% prevent inflation from getting out of control. CONTRACTIONARY MONETARY POLICY.

However, higher base interest rate will encourage people to save more.

e.g. 1/6 people are pensioners, return to savings in income, higher return on savings, more disposable income, increase in consumption by pensioners, leading to demand pull inflation, price level increase from pl1 to pl2.

DIAGRAM FOR COUNTER

Mortgage

When someone borrows from the bank to buy a house.

Interest rate is often called the price of borrowing money.

LOWER INTEREST RATE-MORTGAGES

A reduction in the interest rate reduces the cost of getting a mortgage. What is the likely effect for this.

Cheaper mortgages means more people willing and able to take out a mortgage, '

A reduction in the interest rate makes mortgages more affordable, because less interest has to repaid on a mortgage. Cheaper mortgages enable more consumers to buy houses, which will increase the demand for houses. This will increase the price of houses and leads to the positive wealth effect. The positive wealth effect is where people increase their consumption as a result of an increase in the value of their assets. Consumption is 65% of AD so an increase in consumption will increase aggregate demand.

However, Richard Sousa has shown that the positive wealth effect is non-existent in many European countries. This is because a lot of people do not own their own houses and are saving up for a house. As a result, an increase in house prices will actually make them feel poorer and force them to save even more. This will reduce consumption. Consumption is 65% of AD so a decrease in consumption will decrease aggregate demand.

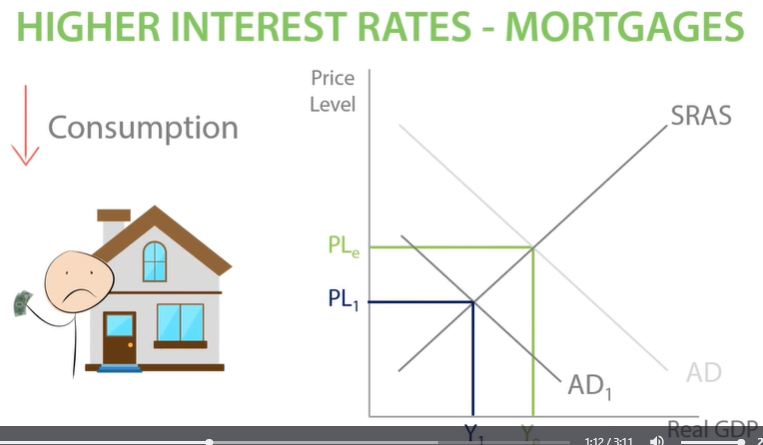

HIGHER INTEREST RATES- MORTGAGES

An increase in base interest rate mean fewer people can afford to take out mortgages.

This decrease demand for house which will decrease price of houses,

The negative wealth effect will occur where people reduce their consumption, as their has been a decrease in the value of their assets.

This reduction in consumption will then decrease AD, allowing for controlled rate of inflation.

Decrease real GDP and decrease price level. Contractionary Monetary policy.

However, lower house prices means consumers save less, increase consumption ,cancel out negatice wealth effect.

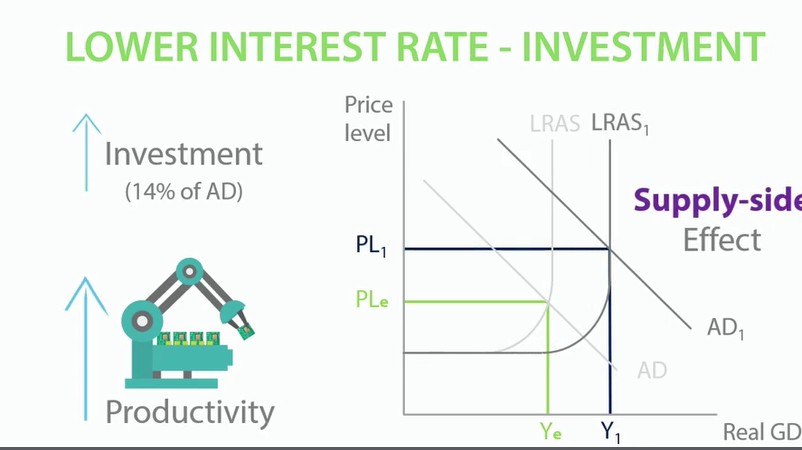

LOWER INTEREST RATE- INVESTMENT

What impact will a reduction in the base interest rate have?

A reduction in the base interest rate will decrease the cost of borrowing and reduce the total amount of money the person borrowing will have to pay back.

LOWER INTEREST RATE- INVESTMENT

State the impact on reduction in the base interest rate on investment.

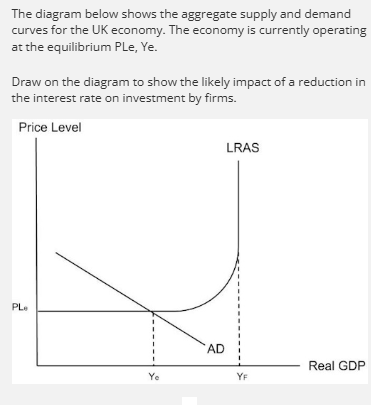

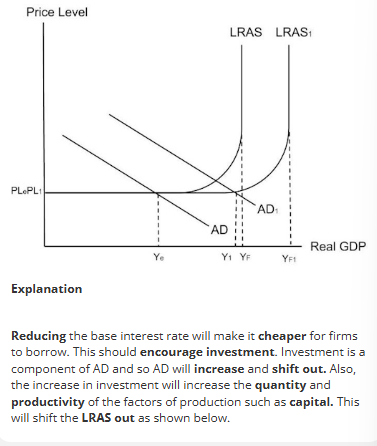

A decrease in the interest rate means that borrowing is cheaper and so investment is likely to increase.

This will shift AD out, because investment is a component of AD. Investment will also increase the productivity of the factors of production, which will shift the LRAS out.

Both of these will increase real GDP and lead to economic growth.

However,

If aggregate demand and animal spirits are particularly low, firms might be concerned that investment will be wasted.

This could mean that they do not make a profit on the investment, leaving them unable to pay it back and therefore in debt.

So, a decrease in the interest rate might not actually increase investment and economic growth.

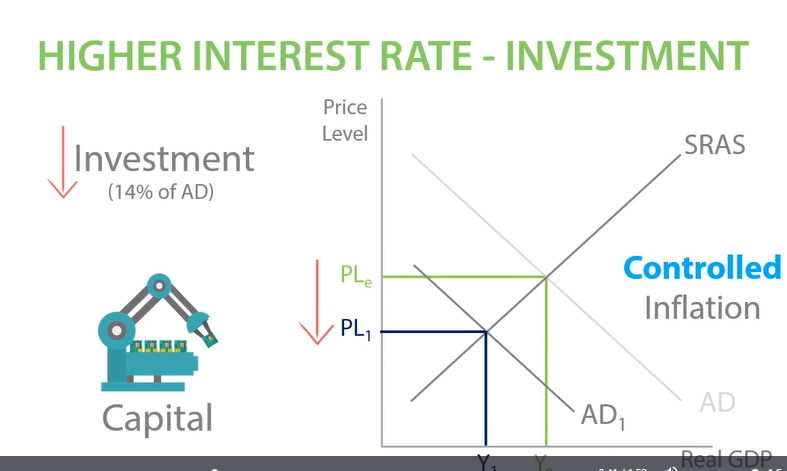

HIGHER INTEREST RATE- INVESTMENT

Show the impact of an increase in interest rate on investment.

An increase in interest rate means firms will have higher repayments when they borrow.

This will lead to a reduction in investment which is a component of aggregate demand.

A reduction in AD should decrease the price level and reduce the rate of inflation,

Higher Interest rate- Investment

Which of the following shows a likely impact of an increase in the cost of loan repayments?

An increase in the interest rate means that borrowing is more expensive and so investment is likely to decrease.

This will shift AD in because investment is a component of AD. Investment will also decrease the productivity of the factors of production, which will shift the LRAS in.

Both of these will decrease real GDP and lead to a reduction in economic growth.

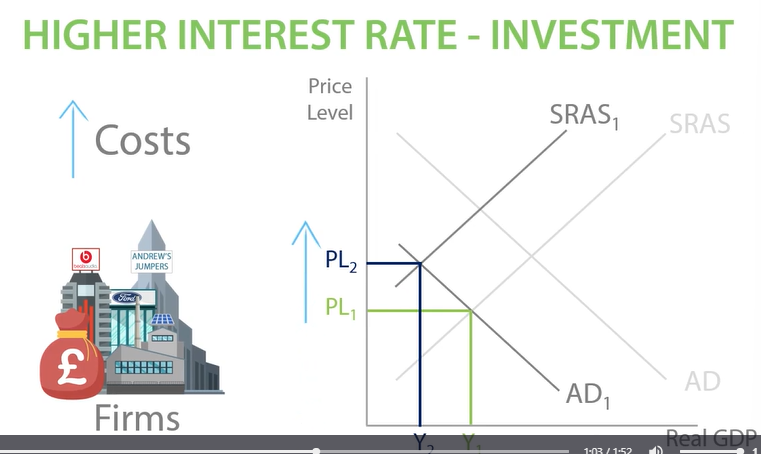

However

An increase in loan repayments will increase costs for firms. This will shift SRAS in and force firms to increase their prices to remain profitable.

This will increase inflation, which goes against the aims of contractionary monetary policy.

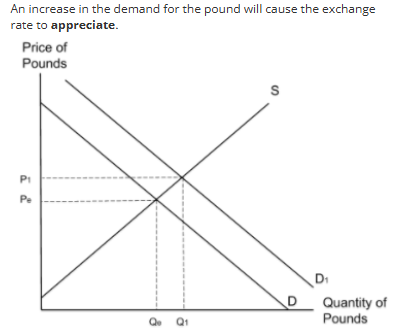

HIGHER INTEREST RATES- IMPORTS & EXPORTS

Will contractionary monetary policy increase or decrease the return from saving?

Contractionary monetary policy involves an increase in the interest rate which will increase the return from saving.

Foreign investors would want to save their money in the UK.

Foreign investors will demand pound sterling, increasing demand for the pound.

APPRECIATION- stronger pound that buys more foreign currency.

An increase in the demand for the pound will cause the exchange rate to appreciate.

Higher demand for pounds makes the pound stronger in value (exchange rate appreciates)

SPICEE

Strong pound = imports cheaper

Exports =Expensive

Appreciation of the exchange rate will cause the import expenditure to increase and export revenue to decrease. This will worsen balance of trade.

-This will decrease AD.

However, UK is a net importer of raw materials. It imports more raw materials into the country than exports.

-Stronger pounds, imports cheaper so firms costs decrease, firms reduce costs/

Therefore. UK exports is cheaper and more competitive and increase demand for UK exports, export revenue will increase.

If UK exports cheaper, UK consumers will substitute away from demanding foreign goods and instead buy UK goods.

Therefore, import expenditure will decrease and export revenue will increase.

This will improve AD and improve current account deficit.

Higher Interest rates -Exports Imports

An appreciation of the pound will reduce the cost of production for firms who import raw materials.

This will reduce their prices and increase the international competitiveness of UK exports.

This will increase demand for UK exports and increase export revenue.

LOWER INTEREST RATE - IMPORTS & EXPORTS

What will happen if the Bank of England decreases the base interest rate?

If the interest rate in the UK falls, the return on savings decrease.

This means foreign investors will want to hold their money in other countries so they will sell their pounds in order to buy other currencies.

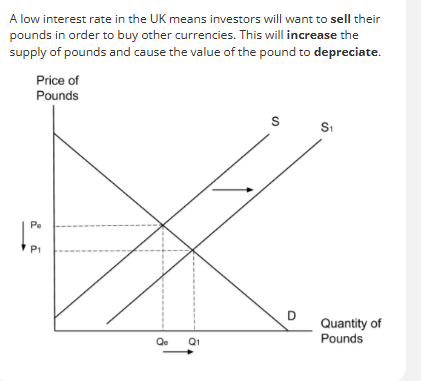

A low interest rate in the UK means investors will want to sell their pounds in order to buy other currencies.

This will increase the supply of pounds and cause the value of the pound to depreciate. (demand for pound falls)

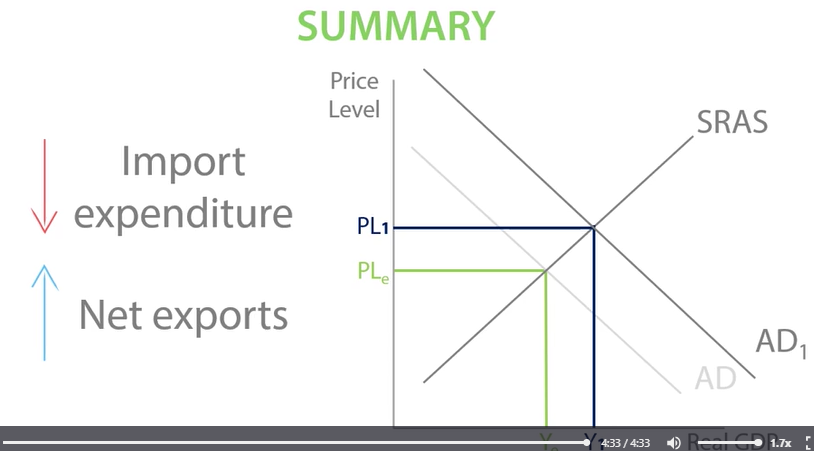

A depreciation of the pound. Imports get more expensive and consumers demand less and import expenditure decreases.

Exports get cheaper and foreign consumers demand more of them and export revenue increases.

This will increase net exports and increase AD.

However, UK is net importer of raw materials. Depreciation of pound makes imports more expensive, raw materials also get more expensive UK firms will see increase in costs to maintain their profits they will increase their prices.

This will decrease the competitiveness of UK exports because they become more expensive for foreign consumers, reduce demand for UK exports so export revenue will decrease.

UK consumers will substitute to foreign goods as they are cheaper, increasing import expenditure.

Import expenditure increase and export revenue decrease which will shift AD left and worsen current account deficit.

LOWER INTERET RATE- EXPORTS IMPORTS

A depreciation of the pound means UK firms importing raw materials see an increase in their costs.

If their costs increase they will need to increase their prices in order to ensure a profit.

If firms increase their prices and export their goods then UK exports will become less internationally competitive.

This will decrease demand for exports and so export revenue will fall and current account will worsen

ADDITIONAL INFO FOR MONETARY POLICY

Less people borrowing and more are saving, there is a fall in demand for assets such as stocks, shares and government bonds.

This leads to a fall in prices for these assets. Therefore consumers will experience negative wealth effect since the value of their assets fall, which will lead to a fall in consumption.

People become less confident…mortgages expensive to repay, less income to spend on goods and services consumption falls.

HOWEVER,

Changes in interest rate take up to 2 years to have their full effect and small changes in interest rates may not affect peoples decisions.

Sometimes interest rates are so low they cannot be decreased any further to stimulate demand.

Range of different interest rates and not all of them affected by Bank of England base rate.

Lack of confidence mean now matter how low interest rates are consumers and business do not want to borrow or banks do not want to lend.

QUANTIATIVE EASING DEFINITION

When the Bank of England buys assets in exchange for money in order to increase money supply and get money moving around the economy during times of low demand.

Can prevent liquidity trap, where even low interest rates cannot stimulate AD.

What is Quantitative Easing?

Quantitative easing is when the central bank buys financial assets such as bonds from high street banks. This increases the money supply for high street banks, which increases the amount of money that banks can lend.

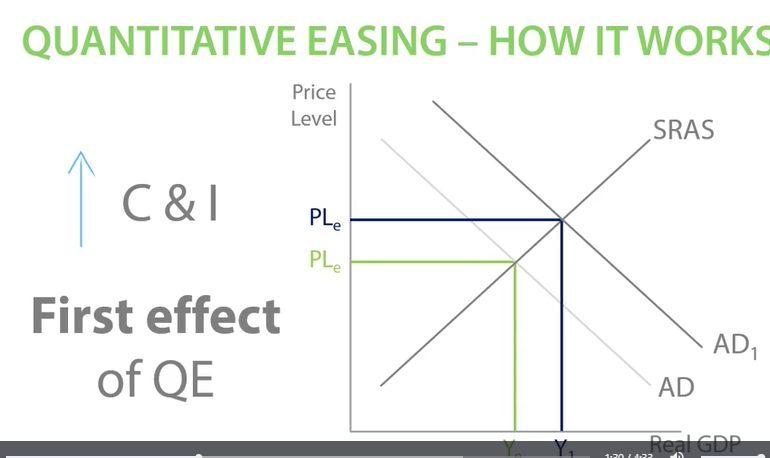

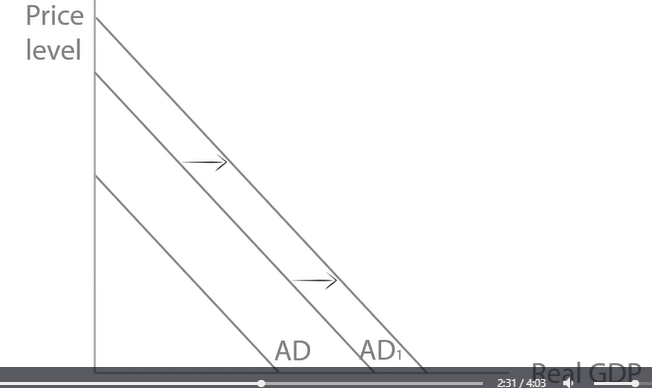

-increases consumption and investment, shifting out AD

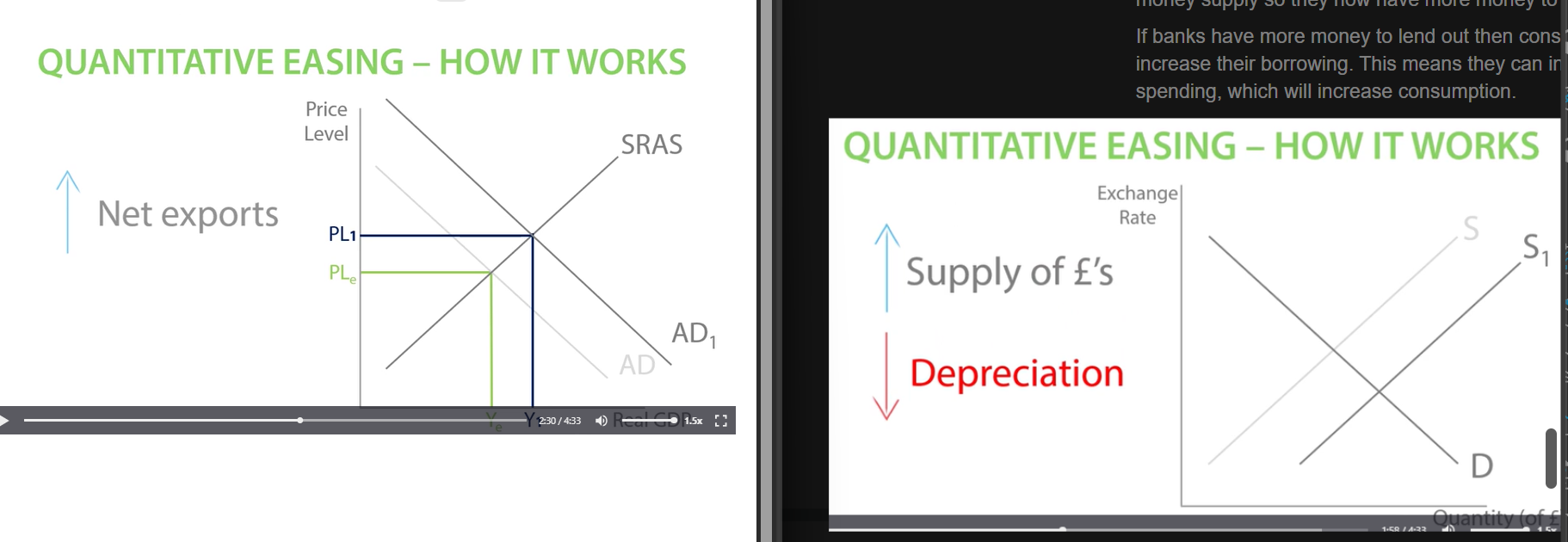

-affects exchange rate, causes pound to depreciate and get weaker because more money printed. imports more expensive, reduce import expenditure, exports cheaper and more competitive export revenue increases.

AGAIN!

Quantitative easing is where the central bank buys financial assets from high street banks. This gives them more money to lend out to consumers and businesses. This will increase consumption and investment which will increase aggregate demand.

However, the increase in the money supply may cause an increase in the price level. High inflation could become hyperinflation.

Quantitative Easing.

When base interest rate close to zero and the central bank can reduce the base interest rate anymore, the central bank uses quantitative easing.

Cannot go below 0, it would be negative.

Lowest possible interest rate is 0 - The zero lower bound.

Quantitative easing- The bank of England electronically creates new money

Central bank uses the new money to buy financial assets such as government bonds from Highstreet banks.

Highstreet Banks receive a lot of money which increases their money supply so they now have more money to lend out

If banks have more money to lend out then consumers will increase their borrowing. This means they can increase their spending, which will increase consumption.

Firms can borrow more easily and investment will increase. Both will increase AD.

An increase in the supply of pounds will cause the exchange rate to depreciate. This will make exports cheaper and imports more expensive, increasing export revenue and decrease import expenditure.

This will lead to an increase in net exports and so aggregate demand will shift out.

Will quantitative easing increase the supply of pounds?

YES, BECAUSE THEY CREATE MORE MONEY ELECTRONICALLY AND HIGHSTREET BANKS RECEIVE ALOT OF MONEY!

An increase in the supply of pounds will cause the exchange rate to depreciate. This will make exports cheaper and imports more expensive, increasing export revenue and decrease import expenditure.

This will lead to an increase in net exports and so aggregate demand will shift out.

QUANTITATIVE EASING BENEFITS:

FIRST: could lend out more, increase consumption and investment leading to increase in AD and real GDP

SECOND: Higher money supply, increase supply of pounds decreased exchange rate, causing a depreciation, increases net exports pushing out AD.

HOWEVER:

Increasing money supply, (there’s more money to lend), economy gets hit with inflation.

Highstreet banks lending out more, consumers and firms could borrow more and increase consumption and investment, increase AD and price level.

Large increase in money supply causes hyperinflation.

ADDITIONAL INFO FOR QUANTITATIVE EASING

Since the bank is buying assets, there is a rise in demand and so asset prices rise. causes positive wealth effect since shares, houses are worth more so people increase their consumption.

Commercial banks may lower interest rates as they are receiving so much money from the Bank of England and so can offer very low interest deals to their customers. The increased money supply will mean that the price of money falls, interest rates are the price of money, The will encourage borrowing, and therefore increase investment and consumption so increase AD. If many banks decide to lower their interest rates, the same mechanisms will apply as those following a reduction in the base rate.

HOWEVER:

Risky and if not controlled could cause hyperinflation.

No guarantee that higher asset prices lead into higher consumption, through the wealth effect, especially if confidence remains low.

Had a large effect on the housing market by stimulating demand and leading to rapid price rises since 2013, help worsen issues of geographical mobility. Also led to rising share prices which increases inequality, since rich grow richer while poor see none of the gains.

Not meant to be permanent, there are concerns that banks and economies are too dependent on quantitative easing, particularly within Eurozone.

The central bank can restrict a banks ability to lend money or who they are allowed to lend it to.

Main aim it to keep inflation at 2% if it goes below 1% or above 3%…,

Since 2009. MPC has kept the bank rate at 0.5% and policy has become focussed on boosting economic growth and employment. Reduced to 0.25% following Brexit vote but rose again November 2017 due to inflation that weak pound brought.

Fiscal Policy

When the government uses tax and government spending to influence the economy.

Contractionary fiscal policy = Tight fiscal policy

When the government increases tax and decreases government spending in order to decrease aggregate demand.

Increase in taxes means more leakages out of the circular flow and decrease in government spending means fewer injections into circular flow.

Circular flow will contract.

But also improves the budget deficit and goc spending less and receive more in tax revenue.

Expansionary fiscal policy= loose fiscal policy

When the government increases government spending and decreases tax in order to increases aggregate demand.

Expansionary fiscal policy also means loose fiscal policy and more money loose floating around the economy.

What does the UK government pursue in order to get the economy out of recession?

EXPANSIONARY FISCAL POLICUy

In a recession, the government would want to use fiscal policy to increase AD. Therefore, decrease taxes to encourage consumption. They will also spend more money. By decreasing tax and increasing spending they will need to borrow more money, which will worsen the budget deficit.

More government spending, more injection into the UK circular flow and decrease taxes means fewer leakages out of the circular flow, expanding the UK economy.

FISCAL POLICY

LOWER INCOME TAX

A lower income tax means that high earning workers pay less tax to the government. This means that they can keep more of their disposable income. So therefore, they will spend more, increasing consumption and increase aggregate demand.This will lead to the multiplier effect.

As consumers spend more, firms will make more sales and therefore more profit. This means that they can invest more. Because investment is a positive component of aggregate demand, AD will increase further.

As consumers spend more and firms make more profit,, corporation tax and VAT revenues will increase. This means that the government can spend more and so AD will increase further.

As firms expand, they will increase their derived demand for labour, so incomes will increase. This will further increase spending and income tax revenue, causing consumption and government spending to increase further. So, the overall impact on aggregate demand will be much larger.

EXPANSIONARY FISCAL POLICY- increase Real GDP Ye-Y1 and the economy expands.

HOWEVER,

The immediate impact of reduction in income tax rate is that revenue from income tax will decrease. Limiting government spending on healthcare, education and benefits. If government spending decreases aggregate demand will fall as government spending is a component of AD. This will reduce Real GDP and contract the economy.

FISCAL POLICY

HIGHER INCOME TAX

=CONTRACTIONARY FISCAL POLICY

A higher income tax means that high earning workers pay more tax to the government. This means that they have less disposable income, so they will spend less. This will decrease consumption, which wil decrease aggregate demand.

Bring price level down from PLe to PL1 reducing inflation.

Higher income tax means increase in income tax revenue means government budget deficit get smaller and move towards a balanced budget.

DOWNWARD MULTIPLIER EFFECT:

Higher income tax rate, workers more disposable income, consume less, decrease in consumption decrease AD. consumers spend less, firms make fewer sales, less profit, invest less, AD will decrease further as investment positive component of AD.

Consumers spend less firms make less profit, corporation tax and VAT revenue decreases. Means government spend less and AD decrease further. As firms contract, decrease derived demand for labour, incomes decrease, further decrease spending and income tax revenue, consumption and gov spending further decrease.

Overall impact on AD will be much larger.

High income workers may avoid high income tax rate, work less or move abroad or sophisticated accountants to help avoid tax payments.

Therefore increasing income tax, it may not actually increase.

INCREASE IN TAX EVASION AND AVOIDANCE.

FISCAL POLICY

HIGHER INCOME TAX RECAP

Raising the income tax rate for high earners decreases their disposable income. This will decrease consumption and aggregate demand, which will help to bring the price level down and control inflation. Also, a higher income tax rate will increase income tax revenue and help the government to balance its budget.

However, a reduction in aggregate demand will reduce real GDP. Also, an increase in income tax may increase tax evasion and avoidance which could even mean that income tax revenue decreases.

FISCAL POLICY

HIGHER BENEFITS

Benefits are payments made by the government to unemployed or low income workers.

EXPANSIONARY FISCAL POLICY- increase spending on benefits and increases consumption, multiplier effect.. this increases economic growth and reduces income inequality.increase AD

Disadvantage of increase benefits too much: Decreased incentive to work. - this is called the BENEFITS TRAP increases unemployment.

FISCAL POLICY

BENEFITS TRAP?

When benefits get too high and unemployed workers are actually better of staying unemployed and claiming benefits than working.

FISCAL POLICY

LOWER BENEFITS

AS PART OF CONTRACTIONARY FISCAL POLICY.

If benefits are reduced, less to spend, then there is reduced consumption.

Benefits are not included in government spending- they are just a transfer from the government to individuals which decreases consumption which shifts AD left, downward multiplier effect.

This decreases economic growth and increases income inequality because poor receive less in benefits.

However, budget deficit will decrease, and escape the benefits trap, which would decrease unemployment.

Budget deficit- when the government spends more money than it receives in tax revenue over a year.

FISCAL POLICY

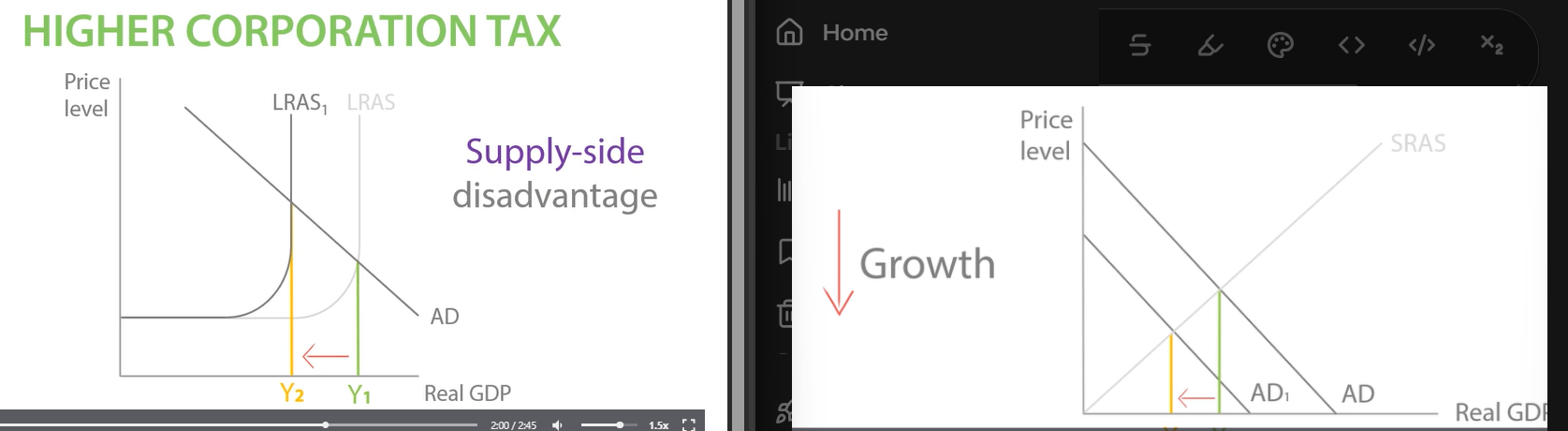

HIGHER CORPORATION TAX

Corporation tax is tax on profits made by a firm.

Government pursue contractionary fiscal policy, corporation tax rates will increase which will increase corporation tax revenue and help government balance its budget.

Or use corporation tax revenue to increase government spending, shifting out AD and increasing economic growth.

HOWEVER,

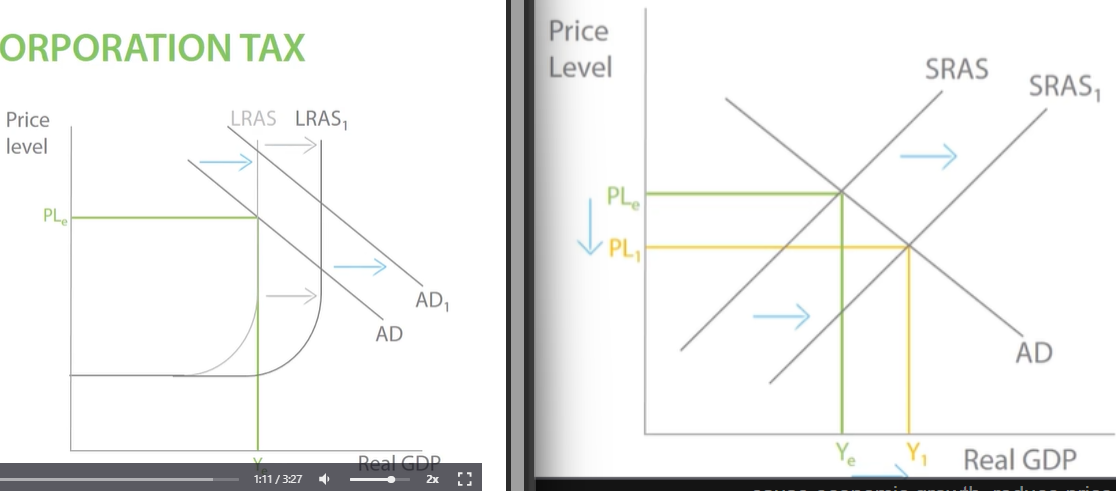

An increase in corporation tax rates means that firms will be able to keep less of their profit. This means that they will decrease their investment, causing a decrease in aggregate demand. shifting AD to AD1 forcing real gdp down from YE to YE1 and decreasing growth. (diagram on right)

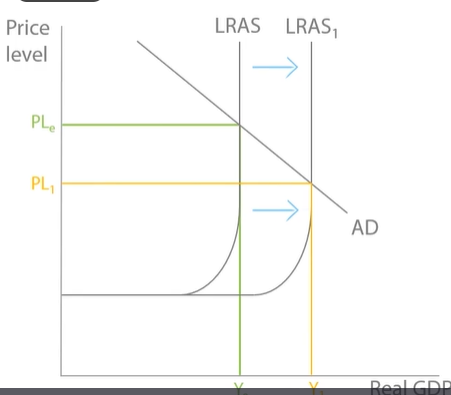

If profit decreases and investment falls, in the long run firms wont be able to invest in new machinery to replace old machinery or capital, so capital will depreciate. Will start to rust and become worn out, productivity will decrease, shifting LRAS to LRAS1, also have supply side disadvantage. (diagram on left)

FISCAL POLICY

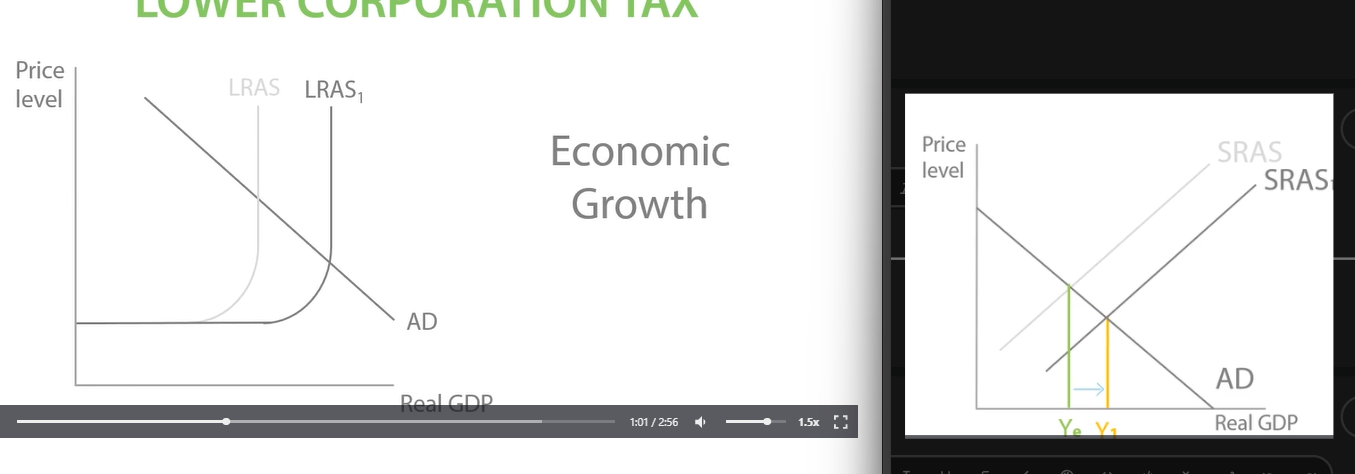

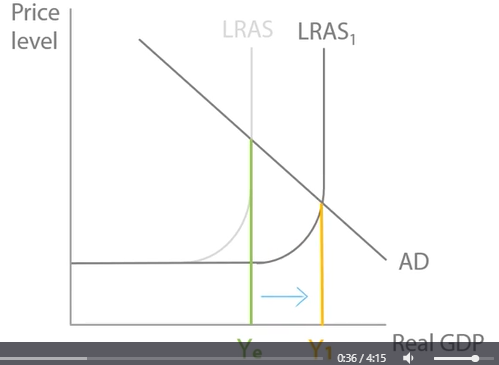

LOWER CORPORATION TAX

Expansionary fiscal policy involves increasing government spending and reducing tax.

A reduction in the corporation tax is likely to decrease the government’s tax revenue.

2017 UK gov cut corporation tax 20% to 19%, lower corporation tax , firms pay less to the government.

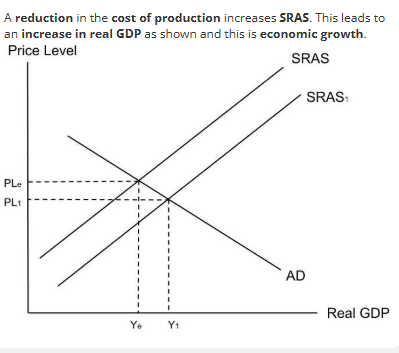

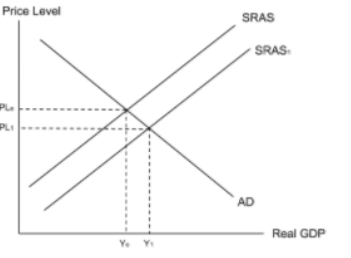

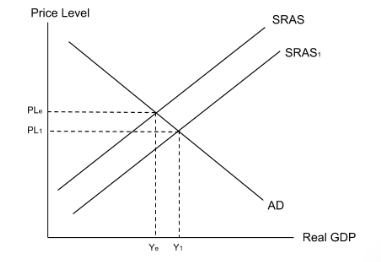

In the short run- A right shift of SRAS if costs decrease. A reduction in corporation tax will decrease costs, not increase them. RIGHT DIAGRAM

This increases real GDP in short run from YE TO Y1.

In the long run - profits can increase investment , increasing AD and more technology in capital will increase productivity, shifting LRAS to LRAS1. lead to more economic growth. LEFT DIAGRAM.

However, government lose corporation tax revenue, cut back on government spending, reduce AD and economic growth and couldn't pay out much benefits to the poor and worsening inequality which would worsen the budget deficit.

When cutting corporation tax and increase firms profit, no guarantee firms will use the extra profits to invest in new capital, owners may just keep the extra profit.

FISCAL POLICY

LOWER CORPORATION TAX RECAP

One advantage of decreasing corporation tax is that it should lower costs for firms. This will shift SRAS to the right and increase real GDP in the short run. Also, firms can keep more of their profit, so they are likely to increase investment, which will increase AD. Increasing investment will increase the productivity of capital and shift LRAS to the right, leading to economic growth.

However, decreasing corporation tax means that the government will receive less tax revenue. Also, the extra profit from reducing corporation tax might just be kept by the owners instead of being used for investment.

FISCAL POLICY:

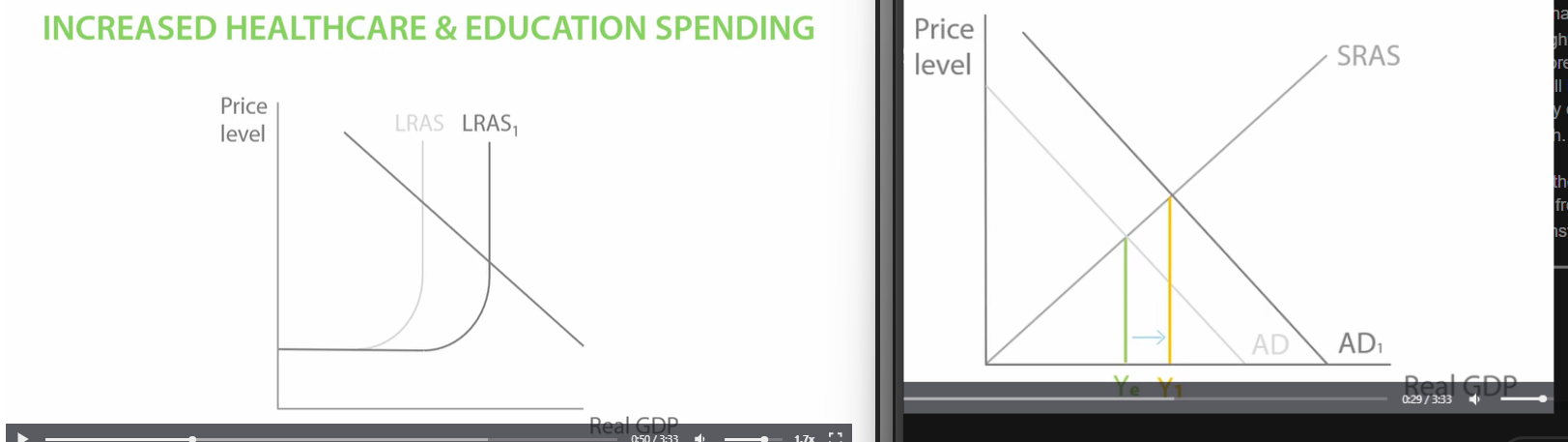

NCREASED HEALTHCARE AND EDUCATION SPENDING

Expansionary fiscal policy involves reducing taxation and increase government spending, which includes spending on healthcare and education.

Increase AD and real GDP from YE TO Y1 .diagram on right

e.g. government could increase subsidies for university, encourage more students to go who will learn new skills such as engineering and become more productive in the workplace, shifting out LRAS increasing GDP. diagram on left

E.g. government could increase funding for NHS, more doctors and nurses could help reduce illness, so workers can be physically fit increasing productivity at work shifting LRAS to the right, they will stay alive longer, quantity of labour able to provide increases which shift LRAS again increasing economic growth.

LONG RUN SUPPLY SIDE BENEFIT OF INCREASED PRODUCTVITY.

However, more government spending on education and healthcare means budget deficit worsens. Increased subsidies only help if students choose courses that actually improve their productivity. studying theoretical subjects like theoretical physics wont necessarily help productivity when they get into the work place and need practical skills.

Increased NHS funding only help if it goes to treating real illnesses. Much of NHS funding goes into paperwork and funding, known as Bureaucracy. Some funding pays for cosmetic surgery such as nose jobs so worker productivity wont increase.

FISCAL POLICY

INCREASED HEALTHCARE AND EDUCATION SPENDING

RECAP!

An increase on government spending is an increase in G, which increases aggregate demand and, therefore, real GDP. Specifically, spending on healthcare and education will make the workforce healthier and more productive, so the LRAS will shift right.

However, this spending will worsen the government’s budget deficit. Furthermore, spending on schools and education could go towards unproductive bureaucracy or useless degrees.

FISCAL POLICY

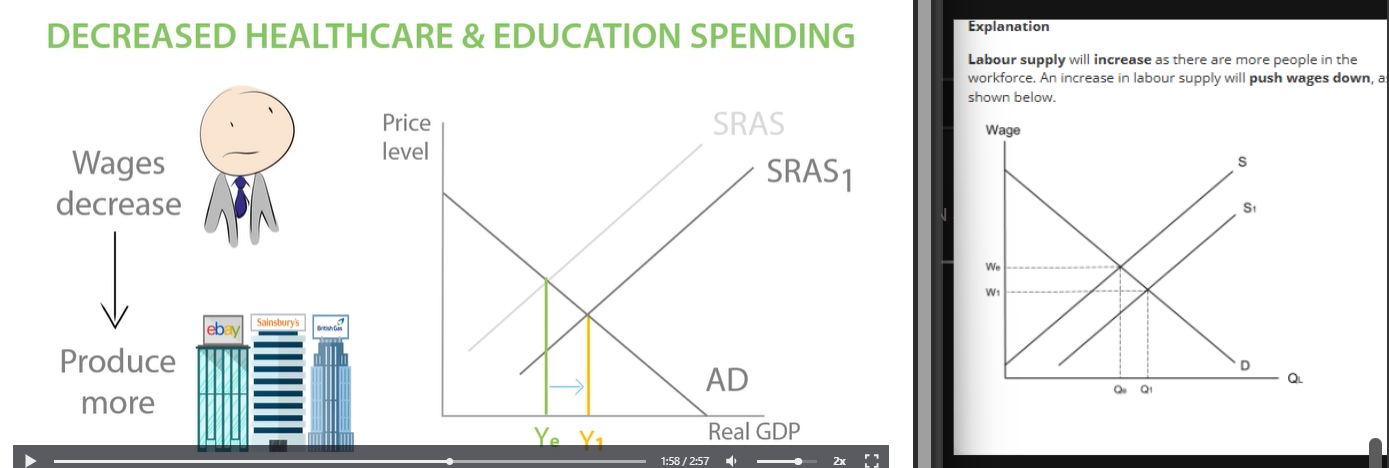

DECREASED HEALTHCARE AND EDUCATION SPENDING

Contractionary fiscal policy involves decreasing government spending and increasing tax.

Cutting the spending will help the government reduce the budget deficit and move closer to balanced budget.

The Healthcare cuts could force NHS to become more efficient and provide more effective treatments, improving workers health and productivity.

The Education cuts such as scrap university subsidies could force more students to enter the labour market after school.

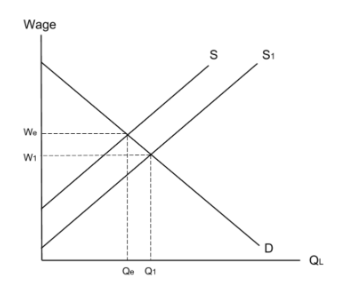

As a result, Labour supply will increase as there are more people in the workforce. An increase increase in labour supply will push wages down and able to produce more, as shown in diagram right . Result in reduction of wages SRAS will shift right. shown in left diagram

However, government spending is a component of aggregate demand, which will decrease if spending on healthcare and education is reduced. This will reduce real GDP.

In the long run, government spending is cut for healthcare, illness will be untreated and there will be less productive workers shifting LRAS in , decreasing long run economic growth.

(the diagram AD and LRAS left)

If government cut university subsidies, students wont know the skills needed in the future, decreasing productivity, shifting LRAS and limiting economic growth.

FISCAL POLICY

RECAP DECREASED HEALTHCARE AND EDUCATION SPENDING

A reduction in spending on education means a higher labour supply which can lower wages and therefore lower real costs for firms. This will shift SRAS to the right and increase real GDP.

However, a reduction in spending on healthcare and education means that the workforce is less productive, so LRAS will shift left, reducing real GDP.

FISCAL POLICY

INCREASED VAT

BUDGET DEFICIT- OCCUR WHEN GOVERNMENT EXPENSES EXCEED REVENUES.

VAT stands for Value Added Tax and is charged as a percentage of the price of the good sold.

An increase in VAT means the government will earn more tax revenue, so they will need to borrow less. This will decrease the budget deficit.

If firms costs increase due to an increase in VAT there is a left shift in short run aggregate supply. Decrease real GDO from YE to Y1, limiting economic growth and pushing up price level leading to cost-push inflation.

RECAP

An increase in VAT will increase tax revenue for the government, which will improve the budget deficit.

However, an increase in VAT will increase costs for firms, which will shift SRAS inwards. This can reduce economic growth and leads to cost push inflation

FISCAL POLICY

DECREASED VAT

A decrease in VAT will decrease costs for firms, which will increase,

A decrease in VAT will decrease costs for firms, which will increase SRAS. This will increase real GDP and economic growth, and bring price level down.

However, a decrease in VAT will decrease tax revenue and worsen the budget deficit.

FISCAL POLICY

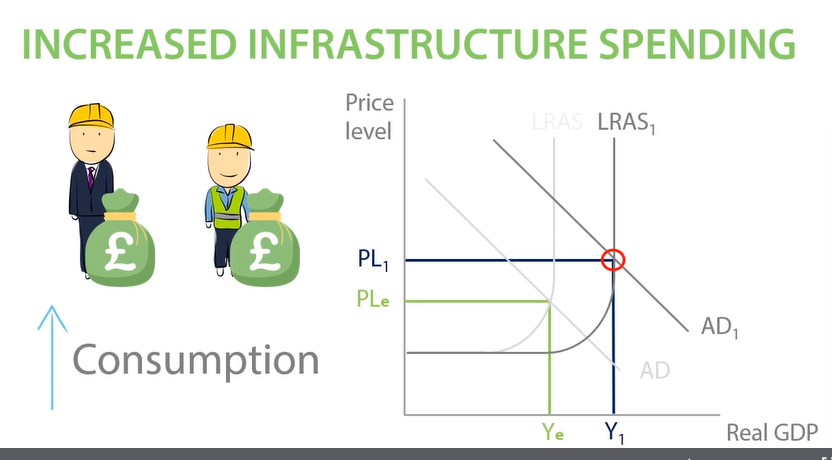

INCREASED INFRASTRUCTURE SPENDING

Infrastructure spending involves spending on things that are required for businesses to operate efficiently. It includes roads, railways, sewer systems, electricity grids, communication networks.

What is likely to occur following building of HS2?

An increase in geographical mobility of labour. This shifts out the LRAS- supply-side effect because more workers able to find jobs in London and start working increasing quantity of labour, earning and spending, consumption increase shifting out AD. equilibrium YE TO Y1 increasing Real GDP..

FISCAL POLICY ]

CROWDING OUT

Expansionary fiscal policy, increase in government spending will increase G and shift out AD and boost in education, health and infrastructure will shift out LRAS .

However, when government increases spending, it can crowd out spending and investments by private firms, using up their resources or push up the cost of borrowing.

E.g. To build new infrastructure the government has to demand more land, labour and capital. Increased demand increased price of capital, labour, land and price of borrowed money is the interest rate.

Government borrowing has pushed up the interest rate and price of land, labour and capital. This means prices for firms are higher so costs will increase. Increase in costs will reduce supply and shift firms supply curve to the left.

Government may be taking resources away from private firms. If economy is operating a full potential, then land labour and capital demanded by government is taken away from being used at the private sector so when governments try to expand, they need to be careful because they might end up crowding out private firms, decreasing firms supply and left shift of short run aggregate supply.

FISCAL POLICY

CROWDING OUT

Explain the likely impact of the government borrowing to spend on land, labour and capital.

Government borrowing has pushed up interest rate and the price of land, labour and capital. This means that prices for firms are higher, so costs will increase. An increase in costs will reduce supply and shift firms supply curve to the left. This occurs for all firms in the economy, SRAS will shift left and decrease Real GDP.

Expansionary fiscal policy can lead to demand in factors of production, need to borrow money and need more land, labour and capital.- WHICH INCREASES INTEREST RATE!

What is the definition of infrastructure?

Items needed for businesses to operate such as roads and telecommunication networks.

What is the definition of crowing out? FISCAL POLICY

When government spending increases, the government demands more borrowed money, land, labour and capital. The price and interest rate increases which increases costs for firms and reduces supply.

Budget deficit

Is when the government spends more than they receive.

Budget surplus

Government receives more money than the spend.

Demand side policies and supply side policies

Demand side policies, such as reducing income tax, are those that mainly affect aggregate demand.

Supply side policies, such as increasing vocational training, mainly affect aggregate supply.

DEMAND SIDE AFFECT SUPPLY SIDE: A reduction in income tax likely to increase labour supply, people can keep more of their income, so likely to want to work more. Increase in labour supply will lower wages. lower wages means lower costs for firms shifting out SRAS .

SUPPLY SIDE AFFECT DEMAND SIDE: increase in vocational training , increase government spending 25% of AD so AD will shift out too.

supply side policy managed by the government.

two types of demand side policy- first is fiscal policy, managed by UK government. Second is monetary policy, managed by Bank of England.

DEMAND SIDE RESPONSES TO THE DEPRESSION AND RECESSION

US RESPONSE TO THE GREAT DEPRESSION 1

A commitment to the gold standard led to a fall in the money supply in the US economy. which eld to economic growth.

Worldwide restrictions on imports led to a collapse in world trade. As a result, firms relied on exports and had to shut down, leading to an increase in unemployment and negative multiplier effects on the world economy. - RESTRICTIVE TRADE POLICY

Hoover’s government employed a contractionary fiscal policy which reduced people’s incomes, discouraged consumption and investment and led to an inward shift in aggregate demand. -CONTRACTIONARY FISCAL POLICY

Increasing interest rates discouraged consumption and investment in the economy. As a consequence, aggregate demand shifted inwards. - INTEREST RATES

RECAP UPLEARN

The US government enabled the Wall Street Crash to turn into the Great Depression because, it introduced restrictive policies which increased the price of imports and caused the collapse of world trade.

Secondly, it engaged in a policy of contractionary fiscal policy because of a belief in balanced budgets.

Finally, it increased interest rates to protect itself from negative consequences of belonging to the gold standard.

DEMAND SIDE RESPONDES TO THE DEPRESSION AND RECESSION

US RESPONSE TO THE GREAT DEORESSION II

Policies inspired by classical economics led to the wall street crash turning into the Great Depression

ROOSEVELT - The New Deal led to an increase in employment, Because more people had incomes, there was an increase in consumption in the economy. This led to an outward shift in aggregate demand and increase in real GDP. - Keynesian expansionary fiscal policy.

ABANDON THE GOLD STANDARD- illegal for Americans to change their dollars into gold. This means US central bank free to increase money supply in the economy by decreasing interest rates led to an increase in consumption and investment in the US economy. As a result, aggregate demand shifted outwards, lead to increase in real GDP.

American companies could export their goods to foreign countries. As a result, American firms could grow and hire new workers. In addition, a growing economy encouraged more consumption which led to outward shift in aggregate demand. - REMOVAL OF IMPORT RESTRICTIONS.

RECAP- Roosevelt implemented expansionary fiscal policy by introducing a series of policies known as the New Deal.

In addition, he left the gold standard, which enabled policy makers to decrease interest rates and increase money supply.

Finally, he encouraged the growth of world trade by removing import restrictions.

US RESPONSE TO GREAT RECESSION

In response to 2008 financial crisis, US engaged in expansionary monetary policy and fiscal policy. For instance, interest rates were lowered to 0 percent. In addition, 4.5 trillion of quantitative easing pumped into the economy. Finally a tax and spending programme equivalent to 6 percent of GDP was introduced.

DEMAND SIDE RESPONSES TO THE DEPRESSION AND RECESSION

UK RESPONSE TO THE GREAT DEPRESSION

Leaving the gold standard in 1931 meant that the UK was enable to enact expansionary monetary policy. As a result, the amount of consumption and investment in the economy rose.

Therefore, AD recovered more quickly in the UK, which returned to economic growth by 1932.

RECAP

In response to the Great Recession, the UK reduced its interest rate from 5% to 0.5%.

In addition, it engaged in a radical new policy of expansionary monetary policy(quantitative easing), which aimed to boost the economy’s money supply.

The expansionary monetary policy aimed to increase consumption and investment in the economy. 2.2% of GDP pumped into economy, decrease VAT, increase spending. on schools, energy and infrastructure.

IN RESPONSE TO 2008 FINANCIAL CRISIS, UK RESPONDED BY EXPANSIONARY MONETARY POLICY, REDUCE INTEREST RATES, IMPLEMENT RADICAL PROGRAMME OF QUANTITATIVE EASING.

The UK also implemented expansionary fiscal policy. It unleashed a package of tax cuts and government spending equivalent to 2.2% of GDP.

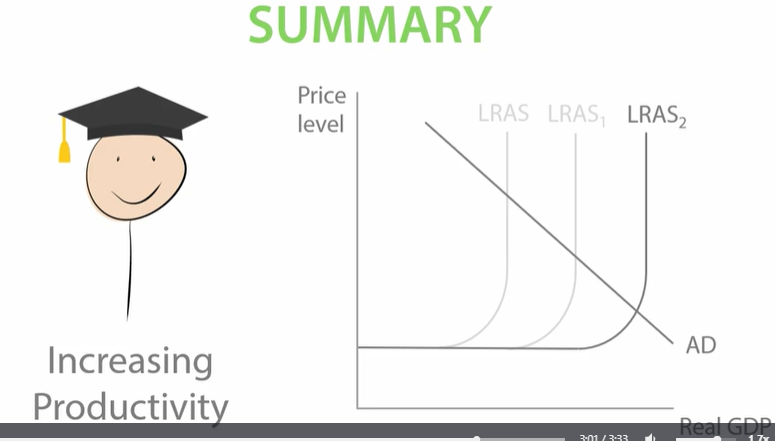

What are supply side policies?

Any government policies which aim to increase the aggregate supply in the economy.

Supply-side policy

What is an interventionist economy?

When the government increases its intervention in the economy to increase productive potential.

SUPPLY SIDE POLICY

Interventionist policy

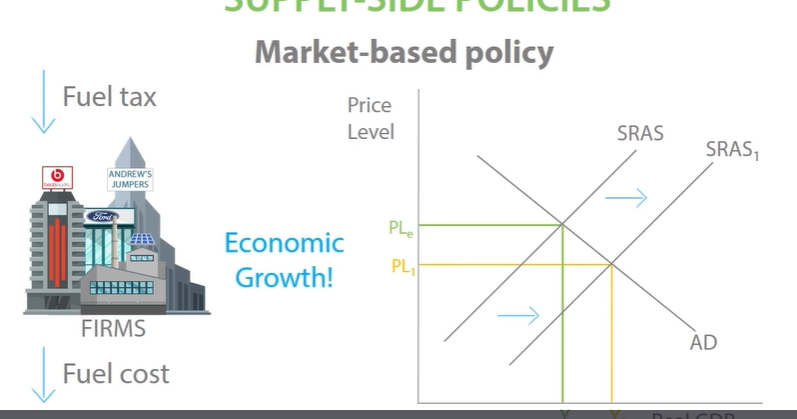

What is the impact of reduction in fuel costs?

When the government increases its intervention in the economy, spending more on infrastructure, building new roads, able to transfer their stock quicker, reducing their fuel cost.

Reduction in the cost of production increases SRAS leading to economic growth.

-designed to correct market failure, free market provides education and government provides it.

Supply-side policy

What is Market-based policy?

When the government decreases its intervention in the economy.

policies designed to prevent free market system working efficiently, causing lower output and higher prices. These barriers reduce willingness of workers to take jobs or lead to inefficient production.

They could reduce government intervention by reducing taxes on fuel, reduce fuel cost for firms so SRAS shift right leading to economic growth.

SUPPLY SIDE POLICY

INFRASTRUCTURE SPENDING

What is the likely impact of government funded infrastructure projects?

Improvement in infrastructure, such as HS2, will improve geographical mobility of labour. This will increase the productivity of labour and shift LRAS out. Increase in real GDP and decrease in the price level. RIGHT DIAGRAM

geographical mobility of labour- how easily workers can move to one area to another to take jobs, reduce structural unemployment, workers can move to areas of job shortage to take job demand.

Improvements in infrastructure will benefit consumers, new improved roads easier for consumers to go to the shops, spend more increasing consumption, 65% of AD, AD will cause further economic growth - demand-side benefit. LEFT DIAGRAM

HOWEVER,

Increase in infrastructure can lead to Crowding out when government spending push up demand for resources, increase their price.

E.g. They will spend money on workers to build infrastructure which will push up wages. Or they will borrow money which will push up interest rate. This makes it more expensive for private sector firms and they have been crowded out. This increases firms costs which shifting SRAS in decreasing real GDP.

RECAP!

Infrastructure projects such as HS2 improve the geographical mobility of labour, increasing the productivity and quantity of labour and causing the LRAS to shift out. Another advantage is that it increases aggregate demand as increases in employment will increase consumption. Both the increase in LRAS and AD will lead to economic growth.

However, a disadvantage is that government spending on infrastructure might crowd out private firms. By borrowing money to spend on new infrastructure, the government is increasing the demand for borrowed money, land, labour and capital. This increases prices for each factor of production, increasing costs for firms. This shifts the SRAS in and reduces real GDP. AD also affected as less consumption.

SUPPLY SIDE POLICY

REDUCING CORPORATION TAX

Reducing corporation tax is an example of market-based supply side policy because it involves the government reducing their intervention and allowing the market forces to operate freely,

Corporation tax lower - incentive to expand and start a new business as firms get to keep their profit, so more entrepreneurship. people start more business, shift SRAS out, cause economic growth, reduce price level. RIGHT DIAGRAM

LONG RUN- profit firms get to keep increases more funds available to invest increasing investment, more productivity and machinery . LRAS will shift out and investment 14% of AD, increased investment will shift AD out and increase in Real GDP.

HOWEVER.

Reduction in corporation tax means that the government receive less tax revenue. The opportunity cost is that there is less money available to spend in other areas such as health, education, health, police, schools, hospital.

Or reduced infrastructure spending.

RECAP

Advantage 1 - A reduction in corporation tax will reduce the cost of production. This will encourage new firms and expansion of existing firms which will shift the SRAS to the right and leads to economic growth and a reduction in the price level.

Advantage 2 - Firms can keep more of their profit and so they are more likely to invest. This will increase the productivity of capital and shift LRAS to the right leading to economic growth and a reduction in the price level.

Advantage 3 - Firms can keep more of their profit and so they are more likely to invest. Investment is a component of AD and so an increase in investment will increase AD which will lead to economic growth.

Disadvantage 1 - A reduction in corporation tax may reduce tax revenue. There is an opportunity cost as there is now less money available to spend in other areas, such as healthcare or infrastructure.

SUPPLY SIDE POLICY

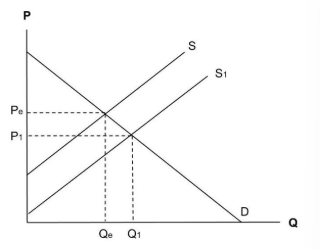

REDUCTION IN THE MINIMUM WAGE

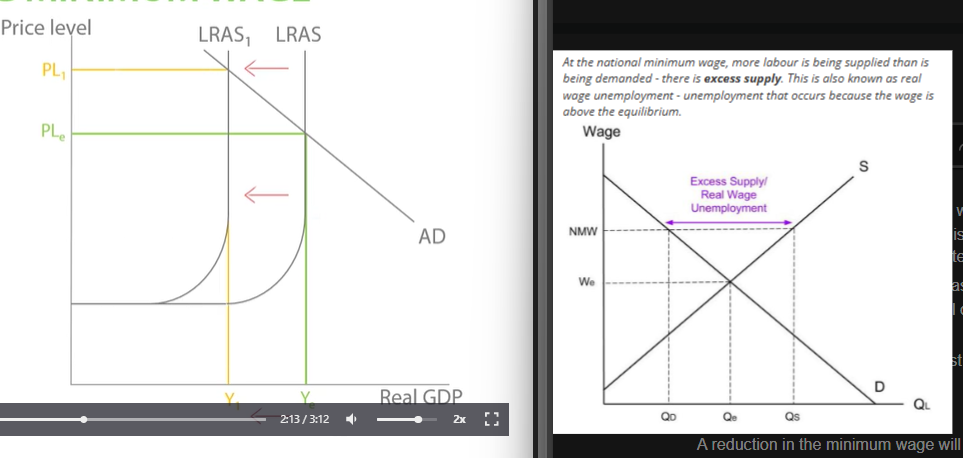

A reduction in the national minimum wage is a market-based supply-side policy. The government is reducing their intervention and allowing market forces to operate freely.

If the national minimum wage decreases, the quantity of labour demanded increases and wages will decrease back to equilibrium wage.

With reduced wages, this lowers cost for firms shift SRAS and increase real GDP.

HOWEVER

A reduction in the minimum wage will reduce spending by households which is known as consumption. This will then decrease aggregate demand and decrease real GDP.

emigration- people leave their own country to work in another one.

Emigration will mean quantity of labour will decrease. This will shift long-run aggregate supply to the left as productive capacity of the economy has decreased. This will decrease real GDP.

RECAP

Advantage 1 - a decrease in wage costs will decrease the cost of production for firms, which will increase short run aggregate supply.

Disadvantage 1 - a reduction in the minimum wage will reduce disposable income for many households. This will reduce consumption and decrease aggregate demand, which will lead to a reduction in real GDP.

Disadvantage 2 - a reduction in the minimum wage may mean that workers emigrate from the UK in search of higher wages. This will reduce LRAS and reduce economic growth.

SUPPLY SIDE POLICY

DEREGULATION

Regulations on airline industry decreased the cost of production. How would this be shown in a diagram?

Regulation removed from markets, lower barrier entry.

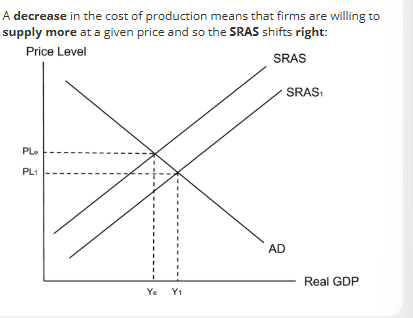

A decrease in cost of production means firms are willing to supply more at a given price so SRAS shifts right, decrease in price level, increase in real GDP.

REMOVE REGULATIONS, reduce cost to enter industry, increase aggregate supply.

Deregulation affects producers so it would be classed as a supply-side policy. It is market-based because it involves removing regulations from the market.

SUPPLY SIDE POLICY

PRIVATISATION

When the government transfers ownership of a public sector firm to the private sector.

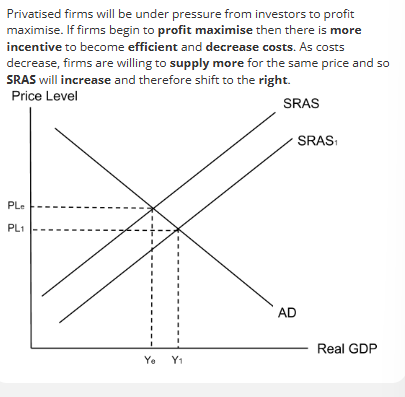

Private firms will be under pressure from investors to profit maximise. If firms begin to profit maximise then there is more incentive to become efficient and decrease costs. As costs decrease, firms are willing to supply more for the same price so SRAS will increase and therefore shift to the right.

SUPPLY SIDE POLICY

EDUCATION SPENDING

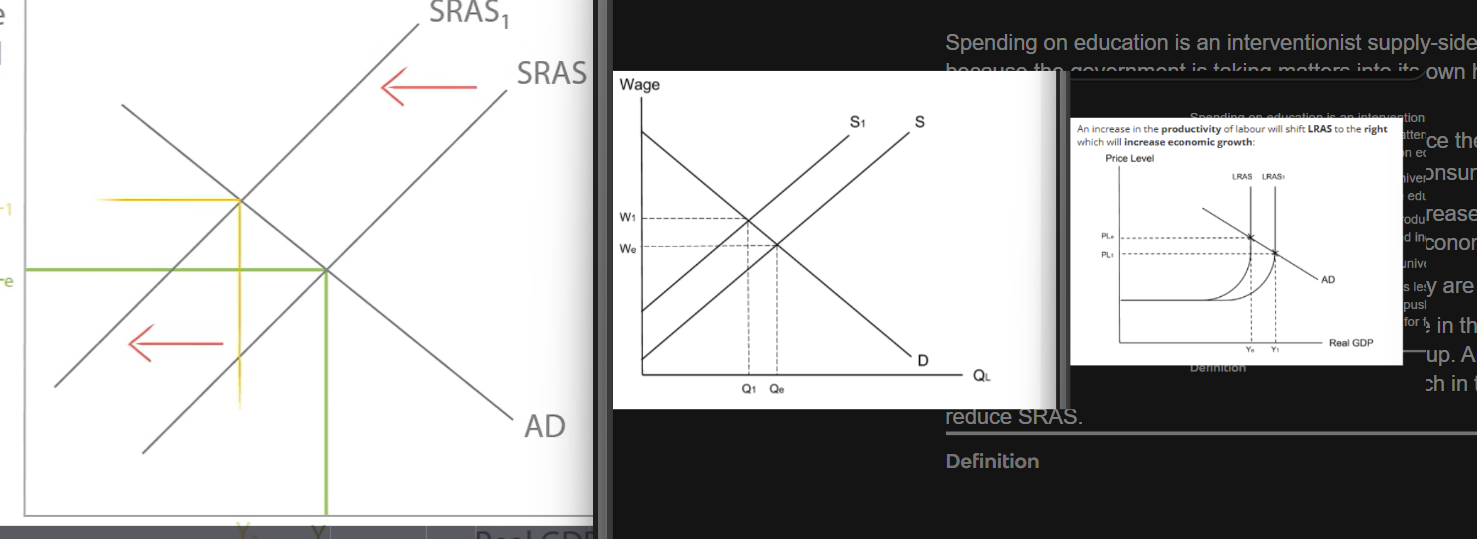

Spending on education is an interventionist supply-side policy because the government is taking matters into its own hands-increasing intervention by spending on education.

government subsidy on education, university reduce the price of courses shift supply out and increase education consumed.

Workers will be more qualified and productive, increase in productivity will shift LRAS to right and increase economic growth.

However, if students are studying at university they are not working,

In the short run, more students means less people in the workforce. This will decrease labour supply and push wages up. An increase in wages will increase production costs for firms which in turn will reduce SRAS.

In the long run, many subjects that wont increase labour productivity , theoretical physics, limited long run growth.

RECAP

Advantage 1 - subsidies allow universities to offer their courses at a lower price, which will encourage more students to pursue higher education. Over time, this will make workers more productive and lead to an increase in labour supply. The LRAS shifts to the right and the economy grows.

Disadvantage 1 - in the short run, education subsidies lead to a decrease in the supply of labour as more people spend their time studying instead of working. This leads to an increase in wages which increases the cost of production and reduces SRAS, leading to a reduction in economic growth in the short run.

Diagram to draw impact of government subsidy for university education.

A government subsidy will reduce cost of production for university education.

SUPPLY SIDE POLICY

REDUCING INCOME TAX

demand side effect- increase in consumption lead to positive multiplier effect. disposable income, consumption, increase profits for companies, hire more people..

Reducing income tac is a market-based supply-side policy because the government is taking a step back and intervening less.

SUPPLY SIDE BECAUSE:

lower tax, increase in amount of income kept, more incentive to work, workers will increase work hours.

Will increase incentive to work, increase labour supply, which cause wage to decrease. decrease in cost of production for firms cause SRAS to shift right.

HOWEVER,

lower income tax, amount of income kept increases, work hours decrease, labour supply decreases. This will increase wages, increase cost of production, cause shift to the left of short-run aggregate supply curve., limiting economic growth

RECAP

Reducing income tax means that workers get to keep more of their earnings and so disposable income increases. This is likely to increase the number of hours they choose to work and so there will be an increase in labour supply. This will decrease wages which will decrease the cost of production. This will shift the SRAS to the right, increasing real GDP.

However, an increase in disposable income could cause some workers to decrease their labour supply as they now need to work less to earn the same amount of money. This might lead to a decrease in labour supply. This will increase wages which will increase the cost of production. This will shift the SRAS to the left, limiting economic growth.

SUPPLY SIDE POLICY

REFORMING BENEFITS

A reduction in benefits is a market-based supply side policy.

The government rolls back their interventions and allows market forces to operate freely.

An increase in labour supply will cause wage to decrease. Decrease in cost of production cause SRAS to shift to the right lead to economic growth and decrease in price level.

HOWEVER,

Reduction in spending on benefits means less money is transferred to unemployed workers and low income households. This means they will have less disposable income and must reduce their spending. This will decrease consumption and lead to decrease in AD. multiplier effect…decrease economic growth and increase income inequality as poor receive less benefits.

Poor households have a high marginal propensity to consume there would be a downward multiplier effect. Therefore reform benefits then reduce benefits 2015 gov reform benefits.

RECAP

Advantage 1 - A reduction in spending on benefits will increase the incentive to work. This will increase labour supply and reduce wages which in turn will reduce the cost of production. SRAS will increase leading to an increase in economic growth and a decrease in the price level.

Disadvantage 1 - A reduction in spending on benefits means that less money is transferred to unemployed workers and low income households. This means that they will have less disposable income and must reduce their spending. This will decrease consumption which will lead to a decrease in A

SUPPLY SIDE POLICY HEALTHCARE SPENDING

Increase in spending on healthcare is an interventionist supply-side policy. The government is actively getting involved in the market.

Increase in funding for NHS will increase productivity and shift LRAS to the right. reduce illness, increase fitness of workers, increase productivity at work

Improved NHS, less sick days, so quantity of labour increases, economic growth.

HOWEVER,

It depends on the quality of healthcare spending. Funding to NHS is taken up by admin work or NHS funding could be spent inefficiently. limited long run effect.

RECAP

Advantage 1 - increasing spending on healthcare will increase the productivity of labour. This will shift the LRAS to the right, increasing economic growth.

Disadvantage 1 - spending on the NHS may be inefficient and of poor quality. If funding is increased, it is not given that all the extra funds will go towards increasing productivity and so the effects on LRAS will be limited.

SUPPLY SIDE POLICY

HIGHLY SKILLED MIGRATION

1. Highly Skilled Migration

Analysis (A):*

An increase in highly skilled migrants raises the quality of the labour force, improving human capital.

This boosts labour productivity, shifting the long-run aggregate supply (LRAS) curve to the right.

With a more productive workforce, firms can produce more at lower unit costs, enhancing international competitiveness.

For instance, skilled migrants in STEM fields can drive innovation and dynamic efficiency, encouraging long-run growth and attracting foreign direct investment (FDI).

This can reduce the natural rate of unemployment (NRU) by filling skills gaps in key industries such as healthcare and IT.

Evaluation (A):*

However, the benefits depend on whether skilled migrants complement domestic workers or replace them. If firms rely on migration rather than investing in UK training, long-term productivity growth may stagnate.

Migration is politically sensitive; restrictions post-Brexit reduced EU labour inflows, showing policy limits.

In the short run, migration may place pressure on housing, schools, and infrastructure, creating negative externalities.

Benefits may also be unevenly distributed, with London and the South East capturing most of the gains.

Evaluation for supply side!

🔹 A* Evaluation Points for Supply-Side Policies

Time Lags

Most supply-side policies take years, even decades, to show results (e.g. education reforms improving skills only when students reach the labour market).

This weakens their effectiveness in solving short-term issues like cyclical unemployment or a recession.

Government Failure

State intervention may misallocate resources (e.g. subsidies to “politically favoured” industries).

Information failure: governments may not know which sectors will deliver the highest productivity gains.

Cost and Fiscal Constraints

Supply-side policies often require large public spending (infrastructure, training, R&D).

In a period of fiscal austerity or high national debt, governments may cut back, limiting effectiveness.

Unequal Impacts

Benefits are not evenly spread — high-skilled workers or certain regions (e.g. London) may gain more, worsening inequality.

Some reforms (e.g. labour market flexibility) may reduce job security, leading to underemployment.

Short vs Long Run Trade-Offs

Some reforms (e.g. deregulation, cutting welfare benefits) may boost incentives but create short-term social costs, like greater inequality or reduced worker protections.

This can undermine long-run productivity if morale and stability are damaged.

CONFLICTS BETWEEN OBJECTIVES

CONFLICTS BETWEEN MACRO OBJECTIVES

Achieving economic growth through tax cuts for the rich means there is a conflict with the aim of low inequality.

-inflation gets higher and lower tax revenue, less benefits for poor, less cash for public services e.g. health, education., meanwhile tax cuts mean richest people in the economy will have higher incomes, gap between richest and poorest will widen.

Growing economy attracts investment, rise in demand for the currency, which increases strength of the currency, increase in imports decrease in exports, current account deficit.

Economic growth conflicts with the aim of achieving a current account equilibrium.

current account equilibrium - value of country’s exports and imports are balanced.

CONFLICTS BETWEEN OBJECTIVES

Growth and environment

Expansionary fiscal policy will mean that people have higher incomes. This in turn will lead to more consumption. As a result, there will be an increased amount of CO2 released into the atmosphere.

CONFLICT BETWEEN ECONOMIC GROWTH AND ENVIRONMENTAL SUSTAINABILITY.

Heavy industry burns huge amount of fossil fuels which release carbon dioxide into the atmosphere. This contributes to climate change and shows how economic growth conflicts with the macroeconomic objectives of protecting the environment.

HOWEVER, some economists argue only the free market can provide solutions to climate change. That is because companies are incentivised by profit. Therefore, they have a incentive to pursue renewable energy’s where they can continue making profits and grow the economy forever, even without non- renewable resources.

This will encourage companies to produce, electric cars, renewable energy and solar energy which will allow consumers to cut down on CO2 emissions.

Economic growth helps economy move form manufacturing to a service economy. This means that economy will be more environmentally sustainable.

RECAP,,

Economic growth conflicts with objective of environmental sustainability because

-Big infrastructure projects release carbon dioxide into the atmosphere.

-Increasing wealth leads to greater consumption of goods that release carbon dioxide into the atmosphere.

HOWEVER,

Economic growth enables companies to make profit. This incentive will encourage innovations and enable humans to reduce carbon dioxide emissions.

CONFLICTS BETWEEN OBJECTIVES

GROWTH AND ENVIRONMENT : EVALUATION

Economic growth allows companies to invent solutions to climate crisis.

Growth leads to structural changes in the economy which reduces carbon emissions.

CONFLICTS BETWEEN OBJECTIVES

BUDGET EQUILIBRIUM AND UNEMPLOYMENT

Increased government spending and lower taxes lead to budget deficit. So governments need to invest by selling government bonds. This will lead to an increase of government debt.

CONFLICT BETWEEN ECONOMIC GROWTH AND BALANCED BUDGET.

In short run there will be increased budget deficit, in long run this deficit will close. With full employment, less people on unemployment benefits, therefore less government spending.

Growing economy, with low unemployment increases tax revenues. Increase in consumption. Bigger tax revenues through VAT and corporation tax.

RECAP,

Conflict between fully employment and budget equilibrium when governments use fiscal and supply-side policy, because governments increase spending and decrease tax cuts.

CONFLICTS BETWEEN OBJECTIVES

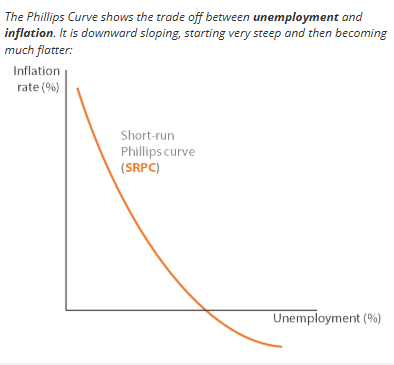

SHORT-RUN PHILIPS CURVE

When unemployment is lower, firms have to fight over the few remaining unemployed people if they want to hire someone new. This means that the remaining unemployed people have lots of bargaining power which can be used to increase wages.

With higher wages, firms will increase their prices, so that they can make a profit despite the higher wage costs.

Therefore, this pushes price level which leads to inflation. LOW UNEMPLOYMENT CAUSES INFLATION.

The Philips curve shows the trade off between inflation and unemployment.

However, some economists argue that in recent years Philips curve has flattened.

For example in 1975 and 2019 where the UK’s unemployment rate was 3.9%. But in 1975, inflation was 24.24 whereas, in 2019 inflation was 1.8%

This is because of adaptive expectations. In 1998 UK established central bank to control inflation.

Since then, inflation has remained low and steady, mostly between 0 and 3 consumers and producers expect inflation to be low, so it stays low.

This is true even when unemployment rates are low.

Adaptive expectations shows how the historic conflict between full employment and low inflation is far less relevant today than it once was.

CONFLICTS BETWEEN OBJECTIVES

SUPPLY SIDE AND FISCAL POLICY CONFLICTS

‘Evaluate the policies governments could use to increase the UK’s productivity.’

‘Evaluate policy responses to the global financial crisis of 2008’

can use fiscal, supply side, monetary policy.

supply side policy, meant to increase economic growth and productivity,

HS2 will boost economic growth by shifting SRAS outwards in the short run and shifting LRAS outwards.

To fund HS2, government use contractionary fiscal policy, lower spending, higher taxes, decrease in disposable income, decrease in consumption, inward shift of AD, will lead to companies closing and increasing unemployment

Therefore, contractionary fiscal policy will reduce economic growth, increase unemployment and reduce productivity in the economy.

CONTRACTIONAL FISCAL POLICY REQUIRED FOR SUPPLY SIDE POLICIES. But, in short term prevents supply side policies in receiving those aims.

THEREFORE RECAP!

Contractionary fiscal policy required to fund supply side policies. And higher tax and lower spending can prevent supply side policies from being effective in the short term.

CONFLCITS BETWEEN OBJECTIVES

FISCAL AND MONETARY POLICY OBJECTIVES

Use expansionary fiscal policy to boost economic growth and reduce unemployment.

Lower taxes, higher incomes, higher consumption, leads to outward shift in AD and increase in real GDP. Affect of shift in AD is inflation. DEMAND PULL INFLATION.

Therefore policy makers will turn to monetary policy, there will be a rise in interest rates which will leas to decrease in consumption, rise in savings and leakage from circular flow of income.

Higher interest rates, higher repayments, less borrowing, less investment.

Government use fiscal policy to increase economic growth but conflict with monetary policy as it is used to contain inflation.

RECAP

How can monetary policy limit the effectiveness of fiscal policy in boosting economic growth?

However, there is a conflict between expansionary fiscal policy and monetary policy. Whilst fiscal policy can shift aggregate demand outwards, this causes an increase in the general price level. To prevent a rapid increase in inflation, central banks will raise interest rates. This will lead to a decrease in consumption, rise in savings and leakage from the circular flow of income. In addition, investment will fall as the borrowing rate rises for companies. The reduction in consumption and investment will prevent AD from shifting outwards. Consequently, monetary policy holds back the economic growth that was the aim of the expansionary fiscal policy. As a result, there is a clear policy conflict between fiscal policy and monetary policy. This conflict, therefore, limits the effectiveness of fiscal policy in boosting economic growth.

CONFLICTS BETWEEN OBJECTIVES

CONFLICT BETWEEN SUPPLY SIDE AND FISCAL POLICIES.

The aim of supply-side policies is to boost economic growth. One example of a policy that aims to do that is the construction of the UK’s HS2 rail link. However, projects such as this are expensive. For instance, HS2 was estimated to cost between £50−£80 billion, and is likely to exceed that estimate. In order to pay for these projects, governments have to raise money through contractionary fiscal policy. So, taxes rise and government spending in other areas falls. This means that AD (C+I+G+(X−M)) will not shift outwards as consumption in the economy will not grow rapidly in the short term. So, there is a clear policy conflict where fiscal policy prevents supply-side policy from achieving its aims in the short term.

CONFLICTS BETWEEN OBJECTIVES

GLOBAL FINANCIAL CRISIS

2008 government cut interest rates from 5% to 0.5%

Economies such as Britain will face policy paralysis in the future recession because response to 2008 Great Recession has left world economies with high debt and low interest rates.

CONFLICTS BETWEEN OBJECTIVES

Explain how the use of interventionist supply-side policies may constrain aggregate supply.

Economies such as Britain would have faced policy paralysis in any future recession because response to the 2008 great recession left world economies with

high debt and low interest rates.

The policy response to the 2008 financial crisis has created a conflict today as policy makers are left with high debt and low interest rates. This is a position of policy paralysis.