Principles of Macroeconomics Chapter 25,26,27,28

1/95

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

96 Terms

aggregate accounting

a set of rules and definitions for measuring economic activity in the economy as a whole

GDP

the total market value of all final goods and services produced in an economy in a one-year period

consumption

spending by households on goods and services

investment

spending for the purpose of additional production

government spending

goods and services that government buys

net exports

spending on exports minus spending on imports

Calculating GDP

C+I+G+(X-M)

consumption + investment + government spending + net exports

wealth accounts

a balance sheet of an economy's assets and liabilities and its is a stock concept

final output

goods and services purchased for final use

intermediate products

used as an input in the production of some other product

value added

the increase in value that a firm contributes to a product or service

depreciation

the amount of capital used up in producing that year's GDP

NDP

measures output available for purchase

Calculating NDP

C+I+G+(X-M) - depreciation

GNP

the aggregate final output of citizens and businesses of an economy in one year

calculating GNP

GDP + net foreign factor income

net foreign factor income

the income from foreign domestic factor sources minus foreign factor income earned domestically

aggregate income == Aggregate Production

the total income earned by citizens and businesses in a country in a year

Employee compensation + Rents + Interests + Profits

inflation

a continual rise in the overall price level

price index

a measure of the composite price of a specified group of goods

nominal GDP

the amount of goods and services produced measured at current prices

real GDP

the total amount of goods and services produced, adjusted for price-level changes

GDP delfator

the price index that includes all goods and services in the economy expressed relative to a base year of 100

consumer price index (CPI)

measures the prices of a fixed basket of goods, weighted according to each components share of an average consumer's expenditures

personal consumption expenditure deflator (PCE)

is a measure of prices of goods that consumers buy that allows yearly changes in the basket of goods that reflect actual consumer purchasing habits

producer price index (PPI)

an index of prices that measures the average change in the selling prices received by domestic producers of goods and services over time

nominal interest rate

the rate you pay or receive to borrow money

real interest rate

the nominal interest rate adjusted for inflation

real wealth

the value of the productive capacity of the assets of an economy measured by the goods and services it can produce now and in the future

nominal wealth

the value of those assets measured at their current market prices

asset price inflation

a rise in the price of assets unrelated to increases in their productive capacity

Purchasing power parity

a method of comparing income that takes into account the different relative prices among countries

Genuine Progress Indicator (GPI)

makes a variety of adjustments to GDP to better measure the progress of society rather than just economic activity

potential output

the highest amount of output an economy can sustainably produce from exist- ing production processes and resources OR potential income

productivity

output per unit of input

Long-run growth analysis focuses on

supply

Say's law

supply creates its own demand. According to Say's law, aggregate demand will always equal aggregate supply.People work and supply goods to the market because they want other goods. The very fact that they supply goods means that they demand goods of equal value.

Rule of 72

The number of years it takes for a certain amount to double in value is equal to 72 divided by its annual rate of increase.

Compounding

growth is based not only on the original level of income but also on the accumulation of previous-year increases in income.

specialization

the concentration of individuals on certain aspects of production

division of labor

the splitting up of a task to allow for specialization of production

per capita growth

producing more goods and services per person

you can approximate per capita growth

Per capita growth % change in output % change in population

The Sources of Growth

1. Growth-compatible institutions.

2. Investment and accumulated capital.

3. Available resources.

4. Technological development.

5. Entrepreneurship.

The flow of invest- ment leads to

the growth of the stock of capital

human capital

the skills that are embodied in workers through experience, education, and on-the-job training, or, more simply, people's knowledge

social capital

the habitual way of doing things that guides people in how they approach production

technology

the way we make goods and supply services

Entrepreneurship

the ability to get things done

Classical growth model

a theory of growth that emphasizes the role of capital in the growth process

law of diminishing marginal productivity

as more and more of a variable input is added to an existing fixed input, eventually the additional output produced with that additional input falls.

new growth theory

a theory of growth that emphasizes the role of technology in the growth process

positive externalities

positive effects on others not taken into account by the decision maker

patents

legal protection of a technological innovation that gives the owner of the patent sole rights to its use and distribution for a limited time

learning by doing

is meant to improve the methods of production through experience

Network externality

is an externality in which the use by one individual makes a technology more valuable to other people

real sector

is the market for the production and exchange of goods and services

financial sector

is the market for the creation and exchange of financial assets

Federal Reserve Bank (the Fed)

The U. S. central bank, whose liabilities (Federal Resreve Notes) serve as cash in the United States

Bank

A financial insitituiton whose primary function is accepting deposits for, and lending money to, individuals and firms

M1

Currency in the hands of the public, checking account balances, and traveler's checks

M2

M1 plus savings and money market accounts, small-denomination time deposits (also called CD's), and retail money funds

Asset Management

How a bank handles its loans ad other assets

Liability Management

How a bank attracts deposits and what it pays for them

Reserves

Currency and deposits a bank keeps on hand or at all the Fed or central bank, to manage the normal cash inflows and outflows

Reserve Ratio

The ratio of reserves to total deposits

Money Multiplier

The measure of the amount of money ultimately created per dollar deposited in the banking system, when people hold no currency

Excess Reserves

Reserves held by banks in excess of what banks are required to hold

Transaction Motive

The need to hold money for spending

Precautionary Motive

Holding money for unexpected expenses and impulse buying

Speculative Motive

Holding cash to avoid holding financial assets whose prices are falling

Financial Assets

are assets such as stocks or bonds, whose benefit to the owner depends on the issuer of the asset meeting certain obligations

Financial liabilities

are obligations by the issuer of the financial asset

Saving

outflows from the spending stream from government, households, and corporations

Loans

made to government, households, and corporations

interest rate

is the price paid for use of a financial asset

Equilibrium output

the level of output toward which the economy gravitates in the short run because of the cumulative cycles of declining or increasing production

Potential output

the highest amount of output an economy can sustainably produce using existing production processes and resources

Paradox of thrift

an increase in saving can lead to a decrease in spending, output, causing a recession and lowering total saving

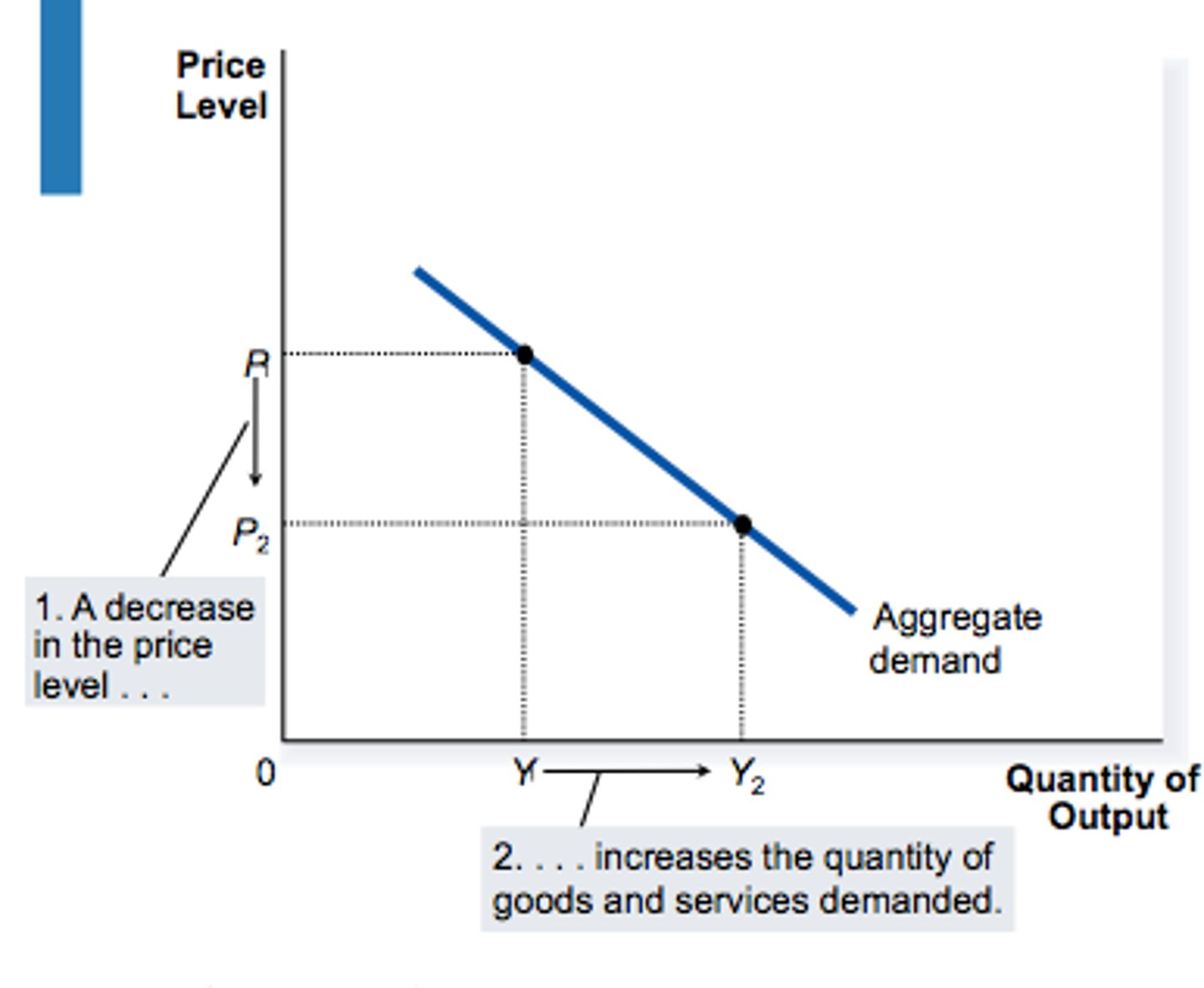

Aggregate Demand (AD) Curve

a curve that shows how a change in the price level will change aggregate expenditures on all goods and services in an economy

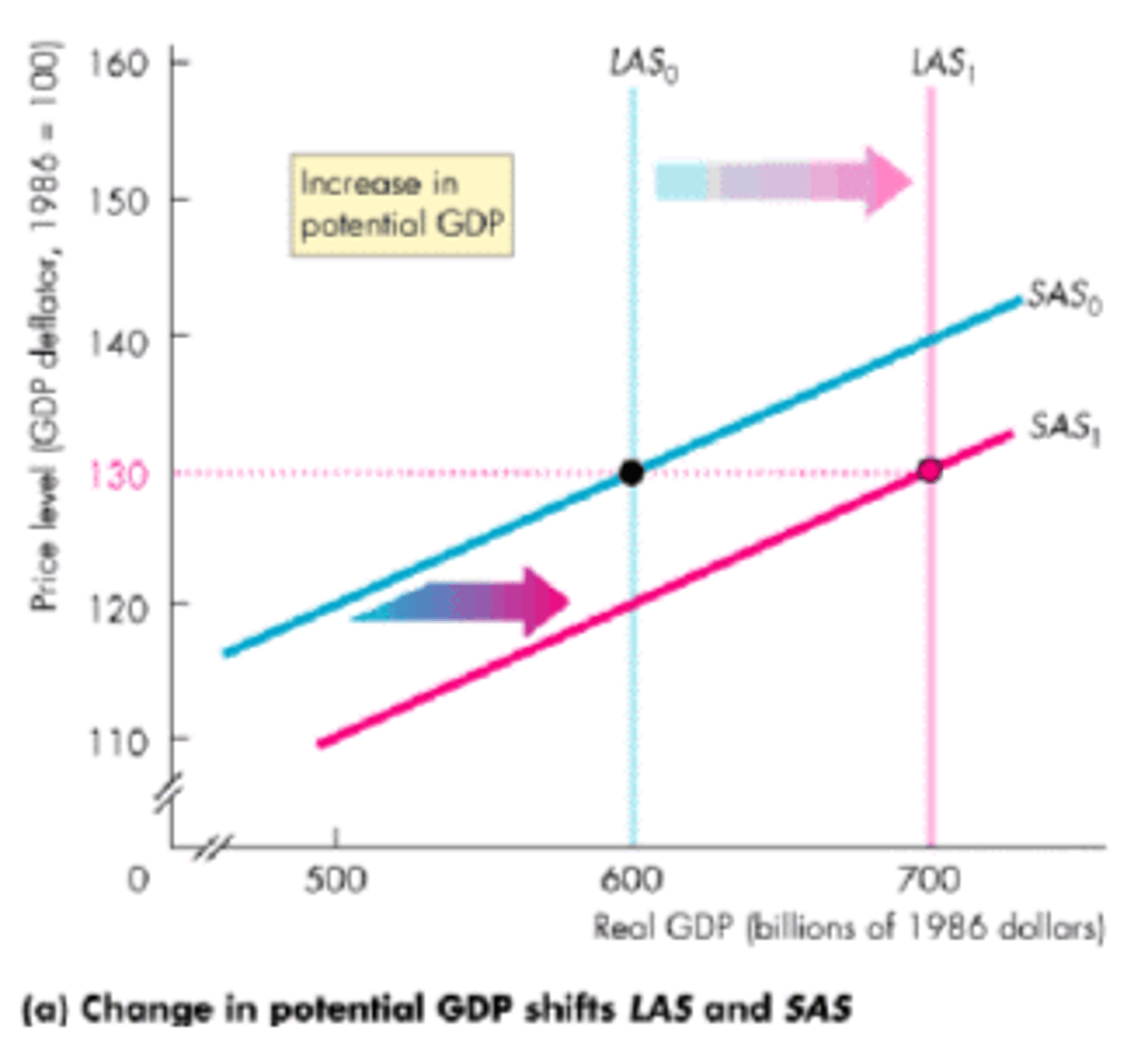

Short-Run Aggregate Supply (SAS) Curve

a curve that specifies how a shift in the aggregate demand curve affects the price level and real output in the short run, other things constant

Long-Run Aggregate Supply (LAS) Curve

Is a curve that shows the long-run relationship between output and the price level

Interest rate effect

the effect that a lower price level has on investment expenditures through the effect that a change in the price level has on interest rates

International effect

as the price level falls (assuming the exchange rate does not change), net exports will rise

Money wealth effect

a fall in the price level will make the holders of money richer, so they buy more

Multiplier effect

the amplification of initial changes in expenditures

Slope of AD curve

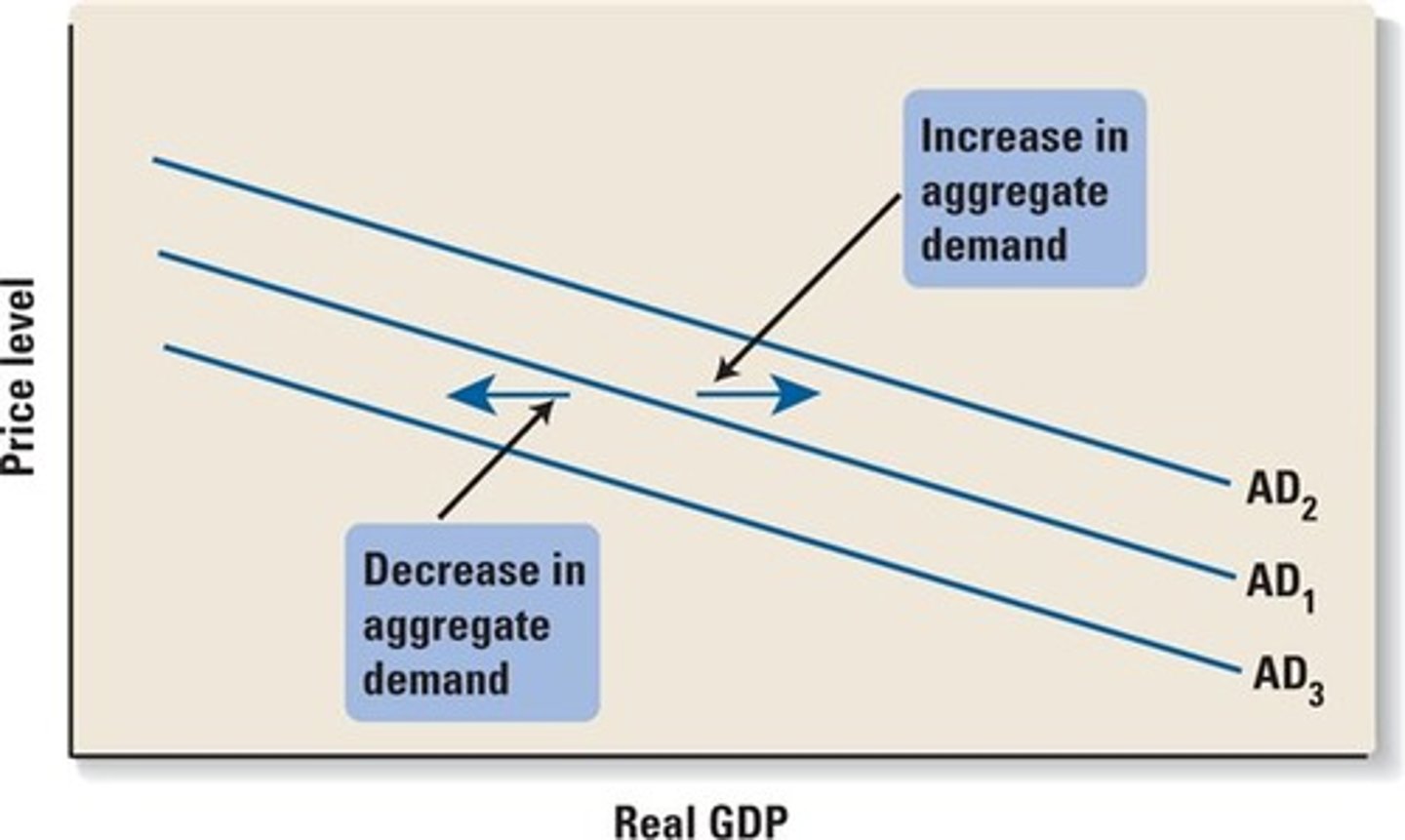

Shifts in the AD Curve

A shift in the AD curve means that at every price level, total expenditures have changed. the 5 important shift factors

1 - Foreign income

2 - Exchange rate fluctuations

3 - Distribution of income

4 - Expectations

5 - Government policies

The Slope of the Short-Run Aggregate Supply (SAS) Curve

reflects auction markets and posted price markets

Auction market

The markets represented by the supply/demand model

Posted price markets == quantity-adjusting markets

markets in which firms respond to changes in demand primarily by changing production instead of changing their prices

Shifts in the SAS Curve

long-run aggregate supply (LAS) curve

shows the long-run relationship between output and the price level

Monetary policy

involves the Federal Reserve Bank changing the money supply and interest rates

Fiscal policy

is the deliberate change in either government spending or taxes to stimulate or slow down the economy