income inequality

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

16 Terms

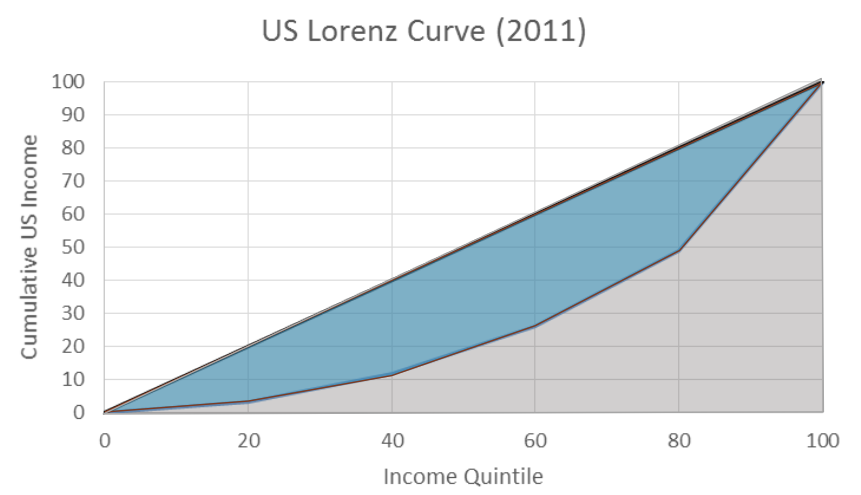

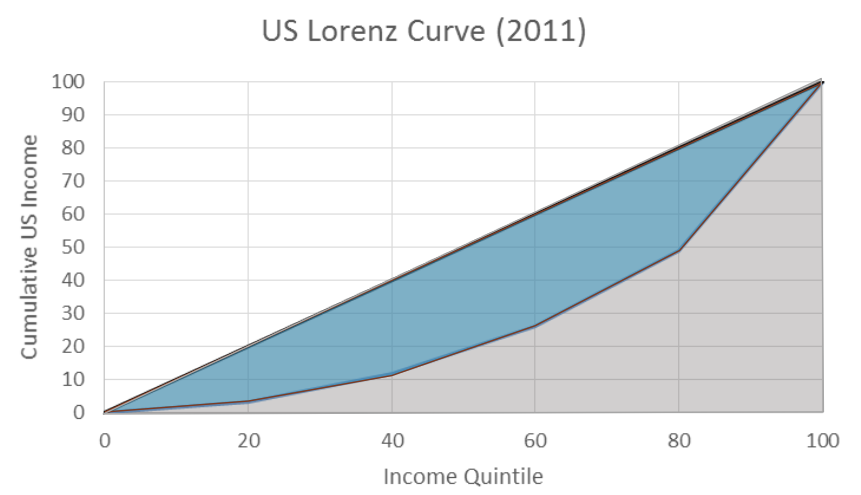

Lorenz curve

graph each income quintile on the x-axis

graph the % income on the y-axis

Gini coefficient

area of space between perfect equality and Lorenz curve (blue)

over

area between perfect equality and perfect inequality (blue + grey)

mini coefficient meanings

ratio of 1 = perfect inequality

ratio of 0 = perfect equality

poverty line

estimated income for a family to avoid hardship

poverty rate

percentage of people below the poverty line

what ways is wealth redistributed in the US?

SNAP

Medicare/medicaid

housing subsidies or public housing

unemployment aid

for a lot of these, they are means-tested, meaning you only qualify if your income is below a certain threshold

can potentially create a poverty trap, as earning more means losing benefits

does redistribution distort incentives?

it may affect how the poor choose to act & depends on labour supply elasticities- may choose to work less

taxing to sponsor these programs creates DWL in the markets that are taxed- can reduce incentives for the rich to produce

example of how redistributive programs distort incentives

on this graph, the optimal consumption bundle is 48 hours

people below income G get additional income to push them up to G (people with income G or above do not get any benefits)

benefit B = max[0, G - (w x h)]

say you work 48 hrs/wk with a wage of $10/hr and G = $680, 680 - (48 × 10) = $200 in benefits

now say you increase your hours to 52 hrs/wk → 680 - (52 × 10) = $160 in benefits

even though you have increased your weekly earnings by $40, you lose $40 in benefits, meaning your total earnings remain at G even though you’re working more

if you get benefits up until $680, you would just choose to work 0 hours!!

![<ul><li><p>on this graph, the optimal consumption bundle is 48 hours </p></li><li><p>people below income G get additional income to push them up to G (people with income G or above do not get any benefits) </p></li><li><p>benefit B = max[0, G - (w x h)] </p></li><li><p>say you work 48 hrs/wk with a wage of $10/hr and G = $680, 680 - (48 × 10) = $200 in benefits </p></li><li><p>now say you increase your hours to 52 hrs/wk → 680 - (52 × 10) = $160 in benefits </p></li><li><p>even though you have increased your weekly earnings by $40, you lose $40 in benefits, meaning your total earnings remain at G even though you’re working more </p></li><li><p>if you get benefits up until $680, you would just choose to work 0 hours!!</p></li></ul>](https://knowt-user-attachments.s3.amazonaws.com/4a660f00-ae0e-4aba-a41f-2dfa4baafea7.png)

how can we avoid this poverty trap?

reduce the marginal tax rate!

before, B = G - (w x h)

same as B = G - (t x w x h) where t = 1 (each additional hour of work was taxed at 100%)

change t to 0.5 (50% tax rate)

this means B = max[0, G - (0.5 x w x h)], meaning you earn benefits up until wages > 2G

this way you earn benefits even when you work a high number of hours per week

the highest indifference curve may still be less work than when without benefits

there is still a distortion of incentives but it is considerably less than before

there remains 2 major problems:

1. the program is now more expensive; those earning more than G will also get benefits

2. more people will therefore have distorted incentives

![<p>reduce the marginal tax rate!</p><ul><li><p>before, B = G - (w x h)</p></li><li><p>same as B = G - (t x w x h) where t = 1 (each additional hour of work was taxed at 100%)</p></li><li><p>change t to 0.5 (50% tax rate) </p></li><li><p>this means B = max[0, G - (0.5 x w x h)], meaning you earn benefits up until wages > 2G </p></li><li><p>this way you earn benefits even when you work a high number of hours per week </p></li><li><p>the highest indifference curve may still be less work than when without benefits </p></li><li><p>there is still a distortion of incentives but it is considerably less than before </p></li><li><p>there remains 2 major problems: </p><p>1. the program is now more expensive; those earning more than G will also get benefits </p><p>2. more people will therefore have distorted incentives </p></li></ul>](https://knowt-user-attachments.s3.amazonaws.com/13f6ecba-a3bf-408b-8d71-aa6fd5872ff4.png)

the “iron triangle” of welfare problems

given G and t as tools, there is no way to do all three of the following:

Encourage work

Redistribute income

Reduce costs

this hinges on the assumption that the majority of workers will be very responsive (in terms of hours worked) to changes in benefits- are they??

are the majority very responsive to changes in benefits? (are their hours worked elastic in response to benefits)

for the poor, they are not near enough to the point where they see much DMU (only really starts to occur when money is in large increments)

many people derive utility from working- they would not choose to work 0 hours as its part of their identity/how they spend their time

it is also a social norm that it is important to work a full-time job

possible causes of increasing inequality and/or poverty rate

globalisation and technological advancements reduce demand and wages for low-skilled labourers

an increase in double income households

changes in governmental policies on poverty/taxation

reasons for the welfare state

fairness/equity

efficiency arguments (poverty incurs a high negative externality on society- healthcare, crime, unemployment)

risk and uncertainty arguments (is income inequality due to luck? a welfare state helps protect individuals against unpredictable financial distress)

efficiency argument for redistribution

all individuals have DMU over consumption

therefore, maximising total surplus means redistributing wealth ($1,000 won’t mean much to a billionaire, but would mean everything to a homeless person)

utilitarian arguments

the government should maximise the overall utility for the majority and maximise total utility overall

complete equality would maximise total utility

however, under complete equality, we have no incentive to earn more money/work more/harder

John Rawls

veil of ignorance

set the system up in a way that the least advantaged groups in society are prioritised (maximising your minimum possible outcome)