Oligopoly, business objectives and rationalisation (Theme 3 CC3)

1/61

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

62 Terms

Market Concentration

measures the degree of competition that exists within a market by calculating the market share of the largest few firms in the industry

Market Share

a company's product sales as a percentage of total sales for that industry. Calculated by TR (Firm) / TR (Industry) x100.

N Firm Concentration Ratio

The share of industry output in sales or employment accounted for by the top firms, the number of firms is measured by N. So the share of the top two firms would be a two firm concentration ratio, the market share of the top three a three firm concentration ratio. For example, a five firm concentration ratio of 60% shows that the five largest firms in the industry have a combined market share of 60%.

Oligopoly

A market structure in which only a few interdependent firms offer similar or identical products supplemented by high BTNs and BTXs, a high concentration ratio and collusion. Examples include the UK supermarket, where four firms control 70% of the industry.

Product Differentiation

a positioning strategy that some firms use to distinguish their products from those of competitors, such as product formulation, packaging, marketing and availability.

Price wars

Mutually destructive situation where businesses involved compete by a series of intensive price cuts to threaten the competitiveness of rival firms. Examples include the Aldi Price Match Scheme operated by Sainsburys

Predatory Pricing

Anti-competitive and illegal strategy where firms set prices below their AVC in the very short run, in order to force other firms out the market.

Limit Pricing

Reducing the price of a good to just above average variable cost to deter the entry of new firms into the market. Prices are set at levels which are likely to make it unprofitable for potential entrants who might consider coming into the market

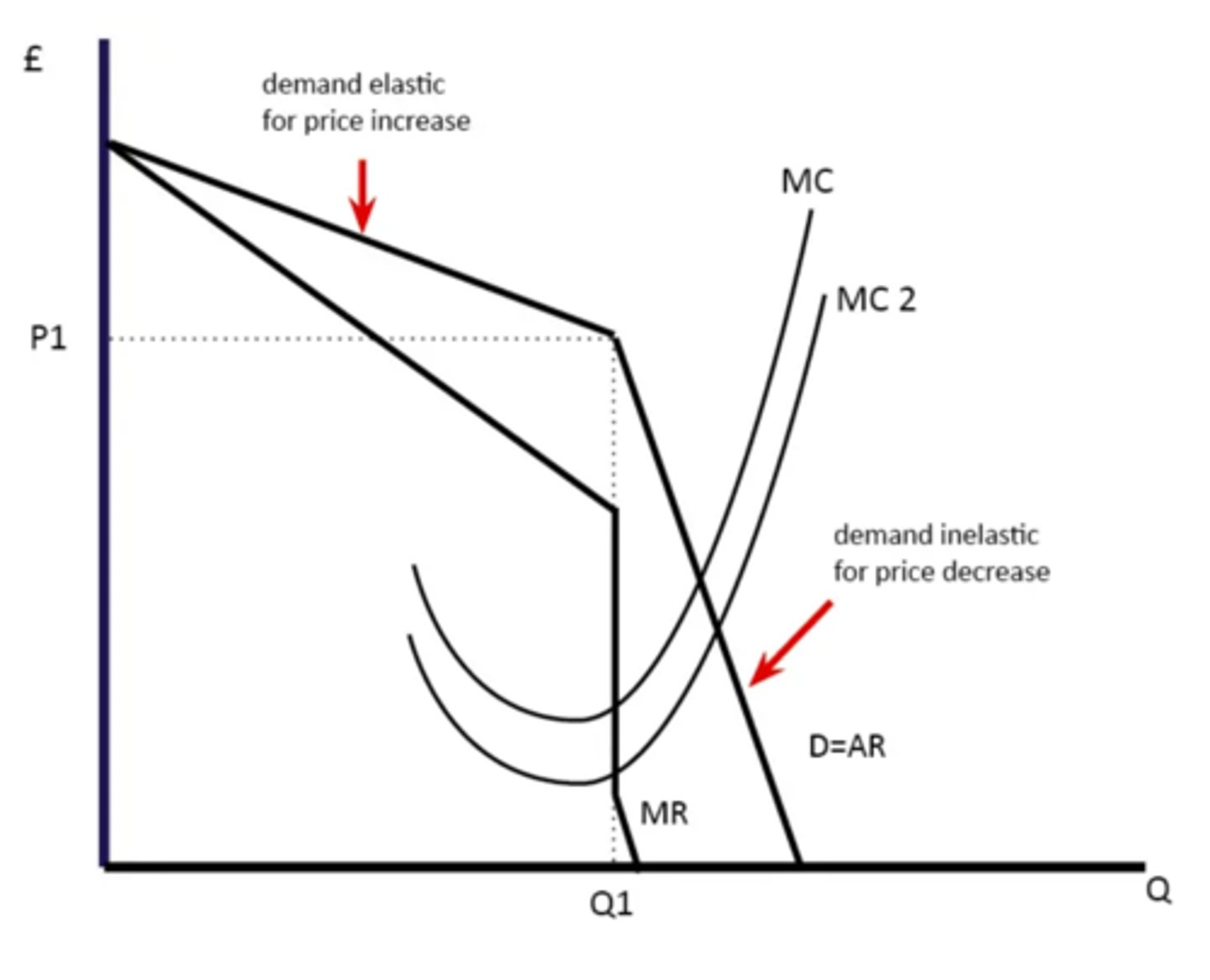

Kinked demand curve theory

In a non collusive theory, the theory that an oligopoly will face a demand curve that is kinked at current markets, as such to reflect how an oligopolist may react to price cuts made by their rival, but not price increases, reflected by the relationship between PED and revenue.

Collusion

Collective agreements between producers which restrict competition and prices in an overt or tacit way.

Collusive oligopoly

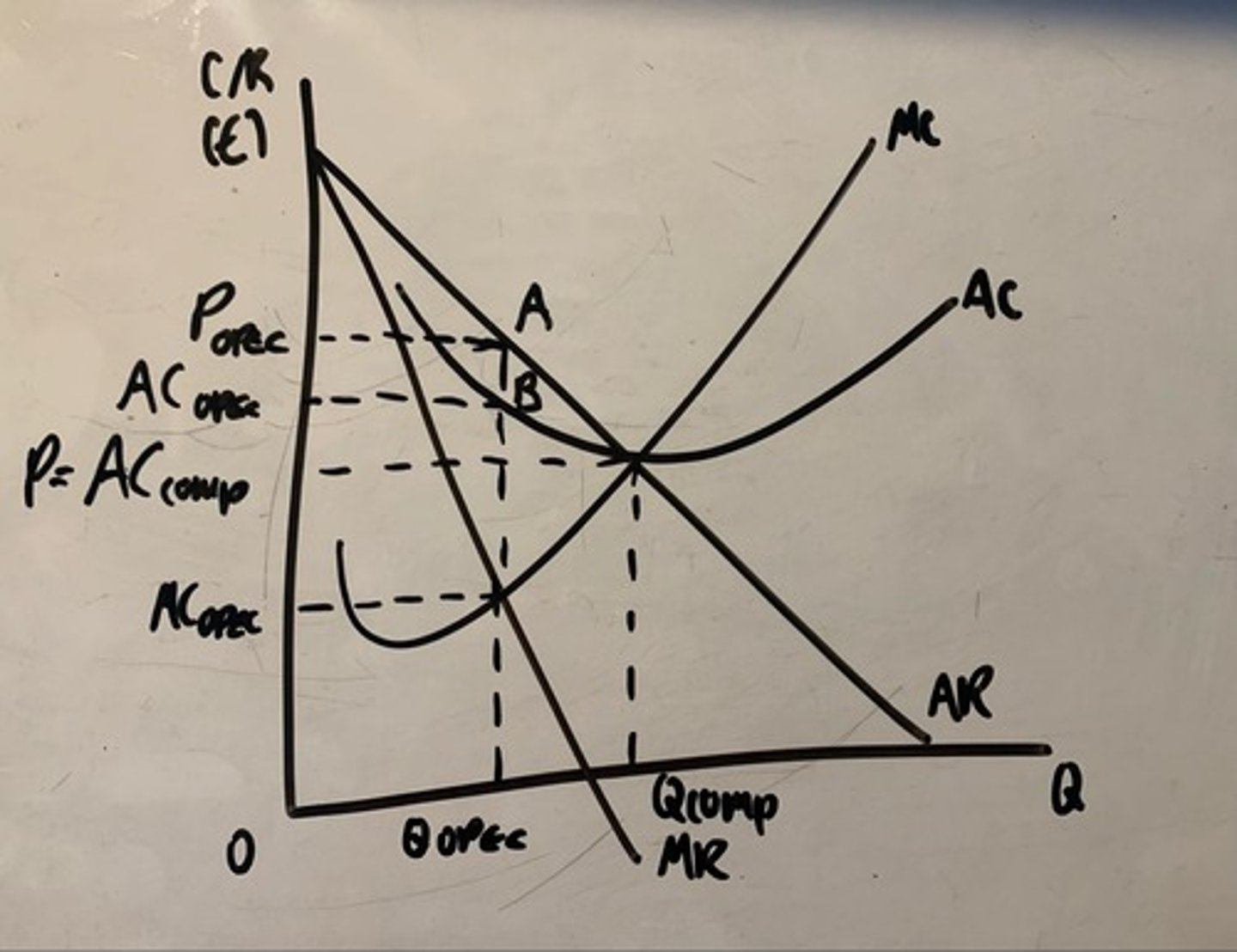

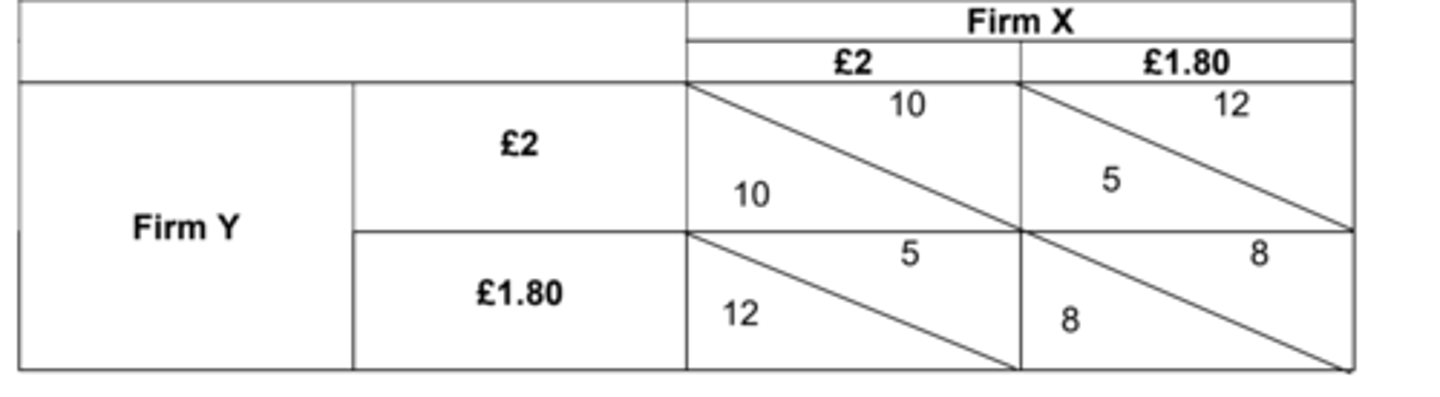

Where a few firms in an oligopoly act together as a cartel to avoid competition by resorting to agreements to fix prices or output.

Non-collusive oligopoly

Where firms in an oligopoly do not resort to agreements to fix prices or output. Competition tends to be non-price. Prices tend to be stable and the firms tend to be interdependent.

Uncertainty

A characteristic of competitive oligopoly where rivals reacting to changing in prices becomes unstable.

Overt collusion

When firms openly agree on price, output, and other decisions aimed at achieving oligopoly profits. These agreements are often verbal to avoid detection. Examples include OPEC and the truck maker Scania or collusion between the major European Beer Firms such as Heineken and InBev.

Tacit collusion

Firms indirectly coordinate actions by signalling their intention to reduce output and maintain pricing above competitive levels. Firms monitor each other's behaviour with unwritten rules developing which define ways of competition. Price leadership is an example. Examples of this can be seen through the UK energy industry and between different supermarket fuel providers.

Cartel

A formal organisation of producers that agree to coordinate prices and production

Price leadership

A form of tacit collusion in which one firm in an oligopoly announces a price change and the other firms in the industry match the change.

Game Theory

Used to show the benefits of collusion, but also how cartels break down: the study of how people behave in strategic, independent situations where the actions of one firm directly affects all other firms, meaning that the best move for the game depends upon how other players react.

First mover advantage

Evaluation to Game Theory: Occurs when a company can significantly increase its market share by being first with a new competitive advantage, such as Dyson with its vacuum cleaners. This allows them to generate brand loyalty and premium pricing?

Penetration Pricing

Opposite of price skimming, setting a low initial price on a new product to appeal immediately to the mass market and attract new consumers and create brand loyalty.

Price skimming

Opposite of penetration pricing, a pricing policy whereby a firm charges a high introductory price, often coupled with heavy promotion at the launch of a new product, often because it faces little competition at the level of advancement that the technology is. Often seen with Apple where they initially 'skim' consumers with low PED by charging really high prices for new iPhones.

Cost-plus pricing

a method of setting prices in which the seller totals all the costs for the product and then adds an amount to arrive at the selling price, the markup represents the profit per unit.

Product line pricing

setting the price steps between various products in a product line based on cost differences between the products, customer evaluations of different features, and competitors' prices such as selling printers at a low price, and ink cartridges at a higher price.

Contestable Market

A market structure where the extent to which barriers to entry and exit in a market are low/insignificant. In other words this market structure is characterised by the ease of firms to access a new market. Examples include Airbnb making the accommodation market more contestable and the budget airline market.

Consumer inertia

Situation in which a consumer tends to continue buying from a certain brand out of habit, until some stronger force motivates him or her to change. Often seen as a reason not to try and engage in price wars as consumers simply may not respond to changes.

Hit and run competition

When firms can enter a contestable market at low cost attracted by high profits and then leave the market at low cost when profits fall

Stakeholders

All the people who stand to gain or lose by the policies and activities of a business and whose concerns the business needs to address.

Orthodox Economic Theory

Assumes shareholders to be the dominant force and hence short-term profit-maximisation is assumed to prevail

Managerial Theory

Assumes that firms wish to maximise managerial objectives (such as prestige and generous self-remuneration) rather than profit, most apparent where there is a divorce of ownership between the principals and directors and the shareholders and asymmetric information, leading to x-inefficiency and the principal agent problem.

Remuneration

Money paid for work or a service

Revenue Maximisation

An alternative goal of firms (as opposed to profit maximization). This occurs when marginal revenue is equal to zero (MR = 0). Manager controlled firms rather than owner controlled firms tend to look for revenue maximisation rather than profit max, as the larger the firm, the larger the pay, benefits and prestige of senior managers. Revenue maximisation can also include predatory pricing. Examples include Twitter pre Musk, as they justified larger revenue to boost strong advertising demand.

Sales Maximisation

An attempt to sell as much as possible in a given time period (or an attempt to generate as much sales revenue as possible in a given time period). Often used to gain market share or drive out rivals, in order to maximise long run profit. Happens at the point where normal profits are achieved, AC=AR. Examples include Amazon where branches such as Amazon Prime and Prime Video in order to boost the consumer base buying Amazon products.

Profit Satisficing

Making just enough profit to satisfy the demands of owners, while maximising the welfare of other stakeholders such as employees as well. Happens at the point where AC+PT=AR. Where Profit Target is essentially an additional fixed cost on top of the AC. Often either to hide monopoly power from regulatory authorities, or if there is lots of market power with a divorce of ownership from control. Examples include Walmart they used a corporation tax cut to raise employee wages and bonuses, prioritising their needs over the needs of the stakeholders.

CMA

Competitions and Markets Authority - an independent, non ministerial government department, which works to promote competition between providers so that consumer's benefit.

Non-price competition

When firms within an oligopoly use non-price factors to compete against each other and take market share off each other. Examples include customer service in UK supermarkets, or Coke and Pepsi competing on branding, advertising and product development.

Social Business Sector

The business sector that may seek to achieve allocative efficiency as it wants to grow the social environment around the business.

Public sector organisation

Organisations that are government owned and operated, such as government departments, local authorities and public corporations.

Limited liability

A form of business ownership in which the owners are liable only up to the amount of their individual investments, rather than the debt obligations of the company. If the corporation is sued, their personal assets such as house or car are not at riskk.

Fiduciary Duty

That duty owed by an agent (Director) to act in the highest good faith toward the principal (Shareholder) and not to obtain any advantage over the latter by the slightest misrepresentation, concealment, duress or pressure.

Principal Agent Problem

A problem caused by an agent pursuing his own interests rather than the interests of the principal who hired him.

Ltd

Private limited company - Company where there is likely to be a lower divorce between ownership and control or none.

PLC

a public limited company; a company whose shares can be traded on the stock market and where there is more likely to be a divorce of ownership between the agents and the directors.

Wall Street Walk

Way that a shareholder can hold a director accountable due to shareholders selling share prices, causing the share prices to fall, increasing pressure from remaining shareholders over the director.

AGM

Annual General Meeting - Opportunity for shareholders to vote on directors and changes to the company.

Niche Market

A smaller part of a larger market in which customers have more specific needs and wants

Organic Growth

A business growth strategy that involves a business growing gradually using its own factors of production. Such as Ikea and Lego.

External Growth

Business expansion achieved by means of merging with or taking over another business, from either the same or a different industry

Merger

Combination of two or more companies into a single firm

Takeover

an act of taking control of a company by buying most of its shares

Hostile takeover

A situation in which the management and board of directors of a firm targeted for acquisition disapprove of the merger

Friendly takeover

An acquisition in which the management of the acquired company welcomes the firm's buyout by another company.

Forward vertical integration

Changes in an industry value chain that involve moving ownership of activities closer to the end (customer) point of the value chain, such as Burberry buying their Chinese franchisees

Backward vertical integration

Changes in an industry value chain that involve moving ownership of activities upstream to the originating supply sources (inputs), involving transfer pricing. Such as Muller buying Robert-Wiseman dairies or Shell or BP buying new oil drilling rights themselves.

Vertical Integration

Practice where a single entity controls the entire process of a product, from the raw materials to distribution

Horizontal Integration

Absorption into a single firm of several firms involved in the same level of production, often competitors and sharing resources at that level. Such as Just Eat buying Hungry House

Conglomerate Integration

Merger with or takeover of a business in a different industry which produces an unrelated product. Such as Google buying green energy companies.

Synergy

When the combined entity resulting from the joining of two or more firms is more valuable than the sum of the component parts. More widely known as the 2+2=5 concept. Opposite is dyssynergy.

Asset Stripping

The practice of buying businesses and breaking them up. The profitable parts are sold for cash and the rest are closed down for a greater value than the sum of the investment. Such as Reading FC and Bearwood Park.

Demerger

When a firm splits into two or more independent businesses in order to avoid dysynnergy (2+2=3 rule) and diseconomies of scale.

Diseconomies of scale

the property whereby long-run average total cost rises as the quantity of output increases - Avoided by demergers.

Two ways of mapping oligopoly behaviour

Kinked demand curve and game theory

Collusion monopoly model

Model which shows how restricting output through collusion can raise supernormal profits while also eliminating allocative efficiency.