Econ 102 - CHAPTER 15: Entry, Exit, and Long-Run Profitability

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

14 Terms

Accounting profit

The total revenue a business receives, less its explicit financial costs.

Accounting profit = Total revenue – Explicit financial costs

Tracks literal money in/out (rent, wages, utilities, ingredients, etc.).

Used to answer: “Where did my money go?”

Economic Profit

The total revenue a business receives, less both explicit financial costs and the entrepreneur’s implicit opportunity costs.

Economic profit = Total revenue – Explicit financial costs – implicit cost (opportunity costs)

Implicit costs include:

Forgone wages (your next-best job)

Forgone interest (money you could’ve earned by investing your startup funds)

used to answer: “Is starting this business actually worth it?”

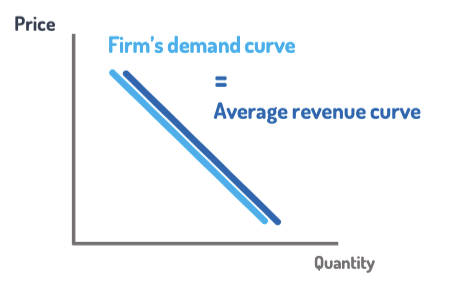

Average Revenue (AR)

your revenue per unit, calculated as the total revenue divided by the quantity supplied

AR = TR / Q = Price

→ Your firm’s demand curve is also your average revenue curve

Average Cost (AC)

your cost per unit, calculated as your total costs (including fixed and variable costs) divided by the quantity produced

AC = Total cost / Quantity = (Fixed + Variable costs) / Q

Fixed costs: Do NOT change with output (rent, equipment, opportunity cost of owner’s time/money).

Variable costs: Change with output (ingredients, worker hours, electricity).

Why Average Cost Is U-Shaped

1. Spreading Fixed Costs (AC decreases early)

Fixed cost per unit falls as Q increases

(e.g., $6,000 rent → $6,000 per unit at Q=1, $3,000 at Q=2, $2,000 at Q=3)

2. Rising Variable Costs (AC increases later)

Due to:

Diminishing marginal product

Crowding

Coordination problems

Overtime

Higher marginal input costs

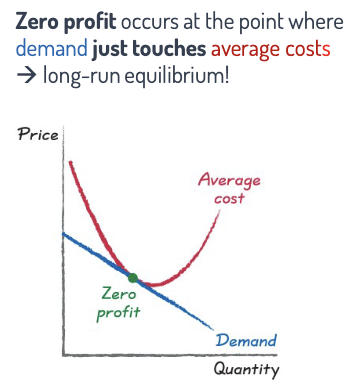

Profit Margin

Profit margin per unit = Price − Average Cost

or

PM = Average Revenue − Average Cost

Profit occurs when the demand curve lies above the AC curve.

Visually, for any given quantity, your profit

margin per unit is the gap between your

firm’s demand curve and its average cost

curve.

Short-run analysis

deciding quantity given today’s market price

Long-run analysis

planning how much to invest for a business expansion; launch decisions.

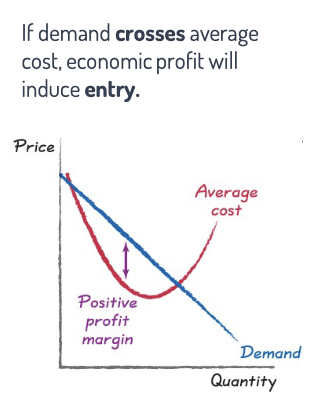

Rational Rule for Entry

Enter if Price > Average Cost → positive economic profit.

Rational Rule for Exit

Exit if Price < Average Cost → negative economic profit.

Effect of Entry

When new competitors enter:

Your demand curve shifts left (fewer customers).

Your demand curve becomes flatter (more elastic) → less market power.

You charge a lower price and sell less quantity.

Effect of Exit

When competitors leave:

Your demand curve shifts right (more customers).

It becomes steeper → more market power.

You charge a higher price and sell more

Long-Run Dynamics

Positive economic profit → ENTRY → profits pushed down.

Negative economic profit → EXIT → profits pushed up.

Long-run outcome with free entry & exit:

Economic profit = 0

In the Long Run…

Price = Average Cost

Demand touching AC → zero economic profit → entry and exit stop.

Price = AC

Economic profit = 0