sustainable energy chp. 3

1/51

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

52 Terms

goal of energy systems analysis methodologies

understand energy production and supply systems and relationships to consumer energy and economy

analysis

identify and evaluate sustainability issues and potentially beneficial developments

constraints

money is not subject to physical constraints

energy is subject to technological and resource restraints

energy systems must deliver energy that is

economical for consumer and profitable for investors

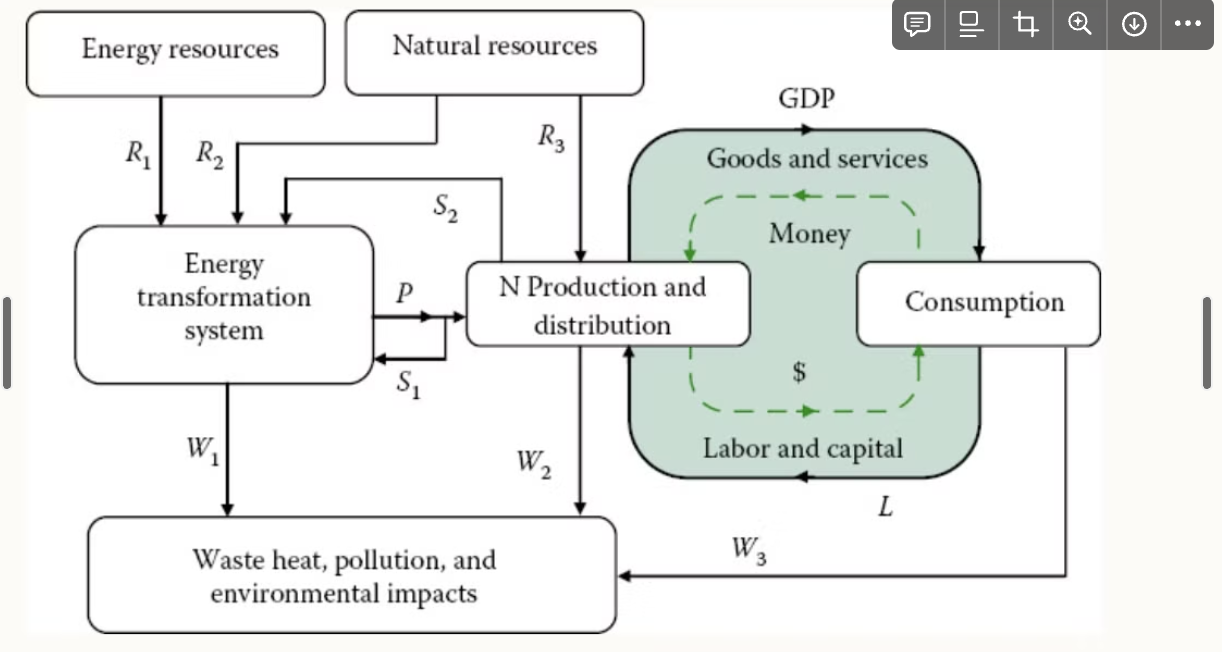

conceptualization of an energy system

flow of energy measured in mass (tons of coal, barrels of oil

flow of capital for buying and selling can be measured in dollars or embedded energy or resources

common characteristics of energy and resource flows

flow of energy consumed by transformation plant (S1)

flow of capital equipment (S2)

production (GDP)

indciators of energy and resource characteristics of the economy

energy conversion efficiency

energy resource intensity

energy intensity of the economy

energy return on energy invested

net energy to the economy

embedded energy

externality loading of conversion

lifecycle assessment

external costs

levelized cost of energy

energy prosperity

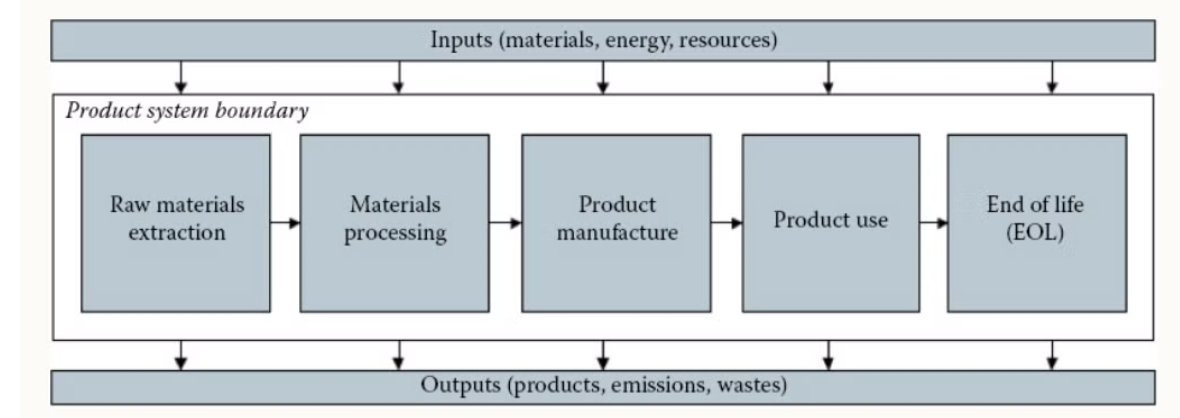

life cycle approach (LCA)

considers full life cycle of a product or service, starting from raw material extraction and processing through to disposal, reuse or recycling (cradle to grave)

useful for comparing costs of competing energy tech

must set clear scope and boundaries

environmental LCA

inventory energy and material requirements that go into producing a product along with environmental discharges and waste

may even assess impacts on resource use, air and water quality, climate, etc.

consequential LCAs

examine how a new product or tech might alter energy resource flows beyond direct use

4 keys steps to LCA

goal definition and scoping

conducting life cycle inventory of energy and material inputs and outputs

assessment of impacts associated with energy and material flows

interpretation

*must choose functional unit for assessment

international organization for standardization (ISO)

independent development organization of representatives from national standards organizations of member countries

make international standards- some for environmental LCA

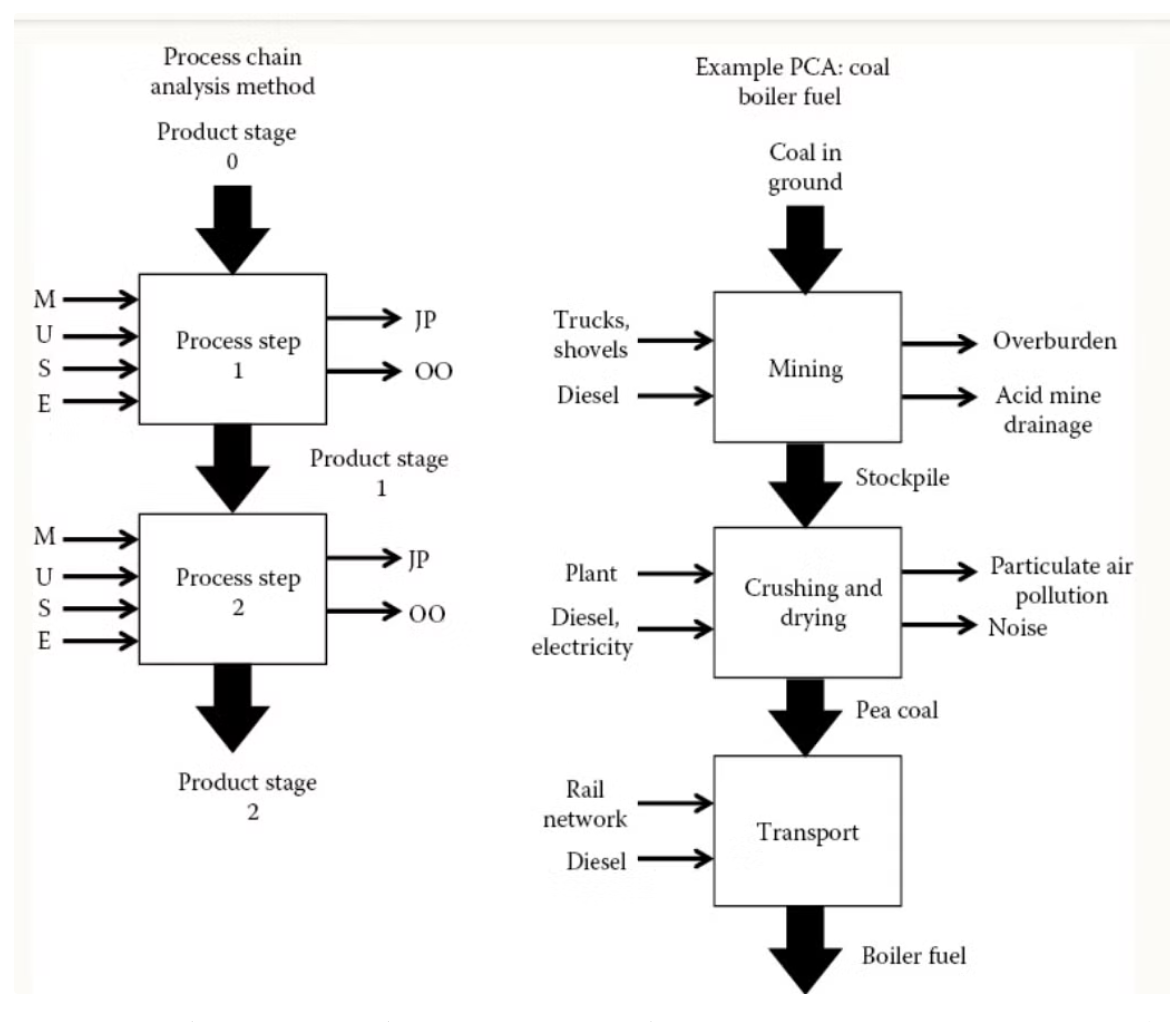

process chain analysis

tool used for auditing any system of a production process or product life cycle

take account of energy and resources needed and waste produced over different production steps

used in another analyses

production steps are separated and inputs and outputs identified at every step

process chain inputs and outputs

utilities (U)

services (S)

materials (M)

equipment (E)

joint products (JP) and other outputs (OO)

elementary inputs

material or energy entering a system that has been drawn from the environment without previous human transformation (coal or groundwater)

elementary outputs

wastes released into the environment that will not undergo subsequent human transformation (CO2 emissions)

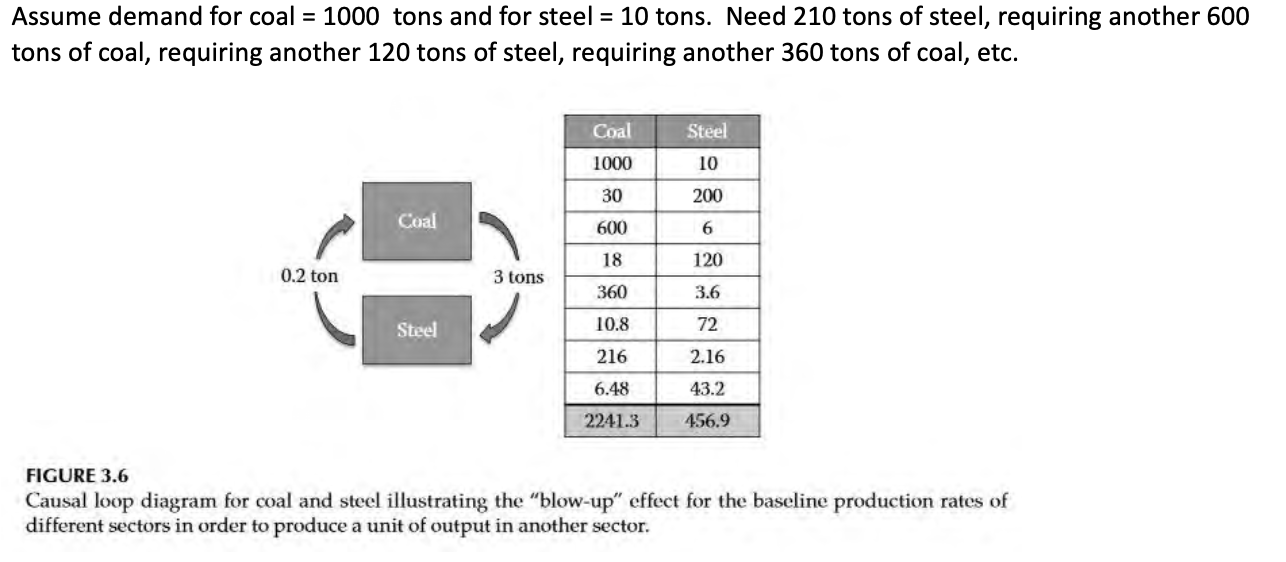

input-output (I/O) analysis

used by economists to characterize the effect of production in one section of the economy on other sectors of the economy

I/O example

2 sector economy- not common

corn and biofuel, casual loops

complete transactions tables

show requirements from each sector needed to produce unit output for each industry- found by dividing entries by total input for each commodity

benefit of input-output analysis

requirements matrix can be used calculate not only direct purchases required to produce given product but also indirect purchases

can be conducted in terms of material flows or money

I/O analysis in terms of energy

E= RX

E- vector of energy or environmental effects

R- square matrix with diagonal elements that represent energy use or environmental burden per dollar

X- vector of required production (dollars)

embedded energy (EE)

calculated through PCA or I/O analysis

measures cost associated with extraction, processing and supply chain

calculated for 1977 and adjusted to 2008 using consumer price index (CPI) of 3.51 due to inflation

consumer price index (CPI)

measure of price of consumer goods and services

lower kWh does not mean production is more efficient, mostly due to inflation

energy intensity

ratio of all such energies to dollar value of product produced

energy intensity values have

decreased significantly for all listed materials and commodities

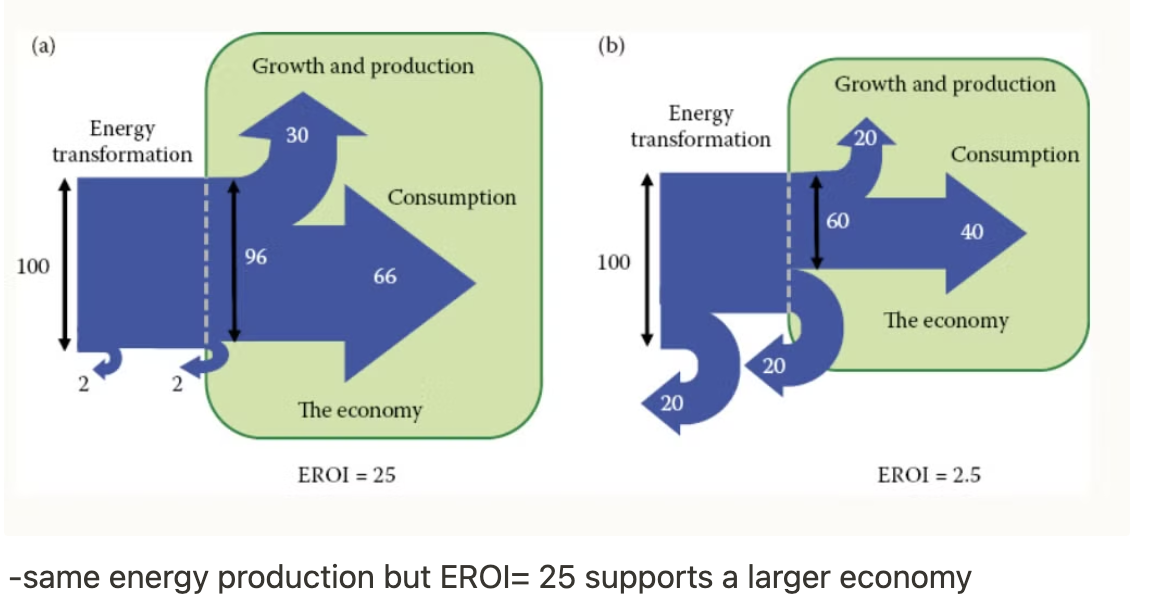

energy return on energy invested (EROI)

measure of energy profitability of an energy transformation system and

indicates availability of energy to meet demand and provide a surplus

can be evaluated for whole energy system in given year or assessed for particular technology over useful life of the planta

EROI formula

EROI= P/(S1+S2)

P- rate of energy production

S1- conversion energy input

S2- embodied energy in various items used by production system

EROI example

18th century farming

S1- food for animals and workers + wood for heat

S2- capital equipment, plough, harnesses

p- produce taken to market

EROI values

large EROI farm- prosperous, well fed

low EROI farm- poor, hungry

negative EROI farm- no farm

strongly positive EROI is the underlying factor for prosperity

payback period

point at which cumulative net energy return reaches zero

in an energy system, profit is

the net energy

net energy yield “N”

can be assessed on yearly basis or lifetime of plant

-may be negative yield at early stages

for primary production

prosperity is more determined by ability to return positive net product to economy than by the prices attached

measure of prosperity

N/P= 1-1/EROI

N/P= 95% implies that all of the energy sector were returned to the economy as useful energy production with 95% rate of return

once N/P < 5, eroi decreases rapidly

highest EROI of any power generation platform

hydroelectricity

-40-100

-can be built at natural outlet of lake

-areas where hydro generation was built developed prosperous economies because of plentiful on demand electricity

second highest EROI

coal

~10

today energy intensity is increasing

and EROI of fuels and electricity is declining

calculating EROI

complicated especially for renewables, depend on a source that varies with time of day, year, location, conventional energy is constant

use embedded standard energy values

use dollar costs for each item, then multiply by energy intensity factor

energy budgets

key for planning a sustainable energy future

budgets include:

energy required to maintain the energy infrastructure

energy required to drill for oil, mine coal, obtain materials for PV cells and wind turbines

energy needed to find more resources

remaining energy, comparing budgets

basic needs to suppport standard of living- health, shelter

discretionary uses associated with lifestyle- entertainment, the arts

*higher EROI supports a larger economy

changing EROI of hydrocarbons

EROI has declined over last 70 years because companies have to drill deeper, higher failure rate, and find smaller fields

1970 EROI ~25

today EROI 3-4

tar sand <5, harmful to environment, oil shale ~2

EROI of renewables

wind- ~30-60

EROI math

total power output x lifetime of system

or total output/total input

convert to kWh, multiply 365 day/yr times 24hr/day

maximizing EROI for renewables

they depend on the lifetime of the system, important to engineer these to maximize lifetimes

greenhouse gas accounting

in the 90s, need for standard protocol for businesses to perform greenhouse gas accounting

corporate accounting and reporting standard- published 2001, revised 2004, used to track and report emissions

companies use GHG accounting to

identify opportunities to reduce emissions

fulfill requirements of voluntary or mandatory reporting programs

support participation in carbon trading markets

report to the public

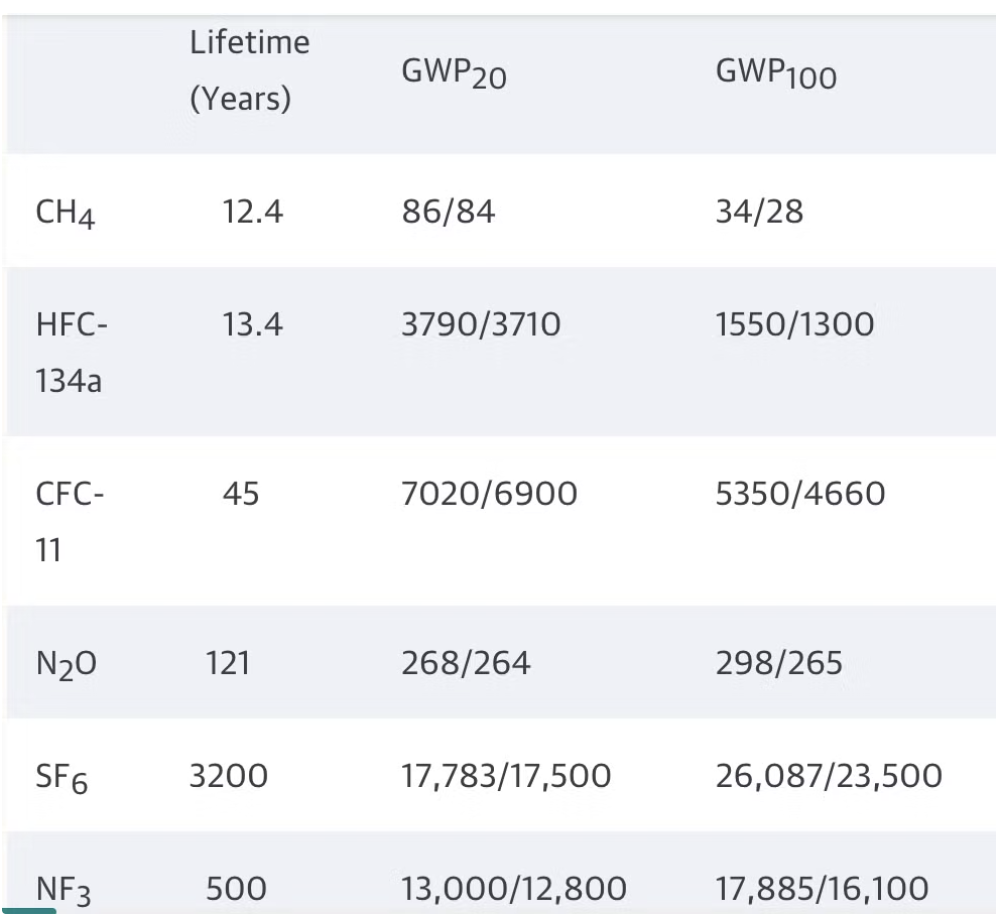

GHG protocol requires reporting of emission of 7 GHG

carbon dioxide (CO2)

methane (CH4)

nitrous oxide (N2O)

perfluorocarbons (PFCs)

hydrofluorocarbons (HFCs)

sulfur hexfaluoride (SF6)

nitrogen trifluoride (NF3)

scope of reporting GHGs (3 tiers)

direct GHG from sources owned or controlled by the company

indirect emissions from generation of purchase electricity used in operations owned or controlled by the company

other indirect emissions that occur as a consequence of the company’s activities but not from direct sources

*companies required to report tier 1 and 2

emissions can be determined through

direct measurements of concentrations and flow rates

engineering estimates

using corporate records of operational activities combined with published emissions factors

measuring combustion emissions- mass balance

required to report emissions of 7 GHGs separately and report combined emissions using

global warming potentials (GWP)

global warming potential (GWP)

amount of energy unit mass of gas will absorb over a given time, relative to amount of energy absorbed by same time period by mass of CO2

reflect differences in IR absorption efficiency

reflect differences in gases’ direct effects

highest and lowest GWP values highest

highest- SF6

lowest- CH4