ACYFARP9: Biological Assets, Wasting Assets & Government Grant

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

17 Terms

Biological assets are measured at

a. Cost

b. Lower of cost or net realizable value

c. Net realizable value

d. Fair value less cost of disposal

d. Fair value less cost of disposal

Agricultural produce is measured at

a. Fair value

b. Fair value less cost of disposal at the point of harvest

c. Net realizable value

d. Net realizable value less normal profit margin

b. Fair value less cost of disposal at the point of harvest

A gain or loss arising on the initial recognition of a biological asset and from a change in the fair value less cost ofdisposal of a biological asset shall be included in

a. The profit or loss for the period

b. Other comprehensive income

c. A revaluation reserve

d. Retained earnings

a. The profit or loss for the period

Which of the following are encouraged disclosures under PAS 41?

a. Price change

b. Physical change

c. Both price and physical change

d. None of the above

c. Both price and physical change

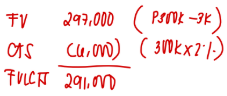

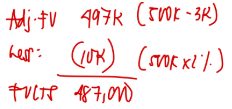

ABC Company purchased chickens at an auction for P300,000 on July 1, 2025. Cost of transporting the chickens back to the company’s office was P3,000 and the company would have to incur cost similar transportation cost if it was to sell the chickens in the auction, in addition an auctioneer’s fee of 2% of sales price.

On December 31, 2025, after taking into account and location, the fair value of the biological assets had increased to P500,000 (that is the market price including the cost of transporting the asset).

What amount should the biological assets be initially recognized?

a. 291,000

b. 294,000

c. 297,000

d. 300,000

a. 291,000

ABC Company purchased chickens at an auction for P300,000 on July 1, 2025. Cost of transporting the chickens back to the company’s office was P3,000 and the company would have to incur cost similar transportation cost if it was to sell the chickens in the auction, in addition an auctioneer’s fee of 2% of sales price.

On December 31, 2025, after taking into account and location, the fair value of the biological assets had increased to P500,000 (that is the market price including the cost of transporting the asset).

What amount should the biological assets be reported in the December 31, 2025 statement of financial position?

a. 487,000

b. 490,000

c. 497,000

d. 500,000

a. 487,000

Exploration and evaluation expenditures are incurred

a. When searching for an area that may warrant detailed exploration even though the entity has not yet obtained the legal rights to explore a specific area

b. When the legal rights to explore a specific area have been obtained but the technical feasibility and commercial viability of extracting a mineral resource are not yet demonstrable

c. When a specific area is being developed and preparations for commercial extraction are being made

d. In extracting mineral resource and processing the resource to make it marketable or transportable

B

Depletion expense

a. Is usually part of cost of goods sold

b. Includes tangible equipment cost in the depletable amount

c. Excludes intangible development cost from the depletable amount

d. Excludes restoration cost from the depletable amount

A

The most common method of computing depletion is

a. Percentage depletion method

b. Decreasing charge method

c. Straight line method

d. Production method

D

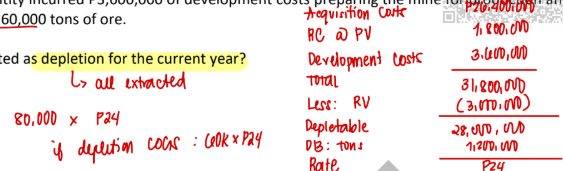

At the beginning of current year, BSA Company purchased a mineral mine for P26,400,000 with removable ore estimated at 1,200,000 tons.

After it has extracted all the ore, the entity will be required by law to restore the land to the original condition at an estimated cost of P2,400,000. The present value of the estimated restoration cost is P1,800,000. The entity believed it will be able to sell the property afterwards for P3,000,000.

During the current year, the entity incurred P3,600,000 of development costs preparing the mine for production and removed 80,000 tons and sold 60,000 tons of ore.

What amount should be reported as depletion for the current year?

a. P1,920,000

b. P1,440,000

c. P1,940,000

d. P1,455,000

A

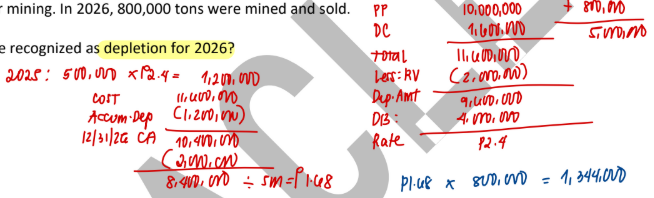

On January 1, 2025, XYZ Company purchased land with valuable natural ore deposits for P10,000,000. The residual value of the land was P2,000,000. At the time of purchase, a geological survey estimated a recoverable output of 4,000,000 tons.

Early in 2025, roads were constructed on the land to aid in the extraction and transportation of the mined ore at a cost of P1,600,000. In 2025, 500,000 tons were mined and sold. A new survey at the end of 2026 estimated 4,200,000 tons of ore available for mining. In 2026, 800,000 tons were mined and sold.

What amount should be recognized as depletion for 2026?

a. P1,344,000

b. P1,920,000

c. P1,200,000

d. P1,600,000

A

Government grant shall be recognized when there is reasonable assurance that

a. The entity will comply with the conditions of the grant

b. The grant will be received

c. The entity will comply with the conditions of the grant and the grant will be received

d. The grant must have been received

c. The entity will comply with the conditions of the grant and the grant will be received

Government grant related to depreciable asset is usually recognized as income

a. Immediately

b. Over the useful life of the asset using straight line method

c. Over the useful life of the asset using sum-of-the-years’ digits method

d. Over the useful life of the asset and in proportion to the depreciation of the asset

d. Over the useful life of the asset and in proportion to the depreciation of the asset

In the case of grant related to an asset, which of the following accounting treatment is prescribed?

a. Record the grant at a nominal value in the first year and write it off in the subsequent year

b. Either set up the grant as deferred income or deduct it in arriving at the carrying amount of the asset

c. Record the grant at fair value in the first year and take it to income in the subsequent year

d. Take it to the income statement and disclose it as an extraordinary gain

b. Either set up the grant as deferred income or deduct it in arriving at the carrying amount of the asset

On January 1, 2025, Pinnacle Company received a grant of P25,000,000 from the U.S. government to defray safety and environmental costs within the area where the entity is located. The safety and environmental costs are expected to be incurred over four years as follows:

2025 P2,000,000

2026 4,000,000

2027 6,000,000

2028 8,000,000

What amount of income from the government grant should be recognized in 2025?

a. P25,000,000

b. P2,000,000

c. P2,500,000

d. P6,250,000

c. P2,500,000

On January 1, 2025, CBA Company received a grant of P10,000,000 from the Japanese government for the construction of a laboratory and research facility with an estimated cost of P15,000,000 and useful life of 5 years. The laboratory and research facility were completed and ready for its intended use on January 1, 2026.

What amount should be included in the 2026 income statement as income from the government grant?

a. P10,000,000

b. P2,000,000

c. P1,500,000

d. P0

b. P2,000,000

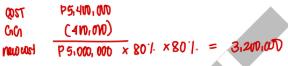

On January 1, 2025, BAA Company purchased a machine for P5,400,000. The entity received a government grant of P400,000 toward the asset cost. The machine is to be depreciated on a 20% reducing balance basis over 10 years with residual value of P200,000. The accounting policy is to treat the government grant as a reduction in the cost of the asset.

What is the carrying amount of the machine on December 31, 2026?

a. P4,000,000

b. P4,040,000

c. P3,456,000

d. P3,200,000

d. P3,200,000