Ch 6

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

what is free cash flow

amount of cash available for investors

why is free cash flow important

a company’s value depends on it

Five uses of free cash flow

pay interest on debt

pay back principal on debt

pay dividends

buy back stock

buy nonoperating assets

delete

delete

NOPAT formula

EBIT(1-tax rate)

what are operating current assets

current assets needed to support operations

what are operating current liabilties?

current liabilties resulting from normal part of operations

Net Operating Working Capital formula

NOWC = Operating CA - Operating CL

Operating CA formula

cash + A/R + Inventories

Operating CL formula

Operating CL = A/P + Accruals

Operating Capital formula

Operating Capital = NOWC + Net fixed asset (PP&E)

free cash flow formula

FCF = NOPAT - Net investment in operating capital

Net investment in operating capital formula

fill in later

capital requirement ratio

total operating capital / sales

operating profitability ratio

NOPAT / Sales

Return on Invested Capital formula

ROIC = NOPAT / Total operating capital

what is economic value added

management effectiveness

Economic Value Added formula

EVA = NOPAT - (WACC)(Total Operating Capital)

are dividends a expense

NO

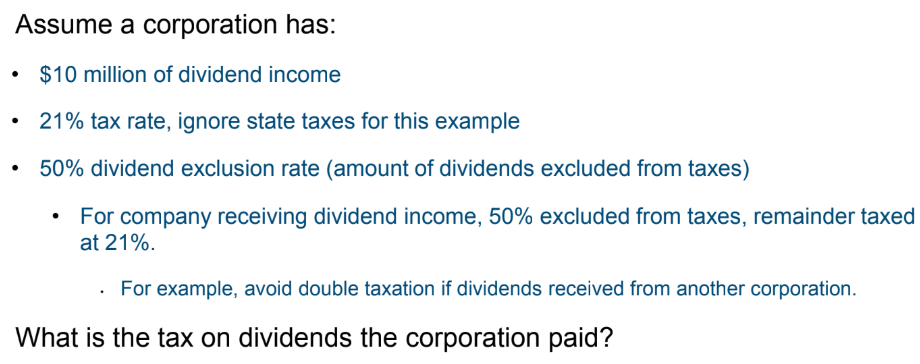

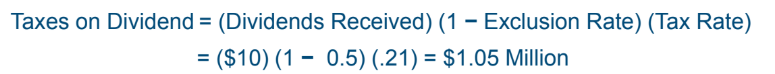

Capital gains are taxed at:

Flat rate of 21% + state rate for corporations

what happened to the personal taxes and the 2017 Tax Cut and Jobs Act

look at slides