EC330 AT W5: Environmental policy instruments

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

38 Terms

Why do externalities cause markets to be inefficient?

The market transactions do not reflect full costs and benefits to society, leading to overproduction or underproduction of goods.

Types of environmental regulation

Command and control

Economic incentives

What is command and control regulation?

Regulators mandate specific actions that polluters must take to control pollution.

Example

Technology Standards:

Require polluters to use a specific type of equipment or method (e.g., installing scrubbers on smokestacks).Performance Standards:

Limit emissions to a certain amount per unit of economic output (e.g., max 100g CO₂ per unit produced).

Advantages of command and control regulation

Certainty: You know exactly how much pollution reduction will result.

Simplified Monitoring: It's easier to check if firms meet the rules than to monitor continuous pollution levels.

Disadvantages of command and control regulation

Rigid: Forces firms to comply in a specific way, reducing flexibility and innovation.

High Information Costs: Regulators need detailed knowledge to design the rules effectively.

Incentives to Misreport: Firms may underreport or manipulate their emissions data.

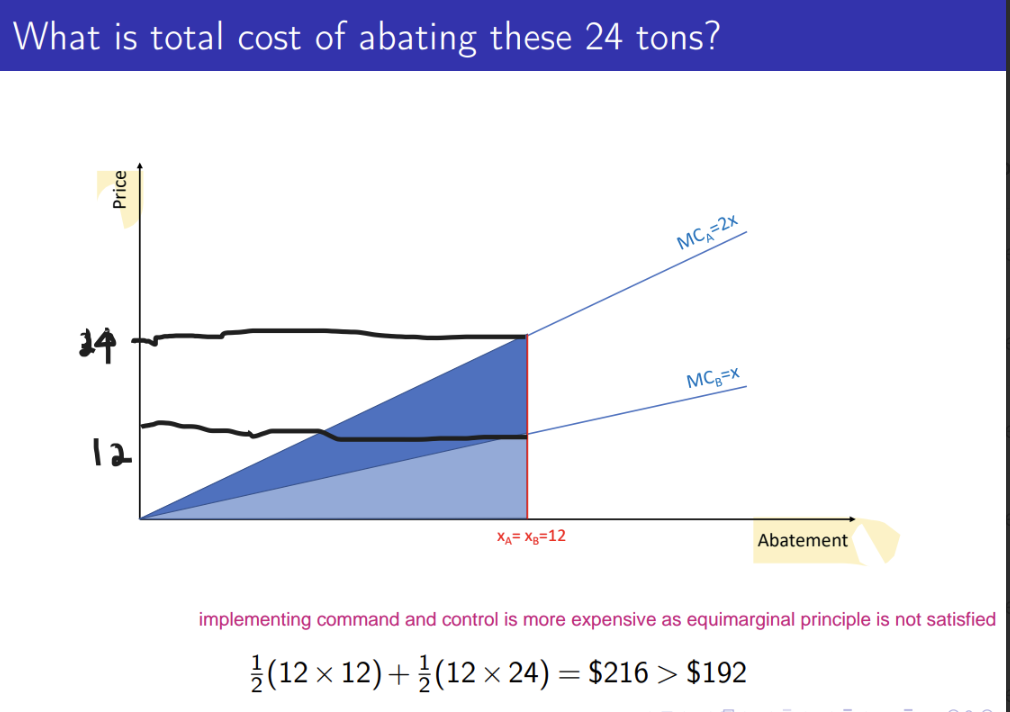

Not cost effective: violates the equimarginal principle

some firms could reduce pollution at a lower cost, but the regulation doesn’t allow them to do it their way

What do economic incentives aim to achieve?

encourage polluters to act in the public interest by making it financially rewarding or punishing to pollute

Types of economic incentives

Pollution Fees (Pigouvian Taxes):

Charge per unit of pollution (e.g. $50 per ton of CO₂).

Marketable Permits (Cap-and-Trade):

Firms are given or buy emission rights and can trade them.

Liability:

Polluters must compensate for environmental damages caused.

Advantages of economic incentives

less significant informational requirements

encourage innovation

firms can cut costs by adopting cleaner tech or practices

polluter pays principle

firms pay for both control costs and damage

cost effective

satisfies the equimarginal principle

pollution is reduced where it’s the cheapest to do so

Disadvantages of economic incentives

difficult to set optimal incentives

authorities need some information to set the “right” tax or cap.

political resistance

adjusting tax levels or caps may face pushback

politically difficult to give transfers from firms to the government

moral objections to treating environment as commodity

Why does command-and-control need more information than economic incentives?

Regulators must design and enforce exact rules under command-and-control, they need detailed knowledge about:

Each firm’s abatement options

Pollution levels & sources

Feasibility of specific technologies

Economic incentives like taxes or permits just set a price on pollution — then let firms figure out how to respond.

Firms already know:

Their own costs of abatement,

Which method is cheapest for them,

Whether it’s better to reduce emissions or just pay the fee.

decentralized decision-making makes incentives more efficient with less burden on the regulator.

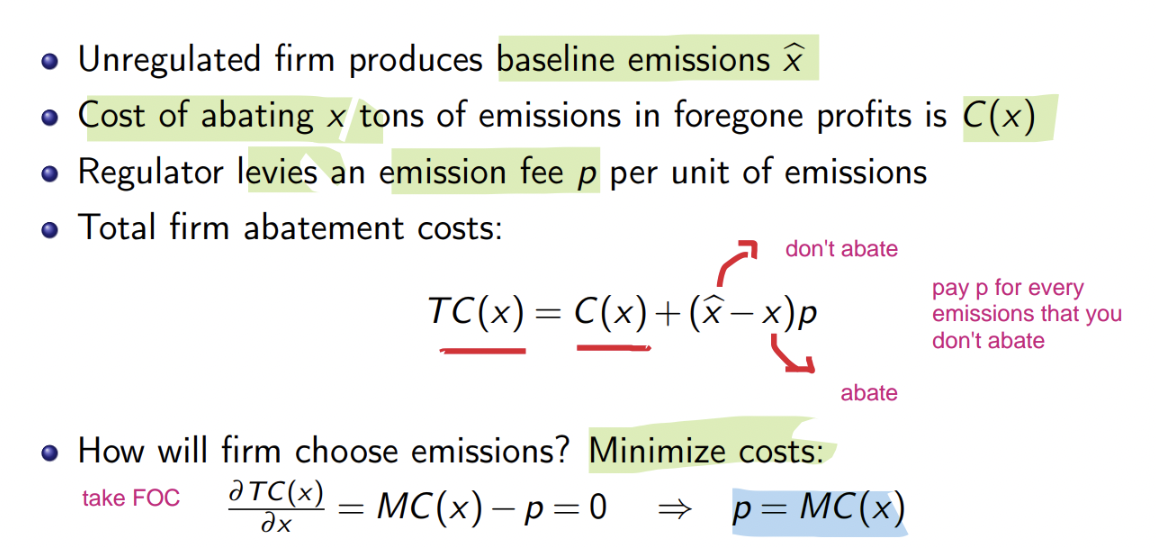

What is the optimal emission level for firms to abate pollution?

Firms will abate pollution up to the point where the marginal cost of abatement equals the emission fee

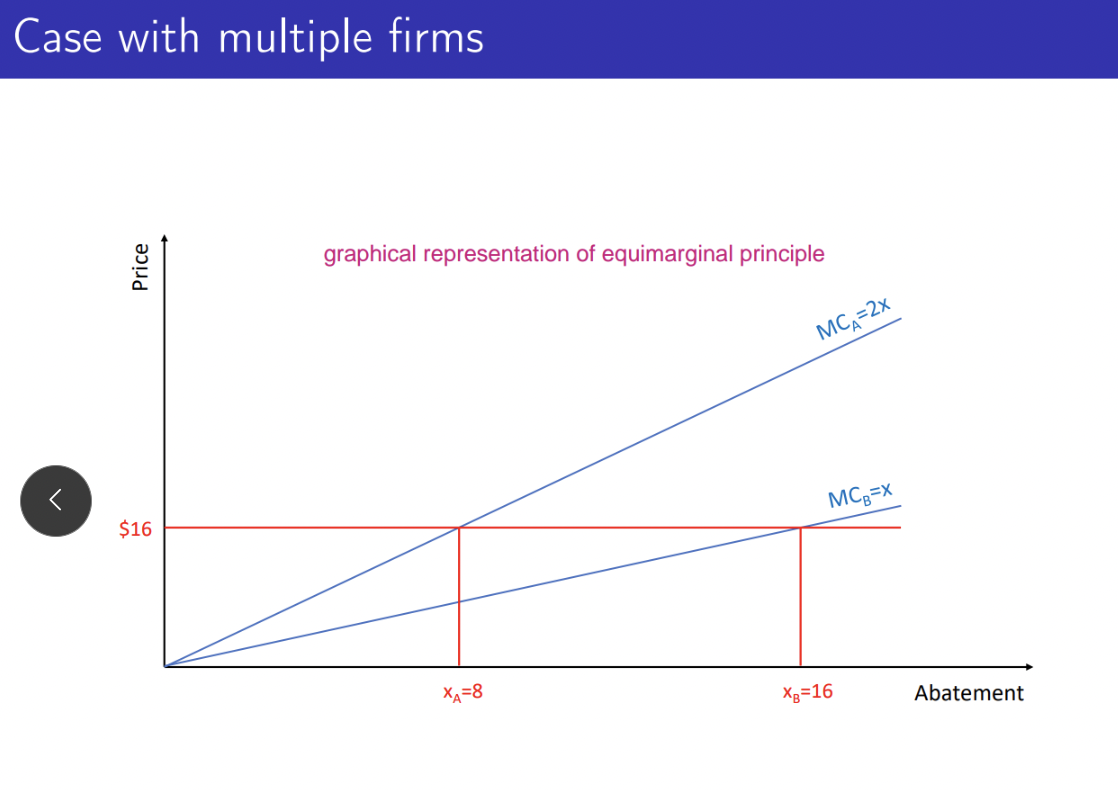

Draw the case of abatement level for multiple firms

What is the equimarginal principle

Pollution should be reduced where it is the cheapest to do so.

the marginal cost of abatement should be equal across all polluters

ensures total pollution is reduced at the lowest total cost to society.

Is prescriptive regulation optimal for abating pollution?

(Regulator is stipulating that each firm must abate desired amount)

No. It is more expensive as equimarginal principle is not satisfied

What is a Pigouvian fee

It is a fee that equals to the external cost or marginal social damage caused by pollution

Difference between pigouvian and emission fee

ll Pigouvian fees are emission fees, but not all emission fees are Pigouvian — only Pigouvian fees are set at the correct level to fully reflect the external damage.

Emission fee leads to firms abating until its own marginal cost of abatement = fee

What is the equation of unabated emissions

e = x’ - x = amount of emissions still released under the policy.

where

x’ : the baseline emissions produced by unregulated firm

x: the emissions reduced through abatement

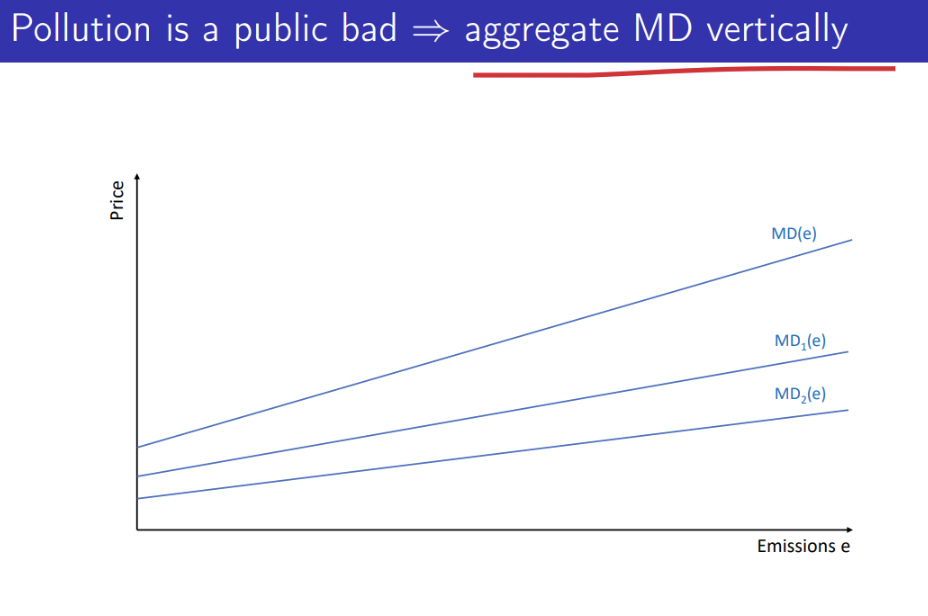

Why do you aggregate marginal damages vertically and marginal cost of abatement horizontally?

Aggregate MD vertically when the good is a public good

it affects everyone at once

total damage at any level of emissions is the sum of individual damages

Aggregate MC horizontally as the abatement is a private action

each firm or individual decides how much to abate based on the cost they face.

At a given price (say, $50), how much will each firm abate?

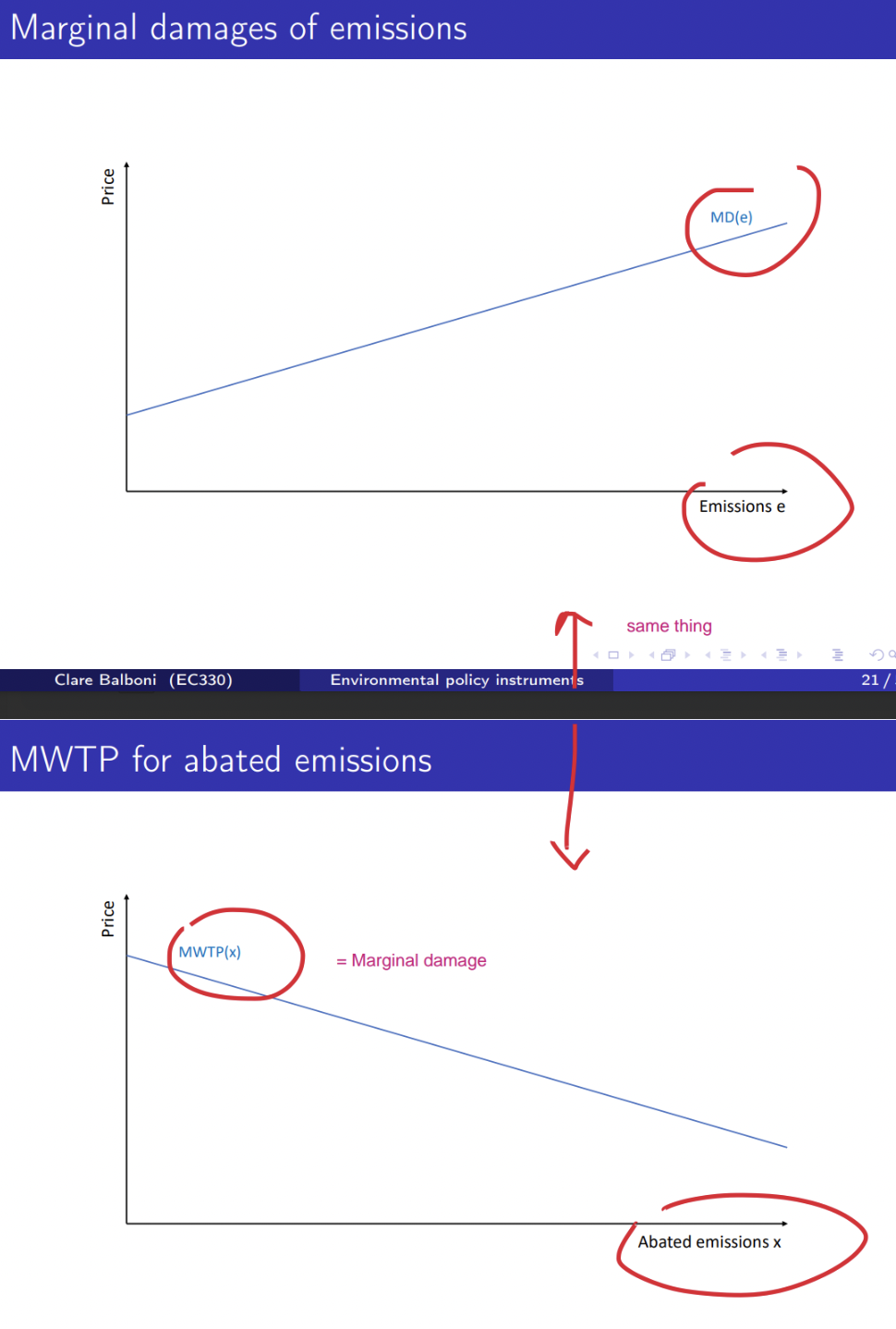

The graphs for marginal damages of emissions and MWTP for abated emissions

What is the efficient level of abatement

when the MWTP coincides with the MC of abatement

What is the optimal level of Pigouvian fee

the level at which

MD from pollution at optimal level of pollution = MWTP for abated emissions at optimal level of abatement

how much society suffers from the last unit of pollution = how much society values one more unit of abatement

Does Pigouvian fee satisfy equimarginal principle?

Yes. Once the Pigouvian fee is in place, each firm reduces pollution until its marginal cost of abatement (MC) = Pigouvian fee, leading to

equal MC across all firms

efficient allocation of abatement effort

Why might implementing the optimal Pigouvian fee be challenging?

Uncertainty about the true marginal damage curve

Estimating the social cost of pollution at every level of emissions is difficult.

Damage may vary by location, population, and exposure.

Regulators may have different goals

may prioritise health standards or political constraints, not maximising the net social benefits

optimal level of pollution or abatement is not the regulator’s target

What happens if the target is wrong and the Pigouvian fee is set wrongly?

Even if the target is set sub-optimally, the unit emission fee (Pigouvian fee) provides the least cost method for achieving a given target

equimarginal principle is still satisfied— firms reduce pollution up to the point where their marginal cost equals the fee.

it is still cost effective

Why might regulators want to use abatement subsidies instead of fees?

Political acceptability:

Taxes are often unpopular, while subsidies sound more supportive.Incentivizes cleaner behavior without sounding punitive.

Why might regulators not use subsidies?

Incurs a fiscal cost

subsidies require government funding, often from taxes or debt

Ambiguous baseline

It’s hard to decide:

What emissions level counts as the "baseline"?

How much subsidy is deserved for abating "below" that?

Morally and ethically complicated

Paying people to do something they shouldn’t do feels wrong

Do emission fees and abatement subsidies yield the same marginal conditions for emissions?

Yes only in the short run for identical firms

Tax: polluter is charged a certain amount per unit of emissions

Subsidy when polluter emits a unit of emissions, they forego the subsidy payment they could have had if they abated the emissions

Since the firms have the same MC of production, they will produce same amount of good and emissions

When do emission fees and abatement subsidies diverge?

Heterogeneous firms in the short run

no firm entry but some firms might shut down

firms shut down when the profits cannot cover average variable cost

if a tax raises AVC, some firms will shut down

if a subsidy lowers AVC, even unprofitable firms may stay open

subsidies vs taxes can lead to different firm survival outcomes.

subsidies can be inefficient in the short run because they allow firms with negative profits to continue operating — even though these firms would shut down under a tax.

Firms in the LONG RUN

firms can enter and exit the market

subsidy effects:

lowers average cost, making the industry more profitable.

attracts more firms into the market.

total number of firms increases, total industry emissions could rise

tax effects

raises average cost, making the entry less attractive

fewer firms survive or enter

TLDR

Subsidies improve firm profits → more firms enter → total pollution may increase, making the subsidy potentially inefficient or counterproductive in the long run

What is tradable emission permit?

quantity-based environmental policy where the government sets a fixed total cap on emissions and issues permits representing the right to pollute.

The permit price emerges from market trading.

This price creates the same marginal incentive as a Pigouvian tax — i.e., firms will reduce emissions until their marginal cost = permit price.

Is the cap and trade system as efficient as a Pigouvian tax?

Yes. It satisfies the equimarginal principle and achieves cost-effective pollution reduction.

What is the relationship between tradable emission permits and emission fees?

They are equal!

Key mechanism of permit market operation

all firms abate emissions until their marginal abatement cost (MAC) = permit price

ensures that firms who can abate cheaply abate more

firms that face high abatement costs prefer to buy permits instead

What is marginal abatement cost equal to?

Forgone profit from choosing to abate pollution rather than emit.

by cutting production, less revenue

or use cleaner alternatives, higher cost

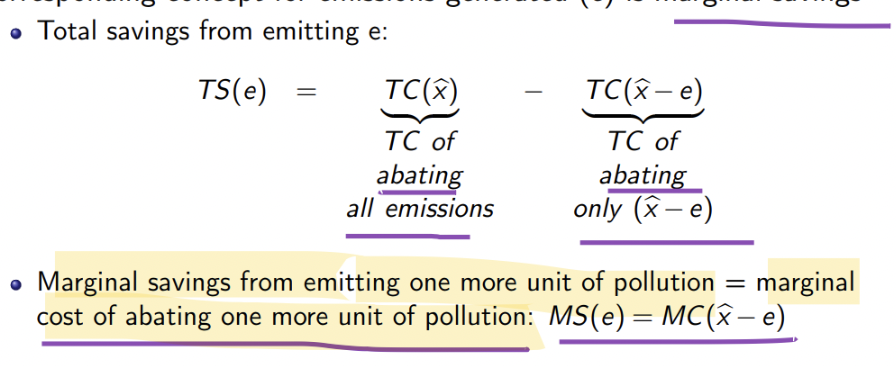

What do you mean by total savings and marginal savings

savings = money the firm saves by not abating pollution.

since abating pollution costs money, if a firm chooses to emit instead of abating, it avoids these costs

TS(e)=Cost of abating all emissions−Cost of abating only some

MS(e) = how much money a firm saves by emitting one more unit of pollution instead of abating it

should equal to the marginal cost of abating one more unit of pollution

MS(e) = MC (x’-e)

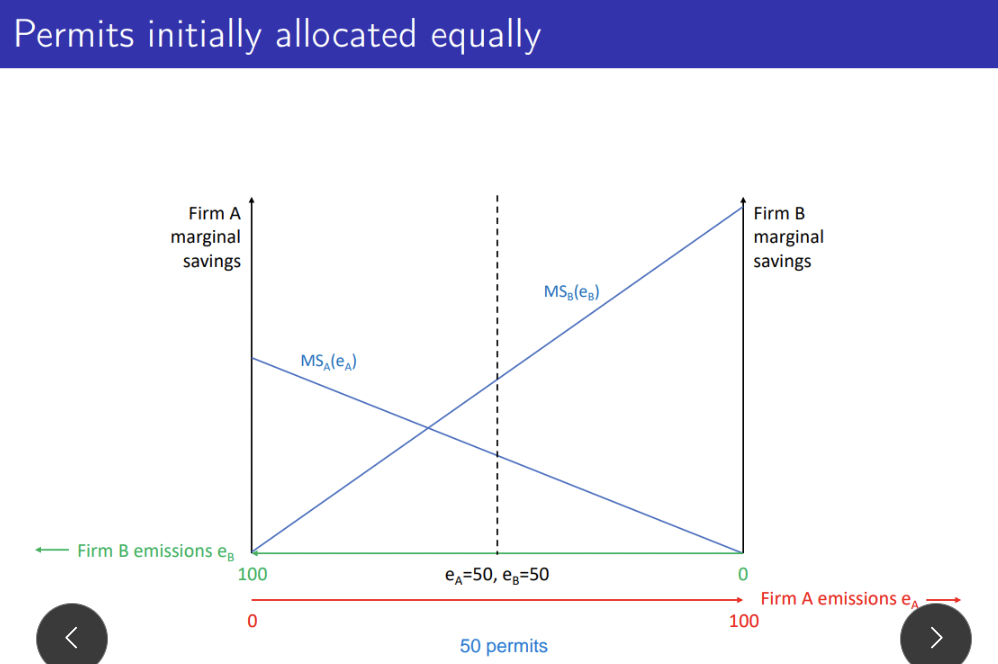

Explain the trading of permits

Firm B has higher marginal savings from emitting than Firm A:

MS_B>MS_A

That means Firm B finds it more costly to abate than Firm A does.

So there's an incentive to trade

Firm B will buy permits from firm A because it values those permits more

Firm A will sell permits and abate more.

Firm B will buy permits and abate less.

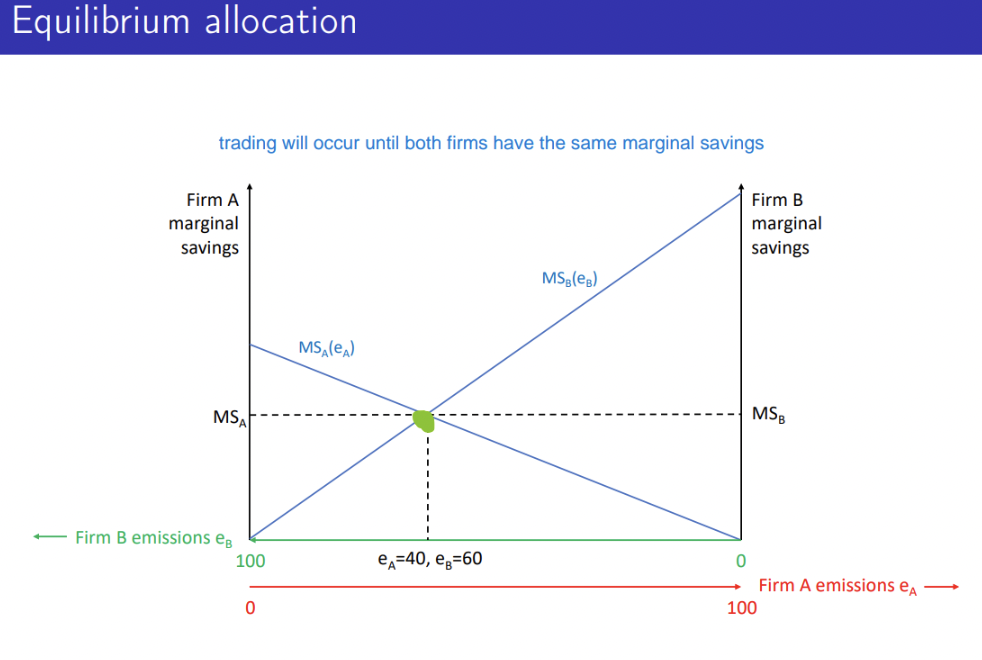

This continues until their marginal savings are equal:

efficient outcome — it satisfies the equimarginal principle, where:

The cost of reducing pollution is minimized,

The firms with lower abatement cost (lower MS) abate more,

And the ones with higher abatement cost (higher MS) pollute more (but pay for it via permits).

What is the equilibrium allocation for trading of permits

Marginal damage = Marginal savings = e*= x’-x

Does it matter how permits are allocated initially?

In theory, a well-functioning permit market will always reach the most efficient outcome, no matter who gets the permits initially.

Firms can buy and sell permits.

The market will reallocate permits to the firms that value them the most (i.e. the firms with the highest marginal savings from emitting).

So, even if the starting point is uneven, the final result is efficient — the right firms abate, and the right firms emit.

So, it doesn’t matter for efficiency

However, it matters for distribution, affecting who gains and who loses

If Firm A is given lots of free permits, they can sell them for profit.

If Firm B has to buy all its permits, it faces higher costs.

Both might end up emitting the same amount either way — but their profits and competitiveness will differ.

Why might initial permit allocation matter in the real world?

In the real world, initial allocation matters because the market isn’t perfect

High transaction costs

firms face administrative, legal or informational costs when buying/selling permits

Regulatory uncertainty

firms may just hold onto permits defensively or avoid participating fully in the market if they are unsure about future rules

Imperfect competition in permit markets

if only few firms dominate the trading, they can manipulate prices or hoard permits (monopoly)

not a fair market price

Firm dynamics

over time, firms enter, exit grow or shrink

if allocation doesn’t adjust accordingly, it may no longer match actual pollution needs

Market thinness

too few buyers or sellers, making it hard for permits to flow efficiently