4.1. Measuring and Reporting Cash Flow

1/10

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

11 Terms

Common Misunderstanding About Cash

that rapid growth means that your business is doing fine

that a good profit situation equals a good cash situation

that just because your company is “making money“, it will be easy to receive a loan

Profit vs Cash Flow: Accrual Accounting vs Cash Accounting

revenue is recognized when earned rather than when cash is collected

it is possible for a company to have a healthy net income (profits) but not have enough cash to fulfill obligations.

Significance of profit diminished unless earnings translate into cash

there are time lags between profit generation and cash generation

Overview of the Cash Flow Statement

provides information about cash receipts and cash payments during an accounting period

tells how cash was generated and used

Differences Between Income Statement and Cash Flow Statement

Cash flow statement is cash-based as opposed to accrual like in income statement

Cash flow statement reflects when the cash was collected not when the revenue was earned

Cash flow statement specifies where the cash was generated and how they are spent

2 Key Questions Answered by the Cash Flow Statement

Does the company generate enough cash from its operations to pay for its news investment, or is the company relying on new debt issuance to finance them?

Does the company pay its dividends to common stockholders using cash generated from operations, from selling assets, or from issuing debt?

The sources of cash are useful for evaluating liquidity, solvency, financial flexibility, and sustainability

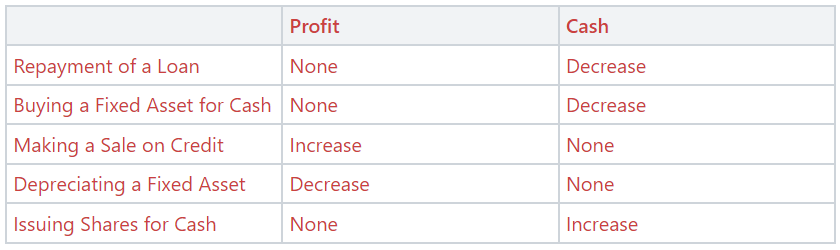

How the Following Scenarios Will Affect the Cash Flow Statement

Layout of Cash Flow Statement

It is important to understand where in the business the cash is being generated and spent, so divided into 3 sections

“+“ in Operating Activities: should be the main source of cash inflow for healthy company

“-” in Investing Activities: as cash is needed to invest in non-current assets to support

“±” in Financing Activities

Cash Flow from Operating Activities

Cash flows for operating activities are cash inflows and outflows directly related to earnings from normal operations

Inflows:

Customers

Dividends and interest on investments (could operation or finance, IFRS is flexible)

Outflows:

Purchase of services (e.g., utilities) and goods for resale

Salaries and wages

Income taxes

Interest on liabilities

Cash Flow from Investing Activities

Cash flows from investing activities are related to the acquisition or sale of long-lived productive assets and investments in the securities of other companies.

Inflows:

Sale or disposal of PP&E

Sale or mutiny of investment in securities

Outflows:

Purchase of PP&E

Purchase of investments in securities

Cash Flow from Financing Activities

Cash flows from financing activities are related to external sources of financing (owners and creditors) for the enterprise

Inflows:

Borrowings on notes, mortgages, bonds from creditors

Issuing stock to owners

Outflows:

Repayment of principal creditors (excluding interest which is an operating activity)

Repurchasing stock from owners

Dividends to owners

2 Formats for Reporting Cash Flow from Operating Activities

Direct Method

reports the net cash effect of each operating activity

more informative as it provides detailed information on cash inflow & outflow, encouraged by both IFRS & GAAP

Indirect Method

starts with accrual net income from income statement, then eliminates noncash items to arrive at net cash flow from operating activities

more popular among companies, as it is deemed easier and less costly

net income (profit) ± adjustments for non items = net cash flow from operating activities