3.3

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

Stockholders’ Equity Statements:

Retained earnings, Statement of Owner’s Equity and balance sheet.

Retained Earnings:

Net income increases retained earnings,

Net loss decreases retained earnings,

Continued net losses can lead to a deficit in retained earnings.

A deficit is reflected as a debit balance in retained earnings and would be deducted in the stockholders’ equity section of the balance sheet.

2. Both cash dividends and stock dividends decrease retained earnings.

3. Changes in accounting principles (discussed in the chapter appendix) and prior period adjustments due to errors may increase or decrease retained earnings, generally as an adjustment to the beginning balance of retained earnings. Recall that revenues and expenses are closed to retained earnings at the end of each year. If an error in a prior period revenue or expense is discovered, it can be corrected in the current period through an adjustment to retained earnings. Adjustments for accounting changes and errors are made net of tax.

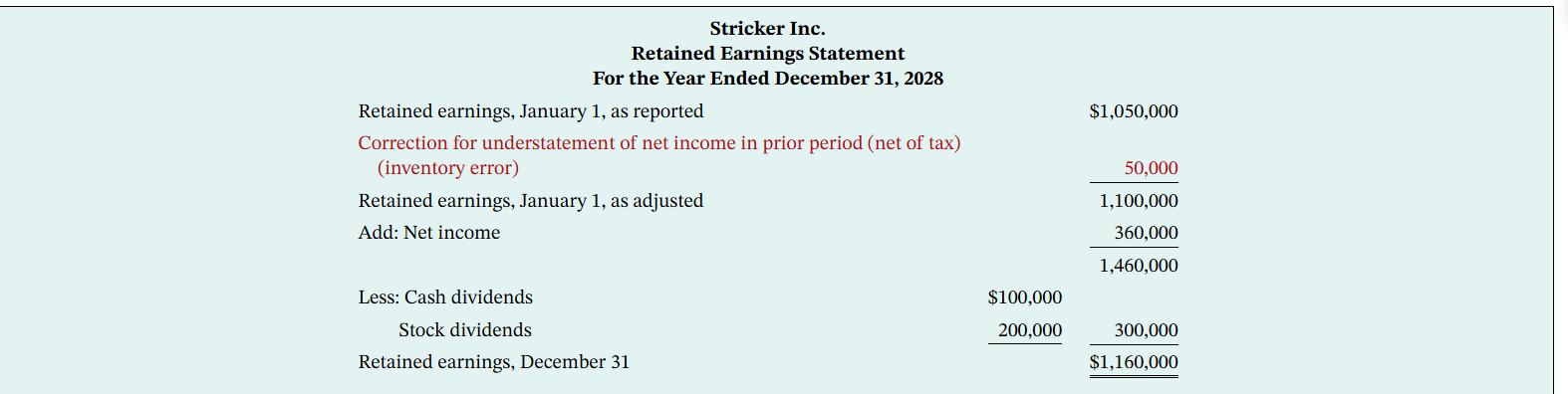

Companies may show retained earnings information in different ways. For example, some companies prepare a separate retained earnings statement, as Illustration 3.10 shows.

Net of Tax:

A change that has to be made first when you have found an error from the revenue or expense statements. You fix your taxes first and then you fix everything else.

Ex: Suppose a company discovers a $10,000 error from last year — they forgot to record some revenue.

If their tax rate is 30%, the tax on that $10,000 would be $3,000.

So, they would increase retained earnings by only $7,000 (which is $10,000 − $3,000).

That’s the net-of-tax adjustment.

Why is this done?

Because retained earnings reflect profits after tax, any correction or change that affects profit must also reflect the after-tax impact — not the gross amount. This keeps everything consistent.

Deficit:

1. (a) A shortfall or negative balance that occurs when expenditures, liabilities, or imports exceed revenues, assets, or exports during a specific period, indicating a financial loss or deficiency.

1. (b) A shortfall or negative balance that happens when expenses, liabilities, or imports exceed income, assets, or exports over a specific period.

In Simple Terms: You're spending more than you're earning.

2. Expandetiures: The action of spending funds./ An amount of money spent. The total amount of money spent by an individual, business, or government to buy goods, services, or settle obligations.

In Simple Terms: It’s money going out to cover costs.

3. Imports: Goods or services brought into a country from another country to be sold or used.

4. Exports: Goods or services produced in one country and sold to another.

By comparing the starting and ending balance of retained earnings, and explaining what happened in between:

we can understand why retained earnings changed during the year.

The association of dividend distributions with net income for the period indicates:

What management is doing with earnings: It may be “plowing back” into the business part or all of the earnings, distributing all current income, or distributing current income plus the accumulated earnings of prior years.

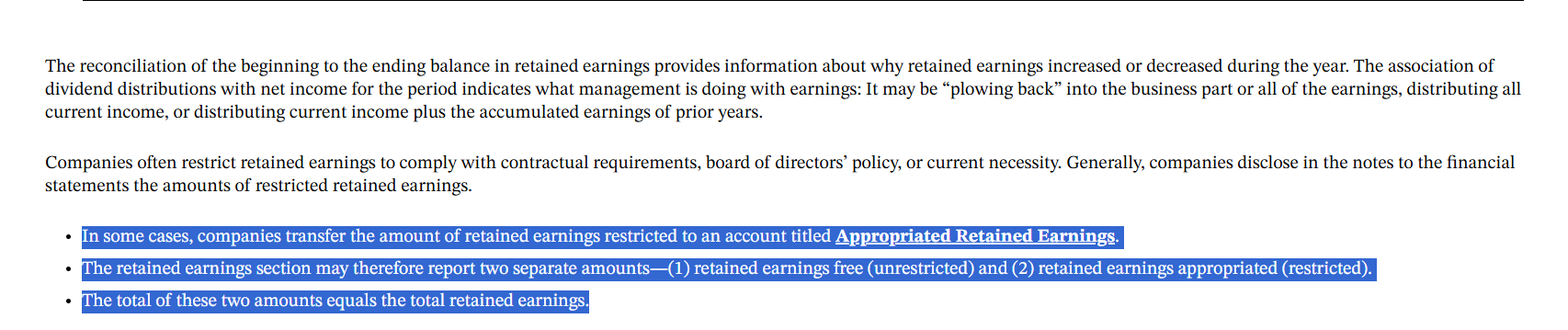

Companies often restrict retained earnings to comply with:

Contractual Requirements

Example: A bank loan might say, “You can’t pay dividends unless your retained earnings stay above $1 million.”

So the company restricts part of retained earnings to meet that condition.

Board Policy

The company’s board of directors might decide to keep a reserve for future needs — like expansion, emergencies, or debt repayment.

Current Necessity

If the company is facing tough times or big upcoming expenses, it may hold back part of the retained earnings to make sure it has enough cash on hand.

Generally, companies disclose in the notes to the financial statements the amounts of restricted retained earnings.

Help

What the Paragraph is Saying

This part is explaining how companies show restricted retained earnings. Instead of just mentioning it in a note, some companies move (or label) the restricted part into a separate account called:

“Appropriated Retained Earnings”

So now, the total retained earnings is shown in two parts:

Retained earnings free (unrestricted) – can be used for dividends, etc.

Retained earnings appropriated (restricted) – set aside for a specific purpose, not available for dividends.

But together, these two amounts still add up to the company’s total retained earnings.

Appropriated Retained Earnings

This is the portion of retained earnings that has been "set aside" for a specific reason (like a loan requirement or future project).

It’s restricted — can’t be used freely, like for paying dividends.

It’s basically a label, not a separate pile of money.

Retained Earnings Free (Unrestricted)

This is the available portion of retained earnings.

The company can use this to pay dividends or reinvest in the business.

No limitations placed on it.

Retained Earnings Appropriated (Restricted)

3. Retained Earnings Appropriated (Restricted)

This is the "restricted" portion of retained earnings.

It has been designated for a special purpose, so the company won’t touch it for regular use.

Examples:

To meet a loan condition

To save up for building a factory

To cover legal obligations

Total Retained Earnings

This is just the sum of both:

Unrestricted (free)

Restricted (appropriated)

✅ Think of it like this:

Total Retained Earnings = Free + Restricted

Statement of Stockholders’ Equity

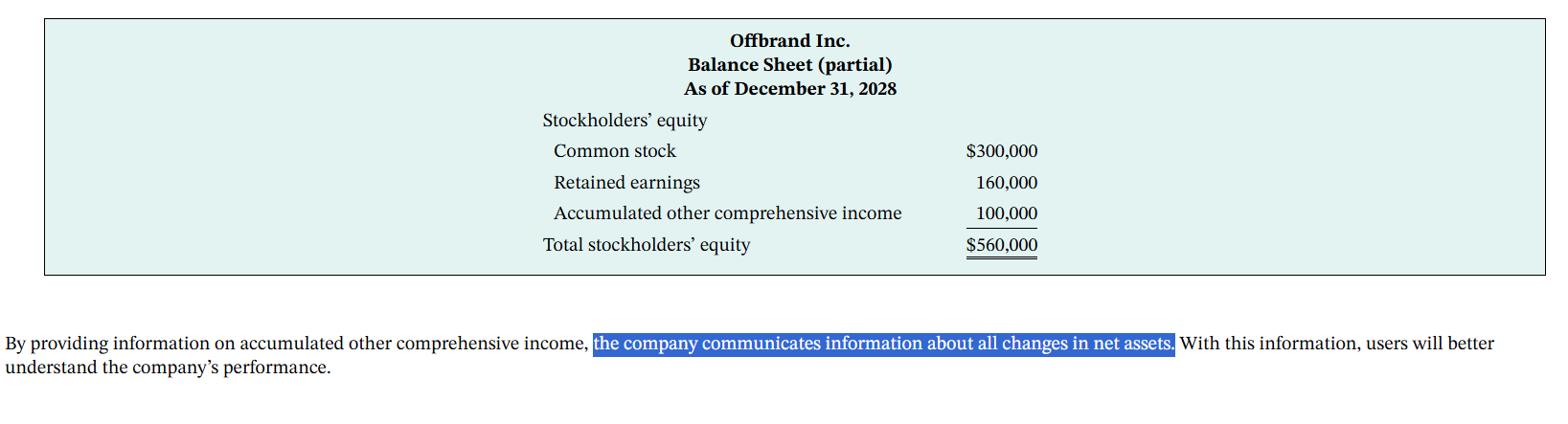

In addition to a balance sheet, statement of cash flows, and a comprehensive income statement, companies also report a statement of stockholders’ equity (often referred to as statement of changes in shareholders’ equity). This statement reports the changes in each stockholders’ equity account and in total stockholders’ equity during the year.

Companies often prepare this statement in columnar form. In this format, they use columns for each account and for total stockholders’ equity. Stockholders’ equity is generally comprised of contributed capital (common and preferred stock and additional paid-in capital), retained earnings, and the accumulated balances in other comprehensive income.

Common Stock

This represents ownership in a company.

Most investors hold common stock.

Common stockholders:

Have voting rights (e.g., electing board members).

Receive dividends (if declared), but after preferred stockholders.

Get paid last if the company goes out of business (after creditors and preferred shareholders).

On the balance sheet, it appears as:

Common Stock, at par value (e.g., $1 per share)

✅ Example:

If a company issues 1,000 shares at $1 par value, it records $1,000 in the "Common Stock" account.

Preferred Stock

A special type of stock that has priority over common stock in two ways:

Dividends: Preferred stockholders get paid before common stockholders.

Liquidation: If the company is dissolved, they’re paid before common shareholders.

Often, preferred stock does not have voting rights.

It may have fixed dividends (like a bond).

✅ Example:

A company issues preferred shares with a $5 annual dividend. If it can’t pay both common and preferred dividends, it must pay preferred first.

Additional Paid-In Capital (APIC)

Also called “capital in excess of par”.

This is the extra amount investors paid above the par value of the stock.

✅ Example:

If a company sells stock at $10 per share with a $1 par value:

$1 goes into Common Stock

$9 goes into APIC

This shows the company raised more money than just the stated par value of the shares.

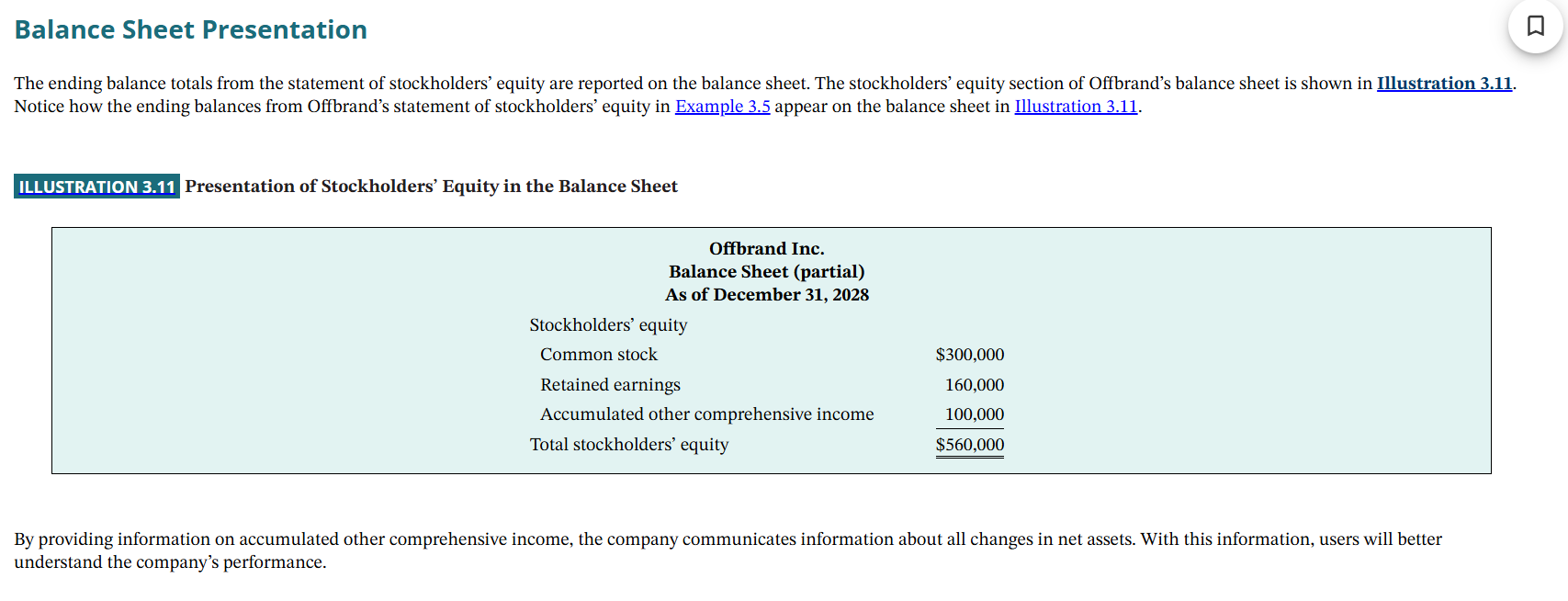

Balance Sheet Presentation

The totals and ending balances from the statement of stockholder’s equity show in the Balance sheet.

By providing information on accumulated other comprehensive income, the company communicates information about all changes in net assets. With this information, users will better understand the company’s performance.

Net assets: Net assets show what the company is actually worth after subtracting its liabilities from its total assets. It's essentially the company’s value that belongs to its shareholders

Net assets:

Represents the value of the company, but that doesn't mean the money is automatically given away. It simply shows the company’s worth after subtracting its liabilities. Shareholders own a portion of this value, but that doesn't mean the company hands over the money. Instead, the value of the company is reflected in things like stock price and dividends (if paid), but it's not cash directly distributed to shareholders unless the company decides to do so.

In short, net assets represent the equity shareholders hold in the company, but it’s not a direct payout. It’s just the value or worth of the company that could be realized in various ways.

They show what the company is actually worth after subtracting its liabilities from its total assets. It's essentially the company’s value that belongs to its shareholders.