2.1 Measures of economic performance

1/169

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

170 Terms

MEPO meaning

Macroeconomic performance objectives

Main MEPOs for the UK government

Steady and sustainable economic growth

Low and stable inflation

Low unemployment

balance of payments

Equation for index number

Index number = (value in year X / value in base year) x 100

Percentage change for indices

Percentage change = ((N- O) / O ) x 100 = change in index number / original index number x 100

Equation for Real GDP

Real GDP = nominal GDP / price level x 100

(Real) GDP

Total value of goods and services produced in the economy

Nominal GDP

Money value of goods and services produced in the economy

Real GDP growth

Increase in the volume of goods and services produced, taking inflation into account

Nominal GDP growth

Increase in money value of goods and services produced in the economy

Actual growth on a PPF

Movement from a point within the PPF to a new point nearer the PPF

Potential growth on a PPF

Outward shift of the PPF

Short run economic growth

Increase in an economy’s real GDP

Axis on a PPF in macro

Y axis- capital gods

X axis- consumer goods

What does GDP not take into account

-equality

-happiness

-environment

-population

Other methods of measuring happiness

GNI (includes income, important for developing countries

HDI (included GDP per capita, mean years of schooling, life expectancy)

Ease of living index

Defenition of economic wellbeing

Standard of living and quality of life of individuals or societies, including income, employment, housing, health, and access to services

Defenition of subjective happiness

Self- reported measure of how individuals perceive their overall happiness and satisfaction with life, influenced by personal and economic facotrs

Importance of economic wellbeing

Indicates quality of life

Influence policy decisions

Derived economic growth

Reduces poverty and inequality

Importance of subjective happiness

Reflects overall life satisfaction

Guides public policy

Improves health outcomes

Enhances social cohesion

Easterlin paradox

As income increases, happiness increase, up to a certain point

PPP

Purchasing power parity

Purchasing power parity

A measure of the price of specific goods in different countries

Makes the purchasing power of one country equal to that of a different country with a different currency

Why is it useful

-makes it easier to make inter-country comparisons

-can gain in sighting into standard of living in different countries

Example of a way of measuring PPP

Big Mac index

What is a form of data that economist adjust to PPP

GDP

Governments target for unemployment

2-3% of people to be unemployed

Define unemployment

When someone of a working age who is willing, able, and actively seeking to work is unable to find a job

Who is not included in unemployment rate

-retired

-under 16

-incapactited

Why does the government want to achieve full employments

-increases tax revenue

-increase growth

-decreases mental health issues

-decreases welfare spending

Does full employment mean 0% unemployment

No, due to frictional unemployment

Where is full employment on a PPF graph

A point on the PPC

Why is labour derived demand

The demand for goods and services has a derived demand for labour

Two methods of measuring unemployment

-rate of unemployment

-level of unemployment

Rate of unemployment

Proportion of labour force out of work (labour force survey method)

Level of unemployment

Number of people willing and able to work unable to find a job (claimant count method)

Labour force survey method

40,000 people are randomly surveyed in the UK and asked about their employment status

LFS pros

More accurate than claimant count method

International standard, and easier to make inter-country comparisons

Cons of LFS method

-expensive

-sampling issues

-may be less up to date than claimant count

Claimant count method

Measure number of people claiming unemployment benefits

Pros of claimant count method

-easy to collect data

-up to date

Cons of claimant count method

-only measures this claiming specific unemployment benefits, but many unemployed people are eligible

-groups like under 18s, and those living with a partner aren’t eligible

-some people don’t claim due to stigma

Would LFS or claimant count usually be higher

LFS

Types of unemployment

-structural

-cyclical/ demand deficiency

-seasonal

-frictional

-long term

-real wage / classical

Defenition of structural unemployment

Long lasting unemployment that comes about due to shifts in an economy

Example of structural

UK steel industry- Chinese steel is cheaper so is used instead

Defenition of cyclical/ demand deficient unemployment

Unemployment due to changes in the economic cycle like a recession, as there is lower demand so less derived demand for labour

Example of cyclical unemployment

An automobile worker laid of in a recession

Defenition of seasonal unemployment

When people are unemployed at certain points of the year when demand is low for the product or service they sell

Example of seasonal unemployment

A ski instructor will be in low demand in summer

Defenition of frictional unemployment

Unemployment that occurs when people are moving from one job to another, which is not necessary in small amounts

Example of frictional unemployment

University graduate looking for a job

Defenition of real wage/ classical

Effect of a sustained increase in real wages above the free market equilibrium wage rate, resulting in excess supply of labour, therefore unemployment

Example of classical unemployment

Minimum wage sometimes

What factors might affect the length of frictional unemployment

Job websites, like LinkedIn

Factors affecting structural unemployment

Geographical immobility

Immobility of labour

Multiplier effect for structural unemployment

Negative multiplier effect

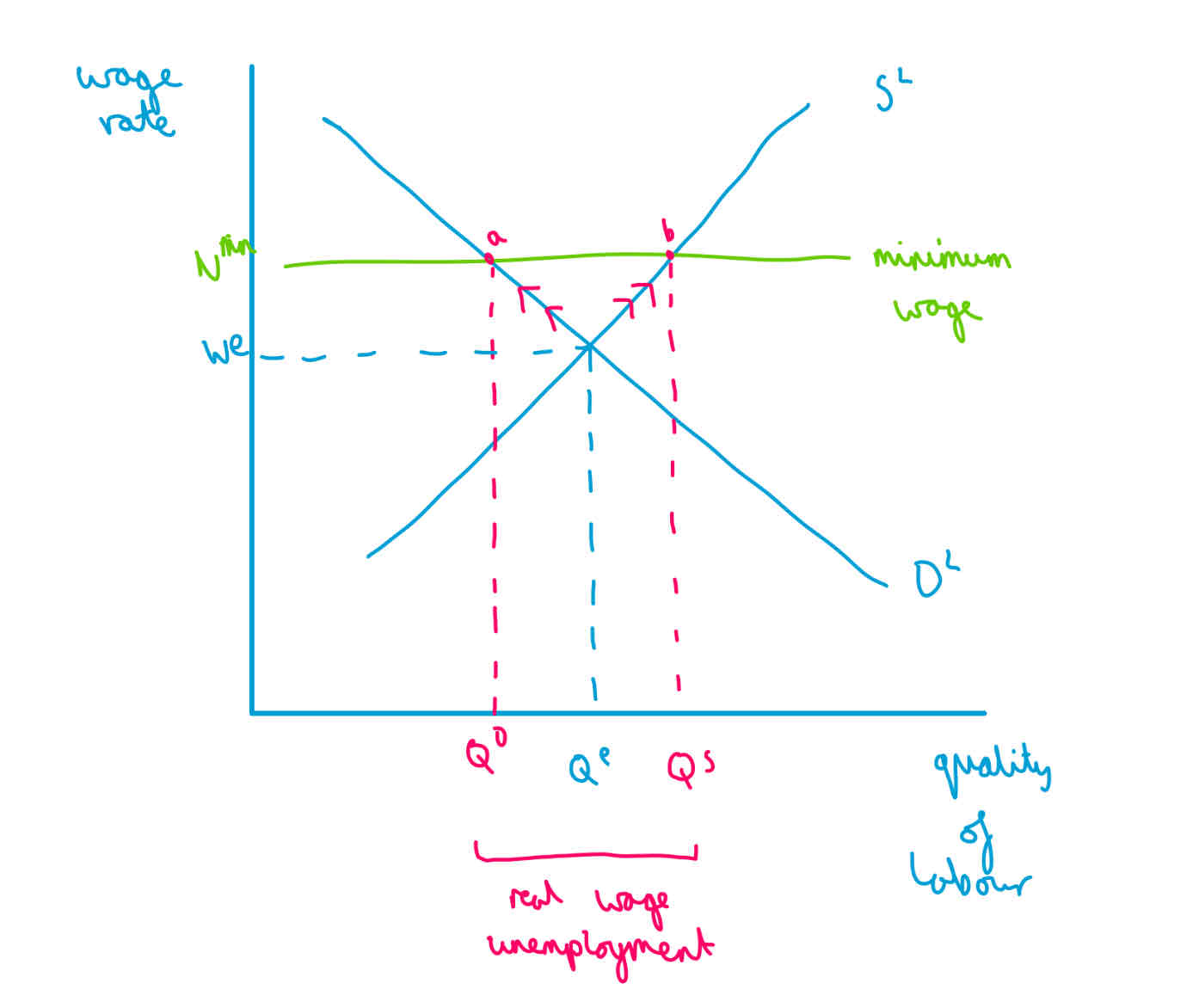

Diagram of real wage unemployment

Consequences of unemployment for individuals

-loss of income

-fall in living standards

-increased health risks: stress, reduction in quality of diet, social exclusion

-loss of marketable skills : hysteresis

Negative consequences of unemployment for firms

-fall in demand for goods and services

-fall in derived demand

-negative multiplier effects

Positive consequences of unemployment for firms

-larger pools of available workers

-less pressure for higher wages

-less risk of unionisation, strikes

Consequences of unemployment for the government

-increased spending on benefits

-fall in tax revenue

Consequences of unemployment for the economy

-lost output, decrease in GDP

-labour market failure, inefficient way of allocating resources

-increase in inequality

-fall in potential GDP due to long term unemployment

Impact of falling unemployment on GDP

-income for households will increase

-demand for goods and services will increase

-positive multiplier effect

Impact of falling unemployment on BoPs

-increase in demand for imports

-trade balance in goods and services will worsen

-growth in AD is reduced

Impact of falling unemployment on Government finances

-increase in tax revenue

-reduction in welfare payments

Impact of falling unemployment on Inflation

-demand pull inflation, as demand increases

-cost push inflation as the economy nears its full potential, however this is not a risk coming out of a recession

Unemployment rate formula

unemployed workers/ economically active population x 100

define inflation

a sustained increase in the general price level of an economy over a period of time

define deflation

negative inflation

disinflation

when the rate of inflation decreases but remains positive

how does inflation impact purchasing power

decrease in purchasing power

how does deflation impact purchasing power

increases purchasing power, but can discourage spending and investment

how does disinflation affect prices

prices are still rising but at a slower rate than before

how is inflation measured in the UK

CPI index: basket of goods, weighted, surveying prices, calculating the index

basket of goods

7000 households are surveyed to find the 650 most popular goods, and % of income spent on them, by the ONS

results represent a ‘basket of goods’ showing typical household consumption

weighting

goods are weighted according to amount of income spent on the item

surveying prices

the ONS conducts a price survey to find average prices of the goods

calculating CPI

uses the weights to calculate a weighted average

what does CPI not include

morgages

alternative to CPI

RPI

RPI

retail price index

what is RPI

CPI but with mortgage payments

which is more commonly used

CPI

which gives a higher rate of inflation

RPI

limitations of CPI

substitution bias

quality changes

substitution bias

CPI assumes constant consumption patterns whereas consumers often adjust purchases in response to changing prices

quality changes

CPI might not adequately account for quality improvement in goods or services over time and may overestimate price increases

BoEs target for inflation

2% ± 1%

two types of inflation

cost push

demand pull

cost push inflation

when an increase in the costs of factors of production means that firms must raise their prices in order to protect profit margins

causes of cost push

wage rises

increase in cost of raw materials

rise in indirect taxes

wage rises

-unions and strikes demand higher wages

-increase in minimum wage

increase in cost of raw materials

-supply shocks such as higher energy and food prices, which impacts businesses

rise in indirect taxes

taxes on goods and spending: VAT, sugar tax, cigarette duty, alcohol duty, fuel duty, ULEZ

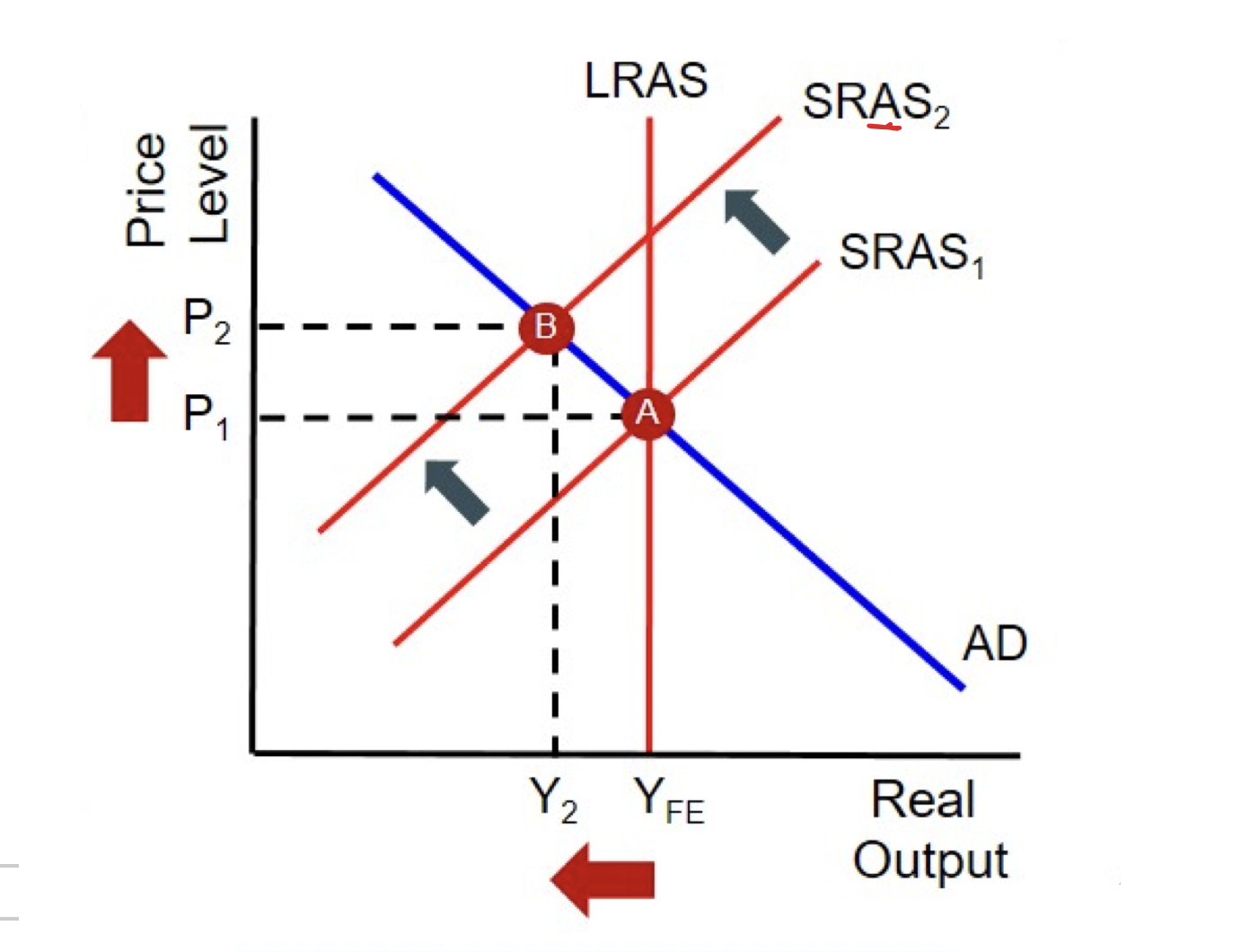

cost push inflation on a diagram

demand pull inflation

when total demand for goods and services grows rapidly and outstrips total supply, thus causing prices across the economy to be bid up

causes of demand pull

high levels of consumption

more demand for UK exports

rapidly growing money supply relative to output

bottleneck shortages

high levels of consumption

-high wages, high real income

-low interest rates, people borrow and spend more

-high confidence in the economy, spending more and not saving

more demand for UK exports

quality of British goods increases

depreciation of currency, so British goods are more price competitive

rapidly growing money supply relative to output

quantitative easing