Chapter 18: Reports on Audited Financial Statements

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

17 Terms

what are critical audit matters

matters arising from the audit of the f/s that are communicated to the audit committee

1. relate to accounts or disclosures that are material to the financial statements

2. involved, especially challenging, subjective, or complex auditor judgment

what are the 8 elements of a report

This report contains eight elements:

1. The report title

2. The addressee

3. The “Opinion” section

4. The “Basis for Opinion” section

5. The “Critical Audit Matters” section

6. The name/signature of the audit firm

7. An indication of how long the auditor has served as the company’s auditor

8. The audit report location and date

what is the private company version of a unqualified report

ummodified report

The standard audit report uses a template or boilerplate. What are some advantages and disadvantages of using this approach in writing the audit report?

Advantages

faster and easier

more structured

quicker for readers

Disadvantages

lack of flexability

not as informative

what is explanatory language

delete

list of adjustment to a standard unqualified unmoidified report (5)

going concern

reference to report on audit of ICFR

opinion based in part on the report of another auditor

lack of consistenct

additional emphasis

if a auditor express an opinion without referring to the work of other auditor in a auditor report, who is responsable

the auditor accepts full responsiblity for the work of the other auditors

if the principal auditor reference other auditor, who is responsable

the principal auditor is sharing responsiblity with other auditor s

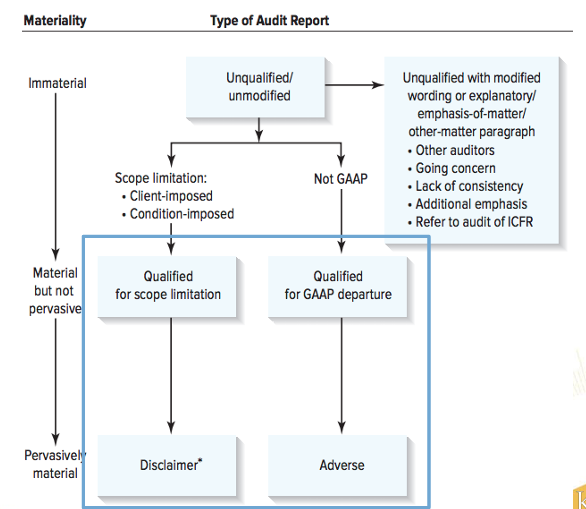

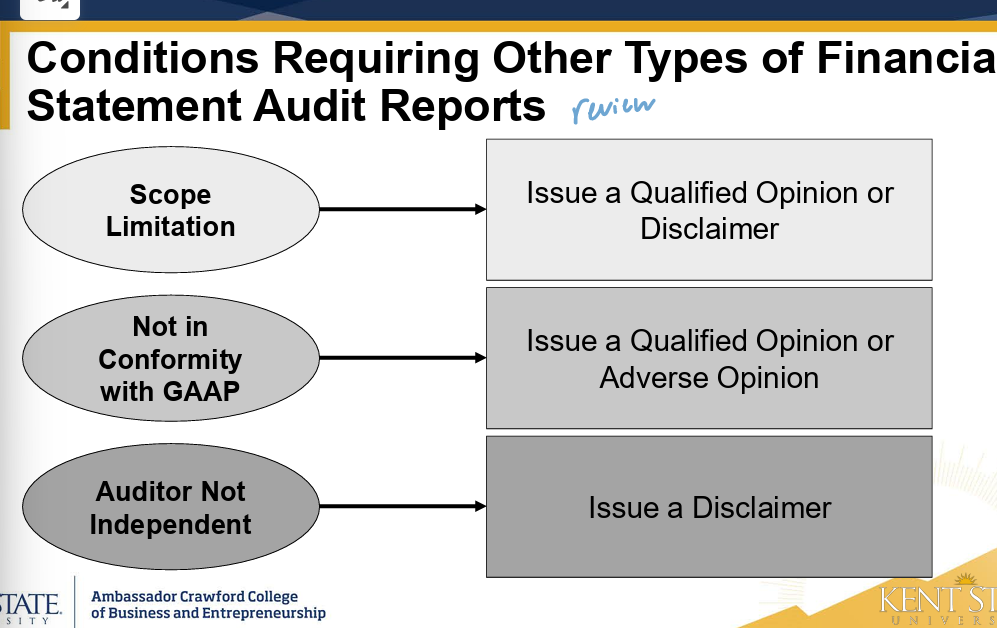

what is scope limitation

not able to collect sufficient appropriate evidence

what is a qualfied opinion

limited and f/s are fine by this part

what is a adverse opinion?

doesn’t follow GAAP

what is a disclaimer

no opinion

what does pervasive effect on materiality mean

affect other parts

if limited, make up a big part of the f/s

need discousure

Audit reports are like pass/fail grades (Unqualified opinion = “pass”; Qualified/adverse opinions = “fail”). Imagine auditors assigned letter grades (A, B, C, D, or E) to a company’s financial reporting instead. Would this be better or worse?

Better

better idea of how business are doing

more informative

Worse

less black and white

misleading

more challenging

shop around for companies that gave easy A

In which of the following circumstances would an auditor usually choose between issuing a qualified opinion or a disclaimer of opinion on a client’s financial statements?

A. Departure from generally accepted accounting principles

B. Inadequate disclosure of accounting policies

C. Inability of the auditor to obtain sufficient appropriate evidence

D. Unreasonable justification for a change in accounting principle

C