CFP - Investment

1/32

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

33 Terms

correlation coefficient

-1 to 1+

1+ = perfect correlation

0 = no correlation

-1 = perfect negative correlation

margin call

purchase price x (1-initial margin/1-maint. Margin)

strong form

all information

semi strong form

all public information is reflected in current prices. insider information will help

weak form

only past information is reflected in current prices. fundamental and insider information can help

standard deviation

- 68 - 34

- 95 - 13.5

- 99 - 2

in the money, at the money, out of the money

in = exercise < common stock price

at = exercise = common stock price

out = exercise > common stock price

intrinsic value

stock price - current price

Beta

captures systematic risk

Pim = Correlation coefficient

Covariance

How investment move in relation to each other

Pij x Oi x Oj

Pij = Correlation Coefficient

Oi = std dev investment 1

Oj = std dev investment 2

Required rate of return

(D1 / P) + G

D1 = dividend payment

P = market price

G = Dividend Growth Rate

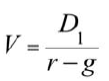

Dividend Growth Model

answer = intrinsic value

compare answer to current market price

V = D1 / (r-g)

D1 = Dividend payment

r = required rate

g = Dividend Growth Rate if multiple, calculate for final year then use formula

Sharpe Ratio

Measures return per unit of total risk. compare two funds to see what one give best return for risk

= Rp-Rf / Op

Rp = portfolio return

Rf = Risk Free

Op = Std dev

Treynor Ratio

Measures return per unit of systematic risk.

Compare fund to market

Current Yield

Annual Interest / Current Market Price

Yield to Call

interest rates fall, will be called

FV = 1 x call %

PV = -1000

PMT = /2

N = x2

yield to maturity

2x /2

FV = 1

Holding period return

return from time you owned it

(end value - beg value +/- cash flow) / beg investment

Security Market Line

shows a security's EXPECTED return as a function of its systematic risk. defined by CAPM

above - undervalued

lower - overvalued

Expected Return

(%1 x %2) + (%1 x %2)

%1 = probability %

%2 = return %

long hedge

transaction where the asset is not currently held but futures are purchased to lock in current prices.

short hedge

transaction involving the sale of futures while holding the asset

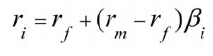

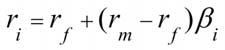

Capital asset Pricing Model

rf + (rm-rf)b

rf = risk free

rm = market return

b = beta

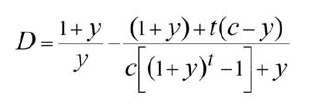

duration

y= yield

c = coupon rate

t = periods till maturity

capitalization approach

earnings / cap rate

alpha

positive means manager outperformed market on risk adjusted basis

indicates how much the realized return differs from the required return

arbitrage pricing theory (APT)

a stock's price depends upon variables other than the market return and the volatility of returns of the stock.

time weighted return

best for evaluating a portfolio managers performance

indifference curve

higher the curve more satisfied the investor

depict investors preference for risk and return

Averse = concave

serial bonds

Series of maturity dates = multiple maturity dates

Typically municipalities

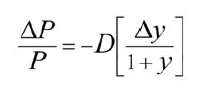

% change in bond price

-duration x change in yield/ (1 + current yield)

capital asset pricing model

expected rate of return

change in bond price (formula)

Delta = Change