Econ Diagrams / gvt policies / eval.

1/54

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

55 Terms

Absolute advantage

can produce a good with fewer resources, countries should specialize

Comparative Advantage

a country can produce a good with lower opportunity cost

Limitations of theory:

unrealistic assumptions (free trade, fixed fop, full employment, perfect comp, no transport costs)

risk of excessive specialization

inability of developing countries to diversify manufacturing

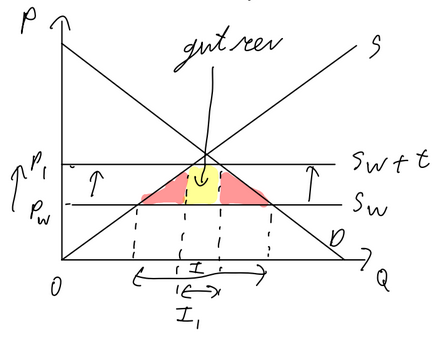

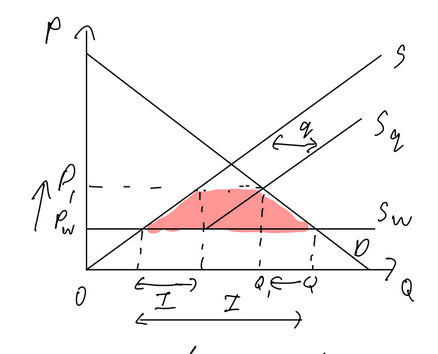

Import Tariff

Pros:

domestic producers gain revenue

workers gain as domestic production increases

gvt revenue

Cons:

price goes up

wellfare loss

imported goods more expensive, domestic productions more expensive

loss of export competitiveness as production price increases

foreign producers lose

global economy lose

risk of retaliation

potential corruption

Import Quota

Pros:

domestic producers gain revenue

workers gain as domestic production increases

Cons:

price goes up

wellfare loss

imported goods more expensive, domestic productions more expensive

loss of export competitiveness as production price increases

foreign producers lose

global economy lose

risk of retaliation

potential corruption

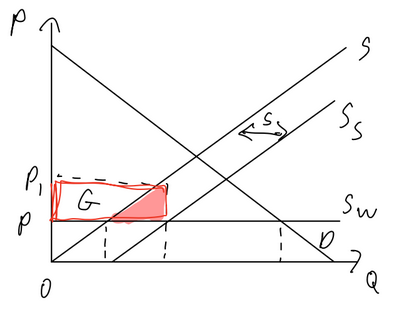

Subsidy (global)

Pros:

domestic producers gain revenue

workers gain as domestic production increases

Cons:

gvt debt

wellfare loss

imported goods more expensive, domestic productions more expensive

loss of export competitiveness as production price increases

foreign producers lose

global economy lose

risk of retaliation

potential corruption

Trade protection

Pros

protect infant industries

diversification of developing countries

national security

health, safety, env. standards

gvt revenue

overcoming trade deficit

anti-dumping

protect domestic jobs

cons

difficult to select what industry to protect

can be used to “protect’ unrelated industries

when relying on tariffs for gvt rev. probabluy means theres a problem w the tax system

retaliation is possible

hard to prove dumping

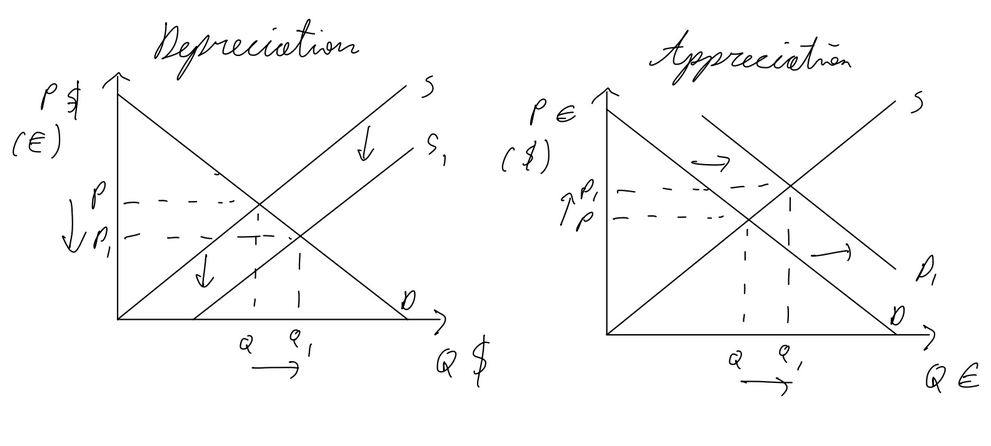

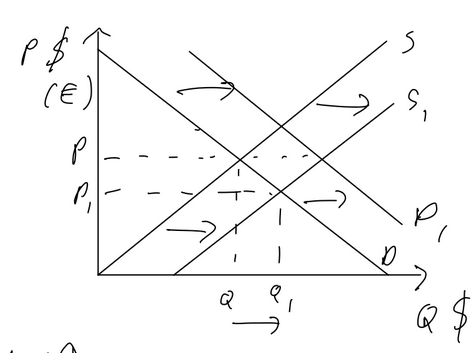

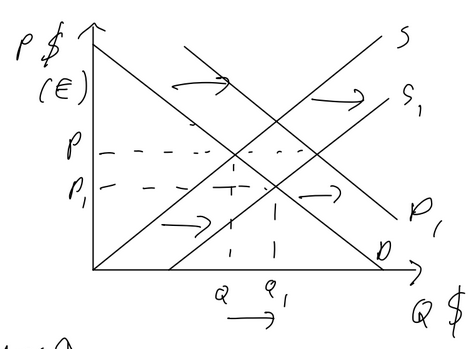

Freely Floating Exchange Rate

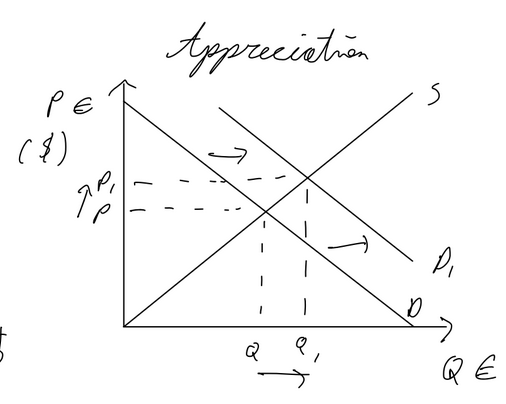

Appreciation: occurs with excess demand. if Americans buy euros w dollars, the demand for euros increases, appreciating the currency

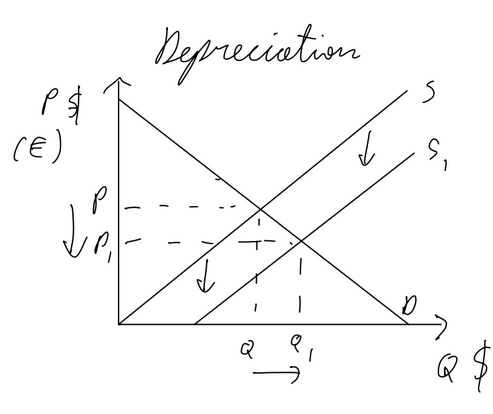

Deppreciation: osccurs with excess supply. the americans buying euros means theyre selling dollars, increasing supply of dollars, leading to depreciation

pros:

allows for greater flexibilty in monetary policies

allows for automatic adjustments to external shocks

Fixed Exchange Rate

fixed at partiy: 1 to 1 ratio, usually doesn’t happen

Appreciation: CB buys it on forex market to increase demand

deppreciation: CB sells it on forex, increase supply

revaluation: change where the exchange rate is fixed to higher price

devaluation: change where the exchange rate is fixed to lower price

pros:

provides stability and predictability

lowers speculative trading and currency volatility

cons:

limits a country’s ability to conduct monetary policies as focus is on exhcange rate and not interest rate

Managed Exchange Rate

allowed to fluctuatie within a specific band, CB intervenes when exchange rate leaves band

Appreciation: CB buys it on forex market to increase demand

deppreciation: CB sells it on forex, increase supply

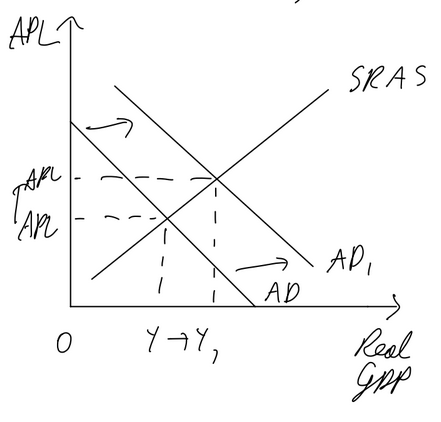

Consequences of curency depreciation

imports are more expensive, exports are cheaper. therefore net exports increase, shifting AD right

cose push inflation as imported raw materials are more expensive

demand pull inflation as AD increases

unemployment falls as exports increase

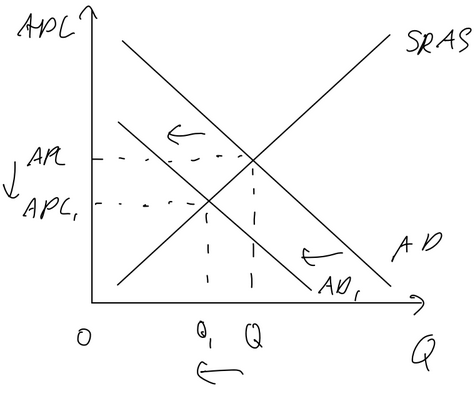

Consequences of currency appreciation

imports are cheaper, exports are more expensive. net exports decrease, AD shifts left

cost push deflation as imported raw materials are cheaper

demand pull deflation as net exports fall

unemployment may increase as less is exported

impact of currenccy depreciation on current account

depreciation → net exports increase → current account balance improves

the extent to which depends on Marshall-Lerner condition

impact of currency appreciation on current account

appreciation → net exports decrease → current account balance worsens

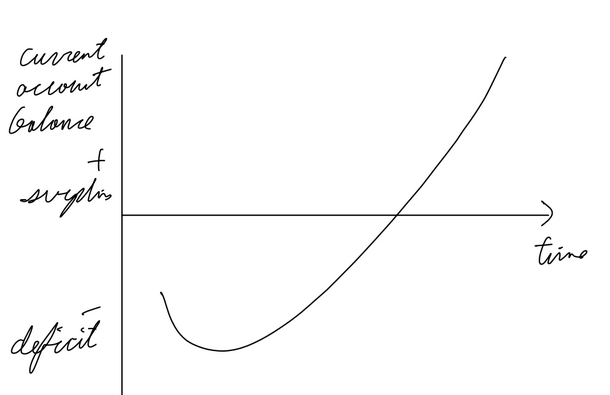

Marshall-Lerner condition / J-Curve

ML condition: extent to which a currency depreciation improves the current account balance, PED imports + PED exports > 1

Time lag between depreciation of a currency and an improvement in current account balance explained by J curve.

If a country’s currency depreciates, its good will become cheaper for other countries. However, it will take time before the other countries switch to that country’s goods as they aren’t sure whether the exchange rate my return in the short run

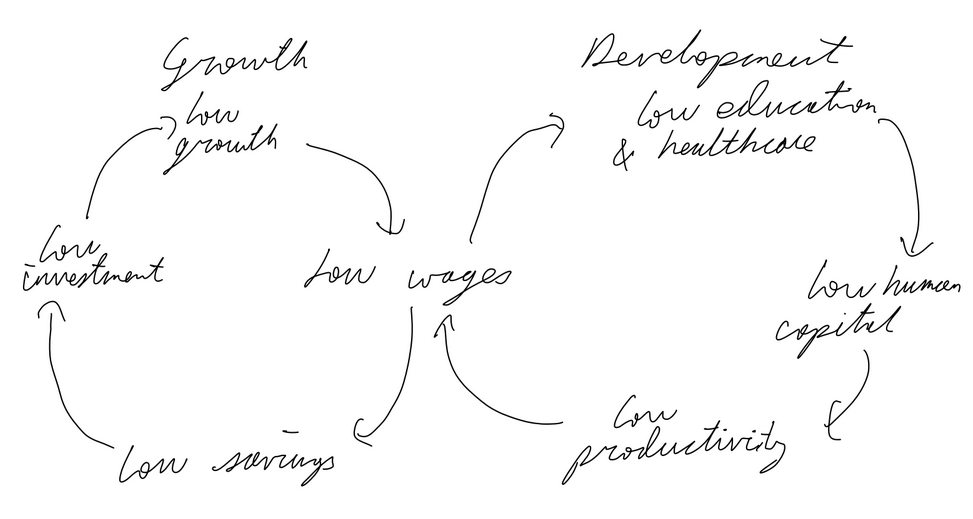

Poverty Cycle

A situation where poverty tends to perpetuate itself from one generation to the next.

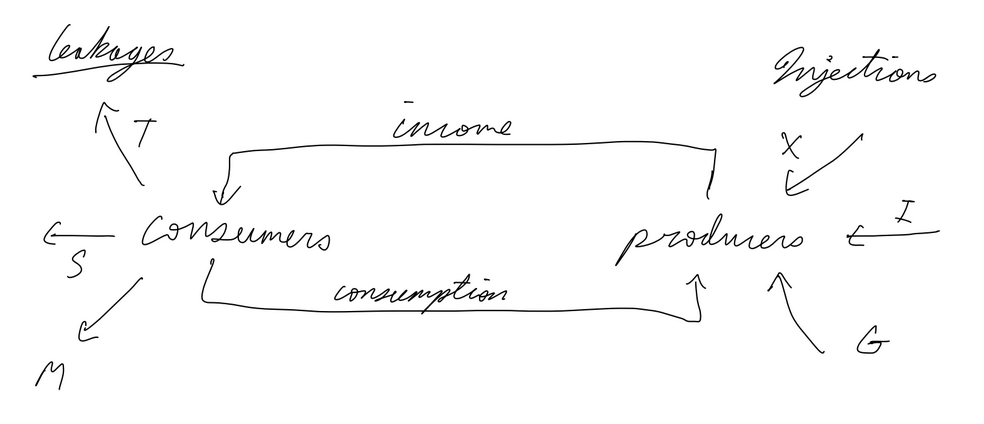

Circular Flow Model

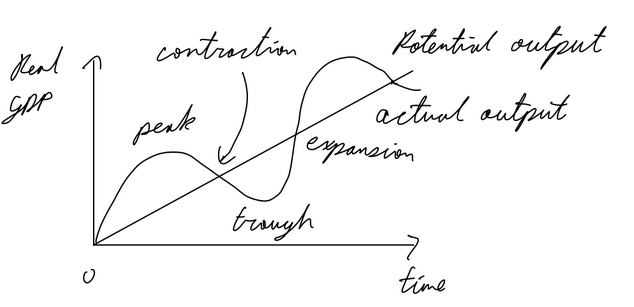

Business Cycle

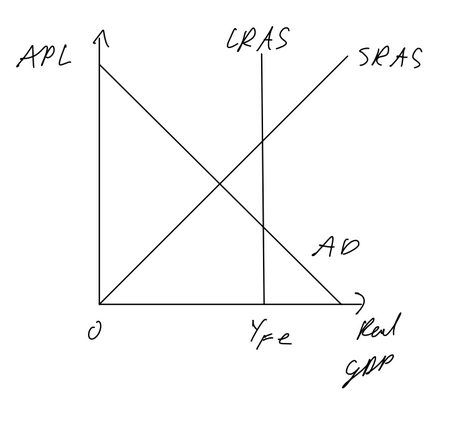

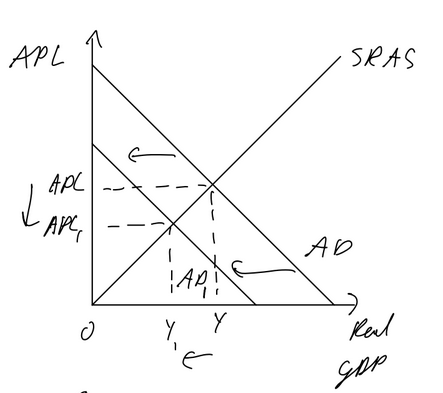

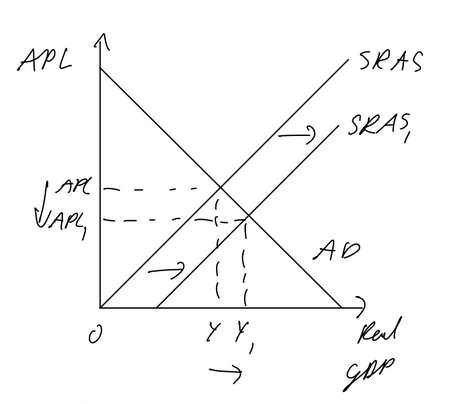

Monetarist AD AS SR

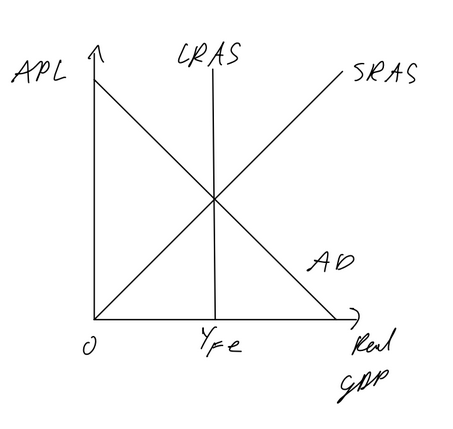

Monetarist AD AS LR

Deflationary gap SR: originally output = yfe, AD decreases, SRAS will increase in LR as prices of wages and resources will also fall bringing output back to yfe

Inflationary gap SR: orignally output = yfe, AD increases, SRAS will decrease in LR as prices of wages and resources increase, bringing output back to yfe

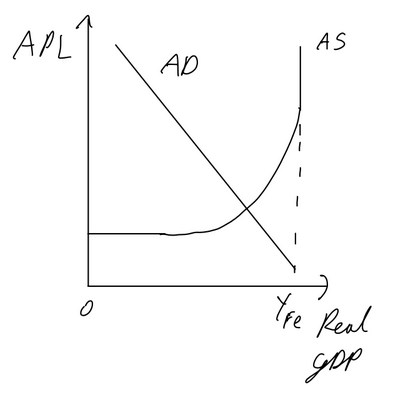

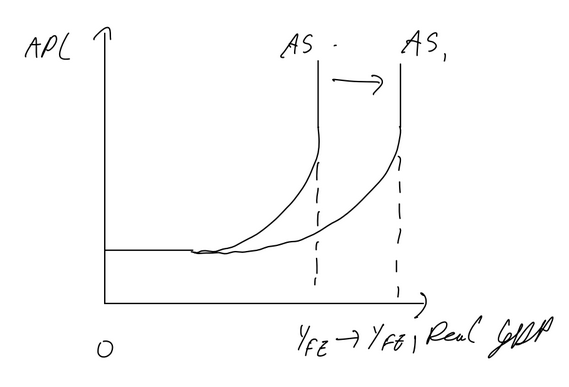

Keynesian AD AS

Assumption:

stickey wages (due to contracts, minimum wages, etc, APL can only fall to a certain extent, therefore APL reaches minimum at horizontal

at low output, spare capacity of the economy is high so firms can increase output without upward pressure on FOP prices, APL won’t change

vertical section exists as AS can’t go past potential output (all resources are used efficiently)

Keynseian AD AS potential growth

Caused by:

increases in quantity of FOP

improvement in quality of FOP

improvement in tech

reduction in natural rate of unemployment

improvement in efficiency

Malign (bad) deflation

Deflation due to fall in AD

as APL falls, consumers and firms avoid spending as they wait for cheaper prices

leads to cycle: APL falls, less spending, AD falls, etc

Benign (good) deflation

Deflation due to increase in AS

doesn’t lead to same cycle as Malign deflation

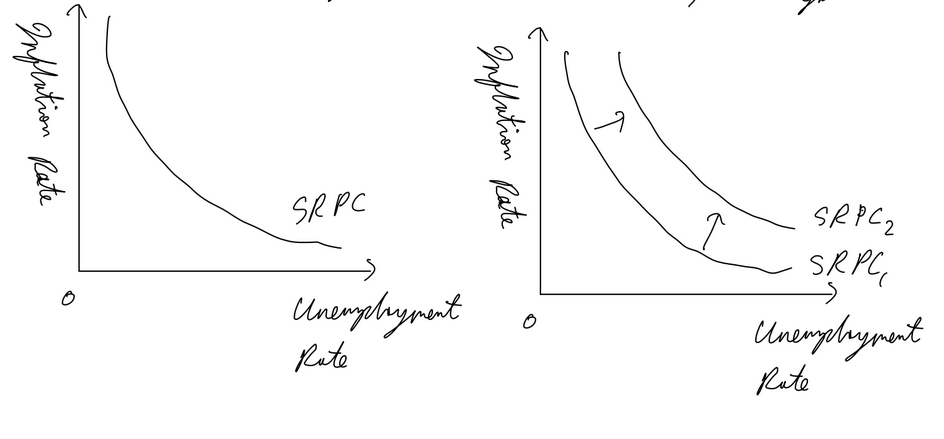

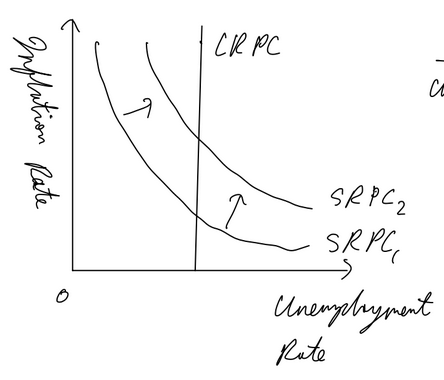

Phillips Curve SR

shows inverse relationship between inflation and unemployment

SR PC assumes fixed SRAS, only movement along

when SRAS decreases, SRPC shifts out (inflation increases and output falls

Phillips Curve LR

as wages and FOP prices change w APL in long run, no trade off exists in LR

LRPC is vertical (in the long run, unemployment rate is independent to APL as monetarist assumes in LR output is alwasy yfe)

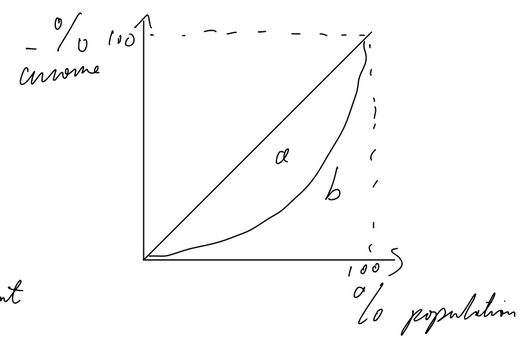

Lorenz Curve

Representation of income distribution

diagonal represents perfect income inequality

curve is Lorenz Curve

Gini coefficient = a/(a+b)

GC = 0 → perfect equality, vice versa

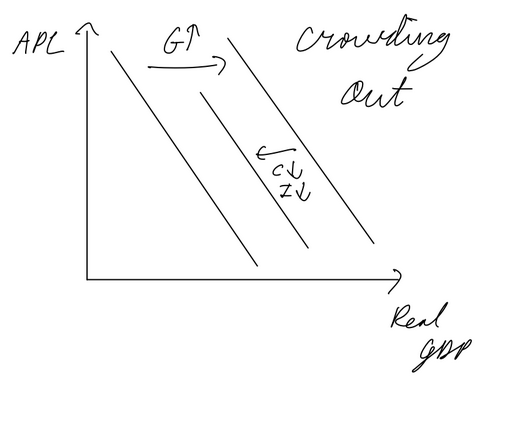

Expansionary/contractionary fiscal policy

By gvt to decrease deflationary/inflationary gap

increase/decrease gvt. spending

reduce/increase taxes

Pros:

targets specific sectors

pulls economy out of deep recession

can impact potential output (if gvt spending done right)

gvt spending guaranteed impact on AD

Cons:

major time lag

political constraints

inflationary

budget deficit

crowding out (gvt must borrow to pay for increase in spending, leads to lower investment and consumption as cost of borrowing increases, cancels out AD increase partially)

expansionary/contractionary Monetary Policy

Done by CB in order to close deflationary/inflationary gap

decrease/increase in interest rate

pros

no political constraints (CB is independant)

interest rates can be adjested incrementaly (bit by bit)

quicker to implement

no budget deficit

no crowding out

Cons:

time lags (not as bad as fiscal policy)

may not be enough in a deep recession

inflationary

cost push inflation

Interventionist supply side policies

gvt intervention to increase LRAS

Done by:

investing in human capital

investing infrastructure

investment in new tech

industrial policies (tax breaks, low interest loans, subsidies to specific industries)

Pro:

provide direct support to areas important for growth

create new jobs and reduce structural unemployment

downwards pressure on inflation (monetarist, same AD curve w higher LRAS curve has lower APL)

economic growth and potential growth

improved equity if investments in human capital are broad

Cons:

long time lag

government spending opp. cost

budget deficit

gvt. has imperfect info. (may support wrong industry)

Market based supply side policy

institutional changes in economy to develop free, competitive markets and their efficiency

done by:

Encouraging competition:

privitization (give company control from gvt. to private owners. as they profit maximzie, efficiency increases)

anti monopoly (increase competition and efficiency)

deregulation (stop protecting firms from competition, let inefficient firms go bankrups)

trade liberalization (foreign competition, domestic firms incentivized to improve efficiency)

Labour market reforms:

reduce labour union power (wages drop, more employment, structural unemployment falls, potential output increases)

abolish/reduce minimum wage (lower labour costs, potential output increases)

reduce unemployment benefit (people want to work more, potential output increases)

reduce job security

Incentive related policies:

cuts in personal income taxes (more income, want to work more)

cuts in business taxes (firms have more profit to invest)

cuts in taxes on capital gains (taxes on profits decreases, people mroe likely to save. more funds for banks to invest in firms, R&D)

Pros:

improved efficiency in production

improved allocation of resources as resources are used better

creation of new jobs

improvement in product quality

downward pressure on inflation as LRAS increases)

economic growth

Cons:

Competition:

privitization leads to higher prices, lower output, increased unemployment

deregulation leads to increased unemployment

trade liberalization lilkey to cause short term losses as inefficient companies shut down

labour market reforms

lower social protection

lower wages, poverty worsens

Incentive related:

income tax cuts may not be enough as people j want to use profits to spend more time on vacation

business tax cuts may worsen equity

bigger budget deficit as taxes decrease

Automatic stabilizers

features in the economy that limit fluctuations in SR

progressive income taxes:

deflationary gap: as GDP and income falls, taxes fall by relatively less, leaving consumers w more income to spends → AD falls less

inflationary gap: as gdp and income increases, taxes rise faster when progressive, disposable taxes rise less, consumers spend less → AD increases less

Unemployment benefits

deflationary gap: as unemployment increases, gvt spending on unemployment benefits increases too, AD falls less as gvt spends on benefits

inflationary gap: as unemployment falls, gvt spending decreases, less gvt. spending means AD increases less

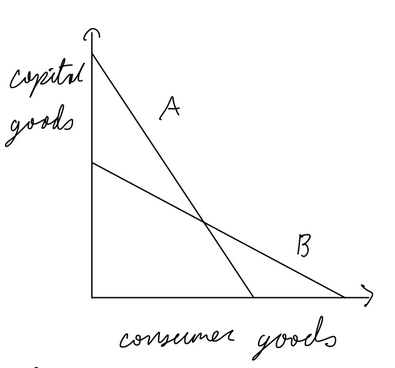

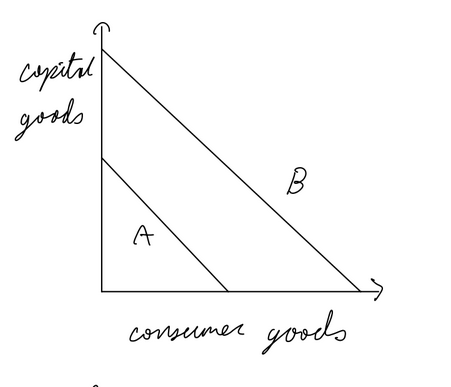

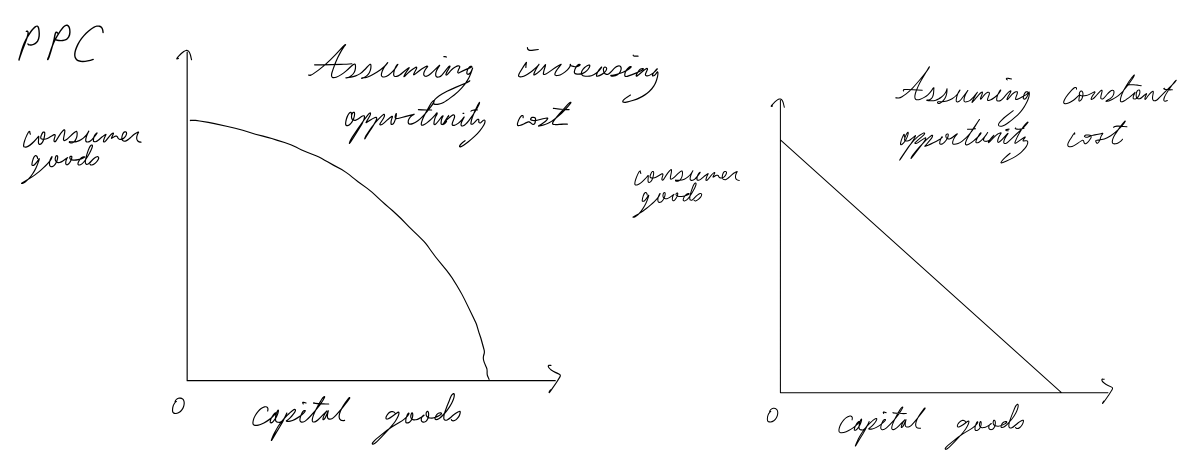

Production Possibilities Curve (PPC)

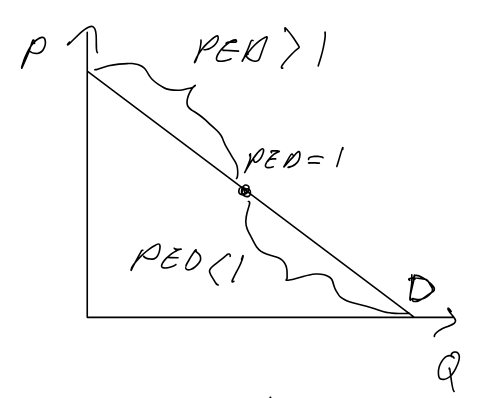

PED

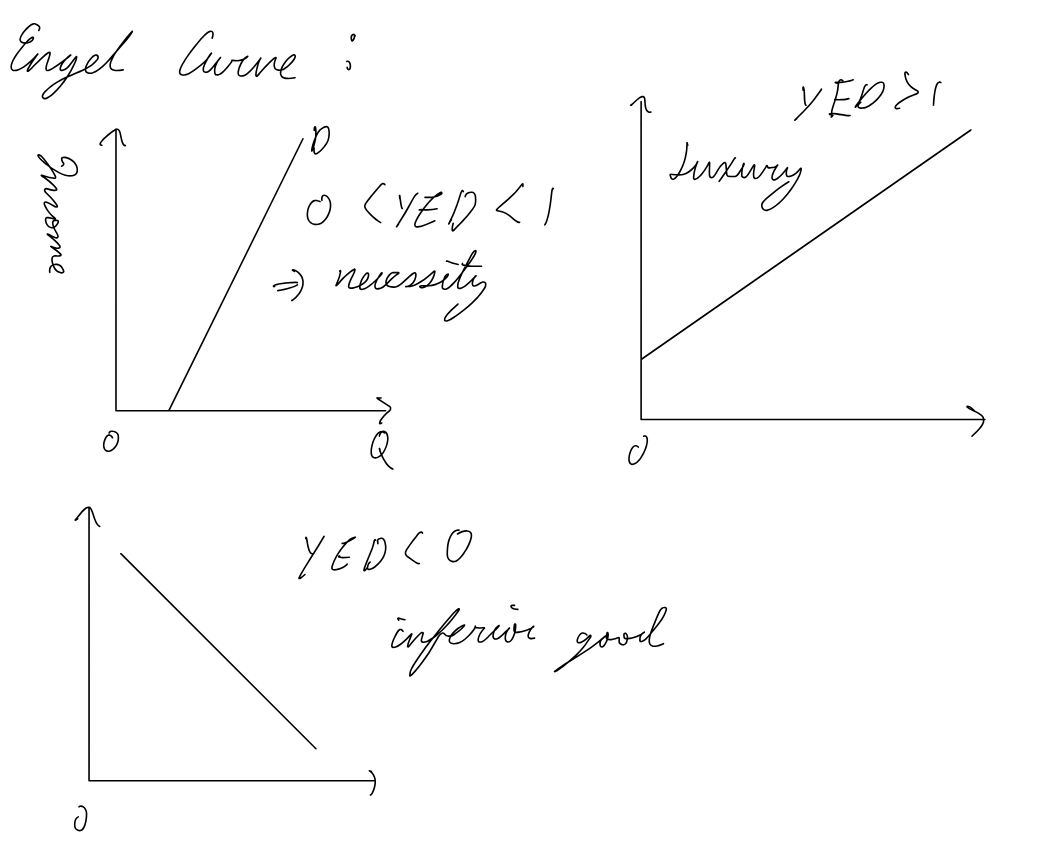

Engel Curve

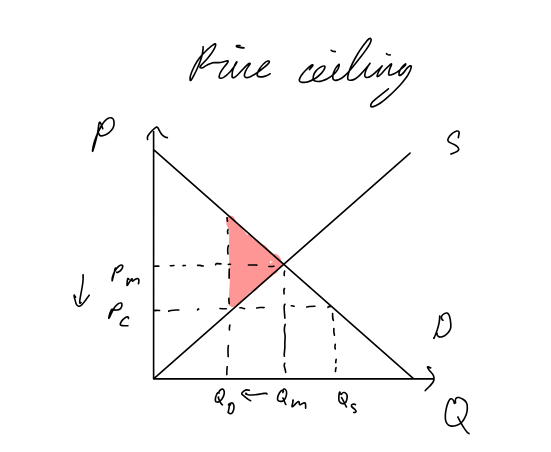

Price Ceiling (Maximum Price)

Pros:

makes necessities affordable for poor people

Cons:

shortages → first come first served, favoritism, parallel markets

inefficient resource allocation → welfare loss

fall in output may lead to unemployment

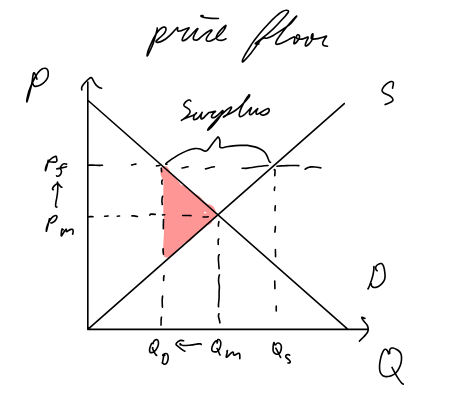

Price Floor (government buys surplus, protect industry eg. farmers)

Pros:

support farmers’ income (protection from sudden disturbances, natural disasters, drought, etc.)

increase in employment as Q increases

Cons:

Gvt spending increases

allows firms with high cost of production (inefficient) to produce → no incentive to become more efficient, r&d etc.

overallocation of resources → welfare loss

higher P for consumers

Price Floor (government doesn’t buy surplus, demerit good / wages)

pros:

protects low skilled workers with minimum wage

decreases incentive to consume demerit goods

cons:

Inefficient resource allocation (overallocation)

surplus, leads to unemployment

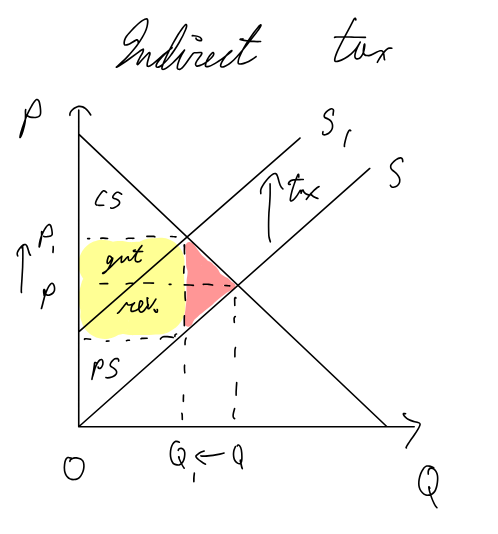

Indirect tax, specific Tax (set value) / pigouvian tax / carbon tax

Pros

can internalize the externality (firm/consumer responsible for third party costs also pays)

less costs than reg. / leg.

gvt. rev

for ext. of production: taxes on emissions and tradable permits are best as they give firms financial incentive to improve sustainability

for ext of consumption: price increase incentivizes consumers to consume less. if the good has price inelastic demand, gvt. rev will be high

Cons:

Taxes / tradable permits: hard to set a value on the external costs of production, therefore hard to set right tax amount to eliminate externality

For consumers: hard to measure value of external costs, therefore right tax amount

if the good has a price inelastic, Q might not decrease by a lot

indirect taxes are regressive (higher % of income for poorer households)

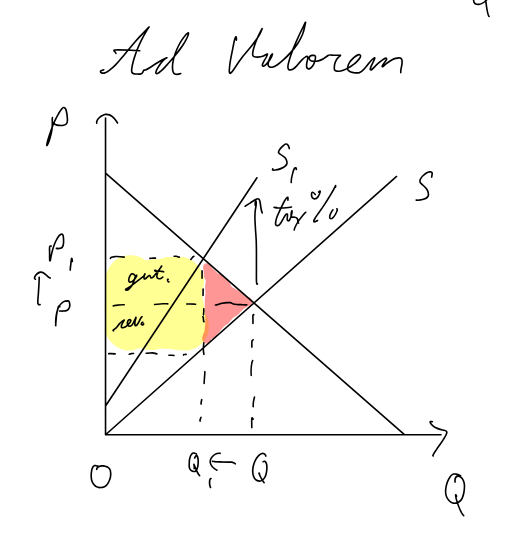

Ad valorem (percentage of P)

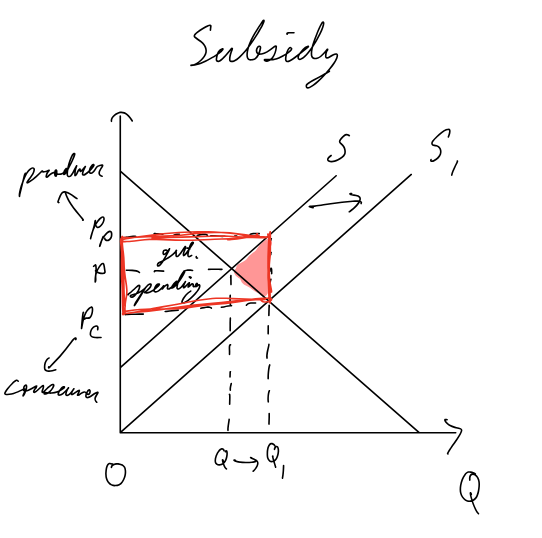

Subsidy

Pros:

effective in increasing R&D

effective in increasing Q

key in making important goods/services affordable to all (education, healthcare, etc.)

Cons:

hard to set right subsidy value

gvt spending

hard to decide what to subsidize (opp. cost), subject to political pressure

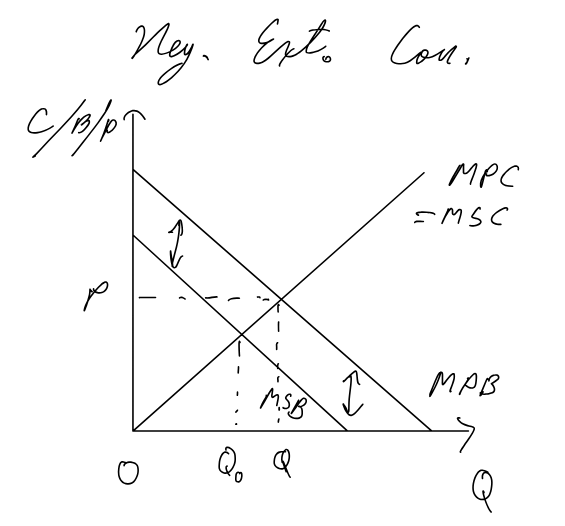

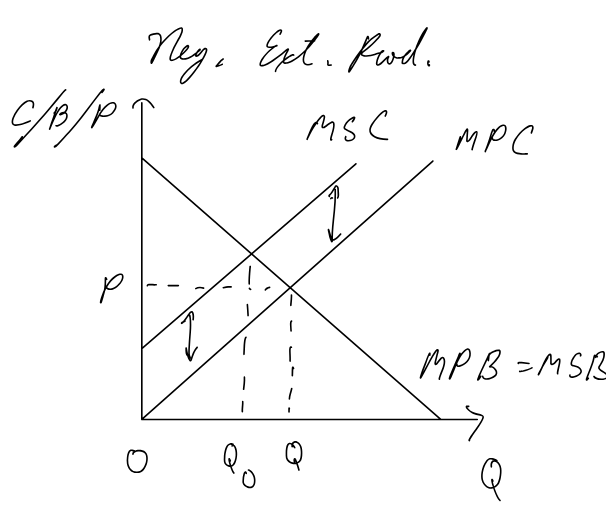

Negative Externalities of consumption

Negative Externalities of production

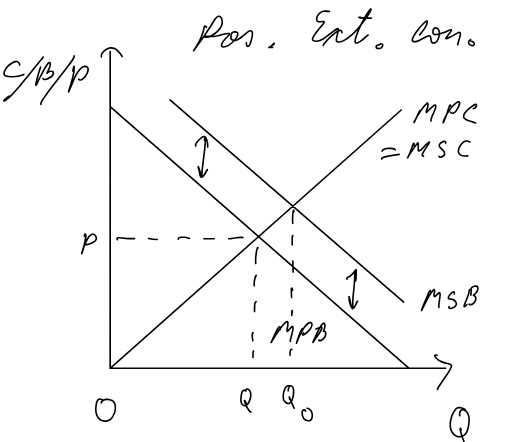

Positive Externalities of consumption

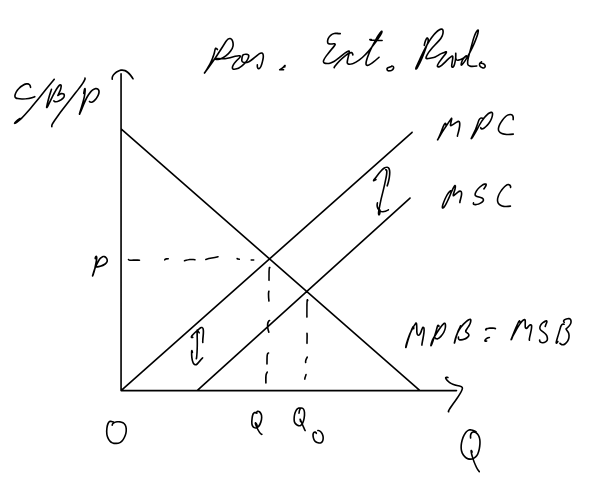

positive externalities of production

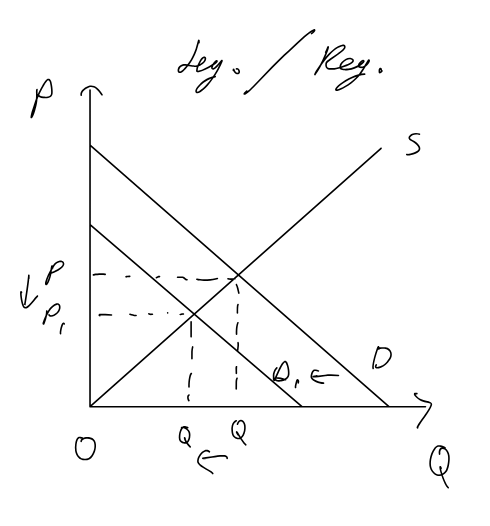

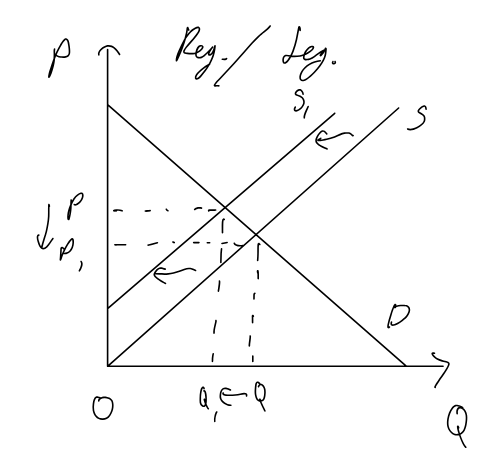

Regulations / legislation (consumer) / education against demerit goods

Pros:

simpole to implement

will atleast partially reduce demand for good

could be more appropriatie compared to market based (drinking age, etc.)

Cons:

probably won’t lower Q enough

funds required for advertizing and education

costs of enforcing rules

Regulations / legislation (producer)

Pros

simpler to implement

effective at least partially

can be more appropriate than market solutions

Cons

costs of monitoring and enforcement

are inefficient as all firms are treated the same

do not provide incentive for firms to improve

no way to know exactly how much production should be limited

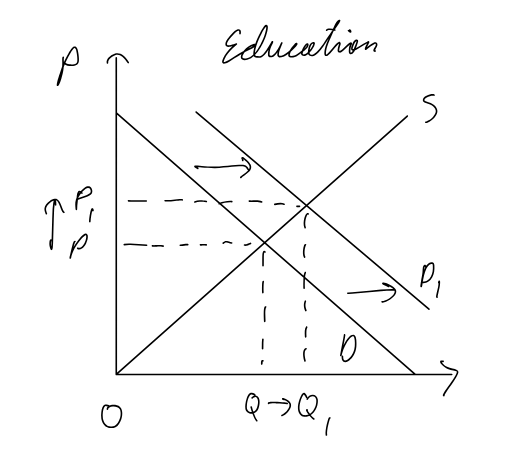

Education for merit goods

Pros:

simple to implement

effective in atleast partially increasing Q

Cons:

likely wont increase Q enough

costs for advertizing/education

hard to enforce

Higher D means higher P, could make goods unaffordable to low income households

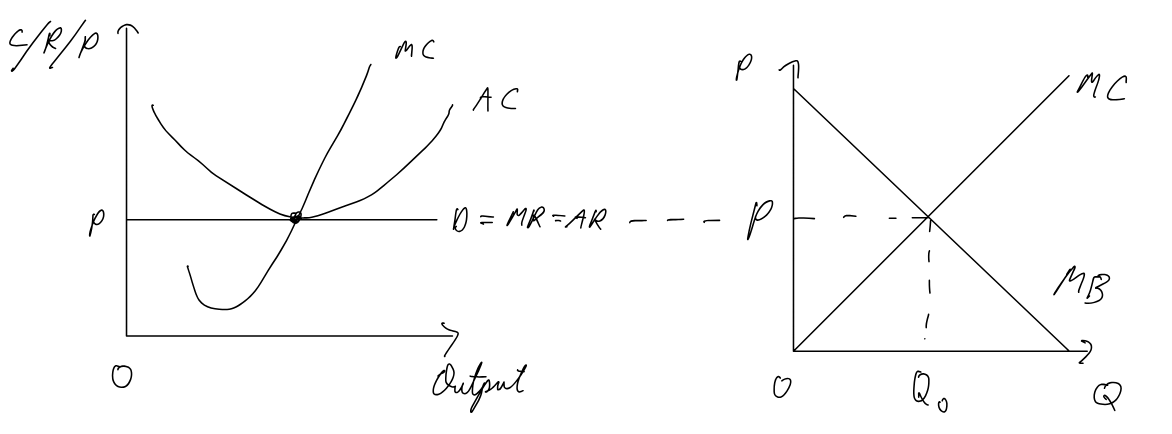

Perfect Competition

Assumptions:

many small firms

homogenous goods

perfect information

no barriers to entry/exit

perfect resource mobility

Pros:

achievement of productive efficiency in LR (minimzed AC)

allocative efficiciency

higher cost (inefficient) firms are forced out

consumers benefit from low costs

consumers decide what is produced and how much

Cons:

unrealistic assumptions

small firms, no economies of scale

firms open and close constantly, could waste resources

homogenous goods, no choice

all firms earn normal profit, unlikley for R&D to occur

only efficient when no externalities

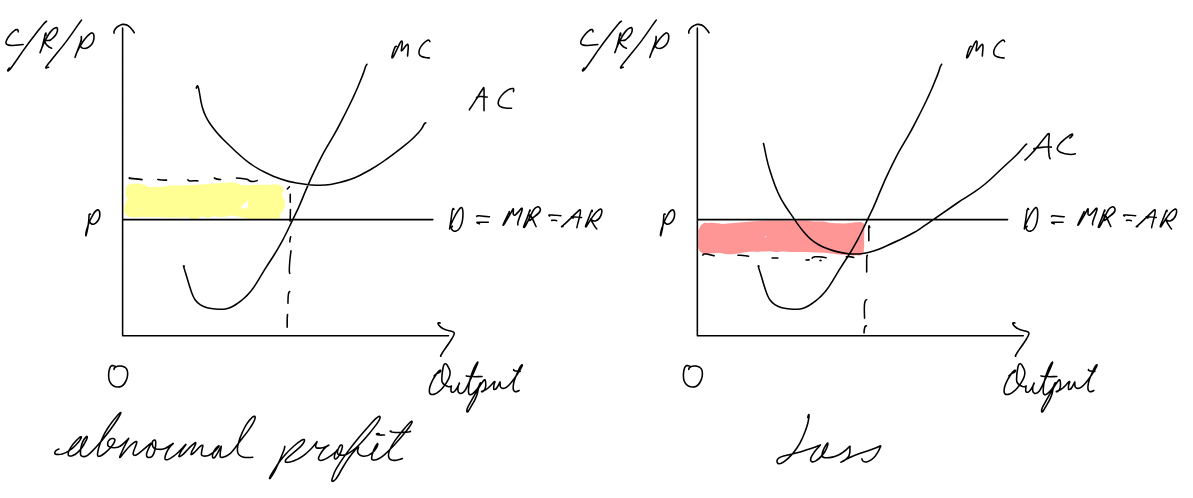

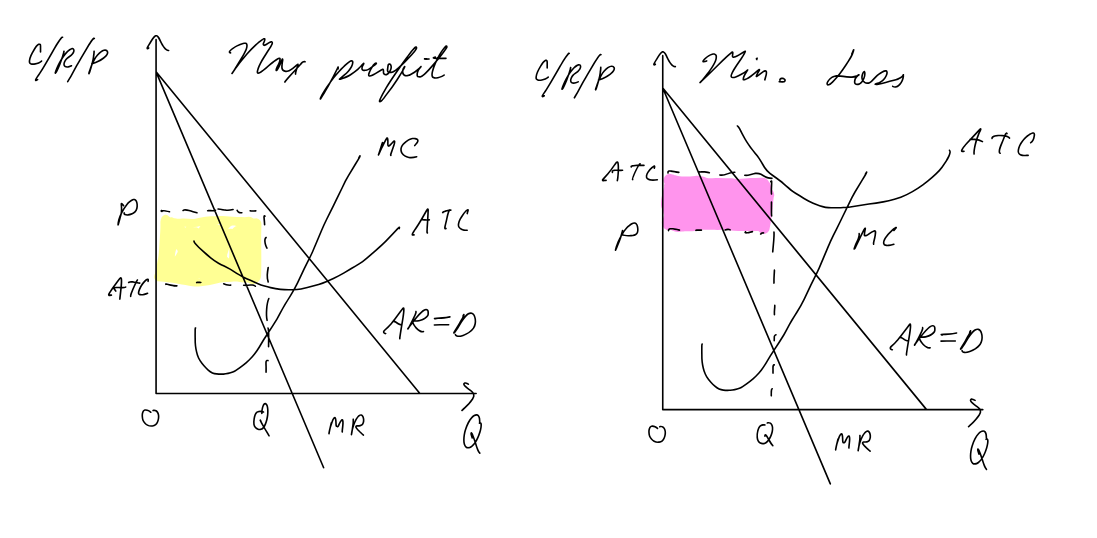

Perfect competition short run

abnormal profit: firms join, supply increases, lower price until normal profit

loss: firms leave, supply decreases, higher price until normal profit

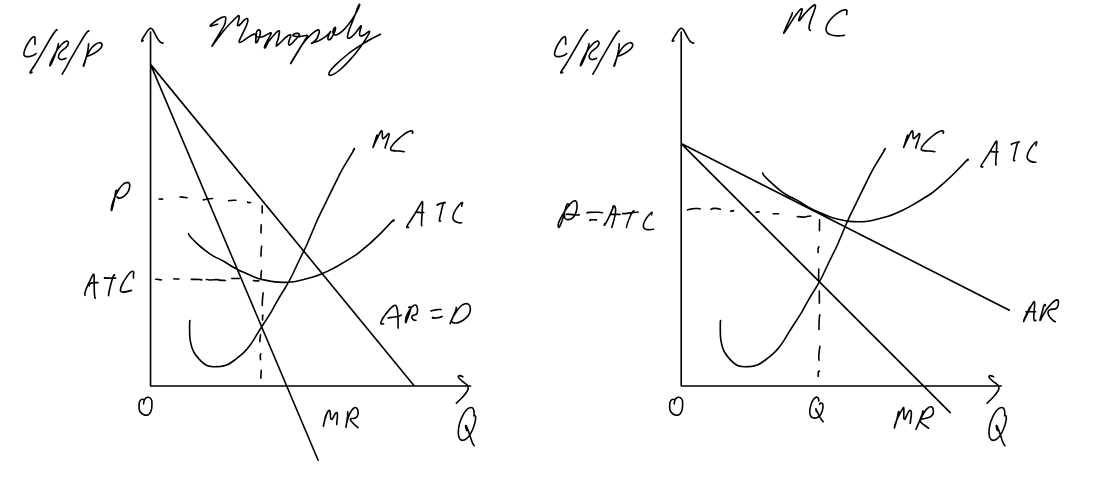

Monopoly / collusive oligopoly acting as monopoly

Assumptions Monopoly:

single dominant firm

no close substitutes

high barriers to entry

Assumptions Oligopoly:

small # of large firms

homogenous goods

high barriers to entry

interdependance among firms

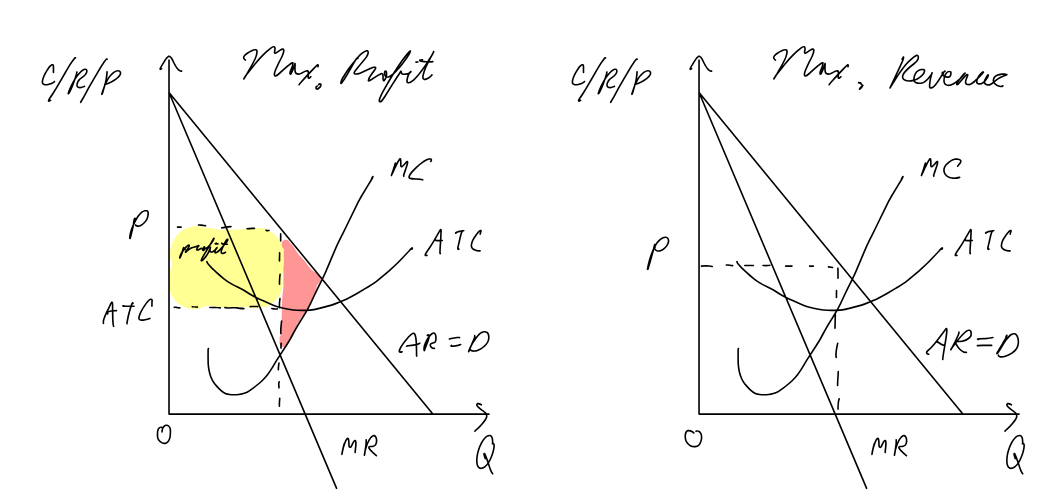

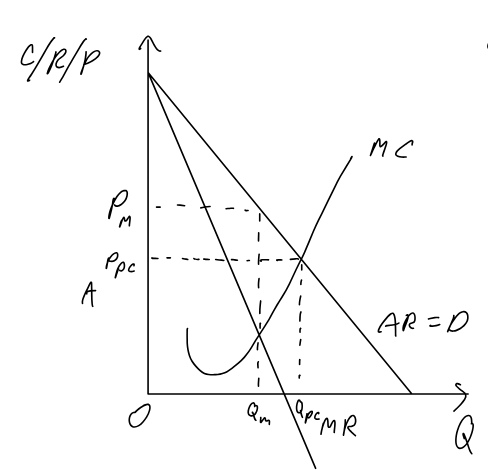

Profit maximizing monopoly vs. perfect competition

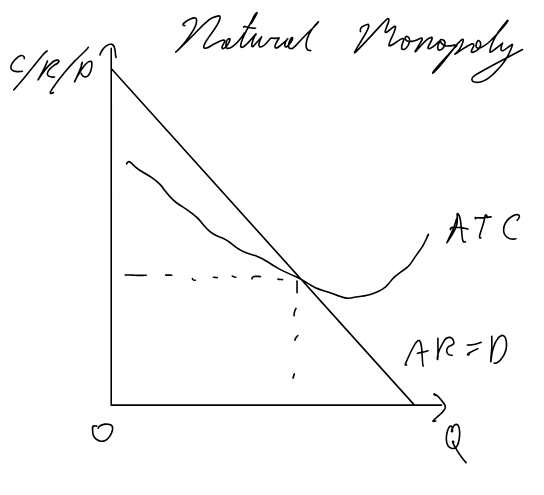

Natural monopoly

AR=D intersects ATC when ATC is still falling (still experiences economies of scale)

Monopolistic Competition SR

Assumptions:

large number of firms

no barriers to entry/exit

product differentiation

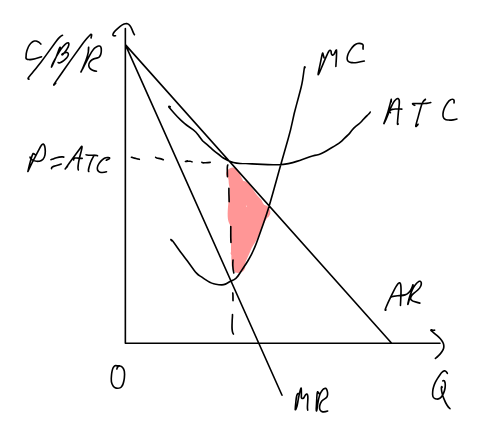

Monopolistic Competition LR

Assumptions:

large number of firms

no barriers to entry/exit

product differentiation

due to no barriers of entry/exit firms earn normal profit in LR

Monopoly vs. Monopolistic Competition

Monopoly demand more inelastic (no close substitutes)