Econ 174 - Exam 1 (ALL Past Exam 1s)

1/164

Earn XP

Description and Tags

Test #1 from: 2022, 2016, 2006, 2001, 2000

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

165 Terms

The father of accounting is: A. David Cutcliffe B. Carl Franks c. Luca Pacioli D. Ted Roof E. Barry Wilson

C

Select the false statement about investors: A. Buyers of shares believe the future of a company to be relatively optimistic. B. Sellers of shares believe the future of a company to be relatively pessimistic. c. If an investor feels current accounting information signals a stock price rise, buying is appropriate. D. If an investor feels current accounting information signals a stock price drop, selling is appropriate. E. If an investor feels current accounting information signals a stock price rise, selling is appropriate.

E

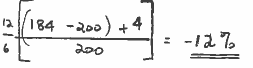

An investor purchases shares on 7/1/A for $200.00. During the next six months, dividends of $4.00 per share were declared and paid. The market price of the stock on 12/31/A is $184.00. What is the investor's annual return on the investment?

A. negative 12%

B. negative 6%

C. positive 4%

D. positive 6%

E. positive 12%

A

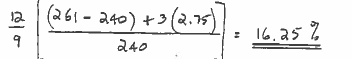

An investor purchases shares on 4/1/A for $240.00. During the year, quarterly dividends of $2.75 per share were declared and paid. The market price of the stock on 12/31/A is $261.00. What is the investor's annual return on the investment?

A. 8.75%

B. 11.67%

C. 12.19%

D. 13.33%

E. 16.25%

E

Revenues can be represented by A. A decrease in liabilities or a decrease in assets. B. A decrease in liabilities or an increase in assets. C. An increase in liabilities or a decrease in assets. D. An increase in liabilities or an increase in assets. E. None of these are completely correct.

B

D

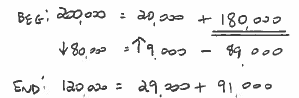

Total assets and total owners' equity are $120,000 and $91,000 at the end of the period. Assets decreased 40% and liabilities increased 45% during the period. What is owners' equity at the beginning of the period?

A. $63,700

B. $70,000

C. $130,000

D. $180,000

E. $200,000

D

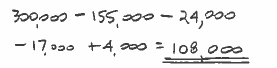

Kline Company has the following reported balances at the end of the current year: revenues $300,000, salary expense $155,000, dividends declared $18,000, dividends paid $15,000, loss on sale of land $24,000, rent expense $17,000, prepaid insurance $12,000 and gain on sale of truck $4,000. What is net income for the year?

A. $ 90,000

B. $ 93,000

C. $104,000

D. $108,000

E. $112,000

D

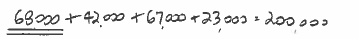

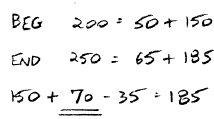

Cash from operating activities increased $42,000.

Cash from investing activities increased $67,000.

Cash from financing activities increased $23,000.

Ending cash is $200,000. What is beginning cash?

A. $ 68,000

B. $152,000

c. $198,000

D. $202,000

E. $332,000

A

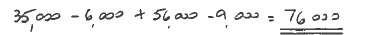

On January 1, Year One, the Green River Company was started when owners contributed cash of $400,000 to start operations. During the first year, the company earned net income of $35,000 and declared $6,000 of dividends and paid $4,500 of dividends. During the second year, the company earned $56,000 of net income and declared $9,000 of dividends and paid $8,250 of dividends. What is retained earnings at the end of Year Two?

A. $63,250

B. $76,000

C. $78,250

D. $91,000

E. $491,000

B

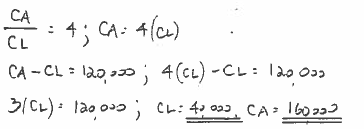

The current ratio is 4 and working capital is $120,000 at the end of the present year for York Company. What are current assets and current liabilities, respectively?

A. $120,000 and $30,000

B. $160,000 and $40,000

C. $160,000 and $120,000

D. $200,000 and $80,000

E. $320,000 and $80,000

B

Which is a real or permanent account?

A. Accumulated Depreciation

B. Rent Revenue

C. Salary Expense

D. Service Revenue

E. Utilities Expense

A

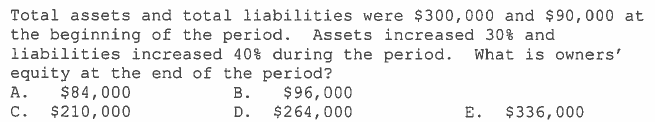

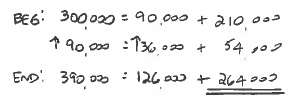

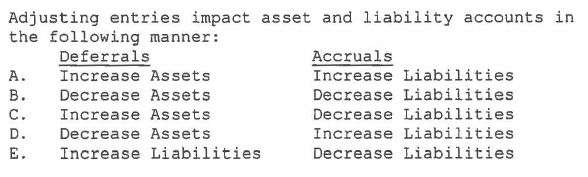

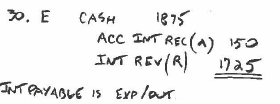

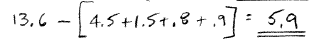

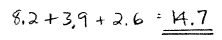

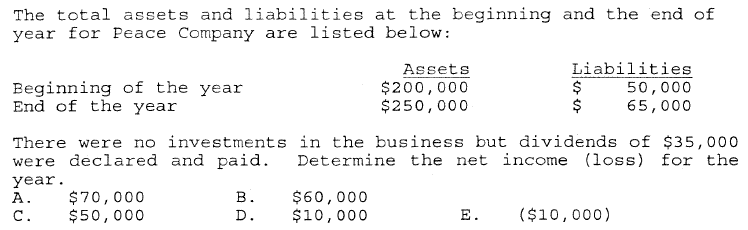

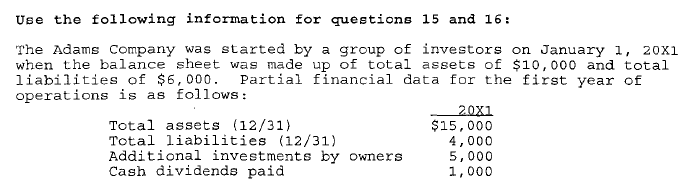

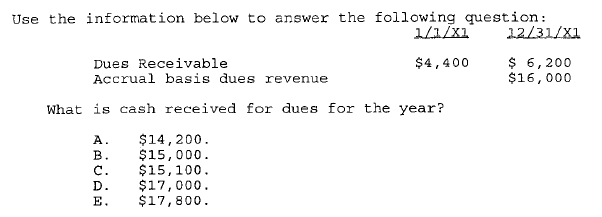

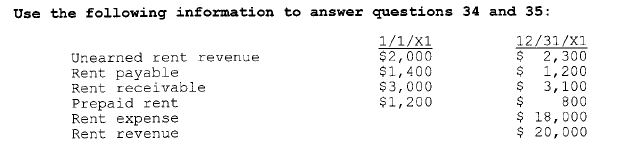

Quesiton in photo

D

Which of the following is/are example(s) of accrual(s)?

A. Interest Payable

B. Unearned Rent

C. Prepaid Wages

D. Dues Revenue Received in Advance

E. Both of A and B

A

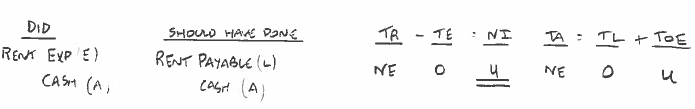

Naples Company made payment on rent owed by erroneously increasing rent expense and properly decreasing cash. An accrual entry for rent expense had previously been properly recorded by properly debiting rent expense and properly crediting rent payable. Which of the following is/are true?

A. Net income is understated.

B. Rent expense is understated.

C. Rent payable is understated.

D. Retained earnings are overstated.

E. All of the above are true.

A

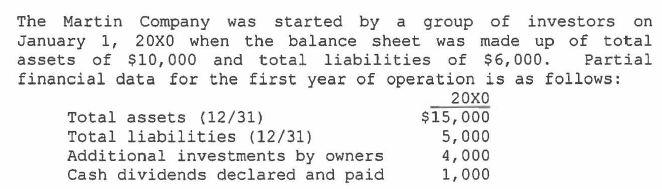

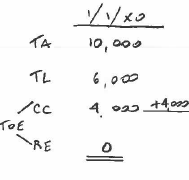

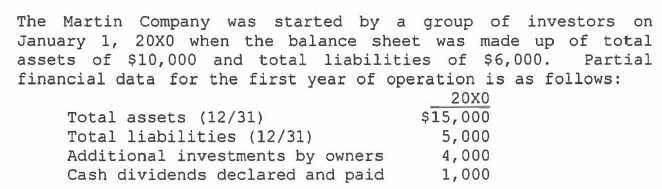

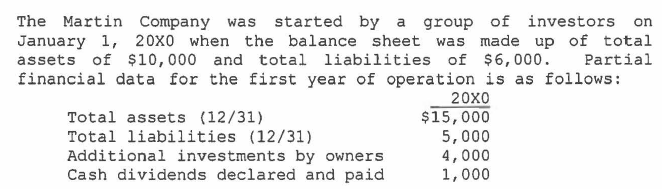

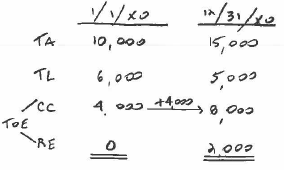

What was the retained earnings balance at January 1, 20X0?

A. $0

B. $4,000

C. $6,000

D. $10,000

E. $16,000

A

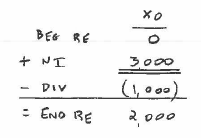

What was the net income (loss) for the year 20X0?

A. ($2,000)

B. ($5,000)

C. $3,000

D. $4,000

E. $5,000

C

What was the ret. earn. balance (deficit) on December 31, 20X0?

A. ($2,000)

B. ($1,000)

C. $2,000

D. $3,000

E. $4,000

C

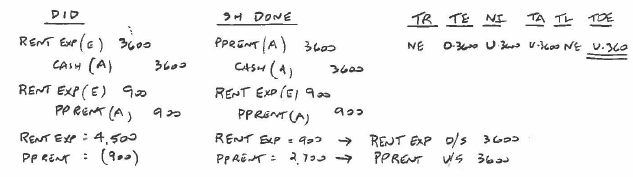

Billy Company pays four months' rent at $900 per month on December 1 for December, January, February and March. Billy records this with a debit to rent expense and a credit to cash for $3,600. When preparing financial statements on December 31, Billy's accountant erroneously believed the entire $3,600 was originally recorded as prepaid rent and made the adjustment based on that assumption . Which of the following will occur?

A. Rent expense will be understated $3,600.

B. Prepaid rent will be overstated $3,600.

C. Rent expense will be overstated $900.

D. Retained earnings will be understated $3,600.

E. None of these will occur.

D

Which of the following accounts would be smaller in amount on an adjusted trial balance than on a trial balance?

A. Rent Payable

B. Service Revenue Received in Advance

C. Interest Receivable

D. All of these

E. None of these

B

Which of the following would be improper in a closing entry?

A. Debiting retained earnings for net loss

B. Debiting revenue accounts

C. Crediting expense accounts

D. Crediting retained earnings for net income

E. Crediting retained earnings for net loss

E

A company recorded the $42,000 adjusting entry for accrued interest revenues on monies it loaned by debiting liabilities and crediting revenues $42,000. Owners' equity is

A. $84,000 understated

B. $42,000 understated

C. $42,000 overstated

D. $84,000 overstated

E. correctly stated

E

A company recorded the $33,000 adjusting entry for the

expiration of prepaid rent by debiting assets and crediting expenses $33,000. Owners' equity is

A. $66,000 understated

8. $33,000 understated

C. $33,000 overstated

D. $66,000 overstated

E. correctly stated

D

A company recorded the $17,000 adjusting entry for the earning of rent received in advance by debiting expenses and crediting liabilities $17,000. Owners' equity is

A. $34,000 understated

8. $17,000 understated

C. $17,000 overstated

D. $34,000 overstated

E. correctly stated

A

A company recorded the $24,000 adjusting entry for the unpaid wages at year end by debiting liabilities and crediting revenues $24,000. Owners' equity is

A. $48,000 understated

8. $24,000 understated

C. $24,000 overstated

D. $48,000 overstated

E. correctly stated

D

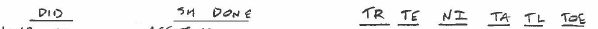

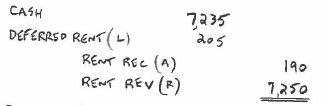

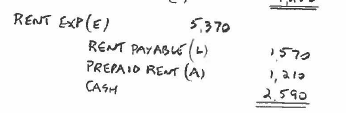

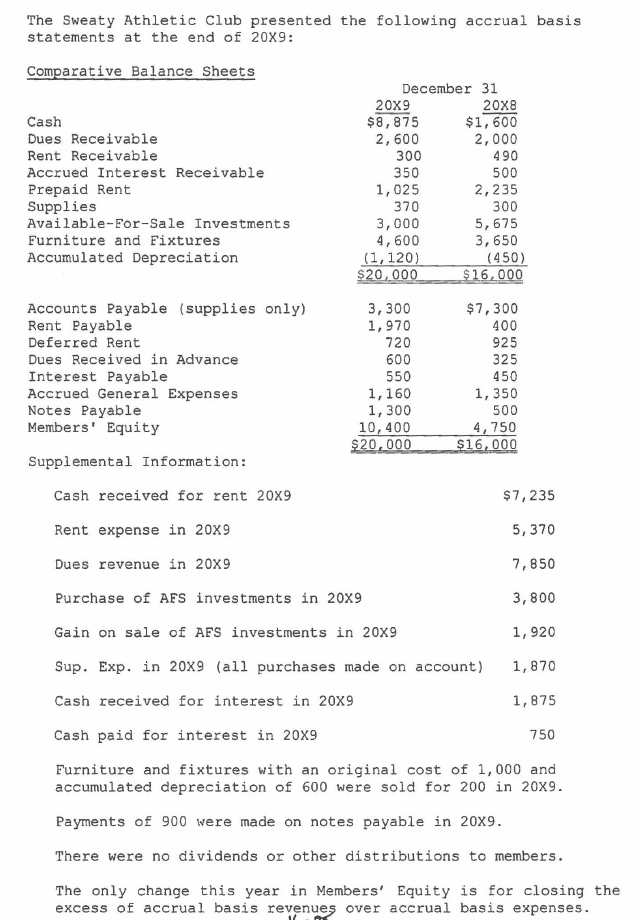

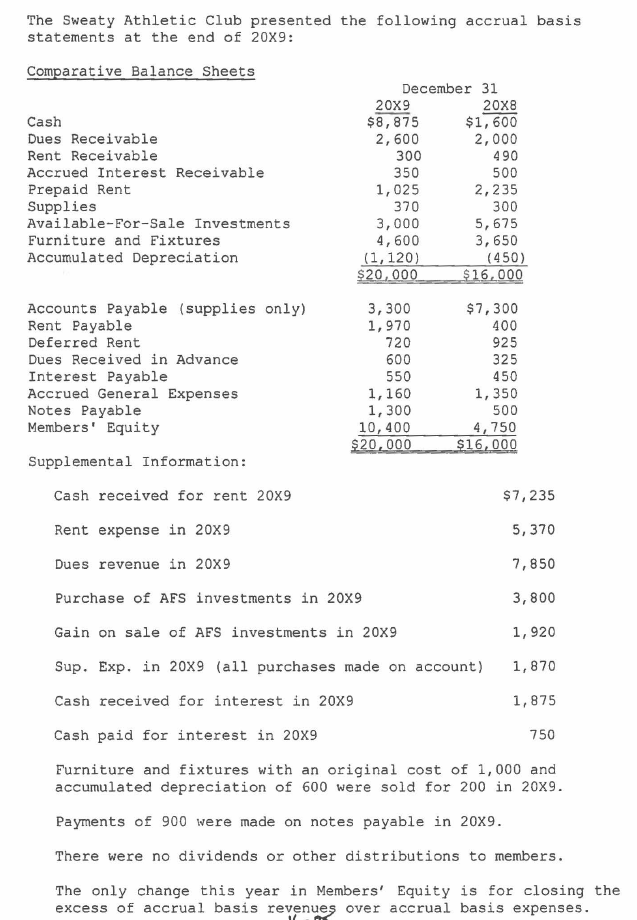

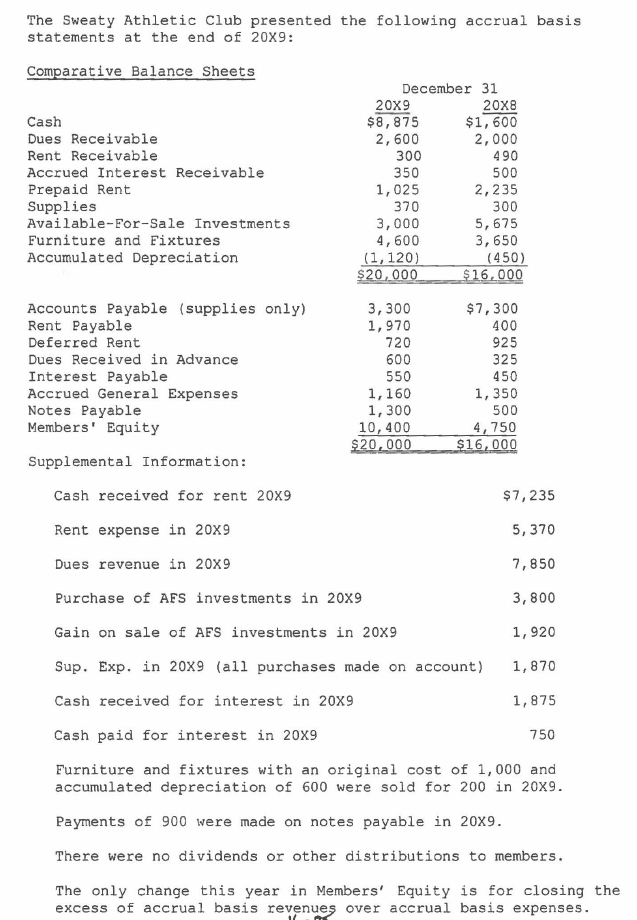

What is accrual basis rent revenue in 20X9?

A. $6,840

B. $7,220

C. $7,250

D. $7,630

E. None of the above.

C

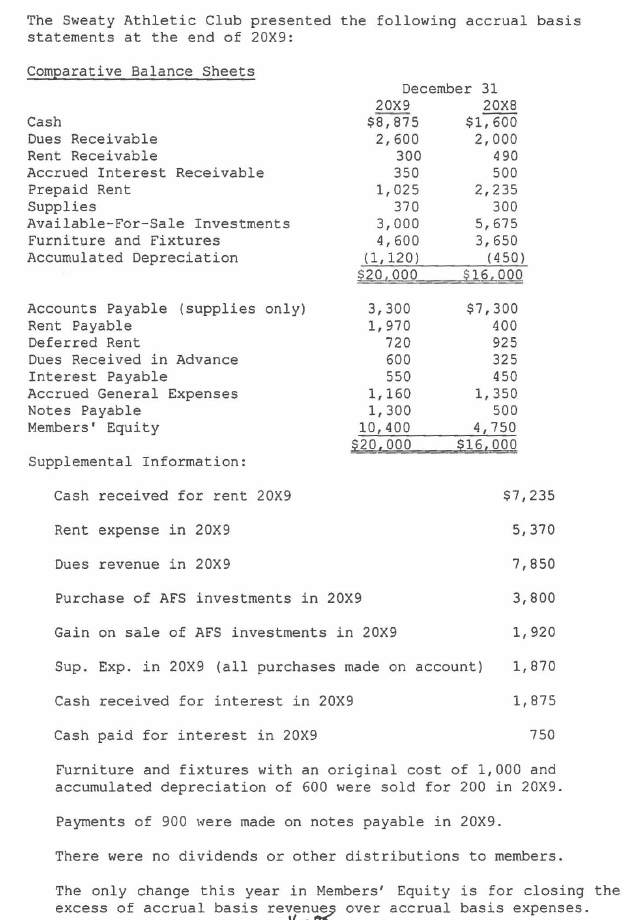

What is cash paid for rent in 20X9?

A. $2,590

B. $5,010

C. $5,730

D. $8,150

E. None of the above.

A

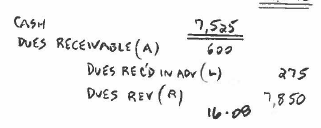

What is cash received for dues in 20X9?

A. $6,975

B. $7,525

C. $8,175

D. $8,725

E. None of the above.

B

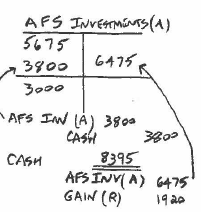

What is cash received from sale of available-for-sale {AFS)

investments in 20X9?

A. $2,675

B. $4,555

C. $6,475

D. $8,395

E. None of the above.

D

What is accrual basis interest revenue in 20X9?

A. $1,625

B. $1,825

C. $1,925

D. $2,125

E. None of the above

E

The father of double entry bookkeeping is:

A. Carmelo Anthony

B. LeBron James

C. Luca Pacioli

D. Pat Riley

E. Dwyane Wade

C

Which of the following is a Big Four firm?

A. Ball and Chain

B. Ernst and Young

C. Mind Body and Soul

D. Parcells and Owens

E. Patience and Prudence

B

The body currently responsible for f orrnulating

standards in the United States of America is the:

A. AICPA

B. APB

C. FASB

D. FDNY

E. WWF

C

All of the following accounts are liabilities except:

A. Accounts Payable

B. Income Taxes Payable

C. Land

D. Notes Payable

E. Unearned Sales Revenue

C

In which section of the ledger does dividends appear?

A. asset

B. expense

C. liability

D. revenue

E. stockholders' equity

E

Which of the following are listed last in the chart of accounts?

A. assets

B. expenses

C. liabilities

D. owners' equity

E. revenues

B

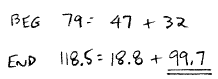

Total assets and owners' equity were $79,000 and $32,000 at the beginning of the period. Assets increased 50% and liabilities decreased 60% during the period. What is owners' equity at the end of the period?

A. $99,700

B. $67,300

C. $49,600

D. $47,000

E. $43,300

A

Total assets and liabilities are $120,000 and $91,000 at the end of the period. Assets increased 50% and liabilities increased 30% during the period. By what amount did owners' equity increase during the period?

A. $10,000

B. $19,000

C. $29,000

D. $81,000

E. $87,300

B

Liabilities and stockholders' equity total $9,000 while assets total $9,700 on a trial balance. The correct balances for both columns are $9,000 if there was/were a:

A. failure to post a $700 credit entry to Accounts Payable

B. failure to post a $700 credit entry to Cash

C. failure to post a $700 credit entry to Stockholders' Equity

D. All of these

E. None of these

B

Which of the following is an example of a real or permanent account?

A. Accounts Receivable

B. Rent Expense

C. Service Revenue

D. Utilities Expense

E. Withdrawals

A

Which of the following is an example of a nominal or temporary account?

A. Accumulated Depreciation

B. Depreciation Expense

C. Interest Payable

D. Prepaid Rent Expense

E. Unearned Dues Revenue

B

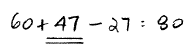

Assume no additional capital contributions. What is net income for the period if beginning owners' equity is $60,000, withdrawals by the owner are $27,000, and ending owners' equity is $80,000?

A. $67,000

B. $47,000

C. $33,000

D. $20,000

E. $7,000

B

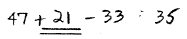

Assume no additional capital contributions. If beginning capital was $47,000, ending capital is $35,000, and owner's withdrawals were $33,000, the amount of net income or loss for the period was

A. net loss of $45,000

B. net loss of $21,000

C. net income of $12,000

D. net income of $21,000

E. net income of $45,000

D

Assume no additional capital contributions. If beginning capital was $35,000, ending capital is $47,000, and owner's withdrawals were $33,000, the amount of net income or loss for the period was

A. net loss of $45,000

B. net loss of $21,000

C. net loss of $12,000

D. net income of $21,000

E. net income of $45,000

E

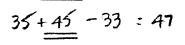

Total assets at the end of the period were $650,000 and liabilities were 40% of owner's equity. What were liabilities at the end of the period?

A. $185,714

B. $260,000

C. $390,000

D. $464,286

E. $910,000

A

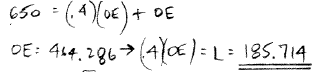

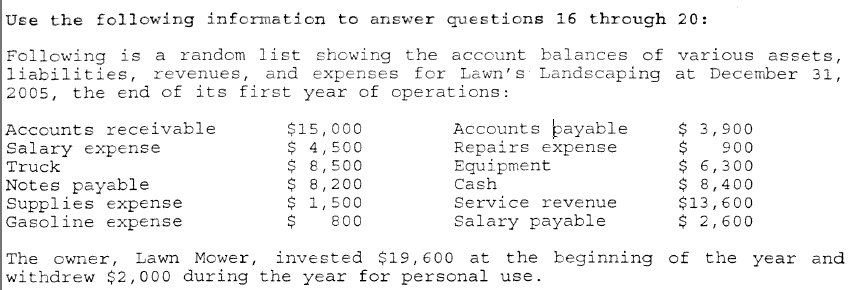

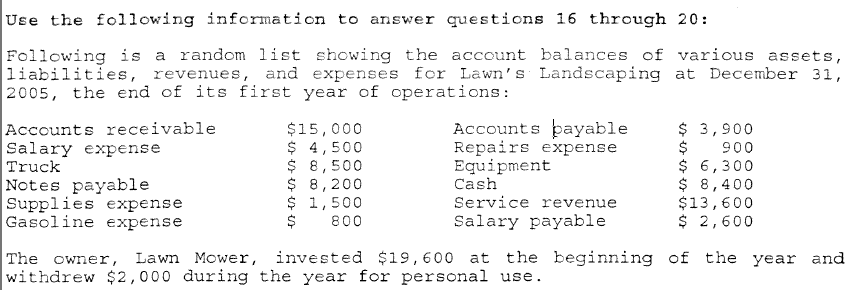

Net income for the year was

A. $3,900

B. $5,100

C. $5,900

D. $7,700

E. $12,800

C

Total assets at December 31, 2005 were

A. $38,200

B. $36,600

C. $36,200

D. $32,700

E. $31,600

A

Total liabilities at December 31, 2005 were

A. $10,400

B. $12,800

C. $13,900

D. $14,700

E. $22,600

D

Owner's equity at December 31, 2005 was

A. $23,500

B. $22,700

C. $22,600

D. $18, 700

E. $13,900

A

The net change in owner's equity (after the original investment) from the beginning of the year to the end of the year was

A. $ 100

B. $ 2,000

C. $ 3,900

D. $ 5,900

E. $14,700

C

The financial statements that are dated for a time period (rather than a point in time) are the:

A. Balance sheet and income statement

B. Balance sheet and statement of retained earnings

C. Balance sheet and statement of cash flows

D. Income statement and statement of cash flows

E. All financial statements are dated for a time period

D

Which of the following groups of accounts have normal credit balances?

A. Assets, revenues, and owner withdrawals

B. Assets, expenses, and owner withdrawals

C. Capital, liabilities, and revenues

D. Liabilities, revenues, and expenses

E. Revenues, expenses, and owner withdrawals

C

Which of the following groups of accounts have normal debit balances?

A. Assets, revenues, and owner withdrawals

B. Assets, expenses, and owner withdrawals

C. Capital, liabilities, and revenues

D. Liabilities, revenues, and expenses

E. Revenues, expenses, and owner withdrawals

B

A business acquires equipment costing $10,000 by making a $4,000 down payment and issuing a note for the balance. This transaction will cause

A. cash to be credited for $6,000

B. cash to be debited for $4,000

C. equipment to be credited for $10,000

D. note payable to be credited for $6,000

E. note payable to be debited for $4,000

D

Providing $5,000 of services where cash is not immediately received will cause

A. accounts receivable to be credited for $5,000

B. accounts receivable to be debited for $5,000

C. cash to be credited for $5,000

D. cash to be debited for $5,000

E. service revenue to be debited for $5,000

B

Determine payments for the beginning accounts payable period if purchases are $58,000, are $34,000, and ending accounts payable are $29,000.

A. $5,000

B. $24,000

C. $29,000

D. $53,000

E. $63,000

E

Determine credit sales for the period if ending accounts receivable are $8,000, beginning accounts receivable are $14,000, and collections are $200,000.

A. $214,000

B. $208,000

C. $206,000

D. $194,000

E. $186,000

D

Performing a service on account would

A. affect the basic general accounting equation the same as if the service had been for cash

B. decrease expenses more than had the service been for cash

C. increase assets less than had the service been for cash

D. increase income less than had the service been for cash

E. increase income more than had the service been for cash

A

Performing a service and immediately collecting the cash would

A. decrease assets more than had the service been performed on account

B. increase income more than had the service been performed on account

C. increase owners' equity more than had the service been performed on account

D. increase assets less than had the service been performed on account

E. have no effect on liabilities

E

The receipt of an amount due from a customer would

A. have no effect on total assets or total liabilities

B. increase owners equity and decrease liabilities

C. decrease net income and increase assets

D. decrease assets and decrease liabilities

E. increase assets and decrease liabilities

A

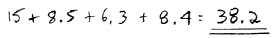

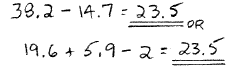

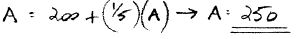

Question in photo

A

A company's owners' equity is one-fifth of its total assets. Its liabilities total $200,000. What is the amount of its total assets?

A. $40,000

B. $ 50,000

C. $200,000

D.$250,000

E. $1,000,000

D

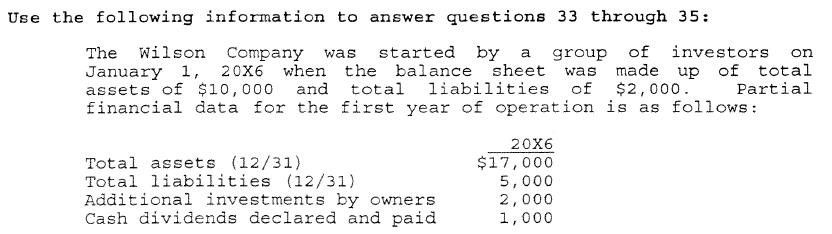

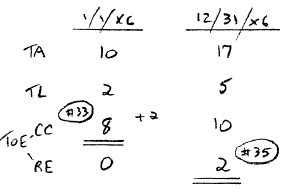

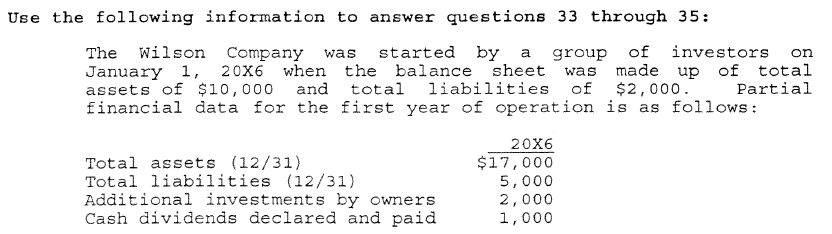

What was the contributed capital balance at January 1, 20X6?

A. $0

B. $2,000

C. $8,000

D. $10,000

E. $17,000

C

What was the net income (loss) for the year 20X6?

A. $5,000

B. ($2,000)

C. $4,000

D. ($5,000)

E. $3,000

E

What was the retained earnings balance on December 31, 20X6?

A. $2,000

B. ($1,000)

C. $3,000

D. ($2,000)

E. $12,000

A

The father of double entry bookkeeping is:

A. Brian Billick

B. Kerry Collins

C. Ray Lewis

D. Art Modell

E. Luca Pacioli

Which of the following is a Big Five firm?

A. DoomsdayDefense

B. PricewaterhouseCoopers

C. PurplepeopleEaters

D. SmotherBrothers

E. Steel Curtain

The financial statements that are dated for period of time (rather than a point in time) are the:

A. Balance sheet and income statement

B. Balance sheet and statement of retained earnings

C. Balance sheet and statement of cash flows

D. Income statement and statement of cash flows

E. All financial statements are dated for a time period

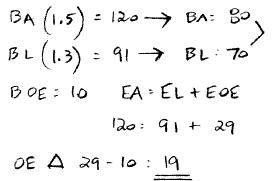

Total assets and liabilities are $120,000 and $91,000 at the end of the period. Assets decreased 40% and liabilities increased 30% during the period. What are total liabilities at the beginning of the period?

A. $63,700

B. $70,000

C. $130,000

D. $168,000

E. $200,000

Total assets and owners' equity were $79,000 and $32,000 at the beginning of the period. Assets increased 50% and liabilities decreased 60% during the period. What is owners' equity at the end of the period?

A. $99,700

B. $67,300

C. $49,600

D. $47,000

E. $43,300

In which section of the ledger does unearned interest income

appear?

A. asset

B. liability

C. stockholders' equity

D. revenue

E. expense

In which section of the ledger does accumulated depreciation appear?

A. asset

B. liability

C. stockholders’ equity

D. revenue

E. expense

Purchasing a tract of land for $80,000 by paying $50,000 in cash and signing a promissory note for the remainder would

A. decrease owners' equity by $30,000

B. increase net assets by $30,000

C. increase liabilities by $30,000

D. increase owners' equity by $30,000

E. both of B and C

Uncollected revenue earned in the current period causes

A. assets to increase and owners' equity to increase

B. assets to decrease and owners' equity to increase

C. assets to increase and liabilities to increase

D. no change in total assets

E. no change in owner's equity

Which of the following transactions would increase one asset, decrease another asset, and increase a liability?

A.. owner invests cash and equipment in the business

B. purchasing supplies and equipment on account

C. purchasing land with cash and a note payable

D. paying liabilities incurred last period

E. both of C and D

Determine withdrawals for the period if net income is

$34,000, beginning owners' equity is $29,000, and ending owners' equity is $58,000.

A. $92,000

B. $87,000

C. $29,000

D. $24,000

E. $5,000

Determine collections for the period if beginning Accounts Receivable is $14,000, Ending Accounts Receivable is $8,000, and credit Sales are $200,000.

A. $214,000

B. $208,000

C. $206,000

D. $194,000

E. $192,000

Which of the following accounts would probably be smaller in amount on an adjusted trial balance than on a trial balance?

A. Rent Receivable

B. Wages Payable

C. Accumulated Depreciation

D. Taxes Payable

E. Rent Received in Advance

A company's weekly payroll of $2,500 is paid on Fridays. Assume that the last day of the month falls on Monday. Which of the following is the required adjusting entry, assuming a work week of Monday through Friday?

A. debit Salaries Expense $2,000 and credit Salaries Payable $2,000

B. debit Salaries Expense $500 and credit Salaries Payable $500

C. debit Salaries Payable $2,000 and credit Salaries Expense $2,000

D. debit Salaries Payable $500 and credit Salaries Expense $500

E. no adjusting entry would be required

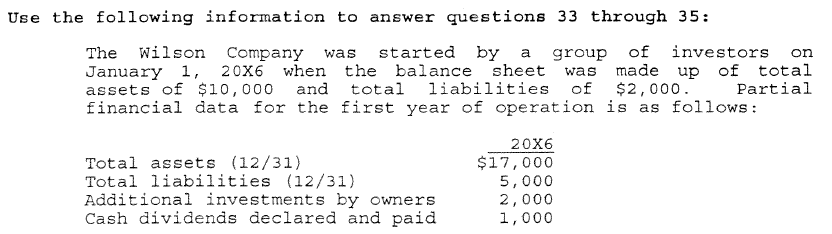

What was the net income (loss) for the year 20X1?

A. $6,000

B. $5,000

C. $4,000

D. $3,000

E. $2,000

What was the 12/31/20X1 retained earnings balance (deficit)?

A. ($3,000)

B. ($2,000)

C. $1,000

D. $2,000

E. $3,000

Which of the following is NOT a nominal or temporary account?

A. Insurance Expense

B. Service Revenue

C. Miscellaneous Expense

D. Interest Revenue

E. Unearned Service Revenue

Which of the following is NOT a real or permanent account?

A. Interest Payable

B. Deferred Subscription Revenue

C. Prepaid Rent Expense

D. Accumulated Depreciation

E. Dividends

Which of the following is NOT an example of an accrual?

A. Interest Receivable

B. Due Payable

C. Interest Payable

D. Unearned Dues Revenue

E. Both of C and D

Which of the following is NOT an example of a deferral?

A. Dues Payable

B. Prepaid Dues

C. Interest Received in Advance

D. Deferred Interest Revenue

E. Both of C and D

Which will always appear in an adjusting entry?

A. A temporary account

B. A real account

C. A cash account

D. Both of A and B

E. All of these

The failure to record the adjusting entry for supplies used at year end would understate

A. expenses

B. revenues

C. owners' equity

D. liabilities

E. assets

The failure to record the adjusting entry for the earning of rent revenue received in advance would overstate

A. assets

B. liabilities

C. owners’ equity

D. expenses

E. both of C and D

The failure to record the adjusting entry for the earning of interest revenue not yet received at year end would overstate

A. assets

B. liabilities

C. revenues

D. expenses

E. none of these

The failure to record the adjusting entry for wages payable yet to be disbursed at year end would overstate

A. assets

B. liabilities

C. owners' equity

D. revenues

E. none of these

Recording the adjusting entry for accrued interest payable by debiting an asset and crediting a liability would overstate

A. assets

B. net income

C. owners' equity

D. all of these

E. none of these

A $400 payment of cash on account was recorded as a debit to cash and a credit to accounts receivable. This error will

A. cause cash to be overstated $400

B. cause cash to be understated $800

C. cause accounts payable to be overstated $400

D. cause accounts receivable to be understated $800

E. cause accounts receivable to be overstated $400

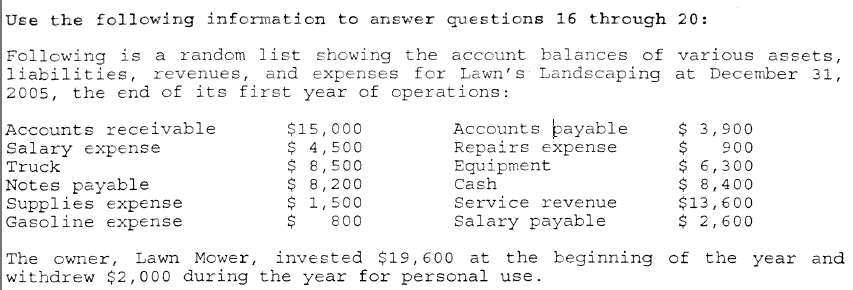

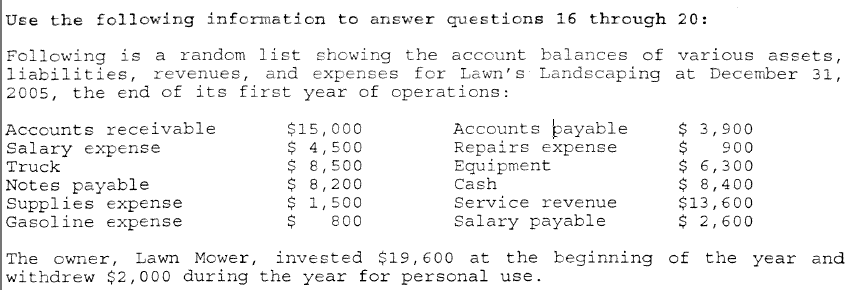

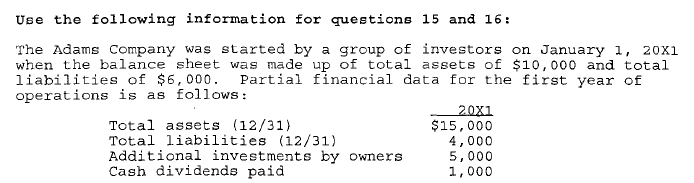

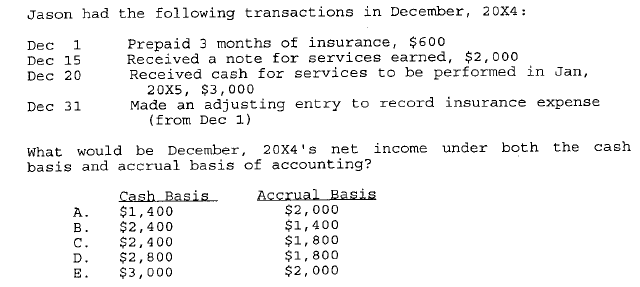

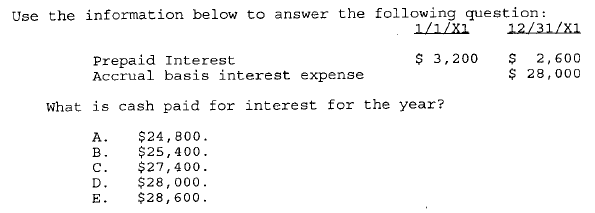

Question in photo

Question in photo

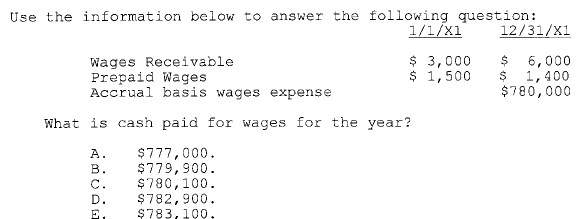

Question in photo

Question in photo

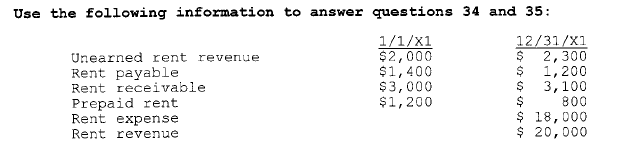

Question in photo

Question in photo

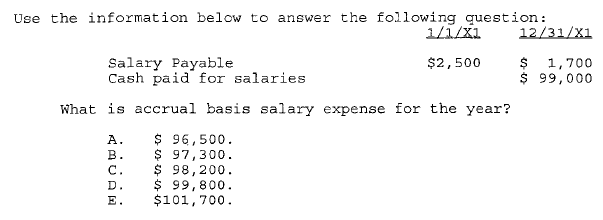

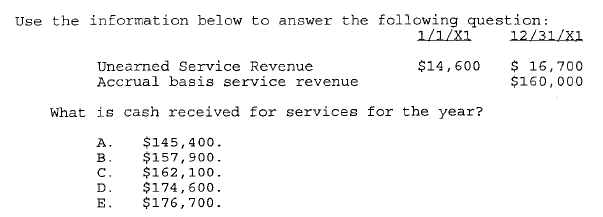

How much cash was received for rent during the year?

A. $19,600

B. $19,800

C. $20,000

D. $20,200

E. $20,400

How much cash was paid for rent during the year?

A. $17,400

B. $17,800

C. $18,000

D. $18,200

E. $18,600