Module 9: Firms and Industries: Basic Structures, Production, and Costs

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

24 Terms

Accounting Profit

Total revenue received minus total explicit cost paid by a firm.

Economic Profit

The total revenue minus the total explicit cost and the opportunity costs paid by a firm.

Command System

A managerial hierarchy organizing the factors of production.

Incentive System

A managerial method for organizing the factors of production through incentives.

Perfect information

All individuals or participants have immediate and complete information.

Imperfect information

Individuals or participants do not have immediate or complete information.

Symmetric information

All individuals or participants have identical amounts of information.

Asymmetric information

Some individuals or participants have more information than others.

Adverse selection = A market in which buyers and sellers have different amounts of information.

Moral Hazard = Individuals likely engage in risky behavior because others will bear the costs of their actions.

FFCR (Four-Firm Concentration Ratio)

FFCR = (Market Share of Firm 1 + Market Share of Firm 2 + Market Share of Firm 3 + Market Share of Firm 4) / Total Market Share * 100

Measures the market share of the four largest firms in an industry (market). The problem with this measure of competition is it does not measure the market share of the other firm nor the relative size of each firm in the industry.

- An FFCR close to 0% indicates a highly (perfectly) competitive industry.

- An FFCR between 0% and 40% indicates a moderately (monopolistically) competitive industry.

- An FFCR between 40% and 70% indicates moderate to high (oligopoly) market concentration.

- An FFCR between 70% to 100% indicates a very high market concentration.

- An FFCR of 100% indicates total (monopoly) market concentration.

Herfindahl-Hirschman index (HHI)

HHI = sum of (Percentages)²

Measures the degree of market competition and avoids the problems of the four-firm concentration ratio.

It measures the size of each firm relative to the industry by calculating the sum of the squares of each firm's market share within the industry. Regardless of these limitations, both measures provide a rough estimate of the level of competition in an industry.

For both measures, the lower the number, the more competitive the market.

- An HHI below 100 indicates a highly (perfectly) competitive industry.

- An HHI between 100 and 1,500 indicates a moderately (monopolistically) competitive industry.

- An HHI between 1,500 and 2,500 indicates moderate market concentration.

- An HHI above 2,500 indicates a high (oligopoly) market concentration.

- An HHI of 10,000 indicates total (monopoly) market concentration.

Short Run

At least one input is fixed in producing a good or service

Long Run

All inputs are variable in producing a good or service.

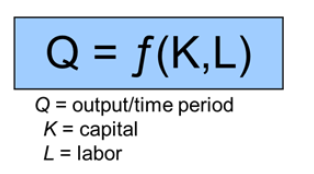

Production Function

The relationship between the output and services and the inputs used to produce the output.

Output/time period = some function of capital and labor inputs

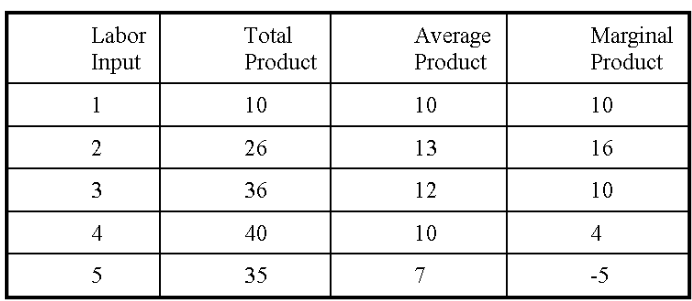

Total, Avg, and Marginal Product

Total Costs Formula

Total costs (TC) = Total fixed costs (TFC )+ Total variable costs (TVC)

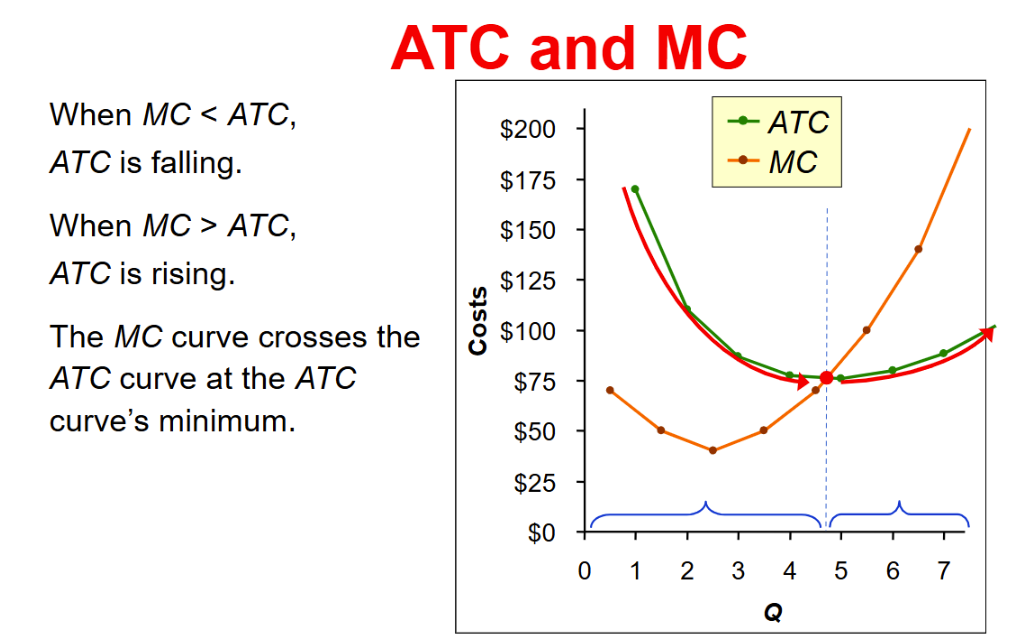

Average total costs (ATC)

total costs (TC) / output (Q)

Avg Variable Costs (AVC) + Average Fixed Costs (AFC)

Average variable costs (AVC)

total variable costs (TCV) / output (Q)

Average fixed costs (AFC)

Total fixed costs (TFC) / output (Q)

Marginal Costs (MC)

change in total cost / change in output

Marginal Cost → Avg Product Curve

When the marginal product curve rises, the average variable cost curve falls.

When to Produce more goods?

Marginal Revenue > Marginal Cost

Marginal Product of Labor (MPL)

MPL = Change in Output / Change in Labor

Q2 - Q1 / L2 - L1

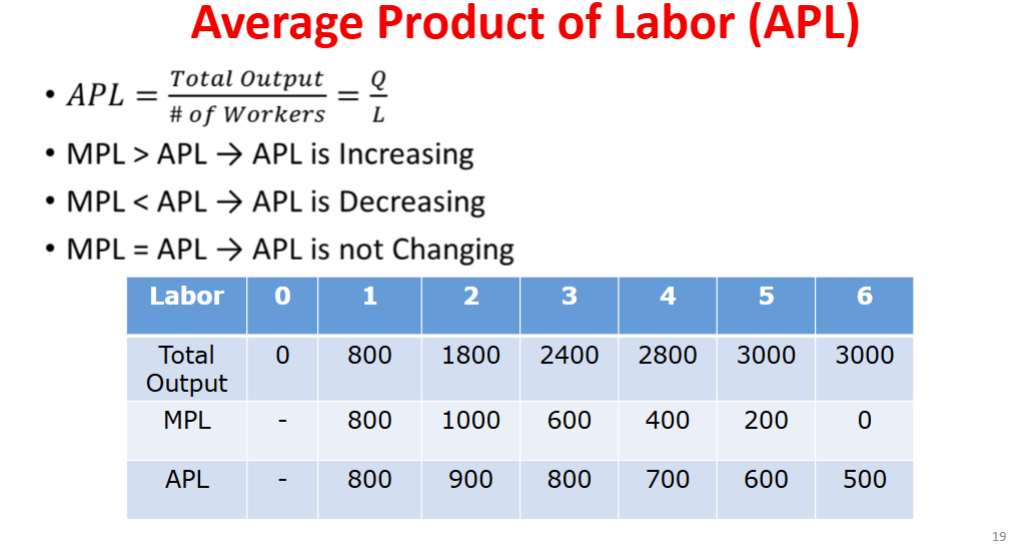

Average Product of Labor (APL)

APL = Total Output / # of workers

MPL > APL → APL is increasing

MPL < APL → APL is decreasing

MPL = APL → APL is not changing

Cost Analysis

If MC < AVC, then AVC is decreasing.

If MC > AVC, then AVC is increasing.