3.5 Profitability + ratio analysis

1/86

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

87 Terms

Ratio analysis

Quantitative management tool that compares diff financial figures to examine + judge the financial performance of a business

Needs info from final accounts: balance sheet, profit + loss account

Purpose of ratio analysis

Examine a firm's financial position

eg its profitability + ST + LT liquidity position

Assess a firm's financial performance

eg its ability to control expenses

Compare actual figures with projected or budgeted figures (variance analysis) in order to improve financial management.

Aid decision-making

eg whether investors should risk their money by investing in the business

2 ways ratios are compared

Inter firm comparisons

Historic comparisons

Historical comparisons + purpose

Comparing the same ratio in 2 diff time periods for the same business

Shows trends → help managers + decision makers assess the financial performance of the business over time

Inter firm comparisons + purpose

Comparing the same ratios of businesses in the same industry

Ratio analysis can show the relative financial performance of businesses competing in the same market.

When is ratio analysis not useful?

When comparing against

Rivals in diff industries

Diff sized businesses in same industry (sole trader vs PLC)

Profitability ratios

Examine profit in relation to other figures

3 profitability ratios

GPM

PM

ROCE

Are profitability ratios more relevant for-profit businesses vs non-profit organizations?

For profit businesses

Profit

The financial surplus earnings of an organization once all costs have been deducted from sales revenue

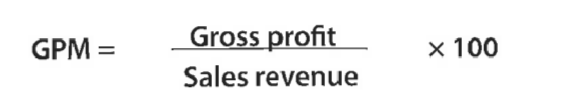

Gross profit margin (GPM)

A profitability ratio that shows the value of a firm's gross profit expressed as a percentage of its sales revenue

GPM = 60%, for every $100 of SR, $60 is GP

Gross profit margin equation

(GP / SR) x 100

Good value for GPM

Higher GPM= better for a business

Bc GP goes towards paying its expenses

2 ways to improve GPM ratio

Increase sales revenue

Reduce direct costs

4 ways to increase sales revenue

Reduce selling price of price elastic products with many substitutes

Increase selling price for price inelastic products with few substitutes

Use improved marketing strategies

Seek alternative revenue streams

2 ways to reduce direct costs

Reduce direct material costs: cheaper suppliers, cheaper materials

Reduce direct labour costs: reduce no. of staff, flextime, use non-financial incentives → labour productivity increases → reduces labour unit costs

Cons of reducing direct material costs by using cheaper materials

Product perceived as lower quality

Cons of reducing direct material costs by reducing direct labour costs

Can cause resentment + demotivation in the workforce

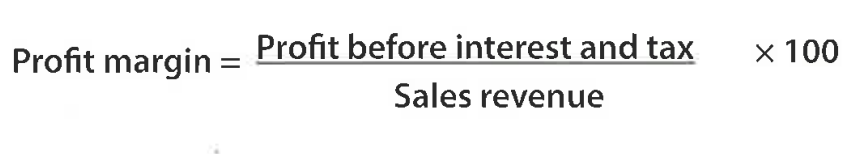

Profit margin (PM)

A profitability ratio that shows the % of sales revenue that turns into profit

ie proportion of SR left, after all direct + indirect costs (all production costs) paid

PM 40% → for every $100 of sales, $40 profit

Profit margin equation

(Profit before interest + tax / sales revenue) x 100

Why is profit before I+T used to calculate PM?

Allows for historical comparisons to be made

Profits change over time due to fluctuating I+T rates (beyond business’s control)

So doesn’t distort underlying financial performance of the business

Between PM + GPM ratio, which is a better measure of a firm’s profitability + why?

PM

Accounts for both cost of sales (direct costs) + expenses (indirect costs)

What does the difference between a firm’s GPM + PM represent?

Expenses

The larger the difference betw GPM + PM…

The more difficult overhead control tends to be

Good value for PM

Higher the better

Why is it common / normal for high volume products (eg fast food) to have a low PM?

High sales volume compensates for low PM

Why is it common / normal for low volume products (eg luxury watches) to have a high PM?

High PM compensates for low sales volume

Besides increasing SR + reducing direct costs, how else can a business improve its PM?

Reduce business expenses

Increase SR

Reduce direct costs

How to reduce business expenses to increase PM

Discuss preferential payment terms with trade creditors + suppliers (delay payments to improve CF position / pay on time to get discounts)

Negotiate cheaper rent

Reduce indirect costs

To calculate GPM + PM, what can be used?

Balance sheet

Profit + loss account

How can a price reduction reduce GPM, but improve PM?

Fall in price reduces GPM

But price reduction attracted more customers

Indirect costs constant

So NPM increase

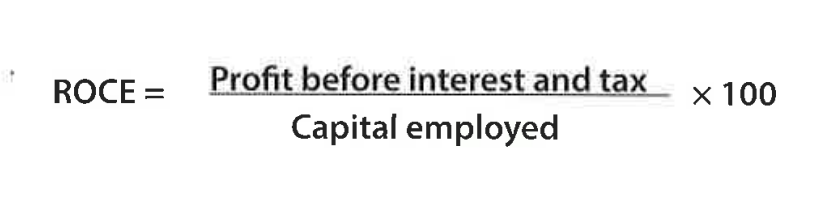

Return on capital employed (ROCE)

A profitability ratio that measures the financial performance of a firm based on the amount of capital invested

Shows profit as a % of capital used to generate it

20% ROCE, for every $100 invested, $20 generated

ROCE equation

(Profit before I+T / capital employed) x 100

On what type of final account is capital employed found on?

Balance sheet

Capital employed

Sum of owner’s equity + non current liabilities

Sum of total internal sources of finance + all LT external SoF

Capital employed equation

NCL + equity

Good value for ROCE

Higher the better

Should at least exceed the interest rate offered at commercial banks

Must be high enough to create an incentive for investors to invest

Why is ROCE calculated using profit before I+T?

Allows for better historical comparisons

Key ratio in business

ROCE

Bc shows how well a firm is able to generate profit from its source of funds

How to improve ROCE

Increase profits

CE falls but NP stays constant

But not desirable irl

Liquidity ratios

Look at the ability of a firm to pay its ST (current) liabilities from its current assets

2 types of liquidity ratios

Current ratio

Acid test (quick) ratio

Why are shareholders / potential investors + creditors / financiers interested in liquidity ratios?

Creditors- helps assess the likelihood of getting back money they are owed

Shareholders- reveal a firm’s ability to repay debts

Liquid assets

The possessions of a business that can be turned into cash quickly w/o losing their value

3 types of liquid assets

Cash

Stocks- finished goods, ready for sale

Debtors

Current ratio

A ST liquidity ratio that calculates the ability of a business to meet its debts within the next 12 months

X:1

CR 2.5:1 Firm has $2.50 of CA (liquid assets) for every $1 of CL

Current ratio equation

Current assets / current liabilities

Good value for current ratio + why

1.5 to 2.0

Saftey net bc irl not possible to sell CA w/o losing some value

Likely have suffcient working capital

Working capital equation

Current assets - current liabilities

Why should a business have a positive working capital?

Has the potential to invest + grow

Why is it bad if a firm’s CA is less than CL (negative working capital, CR<1)?

Has problems paying back trade creditors + suppliers → jeopardises business survival if creditors demand payment

Can lead a firm to go bankrupt

What does it mean if a business has a CR<1?

ST debts of the business are greater than its liquid assets

3 reasons why a firm may have a too high current ratio + cons?

Too much cash in the business → could be better spent to generate more trade

Too many debtors → increases chance of bad debts / customers defaulting on the money they owe

Too much stock → increases storage + insurance costs

Why are supermarkets having a CR of over 2:1 acceptable?

They hold a huge amount of stock, but stocks are highly liquid.

How to improve current ratio?

Increase CA

Decrease CL

How to increase value of CA?

Encourage cash purchases by offering discounts for immediate cash payments or early repayments if they have trade credit

Invest in stock control systems to reduce the amount of stock held (increases the cash balance)

How to reduce value of CL?

Cut overdrafts + use LT loans with lower interest rates

Avoid late payment penalties from creditors by paying on time

Take advantage of cash payment discounts

Use specialist tax accountant services who advise on how to reduce tax liabilities

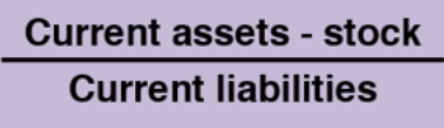

Acid test (quick) ratio

A liquidity ratio that measures a firm's ability to meet its ST debts

It ignores stock bc not all inventories can be easily turned into cash in a short time frame

Acid test ratio equation

(CA- stock) / CL

Why is acid test ratio usually more meaningful than current ratio?

Bc stocks not always easily converted into cash

Eg semi finished goods → not much value added → low price

V expensive stock can’t be turned into cash quickly

What do liquidity ratios measure?

Liquidity crisis

A situation where a firm is unable to pay its short-term debts

CL greater than CA

Ideal benchmark for acid test ratio

1:1

For every $1 of CL, a firm has $1 of cash / debtors to pay for it

Lower than this → firm experiences working capital difficulties / liquidity crisis

What happens if acid test figure is too high?

Firm is holding onto too much cash, rather than using it more effectively

Why are potential investors + ST lenders interested in the firms quick ratio?

Helps reduce risk to investors + financial lenders

Bc ratio measures ability of a firm to cover ST debts

How to improve acid ratio (from equation)?

Increase level of CA (cash / debtors)

Lower amt of CL

Better

Cons of increasing level of debtors

Increases chance of bad debts occuring

Uses of ratio analysis

Cons of financial ratio analysis

Historical account of an organization’s performance

Changes in external business environment can cause a change in financial ratios w/o there being any underlying change in performance of a business

No universal way to report final accounts → inter-firm comparisons difficult

Qualitative factors that affect business performance are ignored

Organizational objectives differ betw businesses

Examples of quantitative analysis

Cash flow forecasts

Investment appraisal

Financial ratio analysis

Cons of quantitative analysis

It is only partial

Doesn’t provide a complete picture of a firm's overall performance.

Need other quantitative + qualitative considerations to help to make a better assessment of an organization's financial performance

Other quantitative + qualitative considerations to make a better assessment of an organization's financial performance

Historical comparisons

Inter-firm comparisons

The nature of the business + its aims / objectives

State of the economy

Social factors