❤️🔥 3.4 Final Accounts

1/70

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

71 Terms

Final accounts

Published accounts of an organization, made available and used by different stakeholders.

Profit and loss account (income statement) and balance sheet (statement of financial position)

Importance to internal staeholders

Gauge performance of a business, to negotiate pay deals, or judge the level of job security.

Importance to external stakeholders

Make sensible and coherent decisions

Financiers - ability of an organization to afford its debts

Reasons why managers are interested in final accounts

Measure performance against organizational targets

Help with decision-making, sufficient funds for new projects?

Benchmark key indicators against competitors.

Reasons why employees are interested in final accounts

Gauge extent to which jobs are secure

Use final accounts in negotiation process with labour unions to discuss pay rises

Reasons why shareholders are interested in final accounts

Measure profitability and how this has changed over time

Determine how much dividends they receive

Compare financial performance of other businesses to make rational decisions - to buy or sell shares in the company.

Reasons why financiers are interested in final accounts

Decide whether to lend money and how much based on the level of risk

Check on the creditworthiness of the organization before loans are given

Assess extent to which a business is able to pay back its borrowing

Reasons why suppliers are interested in final accounts

Does the business have sufficient liquidity to pay its debt?

Gauge level of risk and creditworthiness.

Negotiate improved credit terms, extend trade credit period, or demand immediate cash payment.

Reasons why customers are interested in final accounts

Determine if the business offers security and reliability in its services

Determine whether there will be future supplies of the product they are purchasing

Is the business financially secure?

Working capital cycle

Lengthy delay between customers paying and receiving the products.

Reasons why governments or tax authorities are interested in final accounts

Verify amount of tax due to to be paid by the business

Ensure business operates within the law, adhering to accounting law and rules

Assess liquidity position of the business, threat of business closure, and extent to which this could cause economic problems (depends on the size and market of the business)

Reasons why competitors are interested in final accounts

Judge their financial performance by comparing their financial accounts with the business

Benchmark best practices by examining what the business does well, and determine how they themselves can improve.

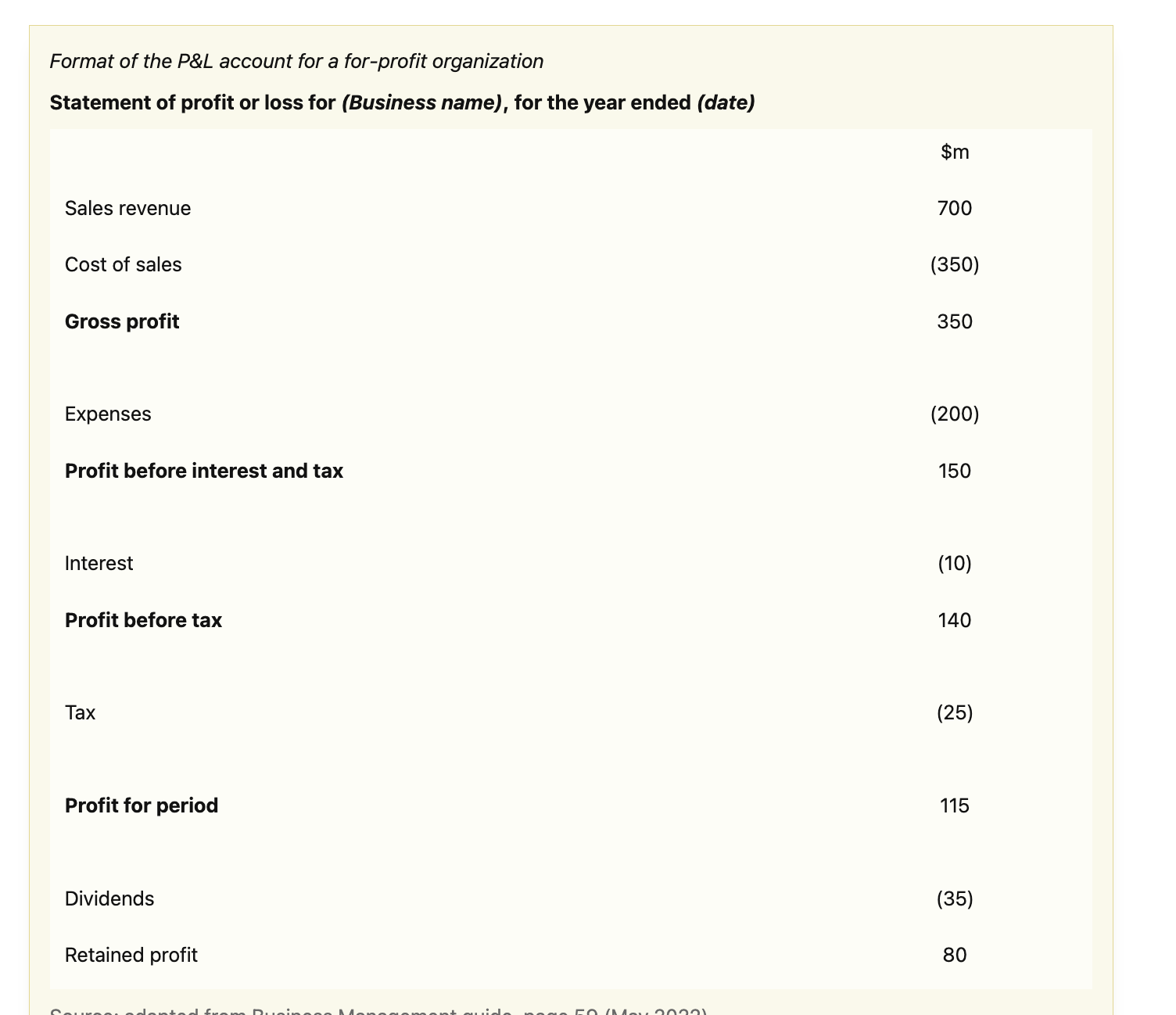

Profit and loss account

Shows a firm’s profit or loss after all production costs have been subtracted from the organization’s revenues, each year.

Profit and loss account format

Sales revenue

Money an organization earns from selling goods and services.

Cost of sales (cost of goods sold)

Direct costs of production (raw materials or direct labor)

= Opening stock + Purchases - Closing Stock

Gross profit

Profit from everyday’s trading activities, calculated as Sales revenue - Cost of sales.

Measure of how much value is added in the production process

Expenses

Firm’s indirect costs of production

Profit before interest and tax

Value of a firm’s profit or loss before deducting interest payments on loans and taxes on corporate payments.

Profit for period

Actual value of profit (profit after interest and tax)

Tax

Compulsory deductions paid to the government as a proportion of a firm’s profits.

Dividends

Payments from a company’s profit (after interest and tax) paid to the shareholders of the company.

What determines amount of dividends paid?

Amount of dividends paid to shareholders is determined by BOD

Amount of dividends paid to an individual shareholder depends on number of shares held

Retained profit

Funds left over from profits that is not paid to shareholders is kept within the business for its own use

= Profit after interest and tax - dividends

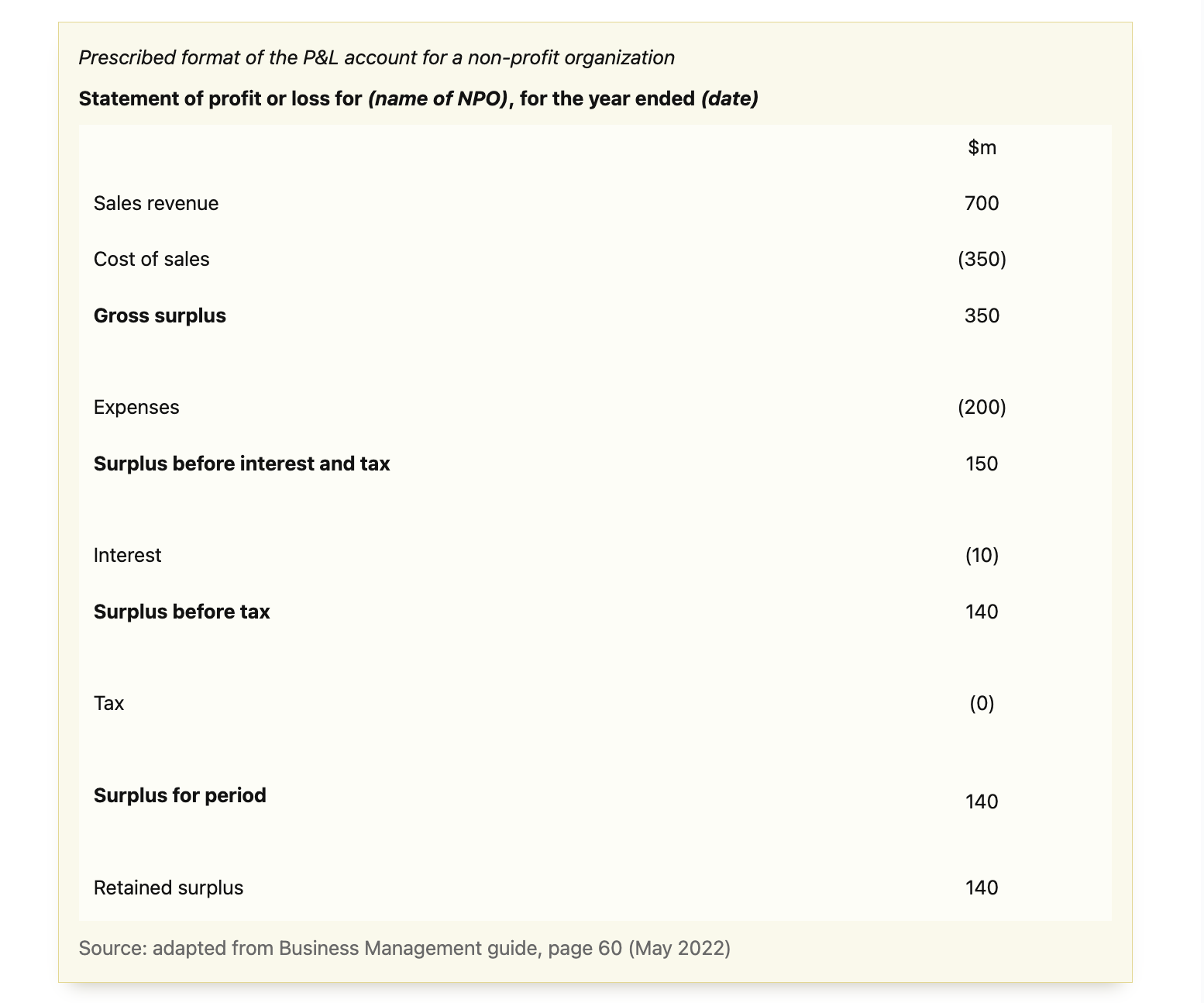

Profit and loss account for a non-profit organization format

Any financial surplus is kept within the business, rather than distributed between shareholders

Lack of dividends for non-profit organizations

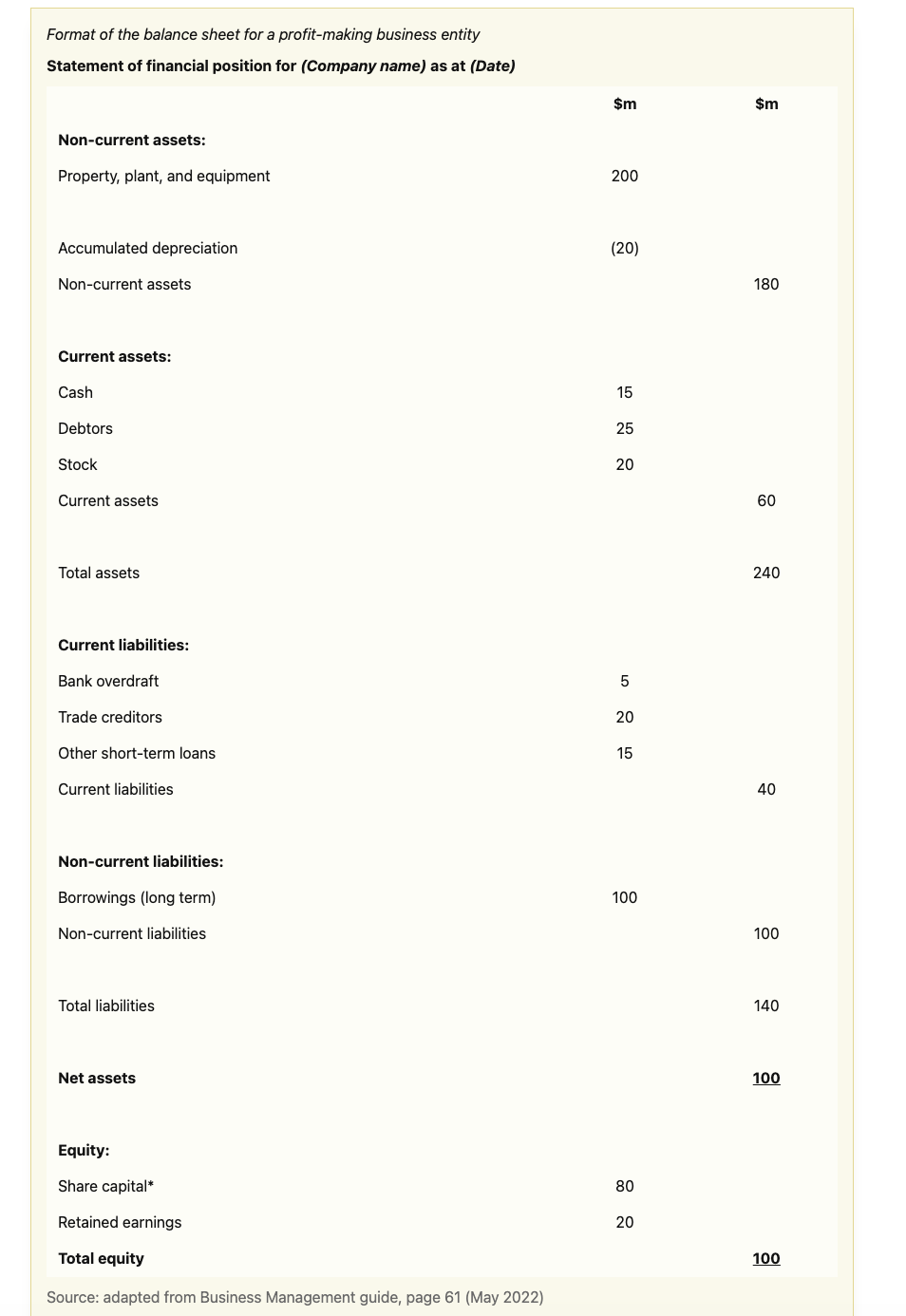

Balance sheet (statement of financial position)

Value of assets, liabilities, and the owner’s investment or equity at a particular point in time.

Reporting date is the same each year

Assets

Possessions of a business that have a monetary value, such as buildings and cash.

Liabilities

Debts of a business or money owed to others, such as trade creditors or financiers.

Balance sheet shows

Sources of finance: borrowed funds/liabilities, equity (investments of shareholders), and accumulated retained earnings.

Uses of finance: purchase of non-current assets and current assets

Format of balance sheet

Share capital is “Owner’s equity” for sole traders, partnerships, and non-profit business entities.

Retained earnings is used for both profit and non-profit organizations

Non-current assets

Long-term assets or possessions of an organization, not intended for resale within the next 12 months of the balance sheet date.

Accumulated depreciation

Sum of the fall in a non-current asset’s value due to wear and tear over time.

Illiquid assets

Items that cannot be sold quickly or are difficult to sell without in incurring a significant loss in value.

Current assets

Possessions with a monetary value, but liquidated within the next 12 months

Include cash, debtors, and stock

Cash

Money a business has in hand and/or at the bank

Most liquid current asset and easily accessible

Debtors

Individual or business customers that owe money to the business because they bought goods and services on trade credit

Stock (inventories)

Good available for sale, per time period and intended to be sold as quickly as possible to generate cash.

Categories of stock

Raw materials, work-in-progress or semi-finished goods, and finished goods.

Raw materials

Natural sources used in the production process.

Work-in-progress (semi-finished goods)

Components of a final product - items in the process of being produced to sell to customers.

Finished goods

Final products that are ready for sale and are of the most value to customers.

Total assets

Current assets + non-current assets.

Current liabilities

Short-term debts and repaid within 12 months.

Examples of current liabilities

Bank overdraft

Trade creditors (typically suppliers)

Short-term loans

Non-current liabilities

Long-term debts of a business, due after 12 months of the balance sheet date

Total liabilities

= Current liabilities + non-current liabilities

Net assets

Value of total assets after all liabilities have been deducted

= Total assets - total liabilities

Equity

Value of owner’s stake, comprised of share capital and retained earnings

Share capital

Value of equity in a business that is funded by shareholders, through an IPO or share issue

Retained earnings

Value of equity in a business that is funded by the accumulated profit after tax that has not been distributed as dividends to shareholders

= Opening retained earnings + Profit after interest and tax for current period - Dividends for current period

Balance balance sheet

Net assets = equity

Sources of finance = uses of finance

Examples of non-current liabilities

Bank loans

Borrow money at an agreed interest rate and repayment schedule

Mortgages

Long-term secured loans from commercial banks or financial lenders used to purchase property

Monthly payments are made, including interest

Corporate bonds

Debt securities (guarantees) sold to investors

Debt obligation that the borrower must repay with interest

Debentures

Long-term loans issued by organizations that borrow money from investors

Depend on creditworthiness, not specific assets

Intangible assets

Type of fixed asset except they are non-physical assets with a monetary value to the business, protected by using intellectual property rights.

Goodwill

Reputation and established networks (know-how) of an organization, adding significance above the market value of the firm’s physical assets

Helps to entice workers to the organization and to retain them.

Helps to attract investors.

However, the value of goodwill is subjective, so only materializes when the business is sold.

License

Gives business the legal right to operate in specific industries, use patented technology, sell particular products, or access certain resources.

Contribute to the organization’s operations and revenue generation.

Patents

Official rights given to a business to exploit an invention or process for commercial purposes.

Give a registered patent holder the exclusive right to use the innovation for a limited time period.

Creates incentive to invest in research and development and add value as the business can gain from having a unique selling point (USP).

Copyrights

Gives the registered owner the legal rights to creative pieces of work.

Exclusive rights to the commercial use of the product.

Trademarks

Form of IPP that give the owner exclusive commercial use of the registered brands, logos, and/or slogans.

Brand value

Expected earning potential of a brand (forecast future sales revenue). How much the brand is worth.

Depreciation

Fall in the value of a non-current asset. As it is used over and over, its value drops due to wear and tear (usage and natural ageing).

Residual value (scrap or salvage value)

Value of the non-current asset at the end of its useful life, before it is replaced.

Straight-line method

Spreads the depreciation evenly over the useful life of the non-current asset being depreciated. Value of the asset falls by equal amounts each year.

Book value

Value of the asset that is recorded in the balance sheet.

= Original cost of asset - Accumulated depreciation

Straight line method calculation

Annual depreciation = (Purchase cost - Residual value) / Estimated value lifespan

Advantages of straight line method

Ease of calculating depreciation, as the same amount is deducted each year. Depreciation is a fixed cost.

Suitable for assets that have a consistent usage rate.

Suitable for assets that have a known useful shelf-life and can be estimated.

Easier to make historical comparisons of the data.

Disadvantages of straight line method

Many non-current assets depreciate in value the most during the initial stages of their useful shelf life. Using a uniform depreciation may be misleading

Many assets do not depreciate consistently as they become less efficient over time.

Units of production method

Apportions an equivalent value of depreciation to a non-current asset based on each physical unit of output.

Method calculates depreciation based on the units of usagae rather than time.

Units of production rate (depreciation per unit)

= (Cost of asset - Salvage value) / Estimated units of production

Depreciation expense

= Units of production rate x Actual rate produced.

Advantages of units of production depreciation

More realistic to depreciate the value of an asset due to usage rather than the passing of time.

More accurate for non-current assets that depreciate directly due to wear and tear, rather than the passage of time.

Useful for manufacturers that experience fluctuations in production, based on changes in consumer demand over time.

Disadvantages of units of production depreciation

More complicated to calculate than the straight line method of depreciation.

Degree of subjectivity as the salvage value if subject to change and units of production is estimated.

Tax authorities do not allow this method, so it can only be used for internal bookeeping.