Unit 4: Fixing the economy part 2- Monetary policy

1/46

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

47 Terms

Medium of exchange

Money is valuable bc it’s accepted in the buying and selling of goods and services. Money makes trading easier than it would be with barter

Store of Value

Money is a way of storing wealth (keep purchasing power). If you work today, you can get paid in money and wait to spend it in the future

Unit of account/standard of value

Money can be used to state how much things are worth. The value of goods and services can be expressed in money prices to allow for each comparisons

Liquidity

Ease with which an asset can be converted to cash without losing much value. Cash is the most liquid asset, while tangible items like a house are less liquid

Commodity money

Something that performs the function of money and that has intrinsic value, derived from the material it is made of, such as gold or silver.

Fiat money

Currency that has no intrinsic value but is established as money by government regulation. Unlike commodity money, its value comes from the trust and confidence of the people who use it. Example paper money

Stocks

(equities) represent ownership of a corporation and the stockholder is often entitled to a portion of the profit paid out as dividends

Bonds

(securities) are loans, or IOUs, that represent debt that the government, business, or individuals must repay to the lender

bond price and interest rates are ___ rated

inversely

Money supply

all the money in society, defined in several ways (ex M1, M2, etc)

M1

coins, currency held by the public, traveler’s checks, checking account balances, and other cash accounts

M2

Includes M1, plus savings and small short-term time deposits (CDs), overnight “repos” at commercial banks, and non-institutional money market accounts. The common economic indicator used to forecast inflation.

M3

Includes M2, plus large time deposits, repos of maturity greater than one day at commercial banks, and institutional money market accounts

Monetary base=

Currency in circulation+ bank reserves

interest rate

percentage extra that must be paid back on a loan

nominal interest rate

total percentage (what you see on the loan)

real interest rate

adjusted for inflation

real interest rate formula

Real Interest Rate = Nominal Interest Rate - Inflation Rate.

Financial market

where households place their current saving and accumulated savings (wealth)

financial assets

are a paper claim to future income (loans, stocks, bonds, bank deposits)

Physical assets

It is a claim on a tangible object (house, lump of gold, car)

Asset

are anything of value (cash, houses, cars, the shirt on your back)

Financial system or financial markets provide 3 key functions

1) Reducing transaction costs

2)Reducing risk

3) providing liquidity

Financial intermediaries

institutions that amasses funds from one group and makes them available to another such as banks, credit unions, and insurance companies. They play a crucial role in facilitating the flow of funds in the economy.

2 traditional ways of borrowing

1) borrow from a bank: the interest rate is set in the contract

2) sell bonds: interest rate is set when bond is auctioned

Bond

promise to pay back a certain amount at a certain time

Maturity date for a bond

when a bond ends and is paid off

face value for a bond

the amount paid to the bondholder at maturity

when bond prices fall, interest rates ___

rise

when bond prices rise, interest rates ___

fall

Nominal interest rates=

real interest rate + inflation

Liabilities

obligations to other parties (debt)

net worth=

assets-liabilities

deposit multiplier (used in t-accounts)

=1/required reserve ratio

if asking abt change in demand deposits the ____ amount of initial deposit gets multiplied through the multiplier (1/RR)

WHOLE

If asking abt change in money supply as a result of a deposit you have to

take out the required reserve amount before multiplying by the multiplier

if asked abt the change based on a fed or central bank purchase multiply the ___ amount to see the overall change in the money supply

full

money market demand graph

A graphical representation of the relationship between the quantity of money demanded and the nominal interest rate, showing how changes in the money supply can affect interest rates and overall economic activity.

DM shifters of the money market demand graph

PL (direct)

rGDP (direct)

technology (inverse)

Monetary policy

The Federal reserve’s ability to stabilize the economy by changing the SM in order to change interest rates

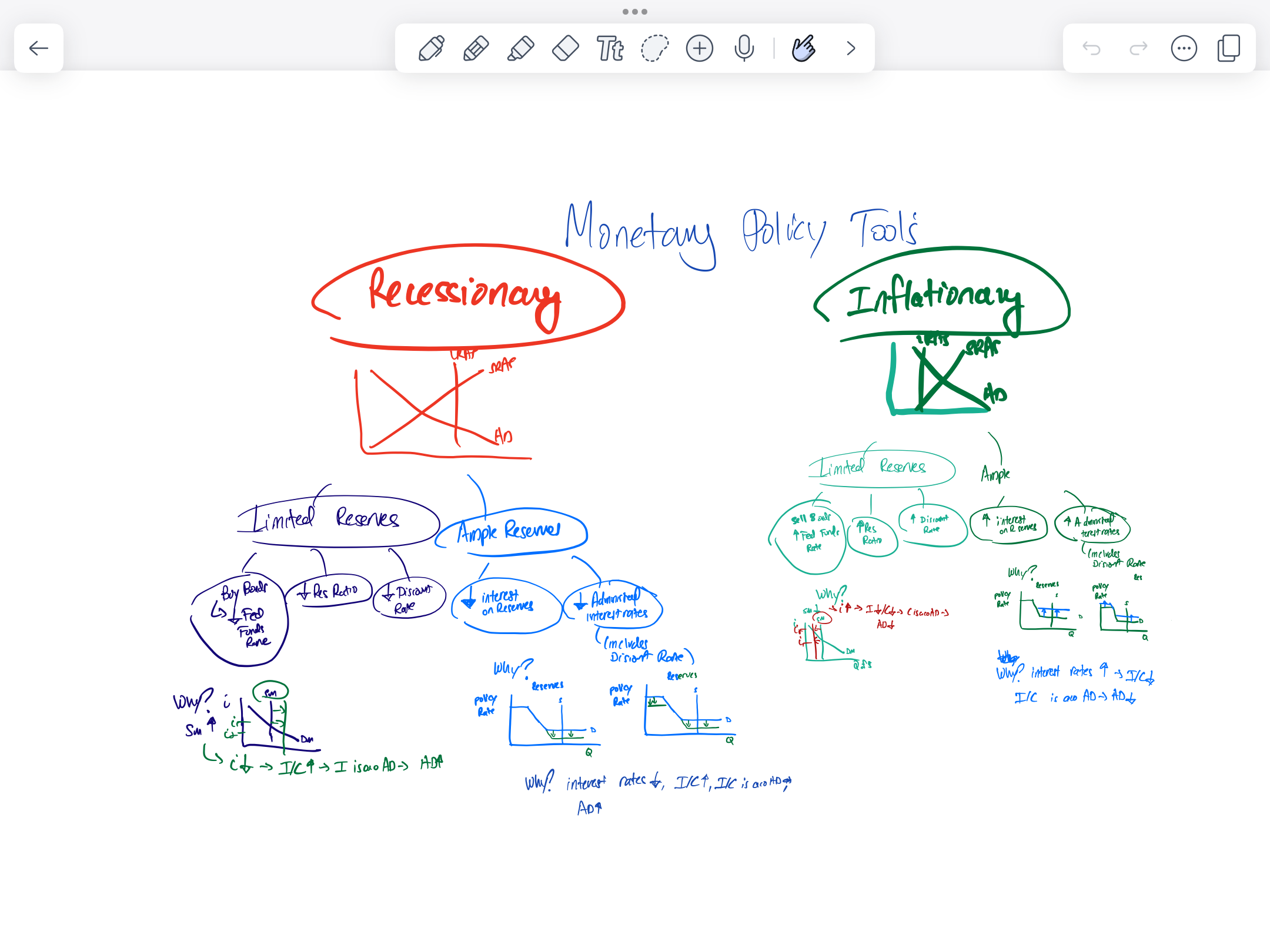

Monetary policy tools for recessionary and inflationary

Interest on reserves (IOR)

The interest rate that the federal reserve pays commercial banks to hold reserves

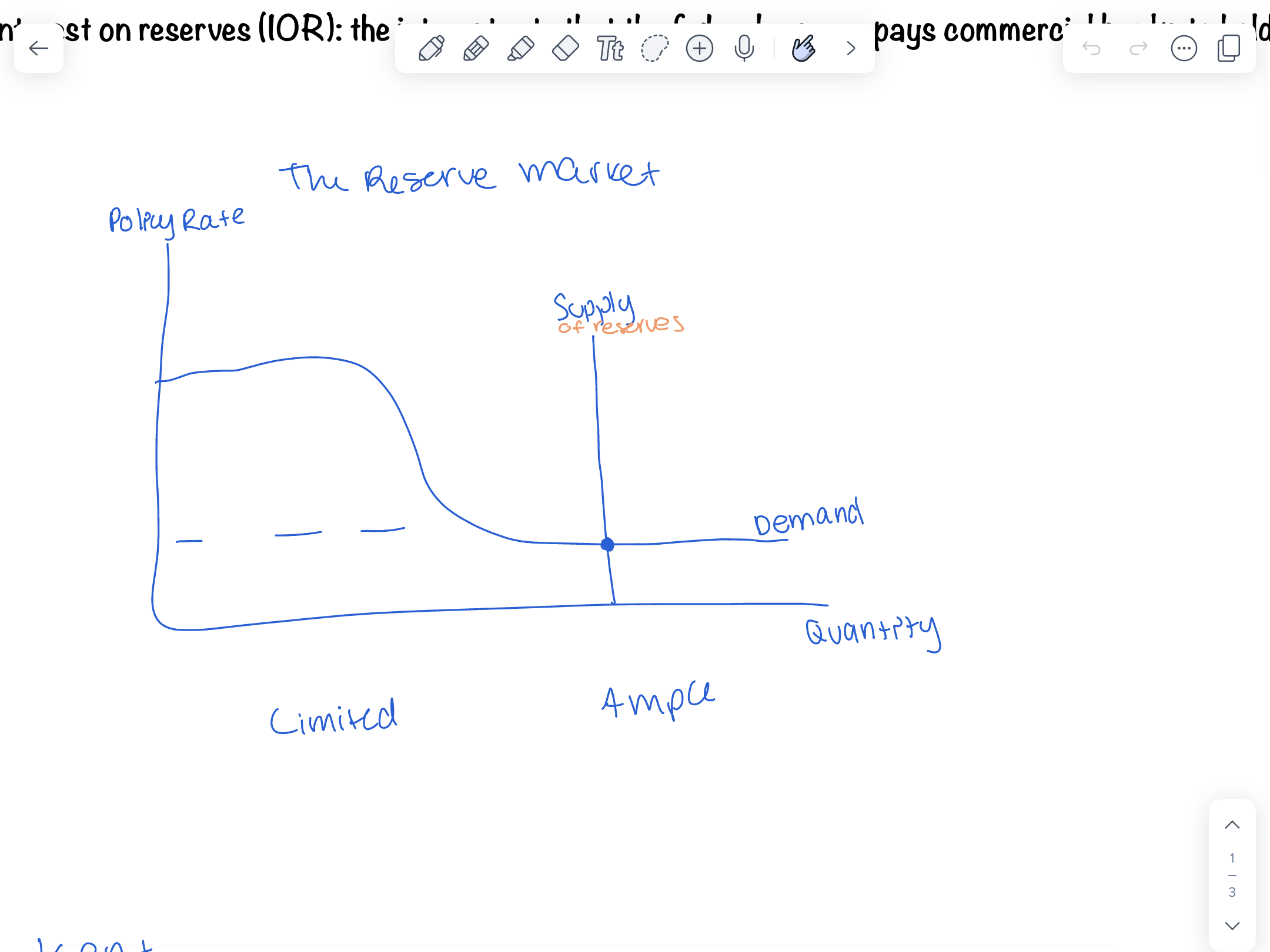

Reserve market graph

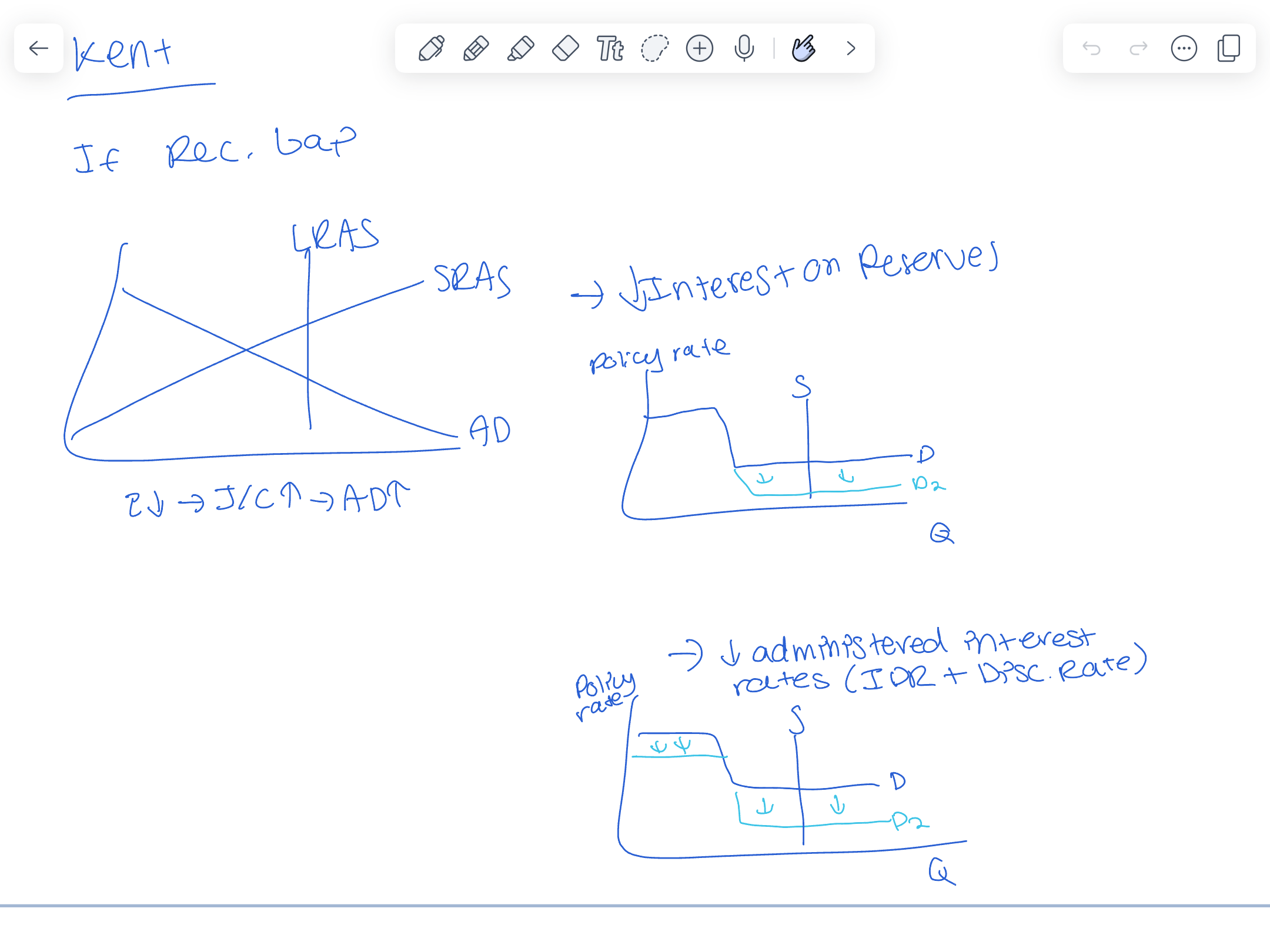

Reserve market graph if recessionary gap

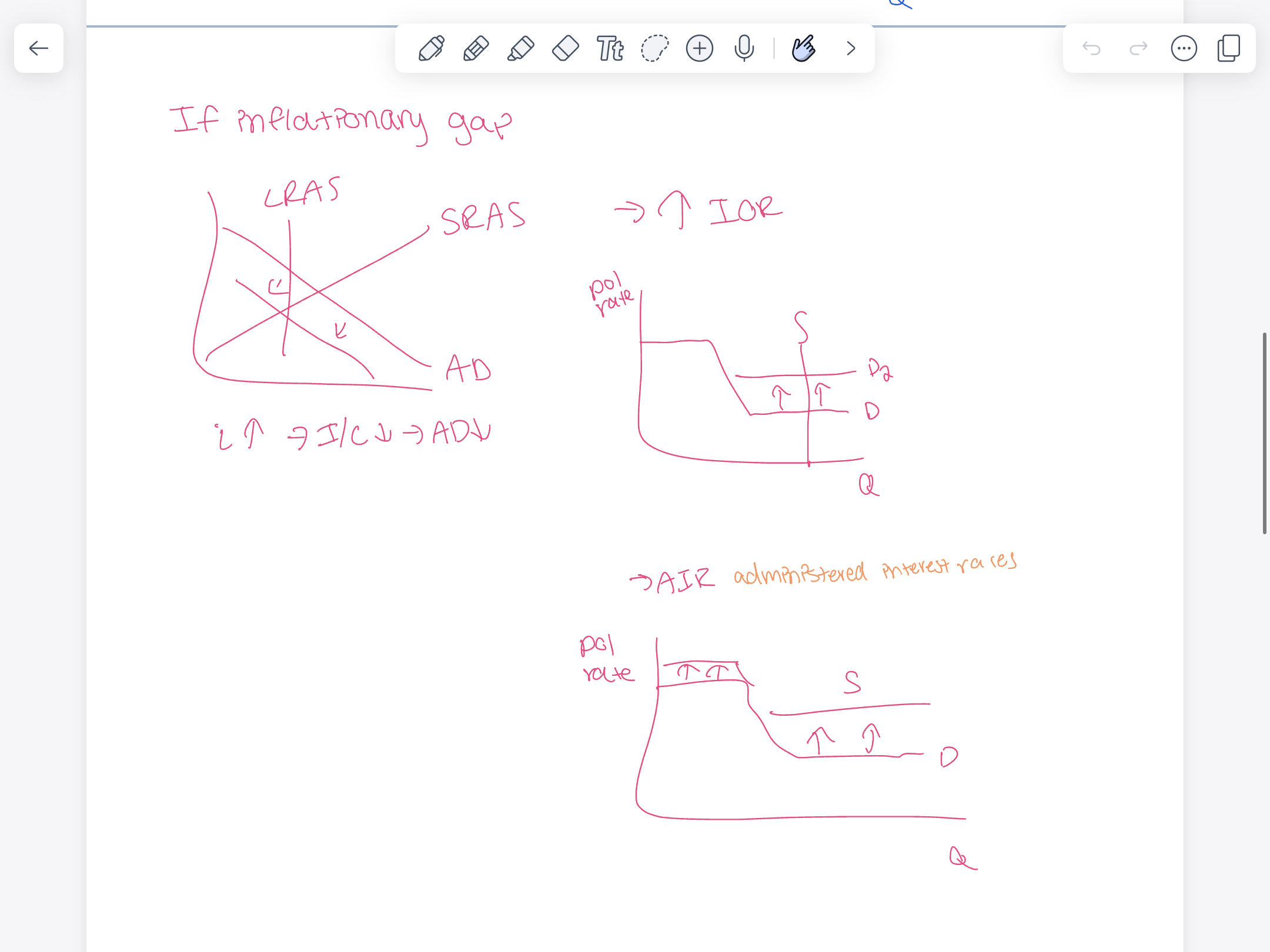

reserve market graph if inflationary gap

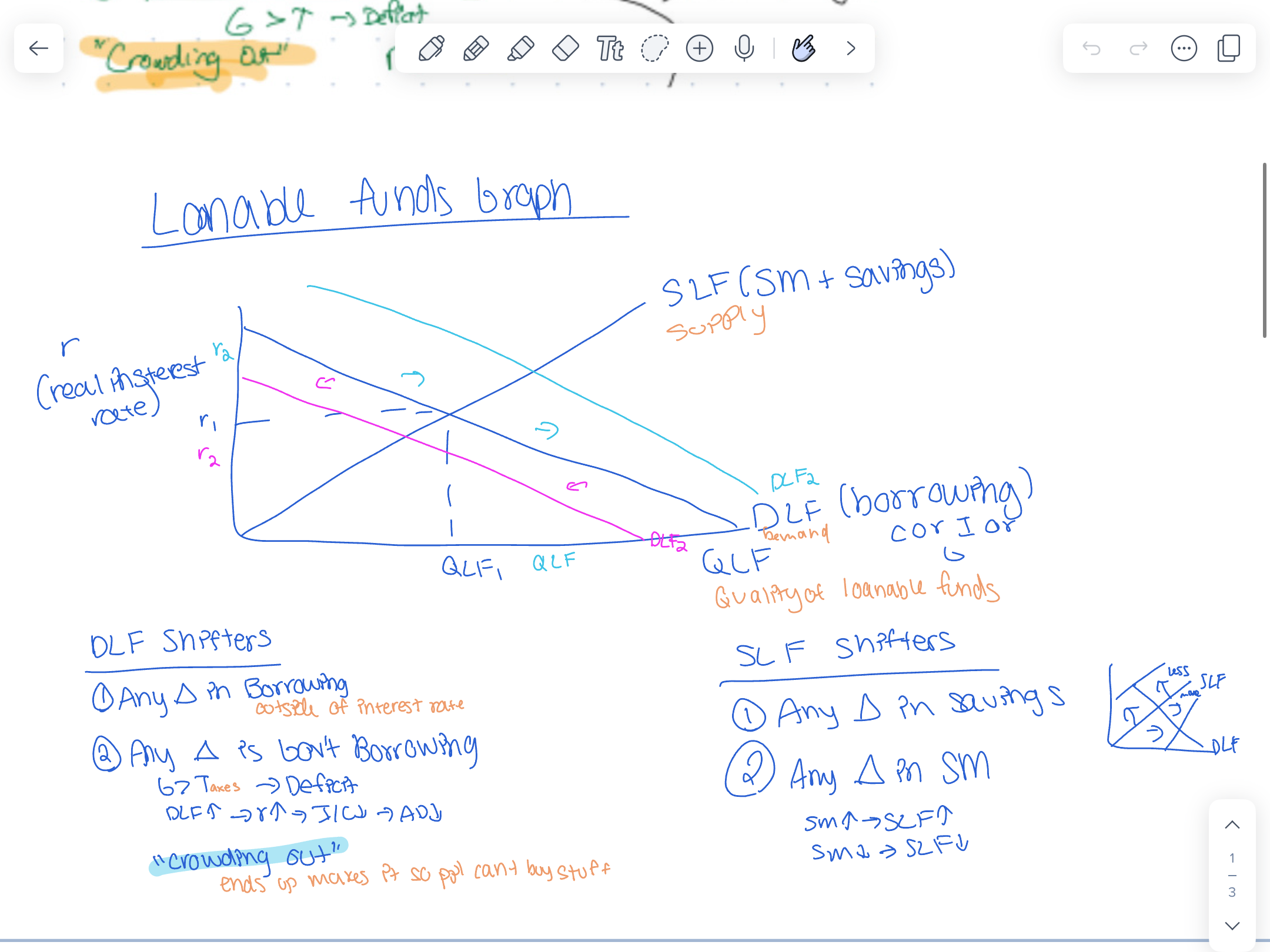

Loanable funds graph

equation of exchange

MV=PY

M= Money supply

V= Velocity of money

P= Price level PxY=nominal GDP

Y= Real output