Classical Long Run Aggregate Supply

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

10 Terms

Long run (Recap)

All factors of production are fully flexible

Classical Economics

emphasises the fact that free markets lead to an efficient outcome and are self-regulating.

Classical Long Run Aggregate Supply

Classical LRAS is the level of real potential GDP in an economy, deemed to be constant at all price levels.

Key Assumption: Unemployment can persist in the short-run, but in the long run flexible wages and prices ensure that the economy operates at the full capacity

Wages (and the other FoP prices) will rise and fall to ensure that there are no surpluses or shortages of inputs

Full employment will hence occur in the long run, and the maximum sustainable level of output, YFE, will be made

Key Implication: The classical view suggests that real GDP is determined by supply-side factors (e.g. the level of I, the level of capital, the productivity of labour, etc.)

In the long-term, an increase in AD (faster than growth in LRAS), will just cause inflation and will not increase real GDP

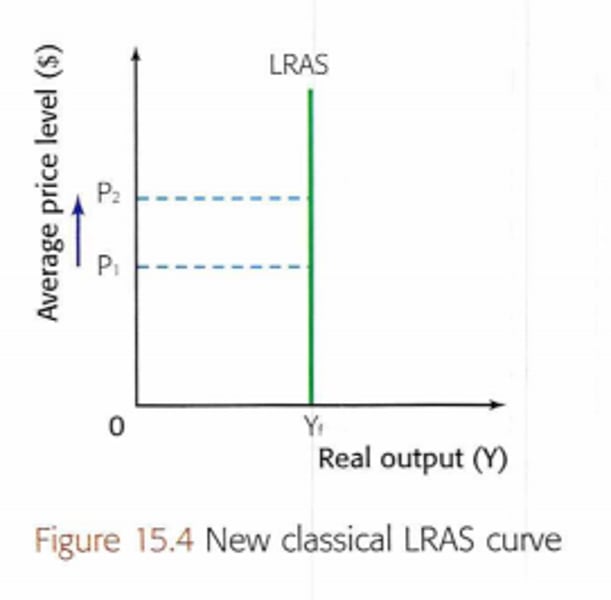

Classical LRAS diagram

Classical LRAS Curve definiton

The Classical LRAS curve graphs the relationship between potential real GDP and the price level.

Why is the Classical LRAS Curve vertical?

Fully flexible wages and factor input prices means that the economy always operates at full capacity regardless of the price level

Movements Along the LRAS Curve

Correspond to changes in price level,

There is no change in long run output (constant at YFE)

Shifts of the LRAS curve

Correspond to changes to either the quality or quantity of the factors of production

Improvements in education and skills

Changes in relative productivity

Changes in government regulations

Demographic changes and migration

Investment