Macroeconomics Unit 6: Foreign Exchange Market

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

19 Terms

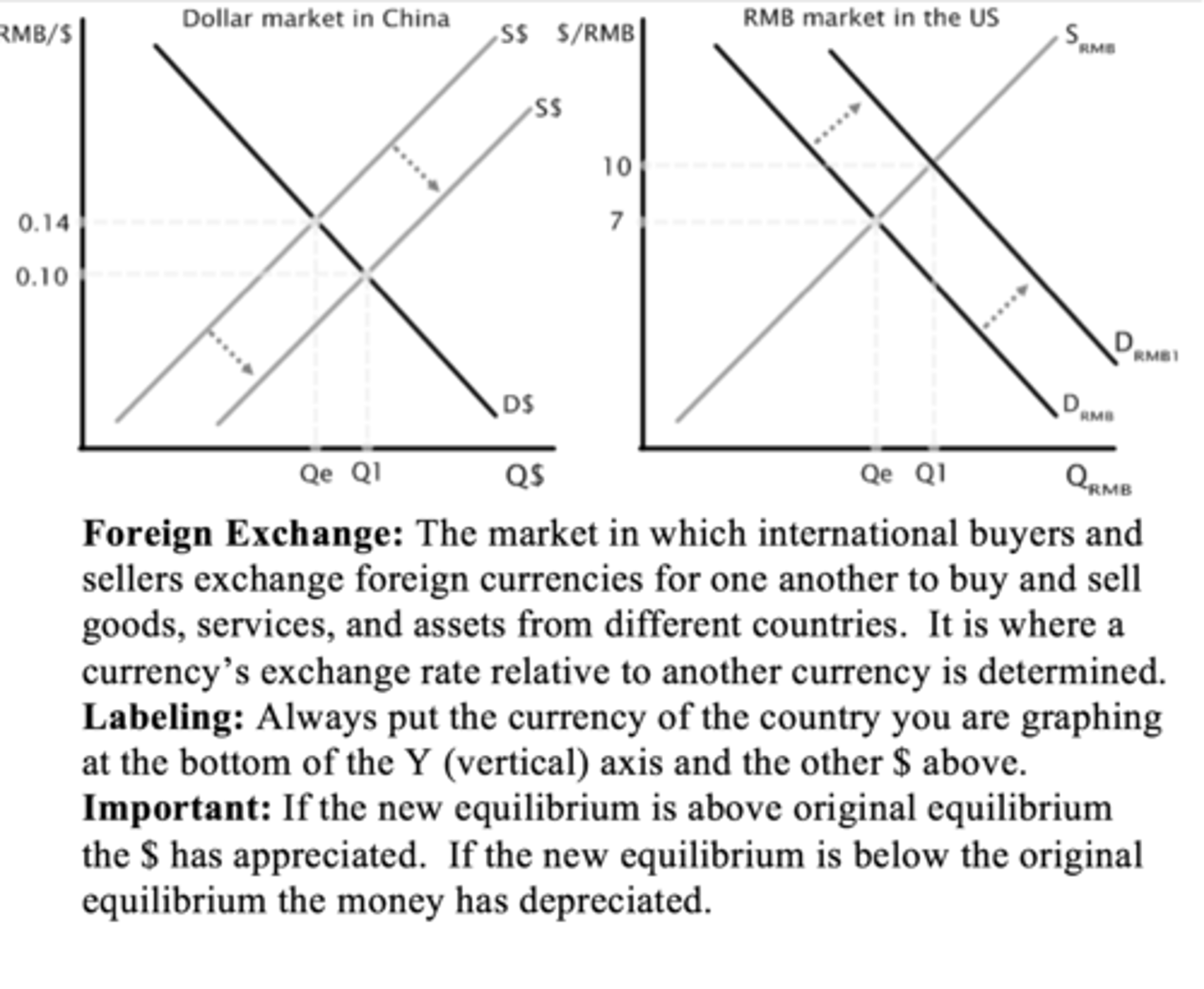

FOREX Market (graph)

Balance of Payments

Measures all the monetary exchanges between one nation and all other nations. Includes the current account and the capital account.

Current Account

Measures the balance of trade in goods and services and the flow of income between one nation and all other nations. It also records monetary gifts or grants that flow into or out of a country. Equal to a country's net exports, or its exports minus its imports.

Exchange Rate

The price of one currency in terms of another currency, determined in the forex market.

Capital (Financial) Account

Measures the flow of funds for investment in real assets (such as factories or office buildings) or financial assets (such as stocks and bonds) between a nation and the rest of the world.

Trade Deficit

When a country's total spending on imported goods and services exceeds its total revenues from the sale of exports to the rest of the world. Synonymous with a deficit in the current account of the balance of payments and with a negative net export component of GDP.

Trade Surplus

When a country's sale of exports exceeds its spending on imports. Synonymous with a surplus in the current account of the balance of payments.

Appreciation

An increase in the value of one currency relative to another, resulting from an increase in demand for or a decrease in supply of the currency on the foreign exchange market.

Depreciation

A decrease in the value of one currency relative to another, resulting from a decrease in demand for or an increase in the supply of the currency on the foreign exchange market.

Floating Exchange Rates

When a currency's exchange rate is determined by the free interaction of supply and demand in international forex markets.

FOREX Markets (Foreign Exchange Market)

The market in which international buyers and sellers exchange foreign currencies for one another to buy and sell goods, services, and assets from various countries. It is where a currency's exchange rate relative to other currencies is determined.

Fixed Exchange Rates

When a government or central bank takes action to manage or fix the value of its currency relative to another currency on the forex market.

Net Exports

A component of aggregate demand that equals the income earned from the sale of exports to the rest of the world minus expenditures by domestic consumers on imports.

real exchange rate

the rate at which a person can trade the goods and services of one country for the goods and services of another without inflation

Purchasing Power Parity (PPP)

The amount of money needed in one country to purchase the same goods and services in another country

devaluation of currency

Refers to a decrease in the value of a currency in the context of a fixed exchange rate system (to be compared with depreciation, which is a decrease in currency value in the context of a floating (or flexible) or managed exchange rate system).

Revaluation (of a currency)

Refers to an increase in the value of the currency in the context of a fixed exchange rate system.

Capital inflows are:

purchases of domestic assets by foreign households and firms

capital outflows

purchases of foreign assets by domestic households and firms