NIPA APA Course 3 - 2024 Practice Exam B

1/99

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

100 Terms

The rules that apply to distributions vary based on all the following, EXCEPT:

A. The type of plan

B. The terms of the plan

C. The participant’s election

D. The employer’s discretion

D. The employer’s discretion

All of the following statements regarding qualified domestic relations order (QDRO) distributions are true, EXCEPT:

A. A QDRO is issued by a state-level domestic relations court.

B. A QDRO distribution must be paid immediately once the QDRO is issued.

C. A QDRO is a judgment, decree or order for a retirement plan to pay child support, alimony or marital property rights.

D. A QDRO awards a portion of a participant's benefit to an alternate payee, who is a spouse, former spouse, child or other dependent of the plan participant.

B. A QDRO distribution must be paid immediately once the QDRO is issued.

All of the following are considered distributable events, EXCEPT:

A. Disability of the plan participant

B. A reservist being called to active duty

C. The college graduation of the participant’s child

D. Retirement at the plan’s normal retirement age

C. The college graduation of the participant’s child

All of the following information is essential to the distribution process, EXCEPT:

A. The participant’s age

B. How the distribution is valued

C. Plan document distribution provisions

D. Whether the termination was voluntary

D. Whether the termination was voluntary

Jenny is a terminated participant in her employer’s qualified plan. Her fixed benefit is payable over her life with no further payments after death. Which form of distribution has Jenny elected?

A. Life annuity

B. Ad-hoc distributions

C. Installment payments

D. Period certain and life annuity

A. Life annuity

All of the following plans are covered by the survivor annuity requirements, EXCEPT:

A. Defined benefit plan

B. Governmental plan

C. Money purchase plan

D. 401(k) plan that offers a life annuity

B. Governmental plan

Which of the following statements regarding the qualified preretirement survivor annuity (QPSA) requirements is TRUE?

A. A QPSA is the required death benefit in a profit-sharing plan.

B. Only fully vested participants are subject to the QPSA rules.

C. A QPSA is not required if a participant hasn’t been married for at least 5 years.

D. QPSA benefits are paid to the participant's surviving spouse if the participant dies before receiving retirement benefits.

D. QPSA benefits are paid to the participant's surviving spouse if the participant dies before receiving retirement benefits.

Which of the following statements regarding the qualified joint and survivor annuity (QJSA) requirements is TRUE?

A. A QJSA is the required form of distribution when vested benefits are $1,000 or more.

B. Benefits payable upon death cannot be less than 100% of the annuity paid during the joint lives of the participant and the participant's spouse.

C. A plan subject to the survivor annuity rules can distribute a form other than a QJSA if the spouse cannot be located.

D. The survivor annuity must be the actuarial equivalent of substantially equal periodic payments made over a five-year period.

C. A plan subject to the survivor annuity rules can distribute a form other than a QJSA if the spouse cannot be located.

Jane is a participant in her employer's defined benefit plan. She is 45 years old, hired at age 35 and retired at 65. Her projected benefit at normal retirement date is $2,400. What is her current accrued benefit?

A. $400

B. $800

C. $1,600

D. $2,400

B. $800

Which two of the following statements regarding a rehired participant’s benefit are TRUE?

A. Under the “buy back” rules, if a rehired participant repays the amount previously distributed, the employer must restore the forfeited amount.

B. The “buy back” must occur within 5 years of the participant’s re-employment, or after 5 breakin-service years, if earlier.

C. Rehired participants who forfeited under a deemed cash-out are not able to “buy back” their previously forfeited amount.

D. The employer must restore the forfeited amount to the employee's account, whether they repay the amount previously distributed.

A. Under the “buy back” rules, if a rehired participant repays the amount previously distributed, the employer must restore the forfeited amount.

B. The “buy back” must occur within 5 years of the participant’s re-employment, or after 5 breakin-service years, if earlier.

A plan may exclude all of the following years of service for vesting purposes, EXCEPT:

A. Years of service performed before the plan’s effective date

B. Years of service performed prior to the participant’s 18th birthday

C. Any year in which a participant isn’t credited with 1,000 hours of service

D. Any year the participant didn’t make an elective deferral to the employer’s 401(k) plan.

D. Any year the participant didn’t make an elective deferral to the employer’s 401(k) plan.

All of the following statements regarding missing participants in an on-going defined contribution plan are true, EXCEPT:

A. The preferred way to distribute benefits to missing participants is 100% income tax withholding.

B. The DOL set the minimum search requirements a fiduciary must take for missing participants.

C. Automatic rollovers for missing participants may be available if the distribution amount is $5,000 or less.

D. Most plans allow for the forfeiture of missing participant account balances, provided forfeited amounts are restored if the participant makes a claim for benefits.

A. The preferred way to distribute benefits to missing participants is 100% income tax withholding.

All of the following amounts may be set as a cash-out threshold in the plan document, EXCEPT:

A. No cash-outs allowed

B. $1,000 or less

C. $7,000 or less

D. More than $7,000.

D. More than $7,000.

All of the following statements regarding automatic rollovers are true, EXCEPT:

A. Automatic rollovers can help reduce a plan’s participant count.

B. The SPD or SMM provided to participants must describe the IRA investments.

C. Automatic rollovers only apply if the plan contains an involuntary cash-out provision.

D. Automatic rollovers only apply to participants with a vested account balance greater than $7,000.

D. Automatic rollovers only apply to participants with a vested account balance greater than $7,000.

All of the following statements regarding the DOL safe harbors for automatic rollovers are true, EXCEPT:

A. The safe harbors limit a plan to a single IRA provider.

B. The safe harbors require a written agreement with an IRA provider.

C. The safe harbors are designed to protect plan fiduciaries when complying with the automatic rollover rules.

D. The safe harbors require that the IRA’s fees may not exceed the fees charged by the institution for comparable IRAs established for rollover distributions.

A. The safe harbors limit a plan to a single IRA provider.

All of the following are safe harbor investment strategies for an automatic rollover, EXCEPT:

A. Money market fund

B. Stable value fund

C. S&P 500 index fund

D. Interest-bearing savings account

C. S&P 500 index fund

Which of the following statements regarding eligible rollover distributions is TRUE?

A. Rollovers under the 60-day rollover rule are not permitted.

B. To be eligible for rollover, a participant's entire vested balance must be distributed at one time.

C. Only distributions from qualified plans that are eligible rollover distributions can be rolled over.

D. An eligible rollover distribution paid to a participant is subject to a mandatory 10% tax withholding.

C. Only distributions from qualified plans that are eligible rollover distributions can be rolled over.

All of the following distributions are eligible rollover distributions, EXCEPT:

A. An offset distribution of a plan loan

B. A distribution from a terminated plan

C. A distribution that is a required minimum distribution

D. A distribution that is part of a series of substantially equal periodic payments paid for 8 years

C. A distribution that is a required minimum distribution

Which of the following statements regarding a direct rollover is TRUE?

A. It is an optional plan provision for outgoing rollovers.

B. A plan must allow all employees, not just plan participants, to make rollovers to the plan.

C. The entire eligible rollover distribution must be rolled over.

D. The distributable funds are paid directly to the qualifying plan.

D. The distributable funds are paid directly to the qualifying plan.

Which of the following statements regarding direct rollover procedures is TRUE?

A. Direct rollover rules make it mandatory for a qualified plan to accept inbound direct rollovers. B. A plan administrator can set a policy limiting inbound rollovers.

C. A plan administrator must accept rollovers to the plan in-kind.

D. A plan administrator must accept rollovers from 403(b) plans.

B. A plan administrator can set a policy limiting inbound rollovers.

All of the following rollovers satisfy the rollover rules, EXCEPT:

A. Hardship distributions

B. A spouse alternate payee rolling over a QDRO distribution to a 401(k) plan

C. A 401(k)-plan participant rolling over her designated Roth account to a Roth IRA

D. A surviving spouse rolling over the decedent's 401(k) funds to a profit-sharing plan in which the spouse participates

A. Hardship distributions

All of the following statements regarding the 60-day rollover rules are true, EXCEPT:

A. The 60-day rollover option is occasionally used to make up for in-kind distribution.

B. The 60-day rollover period can be waived if the participant’s Federal tax return is extended. C. Under the 60-day rollover, the participant can roll over all or a portion of the distribution amount.

D. The participant has 60 days from the date the distribution was received to make a deposit to an IRA or an eligible employer plan.

B. The 60-day rollover period can be waived if the participant’s Federal tax return is extended.

Katie terminated employment at age 50 and requests a distribution of her $100,000 money purchase vested account balance, which includes $25,000 of after-tax employee contributions. Katie rolls over $75,000 to an IRA and receives a distribution of $25,000. How much of her distribution is included in taxable income?

A. $0

B. $25,000

C. $75,000

D. $100,000

A. $0

Charley terminates employment at age 60. When he requests a distribution of his plan benefits, he’s paid a $5,000 corrective distribution due to excess deferrals, plus his remaining $100,000 vested amount balance. Within 60 days of the distributions, Charley decides to roll over his plan money to an IRA. What is the maximum amount he can roll over?

A. $0

B. $80,000

C. $100,000

D. $105,000

C. $100,000

All of the following distributions are in-service distributions that may be made from a profit-sharing plan if allowed by the plan, EXCEPT:

A. A distribution due to financial hardship

B. A distribution upon the participant becoming disabled

C. A distribution upon attainment of 60 months of plan participation

D. A distribution of 401(k) accounts without restriction when part of a profit-sharing plan

D. A distribution of 401(k) accounts without restriction when part of a profit-sharing plan

Which two of the following distributions are in-service distributions that may be made from a 401(k) plan?

A. A distribution of rollover accounts

B. A distribution of elective deferrals at any time for any reason

C. A distribution of profit-sharing contributions at any time for any reason

D. A distribution of qualified matching contributions after five years of plan participation

A. A distribution of rollover accounts

C. A distribution of profit-sharing contributions at any time for any reason

Which of the following in-service distributions may be made from a pension plan, if permitted by the plan?

A. A distribution due to hardship

B. A distribution to a 59½ year-old participant

C. A distribution to a participant under the 2-year aging rule

D. A distribution to an employee who has been a participant for at least 5 years

B. A distribution to a 59½ year-old participant

Which of the following statements regarding hardship withdrawals is TRUE?

A. A. All 401(k) plans are required to allow hardship withdrawals.

B. Safe harbor contributions may not be distributed as a hardship withdrawal.

C. A hardship withdrawal may not exceed the amount of the participant’s need.

D. A participant is not permitted to take a hardship withdrawal on behalf of the participant's beneficiary.

C. A hardship withdrawal may not exceed the amount of the participant’s need.

Which of the following statements regarding whether an immediate and heavy financial need qualifies for hardship withdrawal is TRUE?

A. The prevention of foreclosure on the home of the participant's child qualifies as an immediate and heavy financial need.

B. Post-secondary educational fees for a participant's dependents are not deemed to be an immediate and heavy financial need.

C. FEMA declared disasters qualify as an immediate and heavy financial need if the participant’s principal residence is in the designated area.

D. Expenses for repairs to the participant's principal residence that qualify for the casualty deduction without regard to a federally declared disaster qualify as an immediate and heavy financial need.

D. Expenses for repairs to the participant's principal residence that qualify for the casualty deduction without regard to a federally declared disaster qualify as an immediate and heavy financial need.

All of the following statements regarding whether a hardship withdrawal is necessary to satisfy a financial need are true, EXCEPT:

A. The employer must inquire into a participant’s financial status.

B. The plan may require the participant to first obtain all nontaxable plan loans available.

C. The distribution can include additional amounts to pay expected income taxes or penalties on the distribution.

D. Cash or liquid assets earmarked for another expense, such as rent, are not considered reasonably available to the participant.

D. Cash or liquid assets earmarked for another expense, such as rent, are not considered reasonably available to the participant.

Mandy became a participant in her employer’s 401(k) plan on January 1, 2014. From 2014 to 2019 Mandy contributed elective deferrals of $2,000 each year. On January 1, 2020, Mandy took an $8,000 hardship withdrawal, and didn’t contribute to the plan for the rest of the year. In 2021 Mandy began making elective deferrals again of $2,000 per year through 2023. As of December 31, 2023, her total account balance is $11,500. Mandy requests a hardship withdrawal on January 1, 2024. The plan allows hardship distributions from elective deferrals, excluding earnings. What is Mandy’s maximum hardship withdrawal amount?

A. $4,000

B. $6,000

C. $10,000

D. $11,500

C. $10,000

Which of the following statements regarding the taxation of hardship withdrawals is TRUE?

A. They are taxed in the year of receipt

B. The 10% additional tax on early distributions is waived

C. Distributions of hardship withdrawals can be rolled over

D. The 20% withholding rules apply to hardship withdrawals

A. They are taxed in the year of receipt

In 2023, Jane has an excess deferral of $2,000. She is not eligible for catch-up contributions, nor has she made any designated Roth contributions. The plan administrator has determined that the earnings related to her excess is $100. To correct the excess, Jane receives a distribution of $2,100. Which of the following statements regarding the taxation of her corrective distribution is TRUE?

A. If the distribution is made on March 25, 2024, her 2023 taxable income is $100 and her 2024 taxable income is $2,000.

B. If the distribution is made on March 25, 2024, her 2023 taxable income is $2,000 and her 2024 taxable income is $100.

C. If the distribution is made on March 25, 2024, her 2023 taxable income is $2,100 and her 2024 taxable income is $0.

D. If the distribution is made

B. If the distribution is made on March 25, 2024, her 2023 taxable income is $2,000 and her 2024 taxable income is $100.

Lilly has an excess contribution of $75 from her employer’s 401(k) plan for the plan year ending December 31, 2023. Earnings on the excess are $5. Which of the following statements regarding the correction of her excess contribution is TRUE?

A. A corrective distribution of $80 on March 11, 2024 is taxable in 2023.

B. A corrective distribution of $80 by December 31, 2024 is a timely correction.

C. A corrective distribution must be made by the 2023 Form 5500 filing deadline in order for the employer to avoid the 10% excise tax.

D. If the entire excess contribution represents designated Roth contributions, an $80 corrective distribution on April 4, 2024 would be fully taxable in 2024.

B. A corrective distribution of $80 by December 31, 2024 is a timely correction.

Larry has an excess aggregate contribution of $500 from his employer’s 401(k) plan for the plan year ending June 30, 2023, consisting entirely of vested matching contributions. Earnings on the excess are $50. Larry receives a distribution of $550 on August 29, 2023. What year is his corrective distribution taxable?

A. 2022

B. 2023

C. 2024

D. The corrective distribution is not taxable.

B. 2023

Which two of the following statements regarding the correction of excess annual additions are TRUE?

A. All related matching contributions must be forfeited.

B. A corrective distribution is taxable in the year distributed.

C. A corrective distribution is not required to include allocable earnings.

D. The excess that includes elective deferrals may be used to reduce employer contributions for the following year.

A. All related matching contributions must be forfeited.

B. A corrective distribution is taxable in the year distributed.

A 401(k) plan’s tax-qualified status is protected under all of the following corrective distributions, EXCEPT:

A. A tax year 2023 excess deferral distributed on December 28, 2023

B. A plan year ending June 30, 2023 excess annual addition distributed on February 15, 2024

C. A plan year ending November 30, 2023 excess contribution distributed on September 15, 2024

D. A plan year ending December 31, 2023 excess aggregate contribution distributed on January 5, 2025

D. A plan year ending December 31, 2023 excess aggregate contribution distributed on January 5, 2025

Which of the following statements regarding the tax and reporting rules of corrective distributions is TRUE?

A. They are subject to the mandatory 20% tax withholding.

B. They may be rolled over within 60 days of distribution.

C. They are subject to the 10% additional income tax on early distributions.

D. Distribution codes on Form 1099-R indicate the type of corrective distribution and the year the amount is taxed.

D. Distribution codes on Form 1099-R indicate the type of corrective distribution and the year the amount is taxed.

Bill is a highly compensated employee (HCE) in a calendar-year 401(k) plan. Based on the following information, what is the additional corrective distribution that must be paid to Bill?

Bill’s excess deferral = $1,000 (distributed February 21st)

Bill’s excess contribution = $3,000 (not yet distributed)

A. $0

B. $1,000

C. $2,000

D. $3,000

C. $2,000

Eve, age 73, has a required minimum distribution of $2,000 in 2023. However, her distributions during the year only total $1,000. Which two statements regarding the excise tax on the failure to make required minimum distributions are TRUE?

A. The excise tax is reported and paid on Form 5329.

B. Eve's employer is subject to a $100 excise tax in 2023.

C. The excise tax may be waived if there was a decline in the economy.

D. The excise tax on the 2023 shortfall does not carry over to subsequent years.

A. The excise tax is reported and paid on Form 5329.

D. The excise tax on the 2023 shortfall does not carry over to subsequent years.

Eric is a participant in his employer’s 401(k) plan and profit-sharing plan. For 2023, his required minimum distribution is $3,000 from the 401(k) plan and $5,000 from the profit-sharing plan. He receives an $8,000 distribution from the profit-sharing plan. Assuming the RMD is not timely corrected, what is the excise tax on failure to make required minimum distributions in 2023?

A. $0

B. $300

C. $750

D. $4,000

C. $750

Cheryl is a participant in her employer’s profit-sharing plan. Her birth date is June 26, 1949. The plan requires payments to begin under the more flexible required minimum distribution rules for non-owners. Cheryl is not an owner, and she elects to retire on December 11, 2022. By what date is she required to begin taking distributions from the plan?

A. December 31, 2020

B. April 1, 2021

C. April 1, 2022

D. April 1, 2023

D. April 1, 2023

Nancy owns 75% of ABC Company. Her date of birth is October 26, 1950, and she retires from the company on January 1, 2023. By what date is she required to begin taking distributions from the company’s 401(k) plan?

A. December 31, 2022

B. April 1, 2023

C. December 31, 2023

D. April 1, 2024

B. April 1, 2023

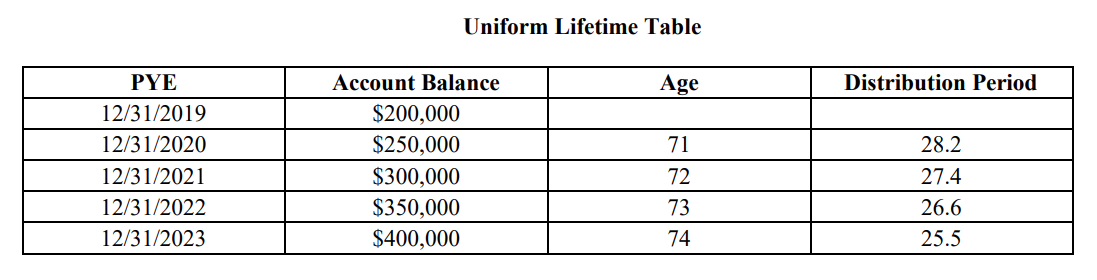

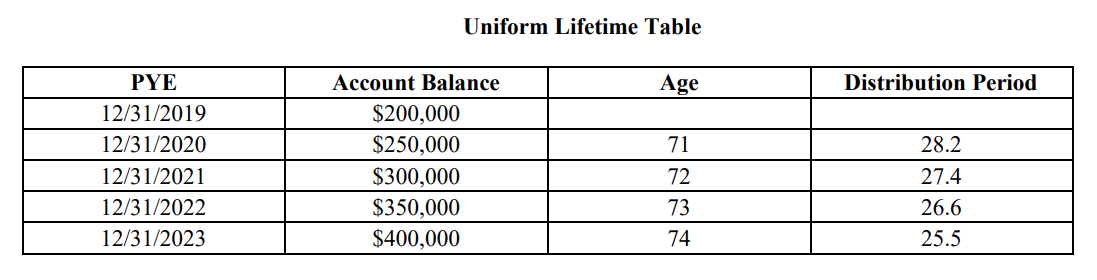

Vicki owns 15% of a business that sponsors a calendar year money purchase plan. Her birth date is February 25, 1949, and her husband, her designated beneficiary, has a birth date of March 19, 1951. Using the following information, what is her required minimum distribution amount for the 2023 distribution year? distribution year?

A. $0

B. $9,124.09

C. $9,433.96

D. $13,725.49

B. $9,124.09

Hampton owns 6% of a business that sponsors a calendar year 401(k) plan. His birth date is July 23, 1949 and his wife, his designated beneficiary, has a birth date of June 26, 1954. On February 4, 2022, Hampton received his first required minimum distribution. Using the information below, what is the 2023 required minimum distribution he must receive by December 31, 2023?

A. $437.96

B. $568.63

C. $490.57

D. $526.32

B. $568.63

Which of the following statements regarding the calculation of the required minimum distribution (RMD) amount is TRUE?

A. RMDs for 5% owners will cease if they sell their ownership interest.

B. The first distribution is required by April 1, 2022 for an owner whose birth date is June 11, 1951.

C. If the RMD for 2023 is $5,000, but $7,500 is actually distributed, the extra $2,500 is used to satisfy the 2024 RMD.

D. The RMD distribution period is based upon the attained age of the participant (and if applicable, the younger spouse) for each distribution calendar year.

D. The RMD distribution period is based upon the attained age of the participant (and if applicable, the younger spouse) for each distribution calendar year.

Jean is age 73 and receives required minimum distribution payments each year from her employer’s profit sharing plan. After receiving her 2023 required minimum distribution, she rolls over her remaining plan benefit to an existing IRA in 2023. Which of the following statements regarding the effect of the rollover on required minimum distribution (RMD) calculations is TRUE?

A. A. The plan must revise the 2023 RMD.

B. The plan must add back the rollover when calculating the 2024 RMD.

C. The IRA takes into account the rollover when calculating the 2023 RMD.

D. The IRA takes into account the rollover when calculating the 2024 RMD.

D. The IRA takes into account the rollover when calculating the 2024 RMD.

Which of the following statements regarding designated beneficiaries for required minimum distribution purposes is TRUE?

A. A participant may not have multiple beneficiaries.

B. A charity can be named as a designated beneficiary.

C. The identity of the designated beneficiary is not necessary during the participant's lifetime.

D. A designated beneficiary must be identified on or before September 30th of the calendar year following the year of the participant's death.

D. A designated beneficiary must be identified on or before September 30th of the calendar year following the year of the participant's death.

All of the following statements regarding required minimum distributions (RMDs) after death are true, EXCEPT:

A. If the participant dies before the required beginning date, the spouse-designated beneficiary may delay distributions until the year the participant would have reached age 70½.

B. If the participant dies on or after the required beginning date without a designated beneficiary, the remaining account balance is distributed over the participant's life expectancy.

C. If the participant dies before the required beginning date, the entire account balance must generally be paid to a non-spouse-designated beneficiary by December 31 of the year following the participant's death.

D. If the participant dies on or after his required beginning date, the remaining account balance is distributed to a non-spouse-designated beneficiary less than 10 years younger than the participant, using the greater of the participant’s or beneficiary’s life expectancy.

C. If the participant dies before the required beginning date, the entire account balance must generally be paid to a non-spouse-designated beneficiary by December 31 of the year following the participant's death.

All of the following statements regarding ancillary death benefits in a defined contribution plan are true, EXCEPT:

A. The plan may provide for 100% vesting upon death.

B. At retirement, an insurance policy in the plan can be transferred to the insured participant for free.

C. In the event of death, the plan may waive the 1,000-hour and/or last day allocation requirements for employer contributions.

D. To make sure insured death benefits are incidental, no more than 25% of employer contributions can be used to buy term life insurance.

B. At retirement, an insurance policy in the plan can be transferred to the insured participant for free.

All of the following statements regarding beneficiary designations are true, EXCEPT:

A. Fiduciaries are liable if the plan pays the wrong beneficiary.

B. The spouse’s right as beneficiary is not always revoked upon divorce.

C. Periodic beneficiary designation review should be part of plan procedures.

D. Death benefits are paid taking into account disclaimed benefits under a prenuptial agreement.

D. Death benefits are paid taking into account disclaimed benefits under a prenuptial agreement.

Which of the following statements regarding rollovers for spousal beneficiaries is TRUE?

A. A spouse is not able to roll over a death benefit under the 60-day rule to an IRA. B. * A spouse can roll over a death benefit as a direct transfer to another qualified plan.

C. A spouse is not able to roll over a death benefit under the 60-day rule to another qualified plan.

D. A spouse can only roll over a death benefit as a direct transfer to an IRA if the IRA is in the name of the deceased participant.

B. A spouse can roll over a death benefit as a direct transfer to another qualified plan.

All of the following statements regarding rollovers for non-spouse beneficiaries are true, EXCEPT:

A. A non-spouse beneficiary cannot roll over a death benefit as a direct transfer to a qualified plan.

B. Any required minimum distributions from the plan do not need to be taken if benefits are rolled over to an inherited IRA.

C. If a non-spouse beneficiary receives a distribution, they cannot later deposit the distribution into an inherited IRA as a rollover.

D. A non-spouse beneficiary can roll over a death benefit as a direct transfer to an inherited IRA titled in the name of the participant.

B. Any required minimum distributions from the plan do not need to be taken if benefits are rolled over to an inherited IRA.

Which of the following statements regarding disability benefits is TRUE?

A. 100% vesting is required.

B. * Whether a participant is disabled is defined by the terms of the plan.

C. Mandatory disability benefits are based on the participant’s imputed compensation.

D. An individual who becomes disabled in qualified military service must be treated as reemployed for purposes of determining entitlement to disability benefits.

B. Whether a participant is disabled is defined by the terms of the plan.

Which of the following is a qualified distribution from a designated Roth account under a 401(k) plan?

A. Claire dies in 2023 at age 55, and her beneficiary receives a distribution of her vested account balance. Claire first made designated Roth contributions to the plan in 2019.

B. Ben terminates employment and receives a distribution of his vested account balance in 2023 at age 55. Ben made designated Roth contributions to the plan each year, beginning in 2020.

C. Juliette turns age 59½ in 2023 and receives an in-service distribution of her vested account balance from her employer's 401(k) plan. Juliette only made designated Roth contributions to the plan in 2016 and 2018.

D. Desmond becomes disabled and receives a distribution of his vested account balance in 2023 at age 50. Desmond has made designated Roth contributions to the plan each year, beginning in 2019.

C. Juliette turns age 59½ in 2023 and receives an in-service distribution of her vested account balance from her employer's 401(k) plan. Juliette only made designated Roth contributions to the plan in 2016 and 2018.

David receives a $20,000 nonqualified distribution from his designated Roth account under his employer's 401(k) plan, consisting of $17,000 in designated Roth contributions and $3,000 in investment earnings. Within 60 days, David rolls over $2,000 to his Roth IRA. What amount is taxable to David in the year the nonqualified distribution is paid?

A. $0

B. $1,000

C. $2,000

D. $3,000

B. $1,000

Georgia makes designated Roth contributions to her employer's 401(k) plan in 2022 and 2023. She terminates employment in 2023. In 2024, she rolls her vested account balance to a Roth IRA she set up and began making designated Roth contributions to in 2019. When does the 5-taxable year period begin under her Roth IRA?

A. 2019

B. 2020

C. 2021

D. 2022

A. 2019

Which of the following statements regarding in-plan Roth rollovers is TRUE?

A. Only amounts currently eligible for distribution may be converted.

B. The 20% mandatory tax withholding rule applies to the in-plan Roth rollover amount.

C. In-plan Roth rollovers can be added to a 401(k) plan that doesn't intend to offer Roth provisions.

D. Although no actual distribution is made from the plan, the amount converted is taxable income to the participant.

D. Although no actual distribution is made from the plan, the amount converted is taxable income to the participant.

Which of the following statements regarding missing participants in a terminated defined contribution plan is TRUE?

A. Establishing an interest-bearing federally insured bank account in the name of the missing participant is not permitted.

B. Checking with a missing participant's plan beneficiaries is not an acceptable method of searching for missing participants.

C. The size of the participant's account and the cost of the search efforts must be considered when determining whether to use a commercial locator service.

D. In lieu of a diligent search for missing participants, fiduciaries can transfer their benefits to PBGC’s Lost Participant Program.

C. The size of the participant's account and the cost of the search efforts must be considered when determining whether to use a commercial locator service.

All of the following statements regarding plan terminations are true, EXCEPT:

A. A final Form 5500 must be filed for the plan year the plan is terminated.

B. The plan must be amended to incorporate all law changes through the termination date.

C. When an employer terminates a plan, all plan benefits must be distributed so the trust account balance is $0.

D. An employer is required to distribute all assets from a terminated plan as soon as administratively feasible.

A. A final Form 5500 must be filed for the plan year the plan is terminated.

Which of the following statements regarding the general tax principles governing distributions from qualified retirement plans is TRUE?

A. Distributions are generally taxable as long-term capital gains.

B. Distributions are taxable in the year the amounts were contributed to the plan. C. Cash-out distributions may be eligible for rollovers under the 60-day rollover rule.

D. Rolling over a distribution from a qualified plan to an IRA causes taxation to be spread over a five-year period.

C. Cash-out distributions may be eligible for rollovers under the 60-day rollover rule.

Sophia is a terminated participant in a qualified profit-sharing plan. Her vested account balance is $100,000, consisting of a $20,000 loan and $80,000 in cash. Sophia's loan is offset, and she elects to have $40,000 of her total eligible rollover distribution rolled into an IRA. What is the required tax withholding amount? A. $4,000

B. $8,000

C. $12,000

D. $18,000

C. $12,000

Mary, age 45, terminates employment with a vested account balance of $50,000 in her former employer’s profit-sharing plan. She has not made any after-tax employee contributions to the plan. Mary elects to roll over $30,000 to an IRA and receive the remainder of her account as a cash distribution. What is the mandatory tax withholding amount?

A. $0

B. $2,000

C. $4,000

D. $6,000

C. $4,000

Tyler, a 75-year-old participant, receives a $1,000 required minimum distribution (RMD) from a qualified plan. Which of the following statements regarding tax withholding is TRUE?

A. Taxes are withheld as if the payment were wages.

B. $100 in taxes must be withheld unless Tyler elects otherwise.

C. No tax withholding is required since Tyler is at least age 70½.

D. No tax withholding is required if the RMD is paid by April 15th .

B. $100 in taxes must be withheld unless Tyler elects otherwise.

Which two of the following statements regarding federal income tax withholding are TRUE?

A. Tax withholding is not required if the distribution is less than $200.

B. Additional withholding is required if the 10% early distribution tax applies.

C. Corrective distributions that are timely paid are not subject to tax withholding. D. Periodic payments from a qualified plan are aggregated with wages to determine the amount of tax withholding.

A. Tax withholding is not required if the distribution is less than $200.

C. Corrective distributions that are timely paid are not subject to tax withholding.

Joseph, age 50, terminates his employment and receives a distribution of his entire vested account balance of $100,000. The cash distribution consists of $50,000 of elective deferrals, $25,000 of employer matching contributions, and $10,000 of after-tax employee contributions. The remaining $15,000 represents earnings on the various contributions. What is the amount of the 10% additional tax on early distributions?

A. $4,000

B. $7,500

C. $8,500

D. $9,000

D. $9,000

Which two of the following distributions are exempt from the 10% additional tax on early distributions?

A. A distribution to a 58-year-old participant

B. A distribution of death benefits to a 27-year-old beneficiary

C. A distribution in 2023 to a 55-year-old participant who terminated in 2021

D. $500 out of a $2,500 distribution to a participant with deductible medical expenses and adjusted gross income of $20,000

B. A distribution of death benefits to a 27-year-old beneficiary

D. $500 out of a $2,500 distribution to a participant with deductible medical expenses and adjusted gross income of $20,000

All of the following distributions are exempt from the 10% additional tax on early distributions, EXCEPT:

A. A distribution that is for a qualified reservist

B. A qualified distribution from a Roth 401(k) plan

C. A distribution due to a participant's short-term disability

D. The portion of a distribution that represents net unrealized appreciation

C. A distribution due to a participant's short-term disability

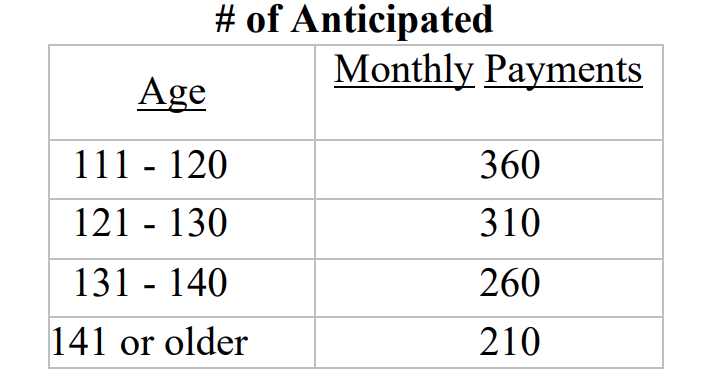

Which of the following statements regarding the recovery of cost basis in annuity payments is TRUE?

A. The total amount of nontaxable annuity income paid over the years can exceed the cost basis.

B. Under the simplified method, years of plan participation will determine the recovery period.

C. The simplified rule must be used for payments from a nonqualified plan.

D. The general rule is used to determine basis recovery for an annuity paid to a participant who is 75 or older on the annuity starting date and payments are guaranteed for at least 5 years.

D. The general rule is used to determine basis recovery for an annuity paid to a participant who is 75 or older on the annuity starting date and payments are guaranteed for at least 5 years.

All of the following give rise to an investment in the contract (cost basis), EXCEPT: A. Elective deferrals to a 401(k) plan

B. After-tax employee contributions

C. Repaid loans that were previously treated as deemed distributions

D. Designated Roth contributions distributed in a nonqualified distribution

A. Elective deferrals to a 401(k) plan

As of January 1, 2023, Bill (age 68) and his wife (age 64) begin receiving a monthly joint and survivor annuity payment of $700. As a participant in his former employer’s plan, Bill contributed $26,000 in after-tax employee contributions. How much of each monthly annuity payment is recovered tax-free?

A. $0.00

B. $100.00

C. $600.00

D. $700.00

B. $100.00

Steve is a participant in a qualified plan. An annuity is purchased for him with his vested account balance. Under its terms, the annuity will pay Steve $600 a month for life, beginning January 1, 2023 at age 77. Since Steve has made after-tax employee contributions to the plan, there is an investment in the contract of $32,256. Under the general rule, what is the tax-free portion of his monthly annuity, assuming his expected return multiple is 11.2?

A. $0

B. $240

C. $360

D. $600

B. $240

All of the following requirements must be met for a distribution to be considered a lump sum distribution, EXCEPT:

A. It is the participant’s entire balance.

B. It is the direct result of a specific triggering event.

C. It is paid in the same tax year of a triggering event.

D. It must include benefits from all the employer’s qualified plans.

C. It is paid in the same tax year of a triggering event.

Which of the following is a triggering event for lump sum distribution purposes?

A. Contributions held in the plan for two years

B. Disability of a self-employed person

C. Forfeiture of a participant's nonvested benefit

D. A participant attains age 55 and is fully vested

B. Disability of a self-employed person

Which of the following statements regarding special tax treatment for lump sum distributions is TRUE?

A. Amounts distributed to participants who are 75 or older are not taxable.

B. 5-year income averaging might be available to a participant who was born before January 2, 1936.

C. A participant eligible for special tax treatment must file Form 4972 in order to obtain the special tax treatment.

D. Capital gains treatment might be available to the whole distribution regardless of the number of months of pre-1974 and post-1973 participation.

C. A participant eligible for special tax treatment must file Form 4972 in order to obtain the special tax treatment.

A participant receives a distribution of employer securities valued at $25,000 with a cost basis of $5,000. The distribution is a lump sum distribution, and net unrealized appreciation tax treatment is elected. All of the following statements regarding the distributions of employer securities is true, EXCEPT:

A. The $5,000 cost basis is exempt from the 10% additional tax on early distributions.

B. The $5,000 cost basis is generally taxed as ordinary income in the year of distribution.

C. The $5,000 cost basis may be eligible for capital gain treatment or the 10-year tax option if the participant was born before January 2, 1936.

D. The participant defers tax on the $20,000 net unrealized appreciation until the securities are sold.

A. The $5,000 cost basis is exempt from the 10% additional tax on early distributions.

A participant contributes both designated Roth contributions and pre-tax elective deferrals to a 401(k) plan. There are no employer contributions to the plan. After contributing to the plan for 3 years, the 40- year-old participant terminates and receives a total cash distribution of her plan benefits. All of the following statements regarding the reporting of the distribution on Form 1099-R are true, EXCEPT:

A. The first year a designated Roth contribution is made is reported on Form 1099-R.

B. The taxable amount for the designated Roth distribution is reported on Form 1099-R as $0.

C. The gross distribution and taxable amount reported on Form 1099-R are the same amounts for the distribution of the pre-tax elective deferrals.

D. The distribution of pre-tax elective deferrals is reported on one Form 1099-R while the distribution of designated Roth contributions is reported on a separate Form 1099-R.

B. The taxable amount for the designated Roth distribution is reported on Form 1099-R as $0.

All of the following statements regarding the IRS 402(f) tax notice are true, EXCEPT:

A. The 30-day notice period may be waived.

B. The notice must be given to recipients of an automatic rollover.

C. A model notice is available that satisfy the requirement under IRC §402(f).

D. The notice must explain the special rules that apply to designated Roth contributions.

B. The notice must be given to recipients of an automatic rollover.

All of the following statements regarding the IRS 402(f) tax notice are true, EXCEPT:

A. The notice must be given to a deceased participant’s beneficiary.

B. The notice must explain the result of not rolling over the distribution.

C. The notice must be written in plain language designed to be easily understood. D. The notice must be provided no more than 90 days before the distribution is to be made.

D. The notice must be provided no more than 90 days before the distribution is to be made.

Which of the following disclosures applies under a plan subject to the survivor annuity rules when vested benefits are $5,000 or less?

A. QJSA notice

B. QJSA waiver

C. IRS 402(f) notice

D. Spousal consent

C. IRS 402(f) notice

Which of the following statements regarding the QJSA notice is TRUE?

A. The notice must specify the participant’s right to waive the QJSA.

B. The notice must be provided to beneficiaries upon a participant’s death.

C. The notice must be provided no more than 30 days before the date benefits commence.

D. The notice must explain that the participant isn’t able to revoke a previously executed waiver.

A. The notice must specify the participant’s right to waive the QJSA.